Market Analysis and Insights

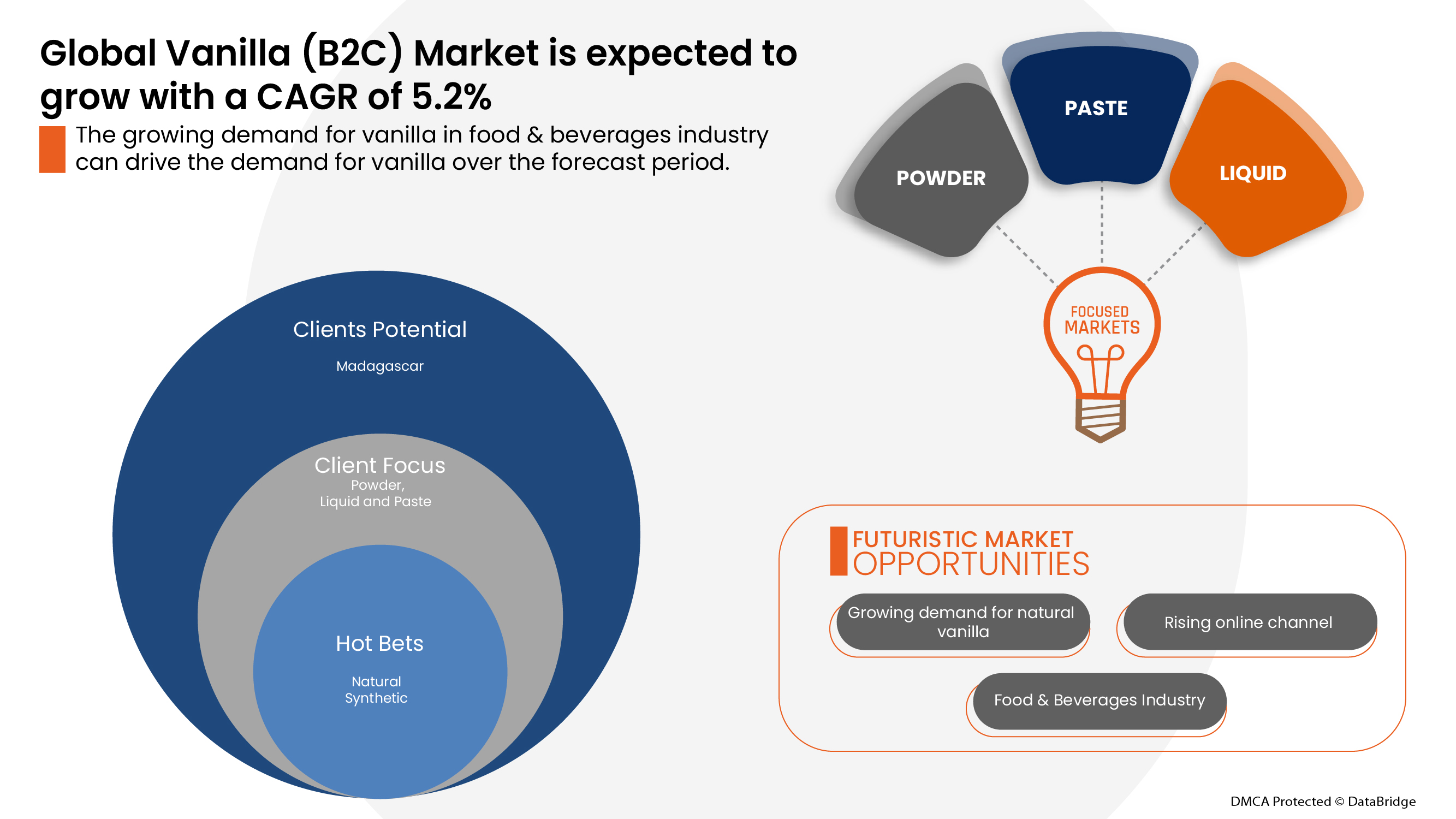

The global vanilla (B2C) market is gaining significant growth due to the growing food & beverage industry and the rise in demand for bakery products. The increase in demand for food and beverages products including bakery is expected to drive the global vanilla (B2C) market. However, stringent government regulations associated with synthetic vanilla is expected to restrain the market growth of vanilla market during the forecast period.

