Global Vehicle Control Unit Market

Market Size in USD Billion

CAGR :

%

USD

7.80 Billion

USD

29.25 Billion

2024

2032

USD

7.80 Billion

USD

29.25 Billion

2024

2032

| 2025 –2032 | |

| USD 7.80 Billion | |

| USD 29.25 Billion | |

|

|

|

|

Vehicle Control Unit Market Size

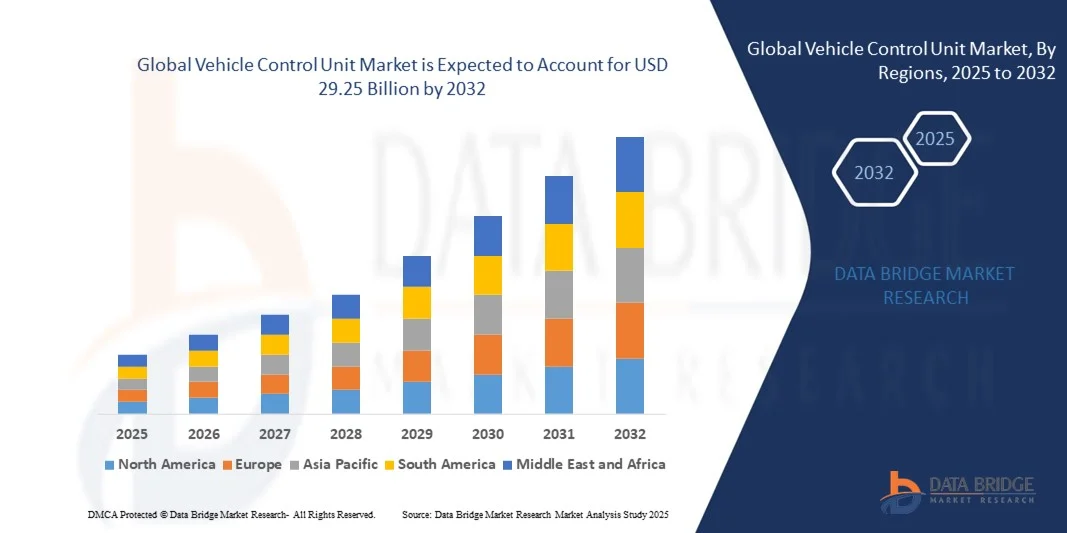

- The global vehicle control unit market size was valued at USD 7.80 billion in 2024 and is expected to reach USD 29.25 billion by 2032, at a CAGR of 17.95% during the forecast period

- The market growth is largely fuelled by the rising adoption of electric vehicles (EVs) and hybrid vehicles, where VCUs play a crucial role in managing power distribution and optimizing vehicle efficiency

- Increasing government regulations for emission reduction and fuel efficiency are further boosting the demand for advanced VCUs across passenger and commercial vehicles

Vehicle Control Unit Market Analysis

- The market is witnessing robust growth due to technological advancements in vehicle electronics and increasing investments by automotive manufacturers in intelligent mobility solutions

- With the shift toward electrification and digitalization of vehicles, VCUs are becoming the central hub for controlling multiple functions, including battery management, powertrain control, and ADAS systems

- North America dominated the vehicle control unit market with the largest revenue share of 39.5% in 2024, driven by strong demand for electric vehicles (EVs), government incentives for electrification, and the widespread adoption of advanced automotive technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global vehicle control unit market, driven by rapid urbanization, rising disposable incomes, expanding automotive manufacturing, and technological advancements in electric and autonomous vehicles

- The passenger vehicle segment held the largest market share in 2024, supported by the rapid growth of electric cars and rising demand for advanced safety features. Increasing adoption of VCUs in EV passenger cars for functions such as propulsion control, energy management, and ADAS integration is boosting segment dominance

Report Scope and Vehicle Control Unit Market Segmentation

|

Attributes |

Vehicle Control Unit Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Vehicle Control Unit Market Trends

Integration of Centralized Domain Controllers in Modern Vehicles

- The growing shift toward centralized domain controllers is reshaping the vehicle control unit market, as automakers move away from distributed ECUs to reduce complexity and wiring. Centralized VCUs enable streamlined communication, faster processing, and enhanced vehicle performance, particularly in electric and autonomous vehicles. This transition is significantly improving vehicle efficiency and reliability

- The rising demand for high-performance computing and real-time data processing is driving adoption of VCUs that can manage multiple domains, including ADAS, infotainment, and powertrain functions. This trend is further supported by OEMs seeking scalable architectures that lower hardware costs while maintaining advanced capabilities

