Global Vegan Dog Food Market

Market Size in USD Billion

CAGR :

%

USD

17.46 Billion

USD

44.79 Billion

2024

2032

USD

17.46 Billion

USD

44.79 Billion

2024

2032

| 2025 –2032 | |

| USD 17.46 Billion | |

| USD 44.79 Billion | |

|

|

|

|

Vegan Dog Food Market Size

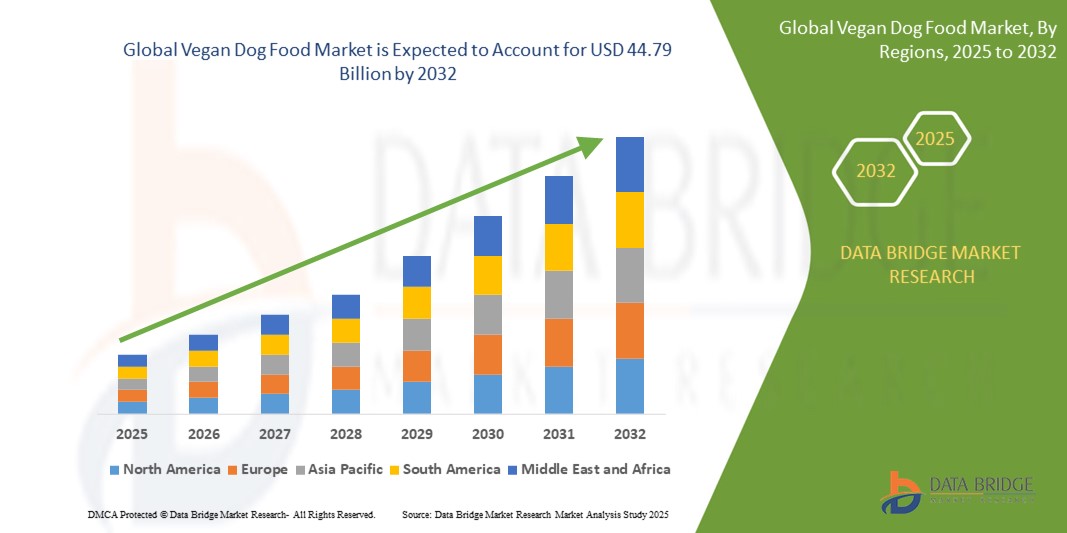

- The global vegan dog food market was valued at USD 17.46 billion in 2024 and is expected to reach USD 44.79 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.50%, primarily driven by rising trend of pet humanization

- This growth is driven by factors such as preference for premium, health-focused diets, ethical and sustainable lifestyles, and concern over pet allergies and wellness

Vegan Dog Food Market Analysis

- Vegan dog food is a plant-based dietary solution formulated to meet the nutritional needs of dogs while aligning with ethical, environmental, and health-conscious consumer preferences

- Market growth is driven by rising pet humanization, growing veganism among pet owners, increased awareness of pet health issues, and demand for sustainable, cruelty-free pet products

- Innovation in plant-based ingredients, fortified formulations, and palatability enhancers is fueling product development and consumer adoption

- For instance, brands such as Wild Earth and V-Dog are introducing nutrient-rich vegan dog foods using ingredients such as yeast protein, lentils, and quinoa to match canine dietary requirements

- The vegan dog food market is projected to experience steady growth from 2025 to 2032, supported by evolving consumer values, regulatory support for sustainable practices, and expanding online retail channels

Report Scope and Vegan Dog Food Market Segmentation

|

Attributes |

Vegan Dog Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vegan Dog Food Market Trends

“Rising Emergence of Lab-Grown Meat Products for Pets”

- One prominent trend in the global vegan dog food market is the rising emergence of lab-grown meat products for pets

- This trend is driven by the increasing demand for ethical, sustainable, and cruelty-free alternatives to traditional meat-based pet foods

- For instance, companies such as Meatly in the UK have introduced cultivated chicken-based dog treats, offering a novel protein source that aligns with both animal welfare and environmental goals

- The development of lab-grown pet food is also encouraging innovation in food safety, nutritional precision, and regulatory compliance

