Global Udder Health Market

Market Size in USD Billion

CAGR :

%

USD

1.63 Billion

USD

2.36 Billion

2024

2032

USD

1.63 Billion

USD

2.36 Billion

2024

2032

| 2025 –2032 | |

| USD 1.63 Billion | |

| USD 2.36 Billion | |

|

|

|

|

Udder Health Market Analysis

The global udder health market is experiencing steady growth, driven by increasing awareness of milk quality, animal health, and the economic impact of udder-related diseases like mastitis. Mastitis remains the most prevalent and economically detrimental disease affecting dairy cattle. This has led to higher adoption of diagnostic tools and preventive measures, such as teat disinfectants and antibiotics. Growing global demand for milk and other dairy products has driven investments in udder health management to ensure quality and productivity.

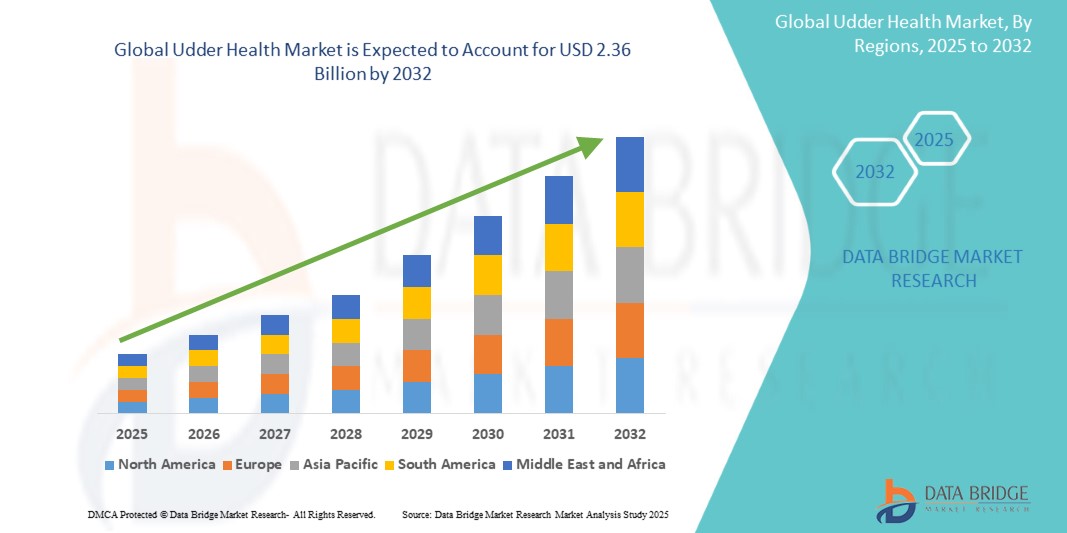

Udder Health Market Size

Global udder health market size was valued at USD 1.63 billion in 2024 and is projected to reach USD 2.36 billion by 2032, with a CAGR of 4.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Udder Health Market Trends

“Adoption Of Precision Dairy Farming Technologies”

The adoption of precision dairy farming technologies is transforming the udder health market by enabling more effective and proactive management of cow health. Advanced tools such as automated milking systems, sensor-based monitoring devices, and predictive analytics provide farmers with real-time insights into individual cow health. Automated milking systems, for instance, measure milk yield and somatic cell counts, which can indicate mastitis or other udder health issues. Similarly, sensors and wearable devices monitor parameters like milk conductivity, temperature, and cow activity, allowing early detection of potential health problems. Predictive analytics, powered by machine learning, further enhances this process by forecasting health risks based on environmental and physiological data, enabling timely and targeted interventions.

These technologies help reduce the incidence and severity of udder diseases like mastitis, minimize the reliance on broad-spectrum antibiotics, and improve overall herd productivity. This has increased the demand for advanced udder health solutions such as vaccines, diagnostic tools, and targeted treatments. While the high initial investment poses challenges, the long-term benefits of improved milk quality, cost efficiency, and enhanced animal welfare are driving widespread adoption, particularly in developed markets. Emerging economies are also beginning to embrace these innovations, positioning precision technologies as a cornerstone of sustainable dairy farming practices globally.

