Global Utility Communication Market

Market Size in USD Billion

CAGR :

%

USD

23.62 Billion

USD

34.56 Billion

2025

2033

USD

23.62 Billion

USD

34.56 Billion

2025

2033

| 2026 –2033 | |

| USD 23.62 Billion | |

| USD 34.56 Billion | |

|

|

|

|

What is the Global Utility Communication Market Size and Growth Rate?

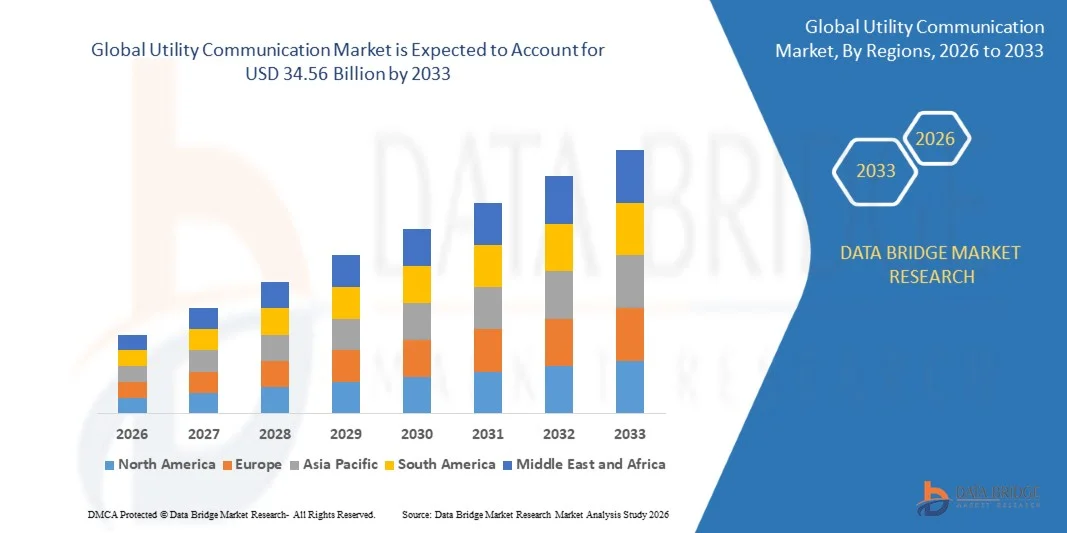

- The global utility communication market size was valued at USD 23.62 billion in 2025 and is expected to reach USD 34.56 billion by 2033, at a CAGR of 4.87% during the forecast period

- Increasing demand for power-efficient and high-performance electronic devices, rising • Market growth is driven by rising demand for reliable and secure communication networks in utilities, increasing grid modernization initiatives, growing deployment of smart meters and smart grids, expanding integration of IoT-based monitoring systems, and the need for real-time data transmission to enhance operational efficiency, reliability, and outage management across utility infrastructures

What are the Major Takeaways of Utility Communication Market?

- Increasing investments in digital utility infrastructure, smart energy management systems, and advanced communication technologies across emerging and developed economies are creating strong growth opportunities for the utility communication market

- However, challenges such as high deployment costs, lack of skilled workforce, cybersecurity concerns, and complexities in integrating legacy systems with modern communication networks are expected to restrain market growth to some extent

- North America dominated the utility communication market with an estimated 41.26% revenue share in 2025, driven by large-scale deployment of smart grid infrastructure, advanced power transmission networks, and strong investments in digital utility modernization across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, fueled by rapid urbanization, large-scale power infrastructure expansion, and accelerating adoption of smart grid and smart utility projects across China, Japan, India, South Korea, and Southeast Asia

- The Wired segment dominated the market with an estimated 58.6% share in 2025, driven by its high reliability, low latency, strong cybersecurity, and suitability for mission-critical utility operations such as power transmission, substations, and industrial control systems

Report Scope and Utility Communication Market Segmentation

|

Attributes |

Utility Communication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Utility Communication Market?

