Global Ultra Wideband Uwb Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

5.38 Billion

2024

2032

USD

1.37 Billion

USD

5.38 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 5.38 Billion | |

|

|

|

|

Ultra-Wideband (UWB) Market Size

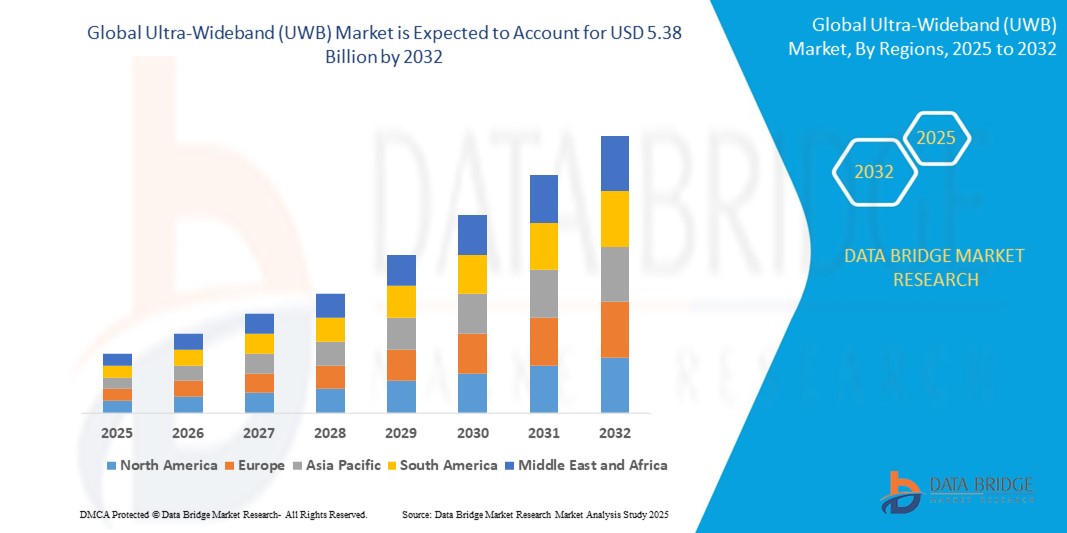

- The global ultra-wideband (UWB) market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 5.38 billion by 2032, at a CAGR of 18.67% during the forecast period

- This growth is driven by factors such as the increasing demand for precise indoor positioning systems, the rising adoption of IoT and connected devices, growing applications in automotive and consumer electronics, and the enhanced security and low-power consumption offered by UWB technology.

Ultra-Wideband (UWB) Market Analysis

- Ultra-wideband technology is increasingly integrated into consumer electronics, enhancing functionalities such as contactless payments and indoor navigation, driven by advancements in compact and cost-effective chipsets

- The automotive sector is adopting ultra-wideband for applications such as keyless entry and vehicle-to-everything communication, aiming to improve safety and convenience in modern vehicles

- North America is expected to dominate the Ultra-Wideband (UWB) market due to its strong technological infrastructure, the presence of major UWB players such as Apple and Google, and the high demand for UWB in sectors such as automotive, consumer electronics, and healthcare, driven by the need for precise location tracking and real-time data services

- Asia-Pacific is expected to be the fastest-growing region in the Ultra-Wideband (UWB) market during the forecast period due to rapid industrialization, increasing adoption of IoT devices, and a surge in demand for precise indoor positioning and real-time location services, particularly in countries such as China and India

- The real time locating systems (RTLS)/WSN) segment is expected to dominate the Ultra-Wideband (UWB) market with the largest share of 52.86% in 2025 due to its ability to provide precise and reliable indoor positioning, which is increasingly being adopted across various industries such as healthcare, retail, and logistics for asset tracking, personnel monitoring, and workflow optimization

Report Scope and Ultra-Wideband (UWB) Market Segmentation

|

Attributes |

Ultra-Wideband (UWB) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Ultra-Wideband (UWB) Market Trends