Data Bridge Market Research analyses that the global vanilla (B2C) market will grow at a CAGR of 5.2% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Tons, Pricing in USD |

|

Segment Covered |

By Vanilla Type (Madagascar, Mexican, Synthetic Origin, India, Indonesian, Tahitian, Tonga, Papua New Guinea, Ugandan and Others), Vanilla Origin (Natural and Synthetic), Grade (Grade A (30% Moisture), Grade B (20% Moisture) and Others), Form (Liquid, Powder and Paste), Distribution Channel (Supermarket, Hypermarket, Specialty Stores, Retail Stores, Online and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, Spain, Turkey, U.K., Netherlands, Russia, Switzerland, Belgium, Luxemburg, Italy, Rest of Europe, China, India, Japan, Australia, South Korea, Malaysia, Singapore, Thailand, New Zealand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Egypt, Saudi Arabia, U.A.E, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

McCormick & Company, Inc., Nielsen-Massey Vanillas, Inc., Madagascar Vanilla Company LLC, Vanilla Pura, Boston Vanilla Bean Company, Native Vanilla, Heilala Vanilla US., Daintree Vanilla & Spice, Lemur International, Inc, Venui Vanilla, Apex Flavor, and others |

Market Definition

Vanilla is a spice derived from the orchids of the genus vanilla. It is widely cultivated in various regions across the world. Moreover, Madagascar, Mexico, and Indonesia are leading in the production of vanilla beans. Vanilla flavor is extracted from the vanilla beans, named natural vanilla extract in the market. However, the demand for vanilla flavor is rising promptly among consumers, leading the vanilla processor to produce synthetic vanilla extract from renewable resource. The vanilla beans are classified into grade A, grade B, and others based on the quality.

Similarly, vanilla is segmented into various forms such as liquid, powder, and paste. The vanilla beans, and extracts are widely used in bakery, confectionery, and dairy based products. In addition, vanilla has extensive pharmaceutical, and personal care products applications.

Global Vanilla (B2C) Market Dynamics

Drivers

-

Growing demand for vanilla in the food & beverage industry

The demand for vanilla in the food & beverage industries is growing rapidly. Vanilla extract is an important flavouring agent in the food and beverage processing industry. In the food industry, vanilla is added to various food applications, including dairy-based products, bakery products, processed foods, chocolate& confectionery, and others, to enhance its flavours and taste. Thus, the increase in demand for vanilla powder, paste, and liquid in the food industry is expected to drive growth in the market.

Meanwhile, vanilla extracts play an important role in reducing bitterness, and enhancing the product's flavour in the chocolate industry. In addition, vanilla will mask the taste variation in chocolate caused by cocoa bran. Hence, the increase in demand for vanilla in the chocolate industry is propelling the growth of vanilla in the market.

-

Growing demand for vanilla in the pharmaceutical and personal care industry

In recent years, the demand for fragrance-based cosmetic, and personal care products has been increasing among customers across the globe. Hence, the rise in the need for vanilla-added cosmetic products is impelling the growth of vanilla in the market. Besides fragrance, vanilla has a particular functional property that enables the repair of skin damage.

For instance, vanilla is naturally rich in antioxidants, which help neutralize the free radicals and reduce skin damage. Due to its functional property, vanilla liquids, powders, and pastes are largely used in cosmetic products. Thus, the increasing usage of vanilla in the cosmetic industry will drive growth in the market. Moreover, the Madagascar vanilla has extensive application in personal care products such as lotion, anti-aging creams, and lip balm enriched with vitamin B, which is responsible for healthy skin. Thus, cosmetic manufacturers are adding vanilla into their products.

Hence, the growing demand for Madagascar vanilla in personal care product will propel the market growth.

Opportunity

-

Rising demand for synthetic vanilla extracts

Although the low production of vanilla beans reduces the production of natural vanilla extracts in the market. To encounter the demand, the vanilla extracts manufacturers are focused on producing synthetic vanilla extract. This further creates an opportunity for vanilla extract producers to expand their value in the global market. As a result of rising consumer preference for vanilla-flavored food products, the food industry demands more synthetic vanilla extract in the market.

In recent years, immense interest has been grown among chemical industries due to the viable opportunity to substitute synthetic vanilla products with renewable resources. According to U.S. regulation, the derivation of vanilla extract from renewable sources can be labeled as natural. Thus, the manufacturers emphasize producing vanilla extract using the biotechnological method.

Restraints/Challenges

- Fluctuating price of raw materials

The demand for vanilla flavors is increasing among industries and customers across the globe. However, the demand for vanilla exceeds the supply of vanilla in the market.

For instance,

- Based on the NPR report, the rising demand for Madagascar vanilla bean increased the product's price by ten times in 2017 compared to previous years. Hence, the increasing price of Madagascar beans will decrease the growth in the market as the customers are sensitive to price.

