Global Venous Blood Collection Devices Market

Market Size in USD Billion

CAGR :

%

USD

6.84 Billion

USD

11.13 Billion

2024

2032

USD

6.84 Billion

USD

11.13 Billion

2024

2032

| 2025 –2032 | |

| USD 6.84 Billion | |

| USD 11.13 Billion | |

|

|

|

|

Venous Blood Collection Devices Market Size

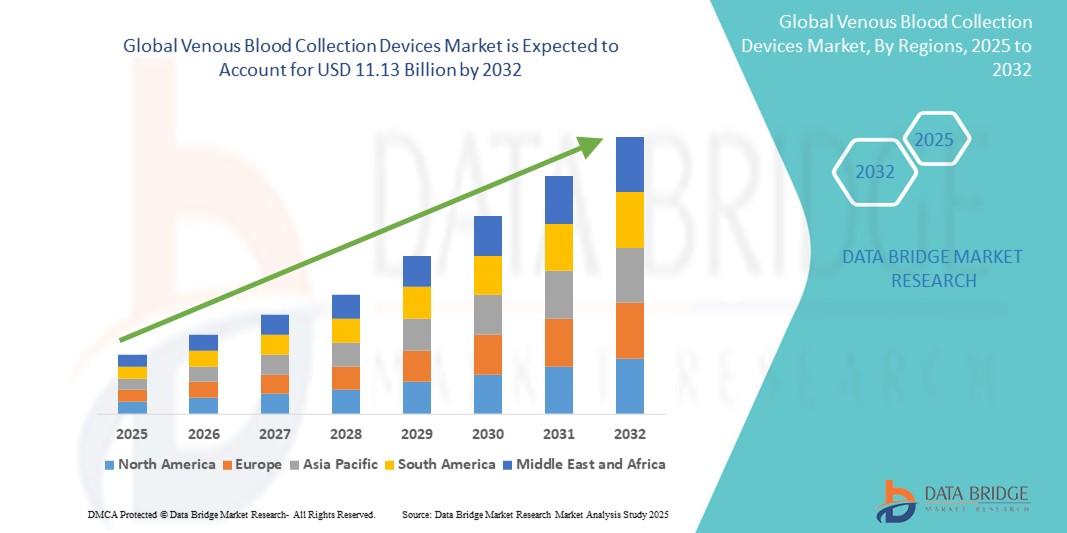

- The global venous blood collection devices market size was valued at USD 6.84 billion in 2024 and is expected to reach USD 11.13 billion by 2032, at a CAGR of 6.27% during the forecast period

- This growth is driven by factors such as the increasing demand for diagnostic testing, the growing number of chronic diseases, advancements in medical technology, and the rising awareness of the importance of early disease detection

Venous Blood Collection Devices Market Analysis

- Venous blood collection devices are essential tools used in clinical and diagnostic settings to obtain blood samples for various tests and treatments. These devices, including needles, syringes, and collection tubes, are crucial for procedures such as routine blood testing, blood transfusions, and diagnosis of chronic diseases

- The demand for venous blood collection devices is significantly driven by the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer, as well as a growing emphasis on preventive healthcare and early disease detection

- North America is expected to dominate the venous blood collection devices market with largest market share of approximately 75.5%, due to advanced healthcare infrastructure, high healthcare spending, and increasing diagnostic testing demand. The region also benefits from a large number of healthcare facilities and a well-established reimbursement system

- Asia-Pacific is projected to be the fastest-growing region in the venous blood collection devices market during the forecast period, due to rising healthcare access, increasing awareness about blood-related diagnostic testing, and expanding healthcare infrastructure in countries like China and India

- Plastic segment is expected to dominate the market with a largest market share of approximately 88.5%, due to the cost-effectiveness of plastic, which makes it more affordable to produce and purchase compared to glass alternatives. Plastic blood collection devices are also safer and more durable, as they are less prone to breakage, reducing the risk of injury during handling and transportation

