Global Vacation Rental Market

Market Size in USD Billion

CAGR :

%

USD

88.26 Billion

USD

138.57 Billion

2024

2031

USD

88.26 Billion

USD

138.57 Billion

2024

2031

| 2025 –2031 | |

| USD 88.26 Billion | |

| USD 138.57 Billion | |

|

|

|

|

Vacation Rental Market Size

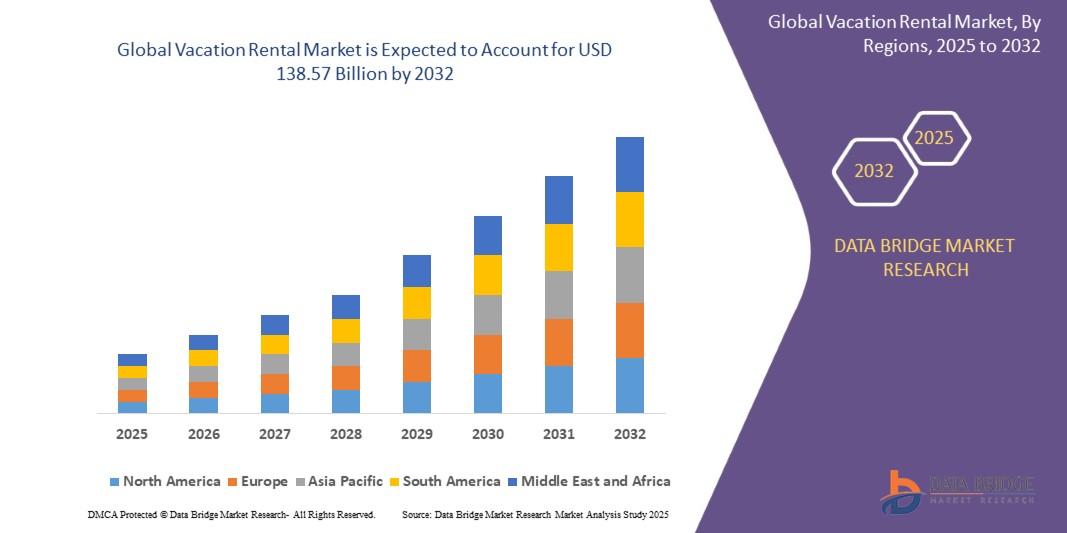

- The global vacation rental market size was valued at USD 88.26 billion in 2024 and is expected to reach USD 138.57 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the rising preference for affordable and spacious accommodation, increasing disposable incomes, and a growing trend of experiential and extended travel stays

- The expansion of digital booking platforms and mobile apps has significantly improved accessibility and visibility for hosts and travelers, further accelerating global market penetration

Vacation Rental Market Analysis

- Growing popularity of peer-to-peer rental platforms such as Airbnb, Vrbo, and Booking.com is reshaping how travelers book short-term accommodations, with increasing trust in user-generated reviews and real-time availability

- Travelers are shifting away from traditional hotel models, seeking personalized and home-like experiences, especially among millennials and digital nomads who value flexibility and local immersion

- North America dominated the vacation rental market with the largest revenue share of 36.7% in 2024, driven by the rising demand for alternative accommodations, strong digital booking infrastructure, and the growth of leisure and work-from-anywhere travel

- Asia-Pacific region is expected to witness the highest growth rate in the global vacation rental market, driven by expanding tourism across countries such as China, India, and Thailand, coupled with rapid urbanization, rising middle-class income, and the adoption of mobile-based booking services across both rural and urban destinations

- The home segment dominated the market with the largest revenue share in 2024, driven by the rising preference for spacious, private, and customizable lodging options that offer a homely environment. Travelers, especially families and long-stay tourists, increasingly favor vacation homes for their comfort, privacy, and flexibility compared to traditional hotel rooms. Homes also appeal to consumers due to their availability in diverse locations, from urban neighborhoods to secluded countryside escapes, catering to various traveler interests

Report Scope and Vacation Rental Market Segmentation

|

Attributes |

Vacation Rental Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vacation Rental Market Trends

“Rising Demand for Workation-Friendly Vacation Rentals”

- The shift to remote work has significantly boosted demand for vacation rentals that can double as workspaces, as travelers seek extended stays that balance productivity with leisure in comfortable and inspiring environments