Similarly, the customers are looking for clean label products and demand natural, and organic products. Therefore, the companies produce vanilla extracts from a natural source to satisfy the customers. Despite that, less raw material availability leads the manufacturers to sell their products at a higher cost. As a result of elevated prices, the demand for vanilla will decline and obstruct the global market's growth.

- Availability of substitute products

Vanilla is the most common flavor among consumers, although the availability of alternative flavors in the market is a major challenge for the growth of vanilla in the market. Maple syrup, almond extract, citrus zest, and others are the substituent flavors available in the market. Maple syrup is a substitute for vanilla extracts which offers a pleasant aroma, and vanilla's mellow flavors.

Maple syrup is ideal for preparing pancakes, cookies, roasted vegetables, and other food applications.

As it is cost-effective, the consumers opt for maple syrup as an alternative to vanilla flavor. Hence, the increasing demand for maple syrup will decline the growth of vanilla in the market. Consequently, almond extract is also used as an alternative source of vanilla extract. Moreover, almond extract is significantly more potent than vanilla flavor. This extract is widely added to baked goods and other desserts to enhance its flavor and taste. Therefore, the rising demand for almond extract in the bakery industry will obstruct the growth of vanilla in the market.

Post COVID-19 Impact Global Vanilla (B2C) Market

Post COVID-19, the demand for vanilla is increased in Asia-pacific region due to change in buying pattern of consumers and gradual shift towards to increasing the demand of variety of flavored products among various end users such as food & beverages, and others. Due to the discontinuation of many strict mandates and restrains manufactures and producers are able to fulfil the demand for vanilla in the region.

The increased demand for different flavored food items enables manufacturers to launch various organic and synthetic vanilla, which has helped the market grow.

Recent Developments

- In January 2020, ADM acquired Yerbalatina Phytoactives, a leading manufacturer of plant-based extracts and ingredients. This acquisition helped in expanding ADM's business in Brazil and strengthening its position in the health & wellness market

- In December 2019, ADM acquired Rodelle, a vanilla ingredient supplier in 2019. Rodelle is a joint venture of Sahanala. Sahanala is the industry's first farmer-owned processor and exporter of vanilla beans. This acquisition enlarges the supply chain and now positioned the ADM as a global industry leader in vanilla and citrus flavor. Hence, it improves the company's share in the market

