Global Uhb Tape Market

Market Size in USD Billion

CAGR :

%

USD

2.51 Billion

USD

3.59 Billion

2024

2032

USD

2.51 Billion

USD

3.59 Billion

2024

2032

| 2025 –2032 | |

| USD 2.51 Billion | |

| USD 3.59 Billion | |

|

|

|

|

UHB Tape Market Size

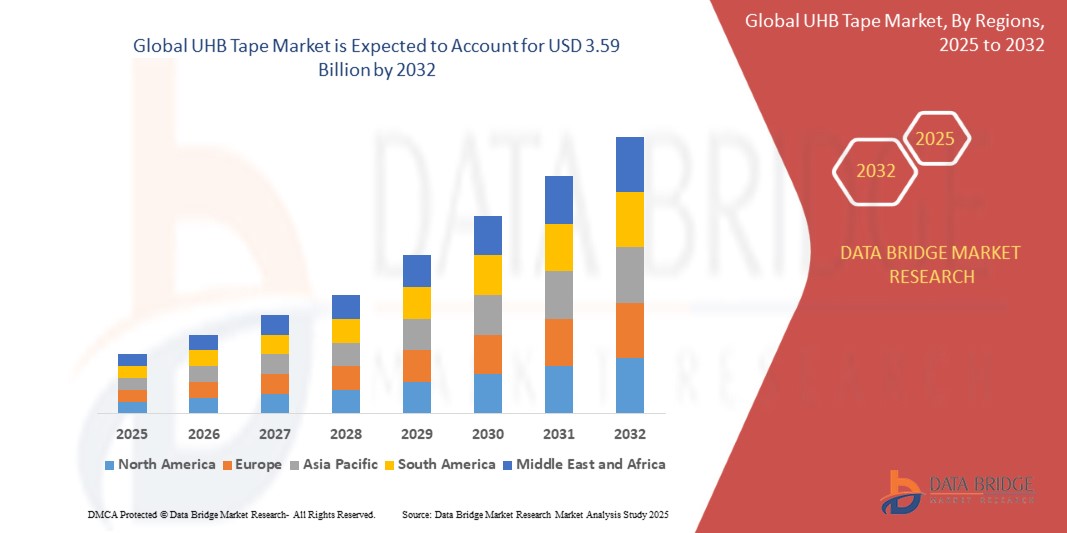

- The global UHB tape market size was valued at USD 2.51 billion in 2024 and is expected to reach USD 3.59 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the increasing adoption of lightweight, fastener-free bonding solutions across automotive, electronics, construction, and industrial applications, driving demand for ultra-high bond (UHB) tapes that offer strong, durable, and versatile adhesion

- Furthermore, rising requirements for efficient assembly processes, reduction of mechanical fasteners, and the need for reliable bonding in high-performance and temperature-sensitive environments are establishing UHB tapes as a preferred solution across multiple industries. These converging factors are accelerating the adoption of UHB tapes, thereby significantly boosting the industry’s growth

UHB Tape Market Analysis

- UHB tapes are high-performance adhesive products designed to provide extremely strong bonding between various substrates, including metals, plastics, composites, and glass. They are widely used in automotive, electronics, aerospace, construction, and retail display applications due to their ability to replace mechanical fasteners and provide clean, durable, and flexible bonding solutions

- The escalating demand for UHB tapes is primarily fueled by increasing industrial automation, growth in lightweight vehicle and electronics manufacturing, rising use of advanced materials requiring specialized adhesives, and the emphasis on cost- and time-efficient assembly processes across global industries

- Asia-Pacific dominated the UHB tape market with a share of 42% in 2024, due to growing automotive production, rapid construction activities, and strong adoption of electronics and retail display solutions

- North America is expected to be the fastest growing region in the UHB tape market during the forecast period due to rising adoption of UHB tapes in automotive, electronics, aerospace, and construction applications

- Double-sided UHB tapes segment dominated the market with a market share of 60.7% in 2024, due to its ability to bond two surfaces effectively without mechanical fasteners. This type is widely used in electronics assembly, automotive interior and exterior applications, and retail display setups, offering clean, strong, and durable bonding solutions. Their compatibility with multiple substrates, including metals, plastics, and glass, enhances their versatility

Report Scope and UHB Tape Market Segmentation

|

Attributes |

UHB Tape Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

UHB Tape Market Trends

Evolving Needs of Automotive Industry

- The automotive sector is driving rapid adoption of UHB tapes as manufacturers replace traditional fasteners with high-strength adhesives for vehicle assembly. This boost in demand is closely linked to the shift toward lighter materials and electric vehicle production

- For instance, 3M has partnered with global automakers to launch UHB tapes for lightweight panel bonding and sensor attachments. Their products help reduce vehicle weight and assembly times while supporting stringent performance and design specifications

