Global Valve Driver Market

Market Size in USD Million

CAGR :

%

USD

290.86 Million

USD

1,859.55 Million

2025

2033

USD

290.86 Million

USD

1,859.55 Million

2025

2033

| 2026 –2033 | |

| USD 290.86 Million | |

| USD 1,859.55 Million | |

|

|

|

|

Valve Driver Market Size

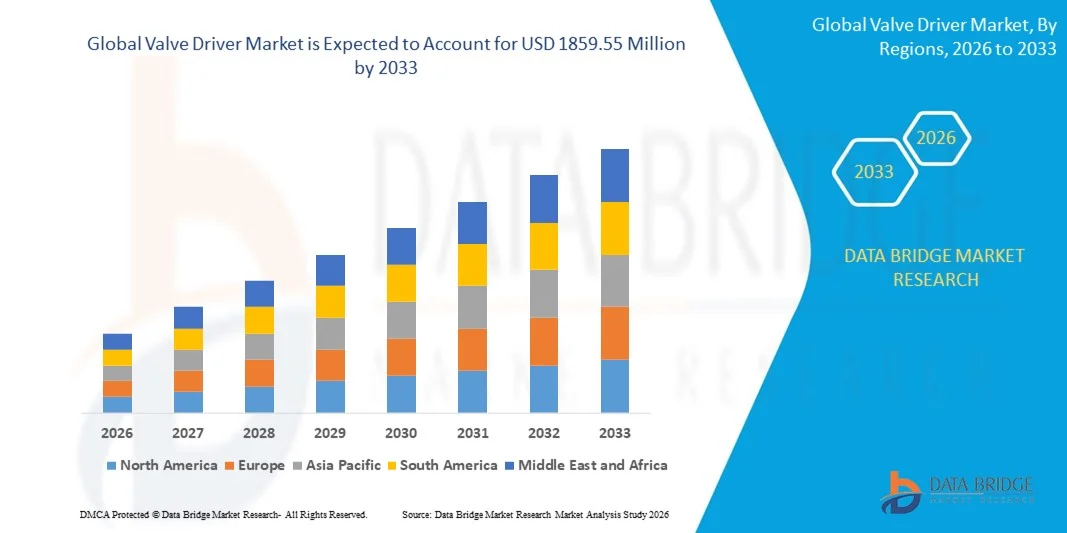

- The global valve driver market size was valued at USD 290.86 million in 2025 and is expected to reach USD 1859.55 million by 2033, at a CAGR of 26.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation and energy-efficient control systems across industrial, commercial, and residential applications, leading to higher demand for precise and reliable valve driver solutions

- Furthermore, rising investment in smart factories, HVAC systems, and process automation is encouraging manufacturers to integrate advanced valve drivers that offer improved control, energy savings, and operational efficiency. These converging factors are accelerating the uptake of valve driver solutions, thereby significantly boosting the industry's growth

Valve Driver Market Analysis

- Valve drivers are electromechanical devices that control the operation of valves by regulating flow, pressure, and temperature in various systems. These devices integrate with industrial automation, smart building solutions, and process control systems, enhancing efficiency, safety, and precision in commercial and industrial applications

- The escalating demand for valve drivers is primarily fueled by growing industrial automation, increasing energy-efficiency requirements, and rising adoption of smart control solutions across manufacturing, HVAC, and commercial sectors

- Asia-Pacific dominated the valve driver market with a share of 36.5% in 2025, due to rapid industrialization, expanding manufacturing and automation sectors, and strong adoption of advanced building and industrial control systems

- North America is expected to be the fastest growing region in the valve driver market during the forecast period due to rising adoption of industrial automation, smart building solutions, and energy-efficient control systems

- Conventional control valve segment dominated the market with a market share of 63% in 2025, due to its robust performance across industrial processes and ease of integration with existing automation systems. Conventional control valves are widely preferred for regulating flow, pressure, and temperature in applications such as water management, HVAC, and power generation

Report Scope and Valve Driver Market Segmentation

|

Attributes |

Valve Driver Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Valve Driver Market Trends