Global Vanilla (B2C) Market Scope

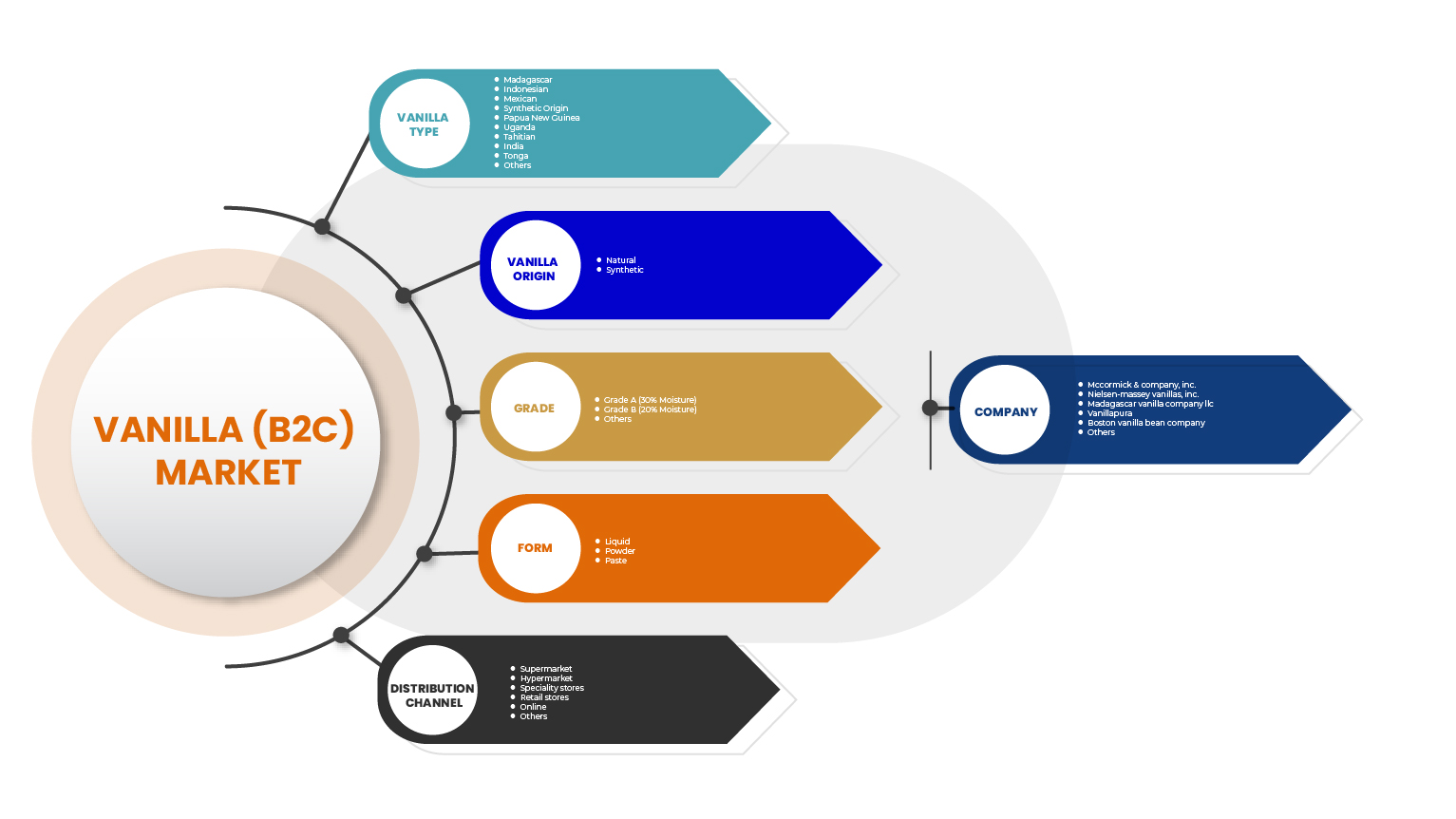

The global vanilla (B2C) market is segmented into five notable segments based on vanilla type, grade, vanilla origin, form and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Vanilla Type

- Madagascar

- Indonesian

- Mexican

- Synthetic Origin

- Papua New Guinea

- Uganda

- Tahitian

- India

- Tonga

- Others

On the basis of vanilla type, the global vanilla (B2C) market is segmented into Madagascar, Mexican, Synthetic origin, India, Indonesian, Tahitian, Tonga, Papua New Guinea, Uganda and others.

Form

- Liquid

- Powder

- Paste

On the basis of form, the global vanilla (B2C) market is segmented into liquid, powder and paste.

Vanilla Origin

- Natural

- Synthetic

On the basis of vanilla origin, the global vanilla (B2C) market is segmented into natural and synthetic.

Grade

- Grade A (30% Moisture)

- Grade B (20% Moisture)

- Others

On the basis of grade, the global vanilla (B2C) market is segmented into grade A (30% moisture), grade B (20% moisture) and others.

Distribution Channel

- Supermarket

- Hypermarket

- Specialty stores

- Retail stores

- Online

- Others

On the basis of distribution channel, the global vanilla (B2C) market is segmented into supermarket, hypermarket, specialty stores, retail stores, online and others.

