Global Vector Database Market

Market Size in USD Billion

CAGR :

%

USD

2.56 Billion

USD

14.06 Billion

2025

2033

USD

2.56 Billion

USD

14.06 Billion

2025

2033

| 2026 –2033 | |

| USD 2.56 Billion | |

| USD 14.06 Billion | |

|

|

|

|

Vector Database Market Size

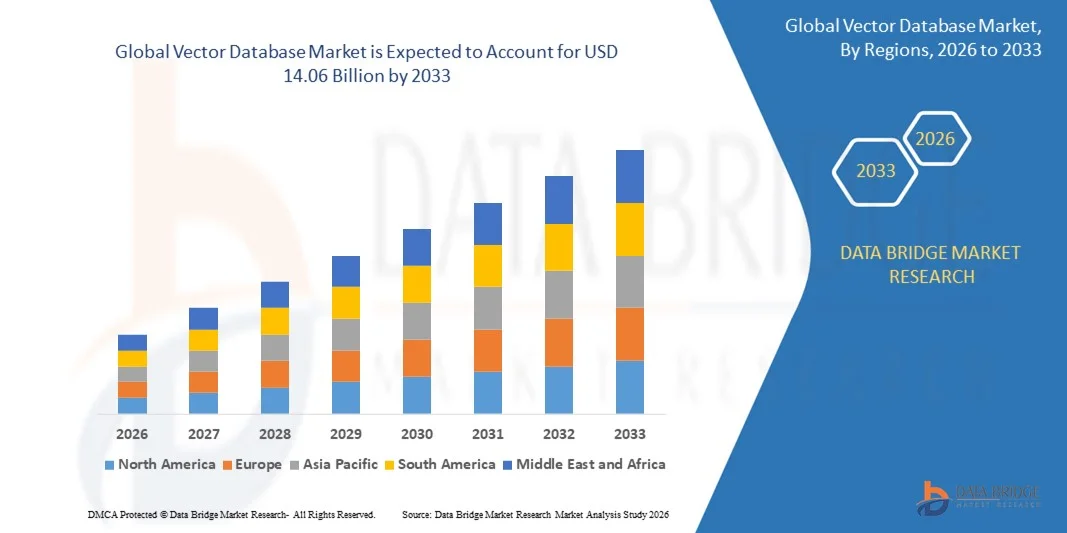

- The global vector database market size was valued at USD 2.56 billion in 2025 and is expected to reach USD 14.06 billion by 2033, at a CAGR of 23.73% during the forecast period

- The market growth is largely fuelled by the increasing adoption of AI and machine learning applications that require high-speed similarity searches

- Growing demand for real-time data processing and analytics across industries such as e-commerce, healthcare, and finance

Vector Database Market Analysis

- Advancements in AI, machine learning, and natural language processing are accelerating adoption of vector databases

- Enterprises are leveraging vector databases for personalized recommendations, fraud detection, semantic search, and real-time analytics

- North America dominated the vector database market with the largest revenue share of 38.7% in 2025, driven by rapid adoption of AI and machine learning applications, increased investment in cloud infrastructure, and strong presence of leading technology companies

- Asia-Pacific region is expected to witness the highest growth rate in the global vector database market, driven by rising AI and machine learning investments, increasing adoption of cloud infrastructure, growing digitalization of enterprises, and supportive government policies in countries such as China, Japan, and India

- The Cloud-Based segment held the largest market revenue share in 2025, driven by scalability, cost efficiency, and managed services offered by leading cloud providers. Cloud deployments allow enterprises to process high-dimensional embeddings and AI workloads without heavy upfront infrastructure investment. In addition, seamless integration with AI frameworks, GPU acceleration, and multi-cloud compatibility make cloud-based solutions highly attractive for tech-driven organizations

Report Scope and Vector Database Market Segmentation

|

Attributes |

Vector Database Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Vector Database Market Trends

Rising Adoption of AI, Machine Learning, and High-Dimensional Data Applications

- The increasing reliance on AI, machine learning, and deep learning applications is significantly shaping the vector database market, as organizations require high-speed similarity searches, semantic search, and efficient handling of unstructured data. Vector databases are gaining traction due to their ability to process embeddings from images, text, and audio in real-time while supporting scalable and low-latency operations. This trend is encouraging enterprises across e-commerce, finance, healthcare, and tech sectors to deploy vector database solutions for advanced analytics and recommendation systems

- Growing adoption of big data analytics and real-time information processing has accelerated the demand for vector databases in cloud, hybrid, and on-premise deployments. Organizations are increasingly leveraging vector databases to manage massive datasets generated from AI workloads, IoT devices, and social media platforms, prompting solution providers to innovate with scalable and high-performance offerings

- Enterprises are emphasizing integration with cloud-native architectures, GPU acceleration, and distributed systems to enhance vector database capabilities. These improvements are helping organizations optimize query speed, storage efficiency, and scalability, thereby driving adoption among AI-driven businesses and startups

