Global Utilities Wheeled Loader Market

Market Size in USD Billion

CAGR :

%

USD

5.52 Billion

USD

7.05 Billion

2024

2032

USD

5.52 Billion

USD

7.05 Billion

2024

2032

| 2025 –2032 | |

| USD 5.52 Billion | |

| USD 7.05 Billion | |

|

|

|

|

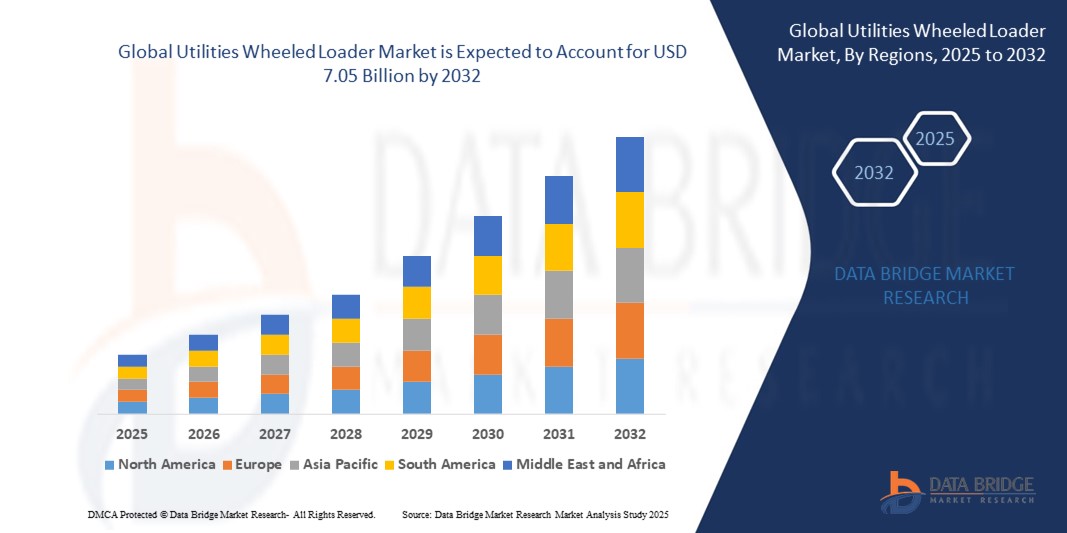

What is the Global Utilities Wheeled Loader Market Size and Growth Rate?

- The global utilities wheeled loader market size was valued at USD 5.52 billion in 2024 and is expected to reach USD 7.05 billion by 2032, at a CAGR of 3.10% during the forecast period

- The global wheeled loader market used in the utilities sector is expected to witness steady growth, driven by factors such as increasing investments in infrastructure development, particularly in emerging economies. Growing demand for efficient and versatile equipment for material handling in utility applications such as trenching, digging, and loading will further propel the market

- In addition, the rise of electric and hybrid wheeled loaders, catering to environmental concerns and stricter emission regulations, is anticipated to create new avenues for growth. However, factors such as fluctuating fuel prices and stringent safety regulations might pose challenges to the market's expansion

What are the Major Takeaways of Utilities Wheeled Loader Market?

- The growth of infrastructure development is a key driver for the global utilities wheeled loader market. Utilities wheeled loaders play a vital role in construction projects by efficiently handling materials and performing various tasks

- As infrastructure activities increase globally, the demand for these versatile loaders rises, contributing to market growth. Utilities wheeled loaders are essential in various applications, offering efficiency and effectiveness, aligning with the expanding needs of the construction and infrastructure development sector

- North America dominated the utilities wheeled loader market in 2024, accounting for the largest revenue share of 34.12%. This dominance is attributed to extensive infrastructure development, high fleet utilization rates, and significant investments in utility, construction, and road maintenance projects

- Asia-Pacific utilities wheeled loader market is projected to grow at the fastest CAGR of 7.12% between 2025 and 2032, driven by rapid urbanization, infrastructure expansion, and strong government-backed development projects

- The compact wheeled loader segment dominated the utilities wheeled loader market with the largest market revenue share of 46.5% in 2024, driven by its versatility, fuel efficiency, and suitability for utility, construction, and municipal applications

Report Scope and Utilities Wheeled Loader Market Segmentation

|

Attributes |

Utilities Wheeled Loader Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Utilities Wheeled Loader Market?

