Global Ultrapure Water Market

Market Size in USD Billion

CAGR :

%

USD

9.55 Billion

USD

17.41 Billion

2024

2032

USD

9.55 Billion

USD

17.41 Billion

2024

2032

| 2025 –2032 | |

| USD 9.55 Billion | |

| USD 17.41 Billion | |

|

|

|

|

Ultrapure Water Market Size

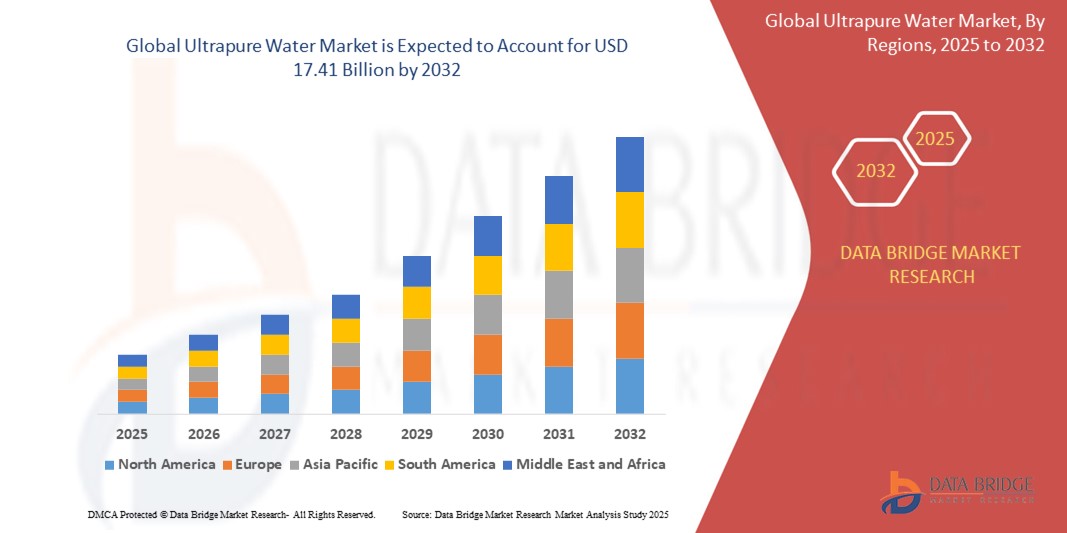

- The global ultrapure water market size was valued at USD 9.55 billion in 2024 and is expected to reach USD 17.41 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by the increasing demand for high-purity water across critical industries such as semiconductors, pharmaceuticals, and flat panel displays, where even minimal contamination can compromise product quality and process integrity

- Furthermore, ongoing advancements in purification technologies such as reverse osmosis, electrodeionization, and ultrafiltration are enhancing system efficiency and reliability, driving widespread adoption of ultrapure water systems and significantly boosting the industry's growth

Ultrapure Water Market Analysis

- Ultrapure water (UPW) has been purified to an exceptionally high level to remove contaminants and impurities. This type of water typically undergoes multiple purification processes, such as reverse osmosis, deionization, and distillation, to achieve a level of purity that exceeds that of standard drinking water

- The escalating demand for ultrapure water is primarily driven by the rapid growth of high-tech manufacturing, strict regulatory standards for water quality, and the expanding use of advanced purification technologies to meet evolving industrial requirements

- North America dominated the ultrapure water market with a share of 40.5% in 2024, due to strong demand from the semiconductor and pharmaceutical industries, where stringent water purity standards are critical for operational precision

- Asia-Pacific is expected to be the fastest growing region in the ultrapure water market during the forecast period due to large-scale expansion in the semiconductor, flat panel display, and pharmaceutical sectors

- Pre-treatment segment dominated the market with a market share of 61.9% in 2024, due to its essential role in removing bulk contaminants before water undergoes final polishing stages. Proper pre-treatment safeguards downstream equipment and enhances the overall life cycle and performance of ultrapure water systems

Report Scope and Ultrapure Water Market Segmentation

|

Attributes |

Ultrapure Water Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultrapure Water Market Trends

“Advanced Integration of Multi-Stage Filtration Systems”