“Increasing Shift Toward High-Speed, Compact, and PC-Based Utility Communications”

- The utility communications market is witnessing growing adoption of compact, USB-powered, and high-performance communication and monitoring solutions designed to support smart grids, IoT-enabled utilities, real-time data acquisition, and advanced network diagnostics

- Vendors are introducing multi-channel, high-bandwidth, and software-defined communication platforms with advanced analytics, deeper data storage, and seamless integration with modern utility management systems

- Rising demand for cost-efficient, lightweight, and field-deployable communication equipment is driving adoption across power utilities, water utilities, oil & gas operators, and municipal infrastructure

- For instance, companies such as Siemens, Schneider Electric, ABB, and Cisco are upgrading utility communication solutions with enhanced protocol support, cybersecurity features, and cloud-based monitoring capabilities

- Increasing need for real-time monitoring, rapid fault detection, and reliable data transmission is accelerating the shift toward PC-integrated and digital utility communication systems

- As utility networks become more interconnected and data-intensive, Utility Communications will remain critical for efficient grid management, system reliability, and smart infrastructure development

What are the Key Drivers of Utility Communication Market?

- Growing demand for reliable, scalable, and secure communication networks to support smart grids, renewable energy integration, and digital utility operations

- For instance, in 2025, leading companies such as Siemens, Hitachi Energy, and Nokia enhanced their utility communication portfolios with high-speed networking, advanced cybersecurity, and real-time analytics capabilities

- Rising adoption of IoT devices, smart meters, distributed energy resources, and automation systems is boosting demand for robust utility communication infrastructure across North America, Europe, and Asia-Pacific

- Advancements in wireless technologies, fiber-optic networks, data compression, and edge computing have improved performance, latency, and operational efficiency

- Increasing deployment of AI-based grid management, predictive maintenance, and digital substations is creating demand for high-capacity, low-latency communication systems

- Supported by sustained investments in smart infrastructure, energy transition, and digital transformation, the Utility Communications market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Utility Communication Market?

- High implementation and upgrade costs associated with advanced communication networks, cybersecurity solutions, and integrated utility platforms limit adoption among smaller utilities

- For instance, during 2024–2025, rising hardware costs, semiconductor supply constraints, and longer deployment timelines increased overall project expenses for several utility operators

- Complexity in managing heterogeneous networks, legacy system integration, and multi-protocol communication environments increases operational and technical challenges

- Limited technical expertise and awareness in developing regions regarding advanced utility communication technologies slow market penetration

- Competition from alternative communication solutions, proprietary systems, and regional vendors creates pricing pressure and interoperability challenges

- To overcome these barriers, companies are focusing on modular architectures, cost-optimized deployments, workforce training, and cloud-based utility communication solutions to expand global adoption

How is the Utility Communication Market Segmented?

The market is segmented on the basis of technology, component, utility, type, and end use.

• By Technology

On the basis of technology, the utility communication market is segmented into Wired and Wireless communication systems. The Wired segment dominated the market with an estimated 58.6% share in 2025, driven by its high reliability, low latency, strong cybersecurity, and suitability for mission-critical utility operations such as power transmission, substations, and industrial control systems. Fiber-optic and Ethernet-based networks are widely deployed across power grids, oil & gas facilities, and water utilities to ensure uninterrupted data flow and real-time monitoring.

The Wireless segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rapid deployment of smart grids, smart meters, and IoT-enabled utility infrastructure. Technologies such as LTE, 5G, RF mesh, and private wireless networks offer scalability, flexibility, and cost efficiency, particularly in remote and geographically challenging areas. Rising investments in digital utilities and real-time field communication are accelerating wireless adoption.

• By Component

On the basis of component, the utility communication market is segmented into Hardware and Software. The Hardware segment dominated the market with a 61.3% share in 2025, supported by high demand for communication devices such as routers, switches, modems, smart meters, sensors, and network infrastructure equipment. Utilities continue to invest heavily in physical infrastructure upgrades to support grid modernization, automation, and secure data transmission.

