Global Ultra High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Market Size in USD Billion

CAGR :

%

USD

4.14 Billion

USD

6.17 Billion

2024

2032

USD

4.14 Billion

USD

6.17 Billion

2024

2032

| 2025 –2032 | |

| USD 4.14 Billion | |

| USD 6.17 Billion | |

|

|

|

|

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Size

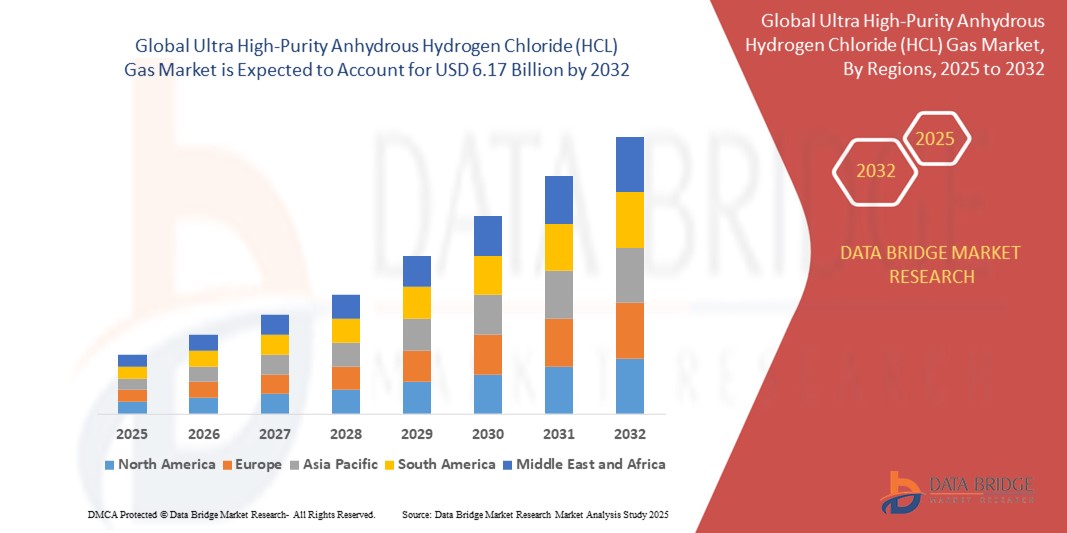

- The global ultra high-purity anhydrous hydrogen chloride (HCL) gas market size was valued at USD 4.14 billion in 2024 and is expected to reach USD 6.17 billion by 2032, at a CAGR of 5.12% during the forecast period

- The market growth is largely fuelled by the rising demand from the semiconductor industry for high-purity gases used in chip manufacturing and etching processes, along with increased adoption in pharmaceutical synthesis and specialty chemical production

- Growing investments in electronics manufacturing across Asia-Pacific and North America are boosting the consumption of ultra high-purity anhydrous hydrogen chloride gas, particularly in the production of integrated circuits and display panels

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Analysis

- The market is experiencing increased demand from the electronics industry where high-purity gas is essential for etching and cleaning in semiconductor fabrication

- Manufacturers are focusing on refining gas quality and ensuring consistency to meet stringent industry specifications

- North America dominated the ultra high-purity anhydrous hydrogen chloride gas market in 2024, driven by strong demand from the electronics and semiconductor sectors, particularly in the U.S. and Canada

- Asia-Pacific region is expected to witness the highest growth rate in the global ultra high-purity anhydrous hydrogen chloride (HCL) gas market, driven by rapid industrialization, expanding semiconductor manufacturing, and rising investments in electronics and pharmaceutical sectors across countries such as China, Japan, and South Korea

- The electronics grade segment dominated the market with the largest revenue share in 2024, owing to its critical role in semiconductor fabrication, especially in etching and cleaning processes. The high purity of this grade ensures minimal contamination during the production of microelectronic components. As chip complexity and miniaturization advance, the demand for ultra-pure HCL gas for ensuring performance consistency and yield in wafer processing is rising

Report Scope and Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Segmentation

|

Attributes |

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Gas Innovations (U.S.) |

|

Market Opportunities |

• Rising Demand from The Semiconductor and Electronics Manufacturing Industries • Expanding Use in Advanced Pharmaceutical Synthesis and Chemical Processing |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Trends

“Growing Adoption in Semiconductor Manufacturing”

- High-purity hydrogen chloride is essential in semiconductor processes such as wafer cleaning and etching, where contamination control is critical for chip integrity