Report Scope and Udder Health Market Segmentation

|

Attributes |

Udder Health Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Merck & Co., Inc. (US), Zoetis Inc. (US), Boehringer Ingelheim GmbH (Germany), Elanco Animal Health Incorporated (US), Ceva Santé Animale (France), Vetoquinol S.A. (France), Virbac S.A. (France), Ecolab Inc. (US), GEA Group Aktiengesellschaft (Germany), DeLaval International AB (Sweden), BouMatic LLC (US), Orffa International Holding B.V. (Netherlands), Lely International N.V. (Netherlands), AHV International B.V. (Netherlands), Albert Kerbl GmbH (Germany), G. Shepherd Animal Health Limited (UK), Ambig Equipment Limited (England), Draminski S.A. (Poland), Zenex Animal Health India Private Limited (India), Blackmango Herb (India), Nicosia Biolabs International Private Limited (India), Ring Biotechnology Co., Ltd. (China), Koru Diagnostics Ltd. (New Zealand), Mastaplex Limited (New Zealand), AR Brown Co., Ltd. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Udder Health Market Definition

Udder health refers to the overall well-being of a cow's mammary gland, which is critical for dairy production. It encompasses the detection, prevention, and treatment of udder diseases such as mastitis, which is an inflammation of the udder tissue caused by bacterial infection. Good udder health ensures optimal milk quality and yield, as well as the welfare of the cow. Advanced management practices like regular monitoring, proper milking techniques, and the use of udder health monitoring technologies help in early detection of problems, timely treatment, and prevention strategies to minimize the incidence of diseases. These practices are crucial for maintaining herd health and maximizing dairy farm productivity.

Udder Health Market Dynamics

Drivers

- Increasing Prevalence of Mastitis

Mastitis is a major health issue in dairy animals, leading to reduced milk yield, lower quality, and economic losses. This has driven the demand for effective udder health solutions, including advanced diagnostic kits (somatic cell counters, PCR testing) and preventive measures like teat disinfectants and vaccines. For instance, products that detect and manage mastitis are being widely adopted in both developed and developing dairy industries. For instance, according to the American Pet Products Association (APPA), the overall prevalence of mastitis at the cow level was 39.67% (210/532) of which clinical (CM) and subclinical (SCM) were 16.70% and, 22.70%, respectively. The prevalence of CM and SCM were increasing as the age of cows increased. The prevalence of CM and SCM was higher in parity of 1–3 calving than in others. Hence, the rise in prevalence of mastitis drives the demand of pharmaceuticals and devices for effective udder health.

- Growing Global Demand for Dairy Products

The global demand for dairy products, such as milk, cheese, yogurt, and butter, is increasing due to population growth, urbanization, and evolving dietary preferences, particularly in emerging markets where dairy consumption is rising as incomes grow. This heightened demand has placed significant pressure on dairy farmers to boost production while maintaining high-quality standards. To achieve this, there is a growing emphasis on improving animal health and productivity, with a particular focus on udder health, as it directly impacts milk yield and quality. Farmers are investing in a range of udder health management tools, including hygiene products to prevent infections, nutritional supplements to boost immunity, and advanced disease monitoring systems for early detection and intervention. These innovations reduce the risk of diseases like mastitis, which can significantly impact productivity, and improve overall herd welfare.

Additionally, technologies like precision dairy farming systems are being adopted to monitor udder health parameters in real time, further enhancing efficiency and meeting the global surge in dairy demand. This trend reflects the interconnectedness of animal health, sustainable farming practices, and the evolving needs of the global dairy market.