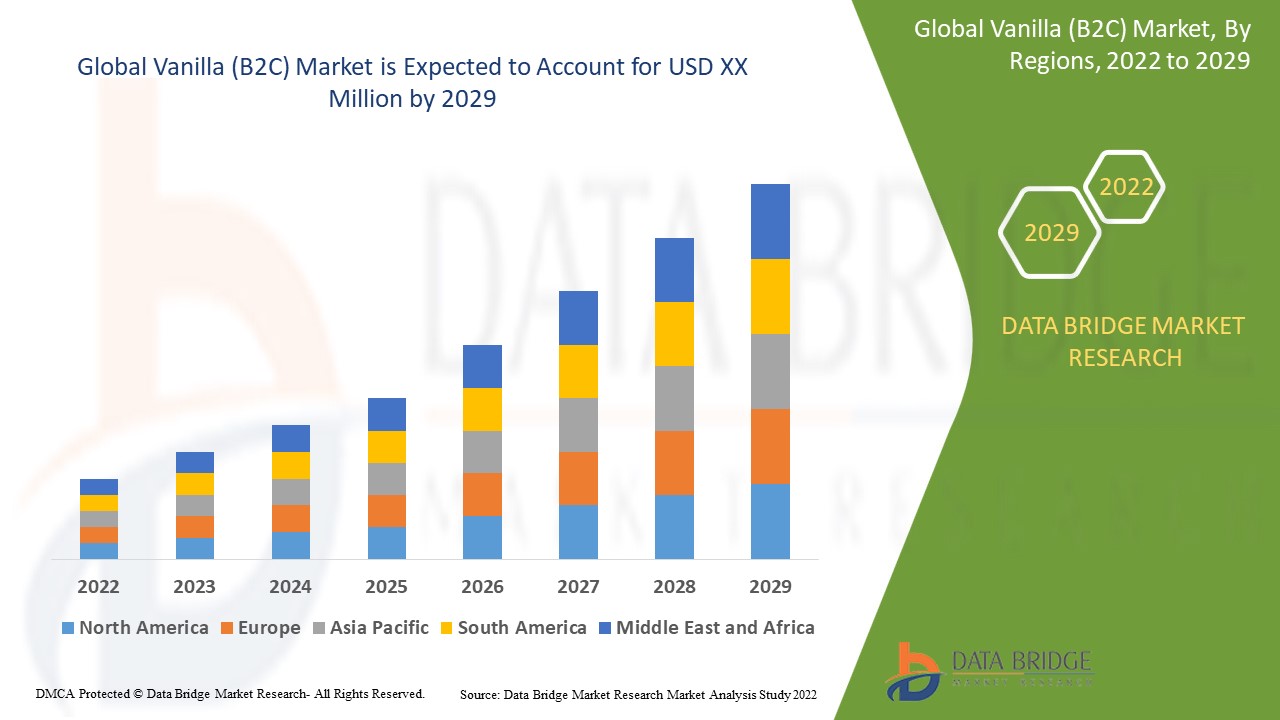

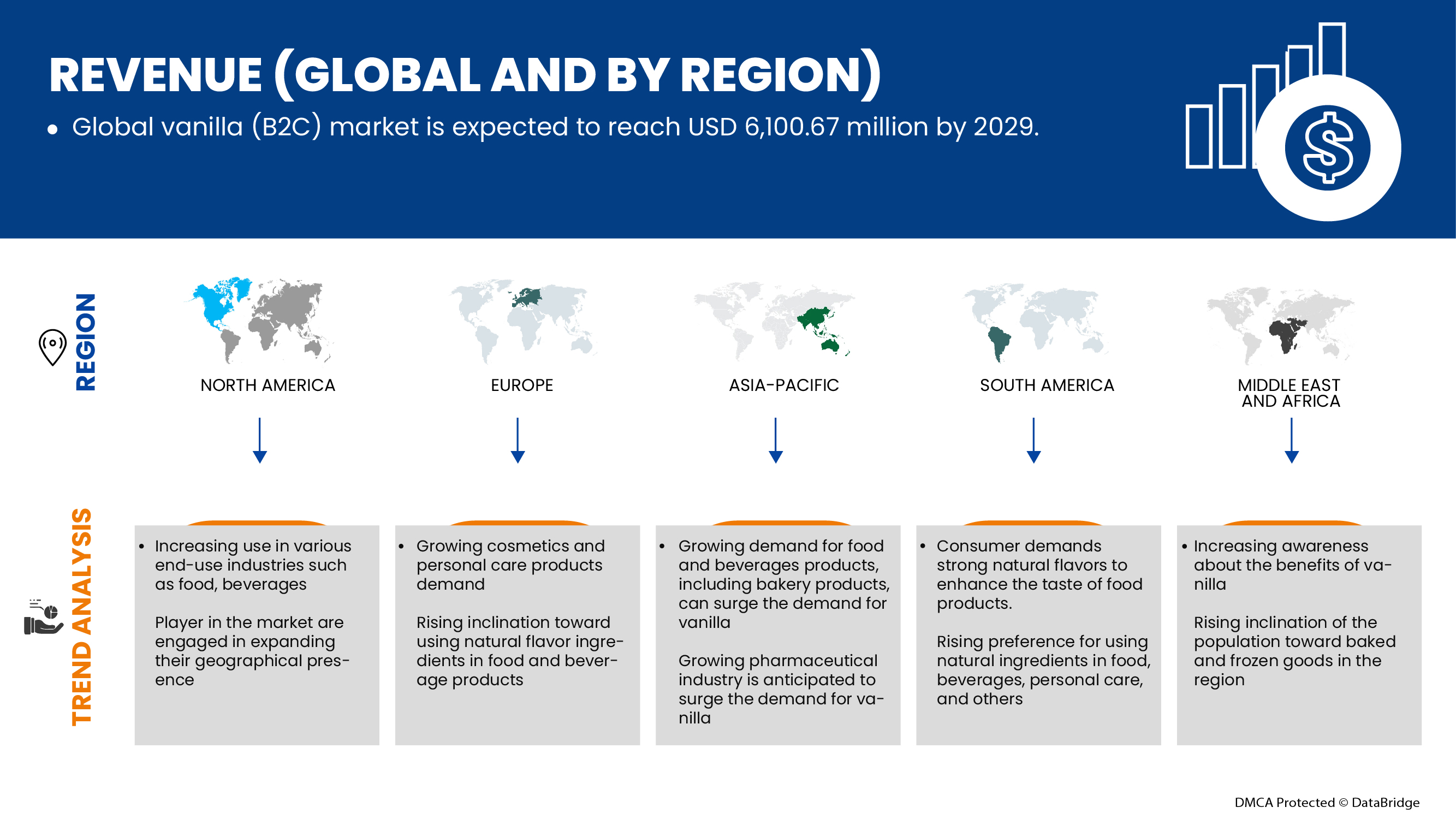

Global Vanilla (B2C) Markets Regional Analysis/Insights

The global vanilla (B2C) market analyzed and market size insights and trends are provided based on as referenced above.

The countries covered in the global vanilla (B2C) markets report are U.S., Canada, Mexico, Germany, France, Spain, Turkey, U.K., Netherlands, Russia, Switzerland, Belgium, Luxemburg, Italy, Rest of Europe, China, India, Japan, Australia, South Korea, Malaysia, Singapore, Thailand, New Zealand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Egypt, Saudi Arabia, U.A.E, Israel, Rest of Middle East and Africa.

North America is expected to lead the global vanilla (B2C) market due to its increasing use in various end-use industries such as food, beverages, pharmaceuticals and others.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Vanilla (B2C) Market Share Analysis

The global vanilla (B2C) market competitive landscape provides details of the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies’ focus on the global vanilla (B2C) market.

Some of the major players operating in the global vanilla (B2C) market are McCormick & Company, Inc., Nielsen-Massey Vanillas, Inc., Madagascar Vanilla Company LLC, Vanilla Pura, Boston Vanilla Bean Company, Native Vanilla, Heilala Vanilla US., Daintree Vanilla & Spice, Lemur International, Inc, Venui Vanilla, Apex Flavor, and others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VANILLA MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE (B2B)