- Increasing miniaturization of chips is driving demand for ultra-pure gases to meet the tight tolerances of next-gen microelectronics

- Companies such as Samsung are partnering with regional gas suppliers to create customized purity solutions for advanced semiconductor nodes

- The surge in semiconductor fab construction in Taiwan and South Korea is boosting bulk procurement of high-purity hydrogen chloride

- Gas manufacturers are scaling up purification infrastructure to meet quality and volume demands from high-tech clients in the electronics sector

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Dynamics

Driver

“Expansion of the Semiconductor Industry”

- The rapid expansion of the semiconductor industry is a major driver for the ultra high-purity anhydrous hydrogen chloride gas market, with increased demand for high-performance microchips across devices such as smartphones, laptops, and smart appliances

- This gas is essential for critical semiconductor manufacturing steps such as etching and doping silicon wafers, where purity is crucial to prevent defects and ensure chip reliability

- The growing adoption of advanced technologies such as 5G, AI, and IoT is pushing chipmakers to produce more complex integrated circuits, increasing the need for ultra-pure gases

- New semiconductor fabrication facilities in countries such as Taiwan, South Korea, and the U.S. have significantly increased demand for ultra-pure hydrogen chloride; for instance, TSMC's expansion in Arizona is fueling demand from regional gas suppliers

- To meet rising demand, gas producers are investing in advanced purification technologies and strict quality assurance systems to support the growing needs of the global semiconductor supply chain

Restraint/Challenge

“Stringent Handling and Storage Requirements”

- Stringent handling and storage requirements present a major challenge in the ultra high-purity anhydrous hydrogen chloride gas market due to the gas’s corrosive and toxic nature

- Specialized infrastructure, including corrosion-resistant storage tanks and pipelines, is necessary to maintain gas purity and ensure worker safety during transport and application

- Even minor contamination can compromise the gas’s suitability for semiconductor manufacturing, leading to production defects or equipment damage

- Smaller manufacturers often lack the financial capacity to invest in the advanced containment systems and compliance protocols needed to meet international safety regulations

- For instance, delays in export shipments due to strict hazardous material checks or lack of compliant logistics partners can interrupt supply chains for chipmakers relying on uninterrupted gas availability

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Scope

The ultra high-purity anhydrous hydrogen chloride (HCL) gas market is segmented on the basis of product and application.

• By Product

On the basis of product, the ultra high-purity anhydrous hydrogen chloride (HCL) gas market is segmented into electronics grade and chemical grade. The electronics grade segment dominated the market with the largest revenue share in 2024, owing to its critical role in semiconductor fabrication, especially in etching and cleaning processes. The high purity of this grade ensures minimal contamination during the production of microelectronic components. As chip complexity and miniaturization advance, the demand for ultra-pure HCL gas for ensuring performance consistency and yield in wafer processing is rising.

The chemical grade segment is expected to witness a fastest growth rate from 2025 to 2032, driven by its increasing usage in high-precision chemical synthesis and specialty chemical formulations. This grade is particularly useful in applications that demand consistency in reactivity without the risk of metallic or organic impurities, especially in industrial and laboratory-grade chemicals.

• By Application

On the basis of application, the market is segmented into electronics and electricals, pharmaceuticals, chemicals, and others. The electronics and electricals segment held the largest revenue share in 2024, fueled by rapid growth in semiconductor manufacturing and consumer electronics. Ultra high-purity anhydrous HCL gas is widely used in cleaning silicon wafers and as a reactive agent in integrated circuit production, making it indispensable in this sector.

The pharmaceuticals segment is expected to witness a fastest growth rate from 2025 to 2032, driven by increasing adoption in synthesizing active pharmaceutical ingredients (APIs) and fine chemicals. Its purity level makes it ideal for sensitive pharmaceutical formulations, particularly in the production of anti-infective and oncology drugs.

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Regional Analysis

• North America dominated the ultra high-purity anhydrous hydrogen chloride gas market in 2024, driven by strong demand from the electronics and semiconductor sectors, particularly in the U.S. and Canada

• The region’s well-established chemical industry, high purity standards, and growing investments in electronics manufacturing are key factors contributing to market leadership

• Advanced infrastructure, robust R&D activities, and the presence of major end-use industries further support widespread utilization of high-purity gas in North America

U.S. Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The U.S. market captured the largest share in North America in 2024, propelled by increasing use of high-purity gas in electronics manufacturing and pharmaceutical synthesis. The country's strong focus on semiconductor fabrication, coupled with rising demand for precision chemical processing, boosts the adoption of ultra high-purity anhydrous hydrogen chloride gas. The presence of leading manufacturers and favorable industrial policies continue to support the market’s expansion.

