Global Uht Milk Products Market

Market Size in USD Billion

CAGR :

%

USD

39.46 Billion

USD

72.23 Billion

2024

2032

USD

39.46 Billion

USD

72.23 Billion

2024

2032

| 2025 –2032 | |

| USD 39.46 Billion | |

| USD 72.23 Billion | |

|

|

|

|

Ultra-high Temperature (UHT) Milk Products Market Size

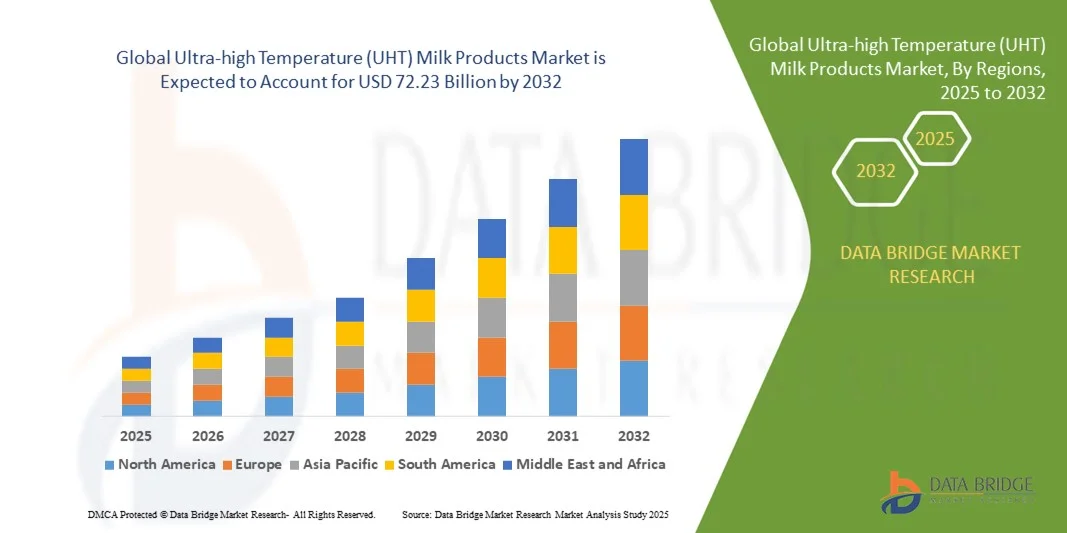

- The global ultra-high temperature (UHT) milk products market size was valued at USD 39.46 billion in 2024 and is expected to reach USD 72.23 billion by 2032, at a CAGR of 7.85% during the forecast period

- The market growth is largely fueled by increasing consumer demand for convenient, long-shelf-life dairy products that reduce wastage and allow easier storage and transportation in both urban and semi-urban households

- Furthermore, rising health awareness and preference for fortified and hygienic milk products are encouraging the adoption of UHT milk across residential, retail, and institutional segments. These factors are driving consistent demand, thereby significantly boosting the industry’s growth

Ultra-high Temperature (UHT) Milk Products Market Analysis

- UHT milk products, offering extended shelf life without refrigeration and maintaining nutritional quality, are becoming essential in modern households, retail chains, and foodservice operations due to their convenience, safety, and ease of use

- The escalating demand for UHT milk is primarily fueled by urbanization, busy lifestyles, increasing middle-class incomes, and the preference for ready-to-use, hygienic, and fortified dairy products that support year-round consumption and minimize spoilage

- North America dominated the ultra-high temperature (UHT) milk products market with a share of 38.06% in 2024, due to high consumer awareness of nutrition and convenience, along with strong retail infrastructure

- Asia-Pacific is expected to be the fastest growing region in the ultra-high temperature (UHT) milk products market during the forecast period due to rising urban populations, increasing disposable incomes, and growing awareness of nutritional and convenience benefits

