Global Ultra High Temperature Ceramics Uhtcs Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

1.95 Billion

2024

2032

USD

1.19 Billion

USD

1.95 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 1.95 Billion | |

|

|

|

|

Ultra-High Temperature Ceramics (UHTCs) Market Size

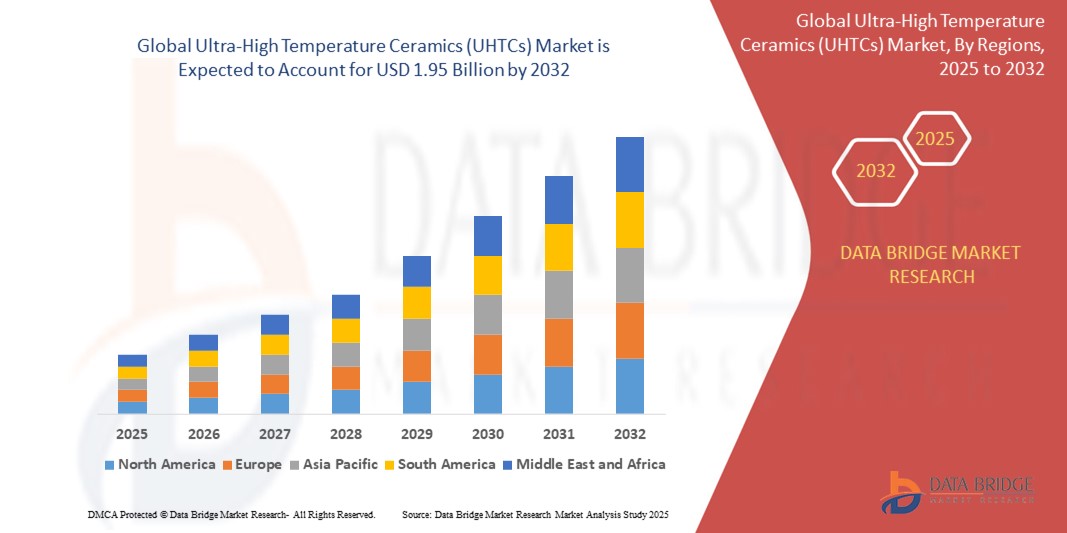

- The global ultra-high temperature ceramics (UHTCs) market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 1.95 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fuelled by the increasing demand for materials capable of withstanding extreme environments in aerospace, defense, and space exploration applications

- The growing number of hypersonic aircraft, space re-entry vehicles, and next-gen propulsion systems is accelerating the use of UHTCs for thermal protection and structural integrity

Ultra-High Temperature Ceramics (UHTCs) Market Analysis

- The UHTCs market is witnessing steady expansion as defense and space agencies increasingly invest in thermal barrier technologies. These ceramics, known for their excellent thermal stability, high melting points, and oxidation resistance, are vital for developing materials for hypersonic weapons, jet engines, and thermal shields

- In addition, technological advancements in powder processing and additive manufacturing are enabling more cost-effective and precise UHTC component fabrication, fostering adoption across industries. The market is also benefiting from growing collaborations between academic institutions, national laboratories, and private companies aimed at scaling UHTC innovations for real-world applications

- North America dominated the ultra-high temperature ceramics (UHTCs) market with the largest revenue share of 36.45% in 2024, driven by increased aerospace & defense spending, technological advancements, and robust R&D activities by leading manufacturers and research institutions

- Asia-Pacific region is expected to witness the highest growth rate in the global ultra-high temperature ceramics (UHTCs) market, driven by rising investments in space exploration, defense modernization, and high-temperature industrial applications in emerging economies such as China, India, and Japan

- The silicon carbide segment held the largest market revenue share in 2024, driven by its exceptional thermal conductivity, mechanical strength, and oxidation resistance. SiC is widely used in high-temperature structural applications, especially in aerospace and defense sectors, due to its ability to withstand temperatures exceeding 1600°C. Its lightweight properties and compatibility with advanced manufacturing techniques such as additive manufacturing also make it a preferred choice in complex component design

Report Scope and Ultra-High Temperature Ceramics (UHTCs) Market Segmentation

|

Attributes |

Ultra-High Temperature Ceramics (UHTCs) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Hypersonic Vehicles and Reusable Launch Systems in Aerospace and Defense • Increasing Adoption of UHTCs in Next-Generation Nuclear Reactors and Space Exploration Missions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultra-High Temperature Ceramics (UHTCs) Market Trends

“Rising Adoption of UHTCs in Hypersonic and Aerospace Applications”

- UHTCs are increasingly used in hypersonic vehicles and aerospace systems due to their superior thermal stability and oxidation resistance

