Global Vegetable Snacks Market

Market Size in USD Billion

CAGR :

%

USD

4.83 Billion

USD

7.02 Billion

2024

2032

USD

4.83 Billion

USD

7.02 Billion

2024

2032

| 2025 –2032 | |

| USD 4.83 Billion | |

| USD 7.02 Billion | |

|

|

|

|

Vegetable Snacks Market Size

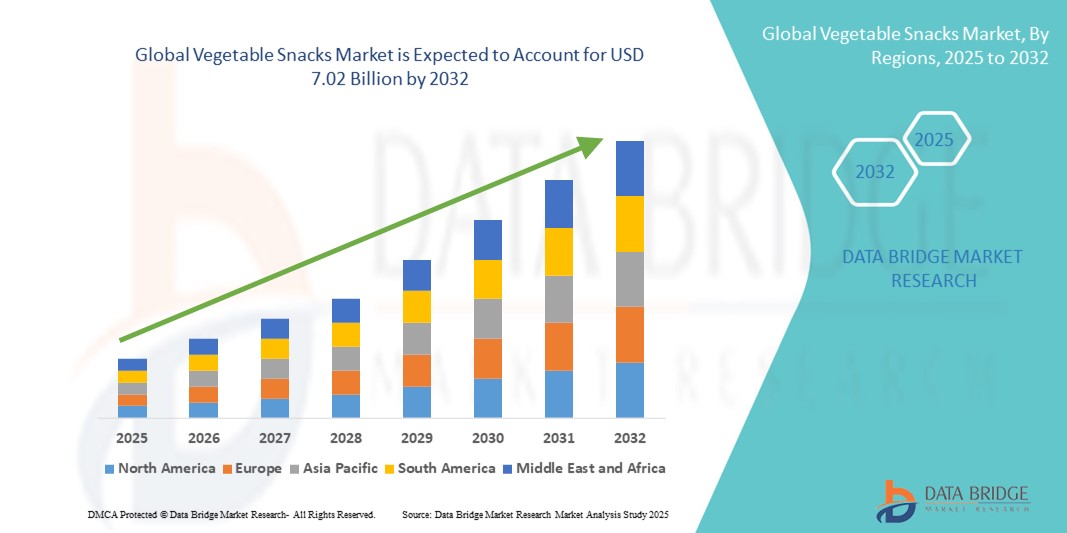

- The global vegetable snacks market size was valued at USD 4.83 billion in 2024 and is expected to reach USD 7.02 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by increasing consumer preference for healthier snacking alternatives, driven by rising awareness of nutrition, weight management, and clean-label ingredients, especially among urban populations

- Furthermore, the expansion of vegan, plant-based, and allergen-free diets is establishing vegetable snacks as a popular choice for health-conscious consumers. These converging factors are accelerating product innovation and availability, thereby significantly boosting the industry's growth

Vegetable Snacks Market Analysis

- Vegetable snacks are made from dried, baked, or fried vegetables such as sweet potatoes, carrots, beets, kale, and peas, offering a nutritious alternative to conventional snacks. These products are rich in fiber, vitamins, and antioxidants, and are often marketed as non-GMO, gluten-free, or organic to appeal to wellness-driven consumers

- The rising demand for convenient, on-the-go nutrition, combined with the growing popularity of clean-label and functional foods, is fueling market expansion. Manufacturers are increasingly focusing on innovative flavors, sustainable packaging, and nutrient-dense formulations to capture evolving consumer preferences across global markets

- North America dominated the vegetable snacks market with a share of 35.8% in 2024, due to increasing consumer demand for healthy, plant-based snacking alternatives and the rising prevalence of lifestyle-related health issues

- Asia-Pacific is expected to be the fastest growing region in the vegetable snacks market during the forecast period due to a combination of urbanization, increasing disposable incomes, and growing awareness of dietary wellness.

- Pouches segment dominated the market with a market share of 48.3% in 2024, due to their portability, cost-effectiveness, and versatility across snack categories. Pouch packaging offers ease of resealing, extended shelf life, and lighter weight compared to rigid containers, making it ideal for on-the-go consumption and e-commerce shipping. Brands are increasingly adopting eco-friendly and recyclable pouch materials in response to growing environmental concerns, further supporting segment expansion

Report Scope and Vegetable Snacks Market Segmentation

|

Attributes |

Vegetable Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vegetable Snacks Market Trends

Surging Demand for Clean & Sustainable Snacks

- The vegetable snacks market is rapidly growing as consumers increasingly seek clean-label, natural, and sustainably produced snack options that provide health benefits without synthetic additives or preservatives

