Global Urinary Incontinence Care Products Market

Market Size in USD Billion

CAGR :

%

USD

12.88 Billion

USD

22.98 Billion

2024

2032

USD

12.88 Billion

USD

22.98 Billion

2024

2032

| 2025 –2032 | |

| USD 12.88 Billion | |

| USD 22.98 Billion | |

|

|

|

|

Urinary Incontinence Care Products Market Size

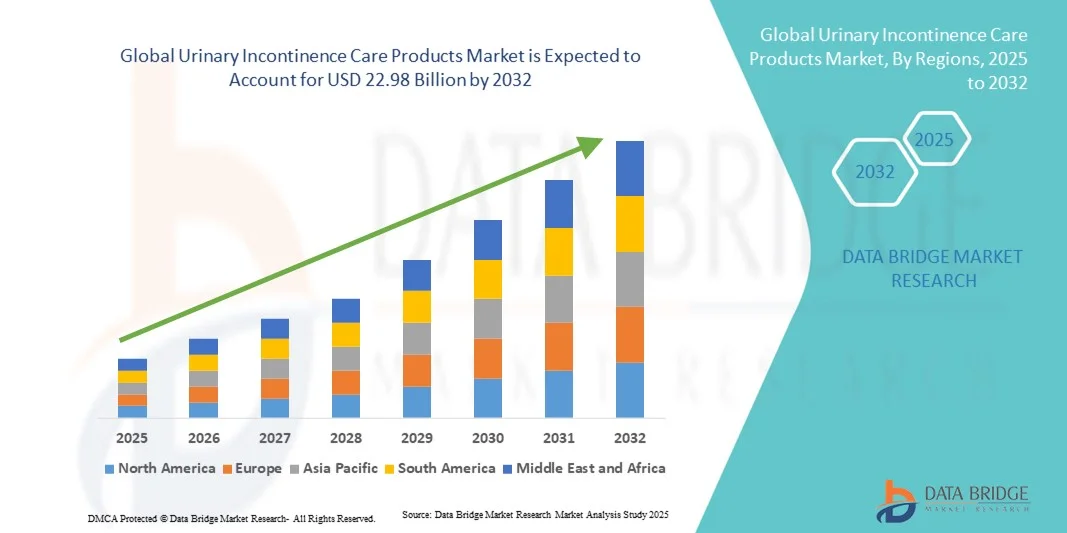

- The global urinary incontinence care products market size was valued at USD 12.88 billion in 2024 and is expected to reach USD 22.98 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of urinary incontinence across all age groups, particularly among the elderly and women, leading to increased demand for effective, convenient, and comfortable care products

- Furthermore, growing awareness about personal hygiene, advancements in absorbent materials, and the development of user-friendly, discreet, and eco-friendly solutions are accelerating the adoption of Urinary Incontinence Care Products, thereby significantly boosting the industry's growth

Urinary Incontinence Care Products Market Analysis

- Urinary Incontinence Care Products, including adult diapers, absorbent pads, and other continence aids, are increasingly essential in providing comfort, hygiene, and quality of life for individuals with bladder control issues, particularly among the elderly and patients with chronic conditions

- The escalating demand for urinary incontinence care products is primarily driven by the growing geriatric population, rising prevalence of urinary disorders, and increasing awareness of hygiene and personal care solutions

- North America dominated the urinary incontinence care products market with the largest revenue share of 38.52% in 2024, characterized by a well-established healthcare infrastructure, high adoption of homecare products, and strong presence of leading manufacturers, with the U.S. experiencing substantial growth in adult diapers and absorbent pads, driven by rising awareness and supportive reimbursement policies

- Asia-Pacific is expected to be the fastest growing region in the urinary incontinence care products market during the forecast period, projected to expand at a CAGR from 2025 to 2032, fueled by rapid urbanization, increasing disposable incomes, rising awareness of continence care, and growing investment in healthcare infrastructure in countries such as China and India

