Global Vehicle Anti Theft System Market

Market Size in USD Billion

CAGR :

%

USD

14.10 Billion

USD

26.30 Billion

2024

2032

USD

14.10 Billion

USD

26.30 Billion

2024

2032

| 2025 –2032 | |

| USD 14.10 Billion | |

| USD 26.30 Billion | |

|

|

|

|

Vehicle Anti-Theft System Market Size

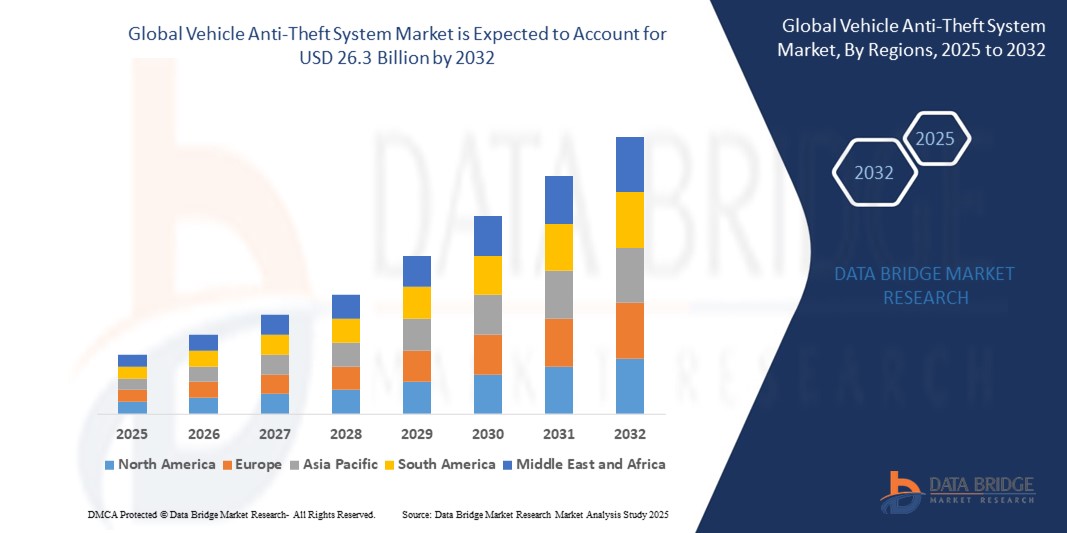

- The Global Vehicle Anti-Theft System Market size was valued at USD 14.1 billion in 2024 and is expected to reach USD 26.3 billion by 2032, at a CAGR of 9.3% during the forecast period

- Continuous innovations such as biometric authentication, GPS tracking, AI-driven surveillance, and remote immobilization are enhancing the effectiveness and appeal of anti-theft systems, fueling market growth.

- Many governments worldwide are mandating the integration of anti-theft devices in vehicles, especially in new models, to improve public safety and reduce crime rates, significantly boosting market demand.

Vehicle Anti-Theft System Market Analysis

- Many governments worldwide are mandating the integration of anti-theft devices in vehicles, especially in new models, to improve public safety and reduce crime rates, significantly boosting market demand.

- New vehicle models are now equipped with features like face recognition, voice detection, and RFID-based access, allowing users to secure and monitor their vehicles remotely. The adoption of Internet-of-Things (IoT), Bluetooth, and near-field communication (NFC) further enhances the connectivity and responsiveness of these systems.

- Asia-Pacific dominates the Vehicle Anti-Theft System Market with the largest revenue share of 42.01% in 2024, Growing awareness about vehicle security and the risks of theft is prompting more consumers to invest in vehicles equipped with robust anti-theft systems, particularly in regions with high crime rates.

- Asia-Pacific is expected to be the fastest growing region in the Vehicle Anti-Theft System Market during the forecast period due to Insurance companies often offer premium discounts or incentives for vehicles equipped with certified anti-theft devices, encouraging both buyers and manufacturers to adopt these technologies.

- Alarm segment dominates the Vehicle Anti-Theft System Market with a market share of 21.2% in 2024, driven by Alarm.

Report Scope and Vehicle Anti-Theft System Market Segmentation

|

Attributes |

Vehicle Anti-Theft System Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vehicle Anti-Theft System Market Trends

“Enhanced Security, Automation, and Cloud Integration”

- A major and accelerating trend in the Global Vehicle Anti-Theft System Market is the integration of advanced digital technologies such as biometric authentication, GPS tracking, and AI-driven surveillance into anti-theft solutions. These technologies are increasingly being embedded in both original equipment manufacturer (OEM) and aftermarket systems, providing real-time monitoring, remote immobilization, and seamless control via mobile applications.

