Global Vascular Snare Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

2.62 Billion

2024

2032

USD

1.68 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Vascular Snare Market Size

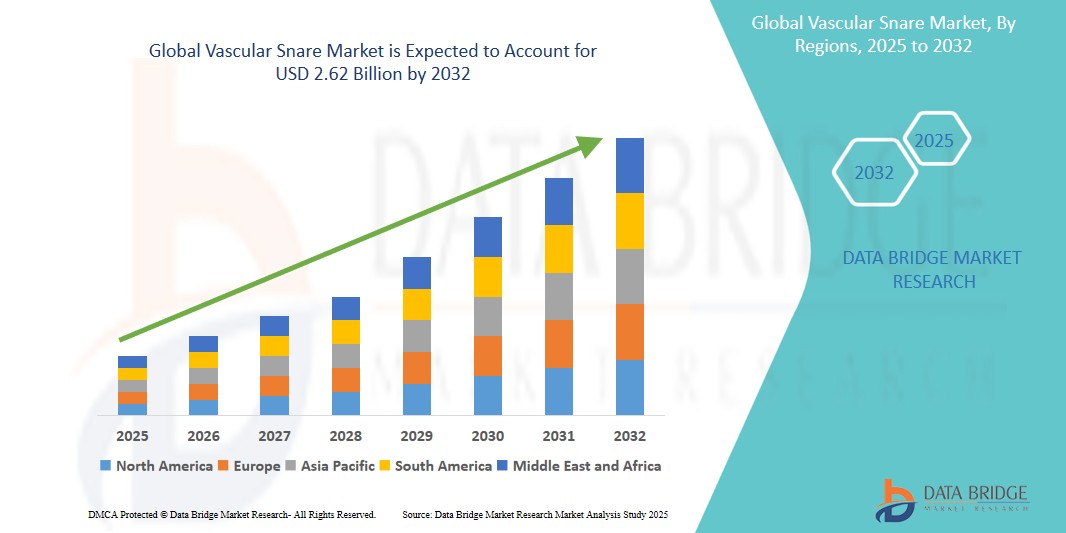

- The global vascular snare market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 2.62 billion by 2032, at a CAGR of 5.75% during the forecast period

- This growth is driven by factors such as rising prevalence of cardiovascular diseases (CVDS) and increasing demand for minimally invasive procedures

Vascular Snare Market Analysis

- Vascular snares are essential tools in interventional procedures, primarily used to retrieve foreign bodies such as dislodged catheters, embolized coils, or guide wires from the vascular system. These devices play a critical role in endovascular surgeries, ensuring the safe extraction of obstructive or misplaced devices during minimally invasive interventions.

- The demand for vascular snares is significantly driven by the rising prevalence of cardiovascular and peripheral vascular diseases, as well as the increasing adoption of minimally invasive procedures across hospitals and specialty clinics. Advancements in catheter-based technologies and multi-loop snare designs have further boosted their usage, offering enhanced flexibility, control, and procedural safety

- North America is expected to dominate the vascular snare market due to its well-established healthcare infrastructure, increasing burden of vascular disorders, and early adoption of advanced interventional tools. Moreover, strong investment in R&D and the presence of key players such as Medtronic and Cook Medical support market growth in the region

- Asia-Pacific is projected to be the fastest-growing region in the vascular snare market during the forecast period, owing to the rising incidence of chronic diseases, increasing access to healthcare facilities, and growing awareness among physicians about minimally invasive retrieval techniques. Countries such as China, India, and Japan are emerging as key markets due to healthcare modernization and government initiatives focused on cardiovascular health

- Inferior vena cava segment is expected to dominate the market with a market share of 56.22% due to its critical role in cardiovascular surgeries, particularly in procedures involving embolized coils, vena cava filters, and other foreign bodies.

Report Scope and Vascular Snare Market Segmentation

|

Attributes |

Vascular Snare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vascular Snare Market Trends

“Technological Advancements and Imaging Integration Driving Innovation in the Vascular Snare Market”

- One of the most prominent trends in the vascular snare market is the technological evolution of snare designs and catheter compatibility, enhancing precision and safety in complex endovascular procedures. Manufacturers are now developing multi-loop snares, steerable retrieval systems, and ultra-flexible materials to navigate tortuous vascular paths more effectively

- Another key trend is the integration of imaging technologies—such as real-time fluoroscopy and intravascular ultrasound (IVUS)—to improve the accuracy of foreign body retrieval and reduce procedural risks. These imaging-guided snare procedures are especially valuable in high-stakes settings such as neurovascular interventions or peripheral embolization cases

- For instance, advanced snares are now being developed with radiopaque markers and high-torque shaft systems that provide superior visibility and control during image-guided procedures. This is particularly beneficial when retrieving embolized coils, catheter fragments, or misplaced devices in intricate vascular territories

- These innovations are transforming the landscape of minimally invasive vascular procedures, reducing procedural times, improving safety, and driving the demand for next-generation vascular snares across interventional cardiology, radiology, and peripheral vascular specialties

Vascular Snare Market Dynamics

Driver

“Increasing Prevalence of Vascular Disorders and Foreign Body Retrieval Procedures”

- The rising incidence of vascular diseases, such as deep vein thrombosis, pulmonary embolism, and peripheral artery disease, is significantly driving the demand for vascular snares. These snares are essential for retrieving dislodged catheters, stents, or embolized coils, ensuring procedural success and patient safety

- In addition, the growing number of interventional cardiology and radiology procedures globally contributes to market expansion, as snares play a crucial role in minimally invasive vascular surgeries

For instance,

- According to the American Heart Association (AHA), cardiovascular disease remains the leading cause of death globally, accounting for nearly 17.9 million deaths annually. With such a high burden, demand for retrieval devices such as vascular snares is expected to grow in tandem

