Global Vascular Surgery And Endovascular Procedures Market

Market Size in USD Billion

CAGR :

%

USD

2.83 Billion

USD

4.69 Billion

2024

2032

USD

2.83 Billion

USD

4.69 Billion

2024

2032

| 2025 –2032 | |

| USD 2.83 Billion | |

| USD 4.69 Billion | |

|

|

|

|

Vascular Surgery and Endovascular Procedures Market Size

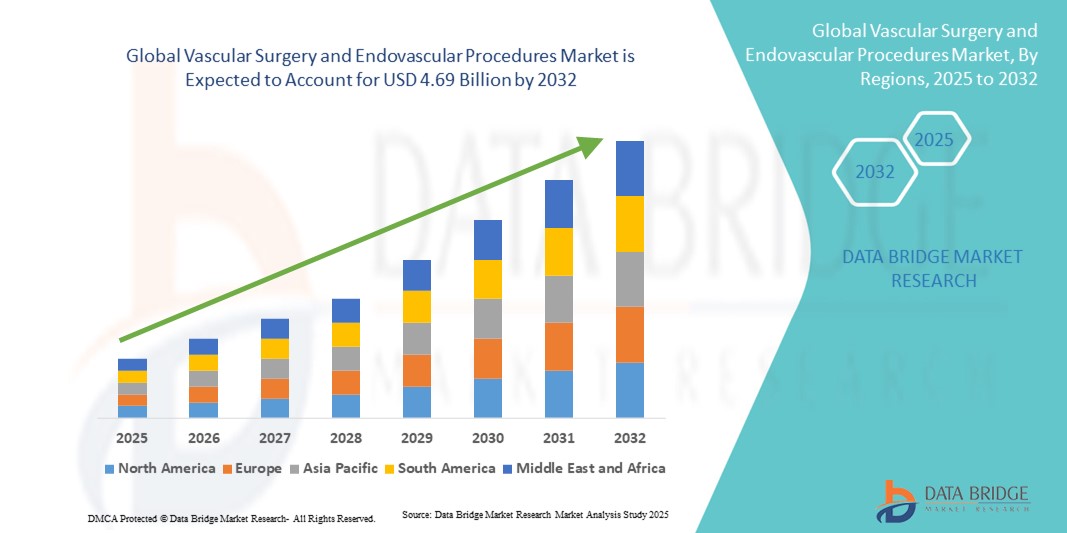

- The global vascular surgery and endovascular procedures market size was valued at USD 2.83 billion in 2024 and is expected to reach USD 4.69 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of vascular diseases, an aging population, and growing preference for minimally invasive procedures, leading to higher adoption of advanced surgical and endovascular solutions in both hospital and outpatient settings

- Furthermore, rising demand for safer, efficient, and technologically advanced treatment options is positioning endovascular and hybrid surgical procedures as the preferred choice for vascular care. These converging factors are accelerating the uptake of these procedures, thereby significantly boosting the industry's growth

Vascular Surgery and Endovascular Procedures Market Analysis

- Vascular surgery and endovascular procedures, encompassing both minimally invasive and traditional surgical interventions for treating vascular diseases, are increasingly vital components of modern healthcare due to their improved patient outcomes, reduced recovery times, and integration with advanced imaging and diagnostic technologies in both hospital and outpatient settings

- The escalating demand for vascular surgery and endovascular procedures is primarily fueled by the increasing prevalence of vascular diseases, an aging global population, and a growing preference for minimally invasive treatment options. Technological advancements in endovascular devices and surgical techniques further contribute to the market's growth

- North America dominated the vascular surgery and endovascular procedures market with the largest revenue share of 34.5% in 2024, characterized by advanced healthcare infrastructure, high procedural volumes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in endovascular interventions, driven by innovations from both established medical device companies and startups focusing on stents, grafts, and hybrid operating room technologies

- Asia-Pacific is expected to be the fastest growing region in the vascular surgery and endovascular procedures market during the forecast period due to rising healthcare investments, expanding access to advanced vascular treatments, and increasing awareness of early diagnosis and intervention

