Global Uht Processing Market

Market Size in USD Billion

CAGR :

%

USD

5.12 Billion

USD

8.68 Billion

2024

2032

USD

5.12 Billion

USD

8.68 Billion

2024

2032

| 2025 –2032 | |

| USD 5.12 Billion | |

| USD 8.68 Billion | |

|

|

|

|

UHT Processing Market Size

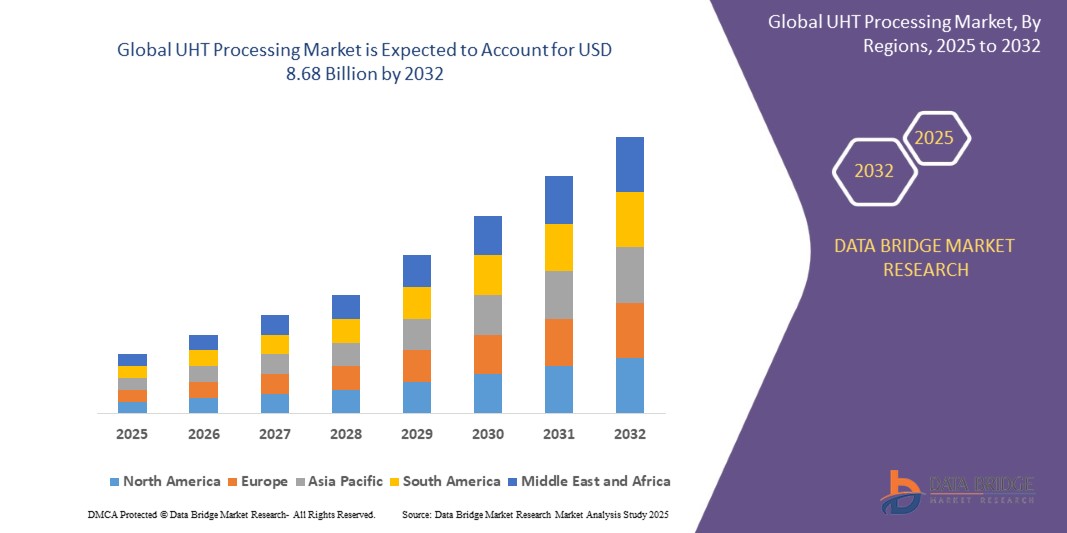

- The global UHT Processing market size was valued at USD 5.12 billion in 2024 and is expected to reach USD 8.68 billion by 2032, at a CAGR of 6.6% during the forecast period

- Market growth is primarily fuelled by the rising demand for shelf-stable dairy and beverage products, expanding food retail networks, and technological innovations enabling longer shelf life and improved product quality without the need for refrigeration.

- Additionally, growing urbanization, increased convenience-driven food consumption, and advancements in UHT equipment driving energy efficiency and process flexibility are accelerating the adoption of UHT processing across both developed and emerging markets.

UHT Processing Market Analysis

- UHT (Ultra-High Temperature) processing is a thermal sterilization technology used to extend the shelf life of liquid foods such as milk, juices, creams, and soups by heating them above 135°C for a few seconds. This process is increasingly critical across dairy, beverage, and food industries due to growing demand for convenient, shelf-stable, and safe products—especially in urban and emerging markets where refrigeration and distribution challenges persist. UHT-treated products retain nutritional quality and safety, making them popular in modern retail and foodservice sectors.

- The rising demand for UHT-processed products is primarily driven by shifting consumer lifestyles favoring ready-to-consume foods, expanding supermarket and convenience store networks, and increased awareness regarding food safety and product longevity. Key industries including dairy, beverages, and ready-to-eat foods are actively turning to UHT technology to meet evolving customer expectations and regulatory standards.

- Asia-Pacific leads the global UHT processing market with the largest revenue share in 2024, supported by rapid population growth, increased dairy consumption, expanding infrastructure, and robust investments in food safety by countries like China, India, and Southeast Asia. Rising consumer preference for shelf-stable and easy-to-transport liquid foods continues to fuel market expansion in the region.

- ·Direct UHT systems dominate the technology segment by offering fast, continuous sterilization suitable for large-scale dairy and beverage manufacturers, while indirect UHT systems provide more energy-efficient and controlled sterilization for specialty and premium products. Equipment innovations including smart heat exchangers, automated homogenizers, and flexible lines broaden application capabilities and process efficiency.

- The milk application segment remains the leading contributor to market traction, given its massive global consumption and supply chain requirements. Meanwhile, other segments such as juices, soups, and functional beverages are experiencing rapid growth owing to health trends, new product launches, and lifestyle shifts favoring nutritious and long-lasting food choices.

