Global Unbleached Softwood Kraft Pulp Market

Market Size in USD Billion

CAGR :

%

USD

35.11 Billion

USD

51.10 Billion

2025

2033

USD

35.11 Billion

USD

51.10 Billion

2025

2033

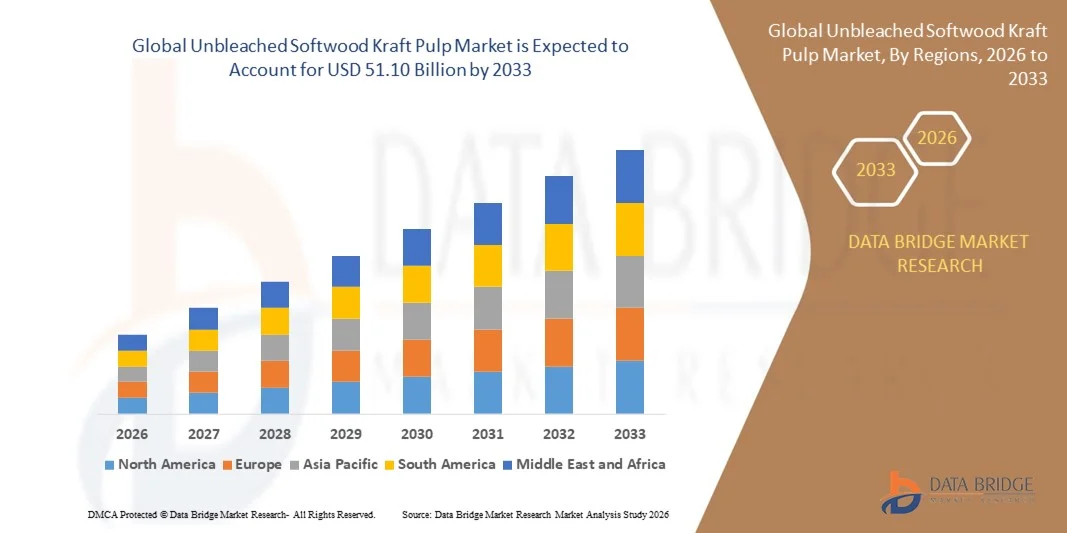

| 2026 –2033 | |

| USD 35.11 Billion | |

| USD 51.10 Billion | |

|

|

|

|

Unbleached Softwood Kraft Pulp Market Size

- The global unbleached softwood kraft pulp market size was valued at USD 35.11 billion in 2025 and is expected to reach USD 51.10 billion by 2033, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the rising demand for sustainable, recyclable, and high-strength paper materials across packaging, tissue, and industrial paper applications, driven by increasing environmental regulations and corporate sustainability commitments

- Furthermore, growing e-commerce activity, expansion of food and beverage packaging, and the shift away from plastic-based materials are reinforcing the preference for unbleached softwood kraft pulp, collectively accelerating market adoption and supporting steady industry growth

Unbleached Softwood Kraft Pulp Market Analysis

- Unbleached softwood kraft pulp, known for its superior fiber strength, durability, and eco-friendly characteristics, plays a critical role in the production of packaging boards, sacks, cartons, and specialty papers across both consumer and industrial end uses

- The escalating demand for robust, biodegradable, and cost-effective paper solutions, combined with advancements in pulping technologies and increasing emphasis on circular economy practices, is driving consistent growth in the unbleached softwood kraft pulp market

- North America dominated the unbleached softwood kraft pulp market with a share of 35.9% in 2025, due to high demand from packaging, tissue, and paper industries, as well as the presence of established pulp manufacturers

- Asia-Pacific is expected to be the fastest growing region in the unbleached softwood kraft pulp market during the forecast period due to rising urbanization, industrialization, and packaging demand in countries such as China, India, and Japan