2.1 TYPE LIFELINE CURVE (B2C)

2.2 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.3 DBMR MARKET POSITION GRID

2.4 VENDOR SHARE ANALYSIS

2.5 MARKET END USER COVERAGE GRID

2.6 SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKET TRENDS

4.2 NEW PRODUCT LAUNCHES

4.3 BIGGEST PLAYERS IN THE MARKET FOR DIRECT TO CONSUMER

4.4 MANUFACTURING PROCESS OF SYNTHETIC VANILLA

4.4.1 PREPARATION OF VANILLA FROM CONIFERIN

4.4.2 PREPARATION OF VANILLA FROM EUGENOL

4.4.3 PREPARATION OF VANILLA FROM SPENT SULPHITE LIQUOR

4.5 MARKETING STRATEGIES

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT

4.6.2 MANUFACTURING PROCESS

4.6.3 MARKETING AND DISTRIBUTION

4.6.4 END-USERS

4.7 VALUE CHAIN ANALYSIS

4.7.1 KEY SUPPLIERS

4.7.2 KEY DISTRIBUTORS

4.7.3 CONSUMERS

4.8 REGULATORY FRAMEWORK

4.9 CONSUMER PREFERENCES

4.1 PRICING ANALYSIS

4.11 DIRECT TO CONSUMER VANILLA PRODUCT PRICING AND MARGINS

4.12 KEY GOVERNMENT INITIATIVES

4.13 IMPORT-EXPORT ANALYSIS

4.13.1 EXPORT OF VANILLA, HS CODE: 0905, 2017-2021, IN USD THOUSAND

4.13.2 EXPORT OF VANILLA, HS CODE: 0905 , 2017-2021, IN TONS

4.13.3 IMPORT OF VANILLA, HS CODE: 0905, 2017-2021, IN USD THOUSAND

4.13.4 IMPORT OF VANILLA, HS CODE: 0905, 2017-2021, IN USD THOUSAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VANILLA IN THE FOOD & BEVERAGE INDUSTRY

5.1.2 GROWING DEMAND FOR VANILLA IN THE PHARMACEUTICAL AND PERSONAL CARE INDUSTRY

5.1.3 INCREASING DEMAND FOR BAKERY PRODUCTS

5.1.4 RISE IN DEMAND FOR CLEAN LABEL PRODUCTS

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON SYNTHETIC VANILLA EXTRACT

