Global Urea Breath Test Market

Market Size in USD Million

CAGR :

%

USD

129.98 Million

USD

199.48 Million

2024

2032

USD

129.98 Million

USD

199.48 Million

2024

2032

| 2025 –2032 | |

| USD 129.98 Million | |

| USD 199.48 Million | |

|

|

|

|

Urea Breath Test Market Size

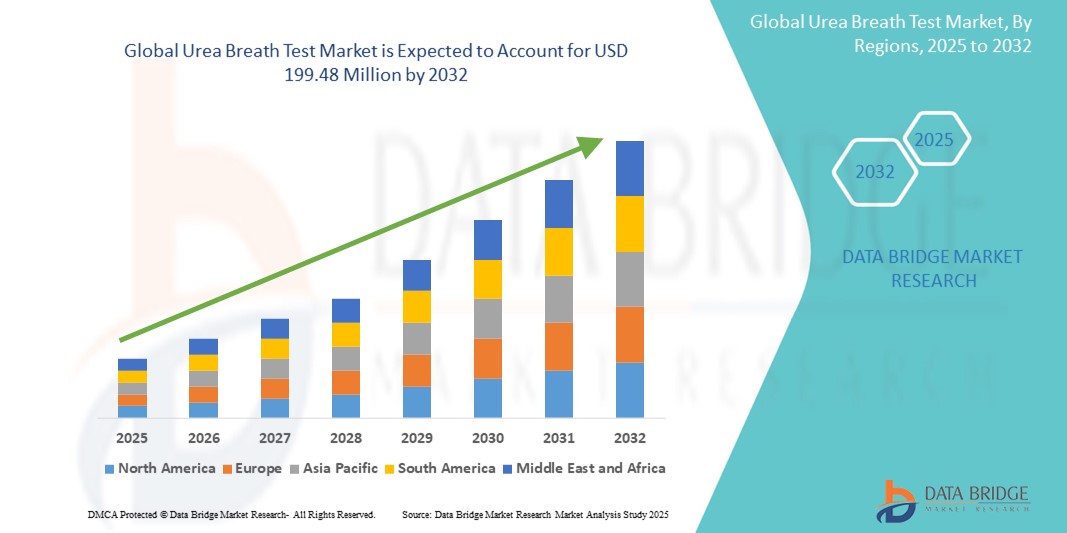

- The global urea breath test market size was valued at USD 129.98 Million in 2024 and is expected to reach USD 199.48 Million by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the growing prevalence of Helicobacter pylori (H. pylori) infections and the increasing awareness regarding non-invasive diagnostic options, driving widespread adoption of the Urea Breath Test (UBT) across both hospital and outpatient settings. UBT offers a rapid, accurate, and patient-friendly diagnostic alternative to endoscopy or biopsy, making it a preferred choice among healthcare providers, particularly in regions with high rates of H. pylori-related gastrointestinal disorders

- Furthermore, advancements in isotope labeling technologies, coupled with the development of portable and automated breath analyzers, are improving test accuracy and accessibility. These innovations are significantly enhancing diagnostic efficiency in both developed and emerging markets, thereby boosting the uptake of Urea Breath Test solutions

Urea Breath Test Market Analysis

- Urea breath tests, used primarily for the diagnosis of Helicobacter pylori infections, are gaining significant traction due to their non-invasive nature, high accuracy, and rapid results. These diagnostic tools are becoming increasingly vital components of gastrointestinal disease management in both clinical and point-of-care settings

- The escalating demand for urea breath tests is primarily fueled by the rising global burden of H. pylori infections, increased awareness regarding early diagnosis of gastric disorders, and the growing preference for non-invasive, patient-friendly diagnostic solutions

- North America dominated the urea breath test market with the largest revenue share of 38.6% in 2024, attributed to advanced healthcare infrastructure, high awareness levels among patients, and favorable reimbursement policies. The U.S. in particular is witnessing strong growth due to technological advancements, increasing outpatient diagnostic volumes, and growing adoption of non-invasive tests

- Asia-Pacific is expected to register the fastest CAGR of 11.4% during the forecast period (2025–2032), driven by expanding healthcare access, rising disposable incomes, and increasing investments in diagnostic technologies in countries such as China, India, and Japan. The rising prevalence of gastrointestinal diseases and initiatives for mass screening are further boosting regional demand

- The Point-of-Care Tests (POCT) segment dominated the market with a revenue share of 59.5% in 2024, driven by the rising demand for rapid and accessible diagnostic solutions, particularly in outpatient clinics and remote care environments. Its convenience, faster turnaround time, and ease of use are significantly enhancing its adoption across various healthcare settings globally

Report Scope and Urea Breath Test Market Segmentation

|

Attributes |

Urea Breath Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Urea Breath Test Market Trends

“Shift Toward Non-Invasive, Rapid Diagnostic Solutions”