- The Natural segment dominated the urinary incontinence care products market with 61.3% revenue share in 2024, largely due to growing consumer preference for chemical-free, skin-friendly products

Report Scope and Urinary Incontinence Care Products Market Segmentation

|

Attributes |

Urinary Incontinence Care Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Urinary Incontinence Care Products Market Trends

Enhanced Convenience and Improved Patient Care

- A significant and accelerating trend in the global urinary incontinence care products market is the increasing focus on patient comfort, hygiene, and ease of use, driven by innovations in product design and materials

- For instance, several leading companies are introducing ultra-thin, highly absorbent adult diapers and pads with improved leak protection and skin-friendly materials, offering discreet and comfortable solutions for daily use

- Innovations in product ergonomics and moisture-wicking technology enable better management of incontinence, reducing skin irritation and enhancing user confidence. Some premium products also feature odor control mechanisms, further improving patient comfort and satisfaction

- The availability of a wide range of product sizes, absorbency levels, and styles caters to diverse user needs, including elderly patients, post-surgery care, and individuals with chronic urinary conditions

- Leading companies such as Kimberly-Clark, SCA Hygiene, and ConvaTec are actively developing and launching new products to improve convenience, comfort, and quality of life for users, emphasizing user-friendly designs and superior material quality

- The demand for innovative and high-performance Urinary Incontinence Care Products is growing rapidly across both homecare and clinical settings, as consumers and healthcare providers increasingly prioritize practical, safe, and reliable continence management solutions

Urinary Incontinence Care Products Market Dynamics

Driver

Growing Need Due to Increasing Aging Population and Chronic Conditions

- The rising prevalence of urinary incontinence, driven by an aging global population and higher incidence of chronic conditions such as diabetes, prostate issues, and neurological disorders, is significantly increasing the demand for Urinary Incontinence Care Products

- For instance, companies like Kimberly-Clark, ConvaTec, and SCA are continuously innovating in adult diapers, pads, and wearable incontinence solutions, enhancing comfort, absorbency, and skin-friendliness, which is expected to drive substantial growth in the forecast period

- As patients and caregivers seek greater independence and convenience, the adoption of discreet, high-performance incontinence products is rising across both home care and clinical settings. These products are increasingly considered essential for maintaining hygiene, dignity, and quality of life for affected individuals

- Furthermore, the expanding home healthcare ecosystem and growing preference for outpatient care have accelerated the demand for products that are easy to use, highly absorbent, and capable of long-term wear, addressing the practical needs of patients and caregivers alikeIn addition, factors driving adoption include odor-control features, customizable sizing, and products designed for sensitive skin, which provide enhanced comfort and protection in daily life. The increasing focus on patient-centric solutions and convenience is fueling continued investment and innovation in this market

Restraint/Challenge

Concerns Regarding Product Costs, Awareness, and Accessibility

- The relatively high cost of premium urinary incontinence care products compared to standard options can limit adoption among price-sensitive consumers, particularly in developing regions and for low-income households

- Limited awareness about available products, proper usage techniques, and benefits among patients and caregivers poses a challenge to market growth, necessitating educational campaigns and training initiatives

- Occasional skin irritation or discomfort due to improper use or lower-quality materials underscores the need for product improvements and higher-quality standards

- The presence of counterfeit or substandard products in certain markets may undermine consumer trust and slow adoption, highlighting the importance of robust regulatory compliance and quality assurance

- Distribution and accessibility challenges, especially in rural or underserved areas, may restrict market penetration, emphasizing the need for wider product availability and improved supply chains

- Overcoming these challenges through continuous product innovation, enhanced affordability, patient and caregiver education, and expansion of distribution networks will be critical for sustained growth in the urinary incontinence care products market

Urinary Incontinence Care Products Market Scope

The market is segmented on the basis of product type, sales channel, raw material, consumer orientation, functionality, product claim, application, incontinence type, disease, and age.

