Global Vehicle Pillar Market

Market Size in USD Billion

CAGR :

%

USD

7.13 Billion

USD

9.32 Billion

2024

2032

USD

7.13 Billion

USD

9.32 Billion

2024

2032

| 2025 –2032 | |

| USD 7.13 Billion | |

| USD 9.32 Billion | |

|

|

|

|

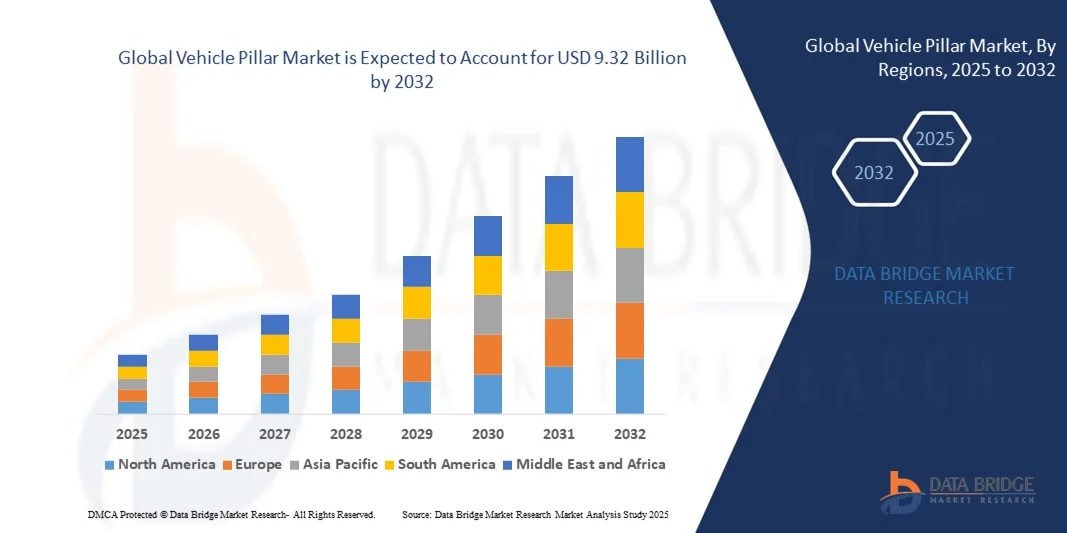

What is the Global Vehicle Pillar Market Size and Growth Rate?

- The global vehicle pillar market size was valued at USD 7.13 billion in 2024 and is expected to reach USD 9.32 billion by 2032, at a CAGR of 4.28% during the forecast period

- Rising passenger safety in automobiles is a crucial factor accelerating the market growth, also currently booming automotive industry, along with progressively increasing disposable income, rising production of vehicles in developing countries, rising repairing of vehicles post-accident due to increased number of vehicles on-road which has led to the rise in number of accidents, rising concerns regarding emissions, increasing consumer demand regarding the advancement of products and increasing demand of vehicles due to increasing populaton are the major factors among others boosting the vehicle pillar market

What are the Major Takeaways of Vehicle Pillar Market?

- Rising improvements in design of automotive pillars also reduce the noise and vibrations, rising technological advancements in the production techniques and increasing modernization in vehicles will further create new opportunities for vehicle pillar market in the forecast period mentioned above

- However, stringent regulations for safety and supplier production capacity limitations, increasing cost of vehicles due to rising modernization are the major factors among others which will curtail the market growth, while increasing maintenance cost of the vehicle will further challenge the vehicle pillar market in the forecast period mentioned above

- Asia-Pacific dominated the vehicle pillar market with the largest revenue share of 42.7% in 2024, driven by rapid industrialization, growing vehicle production, and increasing adoption of lightweight, high-strength pillars in passenger and commercial vehicles

- The North America vehicle pillar market is poised to grow at the fastest CAGR of 7.69% during the forecast period of 2025 to 2032, driven by the resurgence of vehicle manufacturing, increasing adoption of electric vehicles, and rising safety standards in the U.S. and Canada

- The B Pillar segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its critical role in side-impact protection, structural rigidity, and integration with seatbelt anchorage and side curtain airbags

Report Scope and Vehicle Pillar Market Segmentation

|

Attributes |

Vehicle Pillar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Vehicle Pillar Market?

Advanced Lightweight Materials and Enhanced Safety Features

- A key trend shaping the global vehicle pillar market is the increasing adoption of advanced lightweight materials, such as high-strength steel, aluminum alloys, and carbon fiber composites, which improve fuel efficiency without compromising structural integrity

- For instance, many automotive OEMs, including Toyota and Ford, are integrating ultra-high-strength steel and aluminum into A-pillars and B-pillars to reduce vehicle weight while maintaining crashworthiness and safety standards

- The integration of these materials allows for enhanced crash energy absorption and improves passenger safety in frontal and side-impact collisions. Manufacturers are also optimizing pillar designs to accommodate airbags, seatbelt anchorage systems, and sensor placements for ADAS features

- Furthermore, advanced materials enable slimmer pillar profiles, improving driver visibility and reducing blind spots, a critical factor in modern vehicle safety and comfort

- Automakers are also exploring multi-material combinations to balance cost, durability, and performance, resulting in more sustainable and energy-efficient vehicles

- This trend is accelerating the demand for pillars that combine lightweight design with high safety performance, particularly in passenger vehicles, SUVs, and electric vehicles

What are the Key Drivers of Vehicle Pillar Market?