Integration of Advanced Telematics and Autonomous Operation

- A major and accelerating trend in the global utilities wheeled loader market is the adoption of advanced telematics systems and semi-autonomous operating technologies, which are enhancing operational efficiency, safety, and fleet management capabilities

- For instance, Caterpillar’s VisionLink telematics platform enables real-time monitoring of machine health, fuel consumption, and productivity metrics, allowing fleet managers to make data-driven decisions. Similarly, Volvo CE’s Load Assist system integrates with Co-Pilot in-cab displays to provide real-time payload data and performance tracking

- Autonomous and remote-control functionalities are increasingly being incorporated, allowing operators to control machines from safe distances in hazardous environments, reducing the risk of accidents. Komatsu’s semi-autonomous loader systems can automatically perform repetitive tasks such as loading and dumping, improving cycle times and reducing operator fatigue

- Integration with GPS and geofencing enhances site security and precision, ensuring machines operate within defined work zones. Fleet managers can schedule preventive maintenance proactively, reducing downtime and extending equipment lifespan

- The growing interoperability of wheeled loaders with site management software allows for unified control over excavation, material handling, and loading processes, streamlining operations on large-scale projects

- This shift towards smarter, connected, and partially automated wheeled loaders is redefining productivity standards in utilities and construction. Manufacturers such as Caterpillar, Volvo CE, and Komatsu are investing heavily in autonomous capabilities, positioning themselves to meet the rising demand for efficiency and safety in utility applications

- The demand for connected and semi-autonomous wheeled loaders is growing rapidly in utility infrastructure, mining, and large-scale construction projects, as end-users increasingly prioritize efficiency, reduced labor costs, and enhanced safety compliance

What are the Key Drivers of Utilities Wheeled Loader Market?

- Increasing investments in utility infrastructure development and the growing emphasis on operational efficiency are major drivers boosting demand for utilities wheeled loaders

- For instance, in March 2024, Caterpillar announced upgrades to its next-generation medium wheeled loader range, introducing enhanced fuel efficiency, payload accuracy, and automated assist features to meet rising customer demands. Such innovations are expected to propel market growth

- The expansion of urban infrastructure, road construction, and utility installation projects worldwide is creating sustained demand for high-performance material-handling equipment

- Utilities Wheeled Loaders offer versatile applications, including trench backfilling, material loading, snow removal, and site preparation, making them indispensable across utility service providers, municipalities, and contractors

- The rising need for cost-effective and time-efficient equipment is driving adoption, as modern loaders reduce fuel consumption while increasing load cycle efficiency

- In addition, the push toward sustainable operations is encouraging manufacturers to develop electric and hybrid wheeled loader models, aligning with environmental regulations and corporate sustainability goals

- The convenience of advanced operator-assist systems, quick-attach couplers for rapid tool changes, and improved cabin ergonomics are key factors attracting operators and contractors

- Growing rental market opportunities, combined with increased availability of technologically advanced yet user-friendly machines, are further fueling market expansion across both developed and emerging economies

Which Factor is challenging the Growth of the Utilities Wheeled Loader Market?

- One of the major challenges facing the utilities wheeled loader market is the high initial investment cost associated with advanced and specialized models. Utilities wheeled loaders designed for specific applications, such as waste handling, snow removal, or port operations, often require premium attachments, stronger components, and higher-capacity engines, which significantly increase purchase prices. This can be a deterrent for small- and medium-sized utility operators with limited budgets

- For instance, municipal bodies in developing economies often opt for used or lower-specification loaders due to cost constraints, limiting the sales potential of high-end models

- In addition, maintenance and operational costs including fuel consumption, spare parts, and skilled labor for repairs can be substantial, further discouraging adoption among cost-sensitive buyers

- Overcoming these barriers will require manufacturers to focus on cost-optimized designs, flexible financing solutions, and extended product life cycles to appeal to budget-conscious markets without compromising performance

How is the Utilities Wheeled Loader Market Segmented?

The market is segmented on the basis of type and application.

- By Product Type

On the basis of product type, the utilities wheeled loader market is segmented into compact wheeled loader, mini wheeled loader, and large wheeled loader. The compact wheeled loader segment dominated the utilities wheeled loader market with the largest market revenue share of 46.5% in 2024, driven by its versatility, fuel efficiency, and suitability for utility, construction, and municipal applications. Compact models are highly valued for their ability to operate in confined spaces while maintaining excellent lifting capacity, making them a preferred choice for infrastructure maintenance and landscaping. The market also benefits from increasing demand for compact loaders due to their lower operating costs and compatibility with a wide range of attachments.

