Global Variable Rate Technology Market

Market Size in USD Billion

CAGR :

%

USD

2.15 Billion

USD

4.45 Billion

2024

2032

USD

2.15 Billion

USD

4.45 Billion

2024

2032

| 2025 –2032 | |

| USD 2.15 Billion | |

| USD 4.45 Billion | |

|

|

|

|

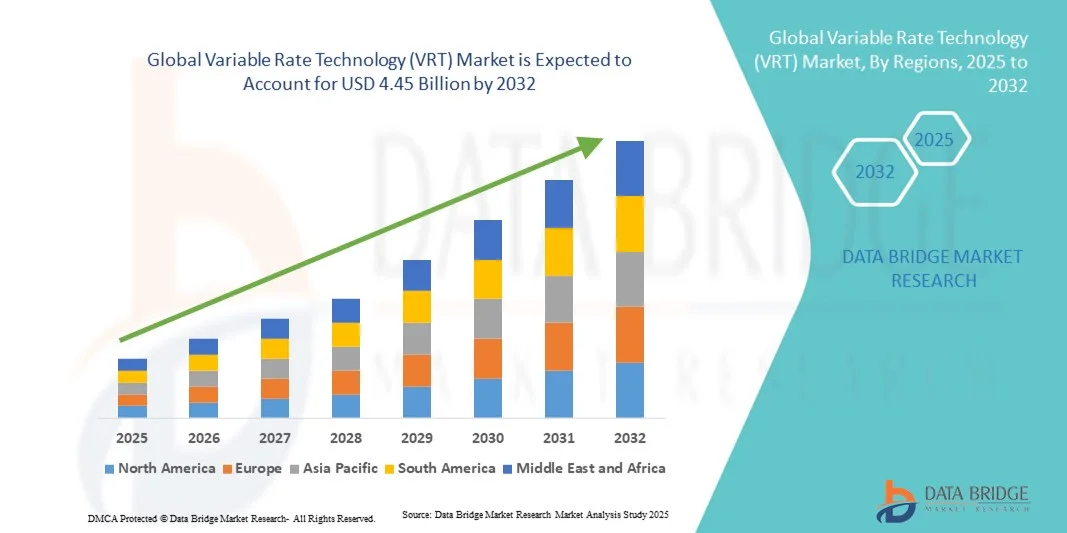

What is the Global Variable Rate Technology (VRT) Market Size and Growth Rate?

- The global variable rate technology (VRT) market size was valued at USD 2.15 billion in 2024 and is expected to reach USD 4.45 billion by 2032, at a CAGR of 9.50% during the forecast period

- The variable rate technology (VRT) market is such asly to gain growth, due to the better efficiency and productivity through improved crop yields and field quality. Also the growing favorable government initiative for the adoption of modern agricultural techniques is expected to drive the market for variable rate technology (VRT)

- Moreover factors such as the various government regulations, enhanced efficiency & productivity and with the enhanced crop yields with increase in average age of farmers in developed regions are the key determinants fueling the growth of the target market

What are the Major Takeaways of Variable Rate Technology (VRT) Market?

- The high initial capital investment and dearth of technical awareness and understanding regarding advantages of VRT over traditional agricultural practices will curb the growth of the variable rate technology (VRT) market, whereas the lack of data management practices for productive utilization of VRT in agriculture have the potential to challenge the growth of growth of the target market

- Moreover, the rapid increase in average age of farmers in developed countries is also projected to thrust the use of variable rate technology (VRT) in the forecast period

- North America dominated the variable rate technology (VRT) market with the largest revenue share of 44.2% in 2024, driven by strong adoption of precision agriculture technologies, advanced farm equipment, and government initiatives promoting sustainable farming practices

- The Asia-Pacific variable rate technology (VRT) market is expected to grow at the fastest CAGR of 7.15% from 2025 to 2032, driven by rapid technological advancements, population growth, and increasing government support for precision farming in countries such as China, Japan, and India

- The Cereals and Grains segment held the dominant market share of 45.8% in 2024, attributed to the extensive global cultivation of wheat, corn, and rice

Report Scope and Variable Rate Technology (VRT) Market Segmentation

|

Attributes |

Variable Rate Technology (VRT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Variable Rate Technology (VRT) Market?