- Northern unbleached softwood kraft pulp segment dominated the market with a market share of 58.5% in 2025, due to its superior fiber quality, higher strength, and suitability for high-performance paper and packaging products. Manufacturers and paper producers often prefer Northern pulp for premium applications due to its consistent fiber length and excellent durability. The segment’s dominance is further supported by established production infrastructure in key regions and its compatibility with various paper grades, enhancing overall product versatility and reliability

Report Scope and Unbleached Softwood Kraft Pulp Market Segmentation

|

Attributes |

Unbleached Softwood Kraft Pulp Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Unbleached Softwood Kraft Pulp Market Trends

Rising Adoption of Sustainable and Recyclable Paper-Based Packaging

- A major trend in the unbleached softwood kraft pulp market is the accelerating shift toward sustainable and recyclable paper-based packaging driven by tightening environmental regulations and corporate sustainability targets. Industries are increasingly replacing plastic and bleached paper materials with stronger, biodegradable pulp-based alternatives to reduce environmental impact

- For instance, Smurfit Kappa Group plc extensively uses unbleached softwood kraft pulp in its paper-based packaging solutions to support recyclable and low-carbon packaging portfolios. This adoption strengthens demand for high-strength pulp that aligns with circular economy goals across food, retail, and industrial packaging

- The growth of e-commerce and logistics packaging is further amplifying the need for durable and tear-resistant paper materials. Unbleached softwood kraft pulp offers superior fiber strength, making it suitable for corrugated boxes and protective packaging used in long-distance transportation

- Consumer preference for natural and minimally processed materials is also influencing packaging design, favoring unbleached paper products for their natural appearance and perceived environmental benefits. This trend is gaining traction among global brands focused on eco-conscious branding strategies

- Manufacturers are increasingly investing in pulp solutions that support recyclability without compromising performance. The rising emphasis on sustainable sourcing and forest certification is reinforcing the adoption of unbleached softwood kraft pulp across global paper value chains

- Overall, the transition toward environmentally responsible packaging solutions is positioning unbleached softwood kraft pulp as a core raw material supporting long-term sustainability trends across multiple end-use industries

Unbleached Softwood Kraft Pulp Market Dynamics

Driver

Increasing Demand for High-Strength Pulp in Packaging and Industrial Applications

- The growing demand for high-strength pulp in packaging and industrial paper products is a key driver of the unbleached softwood kraft pulp market. Industries require materials that provide durability, load-bearing capacity, and resistance to tearing, especially for sacks, cartons, and industrial wrapping papers

- For instance, International Paper Company utilizes unbleached softwood kraft pulp extensively in the production of industrial packaging grades that require enhanced strength and performance. These applications support heavy-duty packaging needs across construction, chemicals, and agricultural supply chains

- The expansion of food and beverage packaging is further fueling demand for pulp that ensures structural integrity while meeting sustainability standards. Unbleached softwood kraft pulp delivers consistent fiber quality suitable for both primary and secondary packaging

- Industrial applications such as cement bags and protective liners rely heavily on high-tensile pulp to prevent material failure during handling and transportation. This dependence strengthens long-term demand from industrial end users

- Technological improvements in pulping and fiber processing are enhancing strength characteristics while improving production efficiency. These advancements support broader adoption across high-performance paper applications. Collectively, the rising reliance on strong, durable, and sustainable paper materials is significantly driving the growth of the unbleached softwood kraft pulp market

Restraint/Challenge

Volatility in Raw Material Prices and Forestry Supply Constraints

- The unbleached softwood kraft pulp market faces challenges related to volatility in raw material prices and constraints in sustainable forestry supply. Fluctuations in wood fiber availability directly impact production costs and supply stability for pulp manufacturers

- For instance, Canfor Corporation has highlighted the impact of timber supply limitations and rising logging costs on pulp production economics. These factors affect long-term pricing strategies and profit margins across the pulp and paper industry

- Stricter forestry regulations and reduced harvesting permits in key producing regions are limiting access to consistent raw material supply. While these measures support sustainability, they also introduce operational complexity for manufacturers

- Natural disruptions such as wildfires and climate-related events further affect forest availability, increasing uncertainty in pulp sourcing. These disruptions contribute to supply chain instability and cost unpredictability

- Overall, raw material price volatility and forestry constraints remain critical challenges that influence production planning, pricing stability, and long-term market growth for unbleached softwood kraft pulp

Unbleached Softwood Kraft Pulp Market Scope

The market is segmented on the basis of product type, grade, application, and end use.

