Global Uht Processing For Dairy Products Market

Market Size in USD Billion

CAGR :

%

USD

84.60 Billion

USD

197.79 Billion

2024

2032

USD

84.60 Billion

USD

197.79 Billion

2024

2032

| 2025 –2032 | |

| USD 84.60 Billion | |

| USD 197.79 Billion | |

|

|

|

|

Ultra High Temperature (UHT) Processing for Dairy Products Market Size

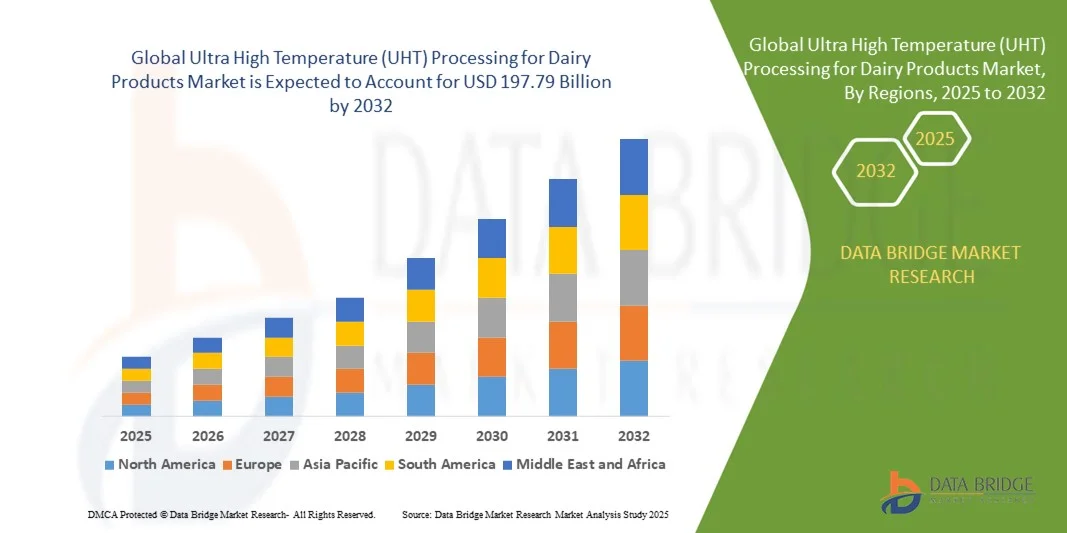

- The global ultra high temperature (UHT) processing for dairy products market size was valued at USD 84.6 billion in 2024 and is expected to reach USD 197.79 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by increasing demand for long-shelf-life dairy products and advancements in UHT processing technologies, enabling manufacturers to deliver safe, high-quality milk and dairy desserts with extended storage capabilities

- Furthermore, rising consumer preference for convenient, ready-to-use dairy products and the expansion of modern retail and foodservice channels are driving the adoption of UHT-processed dairy, significantly boosting market growth

Ultra High Temperature (UHT) Processing for Dairy Products Market Analysis

- UHT processing, which involves rapid heating and aseptic packaging of dairy products, is becoming increasingly essential for ensuring product safety, extended shelf life, and consistent quality in both liquid and semi-liquid dairy segments

- The escalating demand for UHT-processed dairy products is primarily driven by urbanization, increasing disposable incomes, rising consumption of packaged milk, and growing awareness about food safety and convenience among consumers

- Europe dominated the ultra high temperature (UHT) processing for dairy products market with a share of 44.4% in 2024, due to high consumption of packaged milk, growing demand for long-shelf-life dairy products, and well-established dairy processing infrastructure

- Asia-Pacific is expected to be the fastest growing region in the ultra high temperature (UHT) processing for dairy products market during the forecast period due to urbanization, rising disposable incomes, and expanding retail and foodservice channels in countries such as China, India, and Japan

- Liquid segment dominated the market with a market share of 62.8% in 2024, due to high consumption of liquid milk across households and foodservice sectors. Liquid UHT dairy products offer convenience, long shelf life, and compatibility with ready-to-drink packaging, making them a preferred choice for consumers globally. Manufacturers favor liquid formulations as they are easier to process, standardize, and distribute efficiently across cold chain and ambient supply networks

Report Scope and Ultra High Temperature (UHT) Processing for Dairy Products Market Segmentation

|

Attributes |

Ultra High Temperature (UHT) Processing for Dairy Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultra High Temperature (UHT) Processing for Dairy Products Market Trends

