Global Vaccine Contract Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

3.03 Billion

USD

5.48 Billion

2024

2032

USD

3.03 Billion

USD

5.48 Billion

2024

2032

| 2025 –2032 | |

| USD 3.03 Billion | |

| USD 5.48 Billion | |

|

|

|

|

Vaccine Contract Manufacturing Market Size

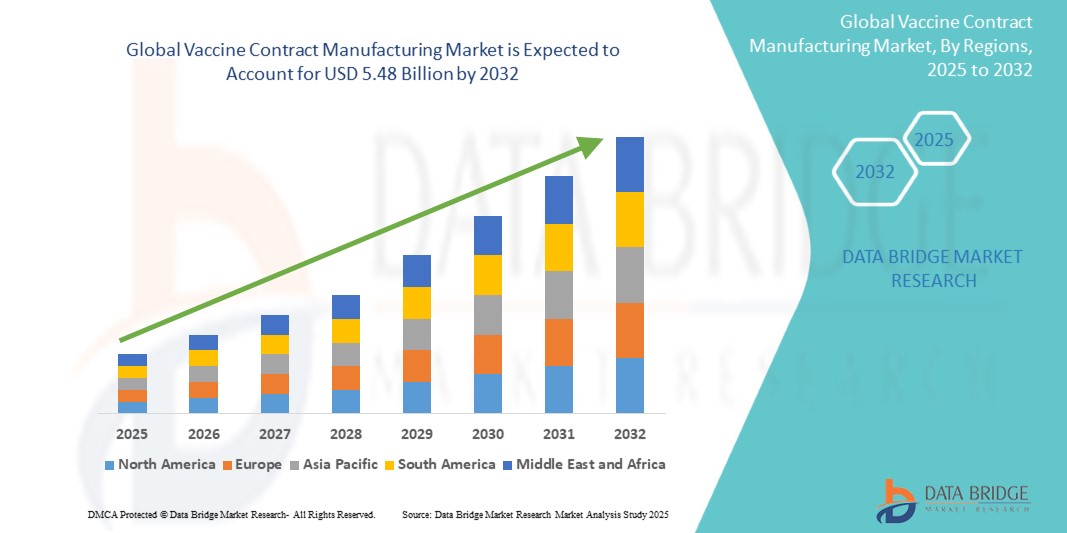

- The global vaccine contract manufacturing market size was valued at USD 3.03 billion in 2024 and is expected to reach USD 5.48 billion by 2032, at a CAGR of 7.68% during the forecast period

- The market growth is largely fueled by the increasing outsourcing of vaccine production by pharmaceutical and biotechnology companies, supported by advancements in bioprocessing technologies and the rising demand for cost-effective, scalable manufacturing solutions across global markets

- Furthermore, the growing prevalence of infectious diseases, government-funded immunization programs, and the need for rapid large-scale production during health crises are establishing contract manufacturing as a vital component of the global vaccine supply chain. These converging factors are accelerating the uptake of vaccine contract manufacturing services, thereby significantly boosting the industry’s growth

Vaccine Contract Manufacturing Market Analysis

- Vaccine contract manufacturing involves outsourcing the development, formulation, and large-scale production of vaccines to specialized contract development and manufacturing organizations (CDMOs). These services provide pharmaceutical and biotech companies with advanced facilities, regulatory expertise, and scalable capacity, reducing the need for heavy capital investment

- The escalating demand for vaccine contract manufacturing is primarily driven by the rising adoption of novel vaccine platforms such as mRNA and recombinant technologies, increasing global vaccination campaigns, and the need for flexible, rapid-response manufacturing capabilities to address emerging public health threats

- North America dominated the vaccine contract manufacturing market with a share of 34.4% due to strong outsourcing demand from pharmaceutical and biotechnology companies for large-scale vaccine production

- Asia-Pacific is expected to be the fastest growing region in the vaccine contract manufacturing market during the forecast period due to rapid urbanization, rising healthcare expenditure, and government initiatives promoting local vaccine production

