Global Vegan Aerosol Whipping Cream Market

Market Size in USD Million

CAGR :

%

USD

501.50 Million

USD

1,107.32 Million

2024

2032

USD

501.50 Million

USD

1,107.32 Million

2024

2032

| 2025 –2032 | |

| USD 501.50 Million | |

| USD 1,107.32 Million | |

|

|

|

|

Vegan Aerosol Whipping Cream Market Size

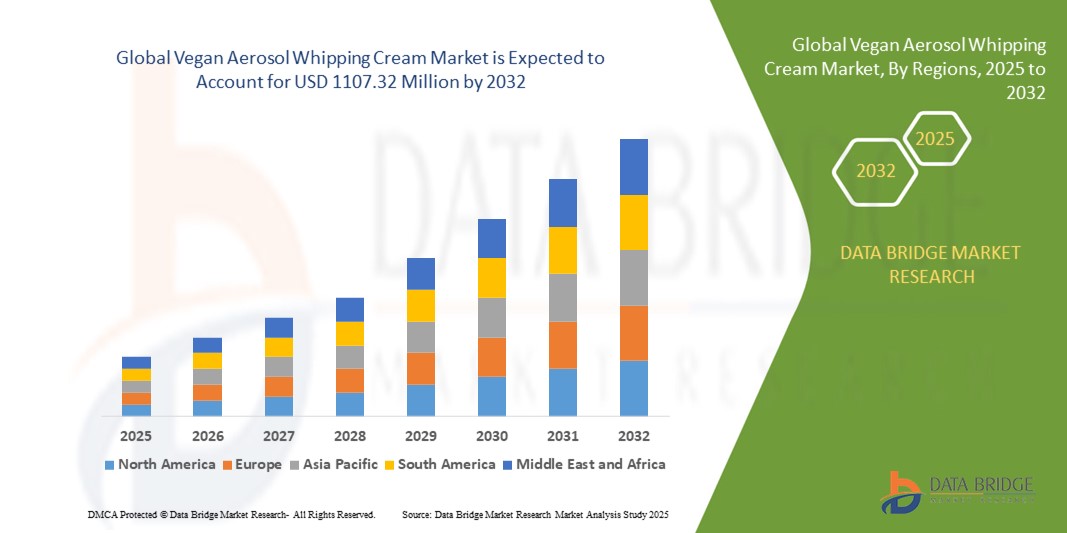

- The global vegan aerosol whipping cream market size was valued at USD 501.50 million in 2024 and is expected to reach USD 1107.32 million by 2032, at a CAGR of 9.20% during the forecast period

- The market growth is primarily driven by the rising adoption of plant-based diets, increasing consumer awareness of health and environmental concerns, and the growing vegan population seeking dairy-free alternative

- The demand for vegan aerosol whipping cream is further propelled by its convenience, versatility in culinary applications, and increasing availability in foodservice and retail channels

Vegan Aerosol Whipping Cream Market Analysis

- The vegan aerosol whipping cream market is experiencing robust growth due to rising consumer preference for plant-based, cruelty-free, and environmentally sustainable products

- The foodservice sector, including cafes and bakeries, is increasingly incorporating vegan whipping cream to cater to vegan and lactose-intolerant consumers, driving demand in commercial applications

- North America dominated the vegan aerosol whipping cream market with a revenue share of 34.1% in 2024, fueled by a strong demand for plant-based products, a well-established foodservice industry, and high consumer awareness of health and sustainability

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing disposable incomes, and growing adoption of Western-style desserts and beverages in countries such as China, India, and Southeast Asian nations

- The coconut-based segment dominated the largest market revenue share of 45.3% in 2024, driven by its rich, creamy texture and natural sweetness, which closely mimic traditional dairy whipped cream. Coconut-based whipping creams are highly versatile, widely available, and appeal to consumers seeking plant-based options with a tropical flavor profile

Report Scope and Vegan Aerosol Whipping Cream Market Segmentation

|

Attributes |

Vegan Aerosol Whipping Cream Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vegan Aerosol Whipping Cream Market Trends

Increasing Innovation in Plant-Based Formulations

- The global vegan aerosol whipping cream market is experiencing a notable trend toward innovation in plant-based formulations to replicate the texture and functionality of dairy-based whipped cream

- Manufacturers are leveraging advanced food science to enhance the stability, texture, and taste of products using ingredients such as coconut, almond, soy, and other plant-based alternatives such as oat and cashew

- These advancements allow vegan whipping creams to perform effectively in diverse applications, from bakery toppings to beverage foams, meeting consumer expectations for dairy-such as quality

