Global Uninterruptible Power Supply Ups Datacenter Power Market

Market Size in USD Billion

CAGR :

%

USD

4.04 Billion

USD

6.48 Billion

2024

2032

USD

4.04 Billion

USD

6.48 Billion

2024

2032

| 2025 –2032 | |

| USD 4.04 Billion | |

| USD 6.48 Billion | |

|

|

|

|

Uninterruptible Power Supply (UPS) Datacenter Power Market Size

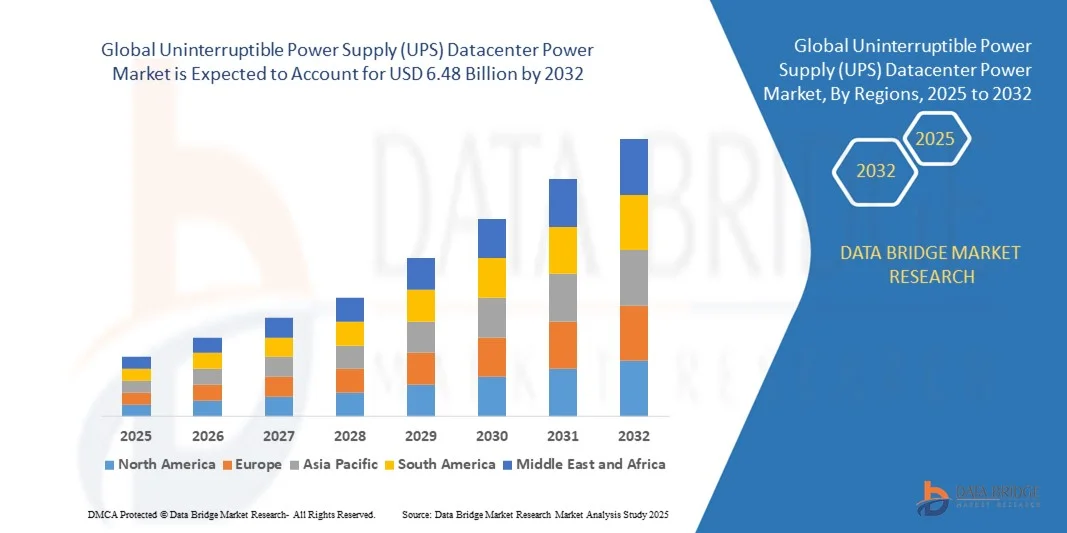

- The global Uninterruptible Power Supply (UPS) Datacenter Power market size was valued at USD 4.04 billion in 2024 and is expected to reach USD 6.48 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by the increasing deployment of data centers, cloud computing infrastructure, and digital services, which are driving demand for reliable and uninterrupted power solutions. The expansion of hyperscale, enterprise, and edge data centers is creating a need for advanced UPS systems capable of ensuring high availability and minimizing downtime

- Furthermore, rising emphasis on energy efficiency, sustainability, and scalable power solutions is encouraging data center operators to adopt modular and intelligent UPS technologies. These converging factors are accelerating the deployment of modern UPS systems, thereby significantly boosting the market's growth

Uninterruptible Power Supply (UPS) Datacenter Power Market Analysis

- UPS systems, providing continuous and reliable power backup for critical IT infrastructure, are becoming essential components of modern data centers due to their ability to protect against outages, voltage fluctuations, and power surges. Their integration with monitoring and management systems ensures operational continuity and efficiency across various data center environments

- The escalating demand for UPS systems is primarily driven by rapid digitalization, the growth of cloud and edge computing, increasing data traffic, and the need to safeguard critical applications. Enterprises, cloud providers, and hyperscale operators are prioritizing advanced UPS solutions to maintain uptime, optimize energy usage, and enhance the resilience of their data center operations

- North America dominated the Uninterruptible Power Supply (UPS) Datacenter Power market with a share of 38.33% in 2024, due to the increasing number of hyperscale and enterprise data centers requiring reliable, high-capacity power backup solutions

- Asia-Pacific is expected to be the fastest growing region in the Uninterruptible Power Supply (UPS) Datacenter Power market during the forecast period due to rapid urbanization, data center expansion, and the rising adoption of cloud services in countries such as China, India, and Japan

- Traditional uninterruptible power supply segment dominated the market with a market share of 55.5% in 2024, due to its long-established use across legacy data centers and proven reliability in ensuring consistent backup power. Traditional UPS systems are widely preferred by organizations prioritizing cost-effectiveness and familiarity with existing infrastructure. Their robust design and ability to support large-scale power continuity without frequent reconfiguration make them a mainstay for mature enterprises and government data centers

Report Scope and Uninterruptible Power Supply (UPS) Datacenter Power Market Segmentation

|

Attributes |

Uninterruptible Power Supply (UPS) Datacenter Power Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Uninterruptible Power Supply (UPS) Datacenter Power Market Trends