- The cost efficiency and modularity of centralized VCUs are making them attractive for both premium and mid-range vehicles. Automakers benefit from simplified manufacturing and easier software updates, allowing quicker deployment of new features. This flexibility supports innovation while lowering long-term maintenance expenses

- For instance, in 2023, leading EV manufacturers adopted next-generation VCUs to consolidate control of propulsion, braking, and battery management, reducing hardware requirements while enhancing energy optimization and driving range. This demonstrated how VCU adoption is helping achieve efficiency goals in next-gen mobility

- While centralized VCUs are redefining vehicle architectures, their success depends on robust cybersecurity, advanced software integration, and compatibility with evolving industry standards. Continuous innovation in chipsets, software platforms, and automotive-grade semiconductors will remain essential for long-term growth

Vehicle Control Unit Market Dynamics

Driver

Rising Adoption of Electric and Hybrid Vehicles Globally

- The global surge in electric and hybrid vehicle production is a primary driver for the VCU market, as these vehicles require advanced controllers to manage propulsion, energy distribution, and regenerative braking. The increasing shift to sustainable mobility is accelerating demand for next-gen VCUs with higher computational power

- Automakers are focusing on optimizing battery efficiency and range, pushing the adoption of intelligent VCUs that ensure precise monitoring and real-time control. This is boosting consumer confidence in EVs, while helping manufacturers comply with stringent emission regulations

- Government initiatives and subsidies for electric mobility are further fueling VCU adoption, as automakers integrate them into mass-market EVs. From premium EVs to two-wheelers, the scope of VCU usage is rapidly expanding across segments

- For instance, in 2022, European EV makers significantly increased VCU integration to meet new CO₂ emission targets, ensuring better energy utilization and system efficiency. This highlighted the growing dependence of the EV ecosystem on advanced control units

- While electrification is driving VCU demand, continued progress will rely on innovation in power electronics, AI-based control algorithms, and collaborations between semiconductor firms and automakers to deliver scalable solutions

Restraint/Challenge

High Cost of Advanced VCUs and Cybersecurity Risks

- The high cost of advanced VCUs equipped with powerful processors, AI capabilities, and multi-domain control functions limits their adoption in low-cost vehicles. Budget-conscious consumers and manufacturers in price-sensitive markets often opt for basic ECUs, slowing wider market penetration

- Cybersecurity risks present another major challenge, as VCUs manage critical functions such as braking, steering, and energy distribution. The need for secure software frameworks, constant updates, and specialized expertise adds complexity and cost, making it harder for small-scale automakers to integrate advanced solutions

- Emerging economies face additional hurdles due to lack of infrastructure and limited technical expertise for VCU calibration and maintenance. This gap restricts adoption in mass-market vehicles where affordability and reliability are prioritized

- For instance, in 2023, several automakers in Southeast Asia reported slower integration of centralized VCUs, citing high production costs and concerns over cybersecurity vulnerabilities in connected vehicles. This delayed adoption in entry-level models

- While advanced VCUs are pivotal to future mobility, reducing cost through economies of scale, improving cybersecurity frameworks, and standardizing integration protocols remain key to unlocking broader market opportunities worldwide

Vehicle Control Unit Market Scope

The market is segmented on the basis of vehicle type, propulsion, capacity, voltage, offering, electric two-wheeler, off-highway electric vehicle type, communication technology, and function.

- By Vehicle Type

On the basis of vehicle type, the vehicle control unit market is segmented into commercial vehicles and passenger vehicles. The passenger vehicle segment held the largest market share in 2024, supported by the rapid growth of electric cars and rising demand for advanced safety features. Increasing adoption of VCUs in EV passenger cars for functions such as propulsion control, energy management, and ADAS integration is boosting segment dominance.

The commercial vehicle segment is expected to witness a fastest growth rate from 2025 to 2032, driven by electrification of fleets, rising government emission regulations, and adoption of connected logistics solutions. Commercial VCUs are being deployed to optimize efficiency, reduce emissions, and improve operational safety, particularly in trucks and buses.

- By Propulsion

On the basis of propulsion, the market is segmented into battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs). The BEV segment accounted for the largest market share in 2024 due to the global push toward zero-emission vehicles and rapid expansion of charging infrastructure. The demand for VCUs in BEVs is rising to manage high-voltage batteries, regenerative braking, and thermal systems.

The PHEV segment is expected to witness a fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for extended driving range and flexibility of dual power sources. VCUs in PHEVs are critical for managing seamless switching between electric and combustion modes, enhancing performance and efficiency.

- By Capacity

On the basis of capacity, the vehicle control unit market is segmented into 16-bit, 32-bit, and 64-bit. The 32-bit segment held the largest revenue share in 2024, driven by its balance of processing power, cost-efficiency, and ability to handle multiple vehicle functions such as energy management and diagnostics.