Rising Demand for Long-Shelf-Life Dairy Products

- The global dairy industry is experiencing a notable shift towards UHT processing due to the increasing demand for products with extended shelf life, allowing distribution to distant markets without refrigeration

- For instance, companies such as Lactalis have leveraged UHT technology to supply milk and cream products across regions with limited cold chain infrastructure, enabling consistent product quality even months after production

- UHT processing offers benefits such as minimizing microbial load while preserving nutritional content, making it a preferred choice for manufacturers aiming to meet stringent food safety standards and ensure product stability during long storage periods

- The growth in e-commerce channels for food delivery has amplified the appeal of UHT-processed dairy, as longer shelf life facilitates simpler logistics and reduced costs associated with temperature-controlled transport

- Manufacturers are increasingly innovating with flavored and functional UHT milk variants such as high-protein and lactose-free options, meeting diverse consumer preferences while capitalizing on extended usability

- Overall, the rising consumer prioritization of convenience, safety, and global product accessibility is steering dairy producers towards investing in advanced UHT capabilities to sustain competitiveness in both local and export markets

Ultra High Temperature (UHT) Processing for Dairy Products Market Dynamics

Driver

Advances in UHT Processing and Aseptic Packaging

- Innovations in UHT processing technologies are enhancing product quality, reducing thermal degradation, and improving sensory attributes, resulting in greater acceptance among consumers and foodservice providers

- For instance, Tetra Pak has introduced advanced aseptic filling systems that maintain sterility while supporting high-speed production, enabling large-scale processing of UHT dairy beverages without compromising flavor or texture

- Modern UHT units incorporate precise temperature control and reduced processing times, ensuring optimal preservation of nutrients such as calcium and protein, while meeting regulatory requirements for safety and shelf stability

- Integration of UHT processing with durable aseptic packaging solutions such as multi-layer cartons further extends shelf life, safeguards products during transit, and reduces reliance on refrigeration across the supply chain

- The convergence of technological developments, consumer trust in shelf-stable formats, and efficiencies in packaging is reinforcing UHT’s role as a driver of growth in the global dairy products sector

Restraint/Challenge

High Setup and Operational Costs

- Establishing UHT processing lines requires significant capital investment in specialized equipment, sterile packaging machinery, and quality assurance systems, which can be challenging for smaller or regional dairy producers

- For instance, medium-scale processors in emerging economies often face financial constraints when attempting to adopt UHT technology, limiting their competitiveness against established multinational corporations such as Nestlé that possess greater resources

- Operational costs remain high due to the need for skilled personnel, rigorous maintenance schedules, and continuous monitoring of sterilization parameters to prevent microbial contamination and ensure compliance with food safety regulations

- Energy consumption in UHT processing and the upkeep of aseptic packaging operations contribute to increased production costs, impacting pricing strategies and potentially reducing accessibility for price-sensitive segments

- Addressing these challenges will depend on industry-wide adoption of cost-efficient equipment designs, collaborative financing models, and technical training programs that promote broader usage and sustainability of UHT technology in the dairy sector

Ultra High Temperature (UHT) Processing for Dairy Products Market Scope

The market is segmented on the basis of equipment type, mode of equipment operations, end product form, application, and distribution channel.

- By Equipment Type

On the basis of equipment type, the UHT processing market is segmented into heaters, homogenizers, flash cooling, aseptic packaging, and others. The heaters segment dominated the market in 2024, accounting for the largest revenue share, driven by their essential role in ensuring precise temperature control during UHT processing. Heaters are critical for achieving product safety, extended shelf life, and consistent quality, making them indispensable across dairy processing plants. Their compatibility with diverse dairy products and integration with automation systems further strengthen demand. The segment benefits from ongoing technological improvements enhancing energy efficiency and reducing thermal degradation, which are highly valued by manufacturers prioritizing quality and cost-effectiveness.

The aseptic packaging segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for ready-to-consume and long-shelf-life dairy products. Innovations in aseptic packaging materials and designs allow for improved product protection, reduced contamination risk, and better convenience for consumers. Increasing consumer preference for portable, single-serve dairy products and expanding modern retail channels are also fueling this growth.

- By Mode of Equipment Operations

On the basis of mode of equipment operations, the market is segmented into direct ultra high temperature processing and indirect ultra high temperature processing. The direct UHT processing segment dominated the market in 2024, supported by its efficiency in rapidly heating dairy products to very high temperatures, ensuring microbial safety while preserving nutritional quality. This method is favored for large-scale production due to reduced processing time and energy consumption, helping manufacturers optimize operational costs. Its ability to maintain product consistency and suitability for a wide range of dairy products underpins its strong adoption in commercial dairy plants.