Rising Adoption of Smart and Energy-Efficient Valve Driver Technologies

- A significant trend in the valve driver market is the increasing adoption of smart and energy-efficient technologies, driven by the growing need for precise control and reduced energy consumption in industrial processes. These technologies are enabling enhanced operational efficiency and reliability across sectors such as oil & gas, water treatment, and chemical manufacturing

- For instance, Emerson Electric and Honeywell offer advanced smart valve drivers with integrated diagnostics and energy optimization features, widely used in process automation systems. These solutions improve system performance, reduce downtime, and lower operational energy costs

- The adoption of digital communication protocols such as FOUNDATION Fieldbus and Modbus is increasing as valve drivers are being integrated into automated control networks. This trend allows real-time monitoring and predictive maintenance, supporting proactive process management

- Industries are focusing on retrofitting legacy valve systems with intelligent drivers to enhance precision, safety, and regulatory compliance. This movement is driving growth in retrofit markets and reinforcing the demand for versatile, upgradeable valve drivers

- Environmental sustainability considerations are influencing the adoption of energy-efficient valve drivers, which help reduce carbon footprints and meet stringent emission regulations. This trend aligns with corporate ESG initiatives and energy-saving mandates across industrial facilities

- The market is witnessing a rising preference for compact and modular valve driver designs that support easy installation, scalability, and integration into diverse industrial setups. These developments are strengthening the overall deployment of smart valve technologies globally

Valve Driver Market Dynamics

Driver

Increasing Industrial Automation and Process Control Requirements

- The rising emphasis on automation and precise process control is driving demand for valve drivers that provide accurate flow regulation, feedback signals, and remote operability. These drivers support improved operational efficiency, safety, and compliance with process standards

- For instance, Siemens supplies valve drivers integrated with advanced control algorithms for the chemical and water treatment sectors, enhancing process stability and reducing manual intervention. Their solutions enable continuous monitoring and adjustment of flow and pressure parameters

- Industries such as oil & gas, power generation, and pharmaceuticals are increasingly relying on automated valve control to optimize throughput, reduce wastage, and maintain regulatory standards. This adoption reinforces the importance of reliable and responsive valve drivers

- The expansion of smart manufacturing and Industry 4.0 initiatives is creating demand for connected valve drivers capable of remote monitoring and predictive maintenance. These drivers allow facilities to anticipate failures, reduce downtime, and lower maintenance costs

- The global push for energy efficiency and sustainability is encouraging the use of advanced valve drivers that minimize energy consumption while maintaining high performance. These drivers are becoming essential components in modern industrial automation architectures

Restraint/Challenge

High Initial Investment and Integration Complexity

- The valve driver market faces challenges due to the high capital expenditure required for smart and energy-efficient systems, which may limit adoption in cost-sensitive industrial segments. These investments include device costs, software integration, and training for personnel

- For instance, ABB’s intelligent valve drivers require significant upfront investment for installation and integration into existing automation systems. Companies may face budgetary constraints when upgrading older facilities to accommodate these advanced drivers

- Integrating smart valve drivers with legacy control systems can be complex, requiring compatibility with various communication protocols and system architectures. This complexity can lead to extended commissioning times and increased engineering effort

- Maintenance and calibration of advanced valve drivers demand specialized skills and knowledge, posing challenges for facilities with limited technical resources. Ensuring consistent performance and reliability adds to operational overhead

- The market also encounters barriers due to the need for system-wide standardization, cybersecurity considerations, and adherence to strict industry regulations. These factors collectively influence adoption rates and require careful planning and resource allocation

Valve Driver Market Scope

The market is segmented on the basis of function, valve type, and end-user.

- By Function

On the basis of function, the valve driver market is segmented into solenoid and proportional. The solenoid segment dominated the largest market revenue share in 2025, driven by its simple design, cost-effectiveness, and widespread use in industrial and residential applications. Solenoid valve drivers are favored for their fast response time and reliable performance in automation systems, making them suitable for fluid control in HVAC, water treatment, and machinery operations. Their compatibility with standard control systems and ease of integration in both new installations and retrofits further support market demand. Manufacturers also focus on enhancing solenoid driver durability and energy efficiency, which boosts adoption across diverse industries.