Report Scope and UHT Processing Market Segmentation

|

Attributes |

UHT Processing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

UHT Processing Market Trends

- A major trend in the global UHT processing market is the adoption of advanced, energy-efficient technologies that reduce resource consumption and environmental impact, supporting both sustainability goals and cost containment for manufacturers. Processing systems are increasingly designed to maximize heat recovery, reduce waste, and minimize water and energy usage during sterilization—aligning with wider industry commitments to eco-friendly production.

- There is growing demand for “clean label” UHT-treated products—liquid foods and beverages free from artificial preservatives or additives—that retain natural flavor, nutritional value, and freshness throughout extended shelf life. This shift is driven by health-conscious consumers, regulatory support for additive reduction, and brand differentiation strategies in dairy, juices, and functional beverages.

- ·The market is experiencing a rise in product innovation, with manufacturers focusing on fortified or functional UHT beverages (including high-protein milks, vitamin-enriched drinks, and plant-based liquids) to address evolving dietary needs and lifestyle trends. Broadening UHT applications beyond milk to include value-added drinks, soups, and ready-to-consume foods is accelerating market expansion.

- Packaging advancements—such as recyclable cartons and lightweight aseptic containers—are increasingly integrated with UHT processing to enhance product convenience, environmental friendliness, and supply chain efficiency. This is particularly important in regions where distribution logistics and sustainability are high priorities.

- The increased adoption of digitalization and automation (for example, smart heat exchangers, real-time monitoring, and advanced quality control systems) is improving operational reliability, traceability, and product consistency in both large-scale and specialty production.

- As global consumers demand more convenient, safe, and sustainable food solutions, companies investing in efficient UHT technologies and health-oriented product development are set to gain competitive advantage in the evolving food and beverage landscape.

UHT Processing Market Dynamics

Driver

Rising Global Demand for Shelf-Stable, Convenient Liquid Foods and Beverages

- The growing demand for ready-to-consume, shelf-stable dairy and beverage products is a major catalyst for the UHT processing market’s expansion. Urbanization, modern retail proliferation, and changing consumer habits favor products with extended shelf life and minimized refrigeration costs.

- Advancements in UHT technology—targeting energy efficiency, product safety, and nutrient retention—are further driving adoption across both large-scale processors and specialty food manufacturers.

- Increasing application of UHT processing in non-dairy beverages, creams, soups, and functional drinks is broadening market opportunities, specifically in regions with limited cold-chain infrastructure or high ambient distribution requirements.

- Supportive government policies and investments in food processing infrastructure, particularly in emerging markets, continue to boost the sector, enabling manufacturers to address supply chain challenges and meet stringent health standards.

Restraint/Challenge

Stringent Food Safety Regulations, Supply Chain Pressures, and Cost Concerns

- Compliance with rigorous food safety, labeling, and quality standards presents challenges for UHT processing operators, especially in highly regulated markets. Meeting diverse regional regulations can increase R&D and documentation costs.

- Supply chain disruptions, inflation, and fluctuating raw material costs impact input pricing, operational margins, and planning, making it harder for some manufacturers to maintain profitability and growth.

- Competition from fresh and minimally processed products, alongside consumer preferences in specific market segments, can limit wider adoption of UHT-processed items.

- The upfront investment in advanced UHT equipment and maintenance, as well as the need to address potential flavor changes through continuous innovation, puts pressure on producers to optimize costs and remain competitive.

- Companies are responding by investing in digitalization, supply chain resilience, and sustainable packaging solutions, while expanding product portfolios to cater to diverse consumer needs and regulatory demands.

UHT Processing Market Scope

The market is segmented on the basis of type, equipment, and application.

- By Type

On the basis of type, the UHT processing market is segmented into direct UHT processing and indirect UHT processing. The direct UHT segment dominates the market in 2024, due to its widespread use in high-volume milk, juice, and beverage production where rapid sterilization and consistent product quality are essential. Indirect UHT processing is projected to grow rapidly from 2025 to 2032, driven by its energy efficiency, precise temperature control, and suitability for specialty or premium products.

- By Equipment

On the basis of equipment, the market is segmented into heaters, homogenizers, separators, and others. Heaters (such as heat exchangers) hold the largest revenue share, being the core component in thermal sterilization. Homogenizers and separators are increasingly adopted for improving texture, stability, and consistency, especially in value-added dairy and beverage products. Ongoing technological upgrades are expanding capabilities and compatibility for diverse production lines.

- By Application

On the basis of application, the UHT processing market is segmented into milk, juices, cream, yogurt, soups, and others. Milk remains the dominant application, supported by consumer demand for long-shelf-life dairy worldwide. Juices, creams, and yogurts are seeing fast adoption rates due to changing dietary trends and the rise of functional beverages and convenience foods. Soup and other liquid food segments are also expanding as manufacturers introduce premium, health-focused products for ready-to-eat consumption.

