Global Van Market

Market Size in USD Billion

CAGR :

%

USD

246.06 Billion

USD

393.67 Billion

2025

2033

USD

246.06 Billion

USD

393.67 Billion

2025

2033

| 2026 –2033 | |

| USD 246.06 Billion | |

| USD 393.67 Billion | |

|

|

|

|

What is the Global Van Market Size and Growth Rate?

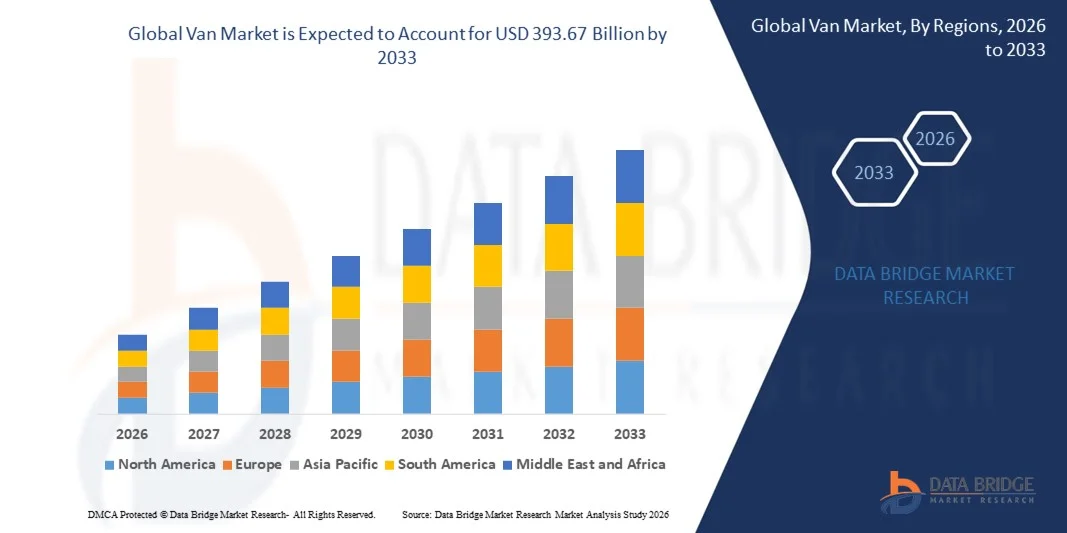

- The global van market size was valued at USD 246.06 billion in 2025 and is expected to reach USD 393.67 billion by 2033, at a CAGR of6.50% during the forecast period

- Increasing demand for efficient, high-performance vans, rising adoption of electric and hybrid propulsion technologies, growth in last-mile delivery and logistics services, expansion of e-commerce and urban mobility solutions, and government incentives for low-emission vehicles are key factors such asly to drive the growth of the van market

What are the Major Takeaways of Van Market?

- Growing demand for commercial and personal vans across developing and developed economies, coupled with infrastructure expansion for EVs, is expected to create significant opportunities for market growth

- Challenges such as high vehicle costs, battery limitations for electric vans, and regulatory compliance complexities may act as restraints on the van market growth

- North America dominated the van market with a 42.67% revenue share in 2025, driven by strong growth in semiconductor design, embedded system development, and electronics manufacturing across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.69% from 2026 to 2033, driven by rapid semiconductor capacity expansion, strong electronics manufacturing ecosystems, widespread 5G deployment, and rising embedded system adoption across China, Japan, India, South Korea, and Southeast Asia

- The Up to 2 Tons segment dominated the market with a 43.7% share in 2025, driven by its versatility for urban logistics, last-mile delivery, and small-scale commercial transport

Report Scope and Van Market Segmentation

|

Attributes |

Van Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Van Market?

Increasing Shift Toward Electric, Connected, and Autonomous Vans

- The van market is witnessing a strong adoption of electric powertrains, connected vehicle technology, and semi-autonomous systems, enabling improved fuel efficiency, telematics integration, and advanced safety features

- Manufacturers are introducing multi-purpose vans equipped with high-efficiency batteries, lightweight chassis, and AI-driven fleet management systems for logistics, delivery, and passenger transport

- Growing demand for eco-friendly, low-emission, and smart mobility solutions is driving usage across urban transportation, e-commerce logistics, and last-mile delivery services

- For instance, companies such as Ford, Mercedes-Benz, Volkswagen, Renault, and Toyota are rolling out electric and hybrid vans with enhanced range, smart fleet connectivity, and driver-assist technologies

- Increasing focus on fleet digitization, route optimization, and vehicle-to-cloud data analytics is accelerating the shift toward connected and autonomous vans

- As urbanization, e-commerce, and environmental regulations intensify, vans will remain critical for sustainable mobility, efficient goods transport, and urban logistics

What are the Key Drivers of Van Market?

