Global Vehicle Dynamic Sensors Market

Market Size in USD Billion

CAGR :

%

USD

33.83 Billion

USD

96.32 Billion

2024

2032

USD

33.83 Billion

USD

96.32 Billion

2024

2032

| 2025 –2032 | |

| USD 33.83 Billion | |

| USD 96.32 Billion | |

|

|

|

|

Vehicle Dynamic Sensors Market Size

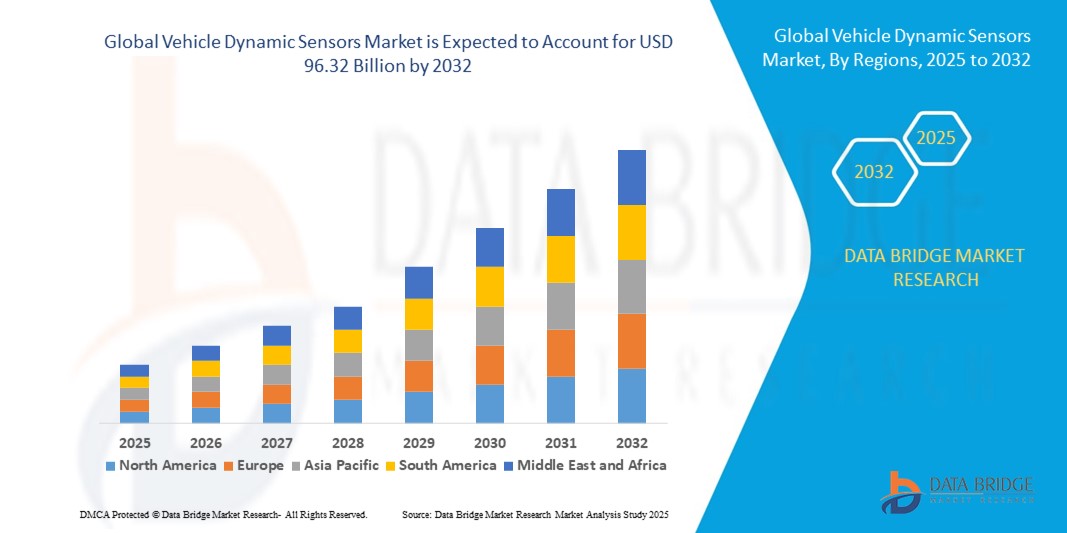

- The global vehicle dynamic sensors market size was valued at USD 33.83 billion in 2024 and is expected to reach USD 96.32 billion by 2032, at a CAGR of 13.97% during the forecast period

- The market growth is largely fueled by the increasing integration of advanced driver-assistance systems (ADAS) and safety technologies such as ESC, ABS, and TPMS, which heavily rely on accelerometers, gyroscopes, yaw rate sensors, and GPS/INS for accurate performance

- Furthermore, stringent government regulations mandating vehicle safety features, coupled with the rising demand for autonomous and electric vehicles, are accelerating the adoption of vehicle dynamic sensors, thereby significantly boosting the industry’s growth

Vehicle Dynamic Sensors Market Analysis

- Vehicle dynamic sensors are precision components that monitor acceleration, angular velocity, yaw rate, and positioning to enhance vehicle stability, safety, and navigation accuracy. These sensors form the backbone of applications such as electronic stability control, traction control, roll stability, and advanced ADAS functions in passenger and commercial vehicles

- The escalating demand for vehicle dynamic sensors is primarily fueled by regulatory mandates for safety compliance, growing consumer emphasis on accident prevention, and the rapid shift toward autonomous and connected mobility solutions, establishing these sensors as a cornerstone of modern automotive innovation

- North America dominated the vehicle dynamic sensors market with a share of 40.5% in 2024, due to the rising adoption of advanced driver-assistance systems (ADAS), electronic stability control (ESC), and stringent government mandates for vehicle safety

- Asia-Pacific is expected to be the fastest growing region in the vehicle dynamic sensors market during the forecast period due to increasing vehicle production, rapid urbanization, and growing consumer demand for safety and driver-assistance technologies

