Global Vein Finders Market

Market Size in USD Billion

CAGR :

%

USD

438.44 Billion

USD

1,024.33 Billion

2025

2033

USD

438.44 Billion

USD

1,024.33 Billion

2025

2033

| 2026 –2033 | |

| USD 438.44 Billion | |

| USD 1,024.33 Billion | |

|

|

|

|

Vein Finders Market Size

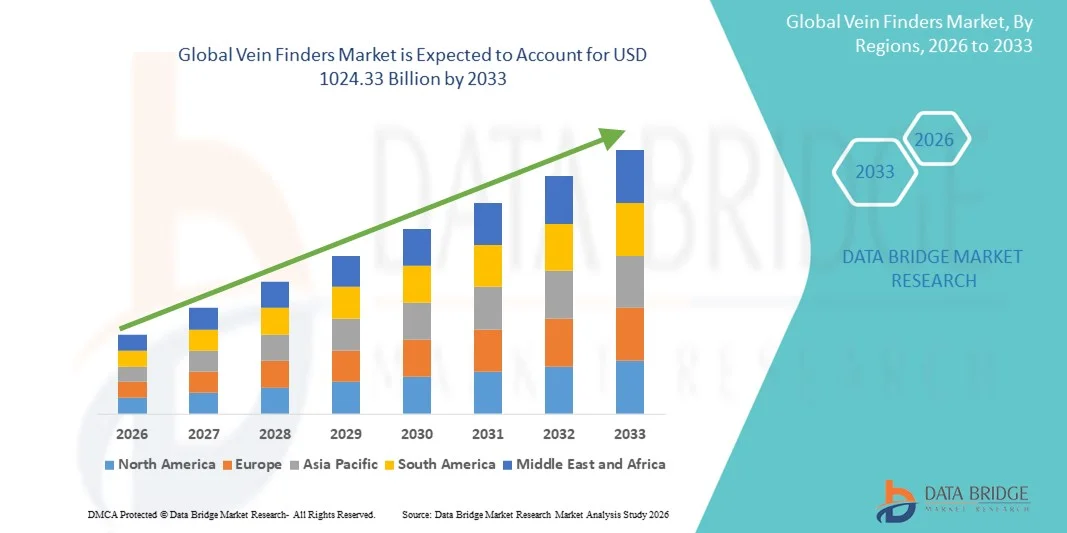

- The global vein finders market size was valued at USD 438.44 billion in 2025 and is expected to reach USD 1024.33 billion by 2032, at a CAGR of11.19% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive medical procedures and continuous technological advancements in vein visualization devices, leading to improved accuracy and efficiency in venipuncture across hospitals, clinics, and diagnostic centers

- Furthermore, rising demand for patient-centric healthcare, reduction in needlestick injuries, and the growing use of vein finders in pediatric, geriatric, and emergency care settings are accelerating the uptake of vein finder solutions, thereby significantly boosting the overall growth of the Vein Finders market

Vein Finders Market Analysis

- Vein finders, which use technologies such as near-infrared (NIR), ultrasound, or transillumination to visualize veins, have become essential clinical tools across hospitals, diagnostic centers, and emergency care settings due to their ability to improve first-stick success rates, reduce patient discomfort, and enhance overall procedural efficiency

- The rising demand for vein finders is primarily driven by the growing volume of blood collection procedures, increasing prevalence of chronic diseases, expanding geriatric and pediatric patient populations, and a strong focus on patient safety and reduction of needlestick injuries among healthcare professionals

- North America dominated the vein finders market with the largest revenue share of approximately 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative medical devices, strong presence of leading manufacturers, and widespread use of vein visualization technologies across hospitals, ambulatory surgical centers, and emergency departments in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the vein finders market during the forecast period, registering a projected CAGR of over 9.1%, driven by expanding healthcare access, rising hospitalization rates, growing investments in medical technology, and increasing awareness of patient-centric care across emerging economies

- The handheld segment accounted for the largest market revenue share of 72.1% in 2025, driven by its portability and flexibility

Report Scope and Vein Finders Market Segmentation

|

Attributes |

Vein Finders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• AccuVein (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Vein Finders Market Trends

Increasing Adoption of Vein Visualization Technologies in Clinical Settings

- A significant and accelerating trend in the global vein finders market is the growing adoption of vein visualization technologies across hospitals, clinics, and emergency care settings to improve venipuncture accuracy and patient comfort

- Vein finders are increasingly used to reduce failed insertion attempts, particularly among pediatric, geriatric, obese, and chronically ill patients

- For instance, in 2024, a major U.S. hospital network expanded the use of handheld near-infrared vein finder devices across its emergency departments to enhance first-attempt success rates for intravenous access

- Technological advancements such as near-infrared imaging, transillumination, and portable wireless designs are improving device accuracy, ease of use, and clinical efficiency