- A prominent trend shaping the global urea breath test market is the growing preference for non-invasive and patient-friendly diagnostic methods for Helicobacter pylori (H. pylori) detection

- The Urea Breath Test is gaining traction as a gold-standard diagnostic alternative due to its high sensitivity and specificity, minimal patient discomfort, and rapid results compared to traditional endoscopic procedures

- Healthcare systems globally are increasingly adopting breath-based diagnostics as part of their outpatient and point-of-care services to reduce patient burden and improve diagnostic turnaround times

- The convenience of minimal preparation and the test's ability to detect both active infection and post-treatment eradication make it a preferred choice in gastroenterology clinics

- Furthermore, increased awareness of H. pylori’s association with gastric ulcers, gastritis, and gastric cancer is boosting routine testing in both developed and developing regions

- The trend is also supported by ongoing innovation in test formats, such as portable UBT kits and analyzer integration, catering to both urban and rural healthcare infrastructure

Urea Breath Test Market Dynamics

Driver

“Rising Prevalence of H. pylori Infections and Demand for Early Detection”

- The global burden of Helicobacter pylori infection—affecting more than 50% of the world population—is a critical factor driving the Urea Breath Test market

- As the infection is a major cause of peptic ulcers and a risk factor for gastric cancer, healthcare providers are increasingly focusing on early diagnosis and eradication

- The Urea Breath Test enables clinicians to accurately detect active infections, monitor antibiotic treatment success, and avoid unnecessary therapies, making it essential in treatment workflows

- In addition, government and public health initiatives focused on gastrointestinal health and cancer prevention in countries such as Japan, China, and South Korea are promoting large-scale screening programs using UBT

- The rising availability of UBT in outpatient clinics, pharmacies, and primary care settings, supported by portable, easy-to-use test kits, is further accelerating adoption

Restraint/Challenge

“Limited Awareness and Accessibility in Low- and Middle-Income Countries”

- Lack of awareness about Helicobacter pylori infection symptoms and the availability of non-invasive diagnostic options like urea breath tests (UBTs) remains a major barrier in many developing regions

- In several low- and middle-income countries (LMICs), healthcare professionals and patients still rely heavily on traditional, invasive diagnostic methods such as endoscopy or stool antigen tests due to limited training or familiarity with UBT technology

- Moreover, the initial setup cost for breath test analyzers and the need for trained personnel can discourage adoption in rural and under-resourced healthcare facilities, especially where diagnostic infrastructure is minimal

- In addition, the limited reimbursement policies and lack of inclusion in public health programs further restrict patient access to UBTs, especially in public hospitals and clinics.

- Overcoming this restraint requires targeted education campaigns, government support for diagnostics accessibility, and strategic partnerships to subsidize and distribute urea breath test solutions in underserved markets

Urea Breath Test Market Scope

The market is segmented on the basis of product type, test type, instrument, and application.

- By Product Type

On the basis of product type, the urea breath test market is segmented into urea breath test kits and urea breath test analyzers. The urea breath test kits segment dominated the market with the largest revenue share of 64.3% in 2024, owing to their widespread adoption in outpatient settings for Helicobacter pylori detection. These kits offer non-invasiveness, ease of use, and cost-effectiveness.

The urea breath test analyzer segment is anticipated to grow at the fastest CAGR of 7.8% from 2025 to 2032, supported by the rising demand for accurate, real-time analysis in hospitals and diagnostic labs.

- By Test Type

On the basis of test type, the urea breath test market is segmented into Point-of-Care Tests (POCT) and laboratory-based tests. The Point-of-Care Tests segment accounted for the largest market share of 59.5% in 2024, due to the increasing demand for rapid diagnosis, especially in outpatient and remote care settings.

The laboratory-based tests segment is expected to grow at a CAGR of 8.4% during the forecast period, owing to growing integration in central labs for comprehensive infection monitoring and follow-up testing.

- By Instrument

On the basis of instrument, the urea breath test market is segmented into mass spectrometer, infrared spectrometer, and laser assisted rationalizer. The infrared spectrometer segment led the market with a revenue share of 52.7% in 2024, attributed to its reliability, affordability, and portability.

The mass spectrometer segment is projected to grow at the highest CAGR of 9.1% from 2025 to 2032, driven by its superior accuracy and rising deployment in research and high-precision diagnostics.

- By Application

On the basis of application, the urea breath test market is segmented into hospitals, specialized clinics, laboratories, and others. The hospitals segment captured the largest market share of 48.6% in 2024, owing to strong infrastructure, higher patient footfall, and insurance coverage for diagnostic procedures.

The specialized clinics segment is forecasted to register the fastest CAGR of 8.9% during the forecast period, driven by the increasing focus on gastroenterology care and personalized infection management.