- Passenger cars segment dominated the market with a market share of 65.2% in 2024, due to the high production volume and integration of advanced safety and comfort technologies in this segment. Growing consumer awareness of safety features, regulatory mandates for ESC and ABS, and rising adoption of ADAS systems have fueled the demand for dynamic sensors in passenger cars. The increasing trend of electrification and connected cars also accelerates the integration of advanced sensing technologies in this category

Report Scope and Vehicle Dynamic Sensors Market Segmentation

|

Attributes |

Vehicle Dynamic Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Vehicle Dynamic Sensors Market Trends

Growing Adoption of MEMS-Based Sensors

- Demand for microelectromechanical systems (MEMS)-based sensor solutions is rapidly increasing in the vehicle dynamic sensors market due to their compact size, high reliability, precision, and ability to enable real-time monitoring and control functions across advanced vehicle platforms

- For instance, automotive manufacturers such as Bosch, Continental, and DENSO are producing MEMS accelerometers, gyroscopes, and pressure sensors that support functions such as electronic stability control, anti-lock braking systems, rollover detection, and advanced driver assistance systems in modern passenger vehicles and commercial fleets

- Expansion of connected car platforms and autonomous vehicles elevates the importance of high-performance MEMS dynamic sensors, driving integration with telematics, vehicle-to-everything (V2X) communications, and smart diagnostics for safer and smarter mobility

- Extended sensor fusion—integrating MEMS dynamic sensors with environmental and position sensors—improves accuracy of situational awareness and supports algorithms for real-time vehicle behavior prediction and response

- Growth of electric and hybrid vehicles accelerates use of MEMS dynamic sensors for optimizing suspension systems, battery management, and adaptive ride control tailored to next-generation automotive architectures

- Rising consumer demand for safety, comfort, and performance features in vehicles is pushing OEMs to expand MEMS sensor arrays, creating diversified opportunities for sensor manufacturers and suppliers

Vehicle Dynamic Sensors Market Dynamics

Driver

Advancements in Sensor Technology

- Ongoing advancements in sensor materials, design, and packaging—including the emergence of smart sensors with AI-enabled calibration and self-diagnostics—are rapidly improving sensitivity, accuracy, and durability, stimulating market growth across automotive applications

- For instance, major automotive semiconductor companies such as Infineon Technologies and NXP Semiconductors are investing in research partnerships and new product launches featuring advanced dynamic sensors with integrated data processing, wireless connectivity, and miniaturized form factors for use in premium vehicle models and autonomous platforms

- Development of multifunctional sensors supporting multiple vehicle dynamics functions (traction, stability, tire pressure, crash detection) streamlines design complexity and elevates overall system performance

- Use of sensor fusion, in addition to enhanced packaging for harsh automotive environments, helps overcome reliability and integration challenges, facilitating broader applications in connected, electric, and autonomous vehicles

- Transition to high-speed, low-cost manufacturing processes alongside AI-powered analytics enables real-time adaptive controls, predictive maintenance, and post-sales diagnostic services

Restraint/Challenge

High Cost of Advanced Sensor Solutions

- Advanced sensor technologies for real-time vehicle dynamics management require significant investment in R&D, precision manufacturing, and quality assurance, resulting in higher purchase costs that can limit adoption in entry-level or price-sensitive automotive markets

- For instance, smaller and emerging OEMs seeking to integrate the latest dynamic sensors into affordable vehicle platforms face barriers due to premium prices from leading sensor suppliers and added costs for system validation, calibration, and certification

- Sophisticated MEMS-based sensor arrays often require specialized design integration, increasing upfront engineering costs as well as ongoing expenses for maintenance and software updates

- Fluctuations in semiconductor supply chain and raw material costs can further elevate pricing, risking project delays or compromises in sensor features for cost containment

- Complexity in global regulatory compliance, interoperability, and IP licensing fees for patented sensor innovations may hinder entry, delay time-to-market, or limit scalability for manufacturers targeting wider adoption

Vehicle Dynamic Sensors Market Scope

The market is segmented on the basis of type, vehicle type, application, and sales channel.

