Global Uv Absorbers Market

Market Size in USD Billion

CAGR :

%

USD

1.13 Billion

USD

1.84 Billion

2024

2032

USD

1.13 Billion

USD

1.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 1.84 Billion | |

|

|

|

|

Ultraviolet Absorber (UV) Market Size

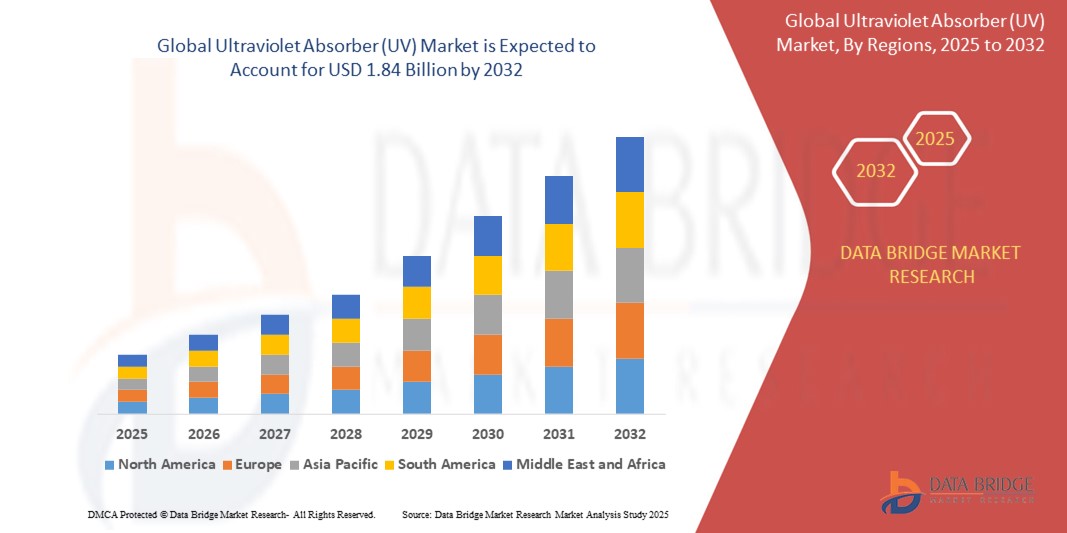

- The global ultraviolet absorber (UV) market size was valued at USD 1.13 billion in 2024 and is expected to reach USD 1.84 billion by 2032, at a CAGR of 6.25% during the forecast period

- The market growth is largely fuelled by the rising awareness of UV-induced degradation and health concerns. Ultraviolet absorbers are widely used to improve product longevity and performance in outdoor applications such as automotive components, construction materials, and agricultural films

- In addition, stringent environmental regulations encouraging the use of UV stabilizers in industrial and consumer goods manufacturing are further propelling market expansion

Ultraviolet Absorber (UV) Market Analysis

- The ultraviolet absorber market is witnessing steady growth due to increasing demand across plastic, coating, and personal care industries, as consumers seek more durable and UV-resistant products

- Manufacturers are focusing on enhancing the efficiency of ultraviolet absorbers to meet evolving application needs, ensuring better protection and longer product life across various end-use sectors

- North America dominated the ultraviolet absorber market with the largest revenue share in 2024, driven by widespread use in plastics and coatings, especially across the automotive and construction sectors

- The Asia-Pacific region is expected to witness the highest growth rate in the global ultraviolet absorber (UV) market, driven by rapid industrialization, expanding packaging and construction sectors, and increasing demand for UV-protective plastics and coatings in countries such as China, Japan, and India

- The benzotriazole segment dominated the market with the largest revenue share in 2024, owing to its superior ultraviolet absorption efficiency and compatibility with a wide range of polymer systems. Its thermal stability and effectiveness in protecting materials from UV-induced degradation make it the preferred choice across various industrial applications, including automotive and packaging. In addition, benzotriazole compounds offer longer-lasting protection, reducing the frequency of maintenance and material replacement

Report Scope and Ultraviolet Absorber (UV) Market Segmentation

|

Attributes |

Ultraviolet Absorber (UV) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultraviolet Absorber (UV) Market Trends

“Increasing Integration of UV Absorbers in Sustainable and Eco-Friendly Products”

- Manufacturers are increasingly incorporating UV absorbers into sustainable and eco-friendly formulations to meet rising consumer demand for greener alternatives

- Environmental regulations and sustainability concerns are encouraging the use of bio-based and non-toxic UV absorber solutions across multiple industries