- Property owners are upgrading their offerings with high-speed internet, office setups, and dedicated work areas to appeal to digital nomads and professionals seeking alternative work environments outside traditional office settings

- Rental platforms are promoting workation-ready properties through advanced filters and marketing campaigns to capture this growing segment, especially in scenic and cost-effective destinations with good infrastructure

- For instance, places such as Bali and Lisbon have witnessed rising bookings among remote workers due to their co-working spaces, affordable living, and reliable connectivity, solidifying their status as global workation hubs

- This trend is expected to persist as hybrid and remote work models gain permanence, encouraging more property owners to cater to the evolving needs of working travelers

Vacation Rental Market Dynamics

Driver

“Surging Popularity of Personalized and Unique Travel Experiences”

- Travelers are moving away from generic hotel stays and increasingly opting for vacation rentals that offer personalized, locally inspired, and authentic living experiences with unique aesthetics and home-like amenities, which allow for greater immersion in regional cultures and traditions

- Features such as private gardens, themed interiors, pet accommodations, and eco-conscious designs are becoming deciding factors for bookings as consumers seek more control over their travel environment and comfort level, especially during long-term or family-oriented vacations

- Social media platforms have amplified this trend by showcasing visually distinctive and immersive rental experiences, pushing hosts to differentiate their offerings with creative design and thoughtful guest services that build loyalty and brand identity among repeat travelers

- For instance, treehouses in Costa Rica or cave homes in Santorini have become top picks among experience-seekers looking for memorable stays that reflect local culture and uniqueness, helping those destinations stand out on global booking platforms

- The growing desire for curated travel experiences continues to drive innovation and diversity in rental options, solidifying personalized lodging as a key competitive differentiator in the market as expectations shift towards emotional value over standardized amenities

Restraint/Challenge

“Lack of Standardization and Regulatory Hurdles”

- One of the key challenges in the vacation rental industry is the inconsistent quality and service standards across properties, which often leads to varied guest satisfaction and trust issues for first-time users, particularly in unbranded or independently managed listings

- Regulatory frameworks governing short-term rentals differ drastically between regions, posing compliance burdens on hosts who must navigate licenses, taxes, occupancy limits, and zoning laws without centralized guidance or standardized legal resources

- Smaller hosts may struggle with the costs and complexities of compliance, resulting in listings being removed or penalized, especially in cities introducing stricter rules to address housing shortages and overtourism caused by unchecked rental growth

- For instance, Amsterdam enforces a 30-day annual cap on rentals, while Barcelona has implemented bans on new vacation rental licenses to protect residential housing stock and local community interests, restricting the market’s ability to expand in high-demand areas

- These barriers could slow the market’s scalability unless platform operators and governments work together to establish uniform regulations, clear host support systems, and enforce quality benchmarks across listings to build trust and operational sustainability

Vacation Rental Market Scope

The market is segmented on the basis of accommodation, booking mode, location type, tourist type, end user, and price point.

• By Accommodation

On the basis of accommodation, the vacation rental market is segmented into home, apartments, resort/condominium, and others. The home segment dominated the market with the largest revenue share in 2024, driven by the rising preference for spacious, private, and customizable lodging options that offer a homely environment. Travelers, especially families and long-stay tourists, increasingly favor vacation homes for their comfort, privacy, and flexibility compared to traditional hotel rooms. Homes also appeal to consumers due to their availability in diverse locations, from urban neighborhoods to secluded countryside escapes, catering to various traveler interests.

The resort/condominium segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing popularity of luxury and semi-luxury getaways that combine privacy with resort-style amenities. These rentals attract couples, international tourists, and remote workers seeking upscale experiences with access to pools, spas, and beach fronts. In addition, the condominium model allows for a blend of independent living with professional maintenance and support, boosting its appeal in tourist hotspots.

• By Booking Mode

On the basis of booking mode, the vacation rental market is segmented into online and offline. The online segment held the largest market revenue share in 2024, owing to the widespread use of mobile apps and travel platforms that offer real-time booking, reviews, and price comparisons. Travelers are increasingly turning to digital platforms such as Airbnb, Booking.com, and Vrbo for convenience, trust signals, and global reach. Seamless digital payment options and personalized recommendations have further fueled this shift toward online booking.