- As consumers seek sustainable yet nutritious options for their pets, the adoption of lab-grown meat products is expected to gain momentum, shaping future product offerings and market direction

Vegan Dog Food Market Dynamics

Driver

“Growth in Veganism & Ethical Consumerism”

- The growth in veganism and ethical consumerism is a key driver of expansion in the vegan dog food market. As more individuals adopt plant-based lifestyles and make values-driven purchasing decisions, they are extending these preferences to their pets’ diets

- This shift is particularly noticeable in North America and Europe, where consumers are actively seeking cruelty-free, environmentally sustainable, and health-conscious pet food options

- With rising concerns over animal welfare, environmental impact, and ingredient transparency, pet owners are turning to vegan alternatives that align with their ethical values and promote pet health

- Innovations in plant-based nutrition, such as complete amino acid profiles and fortified formulas, are making it easier for brands to meet both nutritional and ethical standards

- Major players in the vegan pet food space are capitalizing on this trend to expand their offerings

For instance,

- Wild Earth offers dog food made with yeast protein and has gained visibility through investor support from Mark Cuban on Shark Tank

- The Pack, a UK-based brand, uses novel proteins such as fermented fungi and legumes to develop eco-friendly meals for dogs

- As ethical consumerism continues to influence purchasing behavior, this trend is expected to remain a powerful driver shaping the future of the vegan dog food market

Opportunity

“Rising Adoption of Pets”

- The rising adoption of pets presents a significant opportunity for the vegan dog food market. As more households globally adopt pets, particularly dogs, the demand for specialized, ethical, and health-conscious pet food is growing rapidly

- The increasing number of pet owners is driving the need for diverse, high-quality pet food options, including vegan products that cater to specific dietary preferences and health needs

- This opportunity aligns with the broader societal shift toward plant-based food, as pet owners look for sustainable and cruelty-free food options for their pets

For instance,

- The Honest Kitchen, a well-known brand, offers organic and plant-based options for dogs, capitalizing on the rising demand for health-conscious pet food

- Nutrish, founded by celebrity chef Rachael Ray, recently introduced a plant-based line designed to meet the needs of ethical pet owners

- With the global rise in pet adoption, particularly in urban and millennial-driven markets, the vegan dog food market is expected to see continued growth, providing manufacturers with new opportunities for innovation and market expansion

Restraint/Challenge

“Non-Uniformity in International Trade Regulations”

- Non-uniformity in international trade regulations presents a significant challenge for the vegan dog food market. As the market expands globally, navigating varying regulations on ingredients, labeling, and product safety becomes increasingly complex

- Challenges such as differing standards for vegan food certifications, approval processes for plant-based ingredients, and import/export restrictions complicate market entry and distribution for companies seeking to scale internationally

- This issue is particularly critical in regions with strict pet food regulations, such as the EU and North America, where compliance with both local and international standards can delay product launches and increase operational costs

For instance,

- Companies such as V-Dog, which operate internationally, must adapt to differing labeling requirements and ingredient restrictions in each country they sell to, adding complexity to their supply chain and marketing strategies

- Without addressing these regulatory challenges through stronger compliance strategies, collaborations with local authorities, and investment in legal expertise, international market growth could be slowed, limiting the expansion potential of vegan dog food brands worldwide

Vegan Dog Food Market Scope

The market is segmented on the basis of nature, product, sales channel, and type.

|

Segmentation |

Sub-Segmentation |

|

By Nature |

|

|

By Product |

|

|

By Sales Channel |

|

|

By Type

|

|

Vegan Dog Food Market Regional Analysis

“South America is the Dominant Region in the Vegan Dog Food Market”

- South America dominates the vegan dog food market, driven by the growing availability of pet food, increasing pet adoption, and rising trends of pet humanization

- Brazil holds a significant share due to its large pet population, an expanding middle class, and increasing awareness around the benefits of plant-based diets for pets

- With the growing trend of ethical consumerism and health-conscious pet owners, companies are increasing their investments in plant-based pet food production, catering to the needs of a new generation of pet parents who prioritize sustainability and health

- As South America continues to grow in terms of pet adoption and ethical consumer trends, the region is expected to maintain its dominance in the vegan dog food market through the forecast period of 2025 to 2032

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the vegan dog food market, driven by rapid urbanization, evolving lifestyles, and a rising demand for premium-quality pet food products

- China, Japan, and India are key contributors to this growth, with pet owners becoming increasingly aware of the health benefits of plant-based diets for their pets. The region’s growing middle class and focus on sustainable consumer goods are fueling the demand for vegan pet food.

