Global Urothelial Cancer Drugs Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.80 Billion

2024

2032

USD

1.44 Billion

USD

2.80 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.80 Billion | |

|

|

|

|

Urothelial Cancer Drugs Market Size

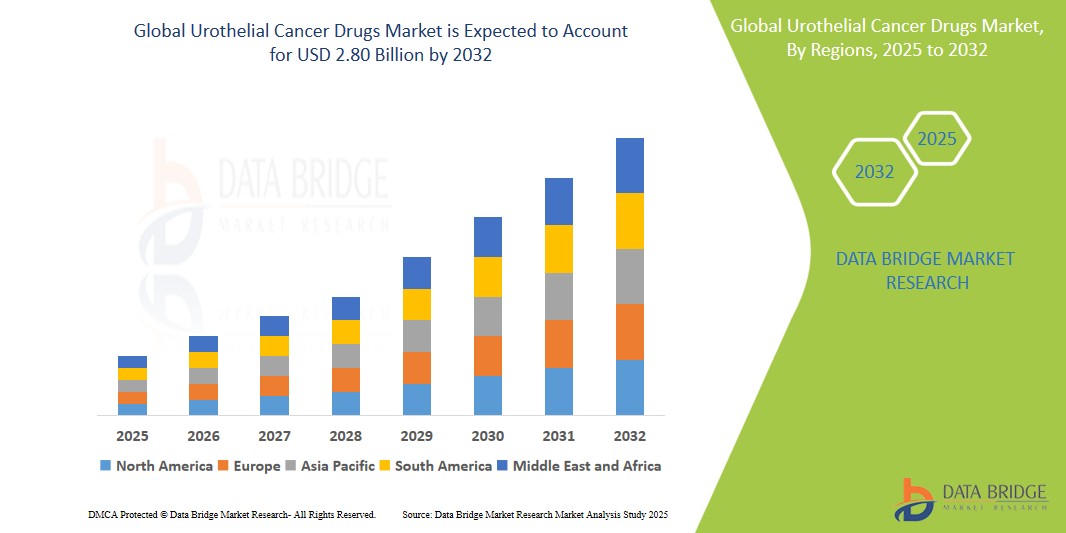

- The global Urothelial Cancer Drugs market size was valued at USD 1.44 billion in 2024 and is expected to reach USD 2.80 billion by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by the rising global burden of bladder cancer, significant advances in immunotherapy, and expanding access to oncology treatment across both developed and emerging economies.

Urothelial Cancer Drugs Market Analysis

- Urothelial cancer drugs have transformed the landscape of bladder cancer treatment. Immunotherapies, especially immune checkpoint inhibitors, have demonstrated durable responses in patients with advanced disease stages. The demand for Urothelial Cancer Drugs is significantly driven by innovations in gene sequencing and biomarkers are facilitating personalized treatment pathways.

- North America leads the market due to early drug approvals, strong reimbursement mechanisms, and high bladder cancer prevalence.

- Asia-Pacific is emerging as the fastest-growing region, driven by increasing cancer awareness, rising diagnostic rates, and regional clinical trial expansion.

- Immune Checkpoint Inhibitors are expected to dominate the market with a share of 44.3% in 2025, supported by positive outcomes in metastatic urothelial carcinoma and growing clinical confidence.

Report Scope and Urothelial Cancer Drugs Market Segmentation

|

Attributes |

Urothelial Cancer Drugs Key Market Insights |

|

Segments Covered |

By Drug Class: Immune Checkpoint Inhibitors, Chemotherapy Drugs, Targeted Therapy, and Others By Disease Type: Non-Muscle Invasive Bladder Cancer (NMIBC), Muscle-Invasive Bladder Cancer (MIBC), Metastatic Bladder Cancer By End User: Hospitals, Oncology Clinics, Academic & Research Institutes, and Others By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Urothelial Cancer Drugs Market Trends

“Biomarker Integration in Drug Development”

The integration of biomarkers has become a cornerstone in the development of urothelial cancer drugs. By leveraging specific biomarkers such as PD-L1 expression and tumor mutational burden (TMB), clinicians and pharmaceutical companies can stratify patients based on their likelihood to respond to immunotherapies. This targeted approach reduces unnecessary exposure to ineffective treatments and improves overall response rates.

For instance, clinical trials for checkpoint inhibitors like atezolizumab and pembrolizumab now routinely incorporate PD-L1 status to determine enrollment eligibility and assess treatment efficacy. Furthermore, tumor mutational burden has emerged as a predictive biomarker in identifying patients who may benefit from immune checkpoint blockade, especially in high-risk or treatment-refractory cases.

This trend is accelerating the development of companion diagnostics and fostering a more personalized oncology treatment paradigm.

Urothelial Cancer Drugs Market Dynamics

Driver

Rising Incidence of Bladder Cancer and Aging Population

- Increasing exposure to risk factors (e.g., smoking, occupational hazards) is elevating bladder cancer cases globally.

