Global Uv Cured Acrylic Foam Tapes Market

Market Size in USD Million

CAGR :

%

USD

527.41 Million

USD

750.03 Million

2024

2032

USD

527.41 Million

USD

750.03 Million

2024

2032

| 2025 –2032 | |

| USD 527.41 Million | |

| USD 750.03 Million | |

|

|

|

|

What is the Global UV Cured Acrylic Foam Tapes Market Size and Growth Rate?

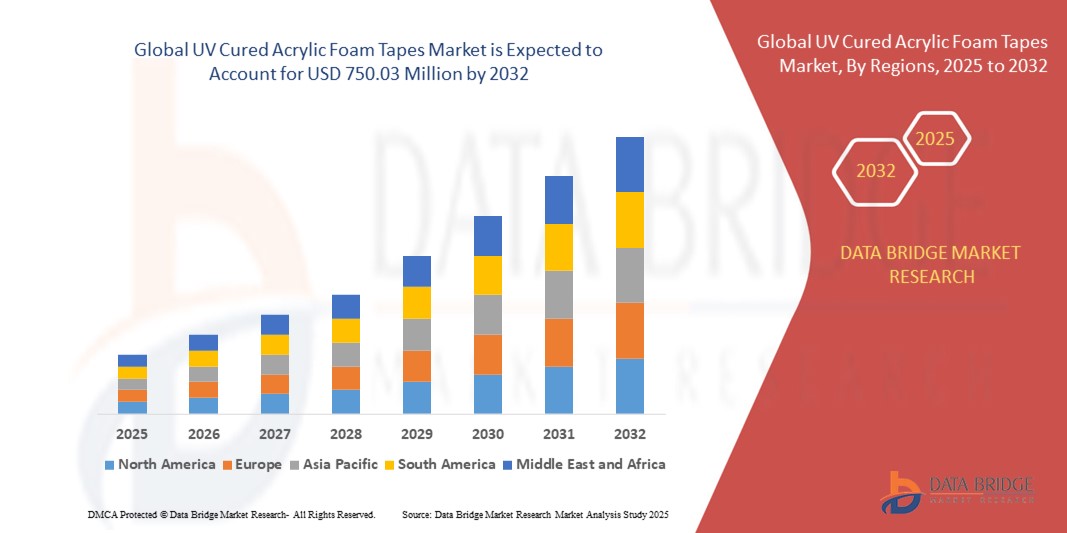

- The global UV cured acrylic foam tapes market size was valued at USD 527.41 million in 2024 and is expected to reach USD 750.03 million by 2032, at a CAGR of 4.50% during the forecast period

- The UV cured acrylic foam tapes market is experiencing significant growth driven by increasing demand across various industries, including automotive, electronics, and construction. These tapes are valued for their superior adhesion, durability, and resistance to environmental factors, making them ideal for applications that require high performance and reliability

- The automotive sector's need for lightweight and efficient bonding solutions, combined with the electronics industry's demand for strong, flexible adhesives, fuels market expansion. In addition, the construction industry's emphasis on innovative materials and sustainable practices supports the adoption of UV cured acrylic foam tapes

What are the Major Takeaways of UV Cured Acrylic Foam Tapes Market?

- The market is characterized by technological advancements and competitive dynamics, with major players such as Saint-Gobain, 3M, Robert Bosch GmBH and others focusing on product innovation and expanding their global reach

- Despite challenges such as high production costs and regulatory hurdles, the overall outlook remains positive, with continued growth anticipated due to ongoing industrial developments and rising demand for advanced adhesive solutions

- Asia-Pacific dominated the UV cured acrylic foam tapes market with the largest revenue share of 42.7% in 2024, driven by rapid industrialization, increasing demand across automotive and electronics sectors, and the adoption of high-performance bonding solutions

- North America UV cured acrylic foam tapes market is poised to grow at the fastest CAGR of 7.98% during 2025–2032, driven by rising demand in automotive, electronics, and construction sectors

- The double-sided segment dominated the market with the largest revenue share of 54.3% in 2024, owing to its superior bonding capabilities and ability to adhere to multiple substrates simultaneously

Report Scope and UV Cured Acrylic Foam Tapes Market Segmentation

|

Attributes |

UV Cured Acrylic Foam Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the UV Cured Acrylic Foam Tapes Market?

