Global Vegan Footwear Market

Market Size in USD Billion

CAGR :

%

USD

35.25 Billion

USD

61.24 Billion

2025

2033

USD

35.25 Billion

USD

61.24 Billion

2025

2033

| 2026 –2033 | |

| USD 35.25 Billion | |

| USD 61.24 Billion | |

|

|

|

|

Vegan Footwear Market Size

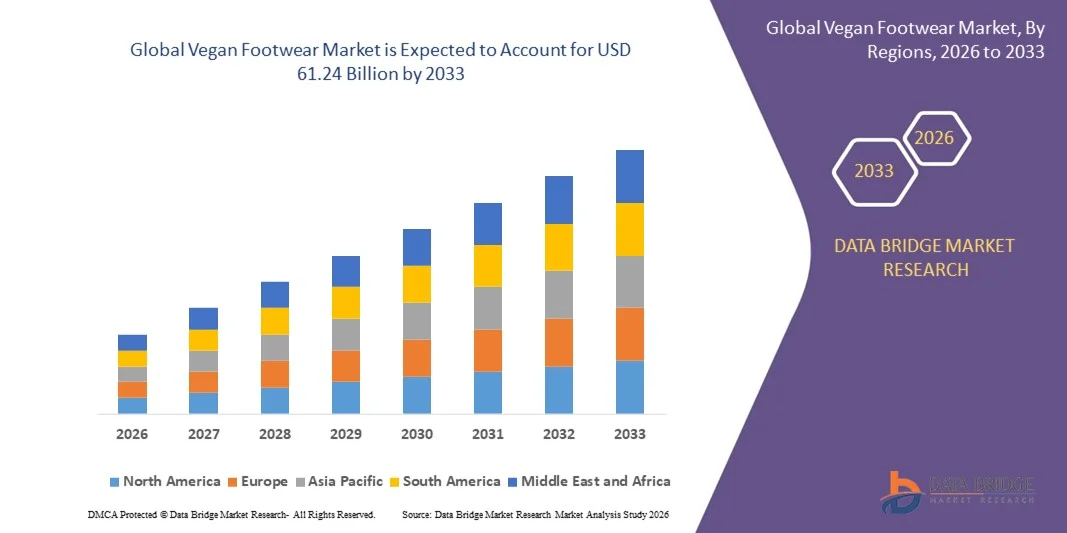

- The global vegan footwear market size was valued at USD 35.25 billion in 2025 and is expected to reach USD 61.24 billion by 2033, at a CAGR of 7.15% during the forecast period

- The market growth is largely fueled by the rising consumer preference for sustainable, cruelty-free, and ethically produced footwear, encouraging both established and emerging brands to expand their vegan product lines. Increased awareness of environmental impact and animal welfare is motivating consumers to shift from traditional leather and synthetic materials to plant-based and recycled alternatives, thereby driving market expansion

- Furthermore, the growing availability of stylish, comfortable, and high-performance vegan footwear across premium and mass-market segments is establishing these products as viable alternatives to conventional shoes. These converging factors, including innovation in bio-based and recyclable materials, are accelerating the adoption of vegan footwear, significantly boosting industry growth

Vegan Footwear Market Analysis

- Vegan footwear, manufactured without any animal-derived materials and increasingly using sustainable components such as microfiber, recycled polyester, and natural rubber, is becoming a key element of ethical and eco-conscious fashion trends. The integration of comfort, durability, and modern design makes these products appealing across casual, athletic, and premium segments

- The escalating demand for vegan footwear is primarily fueled by growing environmental awareness, ethical consumerism, and increasing influence of sustainable fashion in mainstream markets. Consumers are drawn to products that combine style, comfort, and a reduced ecological footprint, driving brands to innovate with alternative materials and expand their vegan collections globally

- North America dominated vegan footwear market with a share of 36.1% in 2025, due to growing awareness of sustainable and cruelty-free fashion, as well as increased demand for ethically produced products

- Asia-Pacific is expected to be the fastest growing region in the vegan footwear market during the forecast period due to rising disposable incomes, urbanization, and increasing fashion consciousness in countries such as China, Japan, and India