- The rising focus on patient-centric care, combined with the need to minimize procedural pain and complications, is driving broader adoption of vein finders across outpatient and home healthcare settings

- This trend is reshaping standard clinical practices, with vein finders increasingly viewed as essential tools for improving workflow efficiency and patient satisfaction

Vein Finders Market Dynamics

Driver

Rising Demand for Improved Venous Access and Patient Safety

- The Vein Finders market is strongly driven by the increasing demand for reliable venous access solutions amid the rising prevalence of chronic diseases, hospital admissions, and diagnostic and therapeutic procedures requiring intravenous access

- For instance, in 2025, a large Asian healthcare provider adopted vein finder devices across multiple dialysis centers to support frequent venous access procedures and reduce complications among long-term patients

- Healthcare professionals are increasingly prioritizing tools that reduce needle-stick injuries, procedure time, and repeated insertion attempts, particularly in high-pressure environments such as emergency rooms and intensive care units

- The expansion of home healthcare services and outpatient treatment models is further boosting demand for portable and easy-to-use vein visualization devices

- Growing awareness of infection control, patient comfort, and clinical efficiency continues to propel the adoption of vein finders across both developed and emerging healthcare markets

Restraint/Challenge

High Device Costs and Limited Adoption in Resource-Constrained Settings

- Despite growing demand, the vein finders market faces challenges related to the relatively high cost of advanced visualization devices, which can limit adoption in small clinics, rural hospitals, and low-resource healthcare settings

- For instance, in 2023, several public hospitals in Latin America delayed procurement of advanced near-infrared vein finder systems due to budget constraints, opting instead for conventional venipuncture methods

- Limited training and awareness among healthcare professionals regarding optimal device usage can also hinder effective implementation and return on investment

- In addition, variability in device accuracy across different skin tones and patient conditions remains a technical challenge for manufacturers

- Overcoming these barriers through cost-effective device development, training initiatives, and continued technological innovation will be essential for sustained growth in the global Vein Finders market

Vein Finders Market Scope

The market is segmented on the basis of type, product, technology, application, and end user.

- By Type

On the basis of type, the Vein Finders market is segmented into active vein finders and passive vein finders. The active vein finders segment dominated the largest market revenue share of 68.4% in 2025, driven by their ability to actively emit infrared or ultrasound signals for precise vein visualization. These devices provide real-time imaging, improving first-attempt venipuncture success rates. Active vein finders are widely adopted in hospitals due to their clinical reliability. They are particularly effective for patients with difficult venous access, including pediatric and geriatric populations. Growing demand from blood donation centers further supports adoption. High accuracy reduces procedural time and patient discomfort. Integration with advanced imaging software enhances performance. Increasing emphasis on patient safety strengthens demand. Technological advancements continue to improve resolution. Their widespread availability across healthcare facilities reinforces dominance. Rising procedural volumes globally support sustained revenue growth. Strong regulatory approvals further boost trust and adoption.

The passive vein finders segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, supported by rising demand for cost-effective solutions. Passive devices enhance vein visibility using ambient light without active emission. These products are easy to use and require minimal training. Lower device costs make them suitable for small clinics. Growing adoption in rural and underserved healthcare settings fuels growth. Portability supports use in mobile healthcare units. Increasing healthcare infrastructure investments in emerging economies drive demand. Reduced maintenance requirements further enhance appeal. Expanding awareness of vein visualization technology supports adoption. Favorable reimbursement trends in developing regions aid growth. Continuous improvements in optical design enhance usability. These factors collectively accelerate segment expansion.

- By Product

On the basis of product, the Vein Finders market is segmented into benchtop and handheld devices. The handheld segment accounted for the largest market revenue share of 72.1% in 2025, driven by its portability and flexibility. Handheld vein finders are widely used at the bedside for quick assessments. Their compact design supports emergency and outpatient settings. Battery-powered functionality enables uninterrupted usage. High adoption among nurses and phlebotomists boosts demand. Ease of disinfection supports infection control protocols. Growing preference for point-of-care devices drives dominance. Continuous ergonomic improvements enhance user comfort. Integration with infrared technology improves accuracy. Rising outpatient visits increase utilization rates. Handheld devices support workflow efficiency. Strong manufacturer focus on miniaturization sustains growth.

The benchtop segment is expected to witness the fastest CAGR of 17.6% from 2026 to 2033, driven by demand for high-precision imaging. Benchtop systems offer enhanced stability during procedures. These devices are preferred in specialized clinics and training institutions. Growing investments in diagnostic infrastructure support adoption. Higher imaging depth improves success in complex cases. Increasing medical education programs use benchtop systems for training. Technological upgrades improve image clarity. Hospitals adopt benchtop units for high-volume procedures. Rising focus on accuracy-driven healthcare supports growth. Integration with hospital IT systems enhances efficiency. Expanding tertiary care facilities boost demand. These factors contribute to rapid CAGR growth.

