Global Vacuum Assisted Biopsy Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.55 Billion

2025

2033

USD

1.60 Billion

USD

2.55 Billion

2025

2033

| 2026 –2033 | |

| USD 1.60 Billion | |

| USD 2.55 Billion | |

|

|

|

|

Vacuum-Assisted Biopsy Market Size

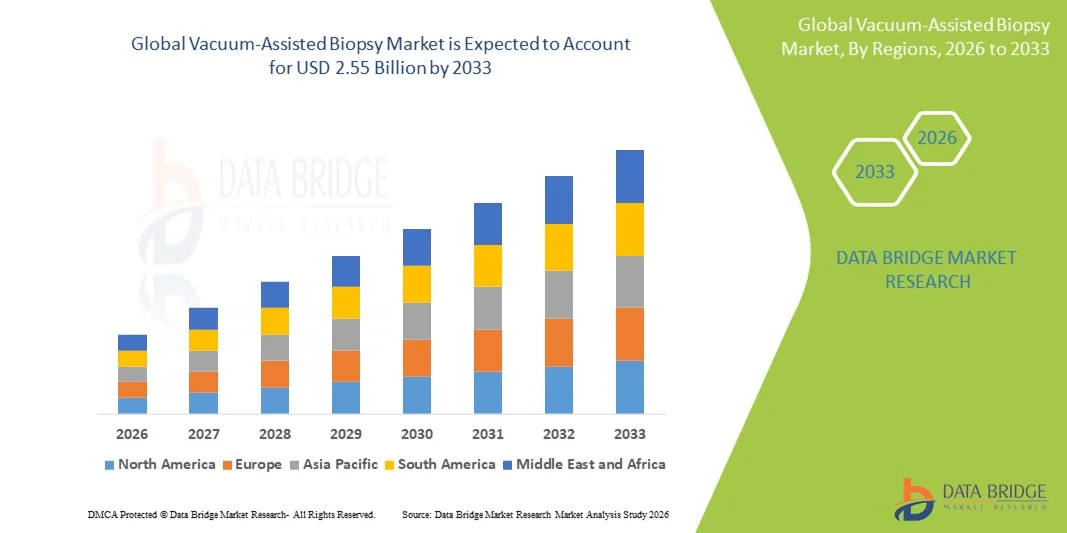

- The global vacuum-assisted biopsy market size was valued at USD 1.60 billion in 2025 and is expected to reach USD 2.55 billion by 2033, at a CAGR of 6.05% during the forecast period

- The market growth is largely fueled by increasing adoption of minimally‑invasive diagnostic procedures rising incidence of cancers and technological progress in imaging‑guided and vacuum‑assisted biopsy devices

- Furthermore, rising consumer and provider demand for accurate, patient‑comfortable, integrated diagnostic solutions in hospitals and imaging/diagnostic centres is establishing vacuum‑assisted biopsy as a preferred method over traditional biopsy approaches. These converging factors are accelerating the uptake of vacuum‑assisted biopsy solutions, thereby significantly boosting the industry’s growth

Vacuum-Assisted Biopsy Market Analysis

- Vacuum-assisted biopsy devices, offering minimally invasive tissue sampling for diagnostic purposes, are increasingly vital components of modern cancer detection and diagnostic workflows in both hospitals and diagnostic centres due to their enhanced accuracy, patient comfort, and seamless integration with imaging systems

- The escalating demand for vacuum-assisted biopsy devices is primarily fueled by the growing adoption of minimally invasive diagnostic procedures, rising incidence of cancers (breast, lung, and prostate), and a preference for accurate, patient-friendly biopsy solutions over conventional methods

- North America dominated the vacuum-assisted biopsy devices market with the largest revenue share of 40.4% in 2025, characterized by early adoption of advanced imaging technologies, strong healthcare infrastructure, and a significant presence of key industry players, with the U.S. experiencing substantial growth in vacuum-assisted biopsy installations, particularly in specialized oncology centres, driven by innovations from both established medical device companies and startups focusing on image-guided and automated biopsy systems