- Eco-friendly UV additives are gaining traction in personal care products, especially in sunscreens featuring reef-safe filters to protect marine ecosystems

- For instance, brands such as Thinksport and Blue Lizard now offer reef-friendly sunscreen lines

- Packaging producers are integrating renewable-source UV absorbers to support circular economy practices and reduce environmental impact

- This trend not only helps lower carbon footprints but also enhances brand reputation and consumer trust in environmentally conscious markets

Ultraviolet Absorber (UV) Market Dynamics

Driver

“Expanding Demand from the Packaging and Polymer Industries”

- The increasing use of ultraviolet absorbers in packaging and polymer industries is a key growth driver, as these sectors require materials that retain their physical and aesthetic properties under UV exposure

- UV absorbers play a vital role in preventing discoloration, brittleness, and structural degradation in polymer-based products, ensuring long-term durability

- In food, cosmetic, and pharmaceutical packaging, UV absorbers help preserve product integrity and extend shelf life by shielding contents from harmful radiation

- The rising production of plastics and growing demand for high-performance additives are accelerating the use of UV absorbers, especially in applications needing extended product lifespan

- For instance, manufacturers of PET bottles and polycarbonate sheets incorporate UV absorbers to improve UV resistance, while e-commerce and global logistics drive demand for durable packaging exposed to varying light conditions

Restraint/Challenge

“Environmental and Health Concerns Related to Chemical Composition”

- Environmental and health concerns around synthetic ultraviolet absorbers are a major challenge, especially due to their non-biodegradable nature and persistence in ecosystems

- Ingredients such as benzophenone have raised alarms for their links to endocrine disruption and aquatic toxicity, prompting regulatory attention

- Europe and parts of North America are enforcing stricter regulations on the use of certain UV absorbers in consumer products and cosmetics

- For instance, some sunscreen ingredients have been banned in areas such as Hawaii to prevent coral reef damage, leading to a push for safer alternatives

- This shift forces manufacturers to invest in reformulating products, increasing costs and complicating compliance while slowing market adoption in eco-sensitive sectors

Ultraviolet Absorber (UV) Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the ultraviolet absorber market is segmented into benzophenone, benzotriazole, triazine, and others. The benzotriazole segment dominated the market with the largest revenue share in 2024, owing to its superior ultraviolet absorption efficiency and compatibility with a wide range of polymer systems. Its thermal stability and effectiveness in protecting materials from UV-induced degradation make it the preferred choice across various industrial applications, including automotive and packaging. In addition, benzotriazole compounds offer longer-lasting protection, reducing the frequency of maintenance and material replacement.

The triazine segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent performance in high-temperature and weather-resistant applications. Its rising adoption in automotive coatings and agricultural films is attributed to its low volatility and long-term protection. Furthermore, growing demand for durable outdoor-use materials is accelerating the shift toward triazine-based ultraviolet absorbers.

- By Application

On the basis of application, the ultraviolet absorber market is segmented into plastics, coatings, adhesives, personal care, packaging, agricultural films, and others. The plastics segment held the largest market revenue share in 2024, driven by increasing usage of UV stabilizers in automotive interiors, electronic devices, and construction materials. These absorbers enhance the lifespan and appearance of plastic products by preventing discoloration, brittleness, and degradation caused by prolonged sun exposure. With plastics being extensively used in outdoor and consumer applications, the demand for effective UV protection continues to rise.

The personal care segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing consumer awareness of skin protection and the increasing use of UV filters in sunscreens, moisturizers, and cosmetics. The rising demand for multifunctional personal care products and expanding middle-class populations in emerging economies contribute to the rapid growth. Continuous innovation in UV-filter technologies also supports the development of safer and more effective formulations for daily skincare.

Ultraviolet Absorber (UV) Market Regional Analysis

- North America dominated the ultraviolet absorber market with the largest revenue share in 2024, driven by widespread use in plastics and coatings, especially across the automotive and construction sectors

- The region benefits from a strong presence of key industry players, stringent regulations promoting UV protection, and ongoing technological innovation in high-performance UV-stabilizing additives

- Consumer demand for durable, UV-resistant materials in end-use applications such as packaging and consumer goods continues to propel growth in the U.S. and Canada

U.S. Ultraviolet Absorber Market Insight

The U.S. ultraviolet absorber market held the largest revenue share within North America in 2024, supported by its well-established plastics and polymer industries. The rising demand for UV protection in packaging, coatings, and electronics contributes significantly to market expansion. Moreover, increasing R&D investments by U.S.-based chemical companies into advanced UV-absorbing compounds fuel innovation and application versatility