- By Product Type

On the basis of product type, the urinary incontinence care products market is segmented into urine bags, urinary catheter, and others. The Urinary Catheter segment dominated the market with a revenue share of 42.5% in 2024, driven by its extensive use in hospitals, nursing homes, and home-care settings. Catheters are preferred for their reliability, patient comfort, and clinical effectiveness in managing urinary retention and incontinence. Adoption is supported by increasing chronic disease prevalence, aging population, and institutional demand. Innovations in anti-infection coatings and user-friendly designs enhance the segment’s appeal. Healthcare providers recommend urinary catheters for long-term and post-surgical care, further driving revenue. Bulk purchasing by hospitals and clinics ensures consistent supply and preference for branded catheters. The segment also benefits from compatibility with modern collection systems and continuous monitoring in institutional care.

The urine bags segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, fueled by rising home-care adoption and patient preference for disposable, hygienic, and easy-to-use urine collection systems. Innovations in lightweight, leak-proof, and odor-resistant designs increase usability. Growing awareness among caregivers and patients about hygienic management of incontinence accelerates adoption. The segment benefits from online sales channels offering convenient delivery and product variety. Expansion of hospital-at-home programs and outpatient care supports growth. Increasing adoption in elderly care facilities and rehabilitation centers also contributes. Rising focus on patient comfort and mobility further drives demand.

- By Sales Channel

On the basis of sales channel, the urinary incontinence care products market is segmented into institutional sales, modern trade, departmental stores, convenience stores, specialty stores, online retailers, drug stores, and other sales channels. The Institutional Sales segment dominated with a revenue share of 44.8% in 2024, owing to bulk procurement by hospitals, nursing homes, and home-care service providers. Institutional buyers prioritize trusted brands, quality compliance, and consistent supply for patient safety. Hospitals and clinics prefer standardized products for efficient inventory management. Government programs and tenders for healthcare institutions also support revenue dominance. Long-term agreements with distributors ensure sustained adoption. Product reliability, clinical recommendations, and institutional training programs reinforce preference. Institutional buyers also influence home-care adoption through professional advice.

The Online Retailers segment is expected to witness the fastest CAGR of 21.1% from 2025 to 2032, driven by convenience, discreet packaging, and growing digital adoption among consumers. Online platforms provide access to a wide range of products, including specialized, organic, and reusable options. Easy ordering, home delivery, and subscription services increase repeat purchases. Patient awareness campaigns and e-commerce promotions further accelerate growth. Rural and semi-urban expansion of e-commerce enables access to previously underserved areas. Online reviews and recommendations enhance trust in products. Flexible pricing and availability of multiple brands on digital platforms further encourage adoption.

- By Raw Material

On the basis of raw material, the urinary incontinence care products market is segmented into Latex, Plastic, Cotton Fabrics, and Super Absorbents. The Super Absorbents segment dominated with 39.7% revenue share in 2024, due to superior liquid retention, skin protection, and comfort during prolonged use. Products with super absorbents reduce leakage, prevent skin irritation, and are preferred in hospitals, nursing homes, and home-care. Adoption is supported by chronic disease prevalence, aging population, and healthcare professional recommendations. High reliability, compatibility with both disposable and reusable designs, and innovations in gel technology enhance the segment’s appeal. Caregivers and patients prioritize performance, comfort, and convenience. Bulk procurement by institutions strengthens dominance.

The Cotton Fabrics segment is expected to witness the fastest CAGR of 18.5% from 2025 to 2032, driven by increasing preference for natural, breathable, and skin-friendly materials. Eco-conscious consumers favor reusable cotton-based products. Demand is rising among home-care users and environmentally aware caregivers. Comfort, hypoallergenic properties, and sustainability are key drivers. Adoption is supported by hospitals promoting green initiatives and reusable options. Growing product availability online accelerates accessibility. Cotton fabrics offer better moisture absorption, durability, and patient satisfaction.