- For instance, companies such as Bountiful and BIOrganics offer a range of vegetable-based chips, sticks, and dehydrated snacks made from organic, non-GMO vegetables, emphasizing transparency in sourcing and eco-friendly packaging

- Innovation in processing technologies such as air frying, vacuum drying, and freeze-drying enhances the nutritional profile and texture of vegetable snacks while reducing oil usage and waste

- Retailers are expanding their shelf space for healthier snacks, partnering with local and international vegetable snack brands to meet demand in supermarkets, specialty stores, and online platforms

- Packaging trends focus on recyclability, reduced plastic use, and compostable materials, aligning with consumer preferences for environmentally responsible products

- Increasing incorporation of functional ingredients such as fiber, antioxidants, and probiotics in vegetable snacks supports the growing trend toward wellness and digestive health

Vegetable Snacks Market Dynamics

Driver

Health Conscious Consumer Trends

- The rising global focus on health and wellness, including weight management, clean eating, and disease prevention, is significantly driving consumer preference for vegetable-based snacks as nutritious alternatives to traditional snacks

- For instance, companies such as PepsiCo (with its Terra Chips brand) and PepsiCo’s Off The Eaten Path snack line have successfully captured market share by delivering tasty vegetable chip options that emphasize natural ingredients and no artificial flavors

- Increasing demand for gluten-free, low-calorie, and allergen-friendly snacks aligns with vegetable snack products, expanding their appeal to a broader demographic including millennials and Gen Z

- Growing penetration of fitness culture and active lifestyles encourages consumers to incorporate vegetable snacks as part of balanced diets and post-workout nutrition

- Awareness campaigns conducted by public health bodies and nutritionists further educate consumers about the benefits of vegetables, stimulating demand for convenient vegetable snack formats

Restraint/Challenge

Limited Shelf Life

- A key challenge for the vegetable snacks market is the relatively short shelf life of natural, preservative-free products, which impacts distribution, retail stocking, and consumer convenience

- For instance, brands such as Terra Chips and Bare Snacks face challenges maintaining crispness, flavor stability, and preventing microbial growth without adding synthetic preservatives, requiring advanced packaging solutions

- Seasonal variability and supply chain complexities in procuring fresh vegetables can affect product consistency and availability, posing risks for uninterrupted production

- The need for cold chain logistics or modified atmosphere packaging to extend shelf life increases operational costs and environmental footprint, creating adoption and pricing challenges

- Consumer expectations for freshness and texture necessitate continual R&D investment in packaging innovations and shelf life extension technologies to remain competitive without sacrificing clean-label status

Vegetable Snacks Market Scope

The market is segmented on the basis of type, distribution channel, and packaging type.

- By Type

On the basis of type, the vegetable snacks market is segmented into chips and crisps, nuts and seeds, dried veggies, biscuits and cookies, and others. The chips and crisps segment dominated the largest market revenue share in 2024, driven by their widespread consumer appeal and extensive product availability across retail shelves. These snacks are favored for their crunch, convenience, and variety of vegetable-based formulations including beetroot, sweet potato, kale, and carrot, often marketed as healthier alternatives to traditional potato chips. The demand for vegetable chips is also reinforced by the growing preference for clean-label and baked or air-fried snack options among health-conscious consumers.

The dried veggies segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer inclination toward nutrient-dense, low-calorie snack formats. These snacks retain much of the vegetable’s original fiber and micronutrient profile, making them attractive for label-savvy consumers seeking functional benefits. The increasing popularity of single-ingredient, minimally processed snacks and expanding vegan and plant-based lifestyles are further driving the segment’s growth across global markets.

- By Distribution Channel

On the basis of distribution channel, the vegetable snacks market is segmented into store-based, supermarket and hypermarket, convenience store, and non-store-based. The supermarket and hypermarket segment accounted for the largest revenue share in 2024 owing to their high consumer footfall, wide product assortment, and ability to promote impulse purchases. These retail formats offer ample shelf space for multiple brands and SKUs, often supported by in-store promotions, sampling, and attractive discounts that boost consumer engagement with vegetable snacks.

The non-store-based segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by the exponential rise of e-commerce and direct-to-consumer snack brands. Online platforms enable health-focused snack companies to target niche audiences through subscription models, customized snack boxes, and detailed ingredient transparency. The convenience of home delivery, coupled with increasing smartphone penetration and digital payment adoption, continues to enhance the appeal of online purchasing channels for vegetable snacks.

- By Packaging Type

On the basis of packaging type, the vegetable snacks market is segmented into pouches, cans, jars, and others. The pouches segment dominated the market with a share of 48.3% in 2024, supported by their portability, cost-effectiveness, and versatility across snack categories. Pouch packaging offers ease of resealing, extended shelf life, and lighter weight compared to rigid containers, making it ideal for on-the-go consumption and e-commerce shipping. Brands are increasingly adopting eco-friendly and recyclable pouch materials in response to growing environmental concerns, further supporting segment expansion.