- Endovascular repair segment dominated the vascular surgery and endovascular procedures market with a market share of 57.5% in 2024, driven by its minimally invasive nature, reduced hospital stays, and established efficacy in treating a wide range of vascular conditions

Report Scope and Vascular Surgery and Endovascular Procedures Market Segmentation

|

Attributes |

Vascular Surgery and Endovascular Procedures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vascular Surgery and Endovascular Procedures Market Trends

Integration of Artificial Intelligence in Vascular Care

- A significant and accelerating trend in the global vascular surgery and endovascular procedures market is the integration of artificial intelligence (AI) in diagnostic imaging, procedural planning, and post-operative care. This fusion of technologies is significantly enhancing clinical decision-making and patient outcomes

- For instance, AI algorithms are being utilized to analyze vascular imaging data, aiding in the detection of abnormalities such as aneurysms and stenosis, thereby improving diagnostic accuracy and treatment planning

- AI integration enables features such as predictive analytics for patient outcomes, personalized treatment plans, and real-time intraoperative guidance, thereby enhancing the precision and effectiveness of procedures

- The seamless integration of AI with existing medical imaging systems facilitates centralized control over various aspects of vascular care, creating a unified and automated treatment experience

- This trend towards more intelligent, intuitive, and interconnected vascular care systems is fundamentally reshaping clinical practices and patient expectations

- The demand for AI-integrated vascular surgery solutions is growing rapidly across both public and private healthcare sectors, as institutions increasingly prioritize technological advancements and improved patient outcomes

Vascular Surgery and Endovascular Procedures Market Dynamics

Driver

Increasing Prevalence of Vascular Diseases and Aging Population

- The escalating prevalence of vascular diseases, such as peripheral artery disease, aortic aneurysms, and deep vein thrombosis, coupled with the aging global population, is a significant driver for the heightened demand for vascular surgery and endovascular procedures

- For instance, the global incidence of aortic aneurysms is rising, leading to an increased need for surgical interventions and endovascular repairs

- As the population ages, the incidence of age-related vascular conditions increases, thereby driving the demand for preventive and corrective vascular procedures

- Advancements in minimally invasive surgical techniques and endovascular devices are improving patient outcomes and reducing recovery times, further propelling the adoption of these procedures

- The growing awareness and early detection of vascular diseases are leading to more patients seeking timely interventions, thereby expanding the market

- Healthcare institutions are investing in specialized vascular care units and training programs to address the rising demand, thereby fostering market growth

Restraint/Challenge

High Procedure Costs and Limited Access in Low-Resource Settings

- The high costs associated with advanced vascular surgeries and endovascular procedures, including specialized equipment and skilled personnel, pose a significant challenge to broader market penetration, particularly in low-resource settings

- For instance, the cost of endovascular stent grafts and hybrid operating room setups can be prohibitively expensive for healthcare facilities in developing regions

- Limited access to specialized training and education in advanced vascular techniques hinders the widespread adoption of these procedures in underserved areas

- The disparity in healthcare infrastructure and resource allocation between urban and rural regions affects the availability and quality of vascular care services

- Regulatory hurdles and reimbursement challenges for new vascular technologies can delay their introduction and adoption in certain markets

- Addressing these challenges through policy reforms, international collaborations, and investment in healthcare infrastructure is crucial for sustained market growth

Vascular Surgery and Endovascular Procedures Market Scope

The market is segmented on the basis of procedure, application, and vascular surgery products.

- By Procedure

On the basis of procedure, the vascular surgery and endovascular procedures market is segmented into aneurysm repair, bypass surgery-peripheral, carotid angioplasty and stenting, carotid endarterectomy, dialysis access surgery, endovascular repair, stent graft, thromboendarterectomy, thrombolytic therapy, and varicose vein treatment. The endovascular repair segment dominated the market with the largest revenue share of 57.5% in 2024, driven by its minimally invasive nature, reduced hospital stays, and faster recovery compared to traditional open surgeries. Patients and physicians increasingly prefer endovascular repair for treating conditions such as abdominal aortic aneurysms and peripheral artery disease. The dominance of this procedure is further strengthened by advancements in imaging technologies, real-time intraoperative guidance, and the growing availability of hybrid operating rooms. Hospitals and clinics are increasingly adopting endovascular repair as the standard of care for suitable patients due to improved safety and patient outcomes.