- A prominent and accelerating trend in the ultrapure water market is the increasing deployment of multi-stage purification systems integrating technologies such as reverse osmosis (RO), ultrafiltration, and electrodeionization (EDI) to meet the ultra-stringent purity levels required across advanced manufacturing sectors

- For instance, Samyang Corporation launched Trilite RO and Trilite EDI to strengthen its high-purity water portfolio, targeting the microelectronics and pharmaceutical sectors with precise and scalable solutions

- These filtration systems enable the removal of microscopic contaminants and ionic impurities, ensuring reliable and repeatable water quality essential for sensitive applications such as semiconductor fabrication and biopharmaceutical production

- Leading manufacturers are investing in process automation and smart sensors to maintain system integrity and reduce downtime, offering continuous compliance with evolving quality standards

- This shift toward integrated, intelligent ultrapure water solutions is setting a new benchmark for water treatment performance and is expected to reshape industry expectations across critical end-use verticals

- The demand for advanced, interconnected ultrapure water systems is growing rapidly as manufacturers prioritize contamination control, process stability, and reduced total cost of ownership in high-tech industries

Ultrapure Water Market Dynamics

Driver

“Surging Demand from the Semiconductor Sector”

- The rising demand for ultrapure water is largely driven by the expanding global semiconductor industry, where ultrapure water is a critical input in wafer production, photolithography, and etching processes

- For instance, Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung are ramping up their fab investments in the U.S. and South Korea, driving significant demand for ultrapure water systems to support their production capacities

- The increasing complexity of chips and the shift toward smaller nanometer nodes require even higher purity levels, prompting manufacturers to invest in cutting-edge water treatment technologies

- The integration of UPW systems into semiconductor fabs is no longer optional but a foundational infrastructure, making the industry one of the most influential drivers of market expansion. As the global race to lead in advanced chipmaking continues, new fab construction in regions such as the U.S., Japan, and Europe will fuel long-term demand for UPW solutions tailored to semiconductor-grade standards

- The industry’s critical dependence on ultrapure water for consistent yield and defect reduction ensures sustained investment in purification infrastructure across the entire value chain

Restraint/Challenge

“High System Costs and Operational Complexity”

- A major challenge for the ultrapure water market is the high capital and operational cost associated with maintaining advanced water purification systems capable of meeting strict industry specifications

- For instance, achieving and maintaining resistivity of 18.2 MΩ·cm and sub-ppb organic content demands extensive multi-step treatment, continuous monitoring, and frequent maintenance, significantly increasing total cost of ownership

- Small and medium-sized enterprises often struggle to justify these costs, particularly in industries with moderate purity requirements or tighter budget constraints. In addition, the complexity of operating and troubleshooting such systems requires highly trained personnel and specialized knowledge, creating an additional barrier for broader adoption

- The need for ongoing replacement of membranes, EDI stacks, and pre-treatment filters further contributes to recurring expenditure, making cost optimization a top concern

- Reducing system complexity, automating maintenance protocols, and offering modular, scalable solutions will be essential to make ultrapure water systems more accessible and economical across industries

Ultrapure Water Market Scope

The market is segmented on the basis of equipment, application, technologies, treatment process, and end use.

• By Equipment

On the basis of equipment, the ultrapure water market is segmented into filtration, consumables, and others. The filtration segment accounted for the largest market revenue share in 2024, driven by the critical role filtration systems play in eliminating micro-contaminants from water used in high-purity industrial processes. These systems are essential in industries such as semiconductors and pharmaceuticals where even minute impurities can compromise product integrity. The robustness, precision, and repeatability of advanced filtration solutions make them indispensable in ensuring consistent ultrapure water output.

The consumables segment is projected to witness the fastest growth rate from 2025 to 2032, supported by continuous demand for cartridges, membranes, and resins that require regular replacement. As water treatment processes become more rigorous and regulatory compliance more demanding, the frequent replacement of consumables ensures system efficiency and purity levels, especially in fast-evolving sectors such as electronics and biotechnology.

• By Application

On the basis of application, the ultrapure water market is segmented into washing fluid and process feed. The process feed segment held the largest market share in 2024 due to its fundamental role in manufacturing environments that demand consistent water quality, such as microelectronics and pharmaceuticals. Process feed water ensures optimal operational output and protects sensitive instruments from contamination or degradation, thus reducing downtime and improving productivity.

