Vehicle Analytics Market Size

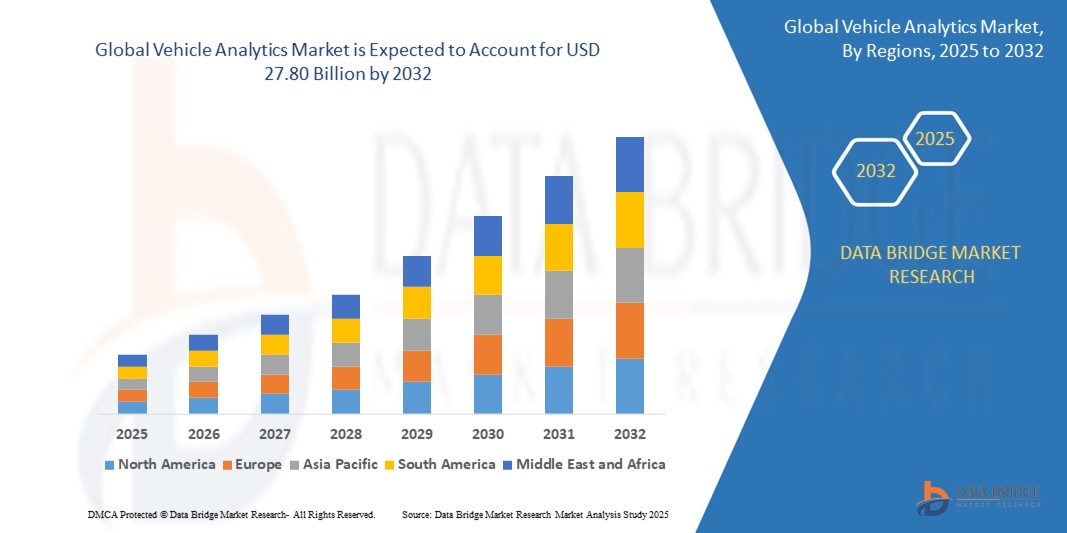

- The global Vehicle Analytics market size was valued at USD 4.30 billion in 2024 and is expected to reach USD 27.80 billion by 2032, at a CAGR of 26.3% during the forecast period

- This growth is driven by factors such as the increasing penetration of connected and autonomous vehicles, advancements in AI and IoT technologies, and the growing demand for predictive maintenance and fleet management solutions.

Vehicle Analytics Market Analysis

- Vehicle Analytics is an advanced technology that tracks and analyzes real-time data from vehicles, providing insights into vehicle performance, driver behavior, and operational efficiency for stakeholders like OEMs, fleet owners, and insurers.

- The demand for vehicle analytics is significantly driven by the global surge in connected vehicles, projected to reach 75% of new vehicle sales in the U.S. by 2025, and the rising adoption of IoT, with 25.2 billion connections expected by 2025.

- North America is expected to dominate the Vehicle Analytics market due to its advanced automotive infrastructure and high adoption of connected vehicle technologies.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid automotive production and smart mobility initiatives in countries like China and India.

- The Predictive Maintenance segment is expected to dominate the market with a market share of 32.5% in 2025 due to its role in reducing vehicle downtime and maintenance costs

Report Scope and Vehicle Analytics Market Segmentation

|

Attributes |

Vehicle Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vehicle Analytics Market Trends

“Rise of Cloud-Based Vehicle Analytics Platforms”

- One prominent trend in the Vehicle Analytics market is the increasing adoption of cloud-based platforms, which have seen over 55% growth due to their scalability and real-time data processing capabilities.

- These platforms enable automotive companies to process vast amounts of data from connected vehicles, improving operational efficiency by up to 25%.

- For instance, in November 2024, Amazon Web Services launched Automotive EDGE and LEAF, cloud-based solutions enhancing connected vehicle analytics for real-time insights.

- These advancements are transforming vehicle analytics, driving demand for innovative platforms with cutting-edge capabilities

Vehicle Analytics Market Dynamics

Driver

“Surging Penetration of Connected and Autonomous Vehicles”

- The rapid growth of connected vehicles, with nearly 75% of new U.S. vehicles expected to be connected by 2025, and the development of autonomous vehicles are significantly contributing to the demand for vehicle analytics.

- Analytics solutions enable real-time monitoring of vehicle performance and driver behavior, enhancing safety and efficiency.

For instance, in February 2025, BYD launched the ‘God’s Eye’ ADAS system, integrating analytics with LiDAR and AI for advanced autonomous features.

- As connected and autonomous vehicle adoption accelerates, the demand for vehicle analytics rises, ensuring enhanced mobility solutions.

Opportunity

“Growing Demand for Predictive Maintenance Solutions”

- Predictive maintenance solutions, which alert owners to potential issues before breakdowns, offer significant opportunities by reducing downtime and maintenance costs by up to 20%.

- These solutions leverage IoT and AI to analyze sensor data, preventing costly repairs and enhancing vehicle longevity.

- For instance, in November 2020, SAP launched the Digital Vehicle Hub, enabling predictive maintenance through a centralized data repository.

- This opportunity drives market growth by addressing the need for efficient and cost-effective vehicle management.