5.2.2 FLUCTUATING PRICE OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SYNTHETIC VANILLA EXTRACTS

5.3.2 INCREASING LAUNCHES OF VANILLA-FLAVORED PRODUCTS

5.4 CHALLENGES

5.4.1 AVAILABILITY OF SUBSTITUTE PRODUCTS

5.4.2 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

6 GLOBAL VANILLA MARKET, BY TYPE

6.1 OVERVIEW

6.2 MADAGASCAR

6.3 MEXICAN

6.4 SYNTHERIC ORIGIN

6.5 INDIA

6.6 INDONESIAN

6.7 TAHITIAN

6.8 TONGA

6.9 PAPUA NEW GUINEA

6.1 UGANDAN

6.11 OTHERS

7 GLOBAL VANILLA MARKET, BY ORIGIN

7.1 OVERVIEW

7.2 SYNTHETIC

7.3 NATURAL

8 GLOBAL VANILLA MARKET, BY GRADE

8.1 OVERVIEW

8.2 GRADE A

8.3 GRADE B

8.4 OTHERS

9 GLOBAL VANILLA MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 POWDER

9.4 PASTE

10 GLOBAL VANILLA MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.3 BEVERAGES

10.4 PERSONAL CARE PRODUCTS

10.5 PHARMACEUTICAL INDUSTRY

10.6 HOUSEHOLDS/ HOME COOKING

10.7 OTHERS

11 GLOBAL MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.3 B2C

12 GLOBAL VANILLA MARKET, BY REGION

12.1 ASIA-PACIFIC

12.2 EUROPE

12.3 SOUTH AMERICA

12.4 NORTH AMERICA

12.5 MIDDLE EAST AND AFRICA:

13 GLOBAL VANILLA MARKET: COMPANY LANDSCAPE (B2B)

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 GLOBAL VANILLA MARKET: COMPANY LANDSCAPE (B2C)

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MCCORMICK & COMPANY, INC.

16.1.1 COMPANY SANPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 IFFINC

16.2.1 COMPANY SANPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 KERRY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GIVAUDAN

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ADM

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 APEX FLAVORS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AUST & HACHMANN (CANADA) LTD/LTÉE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BOSTON VANILLA BEAN COMPANY

16.8.1 COMPANY SNAPSHOT

16.8.2 COMPANY SHARE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 DAINTREE VANILLA & SPICE

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SANPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FIRMENICH SA

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HEILALA VANILLA US

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 LEMUR INTERNATIONAL, INC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LOCHHEAD MANUFACTURING COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MADAGASCAR VANILLA COMPANY LLC

16.15.1 COMPANY SNAPSHOT

16.15.2 COMPANY SHARE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MANE KANCOR

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NATIVE VANILLA

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NIELSEN-MASSEY VANILLAS, INC.

16.18.1 COMPANY SANPSHOT

16.18.2 COMPANY SHARE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 PROVA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 PURE-VANILLA-MG.COM

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SAMBIRANO AROMATIC

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SHANK'S EXTRACTS, INC.

16.22.1 COMPANY SANPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 SYMRISE

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 SYNERGY

16.24.1 COMPANY SANPSHOT

16.25 TAKASAGO INTERNATIONAL CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 THARAKAN AND COMPANY

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 VANILLAPURA

16.27.1 COMPANY SNAPSHOT

16.27.2 COMPANY SHARE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 VENUI VANILLA

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 VIRGINIA DARE.

16.29.1 COMPANY SANPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 VNLLA EXTRACT CO.

16.30.1 COMPANY SANPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Figure

FIGURE 1 GLOBAL VANILLA (B2B) MARKET: SEGMENTATION

FIGURE 2 GLOBAL VANILLA (B2C) MARKET: SEGMENTATION

FIGURE 3 GLOBAL VANILLA (B2B) MARKET: DATA TRIANGULATION

FIGURE 4 GLOBAL VANILLA (B2C) MARKET: DATA TRIANGULATION

FIGURE 5 GLOBAL VANILLA MARKET: DROC ANALYSIS

FIGURE 6 GLOBAL VANILLA (B2B) MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 7 GLOBAL VANILLA (B2C) MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 8 GLOBAL VANILLA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 9 GLOBAL VANILLA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 GLOBAL VANILLA MARKET: DBMR MARKET POSITION GRID

FIGURE 11 GLOBAL VANILLA (B2B) MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 GLOBAL VANILLA (B2C) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL VANILLA MARKET: MARKET END USER COVERAGE GRID

