Global Vapor Barrier Films Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

2.53 Billion

2024

2032

USD

1.53 Billion

USD

2.53 Billion

2024

2032

| 2025 –2032 | |

| USD 1.53 Billion | |

| USD 2.53 Billion | |

|

|

|

|

Global Vapor Barrier Films Market Size

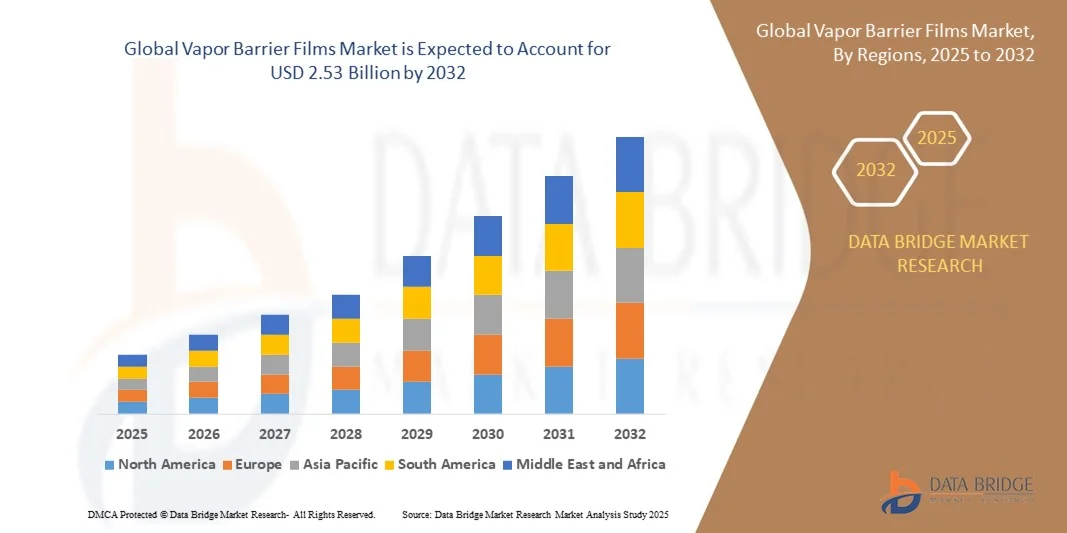

- The global vapor barrier films market size was valued at 1.53 billion in 2024 and is projected to reach USD 2.53 billion by 2032, growing at a CAGR of 6.50% during the forecast period

- Market expansion is primarily driven by rising demand in the construction and packaging sectors, where moisture control and durability are critical, especially in residential, commercial, and industrial applications

- Additionally, increased focus on energy efficiency, sustainability, and the need to protect infrastructure and packaged goods from moisture-related damage are propelling the adoption of vapor barrier films, significantly contributing to the market’s robust growth trajectory

Global Vapor Barrier Films Market Analysis

- Vapor barrier films, designed to prevent moisture transmission across surfaces, are becoming essential components in construction, packaging, and automotive applications due to their ability to enhance durability, protect structural integrity, and improve energy efficiency in both residential and industrial environments

- The growing demand for vapor barrier films is primarily driven by increasing construction activities worldwide, heightened awareness about moisture-related damage, and a global shift toward sustainable and energy-efficient building practices

- North America dominated the vapor barrier films market with the largest revenue share 38.7% in 2024, driven by rising demand for vapor barrier films across diverse applications such as construction, packaging, and agriculture. The strong presence of major key players in the region is expected to further accelerate the market growth during the forecast period, supported by continuous innovation and advancements in film technologies.

- Asia-Pacific is projected to witness significant growth in the vapor barrier films market during the forecast period, fueled by increasing adoption of high-barrier films in packaging applications, particularly for food and other industrial products.

- Polyethylene (PE) segment dominated the vapor barrier films market with a market share of 45.9% in 2024, owing to its superior moisture resistance, cost-effectiveness, and widespread use in construction, packaging, and agricultural applications.