- For instances, companies are developing coconut-based whipping creams with improved aeration for use in professional bakeries and cafes, while almond-based options cater to health-conscious consumers seeking lower-calorie alternatives

- This trend is making vegan aerosol whipping cream more appealing to a broader consumer base, including those with dietary restrictions such as lactose intolerance or vegan lifestyles

- Innovations also include clean-label products with minimal additives, addressing consumer demand for natural and sustainable ingredients

Vegan Aerosol Whipping Cream Market Dynamics

Driver

Growing Adoption of Vegan and Dairy-Free Diets

- Rising consumer awareness of health, environmental, and ethical concerns is driving demand for vegan aerosol whipping cream as a dairy-free alternative

- Features such as cholesterol-free, lactose-free, and cruelty-free formulations enhance the appeal of these products for health-conscious and vegan consumers

- Government and industry initiatives promoting sustainable food choices, particularly in North America and Europe, are encouraging the adoption of plant-based products

- The expansion of 5G and IoT technologies is enabling smarter supply chain management and e-commerce platforms, facilitating broader access to vegan whipping cream products

- Major foodservice chains, such as cafes and bakeries, are increasingly incorporating vegan whipping cream into their menus to cater to growing demand, further boosting market growth

- North America dominated the market due to high demand for plant-based bakery and confectionery products, with the U.S. and Canada leading in consumption

Restraint/Challenge

High Production Costs and Supply Chain Vulnerabilities

- The high cost of sourcing plant-based ingredients, such as coconut, almond, and soy, compared to dairy ingredients, poses a significant barrier to market growth, particularly in price-sensitive regions such as Asia-Pacific

- Developing formulations that mimic dairy whipped cream’s texture and stability requires significant investment in research and development, increasing production costs

- Supply chain vulnerabilities, including reliance on specific agricultural regions for ingredients, expose manufacturers to risks such as crop failures, climate change, and geopolitical instability, potentially disrupting supply and increasing costs

- Data privacy concerns related to e-commerce platforms, which are critical for distribution, raise challenges regarding consumer trust and compliance with regulations such as GDPR in Europe

- The fragmented regulatory landscape across regions, particularly concerning labeling and health claims for plant-based products, complicates operations for global manufacturers

- Despite these challenges, the Asia-Pacific region is the fastest-growing market, driven by rising disposable incomes, urbanization, and increasing adoption of Western dietary trends

Vegan Aerosol Whipping Cream market Scope

The market is segmented on the basis of ingredient type, application outlook, flavor, end-user, and distribution channel.

- By Ingredient Type

On the basis of ingredient type, the global vegan aerosol whipping cream market is segmented into coconut-based whipping cream, almond-based whipping cream, soy-based whipping cream, and other plant-based alternatives. The coconut-based segment dominated the largest market revenue share of 45.3% in 2024, driven by its rich, creamy texture and natural sweetness, which closely mimic traditional dairy whipped cream. Coconut-based whipping creams are highly versatile, widely available, and appeal to consumers seeking plant-based options with a tropical flavor profile. Their stability in aerosol formulations and compatibility with various culinary applications have solidified their preference among manufacturers and consumers.

The almond-based segment is expected to register the fastest growth rate from 2025 to 2032, as health-conscious consumers increasingly opt for lower-calorie and nutrient-rich alternatives. Almond-based whipping creams offer a subtle nutty flavor and are fortified with vitamins and minerals, catering to vegan and lactose-intolerant diets. Their rising popularity in premium and clean-label products, coupled with advancements in formulation for better whipping performance, is driving rapid adoption in both household and commercial settings.

- By Application Outlook

On the basis of application outlook, the global vegan aerosol whipping cream market is categorized into food service, dairy products, bakery products, confectionery, and beverages. The bakery products segment accounted for the highest revenue share in 2024, fueled by the growing demand for vegan baked goods and desserts. Vegan aerosol whipping cream is a key ingredient in cakes, pastries, and frostings, offering ease of use and consistent texture for professional and home bakers. The rise of artisanal baking and plant-based dessert trends further supports this segment’s dominance.

The beverages segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the increasing popularity of specialty coffee, milkshakes, and vegan cocktails that utilize whipped cream as a topping. The convenience of aerosol packaging and the ability to create visually appealing beverages with plant-based whipping cream are key factors boosting demand. The expansion of vegan menus in cafes and restaurants, particularly in urban areas, further accelerates this segment’s growth.