- By Product Type

On the basis of product type, the unbleached softwood kraft pulp market is segmented into Northern Unbleached Softwood Kraft Pulp, Southern Unbleached Softwood Kraft Pulp, and Others. The Northern Unbleached Softwood Kraft Pulp segment dominated the market with the largest market revenue share of 58.5% in 2025, driven by its superior fiber quality, higher strength, and suitability for high-performance paper and packaging products. Manufacturers and paper producers often prefer Northern pulp for premium applications due to its consistent fiber length and excellent durability. The segment’s dominance is further supported by established production infrastructure in key regions and its compatibility with various paper grades, enhancing overall product versatility and reliability.

The Southern Unbleached Softwood Kraft Pulp segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand from emerging economies and expanding paper and packaging industries. For instance, companies such as Suzano Pulp are increasing their production capacities in Latin America to cater to the growing demand for cost-effective yet strong pulp solutions. Southern pulp offers competitive pricing, sustainable sourcing options, and efficient processing characteristics, making it an attractive choice for manufacturers in both packaging and tissue segments. The segment’s growth is further supported by technological advancements in pulping processes and expanding downstream applications across multiple industries.

- By Grade

On the basis of grade, the unbleached softwood kraft pulp market is segmented into Chemical Unbleached Softwood Kraft Pulp, Mechanical Unbleached Softwood Kraft Pulp, and Others. The Chemical Unbleached Softwood Kraft Pulp segment dominated the market in 2025 due to its higher strength, durability, and suitability for premium paper and packaging products. Chemical pulp is preferred for applications requiring superior tear resistance and dimensional stability, making it the first choice for high-end printing, packaging, and specialty papers. Its dominance is reinforced by widespread adoption among major paper producers who prioritize quality, consistency, and performance for industrial and commercial use.

The Mechanical Unbleached Softwood Kraft Pulp segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing adoption in cost-sensitive applications such as newsprint and low-grade packaging. For instance, International Paper has expanded its mechanical pulp production to meet rising regional demand for affordable yet reliable pulp solutions. Mechanical pulp provides energy-efficient processing, reduced chemical use, and suitability for large-volume production, which appeals to manufacturers seeking sustainable and economical options. The segment’s growth is further supported by its ability to meet evolving environmental standards and increasing demand in emerging markets.

- By Application

On the basis of application, the unbleached softwood kraft pulp market is segmented into Printing and Writing, Newsprint, Packaging, Tissue & Toilet Papers, and Others. The Packaging segment dominated the market in 2025, driven by the global surge in e-commerce, retail, and sustainable packaging solutions. Packaging manufacturers favor unbleached softwood kraft pulp due to its high tensile strength, durability, and ability to produce sturdy, recyclable, and eco-friendly cartons and paperboards. The segment’s growth is supported by consumer preference for environmentally responsible packaging and government regulations promoting sustainable materials in industrial and retail packaging.

The Tissue & Toilet Papers segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising hygiene awareness, increasing population, and urbanization in developing regions. For instance, companies such as Kimberly-Clark are expanding their tissue product lines using unbleached pulp to meet growing demand for soft, durable, and environmentally friendly hygiene products. Tissue applications benefit from pulp’s absorbency, softness, and high-quality fiber characteristics, making it ideal for personal care and hygiene products. The segment’s growth is further accelerated by increased production capacities and rising disposable income in emerging markets.