- Emerging markets in Vietnam, Indonesia, and Thailand are also driving the demand for vegan dog food as consumer awareness around health, wellness, and ethical eating practices continues to rise

- With significant investments in pet food innovations, growing disposable incomes, and increasing pet ownership, Asia-Pacific is expected to be the fastest-growing region in the vegan dog food market from 2025 to 2032

Vegan Dog Food Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hill's Pet Nutrition, Inc (U.S.)

- The J.M. Smucker Company (U.S.)

- Schell & Kampeter, Inc. (U.S.)

- Heristo Aktiengesellschaft (Germany)

- Simmon Foods, Inc. (U.S.)

- Wellness Pet. LLC (U.S.)

- The Farmers Dog, Inc. (U.S.)

- JustFoodForDogs (U.S.)

- Ollie Pets Inc. (U.S.)

- NomNomNow, Inc. (U.S.)

Latest Developments in Global Vegan Dog Food Market

- In September 2023, Omni, a U.K.-based vegan pet food company, launched its first meat-like vegan dog food product. This move marks a significant step in the company’s market expansion, as it plans to extend its reach into Western Europe, which is expected to drive growth and increase its international market presence

- In June 2020, Nulo, Inc., a leading manufacturer and distributor of premium pet food products, introduced a new line of flavor-infused water supplements designed to enhance dogs' diets and maximize hydration. This launch is expected to boost the company’s market presence and cater to the growing demand for innovative, health-focused pet products

- In May 2020, West Paw, Inc., a leading U.S.-based pet food brand that manufactures eco-friendly dog products, announced the launch of a new portfolio of dog treats with two innovative flavours: peanut butter with banana and beef liver with liver with pumpkin

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VEGAN DOG FOOD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VEGAN DOG FOOD MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VEGAN DOG FOOD MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 VALUE CHAIN ANALYSIS

5.3 BRAND COMPARATIVE ANALYSIS

5.4 FACTROS INFLUENCING PURCHASE DECISION OF CUSTOMERS

5.5 GROWTH STAREGIES ADOPTED BY KEY PLAYERS

5.6 INDUSTRY TRENDDS AND FUTURE PERSPECTIVE

5.7 TRENDS AT PET OWNER LEVEL

5.8 PROMOTIONAL ACTIVITIES BY KEY PLAYERS

5.9 PORTERS FIVE ANALYSIS

5.1 NEW PRODUCT LAUNCH STRATEGIES

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 PRICING INDEX

8 GLOBAL VEGAN DOG FOOD MARKET , BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BISCUITS

8.3 STRIPS

8.4 VEGETANL STICKS

8.5 KNOTS

8.6 NATURAL AND ORGANIC TREATS

8.7 DENTAL TREATS AND CHEWS

8.8 FUNCTIONAL TREATS

8.9 OTHERS

9 GLOBAL VEGAN DOG FOOD MARKET , BY FORM

9.1 OVERVIEW

9.2 DRY FOOD

9.3 WET FOOD

10 GLOBAL VEGAN DOG FOOD MARKET , BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 GLOBAL VEGAN DOG FOOD MARKET , BY TIME OF CONSUMPTION