- Key aerospace components such as nose cones, leading edges, and propulsion parts benefit from UHTCs' durability under temperatures above 3000°C

- Defense and space agencies are investing in reusable hypersonic and orbital vehicles that demand extreme thermal protection

- UHTCs such as hafnium carbide (HfC) and zirconium diboride (ZrB₂) are preferred for their strength and stability in high-velocity, high-temperature conditions

- For instance, NASA’s Hypersonic Technology Project incorporates UHTCs for leading-edge protection in re-entry systems, enabling vehicles to endure intense aerothermal stress

Ultra-High Temperature Ceramics (UHTCs) Market Dynamics

Driver

“Growing Investments in Defense and Space Programs Worldwide”

- Governments globally are boosting R&D investments in defense, aerospace, and high-speed missile technologies

- UHTCs are vital for thermal protection systems in spacecraft, scramjets, rocket nozzles, and re-entry vehicles

- The materials’ ability to maintain structural integrity under extreme heat makes them indispensable for long-duration missions

- Demand is driven by the need for advanced materials that enhance performance, lifespan, and safety in high-temperature applications

- For instance, DARPA’s Tactical Boost Glide (TBG) program utilizes ultra-refractory ceramics to develop hypersonic glide vehicles with enhanced thermal resistance and flight capability

Restraint/Challenge

“High Production Cost and Complex Fabrication Processes”

- UHTCs require advanced manufacturing techniques such as spark plasma sintering or hot pressing, which are expensive and energy-intensive

- The ceramics’ high hardness and brittleness make machining and forming difficult, leading to limited design flexibility and high material waste

- Scalability remains a major challenge due to the need for specialized equipment and high-temperature furnaces

- The overall high-cost limits adoption outside defense and aerospace, deterring use in cost-sensitive industries such as automotive or consumer electronics

- For instance, the production of hafnium carbide components for aerospace uses involves sintering at over 2000°C, making it unviable for widespread industrial-scale adoption

Ultra-High Temperature Ceramics (UHTCs) Market Scope

The market is segmented on the basis of product type, application, and end-user.

• By Product Type

On the basis of product type, the ultra-high temperature ceramics (UHTCs) market is segmented into silicon carbide (SiC), zirconium diboride (ZrB₂), and titanium diboride (TiB₂). The silicon carbide segment held the largest market revenue share in 2024, driven by its exceptional thermal conductivity, mechanical strength, and oxidation resistance. SiC is widely used in high-temperature structural applications, especially in aerospace and defense sectors, due to its ability to withstand temperatures exceeding 1600°C. Its lightweight properties and compatibility with advanced manufacturing techniques such as additive manufacturing also make it a preferred choice in complex component design.

The zirconium diboride segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its superior hardness and high melting point above 3200°C. Its increasing adoption in hypersonic vehicles and thermal protection systems for space exploration is propelling growth. ZrB₂'s outstanding thermal shock resistance and low density further enhance its application potential in next-generation aerospace materials.

• By Application

On the basis of application, the market is segmented into aerospace, defense, and space exploration. The aerospace segment dominated the market in 2024, driven by the rising demand for heat-resistant materials in turbine engines, thermal shielding, and structural components. With increasing investments in aircraft modernization and space missions, UHTCs are being increasingly integrated into critical systems.

The space exploration segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing number of commercial and government-led deep space missions. UHTCs are integral in creating heat shields, nozzles, and control surfaces for re-entry vehicles due to their ability to withstand extreme aerothermal loads.

• By End-User

On the basis of end-user, the market is segmented into aerospace & defense, automotive, and energy & power. The aerospace & defense segment held the largest revenue share in 2024, attributed to sustained military R\&D programs and the continuous need for thermal protection materials in missiles and hypersonic vehicles.

The energy & power segment is expected to witness the fastest growth rate from 2025 to 2032, due to growing interest in advanced reactors and high-efficiency energy systems. UHTCs are being used in high-temperature fuel cells and nuclear applications, where reliability at extreme temperatures is critical for operational efficiency.

Ultra-High Temperature Ceramics (UHTCs) Market Regional Analysis

- North America dominated the ultra-high temperature ceramics (UHTCs) market with the largest revenue share of 36.45% in 2024, driven by increased aerospace & defense spending, technological advancements, and robust R&D activities by leading manufacturers and research institutions.

- The region benefits from a mature industrial infrastructure and government initiatives to enhance hypersonic and space exploration capabilities. UHTCs are widely used in thermal protection systems, nozzles, and control surfaces for next-generation aircraft and space vehicles.