Rising Demand for Reliable Power in Expanding Data Centers

- The UPS datacenter power market is experiencing robust growth driven by surging global data center deployments and rising demands for uninterrupted, high-quality power infrastructure. As mission-critical IT workloads shift to cloud, hyperscale, and edge facilities, the need for advanced UPS solutions to prevent downtime and ensure data integrity is intensifying across industries

- For instance, Schneider Electric SE has launched scalable, high-efficiency UPS systems purpose-built for hyperscale and colocation datacenters, emphasizing robust failover capabilities and scalable runtime options. The industry’s expansion into AI, IoT, and latency-sensitive workloads is further fueling investments in new-generation power backup platforms

- UPS systems are becoming standard requirements for modern data centers, providing rapid response to grid disturbances and voltage fluctuations while supporting clean shutdowns and continuous operation of hardware and networking assets. Ongoing digital transformation, remote work acceleration, and regulatory compliance needs are increasing pressure to deploy highly reliable, low-latency backup architectures

- In addition, evolving sustainability guidelines and carbon reduction targets are leading operators to seek energy-efficient UPS systems powered by advanced battery technology, monitoring software, and power conversion standards. Lithium-ion and modular VRLA batteries are gaining preference for their longevity and compact footprint compared to legacy lead-acid stacks

- Emerging trends such as microgrid integration, predictive battery management, and DC power architectures are further advancing the role of UPS in supporting green data center initiatives. These innovations are enabling the creation of resilient, adaptive power environments able to scale with dynamic facility requirements and fluctuating workload demands

- As enterprises expand global data infrastructure and edge computing networks, reliable UPS platforms are pivotal for minimizing downtime risk, optimizing mission-critical power management, and supporting 24/7 operational continuity. The ongoing evolution of digital infrastructure places UPS solutions at the heart of resilient, future-ready data center architectures

Uninterruptible Power Supply (UPS) Datacenter Power Market Dynamics

Driver

Modular and Intelligent UPS Adoption for Energy-Efficient Operations

- The growing focus on maximizing energy efficiency and operational agility in datacenter environments is driving adoption of modular and intelligent UPS systems. These solutions allow operators to customize power capacity, optimize redundancy, and manage load balancing with real-time monitoring and automation tools

- For instance, Eaton Corporation plc has expanded its modular UPS product line for data centers, enabling flexible scaling and remote management through integrated software analytics. This modular approach supports facilities in meeting fluctuating power needs, minimizing over-provisioning, and improving overall power usage effectiveness (PUE)

- Intelligent UPS solutions equipped with advanced diagnostics and predictive maintenance algorithms are reducing downtime risks while enabling proactive interventions before system failures occur. These features help operators mitigate power outages due to battery degradation, grid instability, or equipment faults, resulting in higher facility uptime and optimized lifecycle costs

- In addition, modular UPS architectures support phased expansions, allowing data centers to add or reconfigure units as operations scale or change over time. This adaptability is particularly valuable for colocation and hyperscale environments facing rapid workload growth and evolving IT requirements

- The drive toward smart, energy-efficient UPS integration aligns with broader sustainability initiatives and regulatory compliance efforts, reinforcing the need for dynamic and cost-efficient power management strategies in modern data environments

Restraint/Challenge

High Costs and Complexity in Legacy System Upgrades

- Upgrading legacy UPS infrastructure in existing datacenters presents considerable challenges due to high costs, technical complexity, and operational risk. Older facilities often deploy monolithic or outdated backup systems that require substantial investment to retrofit or replace with modern, modular platforms

- For instance, Vertiv Holdings Co. has identified legacy system upgrades as a major pain point involving extended migration timelines, compatibility issues, and complex integration with ongoing business operations. Disruption risks and technical hurdles can lead to lengthy downtime windows during equipment switchover

- The need to adapt supporting electrical systems, reconfigure rack layouts, and implement new battery storage options further increases upgrade project costs and implementation complexity. In addition, training personnel on new equipment interfaces and monitoring protocols adds to transition expenses

- Facilities operating with constrained budgets or limited technical resources may postpone modernization, risking increased downtime, maintenance costs, and compliance penalties. The pace of technology advancement also risks obsolescence for recently updated systems

- Industry participants are addressing these challenges through turnkey upgrade solutions, hybrid UPS models, and structured phased transition strategies that minimize business disruption. As market standards evolve and costs gradually fall, the pace of legacy datacenter power modernization is expected to accelerate, driving broader UPS adoption across critical infrastructure environments globally

Uninterruptible Power Supply (UPS) Datacenter Power Market Scope

The market is segmented on the basis of component, data center size, end-user type, and vertical.