The Software segment is projected to register the fastest CAGR from 2026 to 2033, driven by growing adoption of network management platforms, data analytics, cybersecurity solutions, and cloud-based utility communication software. Increasing focus on predictive maintenance, real-time monitoring, and centralized network control is boosting software demand. As utilities move toward digital and intelligent operations, software-enabled communication solutions are becoming increasingly critical.

• By Utility

On the basis of utility, the market is segmented into Public and Private utilities. The Public utility segment dominated the market with a 65.8% share in 2025, owing to large-scale investments in national power grids, water supply networks, gas distribution systems, and smart city infrastructure. Government-backed modernization programs, regulatory mandates, and grid resilience initiatives strongly support communication infrastructure deployment in public utilities.

The Private utility segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing participation of private players in renewable energy, distributed generation, telecom-backed energy services, and industrial utilities. Private utilities emphasize advanced communication systems to improve operational efficiency, reduce downtime, and enable real-time performance optimization, accelerating segment growth.

• By Type

On the basis of type, the utility communication market is segmented into Oil and Gas, Power Generation, and Others. The Power Generation segment dominated the market with a 44.9% share in 2025, supported by extensive use of communication networks in transmission, distribution, substations, and renewable energy integration. Real-time grid monitoring, fault detection, and load management require robust communication systems across power utilities.

The Oil and Gas segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing digitalization of upstream, midstream, and downstream operations. Rising adoption of remote monitoring, pipeline surveillance, SCADA systems, and safety communication solutions in oil & gas facilities is fueling demand for high-reliability utility communication networks.

• By End Use

On the basis of end use, the utility communication market is segmented into Residential, Commercial, and Industrial sectors. The Industrial segment dominated the market with a 48.7% share in 2025, driven by high deployment of communication systems in manufacturing plants, power facilities, oil & gas sites, and large-scale infrastructure. Industrial users require high-capacity, low-latency, and secure networks for automation, monitoring, and control applications.

The Residential segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of smart meters, home energy management systems, and connected utility services. Increasing focus on energy efficiency, demand response, and digital billing solutions is accelerating communication infrastructure deployment at the residential level.

Which Region Holds the Largest Share of the Utility Communication Market?

- North America dominated the utility communication market with an estimated 41.26% revenue share in 2025, driven by large-scale deployment of smart grid infrastructure, advanced power transmission networks, and strong investments in digital utility modernization across the U.S. and Canada. High adoption of SCADA systems, fiber-optic networks, private LTE/5G, and IoT-enabled communication platforms continues to fuel demand for reliable and secure utility communication solutions across power, water, gas, and oil & gas utilities

- Leading utility communication providers in North America are focusing on high-bandwidth, low-latency, and cybersecurity-enhanced communication systems to support real-time monitoring, grid automation, and outage management. Continuous investments in smart meters, advanced distribution management systems (ADMS), and cloud-based utility platforms strengthen the region’s technological leadership

- Strong regulatory support, skilled workforce availability, and sustained investments in critical infrastructure modernization further reinforce North America’s dominance in the global utility communication market

U.S. Utility Communication Market Insight

The U.S. represents the largest contributor within North America, supported by extensive smart grid rollouts, aging grid replacement initiatives, and widespread adoption of digital communication networks across electric, gas, and water utilities. Increasing focus on grid resilience, renewable energy integration, EV charging infrastructure, and real-time data analytics drives demand for secure and scalable utility communication systems. Presence of major technology vendors, strong R&D ecosystems, and federal infrastructure funding further accelerates market growth.

Canada Utility Communication Market Insight

Canada contributes significantly to regional expansion, driven by modernization of power grids, rising renewable energy adoption, and growing investments in utility automation and cybersecurity. Utilities increasingly deploy fiber-optic and wireless communication systems to improve grid reliability, remote monitoring, and operational efficiency. Government-backed clean energy programs, smart city initiatives, and skilled technical talent support sustained market development across the country.

