Global Ultra Thin Glass Market

Market Size in USD Million

CAGR :

%

USD

465.18 Million

USD

668.65 Million

2025

2033

USD

465.18 Million

USD

668.65 Million

2025

2033

| 2026 –2033 | |

| USD 465.18 Million | |

| USD 668.65 Million | |

|

|

|

|

Ultra Thin Glass Market Size

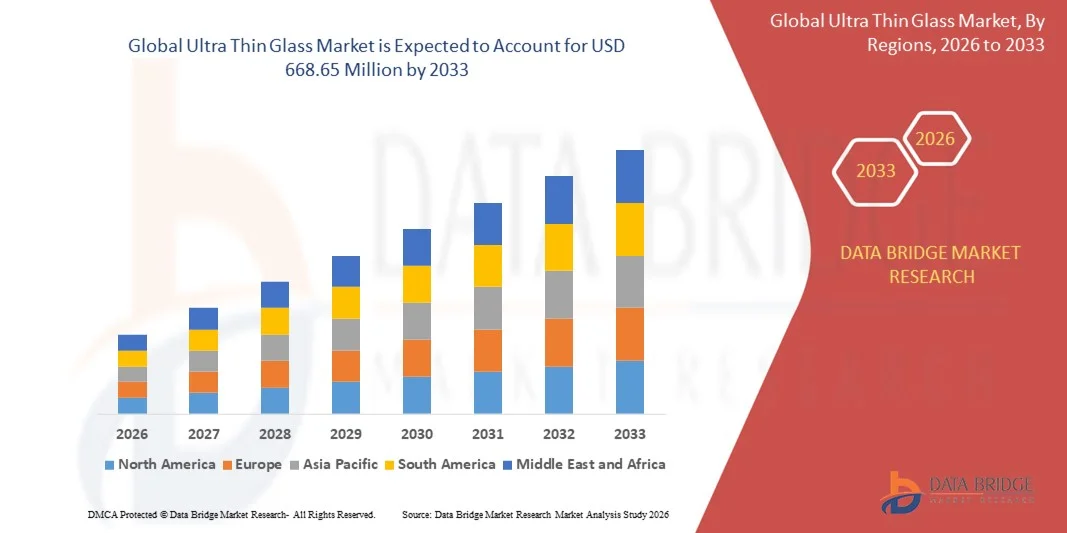

- The global ultra thin glass market size was valued at USD 465.18 million in 2025 and is expected to reach USD 668.65 million by 2033, at a CAGR of 4.64% during the forecast period

- The market growth is largely fueled by the rising adoption of ultra-thin glass in consumer electronics, supported by the expanding production of smartphones, wearables, OLED displays, and touch panels, where manufacturers increasingly rely on ultra-thin glass for its flexibility, scratch resistance, and superior optical clarity

- Furthermore, growing demand from automotive, semiconductor, and solar module manufacturers is expanding the material’s application scope, as industries shift toward lightweight, durable, and high-performance substrates. These converging factors are accelerating the integration of ultra-thin glass across multiple end-use sectors, thereby strengthening overall market expansion

Ultra Thin Glass Market Analysis

- Ultra-thin glass, known for its thinness, flexibility, and high mechanical strength, is becoming an essential material in next-generation consumer electronics and advanced industrial applications due to its ability to enhance device performance, reduce component weight, and support miniaturization trends

- The accelerating demand for ultra-thin glass is primarily driven by continuous advancements in display technologies, increasing consumer preference for sleek device designs, and the expanding use of ultra-thin substrates in areas such as foldable devices, automotive displays, and high-efficiency photovoltaic modules

- Asia-Pacific dominated the ultra thin glass market with a share of 39.4% in 2025, due to strong consumer electronics manufacturing, growing adoption of advanced display technologies, and extensive presence of major glass processing hubs

- North America is expected to be the fastest growing region in the ultra thin glass market during the forecast period due to rising adoption of flexible and foldable displays, growing semiconductor demand, and strong advancements in medical and diagnostic technologies

- 0.1 mm–0.5 mm segment dominated the market with a market share of 44.5% in 2025, due to its optimal balance of strength, flexibility, and lightweight design, making it widely suitable for consumer electronics and automotive displays. Its compatibility with mass production supports cost efficiency, and its performance stability aligns well with high-resolution touch panels and modern device architectures. These advantages reinforced its broad adoption across multiple industries, securing its leading market position

Report Scope and Ultra Thin Glass Market Segmentation

|

Attributes |

Ultra Thin Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultra Thin Glass Market Trends

Increasing Adoption of Ultra-Thin Glass in Foldable Electronics

- A key trend in the ultra-thin glass market is the accelerating adoption of ultra-thin, flexible glass in foldable and next-generation electronic devices, supported by rising demand for slimmer, more durable, and scratch-resistant display materials. This shift is positioning ultra-thin glass as an essential component in advanced consumer electronics requiring high flexibility and optical clarity