Integration of IoT and AI for Precision Farming

- A prominent trend in the global variable rate technology (VRT) market is the integration of Internet of Things (IoT) and Artificial Intelligence (AI) to enhance precision, efficiency, and automation in agricultural practices. This synergy allows real-time data collection from sensors, drones, and satellite imagery to optimize fertilizer, seed, and pesticide applications across variable field conditions

- For instance, Trimble Inc. and John Deere have integrated AI-powered decision-making and IoT-based connectivity in their VRT solutions to deliver precise, field-specific input recommendations. These technologies enhance yield potential while reducing input costs and environmental impact

- The growing use of AI algorithms enables predictive analysis and autonomous decision-making, improving accuracy in soil mapping, moisture detection, and crop monitoring. Farmers can now access real-time data insights and automate machinery adjustments remotely through connected systems

- In addition, IoT integration enables seamless communication between sensors, tractors, and cloud-based platforms, creating a smart farming ecosystem. This interoperability supports better resource management, leading to increased sustainability and profitability

- Companies such as AGCO Corporation and Raven Industries, Inc. are actively developing IoT-enabled VRT platforms with machine learning capabilities to automate input management and enhance operational efficiency

- This trend reflects a transformative shift toward data-driven agriculture, positioning VRT as a cornerstone technology in modern precision farming and sustainable crop production

What are the Key Drivers of Variable Rate Technology (VRT) Market?

- The rising adoption of precision agriculture practices and the need to optimize input utilization are major drivers of the VRT market. Farmers are increasingly focusing on maximizing productivity while minimizing waste and environmental footprint

- For instance, in February 2024, Lindsay Corporation launched a new IoT-based irrigation VRT system designed to deliver precise water management, improving both yield and resource efficiency

- The growing global population and increasing food demand are accelerating the use of VRT solutions that enable farmers to enhance output using data analytics and automation.

- Supportive government initiatives and subsidies promoting smart agriculture technologies, especially in North America, Europe, and Asia-Pacific, are further propelling adoption

- In addition, the integration of GPS-guided equipment and cloud-based analytics is simplifying field operations, making VRT more accessible to medium- and small-scale farmers. The focus on sustainability and cost-efficient resource use continues to drive market growth across developed and emerging regions

Which Factor is Challenging the Growth of the Variable Rate Technology (VRT) Market?

- The high initial cost of implementation and lack of technical expertise among farmers remain significant barriers to VRT adoption. Advanced systems require expensive sensors, controllers, and GPS-guided equipment, which can limit adoption among small-scale producers

- For instance, many farmers in developing regions still rely on manual farming practices due to the high investment and limited awareness about precision technologies such as VRT

- Data privacy and interoperability issues between equipment brands and software platforms also challenge widespread integration, leading to inefficiencies and compatibility concerns

- Furthermore, inconsistent internet connectivity in rural areas hampers the real-time data transfer and cloud-based operations that VRT systems rely on

- Companies such as Trimble Inc. and Topcon Corporation are focusing on providing cost-effective, user-friendly, and scalable VRT solutions with enhanced compatibility to address these challenges

- Overcoming these barriers through affordable technology, farmer training programs, and improved digital infrastructure will be crucial for ensuring sustainable growth and mass adoption of Variable Rate Technology worldwide

How is the Variable Rate Technology (VRT) Market Segmented?

The market is segmented on the basis of crop type, farm size, and offering.

- By Crop Type

Based on crop type, the variable rate technology (VRT) market is segmented into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others. The Cereals and Grains segment held the dominant market share of 45.8% in 2024, attributed to the extensive global cultivation of wheat, corn, and rice. High demand for staple foods and the need to maximize yield in large-scale farms drive the use of precision farming technologies in this segment. VRT enables optimal fertilizer, seed, and pesticide distribution, ensuring consistent productivity and resource efficiency.

The Fruits and Vegetables segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by the increasing adoption of high-value crop farming. Farmers growing perishable and export-oriented crops are increasingly integrating VRT for better quality control, disease management, and precise nutrient application, enhancing both yield quality and profitability.

- By Farm Size

On the basis of farm size, the variable rate technology (VRT) market is divided into Large Farms, Mid-Size Farms, and Small Farms. The Large Farms segment accounted for the largest market revenue share of 51.3% in 2024, primarily due to their greater financial capacity and advanced machinery adoption. Large-scale producers benefit from economies of scale and use VRT to enhance input efficiency, reduce operational costs, and monitor extensive field data effectively.