- Sneakers segment dominated the market with a market share of 36.3% in 2025, due to their widespread adoption for casual and athletic purposes and the increasing preference for sustainable alternatives. Consumers prioritize sneakers for their comfort, versatility, and compatibility with various outfits, while brands focus on innovative, eco-friendly designs that appeal to environmentally conscious buyers. The rising trend of athleisure and fitness-oriented lifestyles further supports the dominance of sneakers in the vegan footwear segment

Report Scope and Vegan Footwear Market Segmentation

|

Attributes |

Vegan Footwear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vegan Footwear Market Trends

Growing Adoption of Sustainable and Cruelty-Free Footwear

- A significant trend in the vegan footwear market is the increasing consumer shift toward sustainable and cruelty-free products, driven by heightened awareness of environmental impact and animal welfare concerns. This trend is pushing both established and emerging brands to innovate with plant-based, recycled, and bio-based materials while maintaining comfort and style across casual, formal, and athletic footwear segments

- For instance, Stella McCartney’s S-Wave Sport sneakers utilize Piñayarn spun from upcycled pineapple leaf waste, while Puma’s Re:Suede 2.0 line incorporates compostable suede and rubber components, demonstrating how luxury and mainstream brands are integrating sustainability into high-performance footwear. These products reduce ecological footprints and also set benchmarks for design and material innovation within the market

- The demand for ethical footwear is particularly pronounced in premium and urban markets where consumers prioritize style, functionality, and sustainability. Brands such as Allbirds and Veja have capitalized on this shift, offering sneakers and casual shoes made from recycled polyester, natural rubber, and other plant-based materials, reinforcing consumer trust in environmentally responsible fashion

- The increasing adoption of vegan footwear is also influenced by social media and influencer advocacy, with campaigns highlighting eco-conscious lifestyles encouraging broader consumer engagement. This trend is elevating vegan footwear from a niche offering to a mainstream product category that spans casual, formal, and athletic markets

- The global push for sustainability regulations and corporate social responsibility is further accelerating the trend, as brands align with ethical standards to meet consumer expectations and reduce environmental impact. By addressing ecological concerns, companies are creating long-term market value and fostering loyalty among ethically minded consumers

- The integration of innovative materials, such as mushroom leather, Piñayarn, and plant-based polymers, is positioning vegan footwear as both fashionable and environmentally responsible, enabling the market to capture a growing share of conscious consumer spending. This trend continues to strengthen the overall momentum toward sustainable footwear solutions worldwide

Vegan Footwear Market Dynamics

Driver

Rising Consumer Preference for Ethical and Eco-Friendly Products

- The rising demand for ethically produced and environmentally friendly footwear is a primary driver for the vegan footwear market. Consumers increasingly prefer products that avoid animal-derived materials and utilize recycled or plant-based alternatives, prompting brands to expand vegan offerings across multiple categories

- For instance, Nine West launched its “VEGEN” sneaker line featuring cruelty-free designs that balance style and comfort, targeting consumers seeking ethical footwear without compromising on aesthetics. Allbirds’ use of recycled polyester and renewable materials for its sneakers further illustrates the market’s focus on sustainability and eco-conscious production

- The shift in consumer behavior toward ethical consumption is reinforced by awareness campaigns, social responsibility initiatives, and growing discourse on the environmental impact of leather and synthetic materials. This is compelling brands to adopt sustainable practices in sourcing, manufacturing, and distribution

- Urbanization and higher disposable incomes in key regions such as North America and Europe are also strengthening this driver, as consumers have both the means and motivation to invest in premium vegan footwear options

- The rising integration of innovative, low-impact materials such as mushroom leather, Piñayarn, and recycled plastics into fashionable designs is enabling companies to differentiate their products, thereby reinforcing the preference for eco-friendly footwear

Restraint/Challenge

High Production Costs and Limited Material Availability

- The vegan footwear market faces challenges due to the high costs associated with sourcing sustainable, bio-based, and recycled materials, which are often more expensive than conventional leather or synthetic alternatives. Limited availability of quality plant-based leathers, microfiber, and other innovative materials constrains large-scale production and affects pricing competitiveness

- For instance, the production of mushroom-based leather for Vivobarefoot’s Gobi sneakers and Piñayarn for Stella McCartney’s S-Wave Sport requires specialized processes and agricultural byproducts, limiting supply capacity and increasing unit costs. These constraints affect both emerging brands and established companies looking to scale vegan footwear lines

