Global Valve Positioners Market

Market Size in USD Billion

CAGR :

%

USD

2.16 Billion

USD

3.24 Billion

2024

2032

USD

2.16 Billion

USD

3.24 Billion

2024

2032

| 2025 –2032 | |

| USD 2.16 Billion | |

| USD 3.24 Billion | |

|

|

|

|

Valve Positioners Market Size

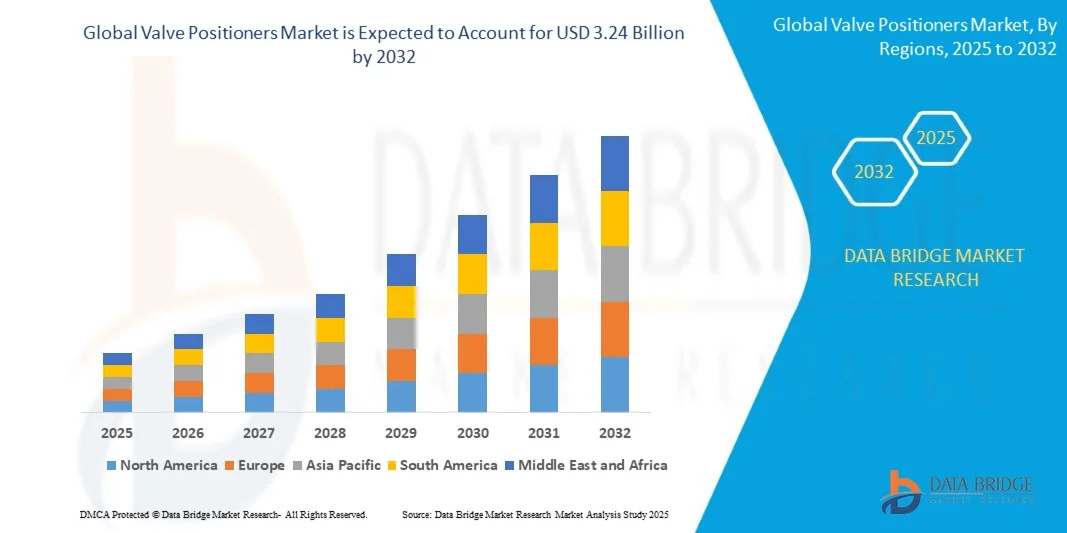

- The valve positioners market size was valued at USD 2.16 billion in 2024 and is expected to reach USD 3.24 billion by 2032, at a CAGR of 5.23% during the forecast period

- The market growth is largely driven by the increasing demand for precise control and automation in industrial processes, as well as the adoption of advanced instrumentation and digital control systems across industries such as oil & gas, chemicals, and water treatment

- Furthermore, the need for improved operational efficiency, reduced energy consumption, and enhanced safety in industrial plants is encouraging the deployment of intelligent valve positioners, thereby boosting the market's expansion

Valve Positioners Market Analysis

- Valve positioners are devices that regulate the position of a valve by receiving a control signal and adjusting the valve actuator accordingly. They ensure accurate flow control, improve process efficiency, and reduce wear on valve components in various industrial applications

- The rising adoption of process automation, stringent safety regulations, and the shift toward smart manufacturing and Industry 4.0 solutions are key factors driving the demand for valve positioners across global industrial sectors

- North America dominated the valve positioners market with a share of 35.8% in 2024, due to the presence of advanced industrial infrastructure and high adoption of automation in process industries

- Asia-Pacific is expected to be the fastest growing region in the valve positioners market during the forecast period due to rapid industrialization, urbanization, and increased automation in process industries in countries such as China, Japan, and India

- Pneumatic segment dominated the market with a market share of 45.92% in 2024, due to its proven reliability, cost-effectiveness, and widespread compatibility with existing industrial valve systems. Pneumatic valve positioners are favored for their simple design, ease of maintenance, and ability to operate in harsh and hazardous environments. Their robust performance under varying pressure and temperature conditions makes them ideal for industries such as oil and gas, chemicals, and power, where continuous and precise valve control is critical

Report Scope and Valve Positioners Market Segmentation

|

Attributes |

Valve Positioners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Valve Positioners Market Trends

“Digital and Smart Factory Integration”