- Full cream UHT milk segment dominated the market with a market share of 45.8% in 2024, due to its rich nutritional profile, higher consumer preference for taste, and strong brand loyalty. Consumers often prioritize full cream UHT milk for its creaminess and perceived health benefits, including higher energy and fat content suitable for all age groups. The segment also benefits from widespread household consumption and its versatility in culinary applications, making it a staple in many diets. In addition, marketing campaigns emphasizing natural and high-quality milk contribute to its sustained demand

Report Scope and Ultra-high Temperature (UHT) Milk Products Market Segmentation

|

Attributes |

Ultra-high Temperature (UHT) Milk Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultra-high Temperature (UHT) Milk Products Market Trends

Growing Demand for Long-Shelf-Life Dairy Products

- The global ultra-high temperature (UHT) milk products market is witnessing increasing consumer preference for long-shelf-life dairy products suitable for modern retail formats and extended storage. UHT processing enables milk to retain nutritional value while ensuring sterility and convenience, making it a preferred choice for consumers with busy lifestyles and limited access to fresh milk supply chains

- For instance, Nestlé S.A. has expanded its UHT milk portfolio under brands such as Nido and Carnation in response to growing global demand for long-lasting dairy options. The company’s investments in advanced sterilization technology and aseptic packaging are enhancing UHT milk availability across developing and urbanizing regions where cold-chain infrastructure remains limited

- The demand for UHT milk products is strongly driven by population growth, shifting consumption patterns, and an increasing focus on food safety and storage efficiency. UHT milk provides a practical solution in regions with fluctuating electricity or inadequate refrigeration, supporting consistent nutrition supply without the need for continuous cold storage

- In addition, the rise in packaged beverage consumption has encouraged dairy producers to diversify product categories such as flavored UHT milk, lactose-free UHT milk, and protein-enriched variants. These products combine extended shelf stability with nutritional innovation, widening consumer appeal across all age groups and dietary preferences

- Retail modernization, particularly in emerging economies, is enabling better product distribution and visibility through supermarkets, hypermarkets, and online platforms. The portability and long shelf stability of UHT milk make it ideal for e-commerce channels where transportation time and temperature variations are less predictable

- The growing emphasis on safe, durable, and nutritious food products continues to bolster the transition toward UHT milk consumption globally. As dairy processors adopt advanced sterilization and aseptic packaging technologies, the market is expected to expand steadily, catering to rising demand for long-lasting and convenient dairy alternatives for both domestic and institutional use

Ultra-high Temperature (UHT) Milk Products Market Dynamics

Driver

Rising Health Awareness and Fortified Milk Preference

- The increasing focus on health and nutrition among consumers is significantly driving the demand for fortified UHT milk products. Consumers are actively seeking dairy options enriched with essential vitamins, minerals, and functional ingredients that contribute to daily dietary balance, especially in regions where nutrient deficiencies are prevalent

- For instance, Danone S.A. has introduced UHT milk enriched with calcium and vitamin D under its global dairy brand portfolio to support bone and immune health. The company’s focus on fortified formulations demonstrates the growing synergy between nutrition enhancement and shelf-stable convenience in the UHT dairy category

- UHT milk serves as an effective medium for fortification due to its sterilized nature and stable structure, allowing the addition of micro-nutrients without compromising product quality. This attribute makes it a reliable nutritional source for children, elderly populations, and consumers seeking balanced diets with extended shelf life benefits

- In addition, the growing trend toward fitness-oriented lifestyles and higher protein intake preferences is fueling the launch of protein-enriched and reduced-fat UHT milk. Such innovations appeal to health-conscious consumers searching for convenient and nutrient-dense on-the-go dairy options aligned with wellness goals

- The continuous integration of health-driven attributes in shelf-stable milk formats is reinforcing consumer trust in packaged dairy products. As manufacturers intensify their focus on fortification, functional innovation, and marketing transparency, the UHT milk products market is poised to maintain long-term growth supported by rising health awareness and nutritional demand