Report Scope and Market Segmentation

|

Attributes |

Details |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Vapor Barrier Films Market Trends

Enhanced Performance Through Advanced Materials and Smart Integration

- A significant and accelerating trend in the global vapor barrier films market is the integration of advanced materials and smart technologies to improve barrier efficiency, sustainability, and functional versatility across construction, packaging, and industrial sectors

- For instance, new-generation vapor barrier films are incorporating high-barrier polymers like EVOH and PVDC to deliver superior moisture resistance while supporting recyclability and compliance with evolving environmental standards

- Material innovations also include the use of nanotechnology and multilayer film structures that enhance durability, flexibility, and water vapor transmission control without increasing thickness or weight. These advancements enable films to meet the demanding requirements of modern infrastructure and packaging

- In addition, smart vapor barrier solutions are emerging with embedded moisture sensors and real-time monitoring capabilities. These films provide early detection of water ingress in buildings, enabling proactive maintenance and reducing potential structural damage

- This convergence of intelligent monitoring and high-performance materials is reshaping expectations for vapor barrier applications, particularly in green construction. Leading companies such as DuPont and BASF are actively developing sensor-integrated and sustainable film technologies tailored to high-efficiency and energy-conscious buildings

- The demand for vapor barrier films with advanced material science and smart functionalities is accelerating globally, as industries increasingly seek to balance performance, environmental impact, and long-term value across residential, commercial, and industrial use cases

Global Vapor Barrier Films Market Dynamics

Driver

Growing Need Due to Rising Construction Activity and Moisture Protection Requirements

-

The increasing global focus on infrastructure development, residential housing, and industrial expansion is a key driver behind the growing demand for vapor barrier films, particularly as awareness of moisture-related damage and energy inefficiency becomes more widespread

- For instance, in March 2024, DuPont launched a new line of high-performance vapor barrier films for building envelopes, targeting both commercial and residential construction markets with enhanced energy efficiency and moisture control capabilities. Such innovations by leading players are expected to accelerate market growth during the forecast period

- As builders and developers prioritize long-term durability and sustainability, vapor barrier films offer critical benefits including protection against mold, corrosion, and structural degradation. This makes them increasingly essential in modern building designs, especially in regions with high humidity or extreme weather conditions

- Furthermore, the rising adoption of green building certifications and energy-efficient construction codes is driving the integration of vapor barrier films in wall assemblies, roofing systems, and flooring underlays. These films help meet compliance requirements while reducing heating and cooling costs over time

- In the packaging sector, vapor barrier films are gaining traction due to their ability to preserve product integrity by protecting against moisture ingress, particularly for electronics, pharmaceuticals, and perishable goods. The demand is also being bolstered by the expansion of e-commerce and the need for protective packaging solutions in global supply chains

Restraint/Challenge

Environmental Concerns and Cost Pressures

-

A key challenge in the vapor barrier films market is the environmental impact of conventional plastic-based films, which are often difficult to recycle and contribute to landfill waste. Growing scrutiny from regulators and consumers regarding sustainability is pressuring manufacturers to develop eco-friendlier alternatives

- For instance, single-use polyethylene vapor barriers, commonly used in construction, face criticism for their limited recyclability and contribution to plastic pollution. As a result, demand is rising for biodegradable, recyclable, or reusable vapor barrier solutions—though these alternatives can currently be more expensive or less readily available

- Addressing these environmental concerns requires innovation in sustainable materials, such as bio-based polymers and advanced recyclable multilayer structures. Companies like Berry Global and BASF are investing in R&D to produce lower-impact films, but scalability and cost remain obstacles

- In addition, the relatively high cost of high-performance or specialized vapor barrier films—particularly those using advanced polymers or nanotechnology—can be a barrier to widespread adoption, especially in cost-sensitive construction markets or developing economies

- Overcoming these challenges will require ongoing material innovation, improved recycling infrastructure, and cost optimization strategies to ensure vapor barrier films can meet both performance and sustainability expectations across diverse end-use sectors

Global Vapor Barrier Films Market Scope

The vapor barrier films market is segmented on the basis of material, thickness and end use industries.

- By Material

On the basis of material, Polyamide (PA), Polyethylene Terephthalate (PET), and Others.Polyethylene (PE) dominated the market with the largest revenue share of 45.9% in 2024, attributed to its excellent moisture resistance, flexibility, and cost-effectiveness. PE-based films are widely used across construction and packaging applications, especially as under-slab barriers and flexible packaging materials. Their ease of manufacturing, recyclability, and availability in various thicknesses further drive their adoption globally.

Polyamide (PA) is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior gas barrier properties, high thermal resistance, and growing demand in high-performance applications such as food packaging and automotive components. PA’s ability to retain barrier properties even under high humidity and temperature makes it increasingly favorable for specialized industrial uses.