- For instance, new vehicle models are now equipped with features like face recognition, voice detection, and RFID-based access, allowing users to secure and monitor their vehicles remotely. The adoption of Internet-of-Things (IoT), Bluetooth, and near-field communication (NFC) further enhances the connectivity and responsiveness of these systems.

- The integration of anti-theft systems with broader connected car and smart mobility platforms is enabling centralized control over vehicle security. Through a single interface—often a smartphone app—users can manage vehicle locking, tracking, and alarm systems, similar to the unified experience seen in smart home security.

- This trend towards intelligent, intuitive, and interconnected vehicle security is fundamentally reshaping consumer expectations, as users increasingly seek comprehensive, easy-to-use solutions that offer both protection and convenience.

- Both OEM and aftermarket channels are expanding, with OEM solutions dominating the market due to their integration into new vehicle models. However, the aftermarket segment is seeing robust growth as consumers seek to upgrade older vehicles with modern security features such as GPS tracking, alarms, and biometric access.

- Asia Pacific is emerging as the fastest-growing region due to Many governments worldwide are mandating the integration of anti-theft devices in vehicles, especially in new models, to improve public safety and reduce crime rates, significantly boosting market demand.

Vehicle Anti-Theft System Market Dynamics

Driver

“Rising Demand for Precise Navigation in Indoor and GPS-Denied Environments”

- The growing adoption of autonomous vehicles, drones, and robotics across sectors such as logistics, manufacturing, and agriculture is driving the demand for reliable navigation solutions in environments where GPS signals are weak or unavailable.

- For instance, in early 2025, Skydio, a U.S.-based autonomous drone company, enhanced its VPS capabilities using machine learning algorithms for improved object tracking and collision avoidance in complex environments such as warehouses and forests.

- Vision positioning systems, which utilize cameras and visual markers for spatial awareness, enable devices to achieve high-precision indoor localization and obstacle avoidance.

- This has spurred adoption in industrial automation, where accurate real-time positioning is critical for efficiency and safety.

Restraint/Challenge

“High Computational Requirements and Environmental Limitations”

- VPS technologies rely heavily on processing large volumes of visual data in real-time, which requires high-performance computing hardware and advanced software algorithms.

- For instance, in 2025, Microsoft’s HoloLens 3, scheduled for release in Q3 2025, has delayed rollout partially due to overheating and battery drain issues associated with its high-fidelity VPS module.

- This increases the cost and power consumption of devices, which can be a barrier in mobile and battery-operated applications such as handheld devices or small UAVs.

- Moreover, VPS performance can degrade significantly in low-light conditions, textureless environments, or rapidly changing surroundings, limiting its applicability in outdoor or industrial settings with variable lighting and surface features.

Vehicle Anti-Theft System Market Scope

The market is segmented on the basis of Product Type, Technology, System, Application, Vehicle Type.

- By component

On the basis of Product Type, the Vehicle Anti-Theft System Market is segmented into Alarm, Immobilizer, Steering Lock, Passive Keyless Entry, Central Locking System, Biometric Capture Device. The Alarm segment dominates the largest market revenue share of 21.2% in 2024, driven by Rising Incidence of Vehicle Theft.

The Immobilizer segment is anticipated to witness the fastest growth rate of 13.7% from 2025 to 2032, fueled by Technological Advancements.

- By Technology

On the basis of Technology, the Vehicle Anti-Theft System Market is segmented into Global Positioning System, Global System for Mobile Communication, Face Detection System, Real-Time Location System, Automotive Biometric Technology, Remote Frequency Identification Device. The Global Positioning System segment held the largest market revenue share in 2024 driven by Stringent Government Regulations.

The Global System for Mobile Communication segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Integration with Connected and Smart Vehicles.

- By System

On the basis of System, the Vehicle Anti-Theft System Market is segmented into Active Anti-Theft System, Passive Anti-Theft System. The Active Anti-Theft System segment held the largest market revenue share in 2024, driven by OEM Integration and Aftermarket Growth.

The Active Anti-Theft System is expected to witness the fastest CAGR from 2025 to 2032, driven by Growing awareness about vehicle security and the risks of theft is prompting more consumers to invest in vehicles equipped with robust anti-theft systems, particularly in regions with high crime rates.