The stent graft segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its effectiveness in reinforcing weakened blood vessels and preventing rupture. Technological improvements in graft materials, enhanced delivery systems, and minimally invasive deployment techniques are driving adoption. Rising awareness of preventive vascular care, early diagnosis, and favorable clinical outcomes are further contributing to the rapid growth of stent graft procedures in both developed and emerging markets.

- By Application

On the basis of application, the vascular surgery and endovascular procedures market is segmented into government hospitals, private hospitals and surgical clinics, and academic and research institutes. The government hospitals segment dominated the market in 2024 due to public funding, wide accessibility, and the high volume of patients requiring vascular interventions. Government hospitals often provide treatment at lower costs, making them a primary provider of vascular care in many regions. They also serve as centers for training healthcare professionals and conducting clinical trials, contributing to procedural adoption. Moreover, government support programs and health initiatives targeting cardiovascular diseases further reinforce the dominance of this segment.

The private hospitals and surgical clinics segment is anticipated to witness the fastest growth from 2025 to 2032, driven by the expansion of healthcare infrastructure, shorter waiting times, and availability of advanced vascular procedures. Private institutions increasingly invest in cutting-edge equipment, specialized vascular units, and minimally invasive surgical solutions, attracting patients seeking quality care. Rising patient awareness, focus on personalized treatments, and growing medical tourism also support the rapid growth of this segment globally.

- By Vascular Surgery Products

On the basis of vascular surgery products, the vascular surgery and endovascular procedures market is segmented into scissors, forceps, needle holders, and scalpels. The scissors segment dominated the market in 2024, driven by their essential role in precision cutting during vascular procedures. Surgeons rely on high-quality scissors for tissue dissection, suture cutting, and safe maneuvering in delicate vascular environments. Continuous advancements in instrument materials, design ergonomics, and durability enhance their adoption across hospitals and surgical centers. Scissors are compatible with both minimally invasive and traditional open procedures, which contributes to their broad usage.

The forceps segment is anticipated to witness the fastest growth from 2025 to 2032 due to increasing demand for instruments that assist in grasping, holding, and manipulating tissues during complex vascular procedures. Innovations in forceps design, including ergonomic handles, specialized tips, and material improvements, make them highly suitable for delicate endovascular and open surgeries. Growing procedural volumes and the need for precision tools in advanced surgeries are further boosting the segment's growth globally.

Vascular Surgery and Endovascular Procedures Market Regional Analysis

- North America dominated the vascular surgery and endovascular procedures market with the largest revenue share of 34.5% in 2024, characterized by advanced healthcare infrastructure, high procedural volumes, and a strong presence of key industry players

- Patients and healthcare providers in the region prioritize minimally invasive and technologically advanced vascular procedures, supported by widespread adoption of imaging systems, hybrid operating rooms, and AI-assisted diagnostics

- This widespread adoption is further supported by high healthcare spending, a skilled medical workforce, and growing awareness of early diagnosis and preventive care, establishing vascular surgery and endovascular procedures as preferred solutions for both public and private healthcare facilities

U.S. Vascular Surgery and Endovascular Procedures Market Insight

The U.S. vascular surgery and endovascular procedures market captured the largest revenue share of 35% in 2024 within North America, fueled by advanced healthcare infrastructure, high procedural volumes, and the presence of leading medical device manufacturers. Patients and providers increasingly prioritize minimally invasive and technologically advanced procedures, including endovascular repairs and hybrid surgeries. The adoption of AI-assisted imaging, hybrid operating rooms, and innovative stent technologies is further propelling market growth. Moreover, increasing awareness of early diagnosis, preventive vascular care, and personalized treatment options is significantly contributing to the expansion of the U.S. market.