- The adoption of valve positioners is accelerating as industries transition toward smart factories and digitally connected operations. Modern valve positioners are increasingly equipped with digital communication protocols and smart diagnostics that align with Industry 4.0 requirements, enabling enhanced visibility and efficiency in industrial automation

- For instance, Emerson Electric supplies smart valve positioners with integrated diagnostics and digital protocols such as HART and Fieldbus, allowing seamless integration into digital control systems. ABB also offers intelligent valve positioners that support plant operators with real-time data insights to optimize performance and reliability in process industries

- Digital valve positioners are enabling predictive maintenance by providing insights into valve health, travel deviation, and other critical parameters. This capability minimizes unforeseen downtime, reduces maintenance costs, and ensures optimal operation in continuous process industries such as oil and gas, power generation, and petrochemicals

- Smart factory initiatives are further driving adoption as industries require interconnected systems where valve positioners play a central role in process control. By integrating with control platforms, they allow more precise flow management while contributing to overall operational efficiency and sustainability goals

- The ability to monitor, adjust, and control valve operations remotely aligns valve positioners with the broader digitalization trend. Their advanced connectivity allows integration into centralized monitoring platforms, ensuring optimization of workflows across complex industrial setups

- Overall, the integration of valve positioners into smart and digital factory environments demonstrates a clear shift toward intelligent industrial processes. By providing control precision, predictive capabilities, and seamless data sharing, these solutions are becoming essential for achieving next-generation efficiency and reliability in manufacturing and processing industries

Valve Positioners Market Dynamics

Driver

“Growing Demand for Industrial Automation”

- Rising adoption of automation in industries such as oil and gas, power, chemicals, and pharmaceuticals is driving strong demand for valve positioners. These devices enhance process efficiency by ensuring precise valve control, which is critical for automated systems that prioritize consistency and safety

- For instance, Siemens offers digitally enabled valve positioners to support automation requirements in manufacturing and energy sectors, improving both accuracy and operational productivity. Companies such as Schneider Electric are also investing in valve automation to meet increasing industrial demand for smart and efficient flow control systems

- Industries are looking to minimize manual intervention, reduce downtime, and optimize plant operations, all of which are supported by advanced valve positioner technologies. Positioners with feedback systems ensure greater control over pressure and flow rates, enhancing the overall stability of automated processes

- The ongoing shift toward industrial automation is also creating opportunities for integration with monitoring software, enabling more intelligent process management. This synergy between automation equipment and advanced control solutions reinforces the value of valve positioners within automated facilities

- As industrial automation continues to transform global markets, the need for accurate, reliable, and efficient valve positioners is expected to grow. They are set to remain integral components in ensuring optimized production outcomes and contributing to the overall digital transformation of industries

Restraint/Challenge

“High Cost of Advanced Valve Positioners”

- The high cost associated with advanced digital and smart valve positioners represents a major restraint in the market, particularly for small and mid-sized enterprises. Incorporating sophisticated communication protocols, sensors, and diagnostic features increases the overall pricing compared to conventional mechanical positioners

- For instance, manufacturers such as Emerson and ABB promote advanced smart positioners priced at a premium, mainly targeting large-scale industries such as oil and gas. However, cost considerations often deter adoption in price-sensitive industrial sectors where budgetary limitations restrict modernization efforts

- Integration costs also pose challenges, as advanced valve positioners require skilled technicians, calibration, and compatibility with existing plant control systems. This adds expenditure for training, installation, and system alignment, further increasing the total cost of adoption for many organizations

- Industries in developing regions face additional hurdles due to lack of financial resources and technical infrastructure to support these systems. This limits modernization efforts and widens the gap between advanced economies and emerging markets in smart valve adoption

- Reducing costs through modular designs, standardized protocols, and scaled manufacturing will be crucial for increasing penetration across industries. Addressing cost barriers will ensure that advanced valve positioners can achieve widespread adoption and strengthen their role in enabling smart industrial operations globally

Valve Positioners Market Scope

The market is segmented on the basis of product type, actuation, and end user.

• By Product Type

On the basis of product type, the valve positioners market is segmented into digital, pneumatic, electro-pneumatic, and others. The pneumatic segment dominated the largest market revenue share of 45.92% in 2024, driven by its proven reliability, cost-effectiveness, and widespread compatibility with existing industrial valve systems. Pneumatic valve positioners are favored for their simple design, ease of maintenance, and ability to operate in harsh and hazardous environments. Their robust performance under varying pressure and temperature conditions makes them ideal for industries such as oil and gas, chemicals, and power, where continuous and precise valve control is critical.

