Global Vaccine Adjuvants Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

4.74 Billion

2024

2032

USD

1.73 Billion

USD

4.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.73 Billion | |

| USD 4.74 Billion | |

|

|

|

|

Vaccine Adjuvants Market Size

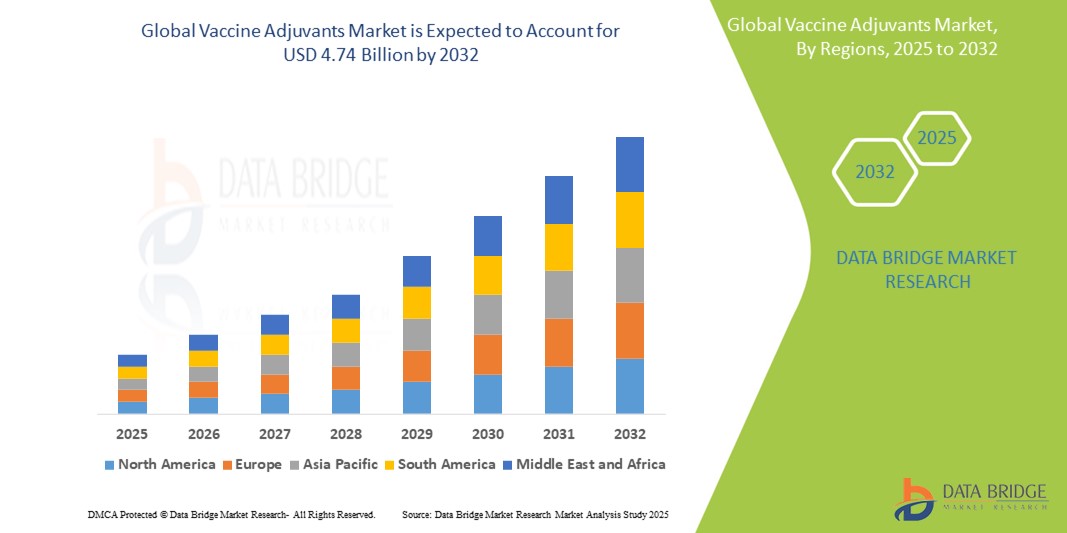

- The global Vaccine Adjuvants market was valued at USD 1.73 billion in 2024 and is expected to reach USD 4.74 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.37 %, primarily driven by the increasing demand for effective vaccines, rising prevalence of infectious diseases, and advancements in adjuvant technologies

- This growth is driven by factors such as the rising vaccine development, increasing investments in healthcare, and growing demand for improved vaccine efficacy

Vaccine Adjuvants Market Analysis

- Vaccine adjuvants are substances that enhance the body’s immune response to an antigen, playing a critical role in the development of more effective vaccines. They are vital in improving vaccine efficacy, particularly for vaccines with weaker immune responses.

- The demand for vaccine adjuvants is significantly driven by the increasing prevalence of infectious diseases, growing immunization programs, and the development of novel vaccines. The market is particularly propelled by the ongoing efforts to develop vaccines for emerging diseases and pandemics

- The North America region is a dominant market for vaccine adjuvants, driven by its advanced research infrastructure, strong pharmaceutical industry, and increasing government support for vaccine innovation and distribution

- For instance, the development and distribution of COVID-19 vaccines boosted the demand for novel adjuvants, with North America leading the way in both research and deployment of vaccines with advanced adjuvant technologies

- Globally, vaccine adjuvants are essential components in vaccine formulations, particularly for enhancing immune responses in vaccines for elderly populations, infants, and immunocompromised individuals, contributing to the market's consistent growth

Report Scope and Vaccine Adjuvants Market Segmentation

|

Attributes |

Vaccine Adjuvants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vaccine Adjuvants Market Trends

“Rising Focus on Novel Adjuvant Development and Precision Vaccinology”

- One prominent trend in the global vaccine adjuvants market is the increasing focus on the development of novel adjuvants and the application of precision vaccinology

- These advancements aim to create more targeted and effective vaccines by tailoring adjuvant formulations to specific populations, such as the elderly, children, or immunocompromised individuals