Europe Vascular Surgery and Endovascular Procedures Market Insight

The Europe vascular surgery and endovascular procedures market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by a rising prevalence of vascular diseases, stringent healthcare regulations, and increasing demand for minimally invasive interventions. Urbanization and enhanced healthcare infrastructure across major European countries are fostering the adoption of advanced vascular procedures. Hospitals and clinics are increasingly integrating endovascular techniques and hybrid surgical approaches, improving patient outcomes. Europe’s strong emphasis on research, innovation, and clinical trials is further supporting market expansion across residential and commercial healthcare setups.

U.K. Vascular Surgery and Endovascular Procedures Market Insight

The U.K. vascular surgery and endovascular procedures market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of cardiovascular and peripheral artery diseases, demand for advanced surgical solutions, and preference for minimally invasive interventions. In addition, the increase in specialized vascular centers and adoption of hybrid operating rooms are encouraging both public and private healthcare providers to offer endovascular procedures. The U.K.’s advanced medical infrastructure, coupled with growing patient awareness and digital healthcare initiatives, is expected to continue stimulating market growth.

Germany Vascular Surgery and Endovascular Procedures Market Insight

The Germany vascular surgery and endovascular procedures market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare spending, advanced hospital infrastructure, and a focus on innovation and technology in surgical care. The country’s emphasis on minimally invasive procedures, precision imaging, and hybrid surgical approaches promotes adoption across both public and private healthcare settings. Furthermore, Germany’s robust healthcare R&D ecosystem and commitment to improving patient outcomes are key factors driving the uptake of vascular surgeries and endovascular interventions.

Asia-Pacific Vascular Surgery and Endovascular Procedures Market Insight

The Asia-Pacific vascular surgery and endovascular procedures market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising prevalence of vascular diseases, growing healthcare infrastructure, and increasing adoption of minimally invasive procedures in countries such as China, Japan, and India. Government initiatives promoting advanced medical care and early disease detection are accelerating procedural adoption. The expanding number of specialized hospitals, skilled healthcare professionals, and medical device investments are enhancing accessibility to vascular procedures, further fueling market growth.

Japan Vascular Surgery and Endovascular Procedures Market Insight

The Japan vascular surgery and endovascular procedures market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and high demand for minimally invasive treatment options. The integration of AI-assisted imaging, hybrid operating rooms, and advanced endovascular devices is driving adoption. Japan’s emphasis on precision medicine, patient safety, and early diagnosis is encouraging both private and public hospitals to expand vascular surgery capabilities. Moreover, the growing geriatric population is expected to spur demand for easier-to-perform and safer vascular interventions in both residential and hospital care settings.

India Vascular Surgery and Endovascular Procedures Market Insight

The India vascular surgery and endovascular procedures market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rising prevalence of vascular diseases, and increasing adoption of minimally invasive techniques. India’s growing number of specialty hospitals, skilled vascular surgeons, and government initiatives to improve access to advanced healthcare are key factors propelling market growth. The increasing awareness of preventive care, coupled with affordable endovascular devices and procedures, is driving widespread adoption across both private and public hospitals in the country.

Vascular Surgery and Endovascular Procedures Market Share

The vascular surgery and endovascular procedures industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Terumo Corporation (Japan)

- B. Braun SE (Germany)

- Cardinal Health (U.S.)

- Stryker (U.S.)

- Koninklijke Philips N.V., (Netherlands)

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Edwards Lifesciences Corporation (U.S.)

- Cook Medical (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Endologix, Inc. (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Avinger, Inc. (U.S.)

- BIOTRONIK SE & Co. KG (Germany)

- Medicover AB (Sweden)

- Terumo Aortic (U.K.)

What are the Recent Developments in Global Vascular Surgery and Endovascular Procedures Market?