- Asia-Pacific is expected to be the fastest growing region in the vacuum-assisted biopsy devices market during the forecast period due to increasing healthcare investments, rising cancer incidence, and expanding availability of diagnostic services in urban centres

- Image-Guided Vacuum Assist Biopsy System dominated the vacuum-assisted biopsy devices market with a market share of 68.8% in 2025, driven by its precision, compatibility with multiple imaging modalities, and higher adoption in hospitals and diagnostic centres for accurate tissue sampling

Report Scope and Vacuum-Assisted Biopsy Market Segmentation

|

Attributes |

Vacuum-Assisted Biopsy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Vacuum-Assisted Biopsy Market Trends

Integration with Advanced Imaging and AI for Precision Diagnostics

- A significant and accelerating trend in the global vacuum-assisted biopsy devices market is the growing integration with advanced imaging modalities and AI-powered diagnostic software. This combination enhances procedural precision, reduces patient discomfort, and improves tissue sampling accuracy

- For instance, Hologic’s ATEC Advantage system integrates AI-assisted imaging for real-time lesion targeting, allowing clinicians to perform faster and more accurate biopsies with minimal invasiveness. Similarly, Devicor’s EnCore system utilizes advanced stereotactic guidance combined with software analytics to optimize tissue sampling

- AI integration in vacuum-assisted biopsy devices enables features such as predicting optimal biopsy paths, reducing unnecessary tissue extraction, and improving diagnostic yield. For instance, Siemens Healthineers’ AI-assisted systems can analyze prior imaging to suggest precise needle placement and alert operators to abnormal tissue structures

- The seamless integration of vacuum-assisted biopsy devices with hospital information systems and PACS allows centralized patient data management, facilitating coordination between radiologists, pathologists, and oncologists for more efficient workflows

- This trend towards more intelligent, automated, and interconnected biopsy systems is fundamentally reshaping expectations in oncology diagnostics. Consequently, companies such as BD and Argon Medical are developing AI-enabled biopsy solutions with automatic lesion detection and imaging compatibility

- The demand for vacuum-assisted biopsy devices with integrated AI and advanced imaging features is growing rapidly across both hospital and diagnostic centre settings, as healthcare providers increasingly prioritize procedural accuracy, efficiency, and patient safety

Vacuum-Assisted Biopsy Market Dynamics

Driver

Rising Cancer Incidence and Demand for Minimally Invasive Procedures

- The increasing prevalence of cancers, particularly breast, lung, and prostate, combined with the rising preference for minimally invasive procedures, is a significant driver for the heightened demand for vacuum-assisted biopsy devices

- For instance, in March 2025, Hologic announced an expansion of its ATEC system deployment in leading oncology centres to improve breast biopsy precision and reduce patient recovery time. Such initiatives by key players are expected to drive industry growth in the forecast period

- As healthcare providers aim to reduce surgical interventions and improve diagnostic accuracy, vacuum-assisted biopsy devices offer enhanced features such as image-guided targeting, real-time tissue sampling, and reduced procedure time, providing a compelling alternative to traditional core needle biopsies

- Furthermore, the growing adoption of outpatient and diagnostic centre-based oncology services is making vacuum-assisted biopsy devices an essential tool for accurate, patient-friendly diagnostics

- Rising government and private healthcare initiatives supporting early cancer detection programs are further boosting market growth. For instance, several U.S. states are funding breast cancer screening programs that incorporate vacuum-assisted biopsy technology in local hospitals

- The ability to perform safe, minimally invasive procedures with higher diagnostic yield and integration with hospital IT systems is a key factor propelling the adoption of these devices in hospitals, academic institutions, and specialized imaging centres

Restraint/Challenge

High Device Cost and Limited Awareness in Emerging Markets

- Concerns surrounding the high upfront cost of vacuum-assisted biopsy devices and related consumables pose a significant challenge to broader market penetration, especially in developing regions

- For instance, the relatively premium pricing of devices such as Hologic ATEC or Devicor EnCore systems compared to conventional core needles can limit adoption in budget-constrained hospitals or smaller diagnostic centres