- The rising demand for safer and more fuel-efficient vehicles is a primary driver for the Vehicle Pillar market. Increasingly stringent safety regulations, including crash-test requirements in the U.S., Europe, and Asia, are prompting manufacturers to adopt stronger, lighter pillars

- For instance, in 2024, Magna International announced a collaboration with automotive OEMs to supply high-strength aluminum and composite pillars for EV platforms, enhancing crash performance while reducing vehicle weight

- Consumers’ growing awareness of vehicle safety features, such as reinforced pillars and integrated side-impact protection, is pushing automakers to innovate with new materials and pillar designs

- The increasing adoption of electric vehicles (EVs) is further driving the market, as lightweight pillars help offset the weight of battery packs and improve driving range

- In addition, advancements in manufacturing technologies, such as hydroforming and precision stamping, enable more complex pillar geometries and integrated functional features, boosting market demand globally

Which Factor is Challenging the Growth of the Vehicle Pillar Market?

- The high cost of advanced materials, such as carbon fiber and high-strength alloys, can limit widespread adoption, particularly in entry-level vehicles and cost-sensitive regions

- Manufacturing complexity and the need for specialized fabrication equipment for lightweight, high-strength pillars pose a challenge for smaller suppliers

- Integrating pillars with multiple safety and sensor systems, such as curtain airbags and ADAS sensors, increases design and production costs, which may slow market growth

- In addition, concerns over material recyclability and sustainability are pressuring manufacturers to invest in eco-friendly alternatives, which can further increase costs

- Overcoming these challenges requires balancing material performance with cost efficiency, leveraging advanced manufacturing technologies, and developing lightweight, high-strength pillars suitable for mass production while meeting safety standards globally

How is the Vehicle Pillar Market Segmented?

The market is segmented on the basis of pillar type, vehicle type, material, and end-user.

- By Pillar Type

On the basis of pillar type, the vehicle pillar market is segmented into A Pillar, B Pillar, C Pillar, and D Pillar. The B Pillar segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its critical role in side-impact protection, structural rigidity, and integration with seatbelt anchorage and side curtain airbags. B Pillars are highly prioritized in vehicle design for crash safety compliance and passenger protection, particularly in passenger cars and SUVs.

The C Pillar segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by the increasing adoption of SUVs, crossovers, and electric vehicles, where rear structural stability and visibility optimization are essential. Innovations in lightweight materials and the integration of sensors for ADAS applications further accelerate C Pillar demand. Manufacturers are leveraging advanced aluminum and composite designs to enhance both safety and fuel efficiency without compromising aesthetics or structural integrity.

- By Vehicle Type

On the basis of vehicle type, the vehicle pillar market is segmented into passenger vehicles and commercial vehicles. The passenger vehicle segment dominated the market with a revenue share of 61.3% in 2024, driven by the growing demand for cars, SUVs, and crossovers equipped with lightweight, high-strength pillars for enhanced safety, fuel efficiency, and aesthetic appeal. Passenger vehicles are also incorporating advanced pillars to accommodate airbags, ADAS sensors, and reinforced roof structures, making them integral to modern vehicle safety architecture.

The commercial vehicle segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, supported by increasing fleet modernization, stricter safety regulations, and a growing emphasis on crash protection for buses, trucks, and vans. Advancements in pillar materials and designs enable commercial vehicles to achieve better load-bearing performance while maintaining compliance with regional safety standards.

- By Material

On the basis of material, the vehicle pillar market is segmented into aluminum, steel, and plastic composites. The steel segment dominated the market with the largest revenue share of 55.4% in 2024, owing to its high strength-to-cost ratio, ease of integration into conventional vehicle manufacturing, and excellent crashworthiness for both passenger and commercial vehicles. Steel pillars remain the industry standard due to their proven performance in side-impact tests and structural durability over the vehicle lifecycle.

The aluminum segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, driven by the automotive industry's focus on lightweighting to improve fuel efficiency and reduce emissions. Aluminum pillars are increasingly preferred in premium passenger vehicles and EV platforms, providing comparable structural strength to steel while significantly reducing vehicle weight. Plastic composites are also emerging in niche applications where flexibility, corrosion resistance, and design freedom are critical.