- In June 2025, Northwestern Medicine Palos Hospital launched a new hybrid vascular operating room featuring a ceiling-mounted fluoroscopic/x-ray system with integrated ultrasound, intravascular ultrasound (IVUS), and navigational software. This advanced setup enables complex vascular procedures to be performed with enhanced precision and efficiency

- In May 2025, UC Davis Health introduced a minimally invasive approach for peripheral artery disease (PAD) treatment, utilizing an endovascular technique that uses a patient's own blood vessels to create a bypass around the diseased or blocked area. This procedure aims to improve blood flow and reduce recovery times for PAD patients

- In March 2025, Yale New Haven Health Heart & Vascular Center adopted a new minimally invasive technique called Balloon-assisted translocation of the mitral anterior leaflet (BATMAN) to treat severe mitral regurgitation in high-risk patients. This method uses a catheter with a balloon to create a controlled tear in the heart valve, allowing unimpeded blood flow and reducing the risks associated with traditional open-heart surgery and transcatheter valve replacements

- In July 2024, MarinHealth performed its first vascular surgical procedure for aneurysm repair utilizing advanced AI technology. The surgical team applied Cydar Maps augmented artificial intelligence technology, making them one of the few nationwide capable of using this advanced system

- In December 2023, Houston Methodist's DeBakey Heart and Vascular Center launched the first robotic vascular surgery program in the U.S., combining the minimal invasiveness of endovascular procedures with the durability of open vascular surgery. This initiative aims to enhance precision and reduce recovery times for patients undergoing complex vascular interventions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

