Global Upstream Bioprocessing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

5.81 Billion

2025

2033

USD

2.47 Billion

USD

5.81 Billion

2025

2033

| 2026 –2033 | |

| USD 2.47 Billion | |

| USD 5.81 Billion | |

|

|

|

|

Upstream Bioprocessing Equipment Market Size

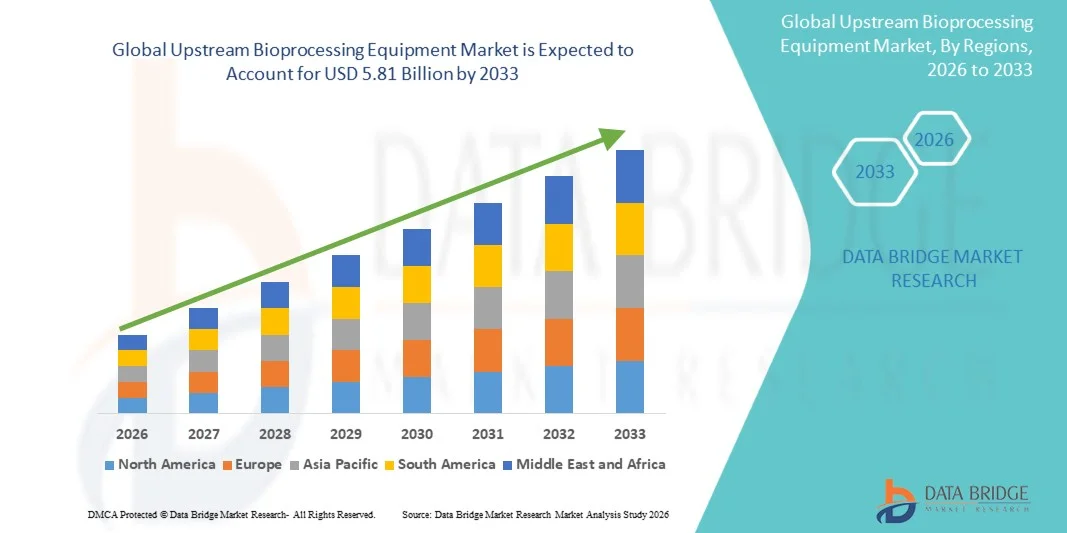

- The global upstream bioprocessing equipment market size was valued at USD 2.47 billion in 2025 and is expected to reach USD 5.81 billion by 2033, at a CAGR of 11.30% during the forecast period

- The market growth is largely fueled by increasing demand for biopharmaceuticals, rising adoption of advanced cell culture and fermentation technologies, and growing investments in biologics and vaccine production

- Furthermore, the need for scalable, efficient, and high-throughput upstream processes in pharmaceutical and biotechnology industries is driving the adoption of upstream bioprocessing equipment. These converging factors are accelerating the uptake of Upstream Bioprocessing Equipment solutions, thereby significantly boosting the industry's growth

Upstream Bioprocessing Equipment Market Analysis

- • Upstream bioprocessing equipment, encompassing bioreactors, filtration systems, media preparation units, and associated automation technologies, is becoming increasingly vital for modern biopharmaceutical manufacturing due to its critical role in enabling efficient cell culture, fermentation, and large-scale production of biologics, vaccines, and advanced therapeutics

- The escalating demand for upstream bioprocessing equipment is primarily fueled by the rapid expansion of biologics and biosimilars, growing investments in biopharmaceutical R&D, rising adoption of single-use technologies, and an increasing preference for scalable, high-efficiency upstream processing solutions

- North America dominated the upstream bioprocessing equipment market with the largest revenue share of 41.5% in 2025, driven by the presence of advanced biopharmaceutical infrastructure, high adoption of cell culture and fermentation technologies, and strong investments in biologics and vaccine manufacturing. The U.S. experienced substantial growth in Upstream Bioprocessing Equipment installations, particularly in contract manufacturing organizations and large-scale bioprocessing facilities, fueled by technological innovations and automation in upstream processes

- Asia-Pacific is expected to be the fastest-growing region in the upstream bioprocessing equipment market during the forecast period, registering rapid growth due to expanding pharmaceutical and biotechnology industries, rising R&D investment, and increasing demand for scalable, high-throughput upstream processing solutions across countries such as China, India, and Japan