Report Scope and Venous Blood Collection Devices Market Segmentation

|

Attributes |

Venous Blood Collection Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Venous Blood Collection Devices Market Trends

“Technological Advancements in Venous Blood Collection Devices”

- One prominent trend in the venous blood collection devices market is the integration of advanced technologies for enhancing the efficiency, safety, and patient comfort during blood collection procedures

- These innovations include the development of safety-engineered devices such as retractable needles, which minimize the risk of needle-stick injuries, and devices that improve blood flow control, reducing patient discomfort and improving the overall collection process

- For instance, advancements in needle design and the introduction of smart blood collection tubes with digital tracking systems enable real-time data collection and improve sample integrity, streamlining the diagnostic process

- These advancements are transforming blood collection practices, improving patient safety and comfort, and driving the demand for next-generation blood collection devices with enhanced features

Venous Blood Collection Devices Market Dynamics

Driver

“Growing Demand Due to Increasing Chronic Diseases”

- The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and obesity is significantly contributing to the increased demand for venous blood collection devices

- As the global population ages and lifestyle diseases continue to rise, there is an increasing need for regular diagnostic testing, which in turn drives the demand for efficient and reliable blood collection methods

- As more individuals undergo routine blood tests for monitoring and managing these chronic conditions, the need for advanced blood collection devices grows, ensuring better diagnosis, treatment, and monitoring

For instance,

- In 2022, the World Health Organization (WHO) reported that the global prevalence of diabetes is expected to rise significantly, with an estimated 700 million people living with the disease by 2045. This increase is directly contributing to the growing need for blood collection devices to monitor diabetes and other chronic diseases

- As a result of the rising incidence of chronic diseases, there is a significant increase in the demand for venous blood collection devices, driving market growth and the adoption of advanced technologies for improved healthcare outcomes

Opportunity

“Expanding Role of Digital Health and AI in Blood Collection”

- The integration of digital health technologies and artificial intelligence (AI) into venous blood collection systems presents a significant market opportunity by enhancing the accuracy, traceability, and efficiency of blood sample management

- AI-driven tools can assist in optimizing vein detection, reducing errors in collection, and improving the overall patient experience, particularly in difficult venous access cases or pediatric and elderly patients

- Smart blood collection devices with connectivity features can automatically log and track samples, integrate with electronic health records (EHRs), and support remote patient monitoring and data analytics

For instance,

- In 2023, multiple healthcare innovators began piloting AI-powered vein visualization and digital labeling systems to reduce human error and streamline pre-analytical processes, contributing to faster diagnostics and improved clinical outcomes

- The integration of AI and digital tools in venous blood collection can lead to increased operational efficiency, reduced sample misidentification, and enhanced diagnostic accuracy—creating new growth avenues in both hospital and home-care settings

Restraint/Challenge

“Risk of Contamination and Needlestick Injuries Hindering Market Growth”

- The risk of bloodborne pathogen transmission and needlestick injuries remains a significant challenge in the venous blood collection devices market, particularly impacting healthcare worker safety and regulatory compliance

- Despite advancements in safety-engineered devices, improper handling, lack of training, and insufficient use of protective technologies in certain regions increase the likelihood of accidents and infections

- These safety concerns can lead to higher liability for healthcare institutions, increased operational costs, and hesitance in adopting new blood collection systems without proven safety records

For instance,

- According to a 2023 report by the World Health Organization (WHO), over 2 million healthcare workers globally experience needlestick injuries annually, with a considerable percentage related to blood collection procedures. This has heightened the demand for strict safety protocols and advanced protective equipment

- Consequently, safety risks and infection concerns act as barriers to wider adoption, particularly in under-resourced healthcare systems, hindering the growth of the global venous blood collection devices market

Venous Blood Collection Devices Market Scope

The market is segmented on the basis of type, material, application, and end users

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By Application |

|

|

By End users |

|

In 2025, the plastic is projected to dominate the market with a largest share in material segment