FIGURE 14 GLOBAL VANILLA MARKET: SEGMENTATION

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL VANILLA (B2B) MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 16 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL VANILLA (B2C) MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 17 GROWING DEMAND FOR VANILLA ((B2B) IN FOOD & BEVERAGE INDUSTRY IS EXPECTED TO DRIVE THE MARKET GROWTH

FIGURE 18 GROWING DEMAND FOR VANILLA (B2C) IN FOOD & BEVERAGE INDUSTRY IS EXPECTED TO DRIVE THE MARKET GROWTH

FIGURE 19 MADAGASCAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VANILLA (B2B) MARKET IN 2022 & 2029

FIGURE 20 MADAGASCAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VANILLA (B2C) MARKET IN 2022 & 2029

FIGURE 21 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR VANILLA (B2B) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 22 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR VANILLA (B2C) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 23 SUPPLY CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL VANILLA MARKET

FIGURE 26 GLOBAL VANILLA (B2B) MARKET, BY TYPE

FIGURE 27 GLOBAL VANILLA (B2C) MARKET, BY TYPE

FIGURE 28 GLOBAL VANILLA (B2B) MARKET, BY ORIGIN

FIGURE 29 GLOBAL VANILLA (B2C) MARKET, BY ORIGIN

FIGURE 30 GLOBAL VANILLA (B2B) MARKET, BY GRADE

FIGURE 31 GLOBAL VANILLA (B2C) MARKET, BY GRADE

FIGURE 32 GLOBAL VANILLA (B2B) MARKET, BY FORM

FIGURE 33 GLOBAL VANILLA (B2C) MARKET, BY FORM

FIGURE 34 GLOBAL VANILLA MARKET, BY END-USER

FIGURE 35 GLOBAL VANILLA (B2B) MARKET, BY DISTIBUTION CHANNEL

FIGURE 36 GLOBAL VANILLA (B2C) MARKET, BY DISTIBUTION CHANNEL

FIGURE 37 GLOBAL VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 38 GLOBAL VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 39 GLOBAL VANILLA (B2B) MARKET: BY REGION (2021)

FIGURE 40 GLOBAL VANILLA (B2C) MARKET: BY REGION (2021)

FIGURE 41 GLOBAL VANILLA (B2B) MARKET: BY REGION (2022 & 2029)

FIGURE 42 GLOBAL VANILLA (B2C) MARKET: BY REGION (2022 & 2029)

FIGURE 43 GLOBAL VANILLA (B2B) MARKET: BY REGION (2021 & 2029)

FIGURE 44 GLOBAL VANILLA (B2C) MARKET: BY REGION (2021 & 2029)

FIGURE 45 GLOBAL VANILLA (B2B) MARKET: BY TYPE (2021 & 2029)

FIGURE 46 GLOBAL VANILLA (B2C) MARKET: BY TYPE (2021 & 2029)

FIGURE 47 ASIA- PACIFIC VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 48 ASIA- PACIFIC VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 49 ASIA- PACIFIC VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 50 ASIA- PACIFIC VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 51 ASIA- PACIFIC VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 52 ASIA- PACIFIC VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 ASIA- PACIFIC VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 ASIA- PACIFIC VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 55 ASIA- PACIFIC VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 56 ASIA- PACIFIC VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 57 EUROPE VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 58 EUROPE VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 59 EUROPE VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 60 EUROPE VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 61 EUROPE VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 62 EUROPE VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 63 EUROPE VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 64 EUROPE VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 65 EUROPE VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 66 EUROPE VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 67 SOUTH AMERICA VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 68 SOUTH AMERICA VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 69 SOUTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 70 SOUTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 71 SOUTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 72 SOUTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 73 SOUTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 74 SOUTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 75 SOUTH AMERICA VANILLA (B2B) MARKET: BY TYPE (2021 & 2029)

FIGURE 76 SOUTH AMERICA VANILLA (B2C) MARKET: BY TYPE (2021 & 2029)

FIGURE 77 NORTH AMERICA VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 78 NORTH AMERICA VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 79 NORTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 80 NORTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 81 NORTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 82 NORTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 83 NORTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 84 NORTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 85 NORTH AMERICA VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 86 NORTH AMERICA VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 87 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 88 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 89 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 90 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 91 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 92 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 93 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 94 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 95 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 96 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 97 GLOBAL VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 98 NORTH AMERICA VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 99 EUROPE VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 100 ASIA-PACIFIC VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 101 GLOBAL VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

FIGURE 102 NORTH AMERICA VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

FIGURE 103 EUROPE VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

FIGURE 104 ASIA-PACIFIC VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

Global Vanilla B2c Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vanilla B2c Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vanilla B2c Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.