- By Component

On the basis of component, the Uninterruptible Power Supply (UPS) Datacenter Power market is segmented into traditional uninterruptible power supply and modular uninterruptible power supply. The traditional UPS segment dominated the market with the largest revenue share of 55.5% in 2024, attributed to its long-established use across legacy data centers and proven reliability in ensuring consistent backup power. Traditional UPS systems are widely preferred by organizations prioritizing cost-effectiveness and familiarity with existing infrastructure. Their robust design and ability to support large-scale power continuity without frequent reconfiguration make them a mainstay for mature enterprises and government data centers.

The modular UPS segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising need for scalable, energy-efficient, and flexible power solutions across modern data centers. Modular UPS systems enable incremental capacity expansion, reducing initial capital expenditure while enhancing operational efficiency. Their compact design, improved serviceability, and high power density make them particularly suitable for cloud and hyperscale data centers experiencing rapid data traffic growth and dynamic load requirements.

- By Data Center Size

On the basis of data center size, the market is segmented into small and mid-sized data centers and large data centers. The large data centers segment held the largest market share in 2024, driven by the growing number of hyperscale and enterprise facilities that require robust and redundant power systems. Large data centers rely heavily on high-capacity UPS solutions to prevent downtime, safeguard data integrity, and meet service-level agreements. The continuous expansion of digital infrastructure by tech giants and financial institutions sustains high demand for large-scale UPS installations.

The small and mid-sized data centers segment is projected to record the fastest CAGR during the forecast period, fueled by increasing edge computing deployments and the proliferation of regional data hubs. These facilities are adopting compact, modular UPS systems to ensure localized data processing with uninterrupted performance. The demand is further accelerated by small enterprises and managed service providers seeking affordable, scalable power protection solutions that align with growing data processing needs at the network edge.

- By End User Type

On the basis of end user type, the market is categorized into enterprises, colocation providers, cloud providers, and hyperscale data centers. The hyperscale data centers segment dominated the market in 2024, owing to the massive power requirements of cloud service operators and large-scale digital platforms. These facilities demand high-efficiency, redundant UPS systems to sustain continuous operations across thousands of servers. The adoption of energy-efficient UPS architectures is rising as hyperscale operators focus on reducing power usage effectiveness (PUE) and meeting sustainability goals.

The cloud providers segment is expected to grow at the fastest rate from 2025 to 2032, driven by the surging adoption of cloud-based services across enterprises and the expansion of public cloud infrastructure. Cloud data centers prioritize modular UPS systems that support fast scalability and remote monitoring capabilities. The rising demand for reliable, low-latency power backup in cloud environments is propelling investments in intelligent UPS technologies integrated with predictive maintenance and real-time performance analytics.

- By Vertical

On the basis of vertical, the UPS Datacenter Power market is segmented into banking, financial services, and insurance (BFSI); media and entertainment; government and defense; healthcare; manufacturing; retail; telecommunications and IT; and others. The telecommunications and IT segment accounted for the largest market share in 2024, driven by the exponential rise in data consumption, 5G deployment, and cloud network expansion. UPS systems in this sector ensure continuous connectivity, data reliability, and service uptime for mission-critical applications. The growing digital transformation initiatives and global rollout of data-intensive technologies further amplify demand in this vertical.

The healthcare segment is projected to exhibit the fastest growth from 2025 to 2032, as hospitals and medical research facilities increasingly adopt digital infrastructure and electronic health record systems. Reliable power backup is crucial for ensuring the uninterrupted operation of life-support systems, diagnostic equipment, and data servers. The growing emphasis on patient safety, telemedicine, and real-time health data management is accelerating UPS deployment across healthcare data centers and IT facilities.

Uninterruptible Power Supply (UPS) Datacenter Power Market Regional Analysis

- North America dominated the Uninterruptible Power Supply (UPS) Datacenter Power market with the largest revenue share of 38.33% in 2024, driven by the increasing number of hyperscale and enterprise data centers requiring reliable, high-capacity power backup solutions

- Organizations in the region prioritize continuous operations and data integrity, which fuels demand for both traditional and modular UPS systems across critical infrastructure and commercial facilities

- This widespread adoption is further supported by technological advancement, high IT spending, and a focus on energy efficiency, establishing UPS solutions as a standard in residential, commercial, and hyperscale data centers

U.S. Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The U.S. UPS Datacenter Power market captured the largest revenue share in North America in 2024, driven by the growing adoption of cloud computing, data center expansion, and enterprise digital transformation initiatives. Businesses and hyperscale operators increasingly focus on energy-efficient and scalable UPS systems to minimize downtime and optimize operational performance. The integration of intelligent monitoring, predictive maintenance, and modular UPS architectures is further accelerating market growth.

Europe Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily due to stringent regulations on data center uptime and energy efficiency. The rise in cloud adoption, digitalization initiatives, and enterprise IT infrastructure upgrades is driving UPS deployment. Countries across Europe are increasingly investing in modular UPS systems that enable scalability, reduce power losses, and support renewable energy integration in both commercial and government data centers.