- Bladder cancer predominantly affects older adults, and the aging global population is expanding the patient base.

- Countries with mature health systems are initiating nationwide screening and early detection programs to address rising demand.

- For instance, in 2024, the American Cancer Society projected over 83,000 new bladder cancer cases in the U.S., reflecting the rising clinical burden.

Opportunity

Breakthrough Designations and Orphan Drug Approvals

- Regulatory support, such as FDA's Breakthrough Therapy and EMA’s PRIME status, is accelerating time-to-market for innovative therapies.

- Rare and advanced urothelial cancer forms are receiving increased investment due to favorable market exclusivity periods and patient need.

- Collaborations between academia and pharma are boosting novel compound discovery for aggressive disease stages.

- For instance, in January 2025, the FDA granted Breakthrough Therapy Designation to a novel FGFR inhibitor developed by Janssen for metastatic bladder cancer.

Restraint/Challenge

High Cost of Immunotherapies and Regional Access Disparities

- Checkpoint inhibitors can cost over USD 100,000 annually, restricting access in low- and middle-income countries.

- Limited public insurance coverage and lack of national guidelines in some countries contribute to underutilization.

- Capacity constraints in diagnostics and infusion infrastructure further hamper adoption in underserved regions.

- For instance, a 2023 study published in The Lancet Oncology highlighted that fewer than 25% of eligible patients in Latin America received immunotherapy due to pricing and regulatory bottlenecks.

Urothelial Cancer Drugs Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Drug Class |

|

|

By Disease Type |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the immune checkpoint inhibitors is projected to dominate the market with a largest share in drug class segment

In 2025, the immune checkpoint inhibitors segment is expected to dominate the Urothelial Cancer Drugs market with the largest market share of 44.35% due to its to the strong clinical efficacy, expanding approval for first-line and maintenance therapy, and growing confidence among oncologists. Immune checkpoint inhibitors such as pembrolizumab and atezolizumab have become preferred treatment options due to their durable responses and relatively favorable safety profiles in both advanced and earlier stages of the disease.

The Metastatic Bladder Cancer is expected to account for the largest share during the forecast period in disease type market

In 2025, the Metastatic Bladder Cancer segment is expected to dominate the market with the largest market share of 49.55% owing to the increasing incidence of late-stage diagnoses, limited curative treatment options at this stage, and greater need for systemic therapies. The unmet medical need and high mortality rates associated with metastatic urothelial carcinoma have pushed pharmaceutical innovation, leading to more targeted therapies, combination regimens, and broader clinical trial activity in this subgroup.

Urothelial Cancer Drugs Market Regional Analysis

"North America Holds the Largest Share in the Urothelial Cancer Drugs Market"

North America dominates the global urothelial cancer drugs market due to well-established healthcare infrastructure, high adoption of immunotherapy, and favorable reimbursement policies. The presence of leading pharmaceutical companies and a high prevalence of bladder cancer cases contribute significantly to regional leadership. The U.S., in particular, benefits from early drug approvals and strong clinical trial networks, which accelerate access to advanced treatments.

"Asia-Pacific is Projected to Register the Highest CAGR in the Urothelial Cancer Drugs Market" Asia-Pacific is expected to witness the fastest growth during the forecast period, driven by increasing healthcare investments, a large patient population, and rising cancer awareness. Countries like China, India, and South Korea are experiencing growing adoption of targeted therapies and immune checkpoint inhibitors. Government-led oncology initiatives, improving access to diagnostics, and entry of multinational pharmaceutical companies are further accelerating market expansion across this region.

Urothelial Cancer Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Eli Lilly and Company (U.S.)

- AstraZeneca (UK)

- GlaxoSmithKline plc (UK)

- Novartis AG (Switzerland)

Latest Developments in Global Urothelial Cancer Drugs Market

- In January 2025, UroGen Pharma Ltd. announced that the FDA accepted the New Drug Application (NDA) for UGN-102, assigning a Prescription Drug User Fee Act (PDUFA) goal date of June 13, 2025. UGN-102 is being developed for the treatment of patients with low-grade intermediate-risk non-muscle invasive bladder cancer (LG-IR-NMIBC).

- In October 2024, Gilead Sciences announced the voluntary withdrawal of its drug Trodelvy for treating metastatic urothelial cancer in the U.S. after a confirmatory trial failed to meet its primary endpoint. The decision was made in consultation with the U.S. FDA, following the drug's inability to improve survival rates and an observed higher number of deaths due to complications compared to alternative therapies.

- In December 2024, AbbVie received regulatory approval for a dual-action monoclonal antibody for inflammatory bowel disease in both U.S. and European markets. This approval enhances AbbVie's immunology portfolio and offers new treatment options for patients.

- In February 2025, Novartis announced the launch of a first-in-class gene therapy for a rare autoimmune skin condition, expanding its specialty biologics portfolio. This move signifies Novartis's commitment to advancing gene therapy treatments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.