Global Vascular Ultrasonography Market

Market Size in USD Billion

CAGR :

%

USD

1.41 Billion

USD

2.19 Billion

2025

2033

USD

1.41 Billion

USD

2.19 Billion

2025

2033

| 2026 –2033 | |

| USD 1.41 Billion | |

| USD 2.19 Billion | |

|

|

|

|

Vascular Ultrasonography Market Size

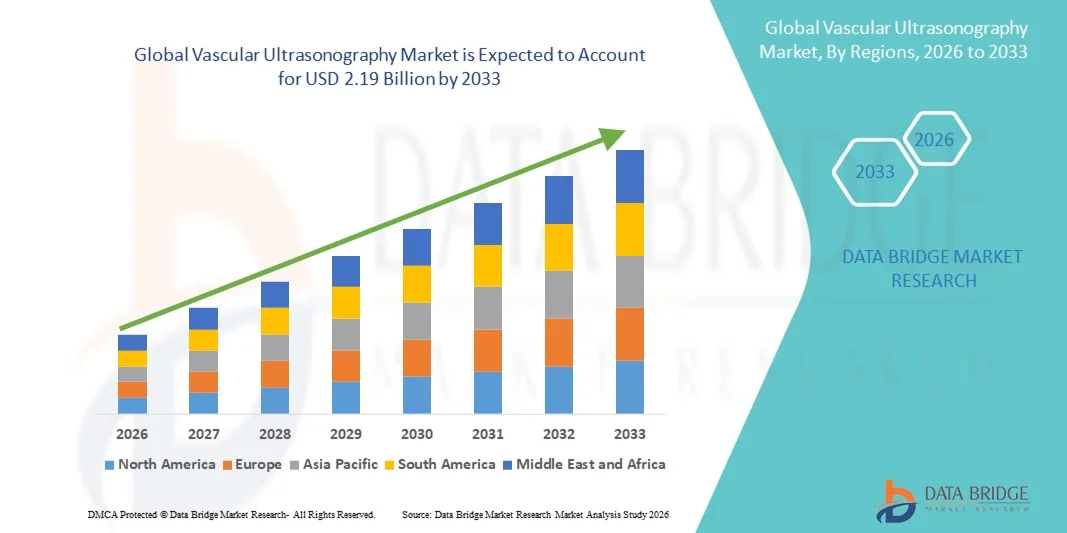

- The global vascular ultrasonography market size was valued at USD 1.41 billion in 2025 and is expected to reach USD 2.19 billion by 2033, at a CAGR of 5.67% during the forecast period

- The market growth is largely driven by the rising prevalence of cardiovascular and peripheral vascular diseases, along with increasing adoption of non-invasive diagnostic imaging technologies across hospitals and diagnostic centers

- Furthermore, growing demand for early disease detection, real-time imaging, and cost-effective diagnostic solutions is positioning vascular ultrasonography as a preferred modality in clinical practice. These converging factors are accelerating the adoption of vascular ultrasound systems, thereby significantly supporting overall market growth

Vascular Ultrasonography Market Analysis

- Vascular ultrasonography, providing real-time, non-invasive imaging of blood vessels, is becoming an essential tool in hospitals, diagnostic centers, and specialty clinics due to its safety, efficiency, and ability to support early detection and monitoring of vascular disorders

- The growing demand for vascular ultrasonography is primarily driven by the rising prevalence of cardiovascular diseases, peripheral artery disease, and venous conditions, along with increasing emphasis on non-invasive diagnostic techniques and preventive healthcare

- North America dominated the vascular ultrasonography market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, high adoption of imaging technologies, and a strong presence of key medical device manufacturers, with the U.S. leading in clinical adoption across cardiology and radiology departments

- Asia-Pacific is expected to be the fastest growing region in the vascular ultrasonography market during the forecast period due to expanding healthcare access, increasing healthcare expenditure, and growing awareness of early vascular disease detection in emerging economies

- Ultrasound segment dominated the vascular ultrasonography market with a market share of 61.2% in 2025, driven by its cost-effectiveness, non-invasive nature, and widespread clinical acceptance for diagnostic applications

Report Scope and Vascular Ultrasonography Market Segmentation

|

Attributes |

Vascular Ultrasonography Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Vascular Ultrasonography Market Trends