- By Consumer Orientation

On the basis of consumer orientation, the urinary incontinence care products market is segmented into Male and Female. The Female segment dominated with 51.2% revenue share in 2024, due to higher prevalence of stress and urge incontinence among women, especially post-pregnancy and during menopause. Products tailored for female anatomy enhance comfort, hygiene, and ease of use. Awareness campaigns, healthcare recommendations, and institutional adoption support dominance. Adoption in hospitals, clinics, and home-care is high. Female-specific products such as pads, catheters, and undergarments are widely available. Innovations in absorbent materials and discreet designs further boost acceptance. Marketing campaigns targeting caregivers and patients reinforce usage.

The Male segment is expected to witness the fastest CAGR of 20.2% from 2025 to 2032, fueled by growing awareness of male-specific incontinence solutions and increasing geriatric population. Products designed for male comfort, discreetness, and effectiveness are gaining traction. Institutional recommendations and home-care usage drive adoption. Marketing initiatives focus on hygiene, convenience, and comfort. Online accessibility enhances product reach. Chronic disease prevalence among men, including prostate disorders, supports demand. Growth in specialized catheters, guards, and wearable devices further accelerates uptake.

- By Functionality

On the basis of functionality, the urinary incontinence care products market is segmented into Disposable and Reusable. The Disposable segment dominated with 55.6% revenue share in 2024, primarily due to its high hygiene standards, ease of use, and strong adoption in hospitals and institutional care. Disposable products minimize the risk of infection, offer simple replacement, and are convenient for both home-care and clinical settings. Caregivers and patients favor their convenience, comfort, and reliability for daily use. Bulk procurement by hospitals and healthcare institutions ensures steady demand and repeat usage. The segment benefits from product innovations, including advanced absorbency, leak protection, and skin-friendly materials. Marketing initiatives and caregiver recommendations enhance awareness and penetration. Outpatient care facilities and home healthcare programs increasingly rely on disposable options for efficiency. Institutional guidelines often recommend disposables for improved hygiene and patient safety. The segment also benefits from rising patient awareness regarding infection control and proper incontinence management.

The Reusable segment is expected to witness the fastest CAGR of 17.9% from 2025 to 2032, driven by increasing preference for cost-effective, eco-friendly, and sustainable solutions. Reusable incontinence products are highly favored in home-care setups and long-term care environments. Durable fabrics, ease of cleaning, and comfort are key factors supporting adoption. Consumers and caregivers are increasingly aware of environmental sustainability, boosting demand for reusable alternatives. Availability through e-commerce, specialty stores, and direct sales enhances reach and convenience. Hospitals and care facilities are promoting reusable products to reduce waste and maintain cost efficiency. Continuous product innovation, including enhanced absorbency and comfort, supports growth. Educational campaigns targeting caregivers and healthcare providers emphasize durability and economic benefits. The segment also benefits from the trend toward sustainable healthcare products in developed and emerging markets.

- By Product Claim

On the basis of product claim, the urinary incontinence care products market is segmented into Organic and Natural. The Natural segment dominated with 61.3% revenue share in 2024, largely due to growing consumer preference for chemical-free, skin-friendly products. Natural incontinence products are widely recommended in hospitals, clinics, and home-care settings to prevent irritation and promote patient comfort. Marketing campaigns, caregiver endorsements, and widespread availability reinforce adoption. Product variety, including pads, catheters, and absorbent garments, enhances penetration across institutional and home-care applications. Institutions value natural products for compliance with hygiene standards and patient safety. The segment is supported by continuous innovations aimed at improving comfort, absorbency, and odor control. Awareness initiatives targeting caregivers, patients, and healthcare professionals further strengthen market position. Convenience and ease of disposal also contribute to dominance. Integration into both outpatient care and long-term care facilities ensures recurring demand.