- Large scale segment dominated the market with a market share of 52.9% due to the increasing demand for mass production of vaccines to meet global immunization programs. Large-scale manufacturers benefit from advanced bioprocessing facilities, high-capacity bioreactors, and automated systems that ensure consistent quality and regulatory compliance. These capabilities make them the preferred partners for global pharmaceutical companies seeking rapid, high-volume vaccine output during pandemics or seasonal outbreaks. Furthermore, their strong financial resources and global supply chain networks enhance their ability to fulfill cross-border vaccine requirements efficiently

Report Scope and Vaccine Contract Manufacturing Market Segmentation

|

Attributes |

Vaccine Contract Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Vaccine Contract Manufacturing Market Trends

Adoption of Advanced Vaccine Platforms

- The vaccine contract manufacturing market is increasingly shaped by the adoption of advanced vaccine platforms that support faster development and scalability. Technologies such as mRNA, viral vectors, recombinant proteins, and nanoparticle-based vaccines are transforming the global landscape, creating new opportunities for contract development and manufacturing organizations (CDMOs) to play pivotal roles

- For instance, Lonza partnered with Moderna to scale up manufacturing of its mRNA COVID-19 vaccine, demonstrating how collaboration between CDMOs and biotech innovators can accelerate vaccine delivery to market. This instance highlights the rising prominence of advanced vaccine platforms in driving demand for specialized contract services

- The rapid shift toward mRNA-based vaccines is prompting CDMOs to expand capabilities in lipid nanoparticle formulation, cold chain logistics, and sterile filling processes. These emerging technologies require specialized infrastructure, which is positioning contract manufacturers as indispensable players in vaccine pipelines

- The expansion of recombinant DNA technologies is enabling the production of more robust and stable vaccines, which are being scaled up by contract manufacturers equipped with bioreactors, fermentation systems, and advanced purification methods. This diversification of platforms is broadening opportunities for CDMOs to serve global pharma clients

- In addition, cell culture-based vaccine production is replacing traditional egg-based methods due to its scalability, flexibility, and efficiency. Contract manufacturers offering optimized cell culture platforms are gaining traction as pharmaceutical firms pursue alternatives to conventional technologies to meet rising demand

- A growing emphasis on personalized medicine and preventive healthcare is also influencing vaccine R&D. Contract manufacturers are being called upon to facilitate rapid development cycles by offering flexible, small-batch production of niche vaccines tailored to specific populations, marking a paradigm shift in vaccine delivery

Vaccine Contract Manufacturing Market Dynamics

Driver

Rising Technological Advancements

- Technological advancements within vaccine development and manufacturing are major drivers for the contract manufacturing market. Innovations in bioprocessing, automation, and digitalization allow faster, more efficient, and higher quality vaccine production that pharmaceutical companies can seamlessly outsource to specialized CDMOs

- For instance, Samsung Biologics has continued to invest in state-of-the-art production facilities featuring high-capacity bioreactors, single-use technologies, and advanced automation systems to expand its vaccine manufacturing capabilities. These investments strengthen their partnerships with global biopharma clients relying on outsourced services

- The rising adoption of modular and flexible biomanufacturing facilities is increasing speed and efficiency while enabling rapid scale-up during pandemic preparedness. This allows CDMOs to quickly adapt to changing vaccine demands without the lengthy setup times of fixed facilities

- The incorporation of advanced analytical tools and process optimization software is improving product consistency and compliance, which are critical for high-quality vaccine production. Contract manufacturers are embedding such digital solutions to ensure better quality checks and improved process control

- In addition, technological progress in cold chain solutions enhances the preservation and global distribution of temperature-sensitive vaccines. CDMOs that provide integrated logistics and distribution support are gaining competitive advantages in this evolving market

- The industry is also experiencing growth through the adoption of next-generation bioprocessing techniques such as continuous manufacturing and high-density perfusion, which reduce costs and allow for faster turnaround compared to traditional batch production systems

Restraint/Challenge

Stringent Regulatory Requirements

- One of the major challenges facing the vaccine contract manufacturing market is stringent regulatory requirements governing vaccine production, testing, and distribution. CDMOs must comply with rigorous global standards which significantly add to operational complexity and timelines