AI-Enhanced Imaging and Portable Ultrasound Devices

- A significant and accelerating trend in the global vascular ultrasonography market is the integration of artificial intelligence (AI) into imaging systems and the development of portable, handheld ultrasound devices. This combination is enhancing diagnostic accuracy and enabling point-of-care vascular assessments

- For instance, Butterfly iQ+ handheld vascular ultrasound allows clinicians to perform bedside imaging and transmit real-time data to cloud-based AI platforms for rapid analysis. Similarly, Philips Lumify provides portable imaging solutions with AI-assisted measurement tools

- AI integration in vascular ultrasonography facilitates automated detection of vascular abnormalities, improved measurement consistency, and real-time interpretation assistance. For instance, some GE Healthcare models utilize AI to identify arterial blockages and generate intelligent alerts if abnormal flow patterns are detected

- The seamless use of portable ultrasound devices combined with AI-powered software allows healthcare professionals to perform vascular diagnostics in remote clinics, emergency settings, and outpatient facilities, enhancing accessibility and efficiency of care

- This trend towards intelligent, portable, and AI-assisted imaging is redefining expectations for vascular diagnostics. Consequently, companies such as Canon Medical Systems are developing AI-enabled vascular ultrasound systems with features such as automatic vessel segmentation and real-time blood flow analysis

- The demand for AI-integrated and portable vascular ultrasonography devices is growing rapidly across hospitals, diagnostic centers, and specialty clinics, as clinicians increasingly prioritize diagnostic precision, speed, and point-of-care accessibility

- Rising investment in miniaturized sensors and battery-powered portable devices is enabling longer usage times, enhanced mobility, and adoption in emergency response and field healthcare scenarios

Vascular Ultrasonography Market Dynamics

Driver

Increasing Prevalence of Cardiovascular Diseases and Emphasis on Early Detection

- The rising incidence of cardiovascular disorders, peripheral artery disease, and venous conditions, coupled with growing awareness of early diagnosis, is a significant driver for the adoption of vascular ultrasonography

- For instance, in March 2025, Siemens Healthineers launched an AI-powered vascular imaging platform aimed at improving early detection of arterial blockages and venous insufficiencies in outpatient and hospital settings. Such initiatives by key players are expected to drive market growth in the forecast period

- As clinicians seek non-invasive, real-time imaging to manage vascular diseases, ultrasonography offers detailed visualization, blood flow analysis, and monitoring capabilities, providing an essential alternative to invasive procedures

- Furthermore, increasing adoption of point-of-care diagnostics and non-invasive imaging techniques is making vascular ultrasonography a critical component in clinical workflows, ensuring rapid, accurate diagnosis

- The ability to perform bedside imaging, generate AI-assisted measurements, and integrate with electronic health records (EHRs) is propelling vascular ultrasonography adoption across hospitals, diagnostic centers, and specialty clinics

- Growing government initiatives and healthcare programs focused on early cardiovascular screening are increasing demand for vascular ultrasonography, particularly in high-risk populations

- Technological advancements in Doppler imaging and 3D/4D vascular imaging capabilities are attracting new clinical applications, further driving adoption across specialized and multi-specialty hospitals

Restraint/Challenge

Operator Dependency and High Equipment Cost

- Concerns related to operator skill requirements and variability in imaging quality pose significant challenges to broader market penetration. As ultrasonography relies on technician expertise, inconsistent results can affect clinical confidence

- For instance, reports highlighting variability in Doppler measurements due to operator technique have caused some clinicians to rely on complementary imaging methods, limiting standalone adoption in certain regions

- Addressing operator dependency through AI-assisted imaging, standardized protocols, and training programs is crucial for improving diagnostic reliability. Companies such as Mindray and GE Healthcare emphasize AI-guided imaging and automated measurements to reduce human error. In addition, the high initial cost of advanced vascular ultrasound systems compared to traditional imaging methods can be a barrier, particularly for smaller clinics or budget-constrained facilities

- While prices are gradually decreasing for portable systems, premium devices with AI integration, 3D imaging, and advanced Doppler capabilities remain expensive, limiting adoption in emerging markets

- Overcoming these challenges through operator training, cost-optimized portable systems, and AI-assisted imaging solutions will be vital for sustained market growth

- Limited standardization in vascular ultrasound protocols across regions can lead to inconsistent diagnostic outcomes, restricting market adoption in some healthcare facilities

- Maintenance costs, calibration requirements, and software update dependencies for advanced ultrasound systems can increase operational expenses, particularly for smaller diagnostic centers, posing additional market challenges

Vascular Ultrasonography Market Scope

The market is segmented on the basis of technology, application, and end user.