The Organic segment is expected to witness the fastest CAGR of 18.8% from 2025 to 2032, fueled by rising awareness regarding environmentally friendly, hypoallergenic, and non-toxic materials. Organic products are gaining traction among eco-conscious consumers and caregivers seeking safe, skin-friendly solutions. Adoption is increasing in both home-care and institutional settings, including hospitals, nursing facilities, and clinics. Online retail, specialty stores, and direct distribution channels improve accessibility and convenience. Continuous product innovation enhances performance, comfort, and absorbency of organic products. Marketing campaigns emphasize sustainability, safety, and hygiene benefits, boosting consumer confidence. Caregiver guidance and physician recommendations further drive growth. Government initiatives supporting environmentally responsible healthcare products also contribute to adoption. The segment benefits from rising demand for premium and safe incontinence solutions among the elderly and chronic disease patients.

- By Application

On the basis of application, the urinary incontinence care products market is segmented into Urine Incontinence, Faecal Incontinence, and Dual Incontinence. The Urine Incontinence segment dominated with 63.5% revenue share in 2024, driven by its high prevalence, extensive clinical adoption, and comfort-focused product development. Hospitals, nursing facilities, and home-care providers prefer urine incontinence products for both short- and long-term care. Chronic disease prevalence, aging population, and increasing institutional recommendations strengthen adoption. Product innovations, such as enhanced absorbency, leak-proof designs, and odor control, further drive penetration. Ease of use, patient comfort, and skin protection remain primary adoption drivers. Bulk procurement and home-care adoption contribute to recurring demand. Caregiver training and awareness campaigns enhance market reach. The segment benefits from technological advancements and continuous improvement in disposable and reusable designs.

The Dual Incontinence segment is expected to witness the fastest CAGR of 19.6% from 2025 to 2032, supported by growing awareness of multifunctional products that address both urinary and fecal incontinence simultaneously. Adoption is rising in elderly care facilities, hospitals, and home-care settings, where patients often require comprehensive solutions. Product innovations focusing on superior absorbency, comfort, skin protection, and odor control are accelerating growth. The segment benefits from the increasing geriatric population and rising incidence of chronic diseases contributing to dual incontinence. Awareness campaigns targeting caregivers and healthcare professionals enhance recognition and uptake. Online retail and institutional procurement channels improve accessibility. Healthcare providers recommend dual-functional products for improved patient compliance and hygiene. Expansion of home-care programs and institutional support further accelerates adoption. Market growth is also fueled by innovations in reusable and eco-friendly options, appealing to both institutional and home-care users.

- By Incontinence Type

On the basis of incontinence type, the urinary incontinence care products market is segmented into Stress, Urge, and Mixed. The Urge segment dominated with a revenue share of 46.7% in 2024, owing to the high prevalence of urge incontinence among adults and geriatric patients. Institutional adoption in hospitals and nursing facilities is high due to the need for effective and hygienic management. Products are designed with superior absorbency, comfort, and leak protection to enhance patient care. Healthcare providers and home-care services strongly recommend urge-specific solutions. Continuous product innovation, including odor control and discreet designs, reinforces market dominance. Awareness campaigns and caregiver guidance contribute to higher adoption. The segment benefits from growing awareness about urinary disorders, technological enhancements in disposable and reusable products, and the preference for convenience among home-care users.

The Mixed segment is expected to witness the fastest CAGR of 18.3% from 2025 to 2032, driven by the rising number of patients experiencing combined urinary disorders. Institutional and home-care demand is growing as dual-functional products become increasingly available. Product innovations focusing on absorbency, skin comfort, and hygiene are accelerating adoption. Market growth is supported by the aging population, increased prevalence of chronic conditions, and expansion of home-care programs. Online sales and direct-to-consumer channels enhance accessibility. Marketing initiatives targeting both patients and caregivers further drive demand. Growth is reinforced by healthcare providers recommending multi-purpose solutions to improve patient compliance.