The 64-bit segment is expected to witness a fastest growth rate from 2025 to 2032, owing to its superior computing performance and suitability for advanced ADAS, autonomous driving features, and high-demand EV architectures. Automakers are increasingly integrating 64-bit VCUs to support next-generation connected and autonomous vehicles.

- By Voltage

On the basis of voltage, the market is segmented into 12/24V and 36/48V systems. The 12/24V segment dominated the market in 2024, mainly due to its widespread use in conventional passenger and light commercial vehicles, particularly for basic control functions.

The 36/48V segment is expected to witness a fastest growth rate from 2025 to 2032, driven by the rising adoption of electric and hybrid vehicles. Higher voltage VCUs allow improved energy efficiency, enhanced vehicle performance, and compatibility with advanced electrification systems.

- By Offering

On the basis of offering, the vehicle control unit market is segmented into software and hardware. The hardware segment captured the largest market share in 2024, supported by the extensive requirement of controllers, processors, and semiconductors for integration across vehicle systems.

The software segment is expected to witness a fastest growth rate from 2025 to 2032, driven by the increasing role of software-defined vehicles and demand for over-the-air (OTA) updates. Advanced software solutions enable continuous improvement in performance, cybersecurity, and predictive analytics.

- By Electric Two-Wheeler

On the basis of electric two-wheeler, the market is segmented into mopeds and e-motorcycles. The e-motorcycle segment held the largest market share in 2024, owing to rising adoption of performance-oriented EV bikes with advanced control units to manage speed, energy efficiency, and battery safety.

The moped segment is expected to witness a fastest growth rate from 2025 to 2032, supported by urban mobility solutions, government subsidies, and cost-effective electrification. VCUs in mopeds are being designed for compact architectures with efficient energy distribution.

- By Off-Highway Electric Vehicle Type

On the basis of off-highway electric vehicle type, the market is segmented into mining, construction, and agriculture. The construction segment held the largest share in 2024, driven by the demand for electrified machinery with enhanced efficiency, safety, and reduced emissions on urban sites.

The mining segment is expected to witness a fastest growth rate from 2025 to 2032, as electrification in heavy-duty equipment reduces fuel dependency, lowers operational costs, and enhances worker safety in harsh environments. VCUs are critical for high-performance coordination in such vehicles.

- By Communication Technology

On the basis of communication technology, the market is segmented into controller area network (CAN), local interconnect network (LIN), and FlexRay Ethernet. The CAN segment dominated the market in 2024, widely used for its reliability, scalability, and cost-effectiveness in both passenger and commercial vehicles.

The FlexRay Ethernet segment is expected to witness a fastest growth rate from 2025 to 2032, supported by rising demand for high-speed data transfer, advanced ADAS, and autonomous driving applications. Automakers are increasingly adopting Ethernet-enabled VCUs to manage large-scale data in real time.

- By Function

On the basis of function, the vehicle control unit market is segmented into autonomous driving/ADAS and predictive technology. The ADAS segment held the largest share in 2024, fueled by growing consumer demand for enhanced safety, driver assistance, and semi-autonomous driving capabilities.

The predictive technology segment is expected to witness a fastest growth rate from 2025 to 2032, as OEMs integrate AI and machine learning into VCUs to optimize vehicle performance, predictive maintenance, and energy efficiency. This function is increasingly vital for connected and software-defined vehicles.

Vehicle Control Unit Market Regional Analysis

- North America dominated the vehicle control unit market with the largest revenue share of 39.5% in 2024, driven by strong demand for electric vehicles (EVs), government incentives for electrification, and the widespread adoption of advanced automotive technologies

- The region benefits from a well-established automotive industry, robust infrastructure for EV charging, and rising investments in research and development for autonomous driving and predictive vehicle technologies

- The growing preference for energy-efficient vehicles and the push toward reducing carbon emissions continue to reinforce the adoption of vehicle control units across both passenger and commercial vehicles

U.S. Vehicle Control Unit Market Insight

The U.S. vehicle control unit market captured the largest revenue share in 2024 within North America, propelled by the accelerated adoption of EVs and hybrid models, along with the integration of advanced driver-assistance systems (ADAS). Increasing consumer preference for connected, software-driven vehicles and the rising importance of predictive vehicle technologies are further boosting growth. The U.S. market is also benefitting from strong collaborations between automakers and technology companies, leading to the development of highly efficient, software-focused vehicle control units.