- By Technology

On the basis of technology, the vascular ultrasonography market is segmented into Computed Tomography (CT), Magnetic Resonance Imaging (MRI), X-ray, Nuclear Imaging, and Ultrasound. The Ultrasound segment dominated the market with the largest revenue share of 61.2% in 2025, driven by its non-invasive nature, cost-effectiveness, and ability to provide real-time imaging of blood vessels. Clinicians widely prefer ultrasound for vascular assessment due to its safety, portability, and absence of ionizing radiation, making it suitable for repeated monitoring. Its broad applicability in diagnostic applications, including Doppler studies and peripheral vascular evaluation, reinforces its leading position. The segment’s dominance is also supported by continuous technological innovations, such as AI-assisted imaging, 3D/4D visualization, and portable handheld devices. Furthermore, ultrasound systems are compatible with diverse healthcare settings, ranging from hospitals to specialty clinics, facilitating widespread adoption. The segment benefits from strong clinician familiarity and high patient acceptance.

The CT segment is anticipated to witness the fastest growth rate of 18.5% from 2026 to 2033, fueled by increasing demand for high-resolution vascular imaging and advanced diagnostic capabilities. CT angiography enables precise visualization of arterial and venous structures, supporting accurate diagnosis of vascular blockages, aneurysms, and stenosis. Hospitals and diagnostic centers are increasingly adopting CT systems to complement ultrasound findings, particularly in complex cases requiring detailed anatomical mapping. Technological advancements, such as reduced radiation dose and faster scan times, are further driving adoption. Moreover, growing investment in hybrid imaging systems combining CT with other modalities enhances workflow efficiency and diagnostic confidence. The growing prevalence of cardiovascular disorders in developed and emerging regions is also accelerating the uptake of CT vascular imaging solutions.

- By Application

On the basis of application, the vascular ultrasonography market is segmented into therapeutic applications and diagnostic applications. The Diagnostic Applications segment dominated the market with the largest share of 72.3% in 2025, driven by the critical need for early detection, monitoring, and management of cardiovascular and peripheral vascular diseases. Ultrasound is extensively used in Doppler studies, arterial and venous evaluations, and pre-surgical assessments. Hospitals and diagnostic centers prefer this application due to its non-invasive nature, real-time feedback, and ability to guide clinical decisions effectively. The growing burden of chronic vascular disorders, increasing preventive healthcare initiatives, and rising awareness among patients further contribute to this dominance. Diagnostic ultrasonography is also supported by AI-assisted systems, enhancing accuracy and reducing operator dependency. Frequent use in both inpatient and outpatient settings reinforces its leadership in the application segment.

The Therapeutic Applications segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, driven by its integration with minimally invasive procedures and vascular interventions. Ultrasound-guided therapies, such as thrombolysis, angioplasty, and catheter placements, are increasingly adopted due to improved precision and patient safety. Growing adoption in interventional radiology, cardiology, and surgical specialties is accelerating market growth. Technological improvements, such as enhanced imaging resolution and portable systems, allow for real-time guidance during therapy. The segment is also supported by increasing training programs for clinicians and rising awareness of ultrasound-assisted interventions. Expansion in outpatient and specialty clinics further enhances the adoption of therapeutic ultrasonography applications.

- By End User

On the basis of end user, the vascular ultrasonography market is segmented into hospitals, diagnostic centers, specialty clinics, and others. The Hospitals segment dominated the market with the largest revenue share of 55.7% in 2025, driven by the availability of advanced imaging infrastructure, high patient inflow, and multi-department usage for cardiology, radiology, and vascular surgery. Hospitals often prefer comprehensive ultrasound systems that can perform a wide range of vascular evaluations. The integration of AI and 3D/4D imaging in hospital-grade systems further reinforces their preference. Hospitals also benefit from economies of scale, enabling high-volume diagnostic throughput. The segment’s dominance is supported by ongoing investments in upgrading imaging equipment and rising awareness of preventive healthcare programs. Hospitals’ strong purchasing power and capability to implement training programs for staff maintain their leading position.