Integration with Advanced Manufacturing and Surface Treatment Technologies

- A major and rapidly growing trend in the global UV Cured Acrylic Foam Tapes market is the increasing adoption of advanced manufacturing techniques and surface treatment technologies, enhancing tape performance, durability, and adhesion across multiple substrates

- For instance, in March 2024, 3M introduced its next-generation high-performance UV cured acrylic foam tapes that leverage precision coating technology, delivering improved bonding strength and resistance to extreme temperatures, highlighting innovation in functional adhesive solutions

- The integration of surface treatment processes such as corona, plasma, and primer coatings with UV cured acrylic foam tapes enables superior adhesion to low-surface-energy materials such as plastics, composites, and metals. This development is crucial for industries such as automotive, electronics, and construction where material versatility is essential

- Leading manufacturers are also focusing on environmentally friendly formulations, offering low-VOC and solvent-free options without compromising performance, aligning with global sustainability initiatives and regulatory requirements

- The trend towards high-performance, multifunctional UV cured acrylic foam tapes is reshaping customer expectations in industrial bonding applications, prompting companies such as Henkel and Avery Dennison to innovate solutions that combine strength, flexibility, and eco-compliance

- Demand for UV cured acrylic foam tapes with enhanced adhesion, durability, and environmental compliance is rising steadily across automotive, electronics, and industrial applications, as manufacturers seek reliable solutions for lightweight, high-strength, and sustainable assemblies

What are the Key Drivers of UV Cured Acrylic Foam Tapes Market?

- The increasing demand for high-performance bonding solutions across automotive, electronics, and construction sectors is a key driver propelling UV cured acrylic foam tapes market growth

- For instance, in February 2024, Nitto Denko Corporation launched UV cured acrylic foam tapes optimized for electric vehicle battery assembly, enabling lightweight, high-strength adhesion that supports EV manufacturing growth

- Growing industrialization and the adoption of lightweight materials necessitate high-performance bonding solutions, making UV cured acrylic foam tapes critical for durable and reliable assembly

- The rising emphasis on energy efficiency and structural integrity in sectors such as automotive and construction drives demand for strong, flexible, and long-lasting adhesive tapes

- The convenience of easy application, compatibility with multiple substrates, and superior bonding performance compared to traditional adhesives is further boosting adoption in manufacturing and assembly lines worldwide

Which Factor is Challenging the Growth of the UV Cured Acrylic Foam Tapes Market?

- High initial costs associated with premium UV cured acrylic foam tapes compared to conventional adhesives pose a challenge to broader market adoption, particularly among small and medium enterprises or price-sensitive sectors

- For instance, some specialty high-strength tapes from companies such as 3M or Avery Dennison carry higher price tags, which can deter adoption despite their superior performance

- In addition, the requirement for specialized surface preparation and precise application in some industrial settings can limit usage among companies lacking technical expertise or equipment

- Environmental and regulatory compliance, including VOC content restrictions, also requires manufacturers to invest in R&D for eco-friendly formulations, which can increase production costs

- Overcoming these challenges through cost-effective solutions, process simplification, and educating end-users on the value and efficiency gains of UV cured acrylic foam tapes will be essential for sustained market growth

How is the UV Cured Acrylic Foam Tapes Market Segmented?

The market is segmented on the basis of type and end-user.

- By Type

On the basis of type, the UV cured acrylic foam tapes market is segmented into double sided and single sided. The double-sided segment dominated the market with the largest revenue share of 54.3% in 2024, owing to its superior bonding capabilities and ability to adhere to multiple substrates simultaneously. Double-sided UV cured acrylic foam tapes are widely preferred in industrial and manufacturing applications where high-strength adhesion, vibration dampening, and clean bonding are critical. These tapes are particularly used in automotive assembly, electronics mounting, and construction applications for permanent and semi-permanent bonding solutions.

The single-sided segment is anticipated to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by its versatility in temporary bonding, packaging, and masking applications. Increasing demand for cost-effective and lightweight bonding solutions across various industries, combined with ease of application, is contributing to the rapid growth of single-sided UV cured acrylic foam tapes.

- By End-User

On the basis of end-user, the UV cured acrylic foam tapes market is segmented into automotive, electronics, construction, aerospace, and others. The automotive segment held the largest revenue share of 46.5% in 2024, driven by the sector’s demand for lightweight, durable bonding solutions to replace mechanical fasteners, improve design flexibility, and enhance structural integrity in vehicles. UV cured acrylic foam tapes are extensively used in interior assembly, exterior trim, and battery pack adhesion in electric vehicles, supporting both performance and aesthetic requirements.

The electronics segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by growing demand for compact, high-performance devices, lightweight electronic components, and efficient heat dissipation solutions. Increasing adoption of UV cured acrylic foam tapes for bonding displays, circuit boards, and semiconductor assemblies is driving rapid market expansion in the electronics sector.

Which Region Holds the Largest Share of the UV Cured Acrylic Foam Tapes Market?