The electro-pneumatic segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in industries requiring precise pressure and flow control. Electro-pneumatic positioners offer enhanced responsiveness, high accuracy, and easy integration with automated control systems. Their adaptability to both existing pneumatic infrastructure and modern digital control networks makes them attractive for retrofitting older plants and deploying in new installations alike.

• By Actuation

On the basis of actuation, the valve positioners market is segmented into single-acting and double-acting. The single-acting segment held the largest market revenue share in 2024 due to its simplicity, reliability, and lower operational cost. Single-acting valve positioners are widely used in various industrial applications because they provide stable operation, require minimal maintenance, and are compatible with a broad range of valves. Their straightforward design allows easy installation and calibration, making them ideal for industries prioritizing operational efficiency and consistent performance.

The double-acting segment is expected to register the fastest growth from 2025 to 2032, driven by applications demanding higher precision, faster response times, and bidirectional actuation. Double-acting valve positioners are particularly favored in complex process industries such as chemicals and oil & gas, where accurate control of flow and pressure is critical. Their ability to handle varying operating conditions and integration with advanced control systems contributes to their growing adoption in modern automated plants.

• By End User

On the basis of end user, the valve positioners market is segmented into oil and gas, energy and power, water and wastewater, metals and mining, chemicals, food and beverages, pharmaceuticals, pulp and paper, and others. The oil and gas segment dominated the largest market revenue share in 2024, owing to the high demand for precise flow and pressure control in upstream, midstream, and downstream operations. Valve positioners in this sector enhance operational safety, reduce maintenance downtime, and ensure compliance with stringent process standards, making them critical for efficient production and transport of hydrocarbons.

The chemicals segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing complexity of chemical processing operations requiring precise control over aggressive and hazardous fluids. Advanced valve positioners improve process accuracy, safety, and energy efficiency, while supporting integration with automation systems for better monitoring and control. The rising investments in chemical plants and adoption of Industry 4.0 solutions further accelerate the demand for high-performance positioners in this sector.

Valve Positioners Market Regional Analysis

- North America dominated the valve positioners market with the largest revenue share of 35.8% in 2024, driven by the presence of advanced industrial infrastructure and high adoption of automation in process industries

- Industries such as oil and gas, energy and power, and chemicals are increasingly implementing valve positioners to enhance operational efficiency and reduce downtime

- The region benefits from a technologically skilled workforce and strong R&D capabilities, supporting the development and deployment of advanced digital and electro-pneumatic positioners

U.S. Valve Positioners Market Insight

The U.S. valve positioners market captured the largest revenue share in 2024 within North America, fueled by extensive adoption in oil and gas, chemicals, and power generation sectors. Industrial players are prioritizing precise control, real-time monitoring, and predictive maintenance, leading to higher demand for digital and electro-pneumatic positioners. The growing trend of retrofitting legacy plants with advanced valve automation systems, alongside government initiatives promoting energy efficiency and industrial safety, further drives market expansion.

Europe Valve Positioners Market Insight

The Europe valve positioners market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent industrial regulations and the increasing need for operational efficiency in chemical, power, and water treatment plants. Countries such as Germany, France, and Italy are witnessing growing adoption of digital and electro-pneumatic positioners to improve process control and reduce operational costs. The region’s focus on sustainability, advanced manufacturing, and modernization of industrial facilities supports the uptake of advanced valve positioners.

Germany Valve Positioners Market Insight

The Germany valve positioners market is expected to grow at a considerable CAGR, fueled by increasing automation across industries and the emphasis on high-precision control systems. Germany’s well-established industrial infrastructure, coupled with innovation in process instrumentation and automation, drives the adoption of digital and electro-pneumatic valve positioners in energy, chemical, and water treatment sectors.

U.K. Valve Positioners Market Insight

The U.K. valve positioners market is anticipated to grow at a noteworthy CAGR, driven by the modernization of manufacturing plants and energy facilities. Rising demand for energy-efficient and reliable valve control solutions, alongside the integration of smart industrial systems, encourages adoption. The U.K.’s focus on Industry 4.0 solutions and regulatory compliance further stimulates market growth.