5.3 SURGERIES/PROCEDURES IN VOLUMES

5.4 HOSPITALS AND UROLOGIST IN MIDDLE EAST REGION

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY PROCEDURE

17.1 OVERVIEW

17.2 OPEN VASCULAR SURGERY

17.2.1 ANEURYSM REPAIR

17.2.1.1. ABDOMINAL AORTIC ANEURYSM (AAA) REPAIR

17.2.1.2. THORACIC AORTIC ANEURYSM (TAA) REPAIR

17.2.2 BYPASS SURGERY

17.2.2.1. CORONARY ARTERY BYPASS GRAFTING (CABG)

17.2.2.2. PERIPHERAL BYPASS SURGERY

17.2.3 ENDARTERECTOMY

17.2.3.1. CAROTID ENDARTERECTOMY

17.2.3.2. FEMORAL ENDARTERECTOMY

17.2.3.3. AORTIC ENDARTERECTOMY

17.2.4 VASCULAR ACCESS SURGERY

17.2.4.1. ARTERIOVENOUS (AV) FISTULA CREATION

17.2.4.2. AV GRAFT PLACEMENT

17.2.4.3. CENTRAL VENOUS CATHETER (CVC) PLACEMENT

17.2.5 OTHERS

17.3 ENDOVASCULAR PROCEDURES

17.3.1 ANGIOPLASTY

17.3.1.1. BALLOON ANGIOPLASTY

17.3.1.2. CAROTID ARTERY ANGIOPLASTY

17.3.1.3. CEREBRAL ANGIOPLASTY

17.3.1.4. CORONARY ARTERY STENT

17.3.1.5. LASER ANGIOPLASTY

17.3.1.6. PTA OF THE FEMORAL ARTERY

17.3.2 ATHERECTOMY

17.3.2.1. DIRECTIONAL ATHERECTOMY

17.3.2.2. ROTATIONAL ATHERECTOMY

17.3.2.3. LASER ATHERECTOMY

17.3.2.4. ORBITAL ATHERECTOMY

17.3.3 ENDOVASCULAR ANEURYSM REPAIR (EVAR)

17.3.4 THROMBOLYSIS

17.3.5 EMBOLIZATION

17.3.5.1. ARTERIAL EMBOLIZATION

17.3.5.2. CHEMOEMBOLIZATION

17.3.5.3. RADIOEMBOLIZATION

17.3.6 OTHERS

18 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY PRODUCTS

18.1 OVERVIEW

18.2 DEVICES

18.2.1 BALLOONS

18.2.1.1. CUTTING BALLOON ANGIOPLASTY

18.2.1.2. SCORING BALLOON ANGIOPLASTY

18.2.1.3. PLAIN OLD BALLOON ANGIOPLASTY (POBA)

18.2.1.4. DRUG-COATED BALLOONS

18.2.2 STENTS

18.2.2.1. BY TYPE

18.2.2.1.1. BARE STENTS

18.2.2.1.1.1 MARKET VALUE (USD MILLION)

18.2.2.1.1.2 MARKET VALUE (UNITS)

18.2.2.1.1.3 AVERAGE SELLING PRICE (USD)

18.2.2.1.2. DRUG-ELUTING STENTS

18.2.2.1.2.1 BIODEGRADABLE

18.2.2.1.2.1.1. MARKET VALUE (USD MILLION)

18.2.2.1.2.1.2. MARKET VALUE (UNITS)

18.2.2.1.2.1.3. AVERAGE SELLING PRICE (USD)

18.2.2.1.2.2 NON-BIODEGRADABLE

18.2.2.1.2.2.1. MARKET VALUE (USD MILLION)

18.2.2.1.2.2.2. MARKET VALUE (UNITS)

18.2.2.1.2.2.3. AVERAGE SELLING PRICE (USD)

18.2.2.1.3. BIOENGINEERED STENTS

18.2.2.1.3.1 MARKET VALUE (USD MILLION)

18.2.2.1.3.2 MARKET VALUE (UNITS)

18.2.2.1.3.3 AVERAGE SELLING PRICE (USD)

18.2.2.1.4. DUAL THERAPY STENTS

18.2.2.1.4.1 MARKET VALUE (USD MILLION)

18.2.2.1.4.2 MARKET VALUE (UNITS)

18.2.2.1.4.3 AVERAGE SELLING PRICE (USD)

18.2.2.2. BY MATERIAL

18.2.2.2.1. METALLIC MATERIALS

18.2.2.2.1.1 STAINLESS STEEL

18.2.2.2.1.1.1. MARKET VALUE (USD MILLION)

18.2.2.2.1.1.2. MARKET VALUE (UNITS)

18.2.2.2.1.1.3. AVERAGE SELLING PRICE (USD)

18.2.2.2.1.2 COBALT ALLOY METAL

18.2.2.2.1.2.1. MARKET VALUE (USD MILLION)

18.2.2.2.1.2.2. MARKET VALUE (UNITS)

18.2.2.2.1.2.3. AVERAGE SELLING PRICE (USD)

18.2.2.2.1.3 GOLD

18.2.2.2.1.3.1. MARKET VALUE (USD MILLION)

18.2.2.2.1.3.2. MARKET VALUE (UNITS)

18.2.2.2.1.3.3. AVERAGE SELLING PRICE (USD)

18.2.2.2.1.4 TANTALUM

18.2.2.2.1.4.1. MARKET VALUE (USD MILLION)

18.2.2.2.1.4.2. MARKET VALUE (UNITS)

18.2.2.2.1.4.3. AVERAGE SELLING PRICE (USD)

18.2.2.2.1.5 PLATINUM CHROMIUM

18.2.2.2.1.5.1. MARKET VALUE (USD MILLION)