- Rising demand for electric and hybrid vans to reduce carbon emissions and comply with stringent environmental regulations is a major growth driver

- For instance, in 2024–2025, leading players such as Ford, Stellantis, and Hyundai expanded their electric van portfolios with higher battery capacity, longer driving range, and fast-charging capabilities

- Growing e-commerce, logistics, and urban delivery services is boosting demand for compact, high-efficiency vans across North America, Europe, and Asia-Pacific

- Advancements in battery technology, regenerative braking, telematics, and lightweight materials have strengthened performance, range, and operational efficiency

- Rising adoption of autonomous driving aids, fleet management software, and vehicle connectivity systems is creating demand for smart, next-generation vans

- Supported by steady investments in electric mobility, smart logistics, and sustainable transport infrastructure, the Van market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Van Market?

- High upfront costs of electric and autonomous vans restrict adoption among small fleet operators and emerging-market buyers.

- For instance, during 2024–2025, raw material price volatility, battery shortages, and semiconductor constraints increased vehicle production costs for several global vendors.

- Complexity in vehicle electronics, autonomous systems, and telematics integration increases the need for skilled technicians and training.

- Limited charging infrastructure and regulatory clarity in some regions slows adoption of electric vans.

- Competition from light trucks, conventional ICE vans, and micro-mobility solutions creates pricing pressure and reduces differentiation.

- To address these challenges, companies are focusing on cost-optimized EV models, modular designs, charging partnerships, and connected service offerings to increase global adoption of vans

How is the Van Market Segmented?

The market is segmented on the basis of tonnage capacity, propulsion, and end-use.

- By Tonnage Capacity

On the basis of tonnage capacity, the van market is segmented into Up to 2 Tons, 2 to 3 Tons, and 3 to 5.5 Tons. The Up to 2 Tons segment dominated the market with a 43.7% share in 2025, driven by its versatility for urban logistics, last-mile delivery, and small-scale commercial transport. These vans offer excellent maneuverability, fuel efficiency, and lower operating costs, making them ideal for SMEs, courier services, and fleet operators. Their compact size and adaptability for cargo, refrigerated transport, and passenger applications contribute to widespread adoption globally.

The 3 to 5.5 Tons segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for medium-duty commercial transport, heavier cargo logistics, and specialized fleet applications. Rising e-commerce penetration, growth in distribution networks, and demand for robust urban-to-regional delivery vehicles are driving this segment’s rapid expansion.

- By Propulsion

On the basis of propulsion, the van market is segmented into Internal Combustion Engine (ICE), Electric, Hybrid, and Others. The ICE segment dominated the market with a 52.1% revenue share in 2025, supported by the well-established infrastructure, lower upfront cost, and widespread availability of fuel stations. ICE vans remain preferred for long-distance delivery and conventional commercial applications due to their reliability and range.

The Electric segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by stringent emission regulations, government incentives, and the rising shift toward zero-emission mobility. Adoption of electric vans is increasing across urban logistics, last-mile delivery, and fleet electrification projects. Advancements in battery density, charging infrastructure, and cost optimization, coupled with growing environmental awareness among businesses and consumers, are accelerating the transition to electric-powered vans globally.

- By End-Use

On the basis of end-use, the van market is segmented into Commercial and Personal. The Commercial segment dominated the market with a 61.5% share in 2025, driven by expanding e-commerce operations, logistics and courier services, urban delivery demand, and fleet modernization programs. Vans are critical for transporting goods, perishable items, and equipment efficiently, which has led to strong fleet deployment across SMEs, large corporations, and public services.

The Personal segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing consumer preference for multi-purpose vans, recreational vehicles, and passenger transport solutions. Rising demand for family-friendly vans with enhanced safety, comfort, and connectivity features, along with flexible seating and cargo options, is fueling this segment’s expansion globally.

Which Region Holds the Largest Share of the Van Market?

- North America dominated the van market with a 42.67% revenue share in 2025, driven by strong growth in semiconductor design, embedded system development, and electronics manufacturing across the U.S. and Canada. Widespread adoption of FPGAs, microcontrollers, high-speed digital interfaces, and advanced communication protocols has significantly increased demand for Vans across R&D labs, automotive electronics testing, aerospace systems, and academic research institutions

- Leading North American vendors continue to launch advanced Vans featuring higher bandwidth, deep memory depth, multi-protocol decoding, and PC-integrated debugging software, reinforcing the region’s technological leadership. Sustained investments in IoT, AI hardware, EV electronics, and high-performance computing are further supporting long-term market expansion

- A strong concentration of skilled engineers, mature innovation ecosystems, and continuous funding for advanced electronics R&D firmly position North America as the largest and most established regional market for Vans

U.S. Van Market Insight

The U.S. represents the largest contributor within North America, supported by extensive semiconductor R&D, rapid adoption of embedded electronics, and heavy usage of digital debugging tools across automotive, aerospace, defence, telecom, and industrial automation sectors. Growing development of AI accelerators, high-speed processors, EV power electronics, and next-generation communication modules is driving demand for Vans capable of high-resolution timing analysis and advanced protocol decoding.