“Integration of Ultra-Wideband in Smart Consumer Devices”

- Smartphones are increasingly equipped with ultra-wideband chips to offer precise device-to-device communication and location-based services

- For instance, Apple’s U1 chip in iPhones enables pinpoint AirTag tracking and spatial awareness for AirDrop

- Wearables are leveraging ultra-wideband to support secure proximity-based authentication and enhanced contextual responses

- For instance, smartwatches use ultra-wideband to unlock devices automatically when in range

- Smart home ecosystems are adopting ultra-wideband for seamless device integration and automation triggers

- Consumer electronics companies are embedding ultra-wideband to enable richer user experiences through precise spatial context

- The rising demand for smart, interconnected devices is fueling innovation and broader deployment of ultra-wideband technology

Ultra-Wideband (UWB) Market Dynamics

Driver

“Rising Demand for Precise Indoor Positioning Systems”

- The increasing demand for accurate indoor positioning systems is driving the ultra-wideband market

- For instance, Ultra-wideband offers centimeter-level precision, making it ideal for indoor environments such as hospitals, warehouses, airports, and malls

- In healthcare, ultra-wideband is being used to track medical equipment in real time, reducing search time and improving efficiency

- For instance, hospitals are using ultra-wideband to track critical assets such as wheelchairs and infusion pumps, ensuring quick availability

- Retailers are adopting ultra-wideband to enhance customer experiences through location-based services

- Businesses are using ultra-wideband to monitor employee movements for safety and productivity in environments such as warehouses

- As industries continue to digitally transform and rely more on real-time data, ultra-wideband is becoming the preferred choice for indoor navigation and tracking systems

Opportunity

“Expansion into Automotive Applications”

- Ultra-wideband is gaining traction in the automotive sector, offering a key opportunity for market expansion

- For instance, the technology is being explored for keyless entry, in-cabin gesture control, and vehicle-to-vehicle communication

- Ultra-wideband enhances digital car keys by providing precise proximity detection, improving security and convenience

- For instance, automakers such as BMW and Audi integrate ultra-wideband into their smart key systems to prevent unauthorized access

- The technology is being used to detect driver presence and enable seamless vehicle personalization

- Ultra-wideband supports advanced driver assistance systems (ADAS) by offering accurate distance and directional data

- As vehicles become more connected and software-driven, ultra-wideband is positioned as a reliable solution for automotive applications

Restraint/Challenge

“High Implementation Cost and Integration Complexity”

- The adoption of ultra-wideband faces challenges due to high implementation costs and integration complexity

- For instance, Ultra-wideband requires specialized hardware, such as dedicated chips and antennas, increasing production costs for manufacturers

- Small and mid-sized companies find it difficult to afford the upfront investments required for ultra-wideband integration

- For instance, many companies already using Bluetooth or Wi-Fi technologies may hesitate to add ultra-wideband due to the added cost

- Integrating ultra-wideband into existing systems is technically complex, requiring hardware redesign and software adjustments

- The complexity of ultra-wideband also extends to the development of new applications, requiring precise calibration and signal optimization

- The limited availability of skilled professionals with experience in ultra-wideband systems contributes to slower adoption

Ultra-Wideband (UWB) Market Scope

The market is segmented on the basis of type, system type, technology, application, service, end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By System Type |

|

|

By Technology |

|

|

By Application |

|

|

By Service |

|

|

By End User |

|

In 2025, the real time locating systems (RTLS)/WSN) is projected to dominate the market with a largest share in application segment

The real time locating systems (RTLS)/WSN) segment is expected to dominate the Ultra-Wideband (UWB) market with the largest share of 52.86% in 2025 due to its ability to provide precise and reliable indoor positioning, which is increasingly being adopted across various industries such as healthcare, retail, and logistics for asset tracking, personnel monitoring, and workflow optimization.

The imaging systems is expected to account for the largest share during the forecast period in system type market

In 2025, the imaging systems segment is expected to dominate the market with the largest market share due to its application in high-resolution imaging and sensing, offering enhanced capabilities in industries such as healthcare, automotive, and consumer electronics.