Urea Breath Test Market Regional Analysis

- In 2024, North America dominated the global urea breath test market, accounting for the largest revenue share of 38.6%

- This dominance is primarily attributed to the region’s strong healthcare infrastructure, rising prevalence of Helicobacter pylori infections, and increasing awareness regarding early diagnosis of gastrointestinal disorders

- The market is further supported by a high rate of insurance coverage, extensive availability of advanced diagnostic tools, and strong regulatory frameworks. Moreover, growing demand for non-invasive diagnostic alternatives has bolstered the adoption of urea breath tests across the region

U.S. Urea Breath Test Market Insight

The U.S. urea breath test market captured the largest revenue share of 81% in 2024. The U.S. market benefits from the widespread adoption of point-of-care diagnostics, high patient awareness, and a significant number of gastrointestinal clinics and hospitals offering urea breath test services. Favorable reimbursement policies and the presence of key manufacturers such as Thermo Fisher Scientific and Meridian Bioscience have strengthened the country’s leadership in this space. In addition, increasing physician preference for accurate and fast detection of H. pylori infections continues to drive market growth.

Europe Urea Breath Test Market Insight

Europe urea breath test market accounted for a significant portion of the global market, securing a revenue share of 28.4% in 2024. The region’s growth is fueled by the growing burden of digestive disorders and a high demand for non-invasive, reliable diagnostics. Countries like Germany, the U.K., France, and Italy are leading adopters of breath testing technology, driven by a shift toward outpatient and preventive care. Strong governmental health policies and investments in early detection methods further contribute to the region’s expanding market size.

U.K. Urea Breath Test Market Insight

The U.K. urea breath test market held 21.6% of the European market share in 2024. This growth is largely due to increasing public health awareness, implementation of national screening programs through the National Health Service (NHS), and a rising preference for cost-effective diagnostic methods. The country's robust digital health infrastructure also supports the easy adoption of point-of-care breath test kits across hospitals and clinics.

Germany Urea Breath Test Market Insight

Germany urea breath test market represented about 25.1% of Europe’s market share in 2024, fueled by rising demand for advanced diagnostic services and a well-established healthcare ecosystem. The country’s emphasis on early detection of gastrointestinal conditions and integration of breath test solutions within outpatient services is contributing significantly to market growth. In addition, Germany's commitment to innovation and high healthcare spending levels are propelling the use of urea breath tests.

Asia-Pacific Urea Breath Test Market Insight

Asia-Pacific urea breath test market is emerging as the fastest-growing region in the urea breath test market, with a projected CAGR of 11.4% from 2025 to 2032. The region held a 20.7% global revenue share in 2024. Growth is driven by increasing urbanization, a rising middle-class population, and growing awareness of gastrointestinal health. Countries like China, Japan, and India are spearheading market expansion through government-led screening initiatives, technological advancements in diagnostics, and expanded healthcare access in urban and semi-urban areas.

Japan Urea Breath Test Market Insight

Japan urea breath test market contributed around 29.4% of the Asia-Pacific Urea Breath Test market share in 2024. Known for its innovation-led healthcare system, Japan is increasingly adopting urea breath test technology for routine screening, particularly within its aging population. The nation’s focus on non-invasive, accurate diagnostics aligns with patient preferences and drives demand in both hospital and homecare settings.

China Urea Breath Test Market Insight

China urea breath test market accounted for the largest share in the Asia-Pacific region, contributing 38.2% of the regional revenue in 2024. Market growth in China is attributed to rapid urbanization, expanding healthcare coverage, and the increasing prevalence of H. pylori-associated diseases. The country's robust manufacturing capabilities and competitive pricing have enabled the widespread availability of breath test kits across public hospitals, clinics, and retail pharmacies. In addition, smart healthcare initiatives and government focus on digital diagnostics are further supporting growth.

Urea Breath Test Market Share

The urea breath test industry is primarily led by well-established companies, including:

- Sercon Group (U.K.)

- Kibion GmbH (Sweden)

- AdvaCare Pharma (U.S.)

- Kizlon Inc. (U.K.)

- Meridian Bioscience Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- Paladin Pharma Inc. (Canada)

- Eurofins Scientific (Luxembourg)

- Beijing Richen-Force Science & Technology Co. Ltd. (China)

- Shenzhen Zhonghe Headway Bio-Sci & Tech Co. Ltd. (China)

Latest Developments in Global Urea Breath Test Market

- In 2021, Otsuka America Pharmaceutical, Inc. transferred its North American BreathTek business to Meridian Bioscience, Inc., a leading global provider of diagnostic testing solutions and life science raw materials. This strategic acquisition is expected to enhance Meridian's standing in the market, particularly in gastrointestinal diagnostics. By integrating the BreathTek portfolio, Meridian can expand its offerings and leverage its existing expertise in the field. This move positions the company for increased growth and competitiveness within the gastrointestinal diagnostic solutions sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.