The indirect UHT processing segment is projected to register the fastest growth from 2025 to 2032, owing to its gentle heat transfer methods that minimize protein denaturation and enhance product taste. This method is increasingly preferred in premium dairy segments and for sensitive products such as flavored milk and dairy desserts. Growing investments in advanced heat exchangers and process automation are further driving the adoption of indirect UHT systems.

- By End Product Form

On the basis of end product form, the market is segmented into liquid and semi-liquid products. The liquid segment dominated the market in 2024, capturing the largest revenue share of 62.8% due to high consumption of liquid milk across households and foodservice sectors. Liquid UHT dairy products offer convenience, long shelf life, and compatibility with ready-to-drink packaging, making them a preferred choice for consumers globally. Manufacturers favor liquid formulations as they are easier to process, standardize, and distribute efficiently across cold chain and ambient supply networks.

The semi-liquid segment is expected to witness the fastest growth from 2025 to 2032, propelled by rising demand for dairy-based smoothies, flavored milkshakes, and specialty beverages. Consumers are increasingly seeking nutrient-rich, on-the-go options, which has encouraged manufacturers to expand semi-liquid product lines. Product innovation and tailored flavor offerings further support the growth of this segment.

- By Application

On the basis of application, the market is segmented into milk, dairy desserts, and others. The milk segment dominated the market in 2024, accounting for the largest revenue share due to its staple consumption and widespread household use. UHT milk provides convenience with extended shelf life, minimal refrigeration requirements, and consistent quality, making it highly preferred by both retailers and consumers. Strong demand from institutional buyers, cafes, and schools also drives adoption, supported by technological advancements that improve nutrient retention and taste.

The dairy desserts segment is projected to witness the fastest growth from 2025 to 2032, fueled by rising consumer preference for indulgent and ready-to-eat products such as flavored puddings, custards, and yogurts. The expansion of modern retail and online channels facilitates easy availability, while product innovation in flavors and packaging enhances consumer appeal.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into warehouse club, convenience stores, specialist retailers, supermarket and hypermarket, variety stores, online retail, and others. The supermarket and hypermarket segment dominated the market in 2024, driven by their extensive reach, organized retail infrastructure, and ability to stock a wide variety of UHT dairy products. Consumers favor these outlets for their accessibility, product variety, and promotional offers, while manufacturers benefit from efficient supply chain and inventory management solutions.

The online retail segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing e-commerce penetration, growing demand for doorstep delivery, and consumer preference for contactless shopping. Expansion of online grocery platforms, subscription-based dairy services, and improved cold chain logistics are major drivers of this trend.

Ultra High Temperature (UHT) Processing for Dairy Products Market Regional Analysis

- Europe dominated the ultra high temperature (UHT) processing for dairy products market with the largest revenue share of 44.4% in 2024, driven by high consumption of packaged milk, growing demand for long-shelf-life dairy products, and well-established dairy processing infrastructure

- European manufacturers are investing in advanced UHT equipment and aseptic packaging to ensure product safety, extended shelf life, and consistent quality

- The region’s mature dairy industry, coupled with strong retail networks and consumer awareness, supports widespread adoption of UHT-processed dairy products

France Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The France market captured the largest share in Europe in 2024, fueled by high demand for long-life milk and dairy desserts. Consumers increasingly prefer UHT milk and dairy products for convenience, quality, and minimal refrigeration requirements. French manufacturers are focusing on efficient UHT processing technologies, flash cooling systems, and aseptic packaging to maintain nutritional quality and extend product shelf life, driving market growth.

Germany Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The Germany market is projected to grow at a notable CAGR during the forecast period, supported by rising consumption of packaged and processed dairy products in both retail and foodservice sectors. The emphasis on quality, product safety, and premium UHT dairy offerings is pushing manufacturers to integrate advanced processing and packaging solutions. Germany’s strong dairy supply chain ensures consistent availability of long-shelf-life products to meet consumer expectations.

U.K. Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The U.K. market is expected to expand steadily due to increasing consumption of UHT milk and dairy desserts in households and cafes. Consumers prefer convenient, ready-to-use dairy products with extended shelf life. Growth is further supported by retail innovations, product launches in aseptic packaging, and adoption of premium UHT products catering to convenience-driven lifestyles.