Asia-Pacific Valve Positioners Market Insight

The Asia-Pacific valve positioners market is poised to grow at the fastest CAGR during the forecast period, driven by rapid industrialization, urbanization, and increased automation in process industries in countries such as China, Japan, and India. The region’s expanding oil and gas, chemical, and power sectors, combined with rising infrastructure development, is driving demand for digital and electro-pneumatic valve positioners. Government initiatives promoting industrial modernization and the establishment of manufacturing hubs for automation equipment further enhance market growth.

China Valve Positioners Market Insight

The China valve positioners market accounted for the largest market revenue share in Asia-Pacific in 2024, owing to rapid industrial expansion, high adoption of automation technologies, and strong domestic manufacturing capabilities. The growing focus on process efficiency, safety, and predictive maintenance in chemical, power, and oil & gas industries drives adoption of advanced valve positioners.

Japan Valve Positioners Market Insight

The Japan valve positioners market is gaining momentum due to advanced industrial infrastructure, high technology adoption, and the demand for precise process control. The integration of digital and electro-pneumatic positioners in chemical, power, and energy industries supports enhanced operational efficiency and reliability. Japan’s industrial focus on automation, energy efficiency, and predictive maintenance is contributing to strong market growth.

Valve Positioners Market Share

The valve positioners industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- ABB (Switzerland)

- Schneider Electric (France)

- Azbil Corporation. (Japan)

- Baker Hughes Company (U.K.)

- Bray International. (U.S.)

- Flowserve Corporation. (U.S.)

- Christian Bürkert GmbH & Co. KG. (Germany)

- CIRCOR International, Inc. (U.S.)

- ControlAir (U.S.)

- Crane Co. (U.S.)

- Dwyer Instruments LTD. (U.S.)

- Metso Corporation (Finland)

- GEMÜ Group (Germany)

- Power-Genex Ltd. (South Korea)

- Rotork (U.K.)

- Siemens (Germany)

- SAMSON USA. (U.S.)

- Spirax Sarco Limited. (U.K.)

- NIHON KOSO CO., LTD (Japan)

- VAL CONTROLS A/S (Denmark)

Latest Developments in Valve positioners market

- In June 2025, Flowserve Corporation (US) and Chart Industries announced a USD 19 billion all-stock merger to create a global leader in industrial process technologies. This strategic merger is set to strengthen their combined footprint in high-growth segments, including valve positioners, by integrating Flowserve’s flow control expertise with Chart’s cryogenic and thermal capabilities. The move is expected to enhance market competitiveness, enable broader customer reach, and accelerate innovation in advanced valve positioning solutions

- In November 2023, Emerson Electric Co. launched a new high-quality, durable, and compact valve positioner designed to provide reliable open/close position feedback across industries such as food & beverage, water & wastewater, and industrial utilities. Constructed with stainless steel components, the product is built to withstand harsh environments, which is likely to increase Emerson’s market share by offering enhanced reliability, longevity, and operational efficiency in challenging industrial conditions

- In October 2023, Emerson Electric Co. (US) finalized its acquisition of National Instruments Corp. (US), expanding its global automation and test equipment portfolio. This acquisition strengthens Emerson’s position in the valve positioner market by leveraging advanced control systems, predictive maintenance, and performance analytics, which are expected to drive improved operational efficiency and data-driven decision-making for clients worldwide

- In August 2024, Azbil Corporation (Japan) established a new production base in Hung Yên Province, Vietnam, to bolster its global manufacturing and procurement capabilities. This expansion enhances production capacity, reduces costs, and diversifies supply chain risk beyond China and Thailand, supporting the long-term growth of Azbil’s valve positioner business and reinforcing market stability in automation products

- In August 2023, Emerson Electric Co. (US) strengthened its factory automation portfolio through the acquisition of Afag Holding AG (Switzerland), a provider of electric linear motion and handling solutions. This acquisition enhances integration of electric motion with pneumatic systems, improving actuation accuracy and energy efficiency. The move directly benefits Emerson’s valve positioner market by enabling better control precision and optimized flow automation, reinforcing the company’s competitive positioning globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Valve Positioners Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Valve Positioners Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Valve Positioners Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.