- For instance, Corning Incorporated supplies ultra-thin glass solutions engineered for foldable smartphones and flexible displays, enabling manufacturers to achieve improved durability and smoother bending performance. Such materials enhance product reliability and support evolving design requirements in premium electronic devices

- The increasing production of foldable smartphones and tablets is strengthening the market’s transition toward ultra-thin glass due to its superior surface hardness and resistance to deformation during repeated folding. This adoption is reinforcing the material’s relevance in next-generation smart device portfolios

- Wearable technologies are integrating ultra-thin glass to support lightweight designs and high-quality touch interfaces, resulting in better user experience and device aesthetics. These applications are contributing to a broader shift toward compact, durable components in personal electronics

- Manufacturers in AR and VR devices are using ultra-thin glass to achieve clearer visuals and reduced device weight, thereby improving ergonomics and user comfort. This integration is driving consistent technological advancements across immersive display solutions

- The expanding need for highly flexible yet robust cover materials across consumer electronics is further strengthening the incorporation of ultra-thin glass. This trend continues to elevate the material’s role in supporting modern electronic designs that require both performance and resilience

Ultra Thin Glass Market Dynamics

Driver

Growing Demand for Lightweight, High-Performance Electronic Components

- Market growth is driven by increasing demand for lightweight, high-performance materials that support advanced functionality in smartphones, wearables, and high-resolution displays. Ultra-thin glass offers superior stiffness, transparency, and barrier properties, making it a preferred choice for compact electronic components

- For instance, AGC Inc. provides ultra-thin glass solutions for touch panels and semiconductor applications that require high thermal stability and precise performance. These materials enhance device efficiency and meet design requirements for thinner consumer electronics

- Demand is increasing across semiconductor packaging and sensor applications where ultra-thin substrates enable faster processing, improved miniaturization, and better signal consistency. This demand is reinforcing the material’s adoption in high-performance electronics

- Wearable electronics require durable yet lightweight components, and ultra-thin glass provides the necessary balance of strength and thinness. This is motivating manufacturers to incorporate it into next-generation smart wearables

- Growing expectations for advanced device design and energy-efficient components are further strengthening the market’s reliance on ultra-thin glass, driving consistent adoption in both established and emerging electronic applications

Restraint/Challenge

Complex Manufacturing and High Fragility During Processing

- The market faces challenges due to the highly complex processes involved in producing ultra-thin glass, which require precision-controlled environments, advanced cutting technologies, and difficult handling procedures. These factors contribute to higher costs and elevate technical barriers for large-scale production

- For instance, SCHOTT and Nippon Electric Glass Co., Ltd. employ specialized melting, drawing, and thinning processes that demand strict precision to maintain material uniformity and mechanical strength. Such detailed procedures increase production difficulty and elevate operational expenses

- Ultra-thin glass is highly fragile during early processing stages, requiring advanced handling systems that add cost and complexity. This fragility limits manufacturing speed and yields

- Ensuring consistent mechanical strength, flexibility, and surface quality requires extensive testing and specialized equipment, which further extends production timelines.Supply chains also face constraints due to the need for highly skilled labor and advanced automated systems to maintain precision at extremely low thickness levels

- These manufacturing and handling challenges continue to restrict cost optimization and scalability, making it difficult for manufacturers to expand output without substantial investment

Ultra Thin Glass Market Scope

The market is segmented on the basis of thickness, manufacturing process, application, and end-use industry.

- By Thickness

On the basis of thickness, the ultra-thin glass market is segmented into <0.1 mm, 0.1 mm–0.5 mm, and 0.5 mm–1.0 mm. The 0.1 mm–0.5 mm segment dominated the market with the largest share of 44.5% in 2025 due to its optimal balance of strength, flexibility, and lightweight design, making it widely suitable for consumer electronics and automotive displays. Its compatibility with mass production supports cost efficiency, and its performance stability aligns well with high-resolution touch panels and modern device architectures. These advantages reinforced its broad adoption across multiple industries, securing its leading market position.

The <0.1 mm segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising demand for ultra-flexible and foldable devices. Its extreme thinness enables superior bendability, transparency, and miniaturization, supporting advanced OLED displays and wearable electronics. Growing investment in flexible device manufacturing and next-generation microelectronic components continues to accelerate its adoption.

- By Manufacturing Process

On the basis of manufacturing process, the market is segmented into Float, Fusion, and Down-Draw. The Fusion process segment dominated the market in 2025 owing to its ability to produce ultra-clean, highly uniform glass sheets ideal for premium electronics. The method eliminates mechanical contact during forming, resulting in fewer surface defects and superior optical clarity demanded for high-resolution displays. Fusion-produced glass supports advanced OLEDs, micro-LED panels, and semiconductor wafers where precision is critical. The process also enables the production of extremely thin glass without sacrificing smoothness or structural consistency. Manufacturers rely on this method to meet strict performance standards required by major consumer electronics brands.