- By Disease

On the basis of disease, the urinary incontinence care products market is segmented into Feminine Health, Chronic Disease, Benign Prostatic Hyperplasia, Bladder Cancer, and Mental Disorders. The Chronic Disease segment dominated with a revenue share of 49.1% in 2024, driven by the high incidence of diabetes, neurological disorders, and other chronic conditions that contribute to incontinence. Institutional adoption in hospitals, clinics, and home-care is significant, with products preferred for reliability and patient comfort. Product innovations include odor control, skin-friendly materials, and disposable/reusable options to meet clinical standards. Awareness campaigns and physician recommendations support higher adoption. Bulk procurement by healthcare institutions strengthens dominance. The segment benefits from increasing elderly population and long-term care needs. Continuous product improvements and caregiver education reinforce usage.

The Feminine Health segment is expected to witness the fastest CAGR of 19.0% from 2025 to 2032, driven by increasing demand for postpartum and menopausal incontinence products. Products are designed for female comfort, discreet usage, and enhanced absorbency. Home-care adoption and e-commerce availability accelerate growth. Awareness campaigns targeting women and caregivers further fuel adoption. Institutional recommendations in hospitals and clinics support market penetration. Innovations in organic and natural materials increase appeal. Marketing efforts highlight hygiene, comfort, and reliability. The segment also benefits from growing disposable income and higher health consciousness among women.

- By Age

On the basis of age, the urinary incontinence care products market is segmented into Below 20 years, 20 to 39 years, 40 to 59 years, 60 to 79 years, and 80+ years. The 60 to 79 years segment dominated with a revenue share of 42.5% in 2024, attributed to the higher prevalence of urinary incontinence in the elderly population. Institutional adoption in hospitals and long-term care facilities is significant, driven by patient care standards and clinical recommendations. Products are designed for comfort, skin protection, and ease of use. The segment benefits from technological innovations, such as disposable, reusable, and ultra-absorbent designs. Awareness campaigns targeting caregivers and elderly patients enhance adoption. Bulk procurement by hospitals and home-care providers strengthens market dominance. Patient preference for discreet and hygienic solutions further supports growth.

The 80+ years segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by rising longevity, higher incidence of chronic diseases, and the increasing adoption of home-care solutions. Products designed for comfort, leak protection, and skin health accelerate market penetration. Hospitals and institutional buyers prefer reliable, standardized solutions for geriatric care. Caregivers favor products that are easy to use and maintain hygiene. E-commerce and retail availability improve access. Marketing campaigns targeting senior citizens and healthcare providers enhance awareness. Innovations in reusable and organic products further support growth. Government initiatives promoting elderly care also contribute to segment expansion.

Urinary Incontinence Care Products Market Regional Analysis

- North America dominated the urinary incontinence care products market with the largest revenue share of 38.52% in 2024, characterized by a well-established healthcare infrastructure, high adoption of homecare products, and strong presence of leading manufacturers. Rising awareness about continence care, supportive reimbursement policies, and growing demand for adult diapers, absorbent pads, and wearable incontinence products are driving substantial growth in the U.S.

- Consumers in the region increasingly prioritize comfort, high absorbency, skin-friendliness, and odor control in incontinence products, which has encouraged manufacturers to innovate and expand their offerings

- The presence of major market players such as Kimberly-Clark, ConvaTec, and SCA, combined with the region’s high disposable income and a strong focus on patient-centric solutions, further supports the adoption of advanced Urinary Incontinence Care Products

U.S. Urinary Incontinence Care Products Market Insight

The U.S. urinary incontinence care products market captured the largest revenue share within North America in 2024, fueled by rising prevalence of chronic diseases, an aging population, and increasing awareness of personal hygiene and homecare solutions. The demand for high-quality adult diapers, pads, and wearable incontinence products is expanding across both homecare and clinical settings, supported by continuous product innovation and availability of reimbursement programs that make premium products more accessible.