- Addressing these affordability concerns through cost-effective models, financing options, and leasing arrangements is crucial for expanding market reach. In addition, limited awareness among clinicians regarding the benefits of vacuum-assisted biopsy compared to traditional biopsy methods can slow adoption

- While training programs and workshops are gradually increasing awareness, the perceived complexity of the devices may still hinder widespread uptake, particularly in regions with less-developed healthcare infrastructure

- Regulatory approval delays and complex certification processes in certain countries may slow the introduction of new models. For instance, navigating FDA, CE, and local health authority requirements can prolong time-to-market for innovative biopsy systems

- Overcoming these challenges through clinician education, local training initiatives, and the development of more affordable device options will be vital for sustained market growth and penetration into emerging economies

Vacuum-Assisted Biopsy Market Scope

The market is segmented on the basis of guiding technique, type, and application.

- By Guiding Technique

On the basis of guiding technique, the market is segmented into stereotactic vacuum assist biopsy system and image-guided vacuum assist biopsy system. The Image-Guided Vacuum Assist Biopsy System segment dominated the market with the largest revenue share of 68.8% in 2025, driven by its high precision, adaptability to multiple imaging modalities (ultrasound, MRI, mammography), and widespread adoption in hospitals and diagnostic centres. Clinicians prefer this system due to its real-time visualization, which reduces procedural errors and improves diagnostic yield. Hospitals with high patient volumes favor image-guided systems for their efficiency and ability to accurately target lesions, particularly in complex breast, lung, or prostate biopsies. The integration of AI-assisted analytics in some systems further enhances accuracy and workflow efficiency. The segment’s strong presence in North America and Europe also contributes to its dominant market position, supported by advanced healthcare infrastructure and higher investment in oncology diagnostics.

The Stereotactic Vacuum Assist Biopsy System segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in emerging markets and expanding breast cancer screening programs. Stereotactic systems are especially valued in regions with limited access to MRI or ultrasound-guided devices, providing precise, minimally invasive biopsy solutions. Technological improvements, such as compact designs and faster imaging processing, are making stereotactic systems more accessible and convenient for both hospitals and specialized diagnostic centres. Growing awareness of minimally invasive procedures in oncology and expanding training programs for clinicians also support the accelerated adoption of stereotactic biopsy systems.

- By Type

On the basis of type, the market is segmented into 9–12G, <9G, and >12G. The 9–12G segment dominated the vacuum-assisted biopsy devices market in 2025 due to its optimal balance of tissue sampling volume and patient comfort. These gauges are widely used in breast and soft tissue biopsies, offering sufficient core size for accurate diagnosis while minimizing tissue trauma. Hospitals and diagnostic centres prefer 9–12G needles for routine procedures due to their compatibility with most biopsy systems and imaging modalities. The segment’s dominance is reinforced by clinician familiarity, availability of consumables, and integration with advanced image-guided systems. Moreover, the broad regulatory approvals and proven safety profile further strengthen adoption in both developed and emerging markets.

The <9G segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for ultra-minimally invasive procedures, particularly in outpatient clinics and research institutes. Smaller gauge needles reduce patient discomfort and recovery time while allowing for repeated sampling if required. Advancements in automated tissue sampling and AI-assisted needle guidance have improved diagnostic accuracy even with smaller gauges. Rising awareness of patient-centric procedures and technological innovations supporting <9G devices are accelerating their uptake across hospitals and academic institutions.

- By Application

On the basis of application, the market is segmented into hospitals, academic & research institutes, and diagnostics & imaging centres. The Hospitals segment dominated the market with the largest revenue share in 2025, driven by the high volume of oncology procedures, comprehensive diagnostic facilities, and preference for integrated biopsy systems. Hospitals offer access to multiple imaging modalities, trained specialists, and post-procedure monitoring, making them the primary choice for vacuum-assisted biopsy procedures. The segment benefits from strong insurance coverage in developed countries, government cancer screening initiatives, and established patient trust in hospital-based procedures. High patient throughput and the ability to perform complex biopsies with minimal complications also reinforce the segment’s market leadership.