The proportional segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing demand for precise flow control and energy-efficient operations. Proportional valve drivers allow variable control of flow and pressure, making them ideal for process industries such as oil & gas, chemical, and automotive manufacturing. Their ability to integrate with advanced automation systems and IoT-based monitoring solutions makes them highly sought after for modern industrial applications. Proportional drivers also support reduced operational costs by minimizing wastage and energy consumption, driving rapid market expansion.

- By Valve Type

On the basis of valve type, the valve driver market is segmented into conventional control valves and expansion valves. The conventional control valve segment dominated the market with the largest share of 63% in 2025 due to its robust performance across industrial processes and ease of integration with existing automation systems. Conventional control valves are widely preferred for regulating flow, pressure, and temperature in applications such as water management, HVAC, and power generation. Their proven reliability, low maintenance requirements, and adaptability to various fluid types make them the primary choice for industries requiring consistent and precise control. Leading manufacturers focus on optimizing valve-driver compatibility and enhancing operational safety, further solidifying their market leadership.

The expansion valve segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand in refrigeration, HVAC, and automotive air conditioning applications. Expansion valve drivers ensure accurate control of refrigerant flow, improving system efficiency and reducing energy consumption. For instance, companies such as Emerson have developed advanced electronic expansion valve drivers that provide precise temperature regulation and seamless integration with smart HVAC systems. Increasing adoption of energy-efficient cooling solutions and stringent regulations on refrigerant management further propel the expansion valve segment.

- By End-User

On the basis of end-user, the valve driver market is segmented into commercial & residential, industrial, and motion equipment. The industrial segment dominated the largest market revenue share in 2025, driven by extensive use in process automation, chemical processing, oil & gas, and power generation industries. Industrial applications demand high-precision valve drivers capable of handling large-scale operations under varying pressure and temperature conditions. Their ability to integrate with advanced automation systems and improve operational efficiency makes them indispensable in industrial setups. Manufacturers also focus on providing durable and energy-efficient solutions tailored for heavy-duty applications, reinforcing market dominance.

The commercial & residential segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for smart HVAC, water management, and automated building solutions. For instance, Schneider Electric offers valve drivers optimized for commercial buildings and residential complexes that enable precise control and energy savings. Growing adoption of smart building technologies and increased focus on sustainable operations drive the segment’s rapid growth. Ease of installation, compatibility with IoT-based systems, and the push for energy-efficient solutions further support market expansion in the commercial & residential sector.

Valve Driver Market Regional Analysis

- Asia-Pacific dominated the valve driver market with the largest revenue share of 36.5% in 2025, driven by rapid industrialization, expanding manufacturing and automation sectors, and strong adoption of advanced building and industrial control systems

- The region’s cost-effective manufacturing, increasing investments in smart industrial equipment, and growing adoption of IoT-enabled automation solutions are accelerating market expansion

- The availability of skilled labor, supportive government initiatives, and rising demand for energy-efficient control systems across commercial and industrial sectors are contributing to increased consumption of valve drivers

China Valve Driver Market Insight

China held the largest share in the Asia-Pacific valve driver market in 2025, owing to its leadership in industrial automation, extensive manufacturing base, and robust infrastructure for smart building and industrial equipment production. The country’s favorable government policies supporting automation, ongoing investment in advanced manufacturing technologies, and focus on energy-efficient control solutions are major growth drivers. Demand is further bolstered by integration of valve drivers in HVAC, water treatment, and process automation systems.

India Valve Driver Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid industrialization, expanding commercial building projects, and increasing adoption of automation in manufacturing sectors. Government initiatives promoting smart factories and energy-efficient building systems are strengthening the demand for valve drivers. In addition, rising investments in industrial automation, HVAC infrastructure, and IoT-enabled control systems are contributing to robust market expansion.