- UHB tape manufacturers are developing advanced formulations to enhance weather resistance and environmental durability in exterior parts. Growing interest in robust adhesives supports automotive structural integrity across EV, passenger, and commercial models

- The focus on modular vehicle architectures is leading to increased use of UHB tapes for vibration dampening and noise reduction. These tapes offer flexibility and design freedom, enabling automakers to innovate with new materials and construction methods

- As sensor density and connected car features grow, UHB tapes are seeing greater use in seamless electronics integration. Their invisible bonding supports slim form factors and next-generation safety functions in modern vehicle platforms

- Global EV growth accelerates UHB tape demand for battery systems and lightweight composite bodywork. Manufacturers are investing in specialized adhesives to address novel engineering and performance requirements in zero-emission transport solutions

UHB Tape Market Dynamics

Driver

Increased Adoption and Prominence Towards Green Building Standards

- Green building standards are prompting construction firms to switch to low-VOC, eco-friendly UHB tape solutions for panel bonding and sealing. These tapes provide durable adhesion while supporting certifications for energy efficiency and sustainability in infrastructure projects

- For instance, NADCO® has expanded its UHB tape portfolio to include formulations for green buildings. Their products help developers achieve faster assembly, less waste, and stronger compliance with LEED and similar environmental benchmarks

- Projects seeking advanced insulation and facade materials favor UHB tapes for their ability to bond diverse surfaces and withstand extreme temperatures. The tapes facilitate efficient modular construction and reduced hardware needs, optimizing energy-efficient designs

- Regulatory shifts and public policies set higher environmental standards, boosting demand for adhesives that deliver performance with reduced emissions. UHB tape makers respond by innovating with recycled and biodegradable content wherever possible

- Growth in prefab and modular construction uses UHB tapes for rapid assembly and design flexibility. Industry players increasingly recognize adhesive strength and reliability as critical to meeting the evolving challenges of modern infrastructure demand

Restraint/Challenge

Adhesive Residue with UHB Tapes

- A major challenge remains the adhesive residue left behind when UHB tape is removed from surfaces. Residue can lead to aesthetics and maintenance issues, requiring costly surface cleaning or repair, especially where finishes must remain pristine

- For instance, University of Surrey researchers developed a dissolvable polymer adhesive capable of minimizing residue left on recyclable substrates. This innovation is now being piloted by packaging firms seeking to reduce damage and cleaning efforts during label removal

- Manufacturers must address compatibility concerns as adhesive residue may interfere with bonding quality or later finishing steps. Failure to control residue can impact customer satisfaction and drive up lifecycle maintenance costs in construction and automotive settings

- Additional cleaning steps to remove UHB residues add time and labor expense for installers. This reduces process efficiency and limits adoption for applications demanding rapid, residue-free disassembly or replacement

- Customer pushback against cleaning challenges is encouraging innovation in low-residue UHB tape products. While new technologies are being introduced, widespread transition remains slow and cost-intensive for many segments

UHB Tape Market Scope

The market is segmented on the basis of type, application, thickness, material, adhesive type, and end user.

• By Type

On the basis of type, the UHB tape market is segmented into acrylic-based UHB tapes, rubber-based UHB tapes, silicone-based UHB tapes, hybrid UHB tapes, foam-based UHB tapes, and others. The acrylic-based UHB tapes segment dominated the largest market revenue share in 2024, owing to its excellent adhesion, high temperature resistance, and versatility across multiple substrates. These tapes are widely preferred in automotive, construction, and electronics applications for their ability to replace mechanical fasteners while ensuring a strong, durable bond. Their compatibility with both smooth and rough surfaces and long-term reliability has further driven adoption among industrial and commercial users. In addition, the availability of diverse thicknesses and backing options enhances their appeal for specialized applications.

The silicone-based UHB tapes segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in high-temperature and chemically challenging environments. Silicone-based tapes provide superior heat resistance, flexibility, and resilience, making them suitable for aerospace, automotive, and electronics industries. The expanding need for durable bonding solutions in advanced manufacturing and harsh environmental conditions is driving their rapid uptake. Rising awareness about long-term performance and reduction of mechanical fasteners in modern assembly processes also contributes to growth.

• By Application

On the basis of application, the UHB tape market is segmented into automotive, construction, electronics, retail and display, and others. The automotive segment held the largest market revenue share in 2024, driven by the growing adoption of lightweight, mechanical-fastener-free assembly methods. UHB tapes are widely used in bonding interior panels, trims, emblems, and structural components, reducing assembly time and enhancing design flexibility. The ability of these tapes to withstand vibration, temperature fluctuations, and environmental exposure has made them a preferred solution in modern automotive manufacturing. Increasing production of electric vehicles and premium vehicles is further boosting demand.