U.K. Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The U.K. UPS Datacenter Power market is anticipated to grow at a noteworthy CAGR, fueled by the rapid expansion of cloud services and digital infrastructure. Data center operators and enterprises are investing in modular and energy-efficient UPS systems to ensure uninterrupted power and reduce operational costs. In addition, the emphasis on green data centers and regulatory compliance is encouraging the adoption of modern, scalable UPS solutions.

Germany Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The Germany market is expected to expand at a considerable CAGR, driven by strong digital infrastructure, technological innovation, and a focus on sustainable power solutions. Data centers in Germany increasingly deploy modular UPS systems to enhance scalability, reliability, and energy efficiency. Integration with smart monitoring and predictive analytics is also supporting demand in commercial, industrial, and hyperscale facilities.

Asia-Pacific Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, data center expansion, and the rising adoption of cloud services in countries such as China, India, and Japan. The region’s demand for reliable and scalable power solutions is supported by investments in hyperscale and edge data centers, as well as government initiatives promoting digital infrastructure and smart city development.

Japan Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The Japan market is gaining momentum due to the country’s strong focus on technology, digital transformation, and highly urbanized commercial infrastructure. Modular UPS systems are increasingly preferred for their compactness, scalability, and energy efficiency, supporting critical applications in enterprise and hyperscale data centers. The adoption of IoT-integrated monitoring and predictive maintenance further drives UPS market growth.

China Uninterruptible Power Supply (UPS) Datacenter Power Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, owing to the rapid expansion of cloud computing, hyperscale data centers, and digital services. The growing middle-class consumer base and industrial digitalization are boosting demand for reliable and modular UPS solutions. Strong domestic manufacturing, cost-effective systems, and government support for smart data infrastructure are key factors driving market growth.

Uninterruptible Power Supply (UPS) Datacenter Power Market Share

The Uninterruptible Power Supply (UPS) Datacenter Power industry is primarily led by well-established companies, including:

- Schneider Electric (France)

- Vertiv Group Corp. (U.S.)

- ABB (Switzerland)

- Eaton (Ireland)

- Delta Power Solutions (Taiwan)

- Huawei Technologies Co., Ltd. (China)

- Legrand SA (France)

- Tripp Lite (U.S.)

- Toshiba International Corporation (Japan)

- Siemens (Germany)

- Mitsubishi Electric Power Products Inc. (Japan)

- Cisco (U.S.)

- Kehua Hengsheng Co., Ltd. (China)

- Socomec (France)

- Rittal (Germany)

- Cyber Power Systems (USA), Inc. (U.S.)

- PDU Experts UK (U.K.)

- Anord Mardix (U.K.)

- Raman Power Technologies (India)

- N1C Technologies, Inc. (U.S.)

Latest Developments in Global Uninterruptible Power Supply (UPS) Datacenter Power Market

- In May 2025, Eaton introduced AI-Responsive Firmware for PXQ UPS Systems. The firmware enables real-time detection and mitigation of AI-driven power surges, such as Single-Sided Oscillations (SSOs), addressing the unique power demands of AI workloads that can cause rapid voltage fluctuations beyond traditional UPS capabilities. By adapting to these dynamic loads, Eaton’s solution ensures uninterrupted power supply, safeguarding critical infrastructure and enhancing overall grid stability

- In December 2024, Schneider Electric launched the Galaxy VXL UPS, a modular, high-density system designed to support AI data centers and large-scale electrical workloads. With power capacities ranging from 500 to 1250 kW, the Galaxy VXL delivers up to 99% efficiency and a compact footprint, achieving up to 52% space savings compared to industry averages. Its scalable architecture allows parallel configurations up to 5 MW, making it ideal for both traditional and AI-intensive applications

- In December 2024, Vertiv launched the Vertiv PowerUPS 9000, a compact and energy-efficient UPS system with high power density to support a variety of IT applications, from traditional computing to high-density environments. Available globally in CE and UL models with power capacities ranging from 250 to 1250 kW per unit, the PowerUPS 9000 enhances operational efficiency and provides reliable power protection for modern data centers

- In May 2024, ABB integrated Nickel-Zinc (NiZn) batteries into its MegaFlex UPS systems, offering a safer, more resilient, and sustainable energy storage solution compared to conventional chemistries. This integration improves energy efficiency, extends battery life, and meets the growing demand for eco-friendly and reliable power solutions in critical data center applications

- In May 2024, ABB unveiled the NiZn battery integration for its MegaFlex high-power UPS, enhancing the reliability and sustainability of UPS deployments for data centers. These batteries provide rapid response to power fluctuations, longer lifecycle performance, and a safer alternative to traditional chemistries, supporting the increasing need for resilient and environmentally conscious energy storage in mission-critical environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.