Europe Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The Europe market is expected to witness a fastest growth rate from 2025 to 2032, supported by rising environmental regulations and growing demand for high-purity chemicals in electronics and pharmaceutical sectors. Countries such as Germany and France are investing in cleaner technologies, and the shift toward sustainable industrial practices is fostering the use of high-purity gas. In addition, the region's commitment to innovation and product quality is encouraging adoption across specialized chemical applications.

U.K. Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The U.K. market is expected to witness a fastest growth rate from 2025 to 2032, driven by technological advancements and a strong pharmaceutical industry. The country’s focus on producing high-quality APIs (active pharmaceutical ingredients) and its participation in European electronics value chains is creating demand for ultra high-purity gas. Ongoing efforts to strengthen domestic manufacturing also enhance the prospects for market growth.

Germany Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The Germany market is expected to witness a fastest growth rate from 2025 to 2032, due to the country's role as a key hub for precision manufacturing and high-purity chemical processing. German industries prioritize strict purity and safety standards, which aligns with the performance characteristics of ultra high-purity anhydrous hydrogen chloride gas. The ongoing development of smart manufacturing and electronic applications further fuels growth in this market.

Asia-Pacific Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The Asia-Pacific is expected to witness a fastest growth rate from 2025 to 2032, supported by rapid industrialization, especially in China, Japan, South Korea, and India. The booming semiconductor industry and significant investment in electronics production are major drivers. Government support for local manufacturing and increasing demand for clean and efficient chemical processes are encouraging widespread use of ultra high-purity gas across diverse applications.

Japan Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The Japan market is expected to witness a fastest growth rate from 2025 to 2032, due to the country's advanced electronics industry and high focus on precision in manufacturing. The demand for ultra high-purity gas is growing in semiconductor production, where chemical purity is critical. Japan’s innovation-driven approach and its adherence to international quality standards support continued market expansion across technical and pharmaceutical applications.

China Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The China accounted for the largest market share in Asia-Pacific in 2024, driven by rapid growth in its electronics, chemical, and pharmaceutical sectors. The country is a major hub for semiconductor production and has been investing heavily in upgrading its manufacturing capabilities. The availability of local suppliers and increasing demand for high-efficiency chemical processing further support market growth across various industries.

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Share

The Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas industry is primarily led by well-established companies, including:

• Gas Innovations (U.S.)

• Air Liquide (France)

• Matheson Tri-Gas, Inc. (Japan)

• WEITAI CHEM (China)

• Linde plc (U.K.)

Latest Developments in Global Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market

- In September 2023, Air Liquide's cylinder treatment program, showcased at the recent Laborama event, emphasizes the importance of ensuring stability and shelf life for calibration gases used in emissions measurement equipment. Recognizing the reactivity of compounds such as hydrogen chloride (HCL), Air Liquide employs various techniques such as vacuuming, heat treatment, internal polishing, etching, and coating to modify the internal surface of cylinders. Marketed under the Aculife and AlphaTech brand names, these treatments are backed by scientific data and offer a consistent three-year shelf life globally

- In November 2021, Linde India (subsidiary of Linde) has finalized a Business Transfer Agreement with HPS Gases Ltd., based in Vadodara, effective November 1, 2021, for the acquisition of its entire packaged gases business and specific distribution assets, totaling an aggregate cash consideration of USD 3.3 Million. This strategic move includes additional agreements such as the Asset Purchase Agreement, Non-Compete Agreement, and Agreement for Product Supply and Purchase

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRICING ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL COVERAGE

4.6 SUPPLY CHAIN ANALYSIS

5 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: REGULATION COVERAGE

6 PRODUCTION CAPACITY OVERVIEW

6.1 ESTIMATED PRODUCTION CAPACITY

7 PRODUCTION CONSUMPTION ANALYSIS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND IN SEMICONDUCTOR INDUSTRY

8.1.2 THE INCREASING UTILIZATION OF ANHYDROUS HYDROGEN CHLORIDE GAS AS A REAGENT IN SPECIALTY CHEMICALS SYNTHESIS

8.2 RESTRAINTS

8.2.1 SIGNIFICANT HEALTH RISKS ASSOCIATED WITH HANDLING ULTRA-HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE

8.2.2 REGULATORY REQUIREMENTS ASSOCIATED WITH ULTRA-HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS.

8.3 OPPORTUNITIES

8.3.1 ADOPTION OF ULTRA-HIGH PURITY ANHYDROUS HCL GAS IN SPECIALIZED RESEARCH AND DEVELOPMENT ACTIVITIES

8.3.2 INTEGRATION OF CUTTING-EDGE PURIFICATION TECHNOLOGIES FOR ULTRA-HIGH PURITY HCL GAS PRODUCTION

8.4 CHALLENGES

8.4.1 DIFFICULTY IN HANDLING AND TRANSPORTATION COST OF ULTRA HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE GAS