18.2.2.2.1.5.2. MARKET VALUE (UNITS)

18.2.2.2.1.5.3. AVERAGE SELLING PRICE (USD)

18.2.2.2.1.6 NICKEL TITANIUM

18.2.2.2.1.6.1. MARKET VALUE (USD MILLION)

18.2.2.2.1.6.2. MARKET VALUE (UNITS)

18.2.2.2.1.6.3. AVERAGE SELLING PRICE (USD)

18.2.2.2.2. POLYMERS BIOMATERIALS

18.2.2.2.2.1 MARKET VALUE (USD MILLION)

18.2.2.2.2.2 MARKET VALUE (UNITS)

18.2.2.2.2.3 AVERAGE SELLING PRICE (USD)

18.2.2.2.3. NATURAL BIOMATERIALS

18.2.2.2.3.1 MARKET VALUE (USD MILLION)

18.2.2.2.3.2 MARKET VALUE (UNITS)

18.2.2.2.3.3 AVERAGE SELLING PRICE (USD)

18.2.2.3. BY MODE OF DELIVERY

18.2.2.3.1. BALLOON EXPANDABLE STENTS

18.2.2.3.1.1 MARKET VALUE (USD MILLION)

18.2.2.3.1.2 MARKET VALUE (UNITS)

18.2.2.3.1.3 AVERAGE SELLING PRICE (USD)

18.2.2.3.2. SELF EXPANDING STENTS

18.2.2.3.2.1 MARKET VALUE (USD MILLION)

18.2.2.3.2.2 MARKET VALUE (UNITS)

18.2.2.3.2.3 AVERAGE SELLING PRICE (USD

18.2.3 CATHETERS

18.2.3.1. BALLOON DILATATION CATHETERS

18.2.3.1.1. MARKET VALUE (USD MILLION)

18.2.3.1.2. MARKET VALUE (UNITS)

18.2.3.1.3. AVERAGE SELLING PRICE (USD)

18.2.3.2. ANGIOGRAPHY CATHETERS

18.2.3.2.1. MARKET VALUE (USD MILLION)

18.2.3.2.2. MARKET VALUE (UNITS)

18.2.3.2.3. AVERAGE SELLING PRICE (USD)

18.2.3.3. INTRAVASCULAR ULTRASOUND (IVUS) CATHETERS

18.2.3.3.1. MARKET VALUE (USD MILLION)

18.2.3.3.2. MARKET VALUE (UNITS)

18.2.3.3.3. AVERAGE SELLING PRICE (USD)

18.2.3.4. PERCUTANEOUS TRANSLUMINAL CORONARY ANGIOPLASTY (PTCA) GUIDING CATHETERS

18.2.3.4.1. MARKET VALUE (USD MILLION)

18.2.3.4.2. MARKET VALUE (UNITS)

18.2.3.4.3. AVERAGE SELLING PRICE (USD)

18.2.3.5. GUIDE EXTENSION CATHETERS

18.2.3.5.1. MARKET VALUE (USD MILLION)

18.2.3.5.2. MARKET VALUE (UNITS)

18.2.3.5.3. AVERAGE SELLING PRICE (USD)

18.2.3.6. MICROCATHETERS

18.2.3.6.1. MARKET VALUE (USD MILLION)

18.2.3.6.2. MARKET VALUE (UNITS)

18.2.3.6.3. AVERAGE SELLING PRICE (USD)

18.2.3.7. DUAL LUMEN CATHETERS

18.2.3.7.1. MARKET VALUE (USD MILLION)

18.2.3.7.2. MARKET VALUE (UNITS)

18.2.3.7.3. AVERAGE SELLING PRICE (USD)

18.2.3.8. OTHERS

18.2.4 GUIDEWIRES

18.2.4.1. CORONARY GUIDE WIRES

18.2.4.1.1. MARKET VALUE (USD MILLION)

18.2.4.1.2. MARKET VALUE (UNITS)

18.2.4.1.3. AVERAGE SELLING PRICE (USD)

18.2.4.2. SPECIALTY GUIDE WIRES

18.2.4.2.1. MARKET VALUE (USD MILLION)

18.2.4.2.2. MARKET VALUE (UNITS)

18.2.4.2.3. AVERAGE SELLING PRICE (USD)

18.2.5 INFERIOR VENA CAVA (IVC) FILTERS

18.2.5.1. PERMANENT FILTERS

18.2.5.2. RETRIEVABLE FILTERS

18.2.6 GRAFTS

18.2.6.1. ENDOVASCULAR GRAFTS

18.2.6.2. SURGICAL GRAFTS

18.2.7 ROTATIONAL ATHERECTOMY SYSTEM

18.3 ACCESSORIES

18.3.1 INTRODUCER SHEATHS

18.3.1.1. STANDARD SHEATHS

18.3.1.2. HYDROPHILIC SHEATHS

18.3.2 CLOSURE DEVICES

18.3.2.1. SUTURE-BASED DEVICES

18.3.2.2. COLLAGEN-BASED DEVICES

18.3.2.3. CLIP-BASED DEVICES

18.3.3 HEMOSTATIC DEVICES

18.3.3.1. THROMBIN-BASED HEMOSTATS

18.3.3.2. FIBRIN SEALANTS

18.3.4 VASCULAR PATCHES

18.3.4.1. BIOLOGICAL PATCHES

18.3.4.2. SYNTHETIC PATCHES

18.3.5 ENDARTERECTOMY SPATULAS

18.3.6 SCISSORS

18.3.7 NEEDLE HOLDERS

18.3.8 FORCEPS

18.3.9 SCALPELS

18.3.10 OTHERS

18.4 OTHERS

19 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 PERIPHERAL ARTERY DISEASE (PAD)