The electronics segment is projected to witness the fastest CAGR from 2025 to 2032, owing to the increasing miniaturization of devices and the need for reliable, compact bonding solutions. UHB tapes provide strong adhesion without adding bulk, supporting the assembly of smartphones, wearables, and other consumer electronics. The growing trend toward flexible displays and lightweight gadgets is accelerating the adoption of these tapes, alongside advancements in conductive and thermally resistant adhesive formulations.

• By Thickness

On the basis of thickness, the UHB tape market is segmented into thin UHB tapes and thick UHB tapes. The thin UHB tapes segment dominated the market in 2024, supported by their versatility in applications requiring minimal profile and discreet bonding. Thin tapes are extensively used in electronics, automotive interiors, and retail display setups where visual aesthetics and precision bonding are critical. Their ability to adhere tightly to irregular surfaces and provide uniform bonding strength has reinforced their preference among manufacturers. In addition, thin tapes enable cost-efficient material use while maintaining high-performance standards.

Thick UHB tapes are expected to witness the fastest growth from 2025 to 2032, driven by applications requiring gap-filling, cushioning, and shock absorption. Industries such as construction and automotive are increasingly adopting thick tapes for structural bonding and vibration damping. The expansion of heavy-duty applications and growing demand for tapes that can accommodate uneven surfaces and provide enhanced mechanical strength is fueling this segment.

• By Material

On the basis of material, the UHB tape market is segmented into steel, iron, and other materials. The steel segment dominated the largest market revenue share in 2024 due to the widespread industrial use of steel components and assemblies. UHB tapes offer excellent adhesion to steel surfaces, enabling replacements for welding, riveting, and other mechanical fastening techniques. Their durability, corrosion resistance, and ability to maintain bond integrity under mechanical stress have made them highly desirable in automotive, construction, and industrial applications.

The “other materials” segment is projected to witness the fastest growth from 2025 to 2032, propelled by increasing use of lightweight composites, plastics, and aluminum in automotive, aerospace, and electronics industries. The need for versatile bonding solutions across diverse substrates and lightweight materials is boosting adoption. Continuous innovation in adhesive chemistry for specialized materials is also driving this rapid growth.

• By Adhesive Type

On the basis of adhesive type, the UHB tape market is segmented into single-sided UHB tapes and double-sided UHB tapes. The double-sided UHB tapes segment dominated the market share of 60.7% in 2024, owing to its ability to bond two surfaces effectively without mechanical fasteners. This type is widely used in electronics assembly, automotive interior and exterior applications, and retail display setups, offering clean, strong, and durable bonding solutions. Their compatibility with multiple substrates, including metals, plastics, and glass, enhances their versatility.

Single-sided UHB tapes are expected to witness the fastest growth from 2025 to 2032, driven by applications requiring protective and sealing properties alongside bonding. Single-sided tapes are increasingly adopted in industrial insulation, packaging, and construction applications where one adhesive surface is sufficient, and the other side requires masking or protection.

• By End User

On the basis of end user, the UHB tape market is segmented into automotive industry, construction industry, electronics and electrical industry, packaging industry, aerospace industry, healthcare and medical devices, retail and consumer goods, and industrial applications. The automotive industry segment dominated the market in 2024, driven by the growing need for lightweight vehicle structures, interior assembly efficiency, and aesthetic enhancements. UHB tapes are widely deployed in bonding trims, emblems, panels, and structural components, providing durability and high-performance adhesion while reducing mechanical fasteners.

The healthcare and medical devices segment is anticipated to witness the fastest growth from 2025 to 2032, owing to the increasing use of UHB tapes in medical equipment, devices, and disposables. The need for secure, reliable, and biocompatible bonding solutions in sensitive applications is driving adoption. Rising demand for innovative medical technologies and compact device designs is further accelerating this segment.

UHB Tape Market Regional Analysis

- Asia-Pacific dominated the UHB tape market with the largest revenue share of 42% in 2024, driven by growing automotive production, rapid construction activities, and strong adoption of electronics and retail display solutions

- The region’s cost-effective manufacturing landscape, rising investments in industrial adhesives, and expanding exports of high-performance tapes are accelerating market expansion

- The availability of skilled labor, supportive government policies, and increasing industrialization across developing economies are contributing to higher consumption of UHB tapes in automotive, construction, and electronics applications

China UHB Tape Market Insight

China held the largest share in the Asia-Pacific UHB tape market in 2024, owing to its position as a global leader in automotive and electronics manufacturing. The country’s strong industrial base, advanced production facilities, and government initiatives supporting high-performance adhesive production are major growth drivers. Demand is further bolstered by rising exports of automotive components, electronics, and construction materials, alongside the growing adoption of lightweight, fastener-free bonding solutions.