9 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 ELECTRONICS GRADE

9.3 CHEMICAL GRADE

10 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS AND ELECTRICALS

10.3 PHARMACEUTICALS

10.4 CHEMICALS

10.5 OTHERS

11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA PACIFIC

11.2.1 TAIWAN

11.2.2 CHINA

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 SINGAPORE

11.2.6 INDIA

11.2.7 MALAYSIA

11.2.8 THAILAND

11.2.9 INDONESIA

11.2.10 AUSTRALIA

11.2.11 NEW ZEALAND

11.2.12 PHILIPPINES

11.2.13 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 U.K.

11.4.4 NETHERLANDS

11.4.5 SWITZERLAND

11.4.6 ITALY

11.4.7 BELGIUM

11.4.8 SPAIN

11.4.9 PORTUGAL

11.4.10 RUSSIA

11.4.11 TURKEY

11.4.12 DENMARK

11.4.13 NORWAY

11.4.14 FINLAND

11.4.15 SWEDEN

11.4.16 REST OF EUROPE

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 EGYPT

11.5.5 ISRAEL

11.5.6 QATAR

11.5.7 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.4 COMPANY SHARE ANALYSIS: EUROPE

12.5 NEW PRODUCTION PLANT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AIR LIQUIDE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 LINDE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MATHESON TRI-GAS, INC. ((A SUBSIDIARY OF NIPPON HOLDINGS GROUP)

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 GAS INNOVATIONS

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 WEITAI CHEM

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ESTIMATED PRODUCTION OVERVIEW

TABLE 3 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL ELECTRONICS GRADE IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL CHEMICAL GRADE IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL ELECTRONICS AND ELECTRICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL PHARMACEUTICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL CHEMICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL OTHERS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 14 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 16 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 17 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 18 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 19 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 20 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 21 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 22 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 23 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 24 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 25 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 26 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 27 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 28 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 30 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 31 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 32 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 33 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 34 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 35 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 36 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 37 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 38 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 39 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 40 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 41 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 42 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 43 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 44 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 45 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 46 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 47 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 48 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 49 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 50 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 51 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 52 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 53 REST OF ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 54 REST OF ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 55 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 57 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 59 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 60 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 61 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 62 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 64 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 65 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 68 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 69 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 70 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 71 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 72 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 73 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 76 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 77 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 78 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 79 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 80 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 81 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 82 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 84 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 85 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 86 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 87 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 88 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 89 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 90 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 91 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 92 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 93 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 94 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 95 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 96 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 97 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 98 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 99 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 100 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 101 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 102 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 103 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 104 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 105 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 106 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 107 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 108 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 109 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 111 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 112 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 113 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 114 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 115 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 117 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 118 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 119 REST OF EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 120 REST OF EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 121 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 123 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 125 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 126 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 127 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 128 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 129 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 130 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 131 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 133 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 134 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 135 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 136 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 137 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 138 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 139 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 140 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 141 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 142 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 143 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 144 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 145 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 146 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 147 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 148 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 149 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 150 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 151 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 152 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 153 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 154 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 155 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 156 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 157 REST OF SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 158 REST OF SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

List of Figure

FIGURE 1 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET

FIGURE 2 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET, AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 RISING DEMAND IN SEMICONDUCTOR INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 14 ELECTRONICS GRADE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET IN 2024 AND 2031

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS IN THE FORECAST PERIOD

FIGURE 16 PRICING ANALYSIS FOR GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (USD/KG)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 20 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET: BY PRODUCT, 2023

FIGURE 21 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET: BY APPLICATION, 2023

FIGURE 22 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 23 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 24 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 25 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 26 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 27 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 28 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET COMPANY SHARE 2023 (%)

FIGURE 29 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

Global Ultra High Purity Anhydrous Hydrogen Chloride Hcl Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultra High Purity Anhydrous Hydrogen Chloride Hcl Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultra High Purity Anhydrous Hydrogen Chloride Hcl Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.