The Diagnostic Centers segment is anticipated to witness the fastest growth rate of 20.1% from 2026 to 2033, fueled by increasing demand for outpatient vascular imaging and cost-effective diagnostic solutions. Diagnostic centers offer faster appointment scheduling, lower costs, and accessibility for patients seeking routine vascular screening. The growing adoption of portable and AI-enabled ultrasound devices allows diagnostic centers to deliver high-quality imaging services without heavy infrastructure investment. Rising awareness of preventive healthcare and early disease detection is driving patient visits to these centers. Technological advancements, including cloud-based reporting and tele-radiology, further enhance their service capabilities. Expanding healthcare access in urban and semi-urban areas is supporting the rapid growth of this segment.

Vascular Ultrasonography Market Regional Analysis

- North America dominated the vascular ultrasonography market with the largest revenue share of 38.5% in 2025, supported by advanced healthcare infrastructure, high adoption of imaging technologies, and a strong presence of key medical device manufacturers, with the U.S. leading in clinical adoption across cardiology and radiology departments

- Hospitals and diagnostic centers in the region prioritize vascular ultrasonography for its non-invasive, real-time imaging capabilities, which support early detection and management of cardiovascular and peripheral vascular diseases

- The widespread adoption is further supported by government initiatives promoting preventive healthcare, high healthcare expenditure, and the availability of skilled medical professionals, establishing vascular ultrasonography as a preferred diagnostic modality across clinical settings in both the U.S. and Canada

U.S. Vascular Ultrasonography Market Insight

The U.S. vascular ultrasonography market captured the largest revenue share of 82% in 2025 within North America, fueled by advanced healthcare infrastructure and widespread adoption of diagnostic imaging technologies. Hospitals and diagnostic centers increasingly rely on vascular ultrasound for early detection and monitoring of cardiovascular and peripheral vascular diseases. The growing trend of preventive healthcare programs, combined with the demand for non-invasive, real-time imaging, further propels market growth. In addition, integration of AI-assisted imaging and portable ultrasound devices is enhancing diagnostic efficiency and accuracy. The availability of skilled sonographers and clinicians supports high adoption rates. Moreover, government initiatives and reimbursement policies encouraging early cardiovascular screening are significantly contributing to the market expansion.

Europe Vascular Ultrasonography Market Insight

The Europe vascular ultrasonography market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of cardiovascular diseases and growing awareness of non-invasive diagnostic solutions. Countries such as Germany, France, and Italy are witnessing higher demand for advanced imaging systems due to stringent healthcare regulations and preventive care initiatives. Hospitals and diagnostic centers are adopting portable and AI-assisted ultrasound devices to improve workflow efficiency and diagnostic accuracy. The rise in outpatient and specialty clinics, along with investment in healthcare infrastructure, supports market growth. European clinicians favor ultrasound due to its safety, cost-effectiveness, and versatility in diagnostic applications. Furthermore, continuous technological advancements in Doppler and 3D/4D imaging are enhancing the adoption of vascular ultrasonography.

U.K. Vascular Ultrasonography Market Insight

The U.K. vascular ultrasonography market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing cardiovascular disease incidence and rising demand for early detection technologies. Hospitals and diagnostic centers are expanding their imaging capabilities with high-resolution ultrasound systems and AI-based analysis tools. The growing awareness of non-invasive, cost-effective diagnostic procedures encourages adoption in both public and private healthcare settings. In addition, the trend toward outpatient screening programs and preventive healthcare is boosting demand. The U.K.’s robust healthcare infrastructure and availability of trained professionals support widespread utilization. Government initiatives promoting early vascular diagnostics are further propelling market growth.

Germany Vascular Ultrasonography Market Insight

The Germany vascular ultrasonography market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of cardiovascular health and adoption of advanced imaging technologies. Hospitals and specialty clinics are increasingly utilizing Doppler, 3D, and AI-assisted ultrasound systems for early diagnosis and treatment monitoring. Germany’s well-developed healthcare infrastructure, emphasis on innovation, and preventive care programs encourage uptake. Increasing investment in portable and point-of-care ultrasound devices further supports adoption in outpatient and emergency settings. The preference for non-invasive, accurate imaging aligns with local clinical practices. Integration with hospital information systems and EHRs enhances workflow efficiency and clinical decision-making.