- The rising global burden of vascular diseases and increasing interventional procedures are driving demand for vascular snares as essential tools for safe and effective foreign body retrieval

Opportunity

“Integration of Advanced Imaging and Navigation Technologies”

- Emerging technologies such as intravascular ultrasound (IVUS), fluoroscopy-guided retrieval, and real-time 3D navigation systems are offering major growth opportunities for vascular snares. These tools enable more accurate retrieval, especially in complex and tortuous vascular anatomies

- In addition, the development of smart snares with enhanced visibility (e.g., radiopaque markers) and steerable delivery systems is boosting precision and safety in foreign body removal

For instance,

- Companies are investing in hybrid snare systems that integrate with advanced imaging platforms, reducing procedural times and complications in high-risk retrieval cases such as embolized vena cava filters or broken catheters

- Emerging technologies such as IVUS, fluoroscopy-guided retrieval, and smart snares with advanced imaging are enhancing precision, safety, and efficiency in vascular snare procedures, offering significant growth opportunities

Restraint/Challenge

“High Cost and Limited Access in Developing Regions”

- The high cost of advanced vascular snare systems and supporting imaging equipment presents a significant barrier, particularly in low- and middle-income countries

- Smaller hospitals and clinics with limited budgets may struggle to invest in these tools, especially where reimbursement systems are weak or absent, leading to underutilization and reliance on outdated retrieval methods

For instance,

- As noted in an industry report by Transparency Market Research (2023), many emerging economies still lack the infrastructure to support image-guided endovascular retrieval procedures, delaying the adoption of vascular snares and limiting procedural safety and effectiveness

- The high cost of advanced vascular snare systems and imaging equipment, particularly in low- and middle-income countries, hampers adoption and limits procedural safety and effectiveness

Vascular Snare Market Scope

The market is segmented on the basis of product and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

In 2025, the inferior Venna cava is projected to dominate the market with a largest share in application segment

The inferior Vena cava segment is expected to dominate the vascular snare market with the largest share of 56.22% in 2025 due to its critical role in cardiovascular surgeries, particularly in procedures involving embolized coils, vena cava filters, and other foreign bodies.

The 3 loop type is expected to account for the largest share during the forecast period in product market

In 2025, the 3 loop type is expected to dominate the market with the largest market share of 51.31% due the 3-loop type vascular snare is the most widely used, accounting for the largest s hare of the market. Its design is favoured for its versatility and effectiveness in a range of retrieval procedures.

Vascular Snare Market Regional Analysis

“North America Holds the Largest Share in the Vascular Snare Market”

- North America dominates the vascular snare market due to advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the strong presence of key market players.

- U.S. holds a significant share in the market, driven by the increasing demand for minimally invasive vascular procedures, the growing prevalence of vascular diseases such as deep vein thrombosis, pulmonary embolism, and peripheral artery disease, and the continuous advancements in retrieval techniques.

- The availability of well-established reimbursement policies and the increasing investments in research & development by leading medical device companies further strengthen the market.

- In addition, rising healthcare expenditure and a high adoption rate of minimally invasive techniques across North America are contributing to the expansion of the vascular snare market

“Asia-Pacific is Projected to Register the Highest CAGR in the Vascular Snare Market”

- Asia-Pacific is expected to witness the highest growth rate in the vascular snare market, driven by the rapid expansion of healthcare infrastructure, increasing awareness about vascular diseases, and rising surgical volumes.

- China, India, and Japan are emerging as key markets due to their large populations and the growing aging demographic that is more susceptible to vascular diseases and related complications, such as deep vein thrombosis and pulmonary embolism.

- Japan, with its advanced medical technology and increasing number of interventional cardiologists and radiologists, remains a critical market for vascular snare systems. The country continues to lead in the adoption of premium medical devices, ensuring enhanced precision and safety in vascular interventions.

- China and India, with their rapidly growing healthcare sectors and rising rates of vascular disorders, are seeing increased investments in modern interventional systems. These investments, coupled with the increasing presence of global medical device manufacturers, contribute to the overall growth in the region

Vascular Snare Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Argon Medical Devices (U.S.)

- Cook (U.S.)

- Merit Medical Systems (U.S.)

- Nordson Corporation (U.S.)

- Medtronic (Ireland)

- pfm medical gmbh (Germany)

- Aspen Surgical Products, Inc. (U.S.)

- Radius Medical, LLC (U.S.)

- Teleflex Incorporated (U.S.)

- Lifetech Scientific Corporation (China)

- Medico's Hirata Inc (Japan)

- Vascular Innovations (Thailand)

- OSYPKA AG (Germany)

- Meliora Medtech (Sweden)

Latest Developments in Global Vascular Snare Market

- In February 2025, Teleflex Incorporated announced it has entered into a definitive agreement to acquire substantially all of the vascular intervention business of BIOTRONIK SE & Co. KG.

- In June 2024, SYNDEO Medical introduced the SYNDEOSnare Endovascular Retrieval System, a single-loop, nitinol-constructed endovascular snare platform designed for peripheral and coronary applications. Initially launched in the European Union and CE-mark jurisdictions, the system includes 15mm and 20mm snares, with additional sizes under development

- In April 2021, Argon Medical Devices, Inc. announced the U.S. commercial launch of its Halo Single-Loop Snare Kits. Designed to enhance both accuracy and reliability, the Halo Single-Loop Snare Kit assists in the retrieval and manipulation of foreign objects from the cardiovascular system or hollow viscus. It aims to improve procedural efficiency by incorporating a reusable, peel-away insertion tool for easy assembly and offering 15° angulation on the snare catheter to provide better directional control.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.