The Down-Draw segment is expected to record the fastest growth from 2026 to 2033, supported by its suitability for producing highly flexible, lightweight glass used in foldable and rollable devices. The technique allows for tight thickness control and enhanced edge strength, making it ideal for emerging flexible electronics applications. Growing adoption of bendable displays in smartphones, automotive clusters, and wearable devices accelerates demand for Down-Draw glass. Its ability to manufacture thinner glass sheets with improved thermal stability further strengthens its appeal in high-growth industries. Manufacturers are increasingly investing in this process to meet expanding demand for next-generation adaptable display technologies.

- By Application

On the basis of application, the ultra-thin glass market is segmented into Semiconductor Substrate, Touch Panel Display, Fingerprint Sensor, and Others. The Touch Panel Display segment dominated the market in 2025 due to surging demand for high-performance smartphones, tablets, and wearables. Ultra-thin glass enhances touch responsiveness, improves display clarity, and provides a sleek form factor compatible with modern, compact device designs. Its scratch resistance and ability to support flexible or curved display layouts elevate its adoption in premium consumer electronics. Increasing production of screen-centric devices, reinforced by rising global digitalization, strengthens the segment’s leadership. Touch technology advancements and premium device penetration further sustain its large revenue share.

The Semiconductor Substrate segment is projected to witness the fastest growth from 2026 to 2033, driven by the increasing need for lightweight, thermally stable materials in advanced chip packaging. Ultra-thin glass offers excellent dimensional stability, low dielectric constant, and high-temperature resistance, making it an ideal substitute for traditional substrates. Growth is supported by rising demand for miniaturized chips, 3D packaging architectures, and high-density interconnects. Semiconductor manufacturers use ultra-thin glass for improved signal integrity and enhanced reliability in high-performance circuits. Expanding semiconductor fabrication capacity worldwide further accelerates adoption across integrated circuits and next-generation electronic components.

- By End-use Industry

On the basis of end-use industry, the market is segmented into Consumer Electronics, Automotive & Transportation, Medical & Healthcare, and Others. The Consumer Electronics segment dominated the market in 2025 owing to the widespread use of ultra-thin glass in smartphones, laptops, tablets, TVs, and wearables. Its exceptional optical clarity, lightweight nature, and compatibility with touch and flexible display technologies make it indispensable for device manufacturers. The rapid upgrade cycle in personal electronics and rising penetration of high-resolution and curved screens further strengthen demand. Major brands rely on ultra-thin glass for durable, premium device aesthetics and performance. Growing consumer preference for sleek, portable, and high-functionality devices ensures the segment’s continued leadership.

The Automotive & Transportation segment is projected to record the fastest growth from 2026 to 2033, driven by the surge in digital cockpit adoption, advanced driver-assistance interfaces, and smart display integration. Ultra-thin glass enables curved infotainment systems, instrument clusters, HUD displays, and touch-enabled vehicle controls. Automotive manufacturers choose this material for its high scratch resistance, thermal stability, and ability to enhance visual clarity under extreme conditions. Increasing production of electric and connected vehicles accelerates the use of sophisticated display components supported by ultra-thin glass. The shift toward immersive, screen-driven automotive interiors further fuels rapid segment expansion.

Ultra Thin Glass Market Regional Analysis

- Asia-Pacific dominated the ultra thin glass market with the largest revenue share of 39.4% in 2025, driven by strong consumer electronics manufacturing, growing adoption of advanced display technologies, and extensive presence of major glass processing hubs

- The region’s cost-effective production capabilities, rising investments in flexible display fabrication, and rapid expansion of semiconductor and touch panel manufacturing are accelerating overall market growth

- The availability of skilled labor, supportive government initiatives, and fast industrialization across developing economies are contributing to the increasing consumption of ultra thin glass across electronics, automotive, and medical applications

China Ultra Thin Glass Market Insight

China held the largest share in the Asia-Pacific ultra thin glass market in 2025 due to its global dominance in consumer electronics manufacturing and large-scale display panel production. The country’s mature supply chain, government-backed investments in OLED, micro-LED, and semiconductor technologies, and strong export capabilities significantly support market growth. Rising production of smartphones, wearables, and automotive digital interfaces continues to reinforce China’s leadership position.

India Ultra Thin Glass Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by expanding electronics manufacturing, rising smartphone assembly operations, and increasing investments in semiconductor and display panel infrastructure. Government initiatives promoting domestic manufacturing, such as the Production-Linked Incentive (PLI) schemes, are boosting adoption of advanced materials including ultra thin glass. Growing demand for medical devices and automotive infotainment systems further contributes to the region’s rapid expansion.