Opportunities

- Integration of Digital Technologies in Udder Health Management

The adoption of digital tools such as IoT sensors, wearable devices, and automated monitoring systems presents a significant opportunity for the udder health market. These technologies enable real-time monitoring of udder conditions, early detection of mastitis, and precise administration of treatments. For example, smart dairy systems that track milk quality and animal health help farmers improve efficiency and reduce losses. For instance, IoT devices like HealthPatch MD and similar biosensors provide continuous monitoring, allowing farmers and veterinarians to detect early signs of mastitis or other udder-related issues, reducing disease prevalence and improving milk yield. The adoption of digital technologies in udder health management represents a paradigm shift towards data-driven, efficient, and sustainable dairy farming practices. By enabling early interventions and better disease management, these tools significantly enhance animal welfare and productivity. As the demand for high-quality dairy products grows globally, the integration of such advanced solutions will remain pivotal for the future of the udder health market.

- Development of Alternative Therapies

The development of alternative therapies for udder health is gaining traction as concerns over antibiotic resistance grow and consumer preferences shift toward organic and sustainable dairy products. Traditional antibiotics, while effective, contribute to the risk of antimicrobial resistance and often leave residues in milk, posing challenges for both public health and compliance with stricter regulatory standards. This has created a strong demand for natural, eco-friendly solutions that support udder health while meeting consumer expectations for clean-label dairy products. Herbal remedies, probiotics, and organic formulations are emerging as promising alternatives. Herbal therapies often leverage the antimicrobial and anti-inflammatory properties of natural compounds like neem, turmeric, and aloe vera to manage infections such as mastitis. Probiotic-based treatments, which use beneficial microorganisms to enhance the cow’s immune response and compete with pathogenic bacteria, offer a sustainable method to prevent and treat udder infections. Additionally, organic solutions, including essential oils and plant-based balms, provide gentle yet effective care, aligning with the principles of organic farming.

These therapies not only reduce dependency on antibiotics but also improve overall animal immunity and welfare, promoting better productivity and higher-quality milk. As the focus on sustainable farming intensifies, the adoption of alternative udder health solutions is expected to grow, further driving innovation in this market segment.

Restraints/Challenges

- High Cost of Advanced Udder Health Solutions

The high cost of advanced udder health solutions presents a significant barrier to their widespread adoption, especially among small-scale farmers who dominate the dairy sector globally. Advanced diagnostic tools, such as biosensors and IoT-enabled monitoring systems, as well as preventive solutions like vaccines and automated milking equipment, require substantial financial investment. These technologies, while effective in improving udder health and productivity, often involve high upfront costs and ongoing maintenance expenses. This makes them less accessible for small and medium-sized dairy farms, which typically operate on tight budgets and limited resources.

Moreover, in developing regions, inadequate infrastructure further compounds the issue. Challenges such as unreliable electricity, limited internet connectivity, and insufficient access to veterinary services reduce the feasibility of implementing digital monitoring systems or other high-tech solutions. These constraints hinder the adoption of advanced udder health measures, leaving many farmers reliant on traditional methods that may not be as effective or sustainable. While governments and organizations are working to address these challenges through subsidies and training programs, significant disparities in access to advanced udder health technologies persist. Bridging this gap requires collaborative efforts to reduce costs, improve infrastructure, and develop affordable, scalable solutions tailored to the needs of small-scale farmers, particularly in emerging markets.

- Antibiotic Resistance and Usage Concerns

The overuse of antibiotics in treating mastitis and other udder-related conditions has led to growing concerns over antibiotic resistance. This not only limits treatment options but also impacts consumer preferences, as there is increasing demand for antibiotic-free dairy products. Regulatory pressure to reduce antibiotic use further complicates the development of effective treatment protocols.

For instance, strict regulations in Nordic countries that limit antibiotic use in dairy farming. These regulations focus on reducing resistance by requiring bacteriological diagnostics before treatment decisions are made. Farmers and veterinarians are mandated to collect milk samples and conduct tests to identify pathogens, often delaying treatment and increasing costs. This structured approach highlights the complexities of balancing effective treatment and antibiotic stewardship.

Addressing the challenges of antibiotic resistance requires a multifaceted approach. Investments in alternative therapies, such as probiotics, vaccines, and natural remedies, combined with stricter antibiotic usage policies, can help achieve a balance between effective treatment and sustainable dairy farming. This shift will be crucial for maintaining consumer trust and meeting the rising demand for safe, high-quality dairy products.