- By Flavor

On the basis of flavor, the global vegan aerosol whipping cream market is segmented into vanilla, chocolate, caramel, and seasonal flavors. The vanilla segment held the largest revenue share in 2024, attributed to its universal appeal and versatility across a wide range of culinary applications, from desserts to beverages. Vanilla-flavored vegan whipping cream is favored for its classic taste, which complements both sweet and savory dishes, making it a staple in households and food service settings.

The seasonal flavors segment is projected to grow at the fastest rate from 2025 to 2032, fueled by consumer demand for innovative and limited-edition offerings such as peppermint mocha, pumpkin spice, and salted caramel. These flavors cater to seasonal trends and festive occasions, driving impulse purchases and enhancing brand differentiation. Manufacturers are leveraging seasonal flavors to attract younger demographics and boost engagement through creative marketing campaigns.

- By End-User

On the basis of end-user, the global vegan aerosol whipping cream market is segmented into household and commercial. The commercial segment accounted for the highest revenue share in 2024, driven by the widespread adoption of vegan whipping cream in food service establishments, including cafes, restaurants, and bakeries. The growing popularity of vegan menus and the need for convenient, ready-to-use toppings in high-volume settings have made aerosol whipping cream a preferred choice for commercial kitchens.

The household segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by the rise in home baking and the increasing availability of vegan aerosol whipping cream in retail channels. Consumers are seeking convenient, high-quality plant-based alternatives to enhance their culinary creations, supported by the growing trend of veganism and health-conscious lifestyles. The affordability and ease of use of aerosol cans further drive adoption among home users.

- By Distribution Channel

On the basis of distribution channel, the global vegan aerosol whipping cream market is segmented into supermarkets and hypermarkets, convenience stores, e-commerce, and others. The supermarkets and hypermarkets segment held the largest revenue share in 2024, attributed to their extensive product offerings, established cold chain infrastructure, and ability to cater to a broad consumer base. These retail outlets provide a variety of vegan whipping cream brands and flavors, supported by promotions and in-store displays that drive consumer purchases.

The e-commerce segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing popularity of online grocery shopping and the convenience of home delivery. E-commerce platforms offer a wide range of vegan aerosol whipping cream products, including niche and premium brands, appealing to tech-savvy and health-conscious consumers. The expansion of cold chain logistics and direct-to-consumer sales further supports this segment’s rapid growth.

Vegan Aerosol Whipping Cream Market Regional Analysis

- North America dominated the vegan aerosol whipping cream market with a revenue share of 34.1% in 2024, fueled by a strong demand for plant-based products, a well-established foodservice industry, and high consumer awareness of health and sustainability

- Consumers prioritize vegan aerosol whipping cream for its versatility in culinary applications, health benefits, and alignment with sustainable lifestyles, particularly in regions with high health and environmental consciousness

- Growth is supported by advancements in plant-based formulation technologies, such as improved texture and stability, alongside rising adoption in both foodservice and household segments

U.S. Vegan Aerosol Whipping Cream Market Insight

The U.S. vegan aerosol whipping cream market captured the largest revenue share of 75.9% in 2024 within North America, fueled by strong demand in the foodservice sector and growing consumer awareness of plant-based diets. The trend towards vegan and lactose-free products, coupled with increasing availability in retail, boosts market expansion. Major brands such as Alamance Foods, with products such as Whipt, complement the market with innovative offerings in oat, almond, and coconut flavors.

Europe Vegan Aerosol Whipping Cream Market Insight

The Europe vegan aerosol whipping cream market is expected to witness significant growth, supported by regulatory emphasis on sustainable food production and consumer demand for dairy-free alternatives. Consumers seek products that offer creamy texture and flavor while catering to vegan and lactose-intolerant diets. Growth is prominent in both commercial foodservice and household applications, with countries such as Germany and France showing notable uptake due to rising environmental awareness and veganism trends.

U.K. Vegan Aerosol Whipping Cream Market Insight

The U.K. market for vegan aerosol whipping cream is expected to witness rapid growth, driven by demand for plant-based dessert and beverage toppings in urban and suburban settings. Increased interest in health-conscious and sustainable food choices encourages adoption. Evolving regulations on food labeling and sustainability influence consumer preferences, balancing flavor variety with ethical consumption.

Germany Vegan Aerosol Whipping Cream Market Insight

Germany is expected to witness rapid growth in the vegan aerosol whipping cream market, attributed to its advanced food manufacturing sector and high consumer focus on health and sustainability. German consumers prefer technologically advanced plant-based creams that mimic dairy texture and contribute to eco-friendly diets. The integration of these products in premium desserts and beverages supports sustained market growth.