Restraint/Challenge

High Production and Packaging Costs

- The requirement for specialized equipment, sterilization systems, and aseptic packaging materials contributes to the high production cost of UHT milk products. Unlike conventional pasteurization, UHT processing demands precise temperature control and contamination-free handling environments, making setup and operation capital-intensive for dairy producers

- For instance, FrieslandCampina N.V. has reported higher overall production expenses for its UHT product line due to continuous technological upgrades and adherence to international food safety standards. This highlights the financial strain associated with ensuring aseptic quality and maintaining high-end processing capabilities in competitive markets

- The cost of advanced multilayer aseptic packaging materials such as Tetra Pak cartons further escalates production expenses, especially when raw material prices for plastics and aluminum fluctuate. These packaging solutions are essential to maintaining product sterility and shelf stability, limiting options for cost reduction without compromising quality

- In addition, high energy consumption in UHT processing adds to the operational burden, particularly in regions with volatile electricity prices. Small and medium-sized dairy operators often face challenges in scaling production profitably due to the combined effects of capital costs, packaging expenses, and limited technological access

- As competition intensifies across regions, optimizing cost structures and adopting energy-efficient production technologies will become essential for maintaining profitability. Strategic investments in localized packaging solutions, renewable energy sources, and process automation are expected to help mitigate cost challenges while sustaining product integrity and long-term market competitiveness

Ultra-high Temperature (UHT) Milk Products Market Scope

The market is segmented on the basis of product and distribution channel.

- By Product

On the basis of product, the UHT milk market is segmented into full cream UHT milk, skimmed UHT milk, and semi-skimmed UHT milk. The full cream UHT milk segment dominated the market with the largest revenue share of 45.8% in 2024, driven by its rich nutritional profile, higher consumer preference for taste, and strong brand loyalty. Consumers often prioritize full cream UHT milk for its creaminess and perceived health benefits, including higher energy and fat content suitable for all age groups. The segment also benefits from widespread household consumption and its versatility in culinary applications, making it a staple in many diets. In addition, marketing campaigns emphasizing natural and high-quality milk contribute to its sustained demand.

The skimmed UHT milk segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing health awareness and rising consumer focus on low-fat diets. Skimmed variants are particularly preferred by health-conscious adults and fitness enthusiasts seeking lower-calorie alternatives without compromising on protein content. Growing prevalence of lifestyle-related health conditions, such as obesity and cardiovascular diseases, is driving demand for skimmed milk. Its compatibility with various dietary plans and availability in convenient packaging formats further accelerate adoption across urban populations.

- By Distribution Channel

On the basis of distribution channel, the UHT milk market is segmented into convenience stores, specialty stores, online retail, and others. The convenience store segment dominated the market in 2024, driven by easy accessibility, widespread presence in urban and semi-urban areas, and quick purchase convenience for daily consumption. Convenience stores often stock popular UHT milk brands and multiple variants, encouraging impulse buying and repeat purchases. The segment also benefits from growing urban lifestyles where time-efficient shopping solutions are highly valued, supporting consistent demand.

The online retail segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising e-commerce adoption, improved cold chain logistics, and increasing preference for home delivery of perishable goods. Online platforms offer subscription services, bulk purchase options, and doorstep delivery, enhancing consumer convenience. The growing penetration of smartphones, digital payment methods, and personalized promotional campaigns further drive the adoption of online channels for UHT milk purchases.