The mini wheeled loader segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in agriculture, small-scale construction, and landscaping projects. Mini loaders offer easy maneuverability, reduced ground impact, and affordability, making them ideal for contractors and operators seeking cost-effective and efficient equipment.

- By Application

On the basis of application, the utilities wheeled loader market is segmented into construction, mining, agriculture, landscaping, and others. The construction segment accounted for the largest market revenue share of 51.2% in 2024, driven by increasing infrastructure development, road expansion projects, and the growing need for efficient material handling equipment in urban and rural construction sites. Utilities Wheeled Loaders in construction applications are prized for their ability to perform multiple tasks such as material loading, grading, and site preparation, thereby improving operational efficiency.

The agriculture segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the rising use of loaders for handling feed, manure, and bulk materials. Growing mechanization in farming, combined with the need for time-saving equipment, is driving demand in this sector.

Which Region Holds the Largest Share of the Utilities Wheeled Loader Market?

- North America dominated the utilities wheeled loader market in 2024, accounting for the largest revenue share of 34.12%. This dominance is attributed to extensive infrastructure development, high fleet utilization rates, and significant investments in utility, construction, and road maintenance projects

- The region benefits from the adoption of advanced loader technologies, including fuel-efficient engines, telematics, and improved operator comfort features. Government spending on public works and the replacement of outdated fleets also boost demand

- The U.S. is the leading contributor, driven by ongoing large-scale urban development, municipal upgrades, and versatile equipment needs for both rural and urban utility applications

U.S. Utilities Wheeled Loader Market Insight

U.S. utilities wheeled loader market captured 81% of North America’s total share in 2024, reflecting its position as a key demand center for construction, municipal services, and infrastructure projects. The market benefits from a steady stream of public and private investments in roads, utilities, and commercial developments. Contractors increasingly prefer compact, fuel-efficient loaders capable of performing in both confined urban spaces and large-scale worksites. In addition, fleet owners are investing in smart loaders with advanced control systems, telematics, and automated features to reduce operational costs. The country’s commitment to upgrading outdated infrastructure ensures strong equipment demand in the foreseeable future.

Europe Utilities Wheeled Loader Market Insight

Europe utilities wheeled loader market is experiencing steady growth, driven by the region’s focus on sustainability, regulatory compliance, and equipment modernization. The adoption of electric and hybrid loaders is rising as governments push for reduced emissions in construction and municipal operations. Significant investments in urban infrastructure upgrades, renewable energy projects, and smart city initiatives are creating new opportunities. Countries such as Germany, France, and the U.K. are embracing loaders with advanced telematics and energy-efficient drivetrains. The emphasis on compact and versatile machinery capable of working in dense urban environments further strengthens market demand across residential, industrial, and municipal applications.

U.K. Utilities Wheeled Loader Market Insight

U.K. utilities wheeled loader market is poised for significant growth in the coming years, supported by large-scale infrastructure projects, urban redevelopment initiatives, and smart city development programs. Increasing investments in public works such as road maintenance, water supply networks, and energy distribution are creating sustained equipment demand. The preference for compact, maneuverable loaders capable of operating in space-constrained urban areas is rising. Furthermore, technological advancements such as operator-assist features, telematics integration, and low-emission engines are influencing purchasing decisions. The government’s push towards greener construction practices and its commitment to improving public utility infrastructure further fuel market expansion across the U.K.

Germany Utilities Wheeled Loader Market Insight

Germany utilities wheeled loader market is benefitting from its reputation for precision engineering, durable machinery, and advanced manufacturing capabilities. Germany’s construction and industrial sectors demand high-performance equipment capable of operating efficiently under strict environmental regulations. Local manufacturers are focusing on hybrid and electric models to meet the country’s climate goals. Infrastructure modernization, renewable energy projects, and extensive public works programs are key growth drivers. Demand for versatile loaders equipped with telematics, safety features, and automation support is increasing. The market’s focus on innovation, productivity, and environmental compliance positions Germany as a leading player in Europe’s utility equipment industry.

Which Region is the Fastest Growing Region in the Utilities Wheeled Loader Market?

Asia-Pacific utilities wheeled loader market is projected to grow at the fastest CAGR of 7.12% between 2025 and 2032, driven by rapid urbanization, infrastructure expansion, and strong government-backed development projects. Key economies such as China, Japan, and India are leading demand, with growth supported by rising construction activity and expanding public utilities. The availability of cost-effective, high-quality loaders from domestic manufacturers is encouraging widespread adoption. Infrastructure upgrades, smart city projects, and the replacement of outdated machinery are also contributing factors. As countries push for more efficient, technologically advanced, and sustainable utility equipment, APAC is set to become a global growth leader.