The offline segment is expected to witness the fastest growth rate from 2025 to 2032, especially among older travelers and in rural or low-connectivity regions. Offline bookings often occur through local travel agents or direct contacts, appealing to tourists seeking bespoke travel planning or preferring a more personal touch. This segment may still see consistent demand in regions where digital adoption is slower or where customers prioritize trust built through personal relationships.

• By Location Type

On the basis of location type, the vacation rental market is segmented into resort area, rural area, small town, and others. The resort area segment led the market in 2024, driven by the consistent demand for coastal and mountain retreats that offer scenic beauty and recreational amenities. Tourists often choose these areas for vacation stays focused on relaxation, adventure, and wellness experiences. Proximity to nature and destination-based activities makes resort locations a top pick for both domestic and international travelers.

The rural area segment is expected to witness the fastest growth rate from 2025 to 2032, spurred by the rise of slow tourism and demand for authentic, off-the-beaten-path experiences. Rural rentals appeal to travelers seeking solitude, cultural immersion, and eco-tourism, especially post-pandemic. Supportive government initiatives promoting rural tourism in countries such as India and France are also contributing to growth in this segment.

• By Tourist Type

On the basis of tourist type, the market is segmented into domestic and international. The domestic segment held the largest market share in 2024 due to rising travel within national borders, especially in the wake of global travel restrictions and economic considerations. Local travelers are increasingly exploring hidden gems, weekend getaways, and regional destinations through vacation rental platforms. Affordability, ease of planning, and familiarity with local languages and customs make domestic rentals more accessible and attractive.

The international segment is expected to witness the fastest growth rate from 2025 to 2032 with the recovery of cross-border tourism. Demand is being driven by vacationers looking for culturally rich experiences, extended stays, and cost-effective alternatives to hotels in foreign destinations. Popular international travel corridors such as Europe-to-Europe, U.S. to Mexico, and intra-Asia continue to contribute to bookings in this segment.

• By End User

On the basis of end user, the vacation rental market is segmented into Gen Z, Millennials, Gen X, and Boomers. The millennial segment dominated the market in 2024, fueled by their preference for unique, affordable, and experience-rich stays. Tech-savvy and adventure-driven, millennials account for a large share of vacation rental bookings through digital platforms. Their willingness to explore new destinations and flexible work culture also contributes to repeat stays and long-term bookings.

The Gen Z segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their social media influence, early adoption of mobile-first travel platforms, and desire for budget-friendly, creative lodging options. They tend to prioritize aesthetic appeal, sustainability, and the ability to share experiences online, encouraging hosts to tailor properties for “Instagrammable” value and minimalistic design.

• By Price Point

On the basis of price point, the market is segmented into economic, mid-range, and luxury. The mid-range segment led the market with the highest share in 2024, offering a balanced mix of affordability, comfort, and convenience that appeals to solo travelers, couples, and families alike. Properties in this segment provide essential amenities such as Wi-Fi, kitchens, and laundry at competitive rates, making them a preferred option for value-conscious tourists.

The luxury segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for premium experiences that include personalized services, prime locations, and high-end amenities. Vacation rentals offering exclusive access, private chefs, or concierge services are increasingly favored by affluent travelers and celebrities seeking privacy and comfort.

Vacation Rental Market Regional Analysis

- North America dominated the vacation rental market with the largest revenue share of 36.7% in 2024, driven by the rising demand for alternative accommodations, strong digital booking infrastructure, and the growth of leisure and work-from-anywhere travel

- Consumers in the region increasingly seek personalized, flexible lodging options that vacation rentals offer, ranging from lakeside cabins to urban lofts, supporting a shift away from standardized hotel experiences

- The high penetration of smartphones and online travel platforms, coupled with an increasing preference for short-term rentals over traditional hotels, is further boosting market expansion across North America

U.S. Vacation Rental Market Insight

The U.S. vacation rental market accounted North America's revenue share in 2024, driven by a strong culture of domestic travel and increasing preference for spacious and private stays. A growing segment of remote workers is turning to vacation rentals for extended stays in scenic or quieter locales, blending leisure and productivity. In addition, the presence of major players such as Airbnb and Vrbo, combined with robust online infrastructure and consumer familiarity with tech-enabled services, is reinforcing consistent demand growth across the country