North America Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The North America market is witnessing moderate growth, driven by adoption of UHT-processed dairy products in retail and foodservice sectors. U.S. and Canada manufacturers are emphasizing energy-efficient processing technologies and aseptic packaging to maintain product stability and extend shelf life. The market benefits from rising demand for convenient dairy products, technological advancements in UHT processing, and increasing awareness about food safety.

Asia-Pacific Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, driven by urbanization, rising disposable incomes, and expanding retail and foodservice channels in countries such as China, India, and Japan. Consumers are increasingly adopting long-shelf-life UHT milk and dairy products, fueling demand for efficient processing and packaging solutions. Manufacturers are focusing on both direct and indirect UHT processing, flash cooling, and aseptic packaging to maintain product quality and meet diverse regional preferences.

China Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing middle class, and increased demand for packaged dairy products. Domestic manufacturers are investing in modern UHT equipment and aseptic packaging technologies to ensure product safety, quality, and longer shelf life, supporting market expansion across milk and dairy desserts.

Japan Ultra High Temperature (UHT) Processing for Dairy Products Market Insight

The Japan market is gaining momentum due to high consumer preference for premium UHT dairy products with extended shelf life and preserved nutritional quality. Focus on technological innovation, convenience, and quality is driving adoption of both direct and indirect UHT processing systems. Japanese manufacturers are integrating advanced aseptic packaging and flash cooling solutions to maintain product taste and support domestic and export opportunities.

Ultra High Temperature (UHT) Processing for Dairy Products Market Share

The ultra high temperature (UHT) processing for dairy products industry is primarily led by well-established companies, including:

- Tetra Pak International S.A. (Switzerland)

- GEA Group Aktiengesellschaft (Germany)

- ALFA LAVAL (Sweden)

- SPX FLOW (U.S.)

- MICROTHERMICS INC. (U.S.)

- REDA S.P.A. (Italy)

- Stephan Machinery (Germany)

- Goma (Germany)

- Almarai (Saudi Arabia)

- CLOVER Corporation (South Africa)

- Amrit Food (India)

- DuPont (U.S.)

- Lactavisa (France)

- Britannia Industries (India)

- HALEEB FOODS LIMITED (Pakistan)

- JBT (U.S.)

- Prabhat Dairy Ltd. (India)

- Purisons Group (India)

- Mondial Foods (Kenya)

- MODERN DAIRY BURUNDI (Burundi)

- Keventers (India)

Latest Developments in Global Ultra High Temperature (UHT) Processing for Dairy Products Market

- In October 2025, Prime Minister Narendra Modi inaugurated Rajasthan's first Ultra High Temperature (UHT) aseptic packaging processing plant at the Bhilwara Milk Producers' Cooperative. This ₹46.82 crore facility is designed to process and package milk and dairy products such as Saras Chhaachh, Saras Lassi, and Saras Cream into 180ml UHT packs, extending their shelf life up to six months. The plant's advanced technology enhances product preservation and packaging capabilities, catering to the growing demand for long-shelf-life dairy products in the region

- In July 2025, drone manufacturer Raphe mPhibr acquired an 11.5-acre plot in Noida from Parag Dairy to expand its production facility. Under this arrangement, Parag Dairy will relocate its operations to a new plant along the Yamuna Expressway with a processing capacity of 4 lakh litres per day. The relocation is expected to enhance Parag Dairy's UHT processing capabilities and support its expansion in long-shelf-life dairy products

- In 2025, Mother Dairy and Ace International announced investments of ₹430 crore and ₹750 crore, respectively, to establish dairy and fruit processing units in Kuppam, Andhra Pradesh. These projects aim to boost the state’s food processing sector and strengthen dairy processing infrastructure while creating significant employment opportunities. The developments are expected to meet growing consumer demand for packaged and UHT dairy products in the region

- In March 2024, Heritage Foods launched a state-of-the-art UHT milk processing plant in Shamirpet, Hyderabad. The facility is equipped with advanced packaging technologies and produces milkshakes, flavoured lassi, cold coffee, whey-based energy drinks, and UHT milk. This development expands Heritage Foods’ product portfolio and enhances production capabilities to cater to the rising demand for long-shelf-life dairy products

- In November 2024, an Indian dairy company partnered with SIG and AnaBio Technologies to introduce the world's first long-life probiotic buttermilk in aseptic cartons. This innovative UHT-processed product ensures extended shelf life without compromising probiotic benefits, meeting the growing consumer preference for functional and convenient dairy beverages

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Uht Processing For Dairy Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Uht Processing For Dairy Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Uht Processing For Dairy Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.