Restraint/Challenge

“High Installation Costs and Data Privacy Concerns”

- The high initial costs of deploying vehicle analytics systems, including sensors and cloud infrastructure, pose a significant challenge, particularly for SMEs.

- Additionally, data privacy concerns, with 60% of consumers worried about vehicle data security in 2024, limit adoption due to regulatory and trust issues.

- For instance, in 2024, IBM reported that 45% of automotive firms faced challenges in complying with GDPR for vehicle data analytics.

- These challenges can hinder market growth, requiring cost-effective and secure solutions to boost adoption

Vehicle Analytics Market Scope

The market is segmented on the basis of component, deployment mode, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Mode |

|

|

By Application |

|

|

By End User

|

|

In 2025, the Predictive Maintenance segment is projected to dominate the market with the largest share in the application segment

The Predictive Maintenance segment is expected to dominate the Vehicle Analytics market with the largest share of 42.18% in 2025 due to its critical role in reducing operational costs and preventing unexpected vehicle failures. As fleet operators and OEMs increasingly focus on enhancing vehicle performance and minimizing downtime, the adoption of predictive analytics tools has surged. Advancements in IoT, real-time data monitoring, and machine learning algorithms further strengthen predictive maintenance capabilities, driving its market growth. The increasing number of connected vehicles and growing awareness about proactive vehicle health management contribute significantly to this segment's dominance.

The Cloud-Based Deployment is expected to account for the largest share during the forecast period in the deployment model segment

In 2025, the Cloud-Based Deployment segment is expected to dominate the Vehicle Analytics market with the largest market share of 63.45%, owing to its scalability, lower upfront costs, and ease of access to real-time vehicle data across diverse locations. Cloud solutions enable automotive companies and fleet operators to integrate, process, and analyze massive volumes of vehicle data efficiently. The increasing preference for SaaS-based analytics platforms, combined with the rapid advancements in 5G and IoT connectivity, is driving the adoption of cloud-based vehicle analytics solutions. As organizations seek more flexible and cost-effective options to manage vehicle insights, cloud-based models are poised for sustained market dominance..

Vehicle Analytics Market Regional Analysis

“North America Holds the Largest Share in the Vehicle Analytics Market”

- North America dominates the Vehicle Analytics market, driven by the early adoption of connected vehicle technologies, strong telematics infrastructure, and the presence of major automotive and tech companies such as IBM, Microsoft, and Oracle.

- The U.S. holds a significant share due to the high penetration of connected cars, increasing demand for predictive maintenance solutions, and the rapid advancement of AI and IoT-based analytics platforms.

- The region benefits from well-established regulatory frameworks supporting vehicle safety and data usage, coupled with strong investments in autonomous driving and fleet management technologies.

- In addition, the rising focus on usage-based insurance models, smart city initiatives, and real-time traffic management solutions is fueling the growth of the Vehicle Analytics market across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Vehicle Analytics Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Vehicle Analytics market, fueled by the booming automotive sector, rapid urbanization, and increased adoption of smart mobility solutions.

- Countries such as China, India, and Japan are emerging as key markets due to the rising vehicle production, growing deployment of telematics systems, and government initiatives promoting smart transportation infrastructure.

- Japan, with its strong automotive industry and focus on autonomous vehicle development, remains a crucial market for vehicle analytics solutions, especially in predictive maintenance and fleet optimization.

- China and India, with their massive vehicle fleets and increasing investments in IoT connectivity and smart city projects, are driving significant demand for advanced vehicle data analytics. The expanding presence of international technology providers and local innovations further contribute to the region’s market growth.

Vehicle Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SAP SE (Germany)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Harman International Industries, Inc. (U.S.)

- Continental AG (Germany)

- Genetec Inc. (Canada)

- CloudMade (Ukraine)

- Teletrac Navman (U.S.)

- Inseego Corp. (U.S.)

- Agnik LLC (U.S.)

Latest Developments in Global Vehicle Analytics Market

- In March 2025, SAP SE launched its enhanced SAP Vehicle Insights 2.0 platform, featuring blockchain-based security for vehicle telematics data and real-time fleet analytics capabilities. The updated platform aims to help fleet operators and OEMs optimize predictive maintenance, driver behavior analysis, and asset tracking across regions with improved data integrity.

- In February 2025, Microsoft Corporation, in collaboration with TomTom, expanded its Azure Maps offerings by integrating advanced real-time traffic analytics and predictive routing features, targeted at smart mobility and connected vehicle ecosystems. This move strengthens Microsoft's position in providing cloud-powered analytics for the automotive sector.

- In January 2025, IBM Corporation announced the launch of its new Fleet Intelligence Suite, specifically designed for electric vehicle (EV) fleets. The solution leverages AI and IoT to optimize battery life, monitor vehicle health, and predict energy consumption patterns, aiming to enhance operational efficiency and reduce downtime for EV fleet operators.

- In December 2024, Harman International (a Samsung company) introduced its Ignite Vehicle Cloud 3.0 platform, focusing on data-driven insights for connected vehicles. The platform enables real-time vehicle analytics, remote diagnostics, and personalized user experiences, supporting OEMs in the transition to software-defined vehicles (SDVs).

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.