The washing fluid segment is expected to grow at the fastest pace from 2025 to 2032, propelled by increasing usage in precision cleaning tasks. Industries such as flat panel display manufacturing and solar cells require ultrapure water for rinsing to prevent microscopic residue formation, ensuring defect-free products and reducing rework rates.

• By Technologies

On the basis of technologies, the market is categorized into reverse osmosis (RO), ion exchange, ultrafiltration, tank vent filtration, resin trap filtration, degasification, electrode ionization, and others. Reverse osmosis (RO) dominated the market revenue in 2024, owing to its proven effectiveness in removing dissolved salts, organic material, and microbial contaminants. RO systems form the core of most ultrapure water setups due to their reliability, scalability, and relatively lower operational costs.

Electrode ionization is projected to record the fastest growth from 2025 to 2032, driven by its chemical-free operation, lower maintenance needs, and ability to produce high-resistivity water continuously. As industries aim to reduce chemical waste and environmental impact, the demand for advanced, sustainable purification methods such as EDI continues to rise.

• By Treatment Process

On the basis of treatment process, the ultrapure water market is divided into pre-treatment and roughening and polishing. The pre-treatment segment led the market in terms of revenue with a share of 61.9% in 2024, driven by its essential role in removing bulk contaminants before water undergoes final polishing stages. Proper pre-treatment safeguards downstream equipment and enhances the overall life cycle and performance of ultrapure water systems.

The roughening and polishing segment is expected to experience the highest CAGR from 2025 to 2032 due to increasing demand for ultra-high purity levels in advanced electronics and pharmaceutical formulations. These stages ensure the final product water meets stringent conductivity and total organic carbon (TOC) standards, vital for defect-free output in critical manufacturing applications.

• By End Use

On the basis of end use, the market is segmented into semiconductors, coal fired power, flat panel display, pharmaceuticals, gas turbine power, and others. The semiconductors segment dominated the market in 2024, with high demand stemming from the industry's extreme sensitivity to contamination. Ultrapure water is used extensively in wafer rinsing, photolithography, and etching, where microscopic residues can result in defective chips or reduced yields.

The flat panel display segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by rapid expansion in consumer electronics and increasing production of OLED and LCD screens. Ultrapure water is critical in the cleaning and development steps of panel fabrication, ensuring the optical clarity and functionality of displays remain uncompromised.

Ultrapure Water Market Regional Analysis

- North America dominated the ultrapure water market with the largest revenue share of 40.5% in 2024, driven by strong demand from the semiconductor and pharmaceutical industries, where stringent water purity standards are critical for operational precision

- The region’s established manufacturing base, combined with investments in microelectronics and biotechnology, supports extensive use of ultrapure water systems across fabrication, research, and process development

- Advanced technological infrastructure, strict regulatory guidelines, and an emphasis on sustainable production practices further drive adoption of high-performance water purification technologies across North America

U.S. Ultrapure Water Market Insight

The U.S. ultrapure water market captured the largest revenue share in 2024 within North America, propelled by its leadership in semiconductor manufacturing and biotechnology research. Major chipmakers and pharmaceutical companies continue to invest in facility expansions that demand highly purified water for wafer processing, drug formulation, and cleaning. The presence of leading ultrapure water system providers, coupled with regulatory pressures to maintain zero-contamination environments, fuels market growth. In addition, innovations in membrane filtration and ion exchange technologies are being rapidly adopted to meet evolving production needs.

Europe Ultrapure Water Market Insight

The Europe ultrapure water market is projected to grow at a healthy CAGR over the forecast period, supported by the rising focus on sustainable industrial processes and stringent EU directives governing water quality. The pharmaceutical and precision manufacturing sectors are key contributors to demand, with increasing investments in cleanroom and R&D infrastructure. European industries prioritize energy-efficient and low-chemical purification solutions, encouraging the shift toward advanced technologies such as electrodeionization. The market is also seeing increased installations in renewable energy and battery manufacturing segments.