India UHB Tape Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing automotive production, expanding electronics manufacturing, and rising construction activities. Government programs promoting industrial growth and “Make in India” initiatives are strengthening demand for UHB tapes. In addition, investments in industrial adhesives, retail display infrastructure, and growing domestic consumption are accelerating market expansion.

Europe UHB Tape Market Insight

The Europe UHB tape market is expanding steadily, supported by high adoption of advanced bonding technologies, stringent quality standards, and growing investments in sustainable manufacturing. The region emphasizes precision, durability, and environmental compliance in automotive, construction, and electronics applications. Rising demand for lightweight assembly solutions and increased use in industrial and consumer applications are further driving growth.

Germany UHB Tape Market Insight

Germany’s UHB tape market is driven by its strong automotive and electronics manufacturing sectors, advanced industrial base, and focus on high-quality adhesive solutions. The country benefits from robust R&D networks and collaborations between manufacturers and research institutions, fostering continuous innovation in UHB tapes. Demand is particularly strong in automotive interior and structural bonding, electronics assembly, and retail display applications.

U.K. UHB Tape Market Insight

The U.K. market is supported by established automotive and electronics industries, growing use of industrial adhesives, and increasing focus on lightweight and efficient bonding solutions. Investments in research, sustainable production, and custom solutions for construction and consumer goods are strengthening adoption. The country continues to leverage its mature industrial infrastructure to maintain a strong position in high-value UHB tape applications.

North America UHB Tape Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising adoption of UHB tapes in automotive, electronics, aerospace, and construction applications. A strong focus on lightweight assembly, industrial automation, and high-performance bonding solutions is boosting demand. In addition, increasing reshoring of manufacturing, technological advancements, and rising investments in adhesive R&D are supporting market expansion.

U.S. UHB Tape Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its extensive automotive, electronics, and aerospace industries. The country’s focus on innovation, high-quality production standards, and demand for durable, versatile bonding solutions is driving UHB tape adoption. Presence of key industry players, advanced distribution networks, and investments in specialty adhesive technologies further solidify the U.S.'s leading position in the region.

UHB Tape Market Share

The UHB tape industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Avery Dennison Corporation (U.S.)

- Nitto Denko Corporation (Japan)

- Tesa SE (Germany)

- LINTEC Corporation (Japan)

- Henkel AG & Co. KGaA (Germany)

- IPG (U.S.)

- Sankei Chemical Co., Ltd. (Japan)

- Shurtape Technologies, LLC (U.S.)

- Saint-Gobain (France)

- SANKO GIKEN Co., Ltd. (Japan)

Latest Developments in Global UHB Tape Market

- In November 2024, Berry Global Group, Inc. announced the sale of its specialty tapes business to Nautic Partners LLC. This strategic divestment is expected to allow Berry Global to streamline its operations and concentrate on its core businesses, while enabling Nautic Partners to leverage the acquired portfolio to expand its presence in the high-performance and specialty tapes market. The transaction reflects a broader industry trend of portfolio optimization and increased focus on innovation-driven growth within adhesive solutions

- In August 2024, H.B. Fuller Company acquired HS Butyl Limited, the UK’s largest manufacturer and distributor of premium butyl tapes. This acquisition strengthens H.B. Fuller’s position in the global specialty construction tapes market and enhances its engineering adhesive solutions capabilities. The move is likely to increase the company’s market share in Europe and reinforce its ability to meet growing demand for durable, high-performance construction and industrial bonding applications

- In June 2024, a research team from Kyushu University, in collaboration with Nitto Denko (Japan), developed a novel tape designed to easily adhere 2D materials to various surfaces. The initial research focused on graphene, renowned for its exceptional strength, flexibility, light weight, and superior thermal and electrical conductivity. This innovation is expected to have a transformative impact on electronics, advanced manufacturing, and next-generation material applications, positioning the developers at the forefront of high-performance adhesive technology

- In January 2024, CCL Design launched the 5400 LSE series of acrylic foam tapes, developed over three years at its R&D center in Venray, Netherlands. The series offers primeless adhesion to plastics, ultra-strong bonds to polypropylene, and excellent compatibility with automotive paints. This product expansion enhances CCL Design’s footprint in automotive and industrial sectors, addressing the rising demand for efficient, reliable, and versatile bonding solutions in high-volume manufacturing environments

- In March 2024, 3M introduced its new line of high-temperature resistant UHB tapes designed for industrial and electronics applications. These tapes provide exceptional bonding strength under extreme heat and are compatible with a variety of substrates including metals, glass, and engineered plastics. The launch is expected to strengthen 3M’s leadership in specialty industrial adhesives and cater to growing demand from automotive, aerospace, and electronics manufacturers seeking reliable, durable bonding solutions in challenging operational conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Uhb Tape Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Uhb Tape Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Uhb Tape Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.