- By Type

On the basis of type, the vehicle dynamic sensors market is segmented into accelerometers, gyroscopes, yaw rate sensors, and GPS/INS. The accelerometers segment accounted for the largest market revenue share in 2024, primarily due to their widespread use in measuring linear acceleration, vibration, and impact forces in vehicles. Accelerometers are critical components in safety systems such as airbags, electronic stability control (ESC), and advanced driver-assistance systems (ADAS), making them indispensable across both passenger and commercial vehicles. Their compact size, affordability, and compatibility with integrated sensor modules also strengthen their dominance in the automotive electronics landscape.

The gyroscopes segment is anticipated to record the fastest growth rate from 2025 to 2032, driven by their vital role in measuring angular velocity and enhancing vehicle navigation accuracy. Gyroscopes are increasingly adopted in ADAS, self-driving technologies, and navigation systems where precise orientation data is essential for vehicle control. The shift toward autonomous and connected vehicles is expected to significantly expand the adoption of MEMS-based gyroscopes, which offer high sensitivity and miniaturization for integration into complex sensor fusion systems.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. Passenger cars dominated the largest revenue share of 65.2% in 2024, supported by the high production volume and integration of advanced safety and comfort technologies in this segment. Growing consumer awareness of safety features, regulatory mandates for ESC and ABS, and rising adoption of ADAS systems have fueled the demand for dynamic sensors in passenger cars. The increasing trend of electrification and connected cars also accelerates the integration of advanced sensing technologies in this category.

Commercial vehicles are projected to register the fastest growth rate during the forecast period, owing to stricter safety regulations and the rising adoption of fleet management systems. Demand for yaw rate sensors, accelerometers, and GPS/INS in trucks, buses, and logistics fleets is growing as operators seek enhanced stability, fuel efficiency, and accident prevention. The expansion of e-commerce and last-mile delivery is further driving commercial vehicle adoption of dynamic sensors to optimize performance and ensure compliance with evolving safety standards.

- By Application

On the basis of application, the vehicle dynamic sensors market is segmented into electronic stability control (ESC), traction control system (TCS), anti-lock braking system (ABS), roll stability control, and tire pressure monitoring system (TPMS). ESC dominated the market revenue share in 2024, largely driven by regulatory mandates making ESC a standard feature in most passenger cars and light commercial vehicles across key markets. ESC relies heavily on accelerometers, gyroscopes, and yaw rate sensors to detect and mitigate skidding or loss of control, making it the largest consumer of vehicle dynamic sensors. The critical role of ESC in preventing accidents has cemented its dominance in the sensor ecosystem.

The roll stability control segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its growing application in heavy-duty trucks, trailers, and SUVs. Roll stability systems integrate multiple sensors to monitor lateral acceleration and rollover risks, which is particularly crucial in high center-of-gravity vehicles. The rise in demand for road safety, coupled with government initiatives to reduce accidents involving large commercial vehicles, is significantly boosting the adoption of roll stability control systems. In addition, increasing emphasis on improving vehicle load safety in logistics and transport industries is contributing to this segment’s accelerated growth.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and aftermarket. The OEM segment held the dominant revenue share in 2024, supported by the growing incorporation of advanced sensor technologies directly during vehicle manufacturing. Automakers increasingly integrate dynamic sensors as standard features to comply with global safety mandates, enhance vehicle performance, and improve customer appeal. OEM dominance is also reinforced by the rising production of electric and autonomous vehicles, where sensor fusion plays a critical role in delivering stability, control, and connectivity.

The aftermarket segment is projected to record the fastest growth over the forecast period, driven by the rising need for replacement and upgrading of vehicle safety components. As older vehicles remain in operation, there is significant demand for aftermarket accelerometers, gyroscopes, and TPMS sensors to ensure compliance with safety norms and extend vehicle lifecycle. Fleet operators in particular are turning to aftermarket solutions to retrofit commercial vehicles with advanced dynamic sensors, enhancing performance monitoring and safety at a lower cost compared to complete system overhauls.