The Diagnostics & Imaging Centres segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising number of outpatient diagnostic facilities and the increasing trend of decentralizing cancer screening. These centres provide cost-effective, patient-friendly biopsy services with shorter waiting times and specialized imaging systems. Technological advancements enabling portable and automated biopsy systems allow imaging centres to perform accurate procedures without requiring full hospital infrastructure. Partnerships with hospitals and academic institutions for collaborative diagnostics further accelerate adoption, particularly in urban and semi-urban areas in Asia-Pacific and Latin America.

Vacuum-Assisted Biopsy Market Regional Analysis

- North America dominated the vacuum-assisted biopsy devices market with the largest revenue share of 40.4% in 2025, characterized by early adoption of advanced imaging technologies, strong healthcare infrastructure, and a significant presence of key industry players

- Clinicians and healthcare providers in the region highly value the precision, integration with multiple imaging modalities and improved diagnostic yield offered by vacuum-assisted biopsy systems compared to conventional biopsy methods

- This widespread adoption is further supported by high healthcare expenditure, established hospital networks, and the growing preference for minimally invasive procedures that reduce patient discomfort and procedural complications, establishing vacuum-assisted biopsy devices as the preferred choice in hospitals, academic centres, and diagnostic facilities

U.S. Vacuum-Assisted Biopsy Market Insight

The U.S. vacuum-assisted biopsy devices market captured the largest revenue share of 81% in 2025 within North America, fueled by the widespread adoption of advanced imaging technologies and increasing prevalence of cancer screening programs. Healthcare providers are prioritizing minimally invasive diagnostic procedures for enhanced accuracy and patient comfort. The growing preference for outpatient procedures, along with strong demand for AI-assisted and image-guided biopsy systems, further propels the market. Moreover, integration of biopsy devices with hospital information systems and PACS enables streamlined workflows and improved diagnostic efficiency, significantly contributing to market expansion.

Europe Vacuum-Assisted Biopsy Market Insight

The Europe vacuum-assisted biopsy devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cancer incidence and stringent healthcare regulations promoting early diagnosis. Increasing urbanization, the growing number of diagnostic centres, and adoption of advanced imaging-guided systems are fostering market growth. European clinicians value the high precision and safety offered by vacuum-assisted biopsy devices, particularly for breast and soft tissue diagnostics. The market is also witnessing growth across both hospital and specialized imaging centre applications, with adoption in new healthcare facilities and upgrade of existing systems.

U.K. Vacuum-Assisted Biopsy Market Insight

The U.K. vacuum-assisted biopsy devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for minimally invasive procedures and accurate cancer diagnostics. Growing awareness of early detection benefits, coupled with government and private cancer screening initiatives, is encouraging hospitals and clinics to adopt advanced biopsy solutions. The UK’s strong healthcare infrastructure, alongside an increasing number of diagnostic centres equipped with image-guided systems, is expected to stimulate market growth. Clinicians are also adopting AI-assisted biopsy devices to improve procedural efficiency and diagnostic yield.

Germany Vacuum-Assisted Biopsy Market Insight

The Germany vacuum-assisted biopsy devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced diagnostic technologies and preference for precise, minimally invasive procedures. Germany’s well-developed healthcare infrastructure, emphasis on innovation, and focus on early cancer detection promote the adoption of vacuum-assisted biopsy devices, particularly in hospitals and specialized diagnostic centres. Integration with digital imaging systems and PACS is also becoming increasingly prevalent, with clinicians preferring devices that enhance accuracy and reduce procedural time.

Asia-Pacific Vacuum-Assisted Biopsy Market Insight

The Asia-Pacific vacuum-assisted biopsy devices market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising cancer incidence, increasing healthcare investments, and expanding diagnostic infrastructure in countries such as China, Japan, and India. The region’s growing inclination towards minimally invasive procedures, supported by government initiatives promoting cancer screening and digital healthcare, is driving adoption. Furthermore, technological advancements and local manufacturing of biopsy systems are improving accessibility and affordability, allowing a broader patient base to benefit from vacuum-assisted procedures.