- For instance, companies such as WuXi Biologics face extensive audits and quality assurance requirements from regulatory authorities such as the US FDA and European Medicines Agency to maintain compliance for their manufacturing services. This level of scrutiny while critical for patient safety adds considerable costs and delays

- The variability of regulatory frameworks across regions represents another major hurdle. Different countries impose distinct clinical trial, approval, and labeling requirements, posing complexities for CDMOs managing global production and distribution contracts

- In addition, the high costs of maintaining compliance infrastructures such as GMP-certified facilities, quality control laboratories, and specialized staff increase the financial burden, particularly for mid-sized or emerging contract manufacturers aiming to scale operations

- The lengthy approval processes for vaccines delay commercialization, making it difficult for manufacturers to respond swiftly to outbreaks or health emergencies. This poses challenges in aligning speed with regulatory rigor, especially in emergency market conditions

- Regulatory shifts towards stricter environmental and biosafety controls are also adding new compliance demands. Manufacturers must constantly upgrade systems to align with evolving frameworks, which impacts cost structures and may limit smaller players from competing effectively

Vaccine Contract Manufacturing Market Scope

The market is segmented on the basis of vaccine type, scale of operation, and end user.

• By Vaccine Type

On the basis of vaccine type, the vaccine contract manufacturing market is segmented into viral vaccines, bacterial vaccines, recombinant vaccines, and toxoid vaccines. The viral vaccines segment dominated the largest market revenue share in 2024, owing to their widespread use in preventing infectious diseases such as influenza, polio, measles, and COVID-19. Contract manufacturers play a crucial role in scaling up production of viral vaccines due to the complexity of viral culture, purification, and formulation processes. The rising global vaccination programs supported by government and international health organizations have also amplified demand for viral vaccine outsourcing. In addition, viral vaccines benefit from advanced bioreactor technologies and cold chain logistics, which enhance their reliability and accessibility across developed and emerging markets.

The recombinant vaccines segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by advancements in genetic engineering and increasing demand for vaccines with high safety and efficacy profiles. Recombinant technology eliminates the need for live pathogens, making production safer and more scalable for contract manufacturers. Growing application of recombinant vaccines in preventing diseases such as hepatitis B, HPV, and emerging viral threats is accelerating their adoption. The ability to rapidly design and produce recombinant vaccines using novel expression systems such as yeast, insect, or mammalian cells further strengthens this segment’s growth. Rising investments in precision medicine and immunization strategies targeting new diseases will continue to boost demand for recombinant vaccine outsourcing.

• By Scale of Operation

On the basis of scale of operation, the vaccine contract manufacturing market is segmented into small scale, medium scale, and large scale. The large-scale segment dominated the market with a share of 52.9% in 2024, driven by the increasing demand for mass production of vaccines to meet global immunization programs. Large-scale manufacturers benefit from advanced bioprocessing facilities, high-capacity bioreactors, and automated systems that ensure consistent quality and regulatory compliance. These capabilities make them the preferred partners for global pharmaceutical companies seeking rapid, high-volume vaccine output during pandemics or seasonal outbreaks. Furthermore, their strong financial resources and global supply chain networks enhance their ability to fulfill cross-border vaccine requirements efficiently.

The small-scale segment is expected to record the fastest growth from 2025 to 2032, as it plays a vital role in supporting early-stage development and niche vaccine candidates. Small-scale facilities are increasingly chosen by biotechnology startups and academic institutions for pilot-scale production and clinical trial supplies. Their flexibility in handling customized batches and novel vaccine technologies, such as mRNA and vector-based vaccines, positions them as key enablers of innovation. Moreover, the rising trend of decentralized vaccine development and government support for local production capabilities is boosting growth in this segment. This agility in adapting to emerging health threats and rapidly shifting demands provides small-scale players with a significant growth advantage.