Ultra-Wideband (UWB) Market Regional Analysis

“North America Holds the Largest Share in the Ultra-Wideband (UWB) Market”

- North America is expected to remain the dominant region in the UWB market with a largest market share of 35.53%

- The U.S. is a major contributor, with companies such as Apple, Google, and Intel incorporating UWB into their products, ensuring continued market leadership

- Canada is experiencing notable growth, particularly in industrial automation and real-time location systems, where UWB is used for asset tracking and operational efficiency

- The region’s strong focus on technological innovation and early adoption of UWB in consumer and industrial applications supports its market dominance

- North America continues to lead in UWB-based solutions for smart devices, automotive, and healthcare, maintaining a strong presence in both commercial and residential applications

“Asia-Pacific is Projected to Register the Highest CAGR in the Ultra-Wideband (UWB) Market”

- Asia-Pacific region is the fastest-growing market for ultra-wideband (UWB) technology, this growth is driven by rapid technological advancements and a surge in the adoption of smart devices across various sectors such as automotive, consumer electronics, and healthcare

- China is leading the UWB market in Asia-Pacific due to its robust manufacturing sector and increasing integration of UWB in smart products and infrastructure

- India is also experiencing significant growth, particularly in automotive and consumer electronics, where UWB is being adopted for enhanced vehicle safety features and device connectivity

- The region’s rapid industrialization, along with the growing demand for precise tracking and location services, contributes to its fast-paced market expansion

- Several governments in Asia-Pacific are investing in smart city initiatives, which are expected to drive the adoption of UWB technology in urban development projects

Ultra-Wideband (UWB) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NXP Semiconductors (Netherlands)

- Texas Instruments Incorporated (U.S.)

- SAMSUNG (South Korea)

- Stanley Black & Decker, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Honeywell International Inc. (U.S.)

- 3M (U.S.)

- Emerson Electric Co. (U.S.)

- Apple Inc. (U.S.)

- Taiyo Yuden Co Ltd. (Japan)

- Zebra Technologies Inc. (U.S.)

- Fractus Antennas S.L. (Spain)

- Nanotron Technologies GmbH (Germany)

- Alereon, Inc. (U.S.)

- Pulse LINK, Inc. (U.S.)

- 5D Robotics, Inc. (U.S.)

- Johanson Technology, Inc. (U.S.)

- DecaWave Ltd. (Ireland)

- BeSpoon SAS (France)

Latest Developments in Global Ultra-Wideband (UWB) Market

- In February 2024, Ceva, Inc., a leading provider of ultra-low-power IP, introduced a new low-power Ultra-Wideband (UWB) IP solution compliant with FiRa 2.0 standards. This advanced solution is designed for consumer and industrial IoT applications, offering highly accurate and reliable wireless ranging capabilities. The development aims to enhance the performance and power efficiency of UWB-enabled devices, making them ideal for applications such as asset tracking, smart home devices, and automotive systems. The new IP will drive innovation in UWB technology by enabling more energy-efficient and precise location-based services. This development is expected to strengthen Ceva’s position in the growing UWB market, which is experiencing increasing demand for accurate indoor positioning systems

- In October 2023, Infineon Technologies acquired Zurich-based start-up 3db Access AG, a pioneer in secured low-power Ultra-Wideband (UWB) technology. This acquisition strengthens Infineon's portfolio for secured smart access, precise localization, and enhanced sensing. By integrating 3db's expertise, Infineon aims to accelerate its IoT roadmap, addressing automotive, industrial, and consumer IoT applications. The combined strengths enable the development of full system solutions with low-power consumption, enhanced physical layer security, and localization-optimized hardware architecture. This strategic move positions Infineon to meet the growing demand for UWB technology in various sectors, enhancing its competitive edge in the UWB market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ultra Wideband Uwb Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultra Wideband Uwb Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultra Wideband Uwb Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.