The Mid-Size Farms segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing awareness of precision agriculture benefits and government support programs promoting smart farming technologies. Affordable, easy-to-integrate VRT solutions tailored for mid-sized operations are making adoption more accessible, allowing these farms to optimize productivity and remain competitive in an increasingly data-driven agricultural landscape.

- By Offering

Based on offering, the variable rate technology (VRT) market is segmented into Hardware, VRT Software, and VRT Service. The Hardware segment dominated the market in 2024 with the largest revenue share of 47.9%, owing to the high demand for precision equipment such as sensors, GPS devices, and controllers. These hardware components form the backbone of VRT systems, enabling accurate field data collection and automated input management. The continuous advancement in sensor accuracy and machine integration further strengthens this segment’s dominance.

The VRT Software segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the increasing use of data analytics, AI, and cloud-based platforms. Software solutions allow real-time data visualization, predictive modeling, and remote operation of VRT equipment, offering farmers actionable insights for decision-making and resource optimization.

Which Region Holds the Largest Share of the Variable Rate Technology (VRT) Market?

- North America dominated the variable rate technology (VRT) market with the largest revenue share of 44.2% in 2024, driven by strong adoption of precision agriculture technologies, advanced farm equipment, and government initiatives promoting sustainable farming practices. The region’s well-established agricultural infrastructure and the presence of key market players such as John Deere, Trimble Inc., and AGCO Corporation are significantly boosting market penetration

- Farmers in North America increasingly value the data-driven precision and input optimization provided by VRT systems, enhancing productivity and profitability while minimizing environmental impact

- This widespread adoption is further supported by technological maturity, high farm mechanization levels, and increased investment in IoT-enabled agriculture. Together, these factors make North America the leading region for the global VRT market

U.S. Variable Rate Technology (VRT) Market Insight

The U.S. variable rate technology (VRT) market captured the largest revenue share of 72% in 2024 within North America, driven by the rapid adoption of smart farming technologies and automation in agriculture. U.S. farmers are leveraging GPS-guided machinery, drones, and AI-based analytics to improve input efficiency and yield management. The rising trend of digital farming platforms, supported by government programs such as the USDA’s precision agriculture incentives, is fostering significant market growth. Moreover, strong collaborations between agri-tech companies and research institutions are accelerating innovation in real-time soil sensing, fertilizer management, and seeding VRT solutions, consolidating the U.S. as a global leader in precision agriculture adoption.

Europe Variable Rate Technology (VRT) Market Insight

The Europe variable rate technology (VRT) market is expected to grow at a steady CAGR during the forecast period, fueled by the region’s focus on sustainable agriculture and compliance with the EU’s Common Agricultural Policy (CAP) promoting smart farming practices. Increasing emphasis on reducing chemical usage and optimizing resources has driven farmers toward precision-based solutions such as VRT. The market is witnessing strong traction across France, Germany, and Spain, where advanced agricultural equipment and data-driven technologies are being integrated into both small and large-scale farms. The use of satellite imagery, drones, and soil sensors to guide variable input applications is becoming increasingly common, supported by subsidies for smart agriculture adoption.

U.K. Variable Rate Technology (VRT) Market Insight

The U.K. variable rate technology (VRT) market is anticipated to grow at a substantial CAGR during the forecast period, driven by the increasing adoption of digital farming practices and a strong focus on environmental sustainability. Farmers are adopting VRT systems to meet regulatory goals for emission reduction and efficient resource utilization. In addition, the integration of VRT with AI-powered analytics platforms and cloud-based farm management tools is enhancing crop yield forecasting and cost management. The U.K.’s growing investment in agritech startups and the modernization of its agricultural infrastructure are expected to sustain market expansion through 2032.

Germany Variable Rate Technology (VRT) Market Insight

The Germany variable rate technology (VRT) market is projected to expand at a considerable CAGR during the forecast period, supported by the country’s strong industrial base, advanced automation capabilities, and focus on data-driven agriculture. German farmers are rapidly adopting precision technologies that align with the nation’s sustainability goals and energy efficiency standards. In addition, partnerships between agri-tech companies and research organizations are promoting the use of VRT in optimizing fertilizer and pesticide usage. The integration of AI, IoT, and GIS-based platforms within farm operations is enabling greater accuracy and productivity, reinforcing Germany’s position as a frontrunner in Europe’s precision agriculture landscape.