• By End User

On the basis of end user, the vaccine contract manufacturing market is segmented into pharmaceutical companies, biotechnology companies, academic and research institutions, government agencies, and non-profit organizations. Pharmaceutical companies accounted for the largest revenue share in 2024, primarily due to their heavy reliance on contract manufacturing partners for large-scale vaccine production and global distribution. These companies benefit from outsourcing as it reduces capital investment in infrastructure while enabling them to focus on R&D and commercialization. Contract manufacturers provide pharmaceutical firms with scalable solutions to meet high demand, especially during pandemic outbreaks, where time-sensitive mass production is critical. In addition, partnerships with CMOs ensure compliance with international regulatory standards, helping pharmaceutical companies expand their vaccine reach across multiple geographies.

The biotechnology companies segment is projected to grow at the fastest pace from 2025 to 2032, driven by the surge in innovative vaccine development using novel platforms such as mRNA, DNA, and viral vectors. Many biotech firms lack large in-house production capacity, making contract manufacturing a strategic necessity. Their focus on niche disease areas and personalized vaccines creates opportunities for CMOs offering flexible, specialized services. Furthermore, increasing venture capital investments and collaborations between biotech firms and global health organizations are accelerating demand for outsourced vaccine production. This trend reflects the growing influence of biotech firms in shaping the next generation of vaccines, positioning them as major contributors to future market expansion.

Vaccine Contract Manufacturing Market Regional Analysis

- North America dominated the vaccine contract manufacturing market with the largest revenue share of 34.4% in 2024, driven by strong outsourcing demand from pharmaceutical and biotechnology companies for large-scale vaccine production

- The region benefits from advanced biomanufacturing infrastructure, a highly skilled workforce, and favorable regulatory frameworks supporting contract development and manufacturing organizations (CDMOs)

- The rising need for vaccines targeting seasonal influenza, COVID-19 variants, and other infectious diseases continues to drive partnerships between global pharma leaders and North American CMOs. Furthermore, robust government funding for immunization programs and investments in biologics manufacturing capacity further strengthen the region’s leadership position

U.S. Vaccine Contract Manufacturing Market Insight

The U.S. vaccine contract manufacturing market captured the largest revenue share in 2024 within North America, fueled by its well-established pharmaceutical industry and rapid adoption of innovative vaccine platforms such as mRNA and recombinant technologies. U.S.-based CDMOs are recognized for their strong regulatory compliance, cutting-edge facilities, and ability to scale production quickly during health crises. Growing collaborations between biotech startups and large CDMOs, combined with the government’s focus on pandemic preparedness and domestic vaccine security, are accelerating market growth. The increasing investment in R&D and expansion of biologics manufacturing hubs further establish the U.S. as the regional leader.

Europe Vaccine Contract Manufacturing Market Insight

The Europe vaccine contract manufacturing market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent regulatory standards, advanced bioprocessing capabilities, and rising vaccine demand across the continent. Outsourcing is gaining momentum as European pharma and biotech companies increasingly rely on CDMOs for both clinical and commercial-scale production. The growth is further reinforced by the region’s focus on preparedness for emerging infectious diseases and its well-established infrastructure for biologics manufacturing. Expansion of production partnerships across Germany, the U.K., and Switzerland is shaping Europe as a major hub for vaccine contract manufacturing.

U.K. Vaccine Contract Manufacturing Market Insight

The U.K. vaccine contract manufacturing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong government support for biomanufacturing and continued investment in vaccine innovation. The country’s agile regulatory environment and focus on advanced vaccine technologies, including viral vectors and recombinant vaccines, are fueling outsourcing demand. The presence of major research institutions and strong collaborations between academia, biotech firms, and CMOs position the U.K. as a key player in Europe’s vaccine manufacturing landscape.

Germany Vaccine Contract Manufacturing Market Insight

The Germany vaccine contract manufacturing market is expected to expand at a considerable CAGR, propelled by its strong pharmaceutical sector, technological expertise, and emphasis on innovation. The country has become a major center for biologics and vaccine production, with CDMOs offering state-of-the-art facilities and scalable solutions. Germany’s focus on sustainability and eco-conscious manufacturing practices also supports its competitive edge in vaccine outsourcing. Increasing investment in vaccine R&D and collaborations with global pharma companies are further strengthening the market outlook.