Japan Utilities Wheeled Loader Market Insight

Japan’s market growth is fueled by extensive infrastructure upgrades, high urban population density, and the demand for compact, highly maneuverable loaders. The country’s focus on technology integration in fleet management, operator safety, and automation is pushing manufacturers to innovate. Public investment in road maintenance, disaster recovery readiness, and municipal service enhancements drives consistent demand. Compact loaders with low-emission engines and hybrid systems are gaining traction due to Japan’s environmental policies. In addition, strong after-sales service networks and high equipment reliability play a crucial role in sustaining market share. Japan’s advanced manufacturing capabilities further ensure consistent product quality and innovation.

China Utilities Wheeled Loader Market Insight

China holds the largest share within the Asia-Pacific region, supported by massive infrastructure projects, extensive road expansion programs, and strong domestic manufacturing capabilities. The government’s focus on urban development, smart cities, and public utility upgrades ensures a steady pipeline of construction activities. Local manufacturers produce a wide range of affordable yet high-quality loaders, enabling strong market penetration across both rural and urban areas. Demand is further fueled by municipal service needs, industrial projects, and large-scale real estate developments. Continuous investment in technology, automation, and fuel efficiency is enhancing product competitiveness and reinforcing China’s leadership in the regional market.

Which are the Top Companies in Utilities Wheeled Loader Market?

The utilities wheeled loader industry is primarily led by well-established companies, including:

- Caterpillar Inc. (U.S.)

- AB Volvo (Sweden)

- Komatsu (Japan)

- J C Bamford Excavators Ltd. (U.K.)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Doosan (South Korea)

- Liebherr (Switzerland)

- Terex Corporation (U.S.)

- XCMG GROUP (China)

- Hyundai Construction Equipment Co., Ltd. (South Korea)

- SDLG (China)

- YANMAR HOLDINGS CO., LTD. (Japan)

What are the Recent Developments in Global Utilities Wheeled Loader Market?

- In July 2024, Liebherr-Werk Bischofshofen GmbH revealed plans to significantly boost its production capacity with a new manufacturing facility in Styria, Austria, dedicated to small wheel loaders. The current facility produces 7,000 units annually, but the expansion is expected to raise capacity to 10,000 units by 2029. The site will manufacture L 504 to L 518 models and units for OEM partners Claas and John Deere. This strategic move aims to meet the rising global demand for compact wheel loaders. The development reinforces Liebherr’s commitment to long-term growth and strengthening its market position in the construction equipment industry

- In June 2024, Doosan Bobcat announced the establishment of its first compact loader production facility in Salinas, Victoria, Mexico, with operations scheduled to begin in 2026. This new plant will increase the company’s loader production capacity in North America by approximately 20%. It will complement existing manufacturing facilities in South Korea, India, China, Germany, France, Czech Republic, and the U.S., demonstrating the company’s expanding global reach. The move highlights Doosan Bobcat’s strategic focus on meeting growing regional demands while strengthening its manufacturing presence in key markets. This expansion is set to enhance competitiveness and operational efficiency across its global operations

- In October 2023, Caterpillar Inc. launched its next-generation compact wheeled loader, featuring improved fuel efficiency and advanced telematics to address evolving industry requirements. This innovative model is designed to deliver optimal performance, lower operating costs, and enhanced connectivity for users across multiple sectors. By integrating modern technology, Caterpillar aims to provide operators with better control, data-driven insights, and greater productivity in demanding applications. The introduction of this equipment reflects Caterpillar’s ongoing commitment to product innovation and meeting customer expectations in a competitive market. This step further solidifies the company’s position as a global leader in construction machinery solutions

- In September 2023, Volvo Construction Equipment introduced a mini wheeled loader that offers superior maneuverability and durability, specifically targeting applications requiring high precision and resilience. The design incorporates advanced engineering features that enhance operator comfort, reduce downtime, and ensure consistent performance in challenging environments. This launch underscores Volvo’s commitment to delivering equipment that aligns with the needs of modern construction and infrastructure projects. By focusing on innovation and durability, Volvo aims to strengthen its market presence and provide long-term value to its customers. This development reflects the company’s proactive approach to addressing specialized equipment requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.