Europe Ultraviolet Absorber Market Insight

The Europe ultraviolet absorber market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing awareness of UV degradation and sustainable product lifecycles. Strong environmental policies and consumer preference for high-performance coatings and plastics in Germany, France, and Italy contribute to demand. The region’s emphasis on eco-friendly and non-toxic UV stabilizers is also pushing manufacturers to develop greener solutions

U.K. Ultraviolet Absorber Market Insight

The U.K. ultraviolet absorber market is expected to witness the fastest growth rate from 2025 to 2032, supported by the expanding construction and automotive sectors. The demand for UV-protective coatings on windows, surfaces, and automotive parts continues to grow amid fluctuating weather patterns. Innovations in lightweight, UV-resistant plastics used in electronics and packaging are also boosting market traction in the region

Germany Ultraviolet Absorber Market Insight

The Germany’s ultraviolet absorber market is expected to witness the fastest growth rate from 2025 to 2032, driven by its leading position in chemical manufacturing and material science. High-performance UV absorbers are being adopted across high-end automotive coatings, solar panels, and electronics components. The nation’s commitment to environmental sustainability is also accelerating the shift towards next-generation, less toxic UV stabilizers

Asia-Pacific Ultraviolet Absorber Market Insight

The Asia-Pacific ultraviolet absorber market is expected to witness the fastest growth rate from 2025 to 2032, attributed to rapid industrialization, growing disposable incomes, and surging demand for plastics and coatings. Key countries such as China, Japan, and India are driving adoption in packaging, personal care, and agricultural films. Local production capabilities and government support for manufacturing innovation also contribute to regional expansion

Japan Ultraviolet Absorber Market Insight

The Japan ultraviolet absorber market is expected to witness the fastest growth rate from 2025 to 2032, due to increasing product use in electronics, automotive components, and personal care items. As a technologically advanced nation, Japan prioritizes material longevity and safety, fostering demand for UV absorbers in diverse high-tech applications. Local innovation in polymer science and environmentally safe UV stabilizers strengthens the country’s position in the global market

China Ultraviolet Absorber Market Insight

The China accounted for the largest revenue share in the Asia-Pacific ultraviolet absorber market in 2024, backed by large-scale production of plastics, packaging materials, and coatings. The rapid growth of construction, automotive, and personal care sectors amplifies the demand for UV protection. China's strong domestic chemical industry and cost-efficient manufacturing further position it as a leading contributor to global supply and consumption of UV absorbers

Ultraviolet Absorber (UV) Market Share

The Ultraviolet Absorber (UV) industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- SONGWON (South Korea)

- Clariant (Switzerland)

- Solvay (Belgium)

- ADEKA CORPORATION (Japan)

- Addivant (U.S.)

- 3V Sigma USA Inc (U.S.)

- Everlight Chemical Industrial Co. (Taiwan)

- Milliken & Company (U.S.)

- SABO S.p.A (Italy)

- Apexical, Inc. (U.S.)

- Dalian Richfortune Chemicals Co., Ltd (China)

- CHEMIPRO KASEI KAISHA, LTD (Japan)

- Chitec Technology Co., Ltd. (Taiwan)

- Valtris Specialty Chemicals (U.S.)

- Lycus Ltd., LLC. (U.S.)

- Everspring Chemical Co., Ltd. (Taiwan)

- Lambson (South Africa)

- MPI Chemie B.V. (Netherlands)

- Nanjing Union Rubber and Chemicals Co., Ltd. (China)

- Huntsman International LLC (U.S.)

Latest Developments in Global Ultraviolet Absorber (UV) Market

- In November 2022, SABO S.p.A. announced its strategic acquisition of the TAA and derivatives business from Evonik Industries AG, including key production sites in Marl, Germany, and Liaoyang, China. This acquisition is vital for securing the raw materials essential for manufacturing Hindered Amine Light Stabilizers (HALS). With this move, SABO aims to ensure a stable supply of additives widely used in automotive components, agricultural films, building materials, and consumer goods

- In October 2022, Clariant introduced AddWorks AGC 970, an advanced light stabilizer solution specifically formulated for polyethylene agricultural films. This cutting-edge innovation significantly enhances product longevity within the mulch sector. By improving film durability against UV exposure and harsh agrochemical conditions, AddWorks AGC 970 allows converters to create more resilient products, ultimately supporting agricultural practices while ensuring efficiency and sustainability in crop management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Uv Absorbers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Uv Absorbers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Uv Absorbers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.