- By Thickness

On the basis of thickness,.The 5 mil – 10 mil segment dominated the market with the largest revenue share of 38.4% in 2024, primarily due to its optimal balance between flexibility, durability, and barrier effectiveness. This thickness range is widely preferred in building & construction applications, including vapor retarders in walls and flooring, as well as in packaging for medium-barrier needs.

The 10 mil – 15 mil segment is projected to witness the fastest CAGR from 2025 to 2032, as demand grows for more robust barrier films capable of withstanding harsh environments and higher mechanical stress. These films are increasingly adopted in industrial and heavy-duty packaging, where moisture protection and long-term durability are critical.

- By End Use Industry

On the basis of end use industry, The Building & Construction segment held the largest market revenue share of 41.3% in 2024, driven by rising demand for moisture-resistant materials in both residential and commercial construction. Vapor barrier films are extensively used in flooring systems, foundation walls, and insulation layers to prevent moisture ingress, enhance structural integrity, and meet energy efficiency codes.

The Pharmaceuticals & Healthcare segment is expected to register the fastest CAGR from 2025 to 2032, due to stringent regulations on packaging and storage, increasing demand for moisture-sensitive products, and the rise in healthcare infrastructure. High-barrier films ensure product safety and shelf life, particularly in packaging for tablets, capsules, and sensitive medical devices.

Global Vapor Barrier Films Market Regional Analysis

- North America dominated the vapor barrier films market with the largest revenue share of 38.7% in 2024, driven by rising construction activities, rapid urbanization, and increased demand for effective moisture control solutions across key industries such as packaging, electronics, and infrastructure.

- Consumers and industries in the region prioritize vapor barrier films for their ability to enhance product longevity, maintain structural integrity, and comply with evolving quality standards in both residential and industrial applications.

- This strong demand is further supported by growing disposable incomes, expanding manufacturing capabilities, and increased investment in infrastructure development. The widespread use of vapor barrier films in applications such as food packaging, electronics protection, and construction insulation continues to establish the material as an essential component in modern development strategies across Asia-Pacific.

U.S. Vapor Barrier Films Market Insight

The U.S. vapor barrier films market captured the largest revenue share of 79% in North America in 2024, driven by rising demand for energy-efficient and moisture-resistant building materials. With stringent building codes and an increased emphasis on sustainable construction practices, vapor barrier films have become essential in residential and commercial projects. The growth of green building initiatives and the widespread use of vapor barriers in infrastructure, packaging, and industrial applications are also key factors. Additionally, the presence of established manufacturers and innovations in multi-layer film technology are supporting continued market expansion in the U.S.

Europe Vapor Barrier Films Market Insight

The Europe vapor barrier films market is projected to grow at a substantial CAGR during the forecast period, supported by strict environmental regulations, increased construction activity, and rising demand for effective moisture control solutions. Countries across Europe are emphasizing sustainable construction and energy efficiency, where vapor barrier films play a crucial role in improving insulation and reducing energy consumption. Moreover, the expansion of the food and electronics packaging industries across the region contributes to the growing use of high-performance barrier films. Renovation of older infrastructure and growing awareness of vapor barriers' role in long-term structural integrity further drive adoption.

U.K. Vapor Barrier Films Market Insight

The U.K. vapor barrier films market is expected to grow at a noteworthy CAGR throughout the forecast period, supported by evolving building regulations aimed at reducing energy consumption and enhancing indoor environmental quality. The increasing need for damp-proof solutions in both new construction and renovation of heritage buildings is fueling demand. Additionally, the growth of the e-commerce packaging sector and a strong focus on recyclable materials are driving innovations in vapor barrier film production. The U.K. market is particularly inclined toward advanced multilayer barrier technologies that support both performance and sustainability goals.

Germany Vapor Barrier Films Market Insight

The Germany vapor barrier films market is forecasted to expand at a considerable CAGR during the forecast period, propelled by strong growth in the construction and automotive sectors. Germany’s focus on precision engineering and high-quality building practices has elevated the importance of vapor barriers in ensuring long-term durability and energy efficiency. The market benefits from widespread adoption of sustainable building certifications such as DGNB and Passive House standards. Furthermore, Germany’s leadership in eco-conscious product development supports increased demand for recyclable and bio-based vapor barrier films across various industrial applications.