Canada Van Market Insight

Canada contributes steadily to regional growth, driven by expanding electronics design clusters, increasing use of embedded systems, and rising investments in telecom, automotive electronics, and defence research. Engineering labs and universities widely deploy Vans for FPGA development, PCB debugging, and IoT validation. Government-backed innovation programs and a skilled technical workforce continue to support market adoption.

Asia-Pacific Van Market

Asia-Pacific is projected to register the fastest CAGR of 8.69% from 2026 to 2033, driven by rapid semiconductor capacity expansion, strong electronics manufacturing ecosystems, widespread 5G deployment, and rising embedded system adoption across China, Japan, India, South Korea, and Southeast Asia. High-volume production of consumer electronics, automotive ECUs, PCBs, and IoT devices is accelerating demand for efficient and portable signal analysis tools.

China Van Market Insight

China leads Asia-Pacific growth due to large-scale semiconductor investments, dominant electronics manufacturing capacity, and strong government support for digital innovation. Increasing development of AI chips, high-speed digital circuits, and advanced communication systems is driving adoption of Vans with higher channel density and multi-bus decoding capabilities.

Japan Van Market Insight

Japan demonstrates stable growth supported by advanced telecom infrastructure, precision electronics manufacturing, and continuous modernization of automotive and industrial control systems. Demand for reliable, high-quality engineering tools sustains adoption of premium Vans across R&D and production environments.

India Van Market Insight

India is emerging as a high-growth market, driven by expanding semiconductor design centres, rising startup activity, and government-led electronics manufacturing initiatives. Increasing development of IoT devices, automotive electronics, and telecom equipment is accelerating the use of Vans for testing, validation, and prototyping.

South Korea Van Market Insight

South Korea contributes strongly due to high demand for advanced processors, memory devices, 5G infrastructure, and high-performance consumer electronics. Rapid innovation in AI servers, automotive electronics, and display technologies is boosting adoption of Vans with high sampling rates and deep memory, supporting sustained regional growth.

Which are the Top Companies in Van Market?

The Van industry is primarily led by well-established companies, including:

- Ford Motor Company (U.S.)

- Mercedes-Benz Group AG (Germany)

- Volkswagen Group (Germany)

- Renault Group (France)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., Ltd. (Japan)

- Hyundai Motor Company (South Korea)

- MITSUBISHI MOTORS CORPORATION (Japan)

- ISUZU MOTORS LIMITED (Japan)

- Stellantis NV (Netherlands)

What are the Recent Developments in Global Van Market?

- In January 2025, Mercedes-Benz Group AG unveiled its next-generation eSprinter electric van at CES, offering a driving range of up to 280 miles, the ability to achieve 80% fast charging in under 30 minutes, and advanced driver assistance features. Planned for a late 2025 launch in North America, the model is positioned to directly compete with the Ford E-Transit and GM BrightDrop in the rapidly growing fleet electrification segment, concluding that Mercedes-Benz is strengthening its competitive position in the electric commercial van market

- In December 2024, Ford announced a USD 2 billion investment to expand production of its E-Transit electric van, aiming to increase annual manufacturing capacity to 90,000 units by 2027. With the E-Transit already holding over 60% share of North America’s electric commercial vehicle market, this expansion underscores Ford’s commitment to scaling electric fleet solutions, concluding that the company is consolidating its leadership in electric commercial mobility

- In December 2024, Mercedes-Benz Group AG introduced the VAN.EA platform as part of its long-term electrification strategy, with the modular electric architecture set to underpin all medium and large vans from 2026 onward. Designed to support both luxury private vans and premium commercial vehicles, the platform integrates advanced technologies such as the Mercedes-Benz Operating System MB.OS, 800-volt charging, and 22 kW AC charging, concluding that VAN.EA will serve as the technological foundation for Mercedes-Benz’s future electric van portfolio

- In March 2024, Volkswagen Group launched the ID. Buzz GTX, featuring a 4MOTION all-wheel-drive system powered by dual electric motors and offered in two wheelbase options with two battery sizes. With high towing capability, fast-charging performance, and enhanced styling, the model expands Volkswagen’s electric van lineup, concluding that the ID. Buzz GTX strengthens the brand’s presence in the premium and performance-oriented electric van segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.