- For instance, in 2024, Pinecone in the U.S. and Milvus in China expanded their vector database platforms to support multi-cloud and GPU-accelerated processing. These deployments responded to increasing enterprise demand for low-latency semantic search, recommendation engines, and AI analytics, with adoption across tech companies, e-commerce platforms, and research institutions

- While the vector database market is expanding rapidly, sustained growth depends on continuous R&D, seamless integration with AI frameworks, and reducing operational complexity. Vendors are focusing on improving interoperability, offering managed services, and delivering cost-effective solutions to meet enterprise requirements and support widespread adoption

Vector Database Market Dynamics

Driver

Growing Demand for AI-Driven, High-Dimensional Data Solutions

- Rising enterprise demand for AI, machine learning, and deep learning applications is a major driver for the vector database market. Organizations require solutions capable of performing high-speed similarity searches on unstructured data, including text, images, and audio embeddings, supporting applications such as semantic search, recommendation engines, and fraud detection

- Expanding applications in e-commerce, finance, healthcare, and social media analytics are influencing market growth. Vector databases improve query performance, storage efficiency, and real-time analytics capabilities while handling increasingly large datasets, enabling enterprises to deploy scalable AI solutions

- Cloud adoption and hybrid deployment strategies are driving increased adoption, as enterprises seek managed vector database services with enhanced performance, reliability, and flexibility

- For instance, in 2023, Pinecone in the U.S. and Zilliz in China reported wider enterprise adoption of vector databases for semantic search and AI-based recommendation engines. The expansion followed higher demand for real-time analytics and personalized user experiences, driving repeat deployment and platform differentiation

- Although AI adoption and big data analytics support growth, wider deployment depends on cost optimization, interoperability with existing data infrastructure, and availability of skilled personnel. Investment in managed services, GPU-accelerated solutions, and cloud integration will be critical to meeting global demand

Restraint/Challenge

High Implementation Costs and Technical Complexity

- The relatively higher implementation cost of vector databases compared to conventional databases remains a key challenge, limiting adoption among price-sensitive enterprises. High infrastructure requirements, GPU or specialized hardware needs, and complex deployment configurations contribute to elevated costs

- Lack of widespread awareness and technical expertise among enterprises, particularly in emerging markets, restricts adoption. Limited understanding of vector database functionality and integration requirements slows deployment across certain industries

- Scalability and integration challenges also impact market growth, as enterprises must manage distributed systems, data consistency, and high-dimensional indexing efficiently. Operational complexities and data storage requirements increase resource needs, adding to implementation overhead

- For instance, in 2024, several mid-sized e-commerce and fintech companies in Southeast Asia reported slower adoption due to high costs and technical challenges in integrating vector databases with existing AI workflows. Infrastructure requirements and maintenance complexity were additional barriers

- Overcoming these challenges will require cost-effective deployment models, simplified integration, and educational initiatives for enterprises. Collaboration with cloud providers, AI platform vendors, and open-source communities can help unlock long-term growth potential. In addition, innovations in managed services, GPU-optimized databases, and user-friendly frameworks will be essential for widespread adoption

Vector Database Market Scope

The market is segmented on the basis of deployment model, application, industry vertical, data source, and storage capacity.

- By Deployment Model

On the basis of deployment model, the vector database market is segmented into On-Premises, Cloud-Based, and Hybrid. The Cloud-Based segment held the largest market revenue share in 2025, driven by scalability, cost efficiency, and managed services offered by leading cloud providers. Cloud deployments allow enterprises to process high-dimensional embeddings and AI workloads without heavy upfront infrastructure investment. In addition, seamless integration with AI frameworks, GPU acceleration, and multi-cloud compatibility make cloud-based solutions highly attractive for tech-driven organizations.

The On-Premises segment is expected to witness the fastest growth rate from 2026 to 2033, as organizations prioritize data privacy, compliance, and low-latency performance. Enterprises in healthcare, finance, and government sectors often prefer on-premises deployments to maintain complete control over sensitive datasets. Customized infrastructure and optimized hardware configurations for high-dimensional indexing also support adoption. On-premises solutions provide flexibility for integration with legacy systems and dedicated resources for mission-critical AI applications.

- By Application

On the basis of application, the market is segmented into Natural Language Processing, Image and Video Recognition, Recommendation Systems, and Fraud Detection. Recommendation Systems held the largest share in 2025, fueled by adoption in e-commerce, media, and streaming platforms for personalized content, product suggestions, and targeted marketing. The ability to handle massive embedding datasets in real-time enhances customer experience and drives loyalty. Enterprises are increasingly leveraging vector databases to deliver semantic search and context-aware recommendations, giving them a competitive edge.