Europe Valve Driver Market Insight

The Europe valve driver market is expanding steadily, supported by high adoption of industrial automation, smart building initiatives, and stringent energy efficiency regulations. The region emphasizes sustainable and energy-saving solutions in industrial and commercial applications. Increasing demand for precision control in HVAC, water management, and process automation further enhances market growth.

Germany Valve Driver Market Insight

Germany’s valve driver market is driven by its strong industrial automation sector, advanced manufacturing technologies, and export-oriented industrial equipment production. The country’s focus on research and development, energy efficiency, and high-precision manufacturing fosters continuous innovation in valve driver technologies. Demand is particularly strong in industrial applications and commercial building automation.

U.K. Valve Driver Market Insight

The U.K. market is supported by a mature commercial infrastructure, growing adoption of smart building solutions, and government-led energy efficiency initiatives. Investments in building automation, precision control systems, and integration of IoT-enabled valve drivers continue to strengthen market demand. R&D collaboration between industry and academia further drives technological advancements in valve drivers.

North America Valve Driver Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of industrial automation, smart building solutions, and energy-efficient control systems. Growing focus on digitalization, integration of IoT-based monitoring, and advanced process control in manufacturing and commercial sectors are boosting demand. Increasing reshoring of industrial production and investment in smart infrastructure support market expansion.

U.S. Valve Driver Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its advanced industrial and commercial infrastructure, strong R&D capabilities, and investment in smart control solutions. The country’s focus on innovation, energy efficiency, and integration of valve drivers in process automation and building management systems strengthens demand. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Valve Driver Market Share

The valve driver industry is primarily led by well-established companies, including:

- Danfoss (Denmark)

- PARKER HANNIFIN CORP (U.S.)

- Emerson Electric Co (U.S.)

- CAREL INDUSTRIES S.p.A (Italy)

- Schneider Electric Group (France)

- MKS Instruments (U.S.)

- HydraForce, Inc. (U.S.)

- Hussmann Corporation (U.S.)

- FUJIKOKI CORPORATION (Japan)

- Sanhua International, Inc (China)

Latest Developments in Global Valve Driver Market

- In November 2024, Bosch Rexroth announced a major contract to deploy its advanced proportional valve driver modules across multiple global production lines. This development highlights increasing industry adoption of high-precision valve driver technologies, which is expected to enhance automation and operational efficiency across manufacturing sectors. The deployment is likely to accelerate integration of smart control systems, improve process accuracy, and reduce energy consumption, strengthening the market’s focus on technologically advanced and reliable valve driver solutions

- In August 2025, Emerson Electric Co. formed a strategic partnership with a leading software firm to develop predictive maintenance solutions for valve drivers. This initiative is expected to transform market dynamics by promoting AI-enabled diagnostics, enabling real-time monitoring and predictive performance optimization. By reducing unplanned downtime and extending equipment lifespan, it enhances operational reliability and efficiency, which encourages wider adoption of intelligent valve driver systems across industrial and commercial applications

- In April 2023, the U.S. Department of Energy announced funding for 17 smart valve driver technology projects to promote energy-efficient manufacturing. This government support reinforces the market’s focus on sustainable and energy-saving technologies, incentivizing manufacturers to adopt smart valve drivers with improved performance and lower operational costs. The initiative is expected to accelerate innovation, drive R&D in advanced valve driver solutions, and expand deployment across energy-intensive industrial processes

- In January 2023, the U.S. Patent and Trademark Office recorded 54 new patents for valve driver innovations. This surge in intellectual property activity reflects growing research and development efforts to improve efficiency, precision, and integration capabilities of valve drivers. It strengthens market competitiveness, encourages technological differentiation among manufacturers, and is likely to accelerate the introduction of advanced, feature-rich valve driver products across industrial and commercial sectors

- In December 2022, ANSI certified 22 new valve driver models under revised industrial safety and energy standards. This certification reinforces market confidence in compliant, safe, and energy-efficient products, encouraging adoption in critical industrial and commercial applications. Compliance with updated standards ensures reliability, enhances operational safety, and supports energy-saving initiatives, making certified valve drivers a preferred choice for companies aiming to optimize performance and adhere to regulatory requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Valve Driver Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Valve Driver Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Valve Driver Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.