- Growing collaborations between defense contractors and space agencies, alongside high investments in thermal management solutions, are expected to sustain the demand for UHTCs in North America.

U.S. UHTCs Market Insight

The U.S. UHTCs market accounted for over 82% of the North American market share in 2024, supported by its leadership in defense innovation and extensive use of advanced materials in aerospace. Strong federal funding and strategic programs such as NASA’s Artemis and the U.S. Department of Defense’s hypersonic weapons development continue to drive adoption. Moreover, increasing interest in UHTCs for use in nuclear reactors and next-gen propulsion systems also boosts market growth.

Europe UHTCs Market Insight

The Europe UHTCs market is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing investments in green energy and aerospace sustainability. The region is witnessing growing demand for high-performance ceramics in gas turbines, scramjets, and space-bound components. European countries are also focusing on energy-efficient, high-durability materials in line with decarbonization policies, further driving the use of UHTCs in thermal barrier coatings and structural components.

U.K. UHTCs Market Insight

The U.K. UHTCs market is expected to witness the fastest growth rate from 2025 to 2032, notably due to rising governmental and private investments in space exploration and defense modernization. The country is emphasizing material innovation to support its growing satellite, aerospace, and energy sectors. Collaboration between universities and manufacturers focused on ceramics research is expected to support sustained adoption of UHTCs in the coming years.

Germany UHTCs Market Insight

The Germany’s UHTCs market is expected to witness the fastest growth rate from 2025 to 2032, driven by its leading role in industrial ceramics and automotive R&D. The country is focusing on eco-efficient propulsion technologies and next-gen high-temperature reactors, where UHTCs serve as critical components. Germany’s strong industrial base and technological leadership support innovations in high-performance materials for defense, aerospace, and energy applications.

Asia-Pacific UHTCs Market Insight

The Asia-Pacific UHTCs market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing defense budgets, space research programs, and growth in advanced manufacturing hubs. Countries such as China, Japan, and India are at the forefront of adopting UHTCs for hypersonic platforms, re-entry vehicles, and power generation systems. Additionally, rising domestic production and strategic partnerships are making UHTCs more accessible in the region.

Japan UHTCs Market Insight

The Japan is emerging as a major consumer of UHTCs due to its emphasis on aerospace innovation, energy sustainability, and ceramic engineering. The country’s robust electronics and material science sectors are contributing to the integration of UHTCs into microturbines, thermal barriers, and fusion reactors. Government-backed R&D projects are also accelerating material development for high-temperature performance.

China UHTCs Market Insight

The China accounted for the largest share of the Asia-Pacific UHTCs market in 2024, supported by its aggressive investment in aerospace, hypersonics, and nuclear power projects. The country’s initiatives to become a leader in high-tech defense and space exploration are directly boosting demand for advanced ceramics. Local manufacturers are scaling production capabilities, further enhancing UHTCs’ availability and cost-effectiveness across end-use industries.

Ultra-High Temperature Ceramics (UHTCs) Market Share

The Ultra-High Temperature Ceramics (UHTCs) industry is primarily led by well-established companies, including:

- Morgan Advanced Materials (U.K.)

- Unifrax (U.S.)

- Dynamic Ceramic (U.K.)

- BNZ Materials Inc. (U.S.)

- Pyrotek Inc. (U.S.)

- Hi-Temp Insulation Inc. (U.S.)

- Cotronics Corporation (U.S.)

- ADL Insulflex Inc. (U.S.)

- Insulcon Group (Netherlands)

- M.E. Schupp Industriekeramik GmbH & Co. (Germany)

- Skamol A/S (Denmark)

- Ibiden Co. Ltd. (Japan)

Latest Developments in Global Ultra-High Temperature Ceramics (UHTCs) Market

- In December 2023, Saint-Gobain Ceramics announced the development of ultra-high temperature ceramics (UHTCs) designed for extreme environments. This innovation enhances the performance of ceramic materials where conventional ceramics fail, enabling applications in high-temperature settings. The advancement is expected to strengthen the company’s position in aerospace and defense sectors requiring superior thermal resistance

- In September 2022, Lockheed Martin inaugurated a new facility in California focused on expanding its research and production of ultra-high-temperature ceramic matrix composites (CMCs). This strategic expansion will boost its hypersonic and aerospace capabilities by supporting thermal protection systems essential for extreme conditions. The facility includes advanced manufacturing tools and testing infrastructure, reinforcing Lockheed Martin’s commitment to innovation and driving growth in the UHTCs market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ultra High Temperature Ceramics Uhtcs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultra High Temperature Ceramics Uhtcs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultra High Temperature Ceramics Uhtcs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.