Europe Vacation Rental Market Insight

The Europe vacation rental market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rich cultural heritage, a strong tourism ecosystem, and increasing traveler interest in local experiences. Travelers across the continent often favor unique accommodations such as countryside cottages, coastal villas, and historic apartments. The market also benefits from efficient transportation networks and rising environmental consciousness, encouraging longer and more immersive regional stays in vacation rentals

U.K. Vacation Rental Market Insight

The U.K. vacation rental market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rise in domestic travel and staycation trends. Many travelers are opting for rural cottages, coastal lodges, and heritage properties that offer privacy and scenic escapes within driving distance. Furthermore, digital adoption and a well-established regulatory structure for short-term rentals are enabling seamless booking and encouraging more homeowners to convert properties into vacation lets

Germany Vacation Rental Market Insight

The Germany vacation rental market is expected to witness the fastest growth rate from 2025 to 2032, backed by increased intra-European travel and evolving consumer preferences toward self-catered, home-style accommodations. German tourists often prioritize privacy, convenience, and affordability, all of which align well with vacation rental offerings. In addition, growing tourism in regions such as Bavaria and the Black Forest is expanding the demand for short-term rentals beyond metropolitan hubs

Asia-Pacific Vacation Rental Market Insight

The Asia-Pacific vacation rental market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing tourism sectors, and increasing digital penetration. Countries such as China, India, Indonesia, and Thailand are experiencing a surge in domestic and international tourist arrivals, with many travelers preferring homestays and private rentals. Government support for tourism and the rise of mobile-based booking platforms are also contributing to market acceleration

Japan Vacation Rental Market Insight

The Japan vacation rental market is expected to witness the fastest growth rate from 2025 to 2032, unique cultural offerings, and increased acceptance of private lodging options post-pandemic. Tourists are showing strong interest in local home experiences near temples, in countryside villages, and around cultural hotspots. The easing of regulatory frameworks for minpaku (private lodging) and the hosting of international events such as Expo 2025 in Osaka are expected to further strengthen demand

China Vacation Rental Market Insight

The China vacation rental market accounted for the largest revenue share within Asia-Pacific in 2024, driven by rising middle-class travel demand, tech-savvy consumers, and widespread adoption of app-based travel booking. Urban travelers frequently use vacation rentals for both leisure and business stays in cities such as Beijing, Shanghai, and Shenzhen. The domestic market continues to benefit from robust tourism infrastructure and the expansion of local platforms offering curated and culturally aligned rental experiences

Vacation Rental Market Share

The Vacation Rental industry is primarily led by well-established companies, including:

- 9flats (Singapore)

- Airbnb, Inc. (U.S.)

- Booking (Netherlands)

- Expedia, Inc. (U.S.)

- MAKEMYTRIP PVT. LTD. (India)

- NOVASOL A/S (Denmark)

- OYO (India)

- TripAdvisor LLC (U.S.)

- Wyndham Destinations (U.S.)

- trivago N.V (Germany)

- Agoda Company Pte. Ltd (Singapore)

- Yatra Online Limited (India)

- HotelsCombined (Australia)

- KAYAK (U.S.)

- The Destination Club (U.S.)

Latest Developments in Global Vacation Rental Market

- In April 2023, Evolve introduced a seasonal analysis report aimed at highlighting emerging trends in the winter 2022–23 vacation rental market. This initiative helps short-term rental owners understand shifting consumer patterns, optimize property performance, and remain competitive. The report delivers actionable insights and benchmarks, supporting hosts in adapting to dynamic demand cycles and evolving guest expectations

- In March 2023, Zumper expanded its portfolio by launching “Vacations by Zumper,” a platform dedicated to short-term rental listings. This strategic development underscores Zumper’s entry into the vacation rental space, enabling the company to offer more comprehensive housing solutions. The move enhances its market positioning by tapping into growing consumer interest in flexible, short-term accommodations

- In September 2022, Arrived Homes diversified its investment offerings by adding short-term vacation rental properties to its real estate platform. This expansion allows individual investors to purchase shares in income-generating vacation homes. It opens new avenues for passive investment and addresses rising demand for alternative investment vehicles in the short-stay segment

- In August 2022, Evolve partnered with Hopper in a strategic collaboration that integrated over 24,000 Evolve-managed vacation homes into the Hopper travel app. This move expanded Evolve’s reach across 750 markets while boosting Hopper’s lodging offerings. The partnership improves vacation rental accessibility for global users and streamlines trip planning with a unified travel ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.