- The Single Function segment held the largest market revenue share of 58.3% in 2025, primarily due to their widespread use in standard ophthalmic diagnostic workflows

Report Scope and Upstream Bioprocessing Equipment Market Segmentation

|

Attributes |

Upstream Bioprocessing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Upstream Bioprocessing Equipment Market Trends

“Technological Advancements and Automation in Bioprocessing”

- Continuous innovation in upstream bioprocessing solutions is driving industry transformation, with increased adoption of automated systems, advanced sensors, and integrated monitoring platforms

- For instance, in September 2023, GE Healthcare launched the Xcellerex XDR single-use bioreactor platform, designed to improve process control and simplify scalable biologics production

- Real-time monitoring technologies are enabling enhanced process understanding, reduced deviations, and faster decision-making for operators

- Increased adoption of PAT (Process Analytical Technology) tools is helping manufacturers maintain consistent product quality

- The expansion of continuous bioprocessing systems is reshaping upstream operations by improving efficiency and reducing facility footprint

- Modular, flexible bioprocessing units are allowing manufacturers to rapidly scale capacity in response to market needs or emerging health threats

- Standardization of single-use components is improving supply chain reliability and reducing operational complexity for biopharmaceutical producers

Upstream Bioprocessing Equipment Market Dynamics

Driver

“Rising Demand for Biopharmaceutical Production and Process Efficiency”

- The global growth in biopharmaceutical production, including monoclonal antibodies, vaccines, cell therapies, and recombinant proteins, is driving strong demand for upstream bioprocessing equipment

- For instance, in March 2024, Sartorius launched its BIOSTAT STR single-use bioreactor system in Europe, offering scalable solutions for both process development and commercial manufacturing. This development is supporting expansion in biologics production worldwide

- Increasing pressure on manufacturers to reduce production costs, improve yield, and accelerate time-to-market is encouraging adoption of efficient upstream systems

- The rising demand for personalized medicines and the rapid expansion of biologics pipelines are boosting bioprocessing capacity requirements globally

- Biopharma companies are increasingly shifting toward single-use technologies to minimize contamination risk, reduce cleaning validation requirements, and improve batch turnaround time

- Expanding investments in vaccine development—driven by infectious diseases and routine immunization needs—continue to strengthen the demand for robust upstream production systems

- Growth of CDMOs (Contract Development and Manufacturing Organizations) worldwide is also increasing reliance on scalable upstream equipment to support multiproduct manufacturing

Restraint/Challenge

“High Capital Investment and Operational Costs”

- High initial investment required for bioreactors, filtration systems, mixers, sensors, and other upstream equipment remains a major challenge, especially for smaller biopharma firms

- For instance, a June 2022 BioProcess International report highlighted that implementing single-use bioreactors in emerging markets faced delays due to elevated capital costs and long-term maintenance requirements

- Skilled workforce shortages in bioprocess engineering, fermentation science, and biologics manufacturing make it difficult for companies to fully adopt advanced systems

- Compliance with stringent regulatory requirements—including validation and quality assurance—adds significant cost and complexity to equipment installation

- Supply chain disruptions and high dependency on specialized components, particularly single-use assemblies, can delay production timelines

- Operational challenges such as managing batch variability, ensuring sterility, and maintaining continuous operations also increase overall costs

- Smaller facilities may struggle with the space, infrastructure, and utilities required to support advanced upstream bioprocessing systems

Upstream Bioprocessing Equipment Market Scope

The market is segmented on the basis of product type and functionality.

• By Product Type

On the basis of product type, the Ophthalmic Perimeters market is segmented into Static, Kinetic, and Combination Perimeters. The Static perimeter segment dominated the largest market revenue share of 46.8% in 2025, driven by its high adoption in routine glaucoma assessment, visual field mapping, and neurological evaluation. Static perimeters are widely preferred in hospitals and ophthalmic clinics due to their accuracy in threshold testing, reproducibility, and ability to detect early-stage visual field loss. Their integration with advanced automated algorithms, shorter testing times, and enhanced patient comfort further strengthens their dominance. The availability of technologically advanced devices with cloud connectivity, automated interpretation, and integrated EMR compatibility also contributes significantly to the segment’s strong performance. Growing demand for early glaucoma diagnosis and the rising geriatric population undergoing regular visual field testing reinforce the segment’s leading position across developed and emerging markets.