Europe Urinary Incontinence Care Products Market Insight

The Europe urinary incontinence care products market is expected to grow steadily throughout the forecast period, driven by rising awareness of continence care, increasing aging population, and well-established healthcare infrastructure. Growth is being observed across residential care, hospitals, and assisted-living facilities, with manufacturers focusing on product comfort, absorbency, and eco-friendly materials. Countries such as Germany, France, and Italy are witnessing significant adoption of advanced incontinence products.

U.K. Urinary Incontinence Care Products Market Insight

The U.K. urinary incontinence care products market is anticipated to expand at a notable CAGR during the forecast period, driven by increasing awareness of adult incontinence issues and growing demand for high-quality absorbent products. Additionally, aging demographics and the presence of homecare services contribute to market expansion, with consumers and healthcare providers prioritizing comfort, convenience, and discreet solutions.

Germany Urinary Incontinence Care Products Market Insight

The Germany urinary incontinence care products market is expected to register steady growth during the forecast period, fueled by a well-developed healthcare system, high patient awareness, and demand for technologically improved, skin-friendly, and eco-conscious incontinence products. Adoption is strong across hospitals, long-term care facilities, and homecare settings, with manufacturers increasingly focusing on sustainable and high-performance product innovations.

Asia-Pacific Urinary Incontinence Care Products Market Insight

The Asia-Pacific urinary incontinence care products market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, rising awareness of continence care, and growing investment in healthcare infrastructure in countries such as China, India, and Japan. The region is witnessing increasing demand for adult diapers, absorbent pads, and wearable incontinence solutions across homecare and clinical settings, fueled by rising elderly populations and chronic disease prevalence.

Japan Urinary Incontinence Care Products Market Insight

The Japan urinary incontinence care products market is gaining traction due to the country’s aging population, growing awareness about continence care, and high standards of healthcare. The market favors products that provide comfort, ease of use, and hygiene, with manufacturers focusing on innovative, skin-friendly, and discreet solutions to meet patient needs.

China Urinary Incontinence Care Products Market Insight

The China urinary incontinence care products market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding middle-class population, rising disposable incomes, and increasing prevalence of chronic diseases. Growing awareness of continence care, along with investments in healthcare infrastructure and homecare services, is accelerating adoption of adult diapers, pads, and wearable incontinence products across residential and healthcare settings.

Urinary Incontinence Care Products Market Share

The Urinary Incontinence Care Products industry is primarily led by well-established companies, including:

- Torrent Pharmaceuticals Ltd. (India)

- Lilly USA, LLC. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma (India)

- Lupin (India)

- Viatris Inc (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Coloplast Group (Denmark)

- Boston Scientific Corporation (U.S.)

- B. Braun SE (Germany)

- BD (U.S.)

- Baxter (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Medtronic (Ireland)

- AstraZeneca (U.K.)

- Merck & Co., Inc. (U.S.)

Latest Developments in Global Urinary Incontinence Care Products Market

- In June 2023, Essity (Sweden) launched TENA Sensitive Care Pads with its SkinComfort formula, designed to provide improved comfort, odor control, and skin protection for individuals with light to moderate incontinence

- In December 2023, Caldera Medical was awarded a national group purchasing agreement for surgical incontinence products with Premier Inc., effective January 2024, enhancing its access to U.S. healthcare providers

- In January 2024, Boston Scientific announced it would acquire Axonics, Inc. for approximately USD 3.7 billion, aiming to strengthen its urology portfolio with technologies to treat urinary and bowel dysfunction

- In September 2022, Essity finalized the acquisitions of Knix Wear Inc. (Canada) and Modibodi (Australia), both leading providers of leakproof apparel for periods and incontinence, to expand its Intimate Hygiene and Incontinence product segment

- In July 2024, Attindas Hygiene Partners announced a USD 25.2 million investment to expand its Greenville, North Carolina facility, increasing production capacity for disposable adult incontinence and hygiene products

- In June 2024, Essity strengthened its financial position by divesting its 51.6% stake in subsidiary Vinda, while reaffirming its commitment to innovation and efficiency in core hygiene and incontinence care product lines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.