The jars segment is expected to record the fastest growth from 2025 to 2032, driven by premiumization trends and consumer demand for resealable, aesthetically appealing packaging. Glass and PET jars are increasingly used for gourmet vegetable snack varieties, including artisanal seed mixes and flavored dried vegetables, as they offer product visibility, protection from moisture, and a perception of higher quality. The reusability of jars also appeals to sustainability-minded consumers, reinforcing their appeal in the mid-to-premium snack segment.

Vegetable Snacks Market Regional Analysis

- North America dominated the vegetable snacks market with the largest revenue share of 35.8% in 2024, driven by increasing consumer demand for healthy, plant-based snacking alternatives and the rising prevalence of lifestyle-related health issues

- Consumers in the region are increasingly opting for low-calorie, high-fiber snack options, fueling the popularity of vegetable-based products such as kale chips, beetroot crisps, and roasted seed mixes

- The growing presence of clean-label and organic snack offerings, combined with strong retail penetration and health-oriented marketing campaigns, continues to reinforce North America’s leadership in the global vegetable snacks market

U.S. Vegetable Snacks Market Insight

The U.S. held the largest revenue share in the North American vegetable snacks market in 2024, driven by a surge in demand for convenient, ready-to-eat snacks that align with wellness goals. Consumers are increasingly seeking minimally processed, additive-free snacks made from real vegetables, pushing manufacturers to innovate with air-fried, baked, and dehydrated formulations. The rise of plant-based lifestyles and the integration of superfoods into snack offerings, such as kale and seaweed, further fuel category growth. In addition, e-commerce and subscription snack boxes are making it easier for niche and premium brands to reach health-driven consumers across the country.

Europe Vegetable Snacks Market Insight

Europe is expected to witness steady growth in the vegetable snacks market, underpinned by a strong emphasis on clean eating, sustainable practices, and health-conscious consumer behavior. The market is shaped by increasing regulatory support for nutritious food options and a maturing demand for organic, vegan, and non-GMO products. Consumers in the region are becoming more selective about ingredient transparency and sustainability in packaging, which is encouraging manufacturers to adopt environmentally friendly production and marketing strategies. The widespread adoption of flexitarian and vegetarian diets across major European countries is also bolstering demand for wholesome, vegetable-based snack alternatives.

U.K. Vegetable Snacks Market Insight

The U.K. vegetable snacks market is projected to grow at a strong CAGR during the forecast period, supported by rising interest in guilt-free indulgence and clean-label snacking. British consumers are becoming more aware of the nutritional profile of their snacks and are increasingly turning to roasted legumes, root vegetable crisps, and baked vegetable biscuits. The expansion of vegan and gluten-free product lines, along with sustainability-led brand initiatives, is attracting a broader consumer base. In addition, strong supermarket chains and digital retail platforms are playing a critical role in ensuring easy access to a diverse range of vegetable snack products.

Germany Vegetable Snacks Market Insight

Germany’s vegetable snacks market is poised for steady growth, driven by the country’s strong commitment to wellness, functional food, and sustainability. German consumers are drawn to products that offer both taste and health benefits, favoring vegetable snacks rich in fiber, vitamins, and natural ingredients. There's increasing demand for organic and regionally sourced vegetable products, with innovations such as probiotic vegetable crisps and energy-boosting seed mixes gaining market share. The emphasis on eco-friendly packaging and clean manufacturing processes also aligns well with local preferences for environmentally responsible consumption.

Asia-Pacific Vegetable Snacks Market Insight

The Asia-Pacific region is expected to register the fastest CAGR from 2025 to 2032 in the vegetable snacks market, driven by a combination of urbanization, increasing disposable incomes, and growing awareness of dietary wellness. Consumers across emerging economies such as China, India, and Southeast Asian nations are rapidly shifting away from fried, high-fat snacks toward healthier alternatives. Vegetable snacks are gaining popularity among younger consumers seeking modern, on-the-go products that don’t compromise on nutrition. The influence of Western dietary trends, alongside government-led health awareness programs and improved retail accessibility, is supporting the widespread adoption of vegetable-based snack products.

Japan Vegetable Snacks Market Insight

Japan’s vegetable snacks market is expanding rapidly due to its cultural alignment with balanced nutrition and the nation’s aging population. Japanese consumers are especially drawn to low-sodium, fiber-rich snacks made from vegetables such as edamame, burdock root, and lotus root. These snacks are often marketed with a focus on simplicity, quality, and health benefits, making them ideal for both older adults and busy professionals. The integration of vegetable snacks into vending machines, convenience stores, and digital grocery platforms is enhancing visibility and accessibility across the country.