Japan Vacuum-Assisted Biopsy Market Insight

The Japan vacuum-assisted biopsy devices market is gaining momentum due to the country’s high technological adoption, increasing number of oncology centres, and demand for precision diagnostics. Hospitals and diagnostic facilities prioritize minimally invasive procedures that reduce patient discomfort and recovery time. Integration with AI-assisted imaging and hospital information systems is fueling adoption, enabling clinicians to improve lesion targeting and tissue sampling accuracy. In addition, Japan’s aging population is expected to spur demand for easier-to-use, efficient biopsy solutions in both hospital and outpatient settings.

India Vacuum-Assisted Biopsy Market Insight

The India vacuum-assisted biopsy devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising cancer awareness, expanding healthcare infrastructure, and increasing number of diagnostic centres. India is emerging as a key market for minimally invasive biopsy procedures, with hospitals and imaging centres adopting advanced, image-guided devices. Government programs promoting early cancer detection and the availability of cost-effective biopsy solutions are key factors propelling market growth. In addition, growing urbanization, increasing disposable incomes, and technological adoption among healthcare providers support the rapid uptake of vacuum-assisted biopsy devices.

Vacuum-Assisted Biopsy Market Share

The Vacuum-Assisted Biopsy industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- BD (U.S.)

- Argon Medical Devices, (U.S.)

- Danaher (U.S.)

- Boston Scientific Corporation (U.S.)

- Cardinal Health (U.S.)

- Cook. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Olympus Corporation (Japan)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Planmed Oy (Finland)

- KUBTEC Medical Imaging, Inc. (U.S.)

- Sterylab S.r.l. (Italy)

- Menarini Silicon Biosystems (Italy)

- Varian Medical Systems, Inc. (U.S.)

- QIAGEN (Netherlands)

- Stryker (U.S.)

- Siemens Healthineers AG (Germany)

What are the Recent Developments in Global Vacuum-Assisted Biopsy Market?

- In October 2025, Mahavir Cancer Sansthan (in Patna, India) began offering day‑care vacuum‑assisted breast biopsy (VABB) for benign tumours sized 3–5 cm, under local anaesthesia, using newly installed VABB technology (cost approx. Rs 52 lakh). The institution emphasised that the procedure takes only 30–35 minutes, avoids hospital admission, and offers a safer alternative to open surgery. This regional adoption highlights the technology’s expanding reach into emerging‑market healthcare settings

- In September 2025, Resitu Medical received U.S. Food and Drug Administration (FDA) 510(k) clearance for its RESL09 device — a handheld, single‑use, vacuum‑assisted tool capable of excising large‑diameter breast tissue samples (up to 9 mm) via ultrasound guidance. The clearance enables a limited U.S. launch and marks a step forward in minimally invasive biopsy device innovation for larger sample harvests with smaller incisions

- In November 2024, Mammotome introduced the AutoCore™ Single Insertion Core Biopsy System, still technically a core‑needle product but relevant to the broader vacuum‑assisted biopsy field as it enhances sample collection efficiency and ergonomics. The system uses a single insertion, spring‑loaded mechanism and automates multiple sampling passes to reduce procedure time and simplify tissue collection in breast biopsies

- In August 2023, Mammotome launched the HydroMARK™ Plus Breast Biopsy Site Marker, a tissue‑marker designed to enhance ultrasound visibility and reduce marker displacement during surgical excision of biopsied sites. The new “dragonfly”‑shaped hydrogel marker expands the company’s portfolio of breast‑biopsy adjunct products and helps surgeons locate previously sampled tissue with greater ease and accuracy

- In March 2023, TransMed7, LLC announced the first clinical use of VacuPac®, a self‑contained vacuum‑assist attachment designed for its Single InsertionMultiple Collection (SIMC®) biopsy platforms. The device eliminates tubing and external vacuum pumps by integrating vacuum functionality into a compact, removable container, aiming to simplify the procedure, improve workflow, and reduce device set‑up complexity during breast biopsy procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.