Udder Health Market Scope

The market is segmented on the basis of product, veterinary care settings, and animal type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market Veterinary Care Settings.

Product

- Devices

- Pharmaceuticals

- Supplements

Veterinary Care Settings

- Dairy Farms

- Veterinary Hospitals & Clinics

Animal Type

- Dairy Cattle

- Sheep

- Others

Disease Type

- Clinical Mastitis

- Others

Udder Health Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, veterinary care settings, and animal type as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America leads the global udder health market due to its advanced dairy farming practices, high awareness about animal health, and the presence of key players such as Zoetis Inc. and Merck Animal Health. The U.S. and Canada have large dairy industries where udder health is a priority to maintain milk quality and productivity. The established infrastructure, widespread veterinary services, and high adoption of advanced technologies such as diagnostic tools and automated systems contribute to the region's dominance.

Asia-Pacific is the fastest-growing region in the global udder health market. Countries like India and China are seeing significant growth in dairy consumption, driven by population growth and changing dietary preferences. Increased investments in dairy farming practices, alongside improving awareness of udder health and quality milk production, are fueling demand. Additionally, there is a rising adoption of technologies and veterinary services, especially in countries like India, where milk production is integral to the agricultural economy.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Udder Health Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Veterinary Care Settings dominance. The above data points provided are only related to the companies' focus related to market.

Udder Health Market Leaders Operating in the Market Are:

- Merck & Co., Inc. (US)

- Zoetis Inc. (US)

- Boehringer Ingelheim GmbH (Germany)

- Elanco Animal Health Incorporated (US)

- Ceva Santé Animale (France)

- Vetoquinol S.A. (France)

- Virbac S.A. (France)

- Ecolab Inc. (US)

- GEA Group Aktiengesellschaft (Germany)

- DeLaval International AB (Sweden)

- BouMatic LLC (US)

- Orffa International Holding B.V. (Netherlands)

- Lely International N.V. (Netherlands)

- AHV International B.V. (Netherlands)

- Albert Kerbl GmbH (Germany)

- G. Shepherd Animal Health Limited (UK)

- Ambig Equipment Limited (England)

- Draminski S.A. (Poland)

- Zenex Animal Health India Private Limited (India)

- Blackmango Herb (India)

- Nicosia Biolabs International Private Limited (India)

- Ring Biotechnology Co., Ltd. (China)

- Koru Diagnostics Ltd. (New Zealand)

- Mastaplex Limited (New Zealand)

- AR Brown Co., Ltd. (Japan)

Latest Developments in Udder Health Market

- In August 2023, Zoetis Inc. introduced Vetscan Mastigram+, a rapid diagnostic tool designed for detecting mastitis pathogens in dairy cows. This technology helps farmers quickly identify infections, reducing the impact on milk production and improving overall udder health management

- In February 2022, Orffa entered into a distribution agreement with Eigenmann & Veronelli, a leading provider of specialty chemicals and food ingredients in Italy. This partnership enabled Orffa to enhance the promotion of its ESSENTIALS product line throughout Italy

- In February 2020, Ecolab Inc. launched Eco-Flex Teat Dip, a cutting-edge solution designed to address key challenges in udder health management. This innovative product focuses on affordability and effectiveness, making it accessible for dairy farmers while providing robust protection against infections. Teat dips like Eco-Flex are integral to udder health as they help maintain teat hygiene, reduce the risk of mastitis, and ensure higher milk quality. Eco-Flex Teat Dip is notable for its unique formulation that offers a balance between cost-efficiency and performance

- In April 2023, Boehringer Ingelheim GmbH, a leading player in the veterinary healthcare sector, recently expanded its mastitis care portfolio with the introduction of advanced intramammary products. These new offerings are specifically designed to enhance the efficacy of treatments for mastitis, a prevalent and costly condition affecting the udder health of dairy cows. By focusing on early-stage infections, these products aim to intervene before the condition escalates, reducing the severity and long-term impact on milk production and overall animal health