Ultra-high Temperature (UHT) Milk Products Market Regional Analysis

- North America dominated the ultra-high temperature (UHT) milk products market with the largest revenue share of 38.06% in 2024, driven by high consumer awareness of nutrition and convenience, along with strong retail infrastructure

- Consumers in the region highly value long shelf-life products that reduce wastage, while maintaining taste and quality comparable to fresh milk

- The widespread adoption is supported by high disposable incomes, health-conscious diets, and the growing preference for ready-to-use milk products in urban households, establishing UHT milk as a preferred choice for both families and commercial use

U.S. Ultra-high Temperature (UHT) Milk Products Market Insight

The U.S. Ultra-high Temperature (UHT) Milk Products Market captured the largest revenue share in North America in 2024, fueled by increasing demand for packaged, long-life milk products and convenience-driven consumption patterns. Consumers are prioritizing products that require minimal refrigeration and offer extended shelf life. The market growth is further supported by rising awareness of fortified and high-quality milk products, expanding supermarket chains, and e-commerce penetration offering home delivery of UHT milk, making it increasingly accessible to households nationwide.

Europe Ultra-high Temperature (UHT) Milk Products Market Insight

The Europe Ultra-high Temperature (UHT) Milk Products Market is projected to grow at a substantial CAGR during the forecast period, primarily driven by demand for hygienic, long-shelf-life milk products and urban lifestyle changes. Stringent food safety regulations and strong dairy processing infrastructure are fostering the adoption of UHT milk. Consumers in the region prefer convenient, ready-to-consume milk products, which are increasingly incorporated into daily dietary habits and institutional food services.

U.K. Ultra-high Temperature (UHT) Milk Products Market Insight

The U.K. Ultra-high Temperature (UHT) Milk Products Market is anticipated to expand at a noteworthy CAGR, driven by growing consumer demand for convenience, health-conscious consumption, and extended shelf-life products. The increasing preference for single-use and packaged milk, supported by retail modernization and home delivery options, is stimulating market growth. Rising awareness of nutritional benefits of fortified milk variants is also contributing to the market’s expansion.

Germany Ultra-high Temperature (UHT) Milk Products Market Insight

The Germany Ultra-high Temperature (UHT) Milk Products Market is expected to witness considerable growth, fueled by high consumer focus on food safety, quality, and sustainability. The country’s well-developed dairy processing industry, coupled with an emphasis on eco-friendly packaging and innovation in milk fortification, promotes UHT milk adoption. Consumers increasingly prefer UHT milk for its convenience, reliability, and long shelf-life, aligning with Germany’s busy urban lifestyles.

Asia-Pacific Ultra-high Temperature (UHT) Milk Products Market Insight

The Asia-Pacific Ultra-high Temperature (UHT) Milk Products Market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising urban populations, increasing disposable incomes, and growing awareness of nutritional and convenience benefits. Countries such as China, Japan, and India are witnessing a surge in demand for packaged milk products due to changing lifestyles and expanding retail channels. In addition, APAC’s strong dairy production base and government initiatives promoting fortified milk consumption are supporting widespread market adoption.

Japan Ultra-high Temperature (UHT) Milk Products Market Insight

The Japan Ultra-high Temperature (UHT) Milk Products Market is gaining momentum due to the country’s aging population, high health awareness, and demand for convenient milk consumption options. Consumers prefer long-life milk products that maintain nutritional value and taste, particularly for households with limited refrigeration capacity. Integration of UHT milk into school, office, and commercial meal programs is also driving demand.

China Ultra-high Temperature (UHT) Milk Products Market Insight

The China Ultra-high Temperature (UHT) Milk Products Market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing middle-class population, and rising preference for safe, high-quality packaged milk. The growing retail and e-commerce networks, coupled with government campaigns promoting fortified and hygienic milk consumption, are fueling adoption. Domestic manufacturers are expanding production and distribution capabilities, making UHT milk widely accessible across urban and semi-urban regions.

Ultra-high Temperature (UHT) Milk Products Market Share

The ultra-high temperature (UHT) milk products industry is primarily led by well-established companies, including:

- KOA GLASS CO., LTD (Japan)

- Bemis Manufacturing Company (U.S.)

- Amcor plc (Australia)

- Ardagh Group S.A. (Luxembourg)

- Dairy Farmers of America, Inc. (U.S.)

- Bemis Company, Inc. (U.S.)