UHT Processing Market Regional Analysis

- Asia-Pacific dominates the UHT processing market with the 40.01% revenue share in 2024, driven by rapid growth in dairy production, population expansion, and rising demand for shelf-stable liquid foods and beverages across countries like China, India, Japan, and South Korea.

- Manufacturers and food processors in the region are increasingly adopting UHT technologies to address logistical challenges, extend product shelf life, and meet changing consumer preferences for convenience and safety—especially in densely populated urban centers.

- The region’s market leadership is strengthened by investments in food processing infrastructure, ongoing modernization of supply chains, and supportive government initiatives promoting food safety, retail growth, and industry innovation. Asia-Pacific’s thriving export activity in dairy and beverage products further contributes to its dominant position in the global UHT processing landscape.

U.S. UHT Processing Market Insight

The U.S. leads the North American UHT processing market in 2024, supported by advanced dairy and beverage manufacturing infrastructure, regulatory emphasis on food safety, and strong consumer demand for convenient, shelf-stable products. Major processors are investing in automation and energy-efficient UHT technologies to enhance product quality and operational sustainability. Demand is robust across milk, juice, and value-added beverage segments, driven by retail expansion and evolving consumer lifestyles.

Europe UHT Processing Market Insight

Europe’s UHT processing market is poised for steady growth, fueled by stringent food safety regulations, growing preference for long shelf-life liquid foods, and rising demand for functional dairy and plant-based beverages. Countries including Germany, France, and the U.K. are central to regional expansion, with local producers innovating in energy-efficient UHT systems and sustainable processing solutions. EU initiatives promoting food safety and technology modernization further drive the market.

U.K. UHT Processing Market Insight

The U.K. UHT processing market is expected to witness notable growth, stimulated by increasing adoption in dairy and beverage manufacturing sectors focused on product safety and market convenience. Modern retail chains and foodservice demand shelf-stable liquid foods, while advancements in indirect UHT technologies support diversification into specialty and premium products.

Germany UHT Processing Market Insight

Germany’s UHT processing market is projected to grow steadily, propelled by its leadership in food technology, engineering excellence, and sustainable manufacturing practices. Strong emphasis on quality control, environmental responsibility, and process efficiency encourages adoption of advanced UHT systems in dairy, juice, and functional beverage production.

Asia-Pacific UHT Processing Market Insight

Asia-Pacific dominates the UHT processing market with the largest revenue share in 2024, driven by rapid population growth, expanding middle class, and rising demand for convenient, shelf-stable food products in countries like China, India, and Japan. Strong dairy and beverage production infrastructure and government initiatives supporting food safety and cold chain logistics underpin the region’s market leadership.

India UHT Processing Market Insight

India’s UHT processing market is expected to experience a substantial CAGR over the forecast period, driven by increased dairy consumption, growing urbanization, and infrastructure development under initiatives like “Make in India.” Rising consumer interest in longer-lasting, safe dairy and beverage products fuels adoption across both traditional and emerging market channels.

China UHT Processing Market Insight

China leads the Asia-Pacific UHT processing market in terms of revenue share, backed by its dominant dairy and beverage production base, technological advancements in UHT equipment, and robust domestic demand. Continued investments in modern food processing facilities and increasing consumer preference for hygienic, convenient liquid foods accelerate the market, complemented by significant export activity.

UHT Processing Market Share

The UHT Processing industry is primarily led by well-established companies, including:

- Tetra Pak (Sweden)

- GEA Group (Germany)

- SPX FLOW (U.S.)

- Microthermics (U.S.)

- Elecster (Finland)

- Alfa Laval (Sweden)

- IMA Dairy & Food (Italy)

- Shanghai Triowin (China)

- Stephan Machinery (Germany)

- Goma Engineering (India)

- Scherjon Dairy Equipment (Netherlands)

- Tetra Laval (Switzerland)

- Krones AG (Germany)

- Bosch Packaging Technology (Germany)

- GEA Process Engineering (Denmark)

- Arla Foods (Denmark)

- Shandong Tianjie (China)

- Foss A/S (Denmark)

Latest Developments in Global UHT Processing Market

- In 2024, Tetra Pak introduced next-generation UHT processing modules featuring enhanced automation, digital monitoring, and energy-saving technologies for large-scale dairy and beverage manufacturers.

- In late 2023, GEA Group launched high-efficiency UHT heat exchangers and advanced energy recovery systems, enabling food processors to reduce operating costs, improve sustainability, and meet stringent environmental standards.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.