11.1 OVERVIEW

11.2 TRAINING

11.3 BONDING

11.4 OCCUPYING TIME

11.5 CLEANING TEETH

12 GLOBAL VEGAN DOG FOOD MARKET , BY PACKAGING TYPE

12.1 OVERVIEW

12.2 CANS

12.3 BAGS

12.4 POUCHES

12.5 PAPER BAGS

12.6 TRAYS

12.7 OTHERS

13 GLOBAL VEGAN DOG FOOD MARKET , BY CATEGORY

13.1 OVERVIEW

13.2 COMPLETE FOOD

13.3 COMPLEMENTARY FOOD

14 GLOBAL VEGAN DOG FOOD MARKET, BY TYPE OF PETS

14.1 OVERVIEW

14.2 PUPPY

14.3 ADULT 1+ YEARS

14.4 MATURE 7+ YEARS

15 GLOBAL VEGAN DOG FOOD MARKET , BY INGREDIENTS

15.1 OVERVIEW

15.2 CARROT SLICES

15.3 LEAFY GREENS

15.4 LENTILS

15.5 QUINOA

15.6 BEANS

15.7 RIVE

15.8 BROCCOLI

15.9 PUMPKIN STRIPS

15.1 SWEET POTATO

15.11 CHICKPEA

15.12 OATS

15.13 ALFALFA

15.14 GINGER

15.15 CHIA SEEDS

15.16 SPINACH

15.17 FRUITS

15.17.1 APPLE

15.17.2 MANGO

15.17.3 STRAWBERRY

15.17.4 BANANAS

15.17.5 OTHERS

15.18 OATS

15.19 OTHERS

16 GLOBAL VEGAN DOG FOOD MARKET , BY END-USER

16.1 OVERVIEW

16.2 HOUSEHOLD

16.3 ANIMAL HOSPITALS AND CLINICS

16.4 PET HOTELS AND RESORTS

16.5 PET DAY CARE CENTRES

16.6 OTHERS

17 GLOBAL VEGAN DOG FOOD MARKET , BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 STORE-BASED REATILERS

17.2.1 SUPERMARKETS/HYPERMARKET

17.2.2 GROCERY STORES

17.2.3 SPECIALTY STORE

17.2.4 PET FOOD SHOPS

17.2.5 OTHERS

17.3 NON-STORE BASED RETAILERS

17.3.1 ONLINE RETAILERS

17.3.2 COMPANY WEBSITES

18 GLOBAL VEGAN DOG FOOD MARKET , COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS & PARTNERSHIP

18.8 REGULATORY CHANGES

19 SWOT AND DBMR ANALYSIS, GLOBAL VEGAN DOG FOOD MARKET

20 GLOBAL VEGAN DOG FOOD MARKET , BY GEOGRAPHY

20.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 EUROPE

20.3.1 GERMANY

20.3.2 U.K.

20.3.3 ITALY

20.3.4 FRANCE

20.3.5 SPAIN

20.3.6 SWITZERLAND

20.3.7 NETHERLANDS

20.3.8 BELGIUM

20.3.9 RUSSIA

20.3.10 DENMARK

20.3.11 SWEDEN

20.3.12 POLAND

20.3.13 TURKEY

20.3.14 REST OF EUROPE

20.4 ASIA-PACIFIC

20.4.1 JAPAN

20.4.2 CHINA

20.4.3 SOUTH KOREA

20.4.4 INDIA

20.4.5 AUSTRALIA

20.4.6 SINGAPORE

20.4.7 THAILAND

20.4.8 INDONESIA

20.4.9 MALAYSIA

20.4.10 PHILIPPINES

20.4.11 NEW ZEALAND

20.4.12 VIETNAM

20.4.13 REST OF ASIA-PACIFIC

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND NORTH AFRICA

20.6.1 NIGERIA

20.6.2 GHANA

20.6.3 UAE

20.6.4 SAUDI ARABIA

20.6.5 OMAN

20.6.6 QATAR

20.6.7 KUWAIT

20.6.8 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL VEGAN DOG FOOD MARKET , SWOT & DBMR ANALYSIS

22 GLOBAL VEGAN DOG FOOD MARKET , COMPANY PROFILE

22.1 BENOVO

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHICAL PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 V-PLANET