- In March 2023, DeLaval launched the DelPro Farm Management System 5.5, a cutting-edge platform that integrates digital technology to revolutionize udder health monitoring and overall dairy farm management. This system combines advanced data analytics, Internet of Things (IoT) devices, and real-time monitoring capabilities to provide farmers with actionable insights into cow health, milk quality, and operational efficiency. One of the key features of DelPro 5.5 is its ability to track individual cow data, such as milk yield, somatic cell count, and udder health indicators, through sensors and automated milking equipment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL UDDER HEALTH MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL UDDER HEALTH MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL UDDER HEALTH MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. EXECUTIVE SUMMARY

4. PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

4.3 COMPETITIVE INTELLIGENCE

5. INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6. EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7. MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8. REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9. PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

10. MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.10 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1 FORECAST MARKET OUTLOOK

10.13.2 CROSS COMPETITION

10.13.3 THERAPEUTIC PORTFOLIO

10.13.4 CURRENT DEVELOPMENT SCENARIO

11. MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12. R & D ANALYSIS

12.1 COMPARATIVE ANALYSIS

12.2 DRUG DEVELOPMENTAL LANDSCAPE

12.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

12.4 THERAPEUTIC ASSESSMENT

12.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

13. MARKET OVERVIEW

13.1 DRIVERS

13.2 RESTRAINTS

13.3 OPPORTUNITIES

13.4 CHALLENGES

14. GLOBAL UDDER HEALTH MARKET , BY PRODUCT

14.1 OVERVIEW

14.2 DEVICES

14.2.1 MILK MANAGEMENT SYSTEM

14.2.2 MILK SAMPLING EQUIPMENT

14.2.3 MILK QUALITY ANALYZER

14.3 PHARMACEUTICALS

14.3.1 BY DRUG TYPE

14.3.1.1. ANTIBIOTIC

14.3.1.1.1. CEPRAVIN DC

14.3.1.1.2. COBACTAN RANGE

14.3.1.1.3. MASTIPLAN LC

14.3.1.2. VACCINES(OXYTOCIN)

14.3.1.3. ANTI-INFLAMMATORY

14.3.1.3.1. FLUNIXIN MEGLUMINE

14.3.1.3.2. KETOPROFEN

14.3.1.3.3. CHLORHEXIDINE

14.3.1.3.4. CLOXACILLIN

14.3.1.4. INTRAMAMMERY INFUSION

14.3.2 BY DRUG FORM

14.3.2.1. BRANDED

14.3.2.2. GENERIC

14.3.3 BY ROUTE OF ADMINISTRATION

14.3.3.1. INJECTABLE

14.3.3.2. ORAL

14.3.3.3. TOPICAL

14.3.4 BY MODE OF PRESCRIPTION

14.3.4.1. PRESCRIPTION

14.3.4.2. OVER-THE-COUNTER

14.3.5 OTHER

14.4 SUPPLEMENTS

14.4.1 NUTRITIONAL SUPPLEMENTS

14.4.1.1. MINERAL

14.4.1.1.1. CALCIUM

14.4.1.1.2. MAGNESIUM

14.4.1.1.3. PHOSPHORUS

14.4.1.1.4. SODIUM AND POTASSIUM

14.4.1.2. VITAMIN

14.4.1.3. FATTY ACIDS & OMEGA-3S

14.4.2 PROBIOTICS & PREBIOTICS

14.4.3 IMMUNE SYSTEM BOOSTERS

14.4.3.1. BETA-GLUCANS

14.4.3.2. YEAST-BASED SUPPLEMENTS

14.4.4 HERBAL & BOTANICAL

14.4.5 ANTI-INFLAMMATORY

14.4.5.1. CURCUMIN

14.4.5.2. OMEGA-3 FATTY ACIDS

15. GLOBAL UDDER HEALTH MARKET , BY ANIMAL TYPE

15.1 OVERVIEW

15.2 DAIRY CATTLE

15.3 SHEEP

15.4 GOATS

15.5 SHEEP

15.6 BUFFALOES

15.7 YAKS

15.8 CAMELS

15.9 OTHERS

16. GLOBAL UDDER HEALTH MARKET, BY END USER

16.1 OVERVIEW

16.2 DAIRY FARMERS

16.3 VETERINARIANS AND ANIMAL CARE PROVIDERS

16.4 RESEARCH INSTITUTIONS

16.5 HOMECARE

16.6 OTHERS

17. GLOBAL UDDER HEALTH MARKET , BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDER

17.3 RETAIL SALES

17.3.1 OFFLINE

17.3.2 ONLINE

17.4 OTHERS

18. GLOBAL UDDER HEALTH MARKET , COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19. GLOBAL UDDER HEALTH MARKET , BY GEOGRAPHY