Vehicle Dynamic Sensors Market Regional Analysis

- North America dominated the vehicle dynamic sensors market with the largest revenue share of 40.5% in 2024, driven by the rising adoption of advanced driver-assistance systems (ADAS), electronic stability control (ESC), and stringent government mandates for vehicle safety

- Automakers in the region are integrating accelerometers, gyroscopes, and yaw rate sensors into a wide range of passenger and commercial vehicles to enhance safety and performance

- The strong presence of leading automotive manufacturers, coupled with a technologically adept consumer base, supports continued market expansion. High disposable incomes and demand for connected and autonomous vehicles further reinforce the region’s leadership position

U.S. Vehicle Dynamic Sensors Market Insight

The U.S. vehicle dynamic sensors market captured the largest revenue share in 2024 within North America, fueled by rapid advancements in ADAS technologies and the rising focus on road safety. Consumers and regulators are emphasizing accident prevention systems, propelling the demand for ESC, ABS, and roll stability control applications. The increasing production of electric and autonomous vehicles is accelerating the deployment of MEMS-based accelerometers and gyroscopes. Furthermore, a strong ecosystem of semiconductor and automotive electronics manufacturers enhances the U.S.’s dominance in this space.

Europe Vehicle Dynamic Sensors Market Insight

The Europe vehicle dynamic sensors market is projected to expand at a substantial CAGR during the forecast period, driven by strict safety regulations mandating ESC, ABS, and TPMS across all new vehicles. Rising urbanization and the shift toward electric mobility are accelerating the adoption of advanced sensing technologies. European automakers are investing heavily in MEMS-based gyroscopes and yaw rate sensors to improve vehicle stability, driver assistance, and autonomous driving functions. The region’s innovation-driven automotive industry, combined with growing consumer awareness of road safety, is fostering significant growth.

U.K. Vehicle Dynamic Sensors Market Insight

The U.K. vehicle dynamic sensors market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing demand for safer and smarter vehicles. The adoption of ADAS and connected vehicle systems is encouraging widespread deployment of accelerometers and gyroscopes. Concerns around road accidents, along with government-led initiatives to improve road safety, are key factors propelling growth. Moreover, the rise of electric vehicle adoption across the U.K. is creating new opportunities for sensor integration in powertrain and stability management systems.

Germany Vehicle Dynamic Sensors Market Insight

The Germany vehicle dynamic sensors market is expected to expand at a considerable CAGR, supported by the country’s position as a hub for automotive innovation and advanced manufacturing. German automakers are leading in the integration of yaw rate sensors and GPS/INS systems into premium and luxury vehicles, enhancing both safety and performance. A strong emphasis on sustainability and eco-friendly mobility solutions also drives the demand for advanced sensor technologies. Furthermore, the integration of dynamic sensors in autonomous driving platforms is rapidly gaining traction within the German market.

Asia-Pacific Vehicle Dynamic Sensors Market Insight

The Asia-Pacific vehicle dynamic sensors market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing vehicle production, rapid urbanization, and growing consumer demand for safety and driver-assistance technologies. Government initiatives mandating ABS and ESC in markets such as China and India are significantly boosting adoption. The region’s role as a global manufacturing hub for automotive electronics and MEMS components is also reducing costs and improving accessibility. Rising disposable incomes and the surge in electric vehicle adoption across China, Japan, and India are further accelerating demand.

Japan Vehicle Dynamic Sensors Market Insight

The Japan vehicle dynamic sensors market is gaining momentum due to the country’s advanced automotive sector and focus on high-tech, safety-driven solutions. Automakers in Japan are heavily investing in gyroscopes and accelerometers to support advanced navigation, ADAS, and autonomous driving applications. A rapidly aging population is also driving demand for vehicles with enhanced safety features. Integration of sensors with IoT-based automotive platforms is strengthening the adoption of intelligent vehicle technologies, making Japan a key growth driver in the region.

China Vehicle Dynamic Sensors Market Insight

The China vehicle dynamic sensors market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country’s massive vehicle production, expanding middle class, and strong focus on road safety. China’s push toward smart mobility and smart city initiatives is significantly boosting demand for yaw rate sensors, accelerometers, and GPS/INS systems. The rapid adoption of electric and autonomous vehicles is also creating strong opportunities for sensor integration. In addition, the presence of large domestic manufacturers and the availability of cost-effective sensor technologies strengthen China’s leading position within the region.