Vehicle Anti-Theft System Market Regional Analysis

- Asia-Pacific dominates the Vehicle Anti-Theft System Market with the largest revenue share of 42.01% in 2024, driven by Original Equipment Manufacturers (OEMs) are increasingly incorporating advanced anti-theft features as standard, while the aftermarket segment offers upgrades and replacements, expanding the market’s reach.

- Growing awareness about vehicle security and the risks of theft is prompting more consumers to invest in vehicles equipped with robust anti-theft systems, particularly in regions with high crime rates.

- Rapid urbanization, especially in Asia-Pacific, and an expanding middle class have led to a surge in vehicle ownership, increasing the need for effective anti-theft solutions to protect these assets.

China Vehicle Anti-Theft System Market Insight

The China Vehicle Anti-Theft System Market captured the largest revenue share of 58% in 2024 within Asia-Pacific, fueled by the rise in theft incidents in parking lots and other public areas has highlighted the necessity for advanced, reliable anti-theft mechanisms to ensure vehicle and passenger safety.

Europe Vehicle Anti-Theft System Market Insight

Both OEM and aftermarket channels are expanding, with OEM solutions dominating the market due to their integration into new vehicle models. However, the aftermarket segment is seeing robust growth as consumers seek to upgrade older vehicles with modern security features such as GPS tracking, alarms, and biometric access.

U.K. Vehicle Anti-Theft System Market Insight

The U.K. Vehicle Anti-Theft System Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by vehicles become more connected and autonomous, manufacturers are investing in cybersecurity measures such as advanced encryption, tamper-resistant key fobs, and real-time monitoring to counteract sophisticated theft techniques and hacking attempts.

Germany Vehicle Anti-Theft System Market Insight

The Germany Vehicle Anti-Theft System Market is expected to expand at a considerable CAGR during the forecast period, fueled by Innovations like automated calibration for keyless entry, AI-powered intrusion detection, and EMI-resistant shielding are being deployed to ensure system reliability and secure communication between components.

Asia-Pacific Vehicle Anti-Theft System Market Insight

The Asia-Pacific Vehicle Anti-Theft System Market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid growth in vehicle ownership, high theft rates, and strong adoption of advanced security technologies in countries like China, Japan, and India.

Japan Vehicle Anti-Theft System Market Insight

The Japan Vehicle Anti-Theft System Market is gaining momentum due A primary driver is the global increase in vehicle thefts, which compels both consumers and automakers to prioritize advanced security solutions to protect assets and reduce losses.

U.S. Vehicle Anti-Theft System Market Insight

The U.S. Vehicle Anti-Theft System Market accounted for the largest market revenue share in Asia Pacific in 2024, driven by Continuous innovations such as biometric authentication, GPS tracking, AI-driven surveillance, and remote immobilization are enhancing the effectiveness and appeal of anti-theft systems, fueling market growth.

Vehicle Anti-Theft System Market Share

The Vehicle Anti-Theft System Market is primarily led by well-established companies, including:

- TOKAIRIKA, CO, LTD.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- DENSO CORPORATION

- U-Shin Ltd.

- Lear

- Mitsubishi Electric Corporation

- Tesla, BorgWarner Inc.

- VOXX International Corp.

- OMRON Corporation

- HELLA GmbH & Co.

- KGaA,

- Valeo

- BMW Canada

- Daimler AG

- Audi AG

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- Volvo Car Corporation

Latest Developments in Global Vehicle Anti-Theft System Market

- In March 2024, Hyundai and Kia implemented enhanced anti-theft measures, including free software upgrades and ignition cylinder protectors, leading to a 37.5% reduction in thefts of their vehicles in the U.S. in 2024.

- In August 2025, Ford introduced a subscription-based security feature for its F-150 and Super Duty trucks, offering theft notifications, a stolen vehicle hotline, and a Start Inhibit feature via the FordPass App, aiming to combat high theft rates.

- In March 2024, OnStar continues to provide in-vehicle security, emergency services, and stolen vehicle tracking across multiple countries, maintaining a significant presence in the vehicle anti-theft market.

- In February 2020, Ituran offers stolen vehicle recovery and tracking services, operating in countries like the U.S., Brazil, and Israel, with over 2 million subscribers as of June 2020.

- In January 2024, Spireon acquired LoJack's U.S. stolen vehicle recovery business, integrating GPS and cellular technology for vehicle tracking and recovery, enhancing its connected car solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.