Asia-Pacific Vascular Ultrasonography Market Insight

The Asia-Pacific vascular ultrasonography market is poised to grow at the fastest CAGR of 23.8% during the forecast period of 2026 to 2033, driven by rising prevalence of cardiovascular diseases, increasing healthcare expenditure, and rapid urbanization in countries such as China, India, and Japan. The growing inclination toward early disease detection and non-invasive diagnostic solutions is driving adoption in hospitals and diagnostic centers. Technological advancements in portable ultrasound systems and AI-assisted imaging improve accessibility and accuracy. Government initiatives promoting preventive healthcare and cardiovascular screening are expanding market reach. The increasing number of specialty clinics and outpatient centers also contributes to adoption. Rising awareness among patients and clinicians about the benefits of real-time vascular imaging is further propelling market growth.

Japan Vascular Ultrasonography Market Insight

The Japan vascular ultrasonography market is gaining momentum due to rising cardiovascular disease prevalence, advanced healthcare infrastructure, and demand for precision diagnostics. Hospitals and diagnostic centers are increasingly adopting portable and AI-integrated ultrasound systems for point-of-care imaging. The Japanese healthcare system emphasizes preventive care, supporting widespread screening programs. Integration of vascular ultrasonography with electronic health records and telemedicine platforms enhances clinical workflow and patient monitoring. In addition, the aging population drives demand for safe, non-invasive diagnostic solutions. Technological innovations in Doppler and 3D imaging further support market expansion across both residential and clinical healthcare settings.

India Vascular Ultrasonography Market Insight

The India vascular ultrasonography market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising cardiovascular disease burden, expanding healthcare infrastructure, and increasing awareness of non-invasive diagnostic solutions. Hospitals, diagnostic centers, and specialty clinics are adopting portable and AI-assisted ultrasound devices to improve early detection and patient management. Government initiatives promoting cardiovascular screening and preventive healthcare are driving adoption. The growing middle class and urbanization, combined with rising disposable incomes, are increasing accessibility to advanced imaging technologies. Domestic manufacturers offering affordable ultrasound systems are further propelling market growth. Rapid expansion of specialty clinics and outpatient diagnostic centers supports increased utilization across India.

Vascular Ultrasonography Market Share

The Vascular Ultrasonography industry is primarily led by well-established companies, including:

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

- Teratech Corporation (U.S.)

- Huntleigh Healthcare (U.K.)

- Ultrasound Technologies (U.K.)

- Fujifilm SonoSite, Inc. (U.S.)

- Esaote S.p.A. (Italy)

- Samsung Medison Co., Ltd. (South Korea)

- Hitachi Medical Systems (Japan)

- EDAN Instruments, Inc. (China)

- Chison Medical Imaging Co., Ltd. (China)

- Unetixs Vascular, Inc. (U.S.)

- Perimed AB (Sweden)

- Hokanson Vascular (U.S.)

- Promed Group (China)

- Trivitron Healthcare (India)

What are the Recent Developments in Global Vascular Ultrasonography Market?

- In August 2025, GE HealthCare launched the Vivid Pioneer, an advanced AI‑powered cardiovascular ultrasound system designed to enhance imaging speed, resolution, and diagnostic confidence across 2D, 4D, and color flow applications, receiving both CE Mark and U.S. FDA 510(k) clearance

- In July 2024, GE HealthCare agreed to acquire the clinical AI software business from Intelligent Ultrasound Group, bringing ScanNav Assist AI and related real‑time image recognition tools into its ultrasound platform to improve diagnostic workflows and image interpretation

- In February 2024, GE HealthCare showcased its elevated LOGIQ Ultrasound portfolio (including systems relevant to vascular diagnostics) at the European Congress of Radiology (ECR) 2024, featuring enhanced imaging performance and workflow tools across clinical settings

- In August 2023, GE HealthCare introduced the Vscan Air SL, a wireless handheld ultrasound device tailored for rapid cardiovascular and vascular patient assessments, enabling clinicians to perform point‑of‑care vascular imaging without tethered cables

- In December 2021, GE HealthCare completed its spin‑off as an independent public company from General Electric, forming a focused imaging and healthcare‑technology entity poised to accelerate innovation in ultrasound imaging, including vascular ultrasonography

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.