Vehicle Dynamic Sensors Market Share

The vehicle dynamic sensors industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Delphi Technologies (Ireland)

- Sensata Technologies (U.S.)

- Murata Manufacturing Co., Ltd. (Japan)

- Analog Devices, Inc. (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- Infineon Technologies AG (Germany)

- Panasonic Corporation (Japan)

- TE Connectivity Ltd. (Switzerland)

- Allegro MicroSystems, LLC (U.S.)

- STMicroelectronics (Switzerland)

- Freescale Semiconductor Inc. (U.S.)

- Aptiv PLC (Ireland)

- Robert Bosch GmbH (Germany)

- ABB Ltd. (Switzerland)

- Honeywell International Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- Kyocera Corporation (Japan)

Latest Developments in Global Vehicle Dynamic Sensors Market

- In March 2024, Applied Intuition launched an automated parking development solution for ADAS and AD engineering teams, enabling the development of ML-based or classical automated parking systems up to 12 times faster. The solution addressed key challenges in engineering automated parking systems, including diverse operational design domains, unpredictable vehicle and pedestrian movement, and the need for highly accurate sensor coverage. By providing pre-constructed ODD taxonomies, 360-degree sensing and perception testing, data mining and curation, synthetic parking datasets, realistic simulated vehicle dynamics, and cloud orchestration, Applied Intuition empowered development teams to enhance safety and reliability while reducing time to market

- In September 2023, the collaboration between Mobileye and Valeo to deliver software-defined imaging radars marked a significant advancement for the vehicle dynamic sensors and ADAS market. By merging Valeo’s hardware expertise with Mobileye’s advanced driver-assistance software capabilities, the partnership strengthens the pathway to more intelligent, automated vehicles. Imaging radar, being a critical sensor technology, enhances situational awareness for next-generation driver assistance and automated driving systems. This collaboration is expected to accelerate the commercialization of highly reliable, hands-off and eyes-off driving features, thereby expanding opportunities for global automakers to integrate premium safety and automation functionalities

- In August 2023, the integration of Hesai Technology’s lidar sensors into NVIDIA DRIVE and Omniverse ecosystems represented a pivotal development for the autonomous driving and dynamic sensors market. This partnership combines Hesai’s cutting-edge lidar hardware with NVIDIA’s AI-driven simulation and development platforms, creating a robust ecosystem for testing and scaling autonomous driving solutions. The move enables higher accuracy in environmental perception, driving forward innovation in both ADAS and fully autonomous systems. By fostering synergy between hardware and software, this collaboration is set to accelerate market adoption of lidar-powered autonomous mobility

- In July 2023, LeddarTech’s LeddarVision software achieved successful integration with Ficosa’s surround-view camera system and additional sensors, reinforcing its impact on the sensor fusion and ADAS software market. This milestone enhances the accuracy and efficiency of perception systems by fusing raw data from radars, cameras, GPS, and IMUs into high-fidelity 3D environmental models. The collaboration positions both companies at the forefront of smart parking and advanced ADAS solutions, addressing growing demand for safer, more efficient urban mobility. By unlocking the potential of low-level sensor fusion, the partnership supports the evolution of intelligent driver assistance and automated driving capabilities, particularly in parking and close-range maneuvering applications

- In October 2022, AB Dynamics and its sister company Dynamics Research Inc (DRI) launched the Soft Motorcycle 360, a next-generation motorcycle test target, to enhance motorcyclist safety and comply with Euro NCAP 2023 and ISO 19206-5 draft requirements. The product featured a modular construction for ease of assembly, increased sensor realism, and minimized hard points to reduce potential damage to test vehicles, addressing the industry's focus on protecting vulnerable road users. The Soft Motorcycle 360 was developed in collaboration with DRI, leveraging their experience in developing realistic, lightweight, and efficient targets for safety testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vehicle Dynamic Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vehicle Dynamic Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vehicle Dynamic Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.