Asia-Pacific Vegan Aerosol Whipping Cream Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding vegan food markets and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of health benefits, lactose intolerance, and environmental concerns boosts demand for vegan aerosol whipping cream. Government initiatives promoting plant-based diets and sustainable food production further encourage the adoption of advanced plant-based products.

Japan Vegan Aerosol Whipping Cream Market Insight

Japan’s vegan aerosol whipping cream market is expected to witness rapid growth due to strong consumer preference for high-quality, plant-based products that enhance culinary experiences and align with health-conscious trends. The presence of major food manufacturers and the integration of vegan whipping cream in both OEM and retail channels accelerate market penetration. Rising interest in plant-based cuisine also contributes to growth.

China Vegan Aerosol Whipping Cream Market Insight

China holds the largest share of the Asia-Pacific vegan aerosol whipping cream market, propelled by rapid urbanization, rising vegan food consumption, and increasing demand for dairy-free alternatives. The country’s growing middle class and focus on health and sustainability support the adoption of vegan aerosol whipping cream. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Vegan Aerosol Whipping Cream Market Share

The vegan aerosol whipping cream industry is primarily led by well-established companies, including:

- So Delicious Dairy Free (U.S.)

- Gay Lea Foods Co-operative Ltd. (Canada)

- Conagra Brands, Inc (U.S.)

- Truwhip (U.S.)

- Trader Joe's (U.S.)

- Natures Charm (U.S.)

- Tropolite (India)

- Heng Guan Food Industrial (Singapore)

- Califia Farms, LLC (U.S.)

- Debic (Belgium)

- Anchor (New Zealand)

- Dutch Farms (U.S.)

- Clover Sonoma (U.S.)

- Land O'Lakes (U.S.)

- Market Pantry (U.S.)

- Cabot Creamery (U.S.)

- Whole Foods Market (U.S.)

What are the Recent Developments in Global Vegan Aerosol Whipping Cream Market?

- In June 2025, Alamance Foods, Savor, and Thimus unveiled a prototype of a carbon-neutral whipped cream at Future Food-Tech Chicago, marking a breakthrough in sustainable food innovation. The product is palm-oil-free and non-dairy, made using gas-based fat technology developed by Savor, which converts captured CO₂, green hydrogen, and methane into customizable fatty acids. Alamance contributed its aerosol expertise, while Thimus applied neuroscience-driven sensory evaluation to optimize consumer experience. This collaboration showcases a bold step toward eco-friendly food systems

- In November 2024, Alamance Foods, a leading producer of aerosol whipped cream, launched its new Whipt product line featuring three vegan whipped cream varieties made from oat, almond, and coconut cream. Designed to meet the rising demand for non-dairy and lactose-free options, Whipt offers a plant-based, gluten-free, and non-GMO alternative to traditional whipped toppings. This launch leverages Alamance’s long-standing expertise in aerosol technology while aligning with modern consumer preferences for sustainability, health-conscious choices, and culinary versatility

- In October 2024, Baileys, owned by Diageo UK, partnered with Arla Foods, a leading dairy cooperative, to launch Baileys’ first-ever whipped cream product in UK retail stores. The collaboration introduced Baileys Canned Squirty Cream, infused with the brand’s signature flavor, in a 250ml aerosol format. Timed for the festive season, the product aims to elevate desserts and cocktails while tapping into consumer demand for indulgent, branded dairy offerings. This strategic move highlights Baileys’ expansion into new product categories and reinforces its appeal among younger, experience-driven shoppers

- In March 2023, Costa Coffee introduced its first-ever dairy-free whipped cream, branded as Light Whip, across all UK stores. This plant-based topping replaced the previous Light Dairy Swirl, which was made with skimmed cow’s milk and unsuitable for vegans. Light Whip is designed to complement Costa’s range of handmade drinks, offering a lighter, vegan-friendly alternative that caters to the growing demand for non-dairy options in the food and beverage industry. The launch reflects Costa’s commitment to inclusive menu innovation and expanding its plant-based offerings

- In March 2023, a vegan whipped cream spray was recalled in Greece due to concerns that it may contain milk, despite being labeled as lactose-free, gluten-free, and soy-free. The product in question was the Schlagfix “Schlagcreme vegan spray topping”, and the recall was ordered by the Hellenic Food Authority (EFET) after the original English label indicated it "may contain traces of milk." This incident underscores the critical importance of accurate allergen labeling and product integrity, especially within the rapidly growing vegan

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vegan Aerosol Whipping Cream Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vegan Aerosol Whipping Cream Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vegan Aerosol Whipping Cream Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.