- High production costs are compounded by the need for advanced manufacturing techniques to ensure durability, comfort, and aesthetic appeal, especially in premium and performance footwear segments. This often results in higher retail prices, which can limit adoption among price-sensitive consumers

- The market also encounters supply chain complexities, as sustainable raw materials are often region-specific and require careful sourcing to maintain consistent quality. These factors introduce vulnerability to supply disruptions and cost fluctuations

- The challenge of balancing eco-friendly production with affordability continues to shape investment strategies, with companies needing to optimize material sourcing, streamline manufacturing, and develop partnerships to overcome cost and availability barriers

Vegan Footwear Market Scope

The market is segmented on the basis of product, sales, material, price range, and end-use.

- By Product

On the basis of product, the vegan footwear market is segmented into loafers, heels, sandals, boots, sneakers, shoes, and others. The sneakers segment dominated the market with the largest market revenue share of 36.3% in 2025, driven by their widespread adoption for casual and athletic purposes and the increasing preference for sustainable alternatives. Consumers prioritize sneakers for their comfort, versatility, and compatibility with various outfits, while brands focus on innovative, eco-friendly designs that appeal to environmentally conscious buyers. The rising trend of athleisure and fitness-oriented lifestyles further supports the dominance of sneakers in the vegan footwear segment.

The heels segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand in the fashion and corporate sectors. For instance, Stella McCartney has introduced sustainable high-heel designs that combine luxury aesthetics with cruelty-free materials, attracting environmentally conscious consumers. Vegan heels offer design flexibility, vibrant aesthetics, and ethical appeal, making them highly desirable among women seeking stylish alternatives to conventional leather products. The growing awareness of animal welfare and sustainability considerations contributes to the rising adoption of vegan heels in urban and premium markets.

- By Sales

On the basis of sales, the vegan footwear market is segmented into direct and indirect channels. The direct segment dominated the market in 2025 due to the increasing number of brands selling through owned websites, exclusive stores, and brand-specific e-commerce platforms. Direct sales enable better control over pricing, brand positioning, and customer engagement while offering personalized shopping experiences and customization options. The ease of accessing brand offerings and limited editions through direct channels has strengthened their market position, particularly in premium and mid-tier segments.

The indirect segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the expanding network of multi-brand retail stores, online marketplaces, and department stores. For instance, Adidas has partnered with online retailers to distribute its vegan footwear collection widely, catering to a diverse audience. Indirect sales provide greater visibility, convenience, and accessibility, particularly in regions where direct brand presence is limited. The growing popularity of omnichannel retail strategies further accelerates the adoption of indirect sales channels in the vegan footwear market.

- By Material

On the basis of material, the vegan footwear market is segmented into microfiber, hemp, natural rubber, cotton, recycled polyester, recycled plastics, polyurethane, and others. The microfiber segment dominated the market in 2025, driven by its lightweight, durable, and versatile properties, making it suitable for diverse footwear styles. Microfiber-based vegan footwear offers enhanced breathability, comfort, and resistance to wear, aligning with consumer demands for long-lasting and eco-friendly products. The availability of advanced manufacturing techniques allows brands to create high-quality, sustainable footwear using microfiber without compromising aesthetics or performance.

The recycled polyester segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing emphasis on circular economy principles and sustainable fashion initiatives. For instance, Allbirds has utilized recycled polyester in its sneakers to reduce environmental impact while maintaining high-performance standards. Recycled polyester enables brands to minimize plastic waste, reduce carbon footprint, and appeal to eco-conscious consumers seeking fashionable yet sustainable footwear alternatives. The growing regulatory support for sustainable materials further boosts the adoption of recycled polyester in vegan footwear production.

- By Price Range

On the basis of price range, the vegan footwear market is segmented into premium and mass categories. The premium segment dominated the market in 2025, driven by the rising demand for high-quality, fashionable, and ethically produced footwear. Consumers in the premium segment value design innovation, material quality, and brand reputation, often willing to pay a higher price for products that align with sustainability and cruelty-free principles. Premium vegan footwear brands have leveraged collaborations, influencer endorsements, and limited-edition releases to reinforce exclusivity and appeal among fashion-conscious buyers.