Europe Vehicle Control Unit Market Insight

The Europe vehicle control unit market is expected to witness a fastest growth rate from 2025 to 2032, primarily supported by stringent emission regulations, a strong emphasis on green mobility, and the rapid rollout of EV infrastructure. Rising adoption of autonomous and semi-autonomous driving technologies across countries such as Germany, France, and the U.K. is significantly enhancing demand. European automakers are also focusing on integrating flexible and high-performance vehicle control units into both premium and mass-market vehicles.

U.K. Vehicle Control Unit Market Insight

The U.K. vehicle control unit market is expected to witness a fastest growth rate from 2025 to 2032, driven by government-led initiatives to promote EV adoption, including subsidies and zero-emission targets. Rising demand for connected and smart vehicles, alongside strong consumer interest in advanced safety features, is accelerating the use of VCUs. The country’s focus on smart mobility solutions, coupled with a robust automotive innovation ecosystem, is expected to continue propelling market growth.

Germany Vehicle Control Unit Market Insight

The Germany vehicle control unit market is expected to witness a fastest growth rate from 2025 to 2032, supported by the country’s strong automotive manufacturing base and leadership in engineering innovation. German automakers are rapidly integrating VCUs into next-generation EVs, hybrids, and luxury vehicles to meet regulatory requirements and consumer expectations for performance, safety, and sustainability. The demand for highly reliable, eco-conscious vehicle control solutions is reinforcing Germany’s role as a key growth hub in Europe.

Asia-Pacific Vehicle Control Unit Market Insight

The Asia-Pacific vehicle control unit market is expected to witness a fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing EV production, and strong government support for electrification in countries such as China, Japan, and India. With APAC emerging as the largest EV manufacturing hub, the region benefits from cost-efficient production and high consumer adoption of smart mobility solutions. Expanding automotive electronics supply chains and digitalization initiatives are also fueling the widespread adoption of vehicle control units.

Japan Vehicle Control Unit Market Insight

The Japan vehicle control unit market is expected to witness a fastest growth rate from 2025 to 2032 due to its advanced automotive ecosystem, high penetration of hybrid and electric vehicles, and the country’s focus on autonomous driving technologies. Japanese automakers are leading innovations in predictive and software-driven VCUs, further enhancing energy efficiency and performance. In addition, the country’s strong consumer preference for technologically advanced, eco-friendly vehicles is driving steady adoption across both passenger and commercial segments.

China Vehicle Control Unit Market Insight

The China vehicle control unit market accounted for the largest market revenue share in Asia Pacific in 2024, driven by its expanding EV industry, rising disposable incomes, and strong government backing for electric mobility. China remains one of the largest producers and consumers of EVs worldwide, with domestic automakers and suppliers leading in cost-effective VCU production. The push toward smart cities, coupled with large-scale investments in EV infrastructure and autonomous driving, continues to make China a key growth engine for the global vehicle control unit market.

Vehicle Control Unit Market Share

The Vehicle Control Unit industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Texas Instruments Incorporated (U.S.)

- Mitsubishi Electric Corporation (Japan)

- STMicroelectronics (Switzerland)

- Autonomous Solutions Inc. (U.S.)

- IET SPA (Italy)

- PI INNOVO (Germany)

- Embitel (India)

- Rimac Automobili (Croatia)

- PUES CORPORATION (South Korea)

- Aim Technologies (South Korea)

- ECOTRONS LLC (U.S.)

- Thunderstruck Motors (U.S.)

- HiRain Technologies (China)

- Denso Corporation (Japan)

- Keihin Corporation (Japan)

- ARADEX AG (Germany)

- NXP Semiconductors (Netherlands)

Latest Developments in Global Vehicle Control Unit Market

- In July 2023, Horizon and NavInfo entered a strategic partnership to enhance autonomous driving technology. The collaboration aims to develop next-generation self-driving solutions and support the mass production of cost-effective autonomous vehicles. By combining Horizon’s Journey 5 intelligent driving chip with NavInfo’s advanced driving systems, the alliance seeks to deliver high-end, reliable autonomous driving platforms. This initiative is expected to accelerate innovation in autonomous mobility, improve vehicle safety, and strengthen market competitiveness

- In May 2023, BYD launched two all-electric vehicles, the DOLPHIN and SEA, at the Automobile Barcelona 2023 event. The DOLPHIN offers three power variants (95 hp, 177 hp, 204 hp), two battery options (44.9 kWh and 60.4 kWh), and four trim levels (Active, Boost, Comfort, Design), while the SEA was introduced to the Spanish market. These launches aim to expand BYD’s EV portfolio, enhance consumer choice, and support the adoption of sustainable mobility solutions, further boosting the company’s presence in the European electric vehicle market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.