Asia-Pacific Vapor Barrier Films Market Insight

The Asia-Pacific vapor barrier films market is poised to grow at the fastest CAGR of 23.5% from 2025 to 2032, driven by rapid urbanization, industrial expansion, and infrastructure development in countries like China, India, and Southeast Asia. Rising awareness of moisture-related damage in buildings and packaged goods is boosting demand for vapor barrier solutions. Government investments in affordable housing, smart city projects, and modern logistics and packaging systems are creating vast growth opportunities. Additionally, APAC’s position as a global manufacturing hub has spurred local production of cost-effective vapor barrier films, accelerating market penetration across both developed and emerging economies.

Japan Vapor Barrier Films Market Insight

The Japan vapor barrier films market is witnessing steady growth due to the country’s advanced construction techniques, strict building standards, and demand for long-lasting, energy-efficient materials. Japanese consumers and businesses prioritize quality and reliability, leading to increased use of high-performance vapor barriers in both residential and commercial sectors. Moreover, the growing electronics and food packaging industries—where moisture control is critical—are driving the need for technically advanced multilayer films. Japan’s emphasis on sustainability and smart infrastructure continues to encourage the integration of vapor barrier films in modern construction and manufacturing.

China Vapor Barrier Films Market Insight

The China vapor barrier films market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s booming construction sector, extensive industrialization, and strong packaging demand. China’s rapid urban growth and aggressive development of infrastructure, housing, and commercial spaces create significant demand for moisture control materials. The nation also leads in the production and consumption of flexible packaging, where vapor barrier films are widely used for food, electronics, and pharmaceuticals. Government initiatives promoting green construction, alongside a large domestic manufacturing base, continue to propel market expansion.

Global Vapor Barrier Films Market Share

The vapor barrier films industry is primarily led by well-established companies, including:

- DuPont de Nemours, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Saint-Gobain (France)

- BASF SE (Germany)

- Raven Industries, Inc. (U.S.)

- Poly-America, L.P. (U.S.)

- The 3M Company (U.S.)

- GCP Applied Technologies Inc. (U.S.)

- Cosella-Dörken Products Inc. (Canada)

- Sika AG (Switzerland)

- Arkema Group (France)

- Clariant AG (Switzerland)

- Kuraray Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Nan Ya Plastics Corporation (Taiwan)

- SKC Co., Ltd. (South Korea)

- RKW Group (Germany)

- Inteplast Group (U.S.)

- Bolloré Group (France)

What are the Recent Developments in Global Vapor Barrier Films Market?

- In May 2023, Berry Global Inc., a leading manufacturer of engineered materials, announced the expansion of its production capacity for high-performance vapor barrier films at its U.S. facility. This investment aims to meet the rising demand in the construction and packaging sectors for moisture-resistant and energy-efficient materials. The expanded capabilities are expected to improve lead times and support the company’s commitment to sustainability through the production of recyclable and lightweight film solutions.

- In April 2023, BASF SE introduced a new range of eco-friendly multilayer vapor barrier films under its Ultramid® brand, targeting applications in food packaging and pharmaceutical industries. The new films offer enhanced oxygen and moisture resistance while aligning with environmental compliance standards in Europe and North America. This innovation highlights BASF's strategy to merge high-performance material science with circular economy principles.

- In March 2023, Saint-Gobain launched Vario® XtraProtect, a next-generation vapor barrier membrane designed specifically for passive and energy-efficient buildings. The solution features adaptive permeability, enabling it to respond to varying humidity levels and prevent condensation within wall assemblies. This product launch reinforces Saint-Gobain’s role in advancing sustainable construction and improving indoor air quality.

- In February 2023, RKW Group unveiled a new line of recyclable polyethylene-based vapor barrier films at the International Building & Construction Show in Germany. These films are designed to serve both residential and commercial construction sectors, offering excellent puncture resistance and long-term durability. RKW’s innovation supports the European Union’s directives on sustainable building practices and waste reduction.

- In January 2023, DuPont de Nemours, Inc. announced a strategic collaboration with a major U.S.-based homebuilder to integrate Tyvek® vapor barrier films into large-scale residential developments across the Midwest. The initiative aims to enhance building envelope performance, improve energy efficiency, and reduce moisture-related issues. This partnership showcases DuPont’s commitment to driving scalable, science-based solutions in modern construction.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vapor Barrier Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vapor Barrier Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vapor Barrier Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.