- Asia-Pacific dominated the UV cured acrylic foam tapes market with the largest revenue share of 42.7% in 2024, driven by rapid industrialization, increasing demand across automotive and electronics sectors, and the adoption of high-performance bonding solutions

- Manufacturers and end-users in the region highly value the versatility, durability, and strong adhesion properties of UV cured acrylic foam tapes, which are critical for applications in construction, automotive assembly, and electronics

- The widespread adoption is further supported by growing urbanization, rising disposable incomes, and expanding industrial manufacturing bases, establishing UV Cured acrylic foam tapes as a preferred solution for both large-scale industrial and commercial applications.

China UV Cured Acrylic Foam Tapes Market Insight

The China UV cured acrylic foam tapes market captured the largest revenue share of 48% in 2024 within Asia-Pacific, fueled by rapid technological adoption, strong manufacturing infrastructure, and the push for high-performance bonding solutions in automotive and electronics applications. Government initiatives supporting smart factories and industrial automation further enhance market growth, while domestic manufacturers provide cost-effective and innovative products for diverse industrial applications.

Japan UV Cured Acrylic Foam Tapes Market Insight

The Japan UV cured acrylic foam tapes market is experiencing steady growth due to the country’s high-tech manufacturing culture, demand for lightweight materials, and adoption in electronics and automotive industries. Increasing urbanization and emphasis on industrial efficiency drive the adoption of UV cured acrylic foam tapes, particularly in high-precision assembly applications where durability and performance are critical.

India UV Cured Acrylic Foam Tapes Market Insight

The India UV cured acrylic foam tapes market is expanding rapidly, supported by rising industrialization, growing automotive and electronics sectors, and increased adoption of high-performance bonding materials. Government initiatives promoting “Make in India” and smart manufacturing are driving demand, while the affordability and availability of UV Cured Acrylic Foam Tapes are making them accessible to a wide industrial base.

Which Region is the Fastest Growing Region in the UV Cured Acrylic Foam Tapes Market?

North America UV cured acrylic foam tapes market is poised to grow at the fastest CAGR of 7.98% during 2025–2032, driven by rising demand in automotive, electronics, and construction sectors. The need for lightweight, durable bonding solutions, coupled with growing awareness of high-performance adhesives, supports rapid market expansion.

U.S. UV Cured Acrylic Foam Tapes Market Insight

The U.S. UV cured acrylic foam tapes market captured a significant revenue share in 2024, fueled by adoption in automotive assembly, electronics manufacturing, and industrial applications. Manufacturers increasingly favor UV cured acrylic foam tapes for their strength, versatility, and compatibility with lightweight and composite materials. Government incentives for advanced manufacturing and automation further propel market growth.

Canada UV Cured Acrylic Foam Tapes Market Insight

The Canada UV cured acrylic foam tapes market is growing steadily due to increasing industrial automation, demand for high-performance bonding solutions, and rising application in automotive and electronics sectors. Adoption of UV cured acrylic foam tapes for structural bonding, component assembly, and vibration dampening is driving market expansion, supported by increasing awareness of efficiency and productivity benefits.

Which are the Top Companies in UV Cured Acrylic Foam Tapes Market?

The UV cured acrylic foam tapes industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- tesa Tapes (India) Private Limited (Germany)

- AVERY DENNISON CORPORATION (U.S.)

- Scapa Group Ltd (U.K.)

- H.B. Fuller Company (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Nitto Denko Corporation (Japan)

- artience Co., Ltd. (Japan)

- Saint-Gobain (France)

- Fleming (U.K.)

- Eurobond Adhesives (U.K.)

- Robert Bosch GmbH (Germany)

What are the Recent Developments in Global UV Cured Acrylic Foam Tapes Market?

- In May 2024, 3M Company, a leading conglomerate, expanded its facility in Valley, Nebraska, to rapidly address the growing demand for personal safety products, demonstrating the company’s commitment to scaling production in response to market needs

- In November 2023, Tesa SE introduced a new adhesive tape, tesa 51345, designed specifically for the packaging sector, featuring fully recyclable materials, highlighting the company’s focus on sustainability and eco-friendly solutions

- In September 2022, Tesa SE developed an innovative packaging tape using recycled post-consumer PET as the backing material, comprising 70% recycled PCR with a water-based acrylic adhesive system, which is stronger, wear-resistant, and reduces noise, reinforcing the company’s dedication to sustainable product innovation

- In August 2022, LINTEC launched a new environmentally friendly, plastic-alternative label stock compatible with direct thermal printers, reflecting the company’s efforts to provide sustainable alternatives in labeling and packaging applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Uv Cured Acrylic Foam Tapes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Uv Cured Acrylic Foam Tapes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Uv Cured Acrylic Foam Tapes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.