The mass segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing affordability, wider availability, and growing consumer awareness of cruelty-free alternatives. For instance, brands such as Veja offer stylish and sustainable sneakers at accessible price points, expanding their reach to mainstream buyers. Mass-market vegan footwear appeals to cost-conscious consumers seeking ethical options without compromising style or comfort. Retail expansions and e-commerce penetration further enhance the adoption of mass-priced vegan footwear globally.

- By End-Use

On the basis of end-use, the vegan footwear market is segmented into women, men, kids, and transgender consumers. The women’s segment dominated the market in 2025, driven by higher fashion-consciousness, diverse product preferences, and increasing awareness of sustainable and cruelty-free products. Women consumers often prioritize style, comfort, and ethical considerations while selecting footwear, prompting brands to offer a wide range of designs, including sneakers, heels, sandals, and boots. The growing popularity of sustainable fashion campaigns and eco-friendly influencers has further strengthened the dominance of women’s vegan footwear in the market.

The kids’ segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by parents’ increasing inclination toward sustainable and non-toxic products for children. For instance, Native Shoes has developed durable and lightweight vegan footwear for kids using environmentally friendly materials, gaining strong market traction. The focus on comfort, safety, and sustainability drives the rising adoption of vegan footwear for children, while educational initiatives on eco-conscious consumption reinforce the trend. The expanding range of colorful, playful, and practical designs contributes to the segment’s rapid growth globally.

Vegan Footwear Market Regional Analysis

- North America dominated the vegan footwear market with the largest revenue share of 36.1% in 2025, driven by growing awareness of sustainable and cruelty-free fashion, as well as increased demand for ethically produced products

- Consumers in the region highly value the combination of style, comfort, and environmental responsibility offered by vegan footwear brands such as Allbirds and Native Shoes

- This widespread adoption is further supported by high disposable incomes, a fashion-conscious population, and the rising preference for eco-friendly lifestyles, establishing vegan footwear as a favored choice among both urban and suburban consumers

U.S. Vegan Footwear Market Insight

The U.S. vegan footwear market captured the largest revenue share in 2025 within North America, fueled by the increasing trend of ethical consumerism and demand for sustainable alternatives. Consumers are prioritizing products that offer style, comfort, and reduced environmental impact, which has led to strong adoption of vegan sneakers, loafers, and casual footwear. The expanding online retail infrastructure, along with collaborations between fashion brands and eco-conscious influencers, further drives market growth, while the integration of innovative materials such as recycled polyester and microfiber in premium vegan footwear is significantly contributing to the U.S. market expansion.

Europe Vegan Footwear Market Insight

The Europe vegan footwear market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental regulations and growing awareness of animal welfare. The increase in urbanization and demand for sustainable fashion is fostering adoption, particularly in countries such as Germany, France, and Italy, while consumers are attracted to the ethical appeal, high-quality craftsmanship, and stylish designs offered by vegan footwear. Significant growth is observed across casual, formal, and premium segments, with brands increasingly incorporating recycled and innovative materials into their collections, strengthening the market’s presence in Europe.

U.K. Vegan Footwear Market Insight

The U.K. vegan footwear market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened consumer focus on sustainability and ethical fashion choices. Concerns regarding animal welfare and environmental impact are encouraging consumers to adopt cruelty-free alternatives for women’s, men’s, and children’s footwear, while the robust retail ecosystem and strong e-commerce penetration continue to stimulate market growth. Brands such as Stella McCartney and Vegetarian Shoes are leading the adoption of stylish, eco-conscious footwear, enhancing visibility and appeal, and promoting the growth of vegan footwear in the U.K.

Germany Vegan Footwear Market Insight

The Germany vegan footwear market is expected to expand at a considerable CAGR during the forecast period, fueled by growing eco-consciousness and demand for premium, sustainable products. Germany’s well-developed infrastructure, strong fashion industry, and focus on innovation promote the adoption of vegan footwear in both urban and suburban regions, while consumers increasingly prefer footwear made from recyclable materials and low-impact production methods. The integration of modern design aesthetics and comfort-oriented features is further driving the popularity of vegan footwear in Germany.

Asia-Pacific Vegan Footwear Market Insight

The Asia-Pacific vegan footwear market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising disposable incomes, urbanization, and increasing fashion consciousness in countries such as China, Japan, and India. The region’s growing interest in sustainable and ethically produced products is promoting the adoption of vegan footwear across premium and mid-range segments, while government initiatives promoting eco-friendly products and the expansion of e-commerce platforms enhance accessibility. Moreover, APAC is emerging as a manufacturing hub for sustainable footwear, making products more affordable and boosting adoption among a broader consumer base.