- By End Use

On the basis of end use, the unbleached softwood kraft pulp market is segmented into Packaging, Food & Beverages, Building and Construction, Agriculture and Allied Industries, Chemicals, Cosmetics & Personal Care, Electrical & Electronics, and Non-Packaging. The Packaging segment dominated the market in 2025, driven by growing e-commerce, retail distribution, and demand for sustainable, recyclable materials. Manufacturers favor unbleached pulp for producing robust cartons, boards, and containers that maintain structural integrity while being eco-friendly. The segment’s dominance is reinforced by global regulations and corporate sustainability initiatives that promote the adoption of recyclable and biodegradable packaging solutions.

The Food & Beverages segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for safe, hygienic, and sustainable food packaging. For instance, Smurfit Kappa has increased its production of unbleached pulp-based packaging to meet the expanding needs of food and beverage companies worldwide. Pulp in this sector ensures strong barrier properties, high durability, and environmental compliance, making it suitable for containers, cartons, and other packaging applications. The segment’s growth is further supported by increasing processed food consumption and a shift toward sustainable and premium packaging solutions.

Unbleached Softwood Kraft Pulp Market Regional Analysis

- North America dominated the unbleached softwood kraft pulp market with the largest revenue share of 35.9% in 2025, driven by high demand from packaging, tissue, and paper industries, as well as the presence of established pulp manufacturers

- Consumers and businesses in the region highly value the superior fiber quality, durability, and performance characteristics offered by unbleached softwood kraft pulp for high-strength applications such as cartons, boards, and specialty papers

- This widespread adoption is further supported by advanced production infrastructure, technological expertise, and regulatory standards favoring sustainable and recyclable paper products, establishing unbleached softwood kraft pulp as a preferred raw material in North America

U.S. Unbleached Softwood Kraft Pulp Market Insight

The U.S. unbleached softwood kraft pulp market captured the largest revenue share in 2025 within North America, fueled by the strong packaging and tissue manufacturing sectors. Rising demand for durable, eco-friendly paper and packaging products is encouraging manufacturers to adopt high-quality pulp solutions. The growing trend of sustainable and recyclable materials in commercial and consumer packaging further propels market growth. Moreover, technological advancements in pulping and processing, coupled with integration into high-performance paper applications, are driving market expansion in the U.S.

Europe Unbleached Softwood Kraft Pulp Market Insight

The Europe unbleached softwood kraft pulp market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the growing need for sustainable paper products and eco-friendly packaging solutions. Increased urbanization and demand for high-strength paperboards are fostering adoption of unbleached pulp. European consumers and manufacturers are also drawn to the fiber’s superior durability and environmental benefits. The region is witnessing strong growth across packaging, tissue, and printing applications, with unbleached softwood kraft pulp being incorporated into both industrial and commercial paper production.

U.K. Unbleached Softwood Kraft Pulp Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for sustainable packaging and premium-quality paper products. Environmental regulations promoting recyclable and biodegradable materials are encouraging manufacturers to adopt unbleached softwood kraft pulp. The UK’s focus on innovative and high-performance packaging, coupled with the expansion of e-commerce and retail sectors, is expected to continue stimulating market growth.

Germany Unbleached Softwood Kraft Pulp Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing adoption of eco-conscious paper products and sustainable packaging solutions. Germany’s well-developed manufacturing infrastructure and emphasis on innovation support the use of unbleached softwood kraft pulp in high-strength paperboards and specialty papers. The integration of high-quality pulp into packaging and tissue applications is becoming increasingly prevalent, with strong demand for environmentally compliant solutions aligning with local consumer expectations.

Asia-Pacific Unbleached Softwood Kraft Pulp Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, industrialization, and packaging demand in countries such as China, India, and Japan. The region’s growing manufacturing base and expansion of paper and tissue production facilities are driving the adoption of unbleached softwood kraft pulp. Furthermore, government initiatives promoting sustainable production and the availability of competitively priced pulp are expanding market penetration across the region.

Japan Unbleached Softwood Kraft Pulp Market Insight

The Japan market is gaining momentum due to high demand for premium-quality paper and packaging materials. Japanese manufacturers emphasize durability, fiber quality, and environmental compliance, driving the adoption of unbleached softwood kraft pulp. Integration into tissue, packaging, and specialty paper applications is fueling growth. Moreover, Japan’s aging population and preference for high-performance, sustainable products are expected to support continued market expansion.