U.K. Ultrapure Water Market Insight

The U.K. ultrapure water market is expected to expand at a steady CAGR through 2032, driven by the country’s growing pharmaceutical and electronics sectors. Companies are upgrading their purification infrastructure to meet export-grade production standards and ensure regulatory compliance. The emphasis on research and clean manufacturing, supported by government initiatives in healthcare and innovation, continues to push the demand for ultrapure water. The market also benefits from increasing interest in modular and compact purification systems suitable for both industrial and laboratory-scale applications.

Germany Ultrapure Water Market Insight

The Germany ultrapure water market is anticipated to witness significant growth, led by the nation’s robust engineering, automotive, and healthcare sectors. German manufacturers demand ultrapure water for precision cleaning, electronic assembly, and pharmaceutical synthesis. High environmental standards and a preference for green technologies are encouraging the deployment of water systems with minimal chemical footprint and high recovery rates. Germany’s focus on automation and Industry 4.0 integration further accelerates the adoption of digitally monitored water purification systems.

Asia-Pacific Ultrapure Water Market Insight

The Asia-Pacific ultrapure water market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by large-scale expansion in the semiconductor, flat panel display, and pharmaceutical sectors across China, South Korea, Japan, and India. Rapid industrialization, favorable government policies for electronics manufacturing, and rising foreign investments are driving demand. Regional manufacturers are increasingly upgrading their purification technologies to meet international quality benchmarks, while the availability of local component suppliers makes ultrapure water systems more accessible and cost-effective.

Japan Ultrapure Water Market Insight

The Japan ultrapure water market is advancing steadily due to its leading position in electronics, nanotechnology, and pharmaceutical manufacturing. The country’s focus on innovation and stringent quality control standards fosters high adoption of ultrapure water systems across R&D labs and industrial facilities. With a mature infrastructure and a high demand for precision manufacturing, Japanese industries prioritize continuous water quality monitoring and advanced treatment techniques such as degasification and EDI, especially in semiconductor fabs and biotechnology labs.

China Ultrapure Water Market Insight

The China ultrapure water market held the largest share in Asia-Pacific in 2024, driven by aggressive expansion of semiconductor fabs, solar panel production, and pharmaceutical manufacturing. With national initiatives such as “Made in China 2025,” demand for ultrapure water has intensified across high-tech sectors. Domestic and multinational companies are heavily investing in advanced water systems to meet rising product quality requirements. The presence of cost-competitive system integrators and rapid urban industrial development continue to strengthen China’s dominance in the regional market.

Ultrapure Water Market Share

The ultrapure water industry is primarily led by well-established companies, including:

- Dow (U.S.)

- General Electric (U.S.)

- Pall Corporation (U.S.)

- Veolia (France)

- Ovivo (Canada)

- DRINK EVOCUS (India)

- Osmoflo (Australia)

- MANN+HUMMEL (Germany)

- Pentair (U.S.)

- Kurita Water Industries Ltd. (Japan)

- Memstar USA (U.S.)

- Synder Filtration, Inc., (U.S.)

- Koch Separation Solutions (U.S.)

- NX Filtration BV (Netherlands)

- Evoqua Water Technologies LLC (U.S.)

Latest Developments in Global Ultrapure Water Market

- In June 2024, Sartorius introduced the Arium Mini Extend with a flexible arm for versatile Type 1 water dispensing, enhancing convenience and adaptability in laboratory environments. This innovation is expected to strengthen the ultrapure water market by addressing growing demand for compact, user-friendly, and high-precision water purification systems in research and pharmaceutical settings

- In December 2023, Samyang Corporation launched two new products under its Trilite brand—Trilite RO membrane and Trilite EDI—marking a significant advancement in core water purification technologies. These additions are likely to drive market growth by expanding high-efficiency solutions for reverse osmosis and electrodeionization, particularly in industrial and semiconductor applications requiring consistent ultrapure water quality

- In June 2022, Evoqua Water Technologies revealed its plans to inaugurate a new manufacturing plant in Singapore. This strategic move aims to bolster the company's presence in the Asia-Pacific region, responding to the escalating need for advanced water treatment solutions

- In November 2022, Merck announced the launch of its latest Milli-Q Ultrapure Water System during a live virtual event on November 22nd, catering to its customers in India. The company expanded its ultrapure water portfolio with the introduction of the Milli-Q EQ 7008/16 Water Purification System, enhancing its benchtop water system offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ultrapure Water Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultrapure Water Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultrapure Water Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.