Asia-Pacific Vaccine Contract Manufacturing Market Insight

The Asia-Pacific vaccine contract manufacturing market is poised to grow at the fastest CAGR during 2025 to 2032, fueled by rapid urbanization, rising healthcare expenditure, and government initiatives promoting local vaccine production. The region is emerging as a cost-effective hub for biologics and vaccine manufacturing, with strong contributions from China, India, South Korea, and Japan. Expanding clinical trials, increasing demand for affordable vaccines, and a growing pool of biotech startups outsourcing production to CDMOs are accelerating market growth. Furthermore, international collaborations and rising investments in GMP-compliant manufacturing facilities strengthen Asia-Pacific’s global presence.

Japan Vaccine Contract Manufacturing Market Insight

The Japan vaccine contract manufacturing market is gaining traction due to its advanced technological base, strong pharmaceutical sector, and increasing adoption of recombinant and mRNA vaccines. Japan’s emphasis on safety, quality, and precision in biologics manufacturing positions it as a high-value outsourcing destination. The country’s aging population and growing demand for vaccines targeting infectious and chronic diseases are driving collaborations between biotech innovators and CDMOs.

China Vaccine Contract Manufacturing Market Insight

The China vaccine contract manufacturing market accounted for the largest share in Asia-Pacific in 2024, supported by its expanding vaccine industry, large domestic population, and strong government backing for self-sufficiency in vaccine production. China is witnessing rapid growth in both domestic and export-oriented vaccine manufacturing, with CDMOs offering competitive pricing and large-scale capacity. The country’s investment in biopharmaceutical clusters and international partnerships has positioned it as a leading hub for global vaccine outsourcing.

Vaccine Contract Manufacturing Market Share

The vaccine contract manufacturing industry is primarily led by well-established companies, including:

- Catalent, Inc. (U.S.)

- Lonza Group Ltd. (Switzerland)

- Fujifilm Diosynth Biotechnologies (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Samsung Biologics (South Korea)

- Emergent BioSolutions Inc. (U.S.)

- Pfizer CentreOne (U.S.)

- Grand River Aseptic Manufacturing (GRAM) (U.S.)

- Albany Molecular Research Inc. (U.S.)

- Boehringer Ingelheim BioXcellence (Germany)

Latest Developments in Global Vaccine Contract Manufacturing Market

- In December 2023, Ajinomoto Co., Inc. completed the acquisition of shares in All Forge Biologics Holdings, LLC, a move that significantly enhances its biologics development and manufacturing capacity. This acquisition is expected to strengthen Ajinomoto’s footprint in the vaccine contract manufacturing market by broadening its technological capabilities and production scale. The expansion provides the company with greater flexibility to support advanced therapies and vaccine development projects, fostering innovation in Japan’s biomanufacturing landscape and contributing to the country’s role as a regional hub for outsourcing solutions

- In September 2023, Pfizer and Moderna jointly announced FDA approval for their updated COVID-19 vaccines designed to protect against the latest variants. This development directly boosts demand for contract manufacturing services as pharmaceutical giants increasingly rely on CDMOs to ensure timely large-scale production and distribution. The decision also underscores the critical role of contract manufacturers in rapidly adapting to evolving pathogens, thereby sustaining market growth and reinforcing the importance of flexible, scalable vaccine production partnerships

- In September 2023, SK bioscience entered a strategic partnership with Serbia to establish vaccine production facilities within the country. This collaboration expands SK bioscience’s global manufacturing footprint and also reflects a broader trend of decentralizing vaccine production to strengthen regional supply chains. For the vaccine contract manufacturing market, this development highlights the growing importance of localized production capabilities, which can address supply security concerns while boosting the role of emerging economies in the global vaccine ecosystem

- In June 2023, FUJIFILM Corporation inaugurated a new commercial office in Tokyo to provide enhanced sales and customer support for its contract development and manufacturing services in biologics and advanced therapies. This expansion is poised to strengthen FUJIFILM’s engagement with Asia-based pharmaceutical and biotechnology companies, facilitating closer collaboration and faster response times. By improving access to its CDMO services, FUJIFILM enhances its competitive position in the Asia-Pacific vaccine contract manufacturing market, supporting the region’s increasing demand for advanced biologics and vaccines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.