- For instance, new-generation adjuvants such as AS03, MF59, and CpG 1018 are being incorporated into vaccine candidates to enhance immunogenicity and ensure long-term protection, especially in pandemic preparedness and chronic disease prevention

- Precision vaccinology leverages data-driven approaches and immunoprofiling to match adjuvants with specific immune system responses, improving vaccine safety and efficacy

- This trend is transforming vaccine development by making it more personalized and effective, thereby fueling demand for innovative adjuvants and expanding the market's scope globally

Vaccine Adjuvants Market Dynamics

Driver

“Increasing Prevalence of Infectious Diseases and Need for Enhanced Vaccine Efficacy”

- The growing prevalence of infectious diseases such as influenza, hepatitis, tuberculosis, and emerging threats such as COVID-19 and monkeypox is significantly contributing to the rising demand for vaccine adjuvants

- As global health systems strive to improve vaccine efficacy and achieve broader immunization coverage, adjuvants play a critical role in enhancing immune responses, especially for populations with weaker immunity

- Adjuvants help reduce the amount of antigen required per dose, which is vital during pandemics and large-scale immunization programs, improving vaccine scalability and accessibility

- The ongoing advancements in immunology and vaccine formulation have led to the development of next-generation adjuvants with improved safety profiles and immunostimulatory capabilities

- This trend is especially important in the context of elderly populations, infants, and immunocompromised individuals who require stronger, longer-lasting protection from vaccines

For instance,

- In June 2022, according to the World Health Organization (WHO), over 1.6 million people died from tuberculosis in 2021, highlighting the urgent need for more effective vaccines with potent adjuvants to boost immune responses

- In January 2023, data from the Centers for Disease Control and Prevention (CDC) emphasized the importance of adjuvants in influenza vaccines for individuals over 65, who represent the majority of flu-related hospitalizations and deaths annually

- As a result of the increasing burden of infectious and chronic diseases, along with a global push for more efficient and longer-lasting vaccines, there is a significant surge in demand for advanced vaccine adjuvants to meet public health goals and enhance immunization outcomes

Opportunity

“Advancements in Biotechnology and Personalized Vaccine Development”

- The rapid progress in biotechnology and immunology is opening new opportunities for the development of highly targeted and personalized vaccine adjuvants, which can significantly improve vaccine efficacy and safety

- Personalized vaccines, particularly in oncology and infectious disease treatment, are gaining traction, with adjuvants being tailored to individual immune profiles to generate optimal responses and minimize side effects

- In addition, these innovations allow for the design of adjuvants that can selectively activate specific immune pathways, enabling the creation of more effective vaccines for diverse populations and complex disease

For instance,

- In October 2024, according to a study published in Nature Reviews Drug Discovery, novel adjuvant systems using nanoparticle and lipid-based delivery technologies have shown promise in improving antigen presentation and stimulating durable immune responses, particularly in cancer and therapeutic vaccines

- In March 2023, the National Institutes of Health (NIH) launched initiatives promoting the development of adjuvants designed for personalized immunization strategies, especially for individuals with rare diseases or immunodeficiencies

- These technological advancements, coupled with growing interest in precision medicine, offer immense potential for expanding the application of vaccine adjuvants beyond traditional infectious diseases—into areas such as cancer immunotherapy, autoimmune diseases, and emerging zoonotic threats. This shift is expected to drive innovation, partnerships, and significant growth opportunities within the global vaccine adjuvants market

Restraint/Challenge

“High Development Costs and Stringent Regulatory Requirements”

- The development of vaccine adjuvants involves high costs and complex research processes, which can act as a major restraint for market expansion, particularly for smaller biotech firms and emerging markets

- Adjuvants must undergo extensive preclinical and clinical testing to ensure safety and efficacy, often resulting in long development timelines and significant investment

- In addition, stringent regulatory requirements across different countries further complicate product approval, leading to delays and increased costs for manufacturers and developers

For instance,

- In September 2024, according to a report by BioProcess International, the cost of developing a novel adjuvant and bringing it to market can exceed USD 500 million, due to the need for multiple clinical trials, rigorous safety assessments, and compliance with evolving global regulatory standards

- In February 2023, a study published in Vaccine journal highlighted that despite promising results, several novel adjuvants face approval delays due to differing regulatory frameworks across the U.S., EU, and Asia, which often require redundant testing and data submissions