- By End Market

On the basis of end market, the vehicle pillar market is segmented into OEM and aftermarket. The OEM segment dominated the market with a revenue share of 70.8% in 2024, fueled by the growing production of new vehicles worldwide and the incorporation of advanced pillars as part of original vehicle design for safety, crash compliance, and lightweighting initiatives. OEMs are increasingly adopting high-strength steel, aluminum, and composite materials to meet regulatory safety standards and improve fuel efficiency.

The aftermarket segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by the rising demand for vehicle repairs, replacements, and retrofits, particularly in regions with aging vehicle fleets. The aftermarket growth is also supported by the popularity of premium customization and reinforcement solutions that enhance safety, aesthetics, and compatibility with modern technologies such as ADAS.

Which Region Holds the Largest Share of the Vehicle Pillar Market?

- Asia-Pacific dominated the vehicle pillar market with the largest revenue share of 42.7% in 2024, driven by rapid industrialization, growing vehicle production, and increasing adoption of lightweight, high-strength pillars in passenger and commercial vehicles

- Automakers in the region are integrating advanced pillars to enhance safety, meet stringent crash standards, and optimize vehicle performance

- The widespread adoption is further supported by increasing disposable incomes, expanding urban mobility, and government initiatives promoting electric vehicles and smart automotive technologies, establishing Asia-Pacific as the largest contributor to global Vehicle Pillar demand

China Vehicle Pillar Market Insight

The China vehicle pillar market accounted for the largest share in Asia-Pacific in 2024, fueled by the country’s rapid urbanization, expanding middle class, and high vehicle production volumes. The adoption of lightweight aluminum and composite pillars for enhanced crash safety and fuel efficiency is driving growth. In addition, China’s push toward smart and electric vehicles, coupled with strong domestic manufacturers, is boosting demand across passenger and commercial segments.

Japan Vehicle Pillar Market Insight

The Japan vehicle pillar market is witnessing robust growth due to the nation’s focus on advanced automotive technologies, safety regulations, and eco-friendly vehicles. The integration of ADAS sensors, lightweight materials, and reinforced pillars is driving demand. Furthermore, Japan’s aging population encourages innovation in ergonomics and vehicle safety, fostering adoption across residential and commercial vehicle segments.

Which Region is the Fastest Growing in the Vehicle Pillar Market?

The North America vehicle pillar market is poised to grow at the fastest CAGR of 7.69% during the forecast period of 2025 to 2032, driven by the resurgence of vehicle manufacturing, increasing adoption of electric vehicles, and rising safety standards in the U.S. and Canada. The growing preference for lightweight materials and advanced pillar designs for crashworthiness and fuel efficiency is accelerating market expansion.

U.S. Vehicle Pillar Market Insight

The U.S. vehicle pillar market captured the largest revenue share of 80% within North America in 2024, fueled by increasing investments in automotive safety, smart vehicle components, and lightweight construction technologies. OEMs are adopting high-strength steel, aluminum, and composite pillars in both passenger and commercial vehicles to meet evolving regulations and consumer expectations.

Canada Vehicle Pillar Market Insight

The Canada vehicle pillar market is witnessing steady growth, supported by government incentives for safer and energy-efficient vehicles, as well as increasing demand for EVs and commercial fleets. Lightweight and reinforced pillars are gaining traction in new vehicle production, driving adoption in both urban and industrial applications.

Which are the Top Companies in Vehicle Pillar Market?

The vehicle pillar industry is primarily led by well-established companies, including:

- Unipres Corporation (Japan)

- KIRCHHOFF Automotive GmbH (Germany)

- TOYODA IRON WORKS CO., LTD. (Japan)

- TOYOTOMI CO., LTD. (Japan)

- G-TEKT CORPORATION (Japan)

- Martinrea International Inc. (Canada)

- AISIN SEIKI Co., Ltd. (Japan)

- Tower International (U.S.)

- Trimurti Enterprises (India)

- Magna International Inc. (Canada)

- GEDIA Automotive Group (Germany)

- Sewon America Inc. (U.S.)

- Gestamp (Spain)

- Doshi Industries (India)

- Ganpati Auto Traders (India)

- Micro Polyster Lamination (India)

- Prashant Auto Parts Private Limited (India)

- Shiloh Industries (U.S.)

What are the Recent Developments in Global Vehicle Pillar Market?

- In November 2024, AUDI launched the E Concept Sportback car in China, featuring a curved pillar-to-pillar 4K touch display and a glass rooftop, marking a significant step in innovative EV interiors and showcasing advanced in-cabin technology

- In October 2024, ZEEKR introduced the MIX EV with distinctive double B-pillar doors, priced below USD 40K, highlighting the company’s focus on affordable yet innovative electric vehicle design and accessibility

- In October 2023, Fisker, an American automotive company founded in 2016, unveiled the production-intent version of its highly anticipated Pear EV at its Los Angeles store, featuring a see-through A pillar design, emphasizing futuristic styling and improved visibility for drivers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.