The Fraud Detection segment is expected to grow at the highest CAGR from 2026 to 2033, driven by rising need for real-time anomaly detection across banking, finance, and digital payment platforms. Vector databases enable rapid comparison of transaction embeddings and behavioral patterns, improving security. AI-powered monitoring and predictive analytics further support fraud mitigation. Growth in online transactions, digital wallets, and cybersecurity investments are key factors accelerating demand.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into Retail, Healthcare, Finance, Telecommunications, and Government. The Retail segment dominated in 2025, due to the extensive use of vector databases for personalized marketing, consumer behavior analysis, and AI-driven recommendation engines. Retailers benefit from real-time insights into customer preferences, enabling better targeting and improved conversion rates. Cloud and hybrid deployments support rapid scaling of AI-powered analytics for seasonal peaks and promotional campaigns.

The Healthcare segment is expected to grow at the highest CAGR from 2026 to 2033, propelled by AI adoption for medical imaging, diagnostics, patient record analysis, and clinical decision support. Vector databases facilitate rapid retrieval and similarity search of unstructured medical data such as X-rays, MRIs, and genomic sequences. Hospitals and research institutions increasingly adopt these solutions to accelerate drug discovery, predictive diagnostics, and patient care efficiency.

- By Data Source

On the basis of data source, the market is segmented into Structured Data, Unstructured Data, and Semi-Structured Data. Unstructured Data accounted for the largest market share in 2025, driven by the surge in images, videos, social media content, and audio datasets. Vector databases allow enterprises to process these high-dimensional datasets efficiently for AI applications such as semantic search, computer vision, and NLP tasks. The rise of social media, IoT devices, and multimedia content continues to fuel demand for unstructured data processing.

Structured Data is projected to grow at the fastest CAGR from 2026 to 2033, as organizations integrate vector databases with relational databases and analytics platforms. Embedding structured data into vector formats enhances AI-based search, recommendations, and predictive modeling. Enterprises leverage structured data integration for operational insights, customer segmentation, and real-time decision-making. Increasing adoption of hybrid analytics solutions supports this growth trend.

- By Storage Capacity

On the basis of storage capacity, the market is segmented into Small Scale, Medium Scale, and Large Scale. Large Scale deployments held the largest revenue share in 2025, driven by the growing volume of embeddings and high-dimensional datasets generated by AI and ML applications. Enterprises processing billions of vectors for recommendation engines, semantic search, and anomaly detection prefer large-scale solutions. Cloud-based infrastructure and distributed computing facilitate rapid scaling and high throughput, supporting enterprise requirements.

Medium Scale deployments are expected to witness the fastest growth from 2026 to 2033, owing to increasing adoption among mid-sized enterprises seeking cost-effective, high-performance solutions. These deployments allow organizations to balance infrastructure costs with processing efficiency. Startups and growing AI-driven businesses adopt medium-scale vector databases to implement recommendation systems, fraud detection, and semantic search without heavy investment in large-scale hardware.

Vector Database Market Regional Analysis

- North America dominated the vector database market with the largest revenue share of 38.7% in 2025, driven by rapid adoption of AI and machine learning applications, increased investment in cloud infrastructure, and strong presence of leading technology companies

- Enterprises in the region prioritize real-time analytics, semantic search, and high-dimensional data processing, leveraging vector databases to improve recommendation systems, fraud detection, and computer vision solutions

- The widespread adoption is further supported by high digital infrastructure maturity, skilled workforce, and growing enterprise AI initiatives, establishing vector databases as a critical solution across multiple industry verticals

U.S. Vector Database Market Insight

The U.S. vector database market captured the largest revenue share in 2025 within North America, fueled by the rising demand for AI-driven applications and real-time data processing. Enterprises are increasingly adopting vector databases for recommendation engines, fraud detection, and NLP tasks to enhance operational efficiency. The growing preference for cloud-native and hybrid deployments, combined with strong AI startup ecosystems and major investments by tech giants, further propels the market. Integration with leading AI platforms and open-source frameworks significantly contributes to market expansion.

Europe Vector Database Market Insight

The Europe vector database market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing AI adoption, data-driven decision-making initiatives, and government support for digital transformation. Rising enterprise focus on semantic search, computer vision, and predictive analytics is fostering adoption. European companies are investing in secure, scalable, and energy-efficient vector database solutions to meet regulatory requirements and support AI innovation. The region is experiencing growth across retail, finance, healthcare, and industrial sectors.

U.K. Vector Database Market Insight

The U.K. vector database market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of AI and machine learning solutions in enterprises and startups. Organizations are leveraging vector databases for personalized recommendations, anomaly detection, and real-time analytics. The country’s robust digital infrastructure, strong research ecosystem, and vibrant technology startup environment are expected to continue driving market growth. Cloud-based deployments and hybrid solutions are particularly popular for their scalability and cost-efficiency.