China Vegetable Snacks Market Insight

China accounted for the largest market share in the Asia-Pacific vegetable snacks segment in 2024, fueled by rapid urbanization, rising middle-class income, and a growing demand for nutritious snacking. Chinese consumers are increasingly embracing vegetable-based snack options for weight management, digestive health, and overall wellness. Local companies are investing in R&D to introduce innovative products featuring familiar regional vegetables and herbs, tailored to the taste preferences of domestic consumers. In addition, the expansion of e-commerce and social media-driven food trends is further accelerating the popularity of vegetable snacks across urban and semi-urban areas.

Vegetable Snacks Market Share

The vegetable snacks industry is primarily led by well-established companies, including:

- Maple Leaf Foods Inc. (Canada)

- Marlow Foods (U.K.)

- Oumph (U.K.)

- Upton’s Natural (U.S.)

- Hilary's - Drink Eat Well, LLC (U.S.)

- Siren Snacks (U.S.)

- Green Park Brands (U.K.)

- Eat Natural (U.K.)

- Primal Spirit Vegan Jerky. (U.S.)

- Louisville Vegan Jerky Company (U.S.)

- Nestle S.A. (Switzerland)

- Conagra Brands, Inc. (U.S.)

- General Mills Inc. (U.S.)

- Outstanding Foods (U.S.)

- Vegan Rob’s (U.S.)

- Amy’s Kitchen Inc, (U.S.)

- Blue Diamond Growers (U.S.)

- Eat Real (U.S.)

- NutriFusion LLC (U.S.)

- Greenleaf Foods, SPC (U.S.)

Latest Developments in Global Vegetable Snacks Market

- In May 2023, Blue Bottle Coffee and The Weeknd collaborated to unveil Samra Origins Coffee, an Ethiopian variety boasting a medium-to-dark roasted aroma. Utilizing advanced freeze-drying technology, this offering promises a unique coffee experience. Inspired by The Weeknd’s Ethiopian heritage, Samra Origins highlights the rich complexity of Ethiopian beans and caters to specialty coffee enthusiasts. The advanced freeze-drying process preserves both flavor and aroma, offering a full-bodied instant coffee experience. Positioned as a premium, culturally rooted product, it blends artistry and innovation to appeal to a wide consumer base, including the artist’s global fan following

- In June 2022, Conagra Brands introduced a range of innovative summer products addressing mealtime challenges with contemporary flavors, trendy ingredients, and convenient preparation methods, catering to diverse cravings and enhancing consumer experiences. This launch focused on simplifying summer dining through a variety of ready-to-eat and ready-to-cook products across multiple brands. Featuring global-inspired flavors, plant-based options, and indulgent snacks, the range was designed for busy households looking for convenience without sacrificing taste. By leveraging current food trends and seasonal consumption patterns, Conagra strengthened its relevance among modern consumers

- In April 2022, Prasuma, a renowned Indian brand for frozen foods, expanded its offerings with Frozen Veg and Chicken Spring Rolls, chicken nuggets, mini samosas, shammi kababs, sheekh kababs, and bacon. This diversification enriches their frozen snacks portfolio. With this expansion, Prasuma broadened its appeal by tapping into both vegetarian and non-vegetarian snack segments that are gaining popularity in Indian households. The products reflect a mix of traditional and western influences, targeting convenience-seeking urban consumers. This move strengthens the brand’s presence in the ready-to-cook snacks category, aligning with evolving consumption habits in India

- In July 2021, Rind Snacks introduced thin-cut fruit chips, enriching the category with added vitamins and fiber. This nutritional boost enhances the appeal of fruit chips, offering consumers a healthier snacking alternative. These chips are crafted using whole fruits, including the peels, to maximize nutritional value and reduce food waste. By focusing on clean-label ingredients and high fiber content, Rind’s offering caters to health-conscious consumers seeking functional snacks with minimal processing. The thin-cut format also provides a satisfying crunch, bridging the gap between indulgence and wellness

- In November 2020, NADI launched Happy Hearts Apple Chips, available in Granny Smith and Ida Red varieties. These vegan, gluten-free, fat-free, and non-GMO snacks provide a healthy option, with each 1.06-oz bag containing just 100 calories. Designed for health-conscious consumers, these apple chips are made from real apples with no added sugar, offering natural sweetness and crunch. The product emphasizes simplicity and transparency, catering to clean-eating trends. Its low calorie count and allergy-friendly profile make it suitable for a broad audience, from children to fitness enthusiasts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.