- Bormioli Rocco S.p.A. (Italy)

- Sonoco Products Company (U.S.)

- Mondi (Austria)

- The a2 Milk Company Limited (New Zealand)

- Mother Dairy Fruit & Vegetable Pvt. Ltd. (India)

- NESTLÉ (Switzerland)

- Groupe Lactalis (France)

- Fonterra Co-operative Group (New Zealand)

- Arla Foods amba (Denmark)

- Danone (France)

- Sodiaal (France)

- Saputo Inc. (Canada)

- FrieslandCampina (Netherlands)

- YILI, INC (China)

Latest Developments in Global Ultra-high Temperature (UHT) Milk Products Market

- In October 2025, India inaugurated a state-of-the-art UHT aseptic packaging plant at the Bhilwara milk producers' cooperative in Rajasthan. This facility, the first of its kind in the region, can handle 200ml packs and extend the shelf life of milk and dairy products such as Chhaachh, Lassi, and Cream up to six months. The plant strengthens local dairy infrastructure, increases production efficiency, and expands access to UHT milk in urban and semi-urban areas, meeting growing demand for convenient, long-shelf-life dairy products

- In April 2025, Malo Dairy, a subsidiary of SILL Enterprises, introduced its first UHT milk in eco-friendly Pure-Pak cartons. This launch highlights the company’s commitment to sustainability and innovative packaging, appealing to environmentally-conscious consumers. The aseptic filling line allows for various carton sizes and configurations, improving production flexibility. The new packaging enhances product shelf life, strengthens market competitiveness, and reinforces consumer trust in long-life milk products

- In January 2025, PT Ultrajaya Milk Industry & Trading (Ultra Milk) in Indonesia launched its first-ever organic UHT milk made entirely from certified organic cow’s milk. This product addresses the growing consumer preference for organic and health-focused options, elevating the company’s presence in the premium UHT segment. By diversifying into organic milk, Ultrajaya meets rising demand for hygienic, nutritious, and ready-to-use milk, strengthening its market share

- In July 2024, Suntado LLC opened a co-manufacturing facility in Burley, Idaho, specializing in UHT and extended shelf-life dairy products. The facility, capable of processing three million pounds of dairy daily, was established through a partnership with Tetra Pak. This expansion enhances production capacity, ensures a consistent supply of long-life milk, and positions Suntado to meet the increasing U.S. demand for convenient and shelf-stable dairy solutions in both retail and institutional sectors

- In January 2023, Nestlé expanded its UHT milk production facility in India to meet rising domestic demand. The expansion allows the company to produce higher volumes of long-life milk, ensuring wider availability across urban and rural markets. This strategic move strengthens Nestlé’s supply chain, supports growing preference for packaged dairy products, and reinforces its leadership in the Indian UHT milk segment, particularly in fortified and ready-to-use milk options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TTELEVISION ADVERTISEMENT

5.4.4.2. OONLINE ADVERTISEMENT

5.4.4.3. IIN-STORE ADVERTISEMENT

5.4.4.4. OOUTDOOR ADVERTISEMENT

5.5 PRIVATE LABEL VS BRAND ANALYSIS

5.6 PROMOTIONAL ACTIVITIES

5.7 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.8 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

5.9 NEW PRODUCT LAUNCH STRATEGY

5.9.1 NUMBER OF NEW PRODUCT LAUNCH

5.9.1.1. LLINE EXTENSTION

5.9.1.2. NNEW PACKAGING

5.9.1.3. RRE-LAUNCHED

5.9.1.4. NNEW FORMULATION

5.1 CONSUMER LEVEL TRENDS

5.11 MEETING CONSUMER REQUIREMENT

5.12 BRAND COMAPARATIVE ANALYSIS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 BRAND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