Asia-Pacific Utility Communication Market

Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, fueled by rapid urbanization, large-scale power infrastructure expansion, and accelerating adoption of smart grid and smart utility projects across China, Japan, India, South Korea, and Southeast Asia. Rising electricity demand, renewable integration, and digital transformation of utilities are increasing the need for advanced wired and wireless communication networks. Growth in industrial automation, smart cities, and digital infrastructure continues to drive strong market momentum.

China Utility Communication Market Insight

China is the largest contributor to the Asia-Pacific market, supported by massive investments in ultra-high-voltage (UHV) transmission, smart substations, and nationwide smart grid programs. Strong government backing for digital energy infrastructure, large-scale renewable integration, and domestic manufacturing capabilities drives widespread adoption of advanced utility communication technologies.

Japan Utility Communication Market Insight

Japan demonstrates steady growth, driven by grid modernization, disaster-resilient communication systems, and advanced automation across power and water utilities. High emphasis on reliability, cybersecurity, and low-latency networks supports adoption of premium utility communication solutions, particularly in urban and industrial regions.

India Utility Communication Market Insight

India is emerging as a high-growth market, supported by rapid electrification, smart metering initiatives, renewable energy expansion, and government-led digital utility programs. Increasing investments in power distribution modernization, telecom-backed utility networks, and smart city development are accelerating adoption of scalable utility communication systems.

South Korea Utility Communication Market Insight

South Korea contributes strongly to regional growth, driven by advanced ICT infrastructure, smart grid pilot projects, and strong demand for secure communication networks in power and industrial utilities. Continuous innovation, high 5G penetration, and integration of digital energy technologies support long-term market expansion.

Which are the Top Companies in Utility Communication Market?

The utility communication industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Schneider Electric (France)

- Hitachi Energy Ltd (Switzerland)

- General Electric (U.S.)

- ABB (Switzerland)

- Motorola Solutions, Inc. (U.S.)

- Fujitsu (Japan)

- Landis+Gyr (Switzerland)

- Itron Inc. (U.S.)

- Sensus (U.S.)

- Digi International Inc. (U.S.)

- GE Grid Solutions, LLC (U.S.)

- Cisco Systems, Inc. (U.S.)

- Nokia (Finland)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Trilliant Holdings Inc. (U.S.)

What are the Recent Developments in Global Utility Communication Market?

- In December 2024, Siemens Smart Infrastructure, SI, partnered with Tietoevry, a Nordic digital services and software company, to accelerate power utility digitalization across the Nordic region by integrating energy systems, buildings, and industries through advanced digital technologies. The collaboration leverages Siemens’ end-to-end portfolio from power generation to consumption to improve efficiency, sustainability, and grid resilience, concluding with a strong push toward intelligent and adaptive utility infrastructure

- In August 2024, the Utilities Technology Council, UTC, and the 450 MHz Alliance announced a strategic partnership to strengthen communication networks for utilities and critical infrastructure worldwide by promoting secure, wide-area 450 MHz wireless connectivity. By supporting smart grids, remote monitoring, and emergency response, the alliance aims to enhance operational reliability, concluding with improved resilience and security for mission-critical utility communications

- In February 2024, Hitachi Energy introduced the TRO670 hybrid wireless router designed for secure and flexible communications in harsh and remote environments, supporting both smart grid and Industrial Internet of Things, IIoT, requirements. The solution addresses connectivity challenges in extreme conditions, concluding with stronger, more reliable wireless utility networks

- In February 2024, Siemens launched its latest Gridscale X solution to help utility companies manage energy transition challenges, accelerate grid expansion, and integrate distributed energy resources with greater flexibility. The platform enables utilities to adapt to evolving grid complexities, concluding with enhanced scalability and future-ready grid operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.