The Kinetic perimeter segment is anticipated to witness the fastest CAGR of 8.9% from 2026 to 2033, supported by the increasing demand for wide-field perimetry and assessment of peripheral visual defects. Kinetic perimeters are increasingly used in the evaluation of neuro-ophthalmic disorders, retinal diseases, and driver’s license eligibility examinations in several countries. Their capability to map peripheral field changes more efficiently than static perimetry is a major growth driver. In addition, advancements in semi-automated and fully automated kinetic systems and increasing adoption in specialty clinics are accelerating the segment’s growth. Rising preference for multimodal visual assessment tools among ophthalmologists, particularly for complex clinical cases, further supports strong future expansion.

The Combination perimeter segment also shows stable growth as hybrid systems offering both static and kinetic assessments gain popularity in high-end ophthalmic centers.

• By Functionality

On the basis of functionality, the Ophthalmic Perimeters market is segmented into Single Function and Multifunction Perimeters. The Single Function segment held the largest market revenue share of 58.3% in 2025, primarily due to their widespread use in standard ophthalmic diagnostic workflows. Single-function devices — typically static or kinetic-only — are cost-effective, easier to operate, and preferred by small ophthalmic clinics and diagnostic centers. Their lower maintenance requirements, strong reliability, and focus on core visual field testing make them the dominant choice in developing economies. Increased demand for glaucoma screening programs, routine visual health assessments, and adoption of automated single-function units in hospitals further reinforce the segment’s leading position. Moreover, healthcare facilities often prioritize standalone perimeters due to limited budget allocations for ophthalmic devices.

The Multifunction segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by the growing preference for advanced systems capable of performing visual field testing along with additional functionalities such as fundus imaging, OCT integration, real-time progression analysis, and automated diagnostic reporting. Multifunction perimeters streamline workflow efficiency and reduce the need for multiple diagnostic devices, making them increasingly attractive to high-volume ophthalmology centers and hospitals. Advancements in AI-driven image interpretation, machine-learning-based visual field prediction, and cloud-based patient data management are accelerating adoption. The rising demand for comprehensive glaucoma management tools and increasing investments in high-end ophthalmic equipment also support strong future growth.

Upstream Bioprocessing Equipment Market Regional Analysis

- North America dominated the upstream bioprocessing equipment market with the largest revenue share of 41.5% in 2025, driven by the presence of advanced biopharmaceutical infrastructure, strong adoption of cell culture and fermentation technologies, and increasing investments in biologics, biosimilars, and vaccine manufacturing

- Consumers in the region highly value automation, process efficiency, and regulatory-compliant production systems, leading to an accelerated shift toward high-performance bioreactors, filtration systems, and media preparation units

- This widespread adoption is further supported by high R&D expenditure, a technologically advanced bioprocessing ecosystem, and the growing preference for integrated, scalable upstream solutions, establishing upstream bioprocessing equipment as an essential component in modern biologics production

U.S. Upstream Bioprocessing Equipment Market Insight

The U.S. upstream bioprocessing equipment market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of biopharmaceutical manufacturing, strong presence of global biologics producers, and the increasing adoption of automated, single-use, and high-throughput upstream systems. The growing demand for monoclonal antibodies, cell and gene therapies, and vaccines is driving large-scale investments in bioreactors, media preparation systems, and perfusion technologies. Additionally, the rise of contract manufacturing organizations (CMOs) and the integration of digital bioprocessing platforms are significantly contributing to market growth.

Europe Upstream Bioprocessing Equipment Market Insight

The Europe upstream bioprocessing equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong regulatory frameworks, growing biologics manufacturing capacity, and rising adoption of advanced fermentation and cell culture equipment. Increasing R&D activities, expansion of biosimilar production, and the modernization of existing bioprocessing facilities are supporting the wider uptake of upstream systems. The region is experiencing strong demand across biopharmaceutical companies, research institutes, and CMOs, with increasing focus on automation, flexibility, and contamination-free processing.