10.1 OVERVIEW

10.2 UHT MILK

10.2.1 UHT MILK, BY TYPE

10.2.1.1. FLAVORED

10.2.1.1.1. FLAVORED, BY TYPE

10.2.1.1.1.1 VANILLA

10.2.1.1.1.2 COCOA

10.2.1.1.1.3 CHOCOLATE

10.2.1.1.1.4 STRAWBERRY

10.2.1.1.1.5 COFFEE

10.2.1.1.1.6 OTHERS

10.2.1.2. UNFLAVORED / PLAIN

10.2.2 UHT MILK, BY FAT CONTENT

10.2.2.1. SKIMMED / NO FAT UHT MILK

10.2.2.2. SEMI-SKIMMED / LOW FAT UHT MILK

10.2.2.3. FULL CREAM / FAT UHT MILK

10.2.3 UHT MILK, BY NATURE

10.2.3.1. ORGANIC

10.2.3.2. CONVENTIONAL

10.2.4 UHT MILK, BY PACKAGING TYPE

10.2.4.1. TETRA PAKS

10.2.4.2. PLASTIC BOTTLES

10.2.4.3. CARDBOARD CONTAINER

10.2.4.4. OTHERS (IF ANY)

10.3 UHT CREAM

10.3.1 UHT CREAM, BY FAT CONTENT

10.3.1.1. LESS THAN 10%

10.3.1.2. 0.1

10.3.1.3. 0.12

10.3.1.4. 0.3

10.3.1.5. 0.36

10.3.1.6. MORE THAN 36%

10.3.2 UHT CREAM, BY NATURE

10.3.2.1. ORGANIC

10.3.2.2. CONVENTIONAL

10.3.3 UHT CREAM, BY PACKAGING TYPE

10.3.3.1. TETRA PAKS

10.3.3.2. PLASTIC BOTTLES

10.3.3.3. CARDBOARD CONTAINER

10.3.3.4. OTHERS (IF ANY)

10.4 UHT YOGURT

10.4.1 UHT YOGURT, BY TYPE

10.4.1.1. FLAVORED

10.4.1.1.1. FLAVORED, BY TYPE

10.4.1.1.1.1 STRAWBERRY

10.4.1.1.1.2 ORANGE

10.4.1.1.1.3 BLUEBERRY

10.4.1.1.1.4 MIXED FRUIT

10.4.1.2. UNFLAVORED / PLAIN

10.4.2 UHT YOGURT, BY NATURE

10.4.2.1. ORGANIC

10.4.2.2. CONVENTIONAL

10.4.3 UHT YOGURT, BY PACKAGING TYPE

10.4.3.1. TETRA PAKS

10.4.3.2. PLASTIC BOTTLES

10.4.3.3. CARDBOARD CONTAINER

10.4.3.4. OTHERS (IF ANY)

10.5 OTHER UHT DAIRY PRODUCTS

11 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, BY NATURE, 2021-2030 (USD MILLION)

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

12.1 OVERVIEW

12.2 TETRA PAKS

12.3 PLASTIC BOTTLES

12.4 CARDBOARD CONTAINER

12.5 OTHERS (IF ANY)

13 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

13.1 OVERVIEW

13.2 LESS THAN 250 ML

13.3 251-500 ML

13.4 501-750 ML

13.5 751-1000 ML

13.6 MORE THAN 1000 ML

14 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

14.1 OVERVIEW

14.2 STORE-BASED

14.2.1 GROCERY STORES

14.2.2 SPECIALTY STORES

14.2.3 SUPERMARKETS / HYPERMARKETS

14.2.4 CONVENIENCE STORES

14.2.5 OTHERS

14.3 NON-STORE BASED

14.3.1 COMPANY OWNED WEBSITES

14.3.2 E-COMMERCE WEBSITES

15 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS & PARTNERSHIP

15.8 REGULATORY CHANGES

16 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, BY GEOGRAPHY, 2021-2030 (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 SWITZERLAND