19.3 ANEURYSMS

19.4 VENOUS DISEASE

19.5 CAROTID ARTERY DISEASE

19.6 DIALYSIS ACCESS MANAGEMENT

19.7 DEEP VEIN THROMBOSIS (DVT)

19.8 PULMONARY EMBOLISM

19.9 OTHERS

20 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY GENDER

20.1 OVERVIEW

20.2 MALE

20.3 FEMALE

21 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY PATIENT TYPE

21.1 OVERVIEW

21.2 CHILD

21.3 ADULT

21.4 GERIATRIC

22 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 ACUTE CARE HOSPITALS

22.2.2 LONG-TERM CARE HOSPITALS

22.2.3 NURSING FACILITIES

22.2.4 REHABILITATION CENTERS

22.3 AMBULATORY SURGICAL CENTERS

22.4 ACADEMIC AND RESEARCH INSTITUTES

22.5 TRAUMA CENTERS

22.6 OTHERS

23 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDERS

23.3 RETAIL SALES

23.3.1 ONLINE SALES

23.3.2 OFFLINE SALES

23.4 OTHERS

24 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, BY COUNTRY

24.1 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. ITALY

24.1.2.5. SPAIN

24.1.2.6. RUSSIA

24.1.2.7. TURKEY

24.1.2.8. NETHERLANDS

24.1.2.9. SWITZERLAND

24.1.2.10. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. SAUDI ARABIA

24.1.5.3. UAE

24.1.5.4. EGYPT

24.1.5.5. ISRAEL

24.1.5.6. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL VASCULAR SURGERY AND ENDOVASCULAR PROCEDURES MARKET, COMPANY PROFILE

27.1 BD

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 B. BRAUN MELSUNGEN AG

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 EDWARDS LIFESCIENCES CORPORATION

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 PFM MEDICAL AG

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 KLS MARTIN GROUP

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 MERCIAN SURGICAL SUPPLY CO LTD

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 BOSS INSTRUMENTS, LTD

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 NEWTECH MEDICAL DEVICES

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 BAROQUE MEDICAL

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 ABBOTT LABORATORIES

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPEMENTS

27.11 BIOTRONIK

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.12 BOSTON SCIENTIFIC

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPEMENTS

27.13 CARDINAL HEALTH

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPEMENTS

27.14 COOK MEDICAL INC.

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPEMENTS

27.15 MICROPORT SCIENTIFIC CORP.

27.15.1 T COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPEMENTS

27.16 TELEFLEX INC.

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPEMENTS

27.17 MEDTRONIC INC.

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPEMENTS

27.18 TERUMO MEDICAL CORPORATION

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPEMENTS

27.19 SIEMENS HEALTHINEERS

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPEMENTS

27.2 KONINKLIJKE PHILIPS N.V

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPEMENTS

27.21 GE HEALTHCARE

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPEMENTS

27.22 SHIMADZU MEDICAL

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPEMENTS

27.23 GALT MEDICAL CORP.

27.23.1 COMPANY OVERVIEW

27.23.2 GEOGRAPHIC PRESENCE

27.23.3 PRODUCT PORTFOLIO

27.23.4 RECENT DEVELOPEMENTS

27.24 CORDIS

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPEMENTS

27.25 ANDRATEC

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPEMENTS

27.26 QUALIMED INNOVATIVE MEDIZINPRODUKTE GMBH

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPEMENTS

27.27 BALTON SP. Z O.O.

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.