Germany Vector Database Market Insight

The Germany vector database market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing investments in AI, big data, and digital transformation initiatives. Enterprises across finance, manufacturing, and healthcare are adopting vector databases for high-performance analytics, NLP, and computer vision applications. Germany’s focus on innovation, technological advancement, and data privacy compliance supports adoption. The integration of vector databases with AI and cloud platforms is becoming increasingly prevalent, enabling enterprises to optimize operations and decision-making.

Asia-Pacific Vector Database Market Insight

The Asia-Pacific vector database market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid digital transformation, increasing adoption of AI and machine learning, and rising investment in cloud infrastructure across countries such as China, Japan, and India. The region’s growing enterprise AI initiatives and government programs promoting smart technologies are accelerating adoption. In addition, the expansion of local AI startups and data centers enhances accessibility and scalability of vector database solutions, allowing more enterprises to leverage real-time analytics and high-dimensional data processing.

Japan Vector Database Market Insight

The Japan vector database market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong AI adoption, high technological penetration, and demand for real-time data processing. Japanese enterprises are deploying vector databases for recommendation systems, semantic search, and computer vision applications. Integration with IoT devices, AI platforms, and cloud infrastructure further supports market growth. Japan’s focus on innovation, automation, and high-tech enterprise solutions is expected to drive long-term adoption across commercial and industrial sectors.

China Vector Database Market Insight

The China vector database market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digitalization, AI-driven enterprise initiatives, and a growing technology ecosystem. China is a leading adopter of AI applications requiring high-dimensional data processing, including e-commerce, finance, and smart city projects. The availability of scalable cloud infrastructure, strong domestic technology providers, and government support for AI innovation are key factors propelling market growth. Enterprises are increasingly leveraging vector databases for real-time analytics, recommendation engines, and fraud detection.

Vector Database Market Share

The Vector Database industry is primarily led by well-established companies, including:

- Alibaba Cloud (China)

- Elasticsearch B.V. (Netherlands)

- Google LLC (U.S.)

- Microsoft (U.S.)

- MongoDB, Inc. (U.S.)

- Pinecone Systems, Inc. (U.S.)

- Redis Inc. (U.S.)

- SingleStore, Inc. (U.S.)

- Zilliz (U.S.)

- Qdrant (Berlin)

- Activeloop (U.S.)

- Weaviate (Netherlands)

- OpenSearch (U.S.)

- Vespa (Italy)

Latest Developments in Global Vector Database Market

- In September 2026, Pinecone (U.S.) announced a major upgrade to its vector database platform, introducing advanced scalability and performance features. The development aims to support enterprises managing large-scale AI and machine learning workloads. This enhancement improves user experience, reduces query latency, and reinforces Pinecone’s market leadership. The upgrade is expected to accelerate adoption across industries requiring high-dimensional data processing and real-time analytics, strengthening competitive positioning in the global vector database market

- In August 2026, Weaviate (Netherlands) secured a strategic partnership with a leading cloud service provider to expand its deployment capabilities. This collaboration enables seamless cloud integration, easier accessibility, and scalable infrastructure for enterprise customers. By leveraging cloud platforms, Weaviate enhances service delivery and meets growing demand for flexible, high-performance vector database solutions. The partnership is likely to boost adoption in AI-driven applications and support growth in global enterprise deployments

- In July 2026, Milvus (China) launched a new version of its open-source vector database with enhanced support for AI-driven applications and embeddings. The update aims to improve real-time semantic search, recommendation systems, and high-dimensional data analytics. By catering to developers and enterprises, Milvus strengthens its competitive position and expands its user base. This release reinforces the trend of integrating vector databases with AI and machine learning workloads, promoting innovation and adoption across industries

- In May 2025, Pinecone (U.S.) rolled out optimized GPU acceleration for its managed vector database platform, targeting enterprises with large-scale embedding and recommendation engine needs. The improvement reduces processing time and operational costs while enhancing system reliability. This development positions Pinecone as a preferred solution for AI-intensive workloads, supporting faster adoption of vector databases in e-commerce, finance, and cloud-based applications

- In March 2024, Zilliz (U.S.) introduced Milvus 2.2, an updated open-source vector database supporting hybrid cloud and on-premises deployment. The launch focuses on improved scalability, multi-cloud compatibility, and faster indexing for high-dimensional data. By enabling flexible deployment options and enhanced performance, Zilliz strengthens its market presence and drives adoption among AI, machine learning, and big data enterprises

- In January 2023, Pinecone (U.S.) expanded its platform capabilities with additional integrations for major AI frameworks, improving interoperability and ease of use. The upgrade allows developers to deploy recommendation systems, semantic search, and real-time analytics more efficiently. This strategic enhancement supports Pinecone’s leadership in the vector database market and encourages wider adoption among startups and enterprise users seeking AI-ready database solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.