16.2.7 NETHERLANDS

16.2.8 BELGIUM

16.2.9 RUSSIA

16.2.10 DENMARK

16.2.11 SWEDEN

16.2.12 POLAND

16.2.13 TURKEY

16.2.14 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 AUSTRALIA

16.3.6 SINGAPORE

16.3.7 THAILAND

16.3.8 INDONESIA

16.3.9 MALAYSIA

16.3.10 PHILIPPINES

16.3.11 NEW ZEALAND

16.3.12 VIETNAM

16.3.13 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 UAE

16.5.3 SAUDI ARABIA

16.5.4 OMAN

16.5.5 QATAR

16.5.6 KUWAIT

16.5.7 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL ULTRA-HIGH TEMPERATURE (UHT) MILK PRODUCTS MARKET, COMPANY PROFILE

18.1 ARLA FOODS AMBA

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 GEOGRAPHICAL PRESENCE

18.1.5 RECENT DEVELOPMENTS

18.2 NESTLE

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 GEOGRAPHICAL PRESENCE

18.2.5 RECENT DEVELOPMENTS

18.3 FONTERRA CO-OPERATIVE GROUP

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 GEOGRAPHICAL PRESENCE

18.3.5 RECENT DEVELOPMENTS

18.4 ROYAL FRIESLANDCAMPINA

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 GEOGRAPHICAL PRESENCE

18.4.5 RECENT DEVELOPMENTS

18.5 DANA DAIRY

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 GEOGRAPHICAL PRESENCE

18.5.5 RECENT DEVELOPMENTS

18.6 DAIRY GROUP

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 GEOGRAPHICAL PRESENCE

18.6.5 RECENT DEVELOPMENTS

18.7 SAPUTO DAIRY AUSTRALIA PTY LTD.

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 GEOGRAPHICAL PRESENCE

18.7.5 RECENT DEVELOPMENTS

18.8 IMEKO

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 GEOGRAPHICAL PRESENCE

18.8.5 RECENT DEVELOPMENTS

18.9 KASKAT

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 GEOGRAPHICAL PRESENCE

18.9.5 RECENT DEVELOPMENTS

18.1 SIA

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 GEOGRAPHICAL PRESENCE

18.10.5 RECENT DEVELOPMENTS

18.11 CREDITON DAIRY

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 GEOGRAPHICAL PRESENCE

18.11.5 RECENT DEVELOPMENTS

18.12 YÖRÜKOĞLU SÜT A.Ş

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 GEOGRAPHICAL PRESENCE

18.12.5 RECENT DEVELOPMENTS

18.13 UNTERNEHMENSGRUPPE THEO MÜLLER

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 GEOGRAPHICAL PRESENCE

18.13.5 RECENT DEVELOPMENTS

18.14 LAEMTHONG CORPORATION GROUP

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 GEOGRAPHICAL PRESENCE

18.14.5 RECENT DEVELOPMENTS

18.15 LACTAVISA

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 GEOGRAPHICAL PRESENCE

18.15.5 RECENT DEVELOPMENTS

18.16 ŁOWICZ

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 GEOGRAPHICAL PRESENCE

18.16.5 RECENT DEVELOPMENTS

18.17 NOUMI LIMITED

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 GEOGRAPHICAL PRESENCE

18.17.5 RECENT DEVELOPMENTS

18.18 NODE NEGOCE

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 GEOGRAPHICAL PRESENCE

18.18.5 RECENT DEVELOPMENTS

18.19 MTRES FOODS

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 GEOGRAPHICAL PRESENCE

18.19.5 RECENT DEVELOPMENTS

18.2 NAMIBIA DAIRIES

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 GEOGRAPHICAL PRESENCE

18.20.5 RECENT DEVELOPMENTS

18.21 FARM FRESH

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 GEOGRAPHICAL PRESENCE

18.21.5 RECENT DEVELOPMENTS

18.22 DUTCH MILL CO., LTD./ DAIRY PLUS CO., LTD

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 GEOGRAPHICAL PRESENCE

18.22.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Uht Milk Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Uht Milk Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Uht Milk Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.