Europe Ultra Thin Glass Market Insight

The Europe ultra thin glass market is expanding steadily, supported by high demand for premium display technologies, strong automotive innovation, and increasing investment in microelectronics and medical device production. The region emphasizes quality, sustainability, and precision-engineered materials, driving the use of ultra thin glass in advanced optical, diagnostic, and automotive applications. Growth is further enhanced by rising adoption of smart consumer devices and high-performance electronic components.

Germany Ultra Thin Glass Market Insight

Germany’s ultra thin glass market is driven by its leadership in automotive innovation, precision engineering, and high-end electronics manufacturing. Strong R&D ecosystems, collaboration between research institutes and technology companies, and rising integration of digital cockpit displays support market growth. Demand is further supported by medical device advancements and increased deployment of specialty glass in industrial automation systems.

U.K. Ultra Thin Glass Market Insight

The U.K. market benefits from a well-established consumer electronics sector, expanding medical technology ecosystem, and rising adoption of advanced display interfaces across commercial and industrial applications. Efforts to strengthen domestic electronics supply chains and investments in flexible display research contribute to growing demand. Increased R&D activity in photonics, optical materials, and diagnostic devices further supports the U.K.’s role in high-value material innovation.

North America Ultra Thin Glass Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of flexible and foldable displays, growing semiconductor demand, and strong advancements in medical and diagnostic technologies. Increased investments in high-performance electronics, electric vehicles, and smart device ecosystems further accelerate the region’s need for ultra thin glass. Strategic collaborations between technology firms and material manufacturers also support long-term market expansion.

U.S. Ultra Thin Glass Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its strong electronics manufacturing base, leadership in medical device innovation, and significant investments in advanced materials. The country’s emphasis on high-quality display technologies, semiconductor development, and automotive digitalization drives steady demand for ultra thin glass. Presence of key technology companies and robust R&D capabilities further strengthen the U.S.’s leading role in the region.

Ultra Thin Glass Market Share

The ultra thin glass industry is primarily led by well-established companies, including:

- Corning Incorporated (U.S.)

- AGC Inc. (Japan)

- CSG HOLDING CO.,LTD. (China)

- SCHOTT (Germany)

- Nippon Electric Glass Co., Ltd. (Japan)

- Taiwan Glass Ind. Corp. (Taiwan)

- GENTEX CORPORATION (U.S.)

- JNS Glass & Coatings (U.S.)

- Abrisa Technologies (U.S.)

- Emerge Glass (Australia)

Latest Developments in Global Ultra Thin Glass Market

- In February 2025, Apple advanced toward launching its first foldable device after securing a major supply agreement with Lens Technology for ultra-thin glass (UTG), covering 70% of its requirements while Corning supplies the raw materials. This development strengthens the adoption of UTG in high-end foldable electronics, signaling strong demand growth for flexible glass solutions as Apple enters the foldable device ecosystem. The involvement of suppliers such as UTI, Dowoo Insys, and Samsung Display further accelerates the global expansion of the UTG supply chain and enhances the market’s long-term growth prospects

- In November 2024, Corning Inc. faced an EU antitrust probe regarding its exclusive Gorilla Glass distribution contracts, prompting regulators to request formal concessions. This scrutiny impacts the ultra thin glass market by increasing pressure for more open supplier competition, potentially reshaping pricing structures, supply agreements, and distribution models. Increased regulatory attention may encourage new entrants and diversify sourcing options across the European region

- In October 2024, SCHOTT AG announced expanded production capacity for its flexible ultra thin glass portfolio to support rising demand from foldable and rollable device manufacturers. This expansion strengthens supply availability for OEMs and reinforces SCHOTT’s role in scaling UTG manufacturing, contributing to market acceleration across consumer electronics and emerging display formats

- In June 2024, AGC Inc. introduced enhancements to its ultra thin glass product range aimed at improving bendability and optical uniformity for advanced OLED and sensor applications. This advancement increases material adoption among display panel producers and supports the transition toward lighter, thinner, and more energy-efficient devices, reinforcing AGC’s influence in the evolving UTG ecosystem

- In April 2024, Glass Acoustic Innovations Ltd. (GAIT) entered a collaboration with Nippon Electric Glass Co. (NEG) to advance ultra-thin glass diaphragm technology for high-fidelity speakers, headphones, and automotive audio systems. This collaboration strengthens the adoption of ultra thin glass in acoustic applications, positioning the material as a superior alternative due to its rigidity, clarity, and sound propagation characteristics. The partnership enhances the material’s penetration into the USD 756 billion audio market and expands UTG’s

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ultra Thin Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultra Thin Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultra Thin Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.