22.2.1 COMPANY OVERVIEW

22.2.2 PRODUCT PORTFOLIO

22.2.3 GEOGRAPHICAL PRESENCE

22.2.4 RECENT DEVELOPMENTS

22.3 VEGECO LTD

22.3.1 COMPANY OVERVIEW

22.3.2 PRODUCT PORTFOLIO

22.3.3 GEOGRAPHICAL PRESENCE

22.3.4 RECENT DEVELOPMENTS

22.4 NATURAL BALANCE PET FOODS, INC.

22.4.1 COMPANY OVERVIEW

22.4.2 PRODUCT PORTFOLIO

22.4.3 GEOGRAPHICAL PRESENCE

22.4.4 RECENT DEVELOPMENTS

22.5 BOND PET FOODS INC.

22.5.1 COMPANY OVERVIEW

22.5.2 GEOGRAPHICAL PRESENCE

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT DEVELOPMENTS

22.6 PETGUARD HOLDINGS, LLC

22.6.1 COMPANY OVERVIEW

22.6.2 GEOGRAPHICAL PRESENCE

22.6.3 PRODUCT PORTFOLIO

22.6.4 RECENT DEVELOPMENTS

22.7 COMPASSION CIRCLE, INC.

22.7.1 COMPANY OVERVIEW

22.7.2 GEOGRAPHICAL PRESENCE

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENTS

22.8 VEGAN4DOGS ‑ DP‑KERN BARTSCH & SCHMIDT GBR

22.8.1 COMPANY OVERVIEW

22.8.2 GEOGRAPHICAL PRESENCE

22.8.3 PRODUCT PORTFOLIO

22.8.4 RECENT DEVELOPMENTS

22.9 SOOPA PETS

22.9.1 COMPANY OVERVIEW

22.9.2 GEOGRAPHICAL PRESENCE

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENTS

22.1 ANTOS B.V.

22.10.1 COMPANY OVERVIEW

22.10.2 GEOGRAPHICAL PRESENCE

22.10.3 PRODUCT PORTFOLIO

22.10.4 RECENT DEVELOPMENTS

22.11 YARRAH ORGANIC PETFOOD B.V.

22.11.1 COMPANY OVERVIEW

22.11.2 GEOGRAPHICAL PRESENCE

22.11.3 PRODUCT PORTFOLIO

22.11.4 RECENT DEVELOPMENTS

22.12 AUGUSTINE APPROVED

22.12.1 COMPANY OVERVIEW

22.12.2 GEOGRAPHICAL PRESENCE

22.12.3 PRODUCT PORTFOLIO

22.12.4 RECENT DEVELOPMENTS

22.13 ISOROPIMENE ZOOTROFE GEORGIOS TSAPPIS LTD.

22.13.1 COMPANY OVERVIEW

22.13.2 GEOGRAPHICAL PRESENCE

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENTS

22.14 4LEGS PET FOOD COMPANY

22.14.1 COMPANY OVERVIEW

22.14.2 GEOGRAPHICAL PRESENCE

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT DEVELOPMENTS

22.15 AMI PET FOOD

22.15.1 COMPANY OVERVIEW

22.15.2 GEOGRAPHICAL PRESENCE

22.15.3 PRODUCT PORTFOLIO

22.15.4 RECENT DEVELOPMENTS

22.16 BENEVO

22.16.1 COMPANY OVERVIEW

22.16.2 GEOGRAPHICAL PRESENCE

22.16.3 PRODUCT PORTFOLIO

22.16.4 RECENT DEVELOPMENTS

22.17 HALO PETS

22.17.1 COMPANY OVERVIEW

22.17.2 GEOGRAPHICAL PRESENCE

22.17.3 PRODUCT PORTFOLIO

22.17.4 RECENT DEVELOPMENTS

22.18 WILD EARTH

22.18.1 COMPANY OVERVIEW

22.18.2 GEOGRAPHICAL PRESENCE

22.18.3 PRODUCT PORTFOLIO

22.18.4 RECENT DEVELOPMENTS

22.19 MARS

22.19.1 COMPANY OVERVIEW

22.19.2 GEOGRAPHICAL PRESENCE

22.19.3 PRODUCT PORTFOLIO

22.19.4 RECENT DEVELOPMENTS

22.2 V-DOG

22.20.1 COMPANY OVERVIEW

22.20.2 GEOGRAPHICAL PRESENCE

22.20.3 PRODUCT PORTFOLIO

22.20.4 RECENT DEVELOPMENTS

Note: the companies profiled is not exhaustive list and is as per our previous client requirement. we profile more than 100 companies in our study and hence the list of Companies can be modified or replaced on request

23 RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Global Vegan Dog Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vegan Dog Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vegan Dog Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.