- By Technology

On the basis of technology, the Vein Finders market is segmented into infra-red, ultra-violet, and ultrasound. The infra-red segment dominated the largest market revenue share of 63.7% in 2025, due to its non-invasive nature. Infra-red technology effectively highlights superficial veins. It is widely used for routine venipuncture procedures. Ease of operation supports widespread adoption. Infra-red vein finders offer quick visualization results. Cost efficiency supports demand across healthcare settings. Compatibility with handheld devices boosts penetration. Continuous innovation improves accuracy and brightness. High patient comfort levels support acceptance. Increasing diagnostic testing volumes drive usage. Strong clinical validation reinforces trust. These advantages sustain segment leadership.

The ultrasound segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by demand for deep vein visualization. Ultrasound technology enables imaging of non-visible veins. It is increasingly used in critical care units. Growing surgical procedures boost adoption. High accuracy reduces complications during IV access. Technological advancements improve portability. Increasing use in oncology supports growth. Expanding emergency care services drive demand. Training improvements enhance clinical adoption. Rising prevalence of chronic diseases increases usage. Advanced hospitals favor ultrasound solutions. These trends collectively fuel strong CAGR growth.

- By Application

On the basis of application, the Vein Finders market is segmented into blood draw or venipuncture and IV access. The blood draw or venipuncture segment accounted for the largest market revenue share of 58.9% in 2025, driven by high diagnostic testing volumes. Vein finders improve blood collection efficiency. Reduced failed attempts enhance patient satisfaction. Growing chronic disease prevalence supports frequent testing. Blood donation centers rely heavily on vein finders. Improved workflow efficiency supports adoption. Rising preventive healthcare testing boosts demand. Use in pediatric care strengthens dominance. Enhanced accuracy reduces staff fatigue. Increased laboratory automation supports utilization. Global diagnostic expansion fuels growth. These factors collectively sustain segment dominance.

The IV access segment is expected to witness the fastest CAGR of 18.3% from 2026 to 2033, driven by rising hospital admissions. Increasing surgical procedures boost IV placement demand. Vein finders reduce catheter insertion failures. Adoption in emergency departments supports growth. Expanding oncology treatments increase IV usage. Rising ICU admissions boost demand. Improved patient outcomes encourage adoption. Growing use in long-term care facilities supports growth. Technological enhancements improve deep vein access. Increasing outpatient procedures drive adoption. Global healthcare expansion accelerates growth. These trends support strong CAGR performance.

- By End User

On the basis of end user, the Vein Finders market is segmented into hospitals, ambulatory surgical centers, specialized clinics, blood donation centers, and others. The hospitals segment dominated the largest market revenue share of 61.5% in 2025, driven by high patient volumes. Hospitals perform frequent venipuncture procedures daily. Availability of skilled staff supports device utilization. Increasing focus on patient safety drives adoption. Emergency departments rely on vein finders. Rising surgical volumes boost demand. Hospitals invest in advanced medical devices. Integration with clinical workflows supports efficiency. Large procurement budgets enable adoption. Growing ICU admissions support usage. Government hospital funding boosts penetration. These factors maintain hospital dominance.

The ambulatory surgical centers segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by outpatient care growth. ASCs perform high volumes of minimally invasive procedures. Need for rapid IV access supports adoption. Cost efficiency drives ASC investments. Short procedure times increase reliance on vein finders. Rising patient preference for same-day surgeries supports growth. Expanding ASC networks globally boost demand. Technological affordability supports adoption. Improved procedural outcomes encourage use. Growing private healthcare investments drive growth. Streamlined workflows increase utilization. These factors contribute to the highest CAGR.

Vein Finders Market Regional Analysis

- North America dominated the vein finders market with the largest revenue share of approximately 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative medical devices, and the strong presence of leading manufacturers

- Healthcare providers in the region highly value vein finders for their ability to improve first-stick success rates, reduce patient discomfort, and enhance clinical efficiency across hospitals, ambulatory surgical centers, and emergency departments

- This widespread adoption is further supported by high healthcare spending, early uptake of advanced visualization technologies, and a strong focus on patient safety and quality of care, establishing vein finders as essential tools in routine and critical care settings

U.S. Vein Finders Market Insight

The U.S. vein finders market captured the largest revenue share within North America in 2025, driven by widespread use of vein visualization devices across hospitals, emergency rooms, and outpatient facilities. High procedural volumes, a strong emphasis on minimizing needlestick injuries, and growing demand for patient-centric care are key factors supporting market growth. Additionally, continuous technological advancements and the presence of major medical device manufacturers further strengthen the U.S. market position.