Which Region is the Fastest Growing in the Variable Rate Technology (VRT) Market?

The Asia-Pacific variable rate technology (VRT) market is expected to grow at the fastest CAGR of 7.15% from 2025 to 2032, driven by rapid technological advancements, population growth, and increasing government support for precision farming in countries such as China, Japan, and India. Rising awareness of resource efficiency and the need to boost crop productivity amid shrinking arable land are accelerating adoption. The region’s emergence as a manufacturing hub for VRT components and equipment has also improved affordability and accessibility for small and medium-scale farmers.

Japan Variable Rate Technology (VRT) Market Insight

The Japan variable rate technology (VRT) market is witnessing robust growth driven by the country’s technological innovation, aging agricultural workforce, and demand for automation in farming. Japanese farmers are adopting AI-integrated VRT systems for irrigation and fertilizer management to enhance operational efficiency and crop quality. Integration of VRT with robotics and smart sensors is also gaining momentum, addressing labor shortages while maintaining productivity. The government’s initiatives promoting smart agriculture under the “Society 5.0” vision further support widespread adoption of precision farming technologies across the country.

China Variable Rate Technology (VRT) Market Insight

The China variable rate technology (VRT) market accounted for the largest revenue share within Asia-Pacific in 2024, fueled by rapid urbanization, modernization of agriculture, and growing adoption of smart farm equipment. As one of the world’s largest agricultural producers, China is investing heavily in precision farming solutions to address land degradation and improve yield efficiency. The government’s “Digital Agriculture Strategy” and subsidies for smart farming equipment are propelling adoption of VRT systems across both state-owned and private farms. The presence of domestic manufacturers offering affordable VRT equipment is also expanding accessibility, positioning China as a key growth driver in the regional market.

Which are the Top Companies in Variable Rate Technology (VRT) Market?

The variable rate technology (VRT) industry is primarily led by well-established companies, including:

- Deere & Company (U.S.)

- AGCO Corporation (U.S.)

- Trimble Inc. (U.S.)

- DJI (China)

- KUBOTA Corporation (Japan)

- Crop Quest, Inc. (U.S.)

- Ag Leader Technology (U.S.)

- CROPMETRICS (U.S.)

- Topcon (Japan)

- Raven Industries, Inc. (U.S.)

- Lindsay Corporation (U.S.)

- Yara (Norway)

- AgJunction (U.S.)

- The Climate Corporation (U.S.)

- TeeJet Technologies (U.S.)

- Sentera, Inc. (U.S.)

- AquaSpy Home – AquaSpy (U.S.)

- Valmont Industries, Inc. (U.S.)

- 360 Yield Center (U.S.)

- Iteris, Inc. (U.S.)

What are the Recent Developments in Global Variable Rate Technology (VRT) Market?

- In May 2025, John Deere acquired Sentera to integrate aerial crop data with its See & Spray systems, enhancing precision in weed detection and management frameworks. This acquisition strengthens Deere’s leadership in smart farming and precision agriculture technologies

- In January 2025, Valmont Industries unified four of its platforms into the AgSense 365 app, streamlining variable-rate irrigation management for improved efficiency and crop productivity. This strategic move reinforces Valmont’s position as an innovator in agricultural water management solutions

- In August 2024, EarthOptics and Pattern Ag merged to deliver high-resolution soil data and predictive analytics, enabling more effective variable-rate fertilization and tillage prescriptions. This merger highlights a growing industry focus on data-driven soil health optimization

- In April 2024, AGCO Corporation acquired an 85% stake in Trimble’s agricultural assets and technologies portfolio for USD 2.0 billion in cash, with Trimble retaining a 15% stake. This acquisition enhances AGCO’s portfolio in precision agriculture and variable rate technologies, solidifying its competitive edge in farm automation innovation

- In October 2022, Deere & Company entered a strategic partnership with Iowa State University to advance research and development in precision agriculture technologies, focusing on improving Variable Rate Technology (VRT) solutions through advanced analytics and automation. This collaboration underlines Deere’s ongoing commitment to agricultural innovation and smart farming excellence

- In August 2021, AGCO Corporation introduced Augmenting Planting and High-Speed Planting of Variable Rate in the Massey Ferguson VE Series Planters, improving the precision of input application across diverse farm operations. This product launch showcases AGCO’s dedication to advancing precision planting technologies and strengthening its global brand presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.