- Consequently, these challenges can limit innovation, slow down product pipelines, and restrict market penetration, especially in low- and middle-income countries, where the burden of disease is high but access to advanced vaccines remains limited

Vaccine Adjuvants Market Scope

The market is segmented on the basis of product type, route of administration, disease type, application, application category, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Route of Administration |

|

|

By Disease Type |

|

|

By Application

|

|

|

By Application Category |

|

|

By End User |

|

Vaccine Adjuvants Market Regional Analysis

“North America is the Dominant Region in the Vaccine Adjuvants Market”

- North America leads the global vaccine adjuvants market, driven by its advanced biopharmaceutical research ecosystem, high healthcare spending, and strong government support for vaccine development and immunization programs

- U.S. accounts for a major market share due to its well-established pharmaceutical industry, widespread vaccine coverage, and active involvement in the development of novel adjuvants for both preventative and therapeutic vaccines

- Regulatory support from agencies such as the FDA and growing investment in personalized and mRNA-based vaccines continue to drive innovation and commercial adoption across the region

- In addition, public-private partnerships, such as those formed during the COVID-19 pandemic, have accelerated adjuvant research and deployment, positioning North America at the forefront of vaccine technology advancement

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to exhibit the highest growth rate in the vaccine adjuvants market, fueled by increasing vaccine production capacity, growing burden of infectious diseases, and expanding government immunization initiatives

- Countries such as China, India, and Japan are emerging as pivotal markets due to their large populations, rising healthcare awareness, and strengthened vaccine infrastructure, particularly in response to pandemics and endemic diseases

- Japan, known for its innovation in life sciences, continues to invest in advanced vaccine technologies, including adjuvant research, to improve immunization outcomes

- China and India, the growing presence of biotech startups, improved regulatory frameworks, and collaborations with global pharmaceutical companies are boosting the production and distribution of adjuvanted vaccines. These developments are further supported by initiatives aimed at enhancing disease prevention and public health across rural and urban areas

Vaccine Adjuvants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Pfizer Inc. (U.S.)

- GSK plc. (U.K.)

- AstraZeneca (U.K.)

- Abbott (U.S.)

- 3M (U.S.)

- Adjuvatis (France)

- Merck KGaA. (Germany)

- Croda International Plc (U.K.)

- Novavax (U.S.)

- InvivoGen (France)

- CSL (Australia)

- SPI Pharma (U.S.)

- Phibro Animal Health Corporation (U.S.)

- SEPPIC (France)

- Agenus Inc. (U.S.)

- OZ Biosciences (France)

- Kineta Inc. (U.S.)

- Vaxine Pty Ltd. (Australia)

- Astellas Pharma Inc. (Japan)

- CureVac SE (Germany)

- Bavarian Nordic (Denmark)

Latest Developments in Global Vaccine Adjuvants Market

- In June 2024, SPI Pharma, Inc. announced a partnership with Inimmune Corp. to advance the commercialization of new vaccine adjuvant solutions. This alliance focuses on developing adjuvants that can improve immune responses and broaden protection against various diseases

- In March 2024, Croda International Plc partnered with the Access to Advanced Health Institute (AAHI) to develop innovative adjuvant formulations. This collaboration aims to enhance vaccine efficacy and stability, particularly in emerging markets

- In February 2024, TollereBio entered into a licensing agreement with the University of Maryland, Baltimore, to commercialize a unique vaccine adjuvant technology based on bacterial enzymatic combinatorial chemistry (BECC). This technology aims to produce cost-effective adjuvants for both therapeutic and prophylactic vaccines

- In February 2023, Adjuvance Technologies Inc. introduced ATX-M102, a saponin-based adjuvant designed for use in various vaccines, including those targeting infectious diseases, cancer, and allergies. Clinical trials have shown it to be safe and effective, marking a significant step in adjuvant innovation

- In January 2023, Dynavax Technologies Corporation partnered with Sanofi Pasteur to develop and commercialize CpG 1018, a synthetic Toll-like receptor 9 agonist. This adjuvant has demonstrated the ability to boost immune responses in influenza vaccine candidates, aiming to produce more effective and affordable vaccines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.