China Unbleached Softwood Kraft Pulp Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrial growth, rising e-commerce, and the expanding packaging and tissue industries. China’s strong domestic manufacturing base, coupled with high demand for recyclable and durable paper products, is propelling market growth. The push towards sustainable production practices and growing adoption of high-quality pulp in both commercial and industrial applications are key factors driving the market in China.

Unbleached Softwood Kraft Pulp Market Share

The unbleached softwood kraft pulp industry is primarily led by well-established companies, including:

- SCG Packaging Plc (Thailand)

- WestRock Group (U.S.)

- Georgia-Pacific LLC (U.S.)

- International Paper Company (U.S.)

- Segezha Group (Russia)

- Gascogne Group (France)

- Komar Alliance, LLC (U.S.)

- Nordic Paper AS (Sweden)

- Uline Inc (U.S.)

- Canadian Kraft Paper Industries Ltd. (Canada)

- Smurfit Kappa Group plc (Ireland)

- Tokushu Tokai Paper Co., Ltd. (Japan)

- Canfor Corporation (Canada)

- Gator Office Products, Inc. (U.S.)

- SSI Packaging Group Inc (U.S.)

- Venkraft Paper Mills Pvt. Ltd. (India)

- Kotkamills Oy (Finland)

- Ahlstrom-Munksjö Oyj (Finland)

- Shanghai Plastech Group Limited (China)

- Pudumjee Paper Products Ltd. (India)

- Fortune Paper Mills LLP (India)

- Suyash Paper Mills (India)

Latest Developments in Global Unbleached Softwood Kraft Pulp Market

- In September 2025, Canfor Corporation (CA) strengthened its position in the unbleached softwood kraft pulp market by launching a blockchain-based supply chain transparency initiative, enabling customers to track sourcing and sustainability credentials in real time. This development enhances customer trust and aligns with rising demand for ethically sourced and traceable pulp products, positioning the company favorably as sustainability becomes a key purchasing criterion. The initiative also differentiates Canfor in a competitive market where transparency and environmental accountability increasingly influence buyer decisions

- In August 2025, West Fraser Timber Co Ltd (CA) announced a major investment in a new production facility to expand its unbleached softwood kraft pulp output, directly addressing growing global demand for sustainable and high-strength pulp products. This expansion is expected to improve supply reliability and strengthen the company’s competitive standing in packaging and industrial applications. The investment also reinforces West Fraser’s long-term sustainability strategy by supporting efficient production and environmentally responsible operations

- In July 2025, Stora Enso Oyj (FI) entered into a strategic partnership with a technology firm to deploy AI-driven solutions for optimizing pulp production processes. This move is anticipated to improve operational efficiency, reduce waste, and lower production costs, enhancing the company’s responsiveness to fluctuating market demand. The integration of advanced digital tools reflects a broader industry shift toward smart manufacturing and positions Stora Enso to maintain competitiveness through innovation

- In June 2025, International Paper Company (U.S.) expanded its unbleached softwood kraft pulp capacity through modernization of existing mills, focusing on energy-efficient technologies and reduced emissions. This development supports the growing demand from sustainable packaging and e-commerce sectors while improving cost efficiency and environmental performance. The upgrade strengthens the company’s ability to supply high-quality pulp consistently, reinforcing its role as a key global supplier

- In May 2025, UPM-Kymmene Corporation (FI) announced the introduction of advanced fiber optimization technologies across its unbleached softwood kraft pulp operations. This initiative aims to enhance pulp strength characteristics while minimizing raw material usage, supporting both performance and sustainability objectives. The development positions UPM to better serve premium packaging and specialty paper segments, where demand for high-strength and eco-friendly pulp solutions continues to rise

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Unbleached Softwood Kraft Pulp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Unbleached Softwood Kraft Pulp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Unbleached Softwood Kraft Pulp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.