19.1 GLOBAL UDDER HEALTH MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1.1 NORTH AMERICA

19.1.1.1. U.S.

19.1.1.1.1. U.S. UDDER HEALTH TREATMENT MARKET, BY PRODUCT

19.1.1.1.2. U.S. UDDER HEALTH TREATMENT MARKET, BY ANIMAL TYPE

19.1.1.1.3. U.S. UDDER HEALTH TREATMENT MARKET, BY END USER

19.1.1.1.4. U.S. UDDER HEALTH TREATMENT MARKET, BY DISTRIBUTION CHANNEL

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 FRANCE

19.2.3 U.K.

19.2.4 ITALY

19.2.5 SPAIN

19.2.6 RUSSIA

19.2.7 TURKEY

19.2.8 NETHERLANDS

19.2.9 SWITZERLAND

19.2.10 AUSTRIA

19.2.11 IRELAND

19.2.12 NORWAY

19.2.13 POLAND

19.2.14 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 TAIWAN

19.3.4 SOUTH KOREA

19.3.5 INDIA

19.3.6 AUSTRALIA

19.3.7 SINGAPORE

19.3.8 THAILAND

19.3.9 MALAYSIA

19.3.10 INDONESIA

19.3.11 PHILIPPINES

19.3.12 VIETNAM

19.3.13 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 CHILE

19.4.4 PERU

19.4.5 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 SAUDI ARABIA

19.5.3 UAE

19.5.4 EGYPT

19.5.5 KUWAIT

19.5.6 ISRAEL

19.5.7 REST OF MIDDLE EAST AND AFRICA

19.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

20. GLOBAL UDDER HEALTH MARKET , SWOT AND DBMR ANALYSIS

21. GLOBAL UDDER HEALTH MARKET , COMPANY PROFILE

21.1 MERCK & CO., INC.

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHIC PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 ZOETIS INC.

21.3 BOEHRINGER INGELHEIM GMBH

21.4 ELANCO ANIMAL HEALTH INCORPORATED

21.5 CEVA SANTÉ ANIMALE

21.6 VETOQUINOL SA

21.7 FRVIRBAC SA

21.8 ECOLAB INC.

21.9 GEA GROUP AKTIENGESELLSCHAFT

21.10 DELAVAL INTERNATIONAL AB

21.11 BOUMATIC LLC

21.12 ORFFA INTERNATIONAL HOLDING BV

21.13 LELY INTERNATIONAL NV

21.14 AHV INTERNATIONAL BV

21.15 ALBERT KERBL GMBH

21.16 G. SHEPHERD ANIMAL HEALTH LIMITED

21.17 AMBIG EQUIPMENT LIMITED

21.18 DRAMINSKI SA

21.19 ZENEX ANIMAL HEALTH INDIA PRIVATE LIMITED

21.20 BLACKMANGO HERB

21.21 NICOSIA BIOLABS INTERNATIONAL PRIVATE LIMITED

21.22 RING BIOTECHNOLOGY CO., LTD.

21.23 KORU DIAGNOSTICS LTD.

21.24 MASTAPLEX LIMITED

21.25 AR BROWN CO., LTD.

21.25.1 COMPANY OVERVIEW

21.25.2 REVENUE ANALYSIS

21.25.3 GEOGRAPHIC PRESENCE

21.25.4 PRODUCT PORTFOLIO

21.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22. RELATED REPORTS

23. CONCLUSION

24. QUESTIONNAIRE

25. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.