U.K. Upstream Bioprocessing Equipment Market Insight

The U.K. upstream bioprocessing equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by robust investments in biotechnology research, expanding biomanufacturing capabilities, and the country’s growing focus on sustainable and efficient biologics production. The increasing emphasis on cell therapy, gene therapy, and vaccine development is boosting the demand for single-use bioreactors, scalable fermentation systems, and advanced upstream process equipment.

Germany Upstream Bioprocessing Equipment Market Insight

The Germany upstream bioprocessing equipment market is expected to expand at a considerable CAGR during the forecast period, driven by strong industrial biotechnology capabilities, high adoption of advanced bioprocessing technologies, and a growing focus on precision manufacturing. Germany’s technologically mature infrastructure and emphasis on process optimization encourage the use of automated upstream systems, high-efficiency filtration devices, and state-of-the-art bioreactors in both research and commercial production facilities.

Asia-Pacific Upstream Bioprocessing Equipment Market Insight

The Asia-Pacific upstream bioprocessing equipment market is poised to grow at the fastest CAGR during 2026–2033, propelled by expanding pharmaceutical and biotechnology sectors, rising demand for biosimilars, and increasing investments in biologics manufacturing capacity across China, India, Japan, and South Korea. Government-led initiatives supporting biomanufacturing, along with the rapid establishment of new bioprocessing facilities and CMOs, are further accelerating equipment adoption.

Japan Upstream Bioprocessing Equipment Market Insight

The Japan upstream bioprocessing equipment market is gaining momentum due to the country’s strong innovation ecosystem, rising biotechnology R&D activity, and growing demand for high-quality biologics and regenerative medicines. The integration of upstream bioprocessing equipment with automation, robotics, and digital monitoring systems is driving adoption across both commercial and research environments.

China Upstream Bioprocessing Equipment Market Insight

The China upstream bioprocessing equipment market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid growth in biologics manufacturing, strong domestic biotechnology expansion, and government-backed initiatives promoting biopharmaceutical innovation. China’s increasing production of biosimilars, vaccines, and monoclonal antibodies is fueling demand for large-scale bioreactors, filtration systems, and automated upstream technologies, with strong contributions from both local and global suppliers.

Upstream Bioprocessing Equipment Market Share

The Upstream Bioprocessing Equipment industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Sartorius AG (Germany)

- Danaher Corporation (U.S.)

- Merck KGaA (Germany)

- Eppendorf SE (Germany)

- PBS Biotech (U.S.)

- GEA Group (Germany)

- Applikon Biotechnology (Netherlands)

- Corning Incorporated (U.S.)

- Pierre Guérin (France)

- Solaris Biotech (Italy)

- PBS Biotech (U.S.)

- Infors HT (Switzerland)

- Biotron Healthcare (India)

- ZETA GmbH (Austria)

- ABEC, Inc. (U.S.)

- Distek, Inc. (U.S.)

- Getinge AB (Sweden)

- Flexicon Liquid Filling (U.K.)

- Stobbe Pharma GmbH (Germany)

Latest Developments in Global Upstream Bioprocessing Equipment Market

- In August 2023, Sartorius and Repligen Corporation announced the launch of an integrated bioreactor system combining Sartorius’ Biostat STR stirred-tank bioreactor with Repligen’s XCell ATF upstream intensification module — aimed at simplifying perfusion-based workflows and improving cell retention while reducing footprint and control complexity

- In April 2023, Cytiva introduced its new X‑platform bioreactors — a modular, single-use upstream bioprocessing solution designed for flexible operation in 50 L to 200 L sizes, offering improved ergonomics, easier scale-up, and streamlined supply-chain operations

- In September 2023, Getinge launched the AppliFlex ST GMP single-use bioreactor tailored for cell and gene therapy as well as mRNA production — marking the company’s push into advanced therapy manufacturing and expanding options for flexible upstream bioprocessing

- In November 2024, a market-forecast report projected that the global upstream bioprocessing market will grow significantly — estimating a rise from its 2023 base value toward a much larger valuation by 2032 — underscoring rising demand for biologics, single-use technologies, and flexible manufacturing solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.