Japan Vegan Footwear Market Insight

The Japan vegan footwear market is gaining momentum due to high fashion awareness, eco-conscious consumer behavior, and demand for comfortable and ethically produced shoes. Consumers value innovative materials such as microfiber and recycled polyester that combine durability, comfort, and sustainability, while the increasing popularity of casual sneakers and loafers for urban lifestyles drives growth. Brands focusing on design, functionality, and eco-friendly production are contributing to the rising adoption of vegan footwear in residential and commercial sectors across Japan.

China Vegan Footwear Market Insight

The China vegan footwear market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, rising disposable incomes, and increasing awareness of sustainable fashion. China is emerging as a significant market for vegan footwear, with growing adoption across urban youth and professional demographics, while domestic brands and affordable, stylish vegan options are propelling market growth. Initiatives promoting green manufacturing and the shift toward sustainable consumer goods further support the market’s expansion in China.

Vegan Footwear Market Share

The vegan footwear industry is primarily led by well-established companies, including:

- Adidas AG (Germany)

- Beyond Skin (U.K.)

- Ethletic (Germany)

- Hexa Shoes (Thailand)

- MooShoes (U.S.)

- Nike, Inc. (U.S.)

- MATT & NAT CANADA (Canada)

- Susi Studio (U.S.)

- VEERAH (U.S.)

- Allbirds Inc. (U.S.)

- Veja (France)

- Native Shoes (Canada)

- Rothy’s (U.S.)

- TOMS (U.S.)

- Ahimsa Shoes (Brazil)

- Nae Vegan Shoes (Portugal)

Latest Developments in Global Vegan Footwear Market

- In December 2025, sustainable footwear innovator Vivobarefoot launched its Gobi sneaker made with mushroom‑based materials, representing a major advance in truly natural and plastic‑free vegan footwear. This product uses 98% plant‑derived materials including mushroom leather and natural rubber, addressing consumer demand for high‑performance, low‑impact shoes and reinforcing the shift away from synthetic plastics in vegan footwear. By showcasing durability and repairability alongside biodegradability, Vivobarefoot’s rollout highlights how material innovation can strengthen sustainable positioning and appeal to environmentally conscious buyers, potentially inspiring competitors to invest in similar biomaterials

- In December 2025, Uncaged Innovations announced a strategic partnership with an Academy Award‑winning actor to promote its plant‑based leather technology, leveraging celebrity advocacy to raise awareness and adoption of its grain‑derived structural protein material across luxury fashion and footwear sectors. This collaboration is poised to accelerate the acceptance of high‑performance, plastic‑free alternatives by aligning ethical messaging with premium brand visibility, helping reshape consumer perceptions of sustainable materials and increasing mainstream interest in vegan footwear solutions that lower carbon footprints relative to traditional leather production

- In August 2025, women’s fashion retailer Nine West introduced its “VEGEN” vegan sneaker line, aimed at consumers prioritizing both style and ethical standards. By launching versatile, cruelty‑free sporty designs in essential colorways, Nine West tapped into the expanding mainstream demand for accessible sustainable footwear, thereby broadening the vegan sneaker segment and encouraging other fashion brands to incorporate ethical alternatives into their core portfolios while not compromising on comfort or design

- In September 2025, performance brand Under Armour partnered with UNLESS to introduce three regenerative footwear styles, marking a significant collaboration within the plant‑based footwear category. This initiative, featuring sneakers engineered to be plastic‑free and biodegradable, strengthens the presence of large athletic brands in the vegan and regenerative space, bringing sustainability narratives to performance‑oriented consumers and helping drive broader industry focus on circular design and end‑of‑life environmental responsibility

- In July 2025, luxury brand Stella McCartney updated its S‑Wave Sport sneaker collection with Piñayarn and fully compostable BioCir Flex components, reinforcing its leadership in circular fashion and sustainable material adoption. This launch demonstrated how high‑end vegan footwear can integrate innovative agricultural byproducts while delivering performance and aesthetic appeal, setting new benchmarks for sustainability in premium shoes and motivating other designers to adopt similarly eco‑friendly production approaches

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.