Europe Vein Finders Market Insight

The Europe vein finders market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing adoption of advanced medical devices and rising awareness of patient safety. Growth in hospital infrastructure, along with the need to improve venous access in pediatric, geriatric, and chronic disease patients, is contributing to market expansion across the region.

U.K. Vein Finders Market Insight

The U.K. vein finders market is anticipated to grow at a notable CAGR during the forecast period, supported by rising investments in healthcare technology and a strong focus on improving clinical outcomes. The increasing use of vein finders in emergency care and outpatient settings, along with efforts to reduce procedural complications, continues to drive market demand.

Germany Vein Finders Market Insight

The Germany vein finders market is expected to expand at a considerable CAGR, driven by the country’s advanced healthcare system and strong emphasis on medical innovation. Increasing adoption of vein visualization technologies in hospitals and diagnostic centers, along with a growing aging population, is supporting steady market growth.

Asia-Pacific Vein Finders Market Insight

The Asia-Pacific vein finders market is expected to be the fastest growing region during the forecast period, registering a projected CAGR of over 9.1%. Growth is driven by expanding healthcare infrastructure, rising hospitalization rates, increasing investments in medical technology, and growing awareness of patient-centric care across emerging economies.

Japan Vein Finders Market Insight

The Japan vein finders market is gaining momentum due to the country’s advanced healthcare system and strong demand for precision medical devices. High adoption of innovative technologies, along with the need to improve venous access in an aging population, is fueling the use of vein finders across hospitals and specialty clinics.

China Vein Finders Market Insight

The China vein finders market accounted for a significant revenue share in Asia Pacific in 2025, supported by rapid expansion of healthcare facilities, increasing government investment in medical infrastructure, and rising adoption of advanced diagnostic and visualization devices. Growing awareness of patient comfort and safety, along with the presence of domestic manufacturers, continues to propel market growth in China.

Vein Finders Market Share

The Vein Finders industry is primarily led by well-established companies, including:

• AccuVein (U.S.)

• Christie Medical Holdings (U.S.)

• Evena Medical (U.S.)

• Veinlite (U.S.)

• Infinium Medical (U.S.)

• De Koningh Medical Systems (Netherlands)

• Venoscope (U.S.)

• Vuetek Scientific (India)

• Biobase Group (China)

• Promed Group (Germany)

• Laxman Surgicals (India)

Latest Developments in Global Vein Finders Market

- In July 2023, AccuVein expanded its market presence through a strategic U.S. distribution partnership with Merz Aesthetics to promote the AccuVein AV500 vein visualization device, enabling integration of real-time near-infrared vein mapping into aesthetic and clinical practices to improve injection accuracy, reduce bruising, and enhance patient comfort. This partnership marked a notable crossover of vein finder technology into cosmetic procedures and broadened adoption in clinical settings beyond traditional venipuncture roles

- In June 2024, AccuVein announced a next-generation vein visualization device featuring enhanced imaging depth, reduced alignment time, and AI-based vein detection, aimed to assist healthcare teams in locating peripheral veins faster and more reliably during venipuncture and IV insertions, reflecting the industry’s push toward more intelligent vascular access tools

- In October 2024, VeinViewer entered into a strategic partnership with Medline Industries to distribute its vein visualization products through Medline’s extensive hospital and acute-care supply network, dramatically expanding the availability of vein finder devices in clinical settings across the United States and enhancing provider access to vascular imaging tools

- In August 2024, Christie Medical introduced the VeinViewer Flex 2.0 with improved portability and near-infrared imaging capabilities, expanding adoption in outpatient surgical centers and emergency care facilities across North America and Europe, illustrating ongoing device evolution focused on mobility and broader clinical use

- In August 2024, VEINCAS introduced a next-generation portable vein finder with high-resolution imaging (0.4 mm), aimed at enhancing venipuncture success rates in pediatric and general care environments, reflecting increasing product diversification and advanced feature adoption among vein finder manufacturers

- In April 2024, several clinical studies highlighted that AI-assisted vein finder devices significantly increased first-attempt venous access success rates by more than 30% in selected hospitals, underscoring the clinical impact of integrating artificial intelligence into vein visualization technologies to improve outcomes and reduce procedural errors

- In March 2025, Nova Medical acquired VeinSeek Technologies, a move aimed at expanding its portfolio of portable vein visualization solutions and strengthening its position in the vein finders market by combining complementary technologies and widening geographic reach to clinics and outpatient facilities

- In January 2025, VeinViewer launched the VeinViewer Pro 2.0, an enhanced near-infrared vein visualization system featuring improved detection depth, expanded patient size compatibility, and cloud-based data capture, designed to support clinicians in locating peripheral veins more quickly across diverse patient populations. This new model represents a significant technology upgrade in the vein finders segment, addressing limitations of earlier imaging depth and data integration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.