The plastic segment is expected to dominate the venous blood collection devices market with the largest share of approximately 88.5%, due to the cost-effectiveness of plastic, which makes it more affordable to produce and purchase compared to glass alternatives. Plastic blood collection devices are also safer and more durable, as they are less prone to breakage, reducing the risk of injury during handling and transportation

The hospitals and clinics is expected to account for the largest share during the forecast period in end users segment

In 2025, the hospitals and clinics segment is expected to dominate the market with the largest market share of approximately 34.2%, due to the high volume of diagnostic tests and increased blood transfusion needs associated with surgeries and chronic conditions. Hospitals and clinics serve as primary centers for patient care, encompassing a wide range of services from routine check-ups to complex surgical procedures, thereby driving the demand for venous blood collection devices

Venous Blood Collection Devices Market Regional Analysis

“North America Holds the Largest Share in the Venous Blood Collection Devices Market”

- North America dominates the venous blood collection devices market with largest market share of approximately 75.5%, driven by a well-established healthcare infrastructure, high healthcare spending, and early adoption of advanced diagnostic technologies

- The U.S. holds a significant share of 28.7%, due to the increasing number of diagnostic tests, strong presence of key players such as Becton, Dickinson and Company, and favorable reimbursement policies that support the widespread use of modern blood collection devices

- The growing burden of chronic diseases such as diabetes, cardiovascular conditions, and cancer continues to drive demand for frequent blood tests, further boosting the market in the region

- The presence of regulatory bodies like the FDA that enforce safety and quality standards also encourages innovation and deployment of advanced, safety-engineered blood collection devices

“Asia-Pacific is Projected to Register the Highest CAGR in the Venous Blood Collection Devices Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the venous blood collection devices market, fueled by the rapid expansion of healthcare infrastructure and increasing investments in healthcare modernization

- Countries such as China, India, and Japan are emerging as key contributors, supported by large patient populations, rising prevalence of lifestyle diseases, and growing demand for improved diagnostic services

- Japan leads in technology adoption, while China and India are seeing rising public and private sector investments to expand diagnostic capabilities, particularly in rural and underserved areas

- Government initiatives promoting early disease detection, coupled with improving access to healthcare services, are accelerating the adoption of venous blood collection devices across the region

Venous Blood Collection Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (US)

- Haematonics (US)

- Terumo BCT (US)

- Fresenius Kabi AG (Germany)

- Grifols, S.A. (Spain)

- Nipro Medical Corporation (Japan)

- Greiner Holding (Austria)

- Quest Diagnostics (US)

- SARSTEDT AG & Co. (Germany)

- Macopharma (France)

- Smiths Medical (US)

- Cardinal Health (US)

- Retractable Technologies (US)

- Liuyang Sanli Medical Technology Development (China)

- F.L. Medical S.R.L (Italy)

- AB Medical (South Korea)

- APTCA SPA (Italy)

- Jiangsu Micsafe Medical Technology CO., LTD. (China)

- Disera Tibbi Malzeme Lojistik Sanayi Ve Ticaret A.Þ (Turkey)

- Ajosha Bio Teknik Pvt. Ltd. (India)

- Preq Systems (India)

- CML Biotech (India)

- Lmb Technologie GmbH (Germany)

- Mitra Industries Private Limited (India)

- Neomedic Limited (UK)

Latest Developments in Global Venous Blood Collection Devices Market

- In August 2020, Greiner Bio-One and Haematologic Technologies announced a strategic collaboration to offer comprehensive end-to-end development and custom manufacturing services for blood collection tubes tailored to the needs of IVD and clinical diagnostic device developers. This collaboration enhances innovation and customization in blood collection tube manufacturing, addressing the growing demand for precision diagnostics. As the market shifts toward more specialized and high-performance diagnostic solutions, such strategic alliances play a crucial role in advancing product quality and accelerating time to market, ultimately supporting the global expansion and technological advancement of venous blood collection devices

- In July 2020, Magnolia Medical introduced the Steripath Gen2 Initial Specimen Diversion Device, featuring an integrated syringe designed to enhance precision in blood sample collection, particularly for patients with compromised vasculature. The launch of the Steripath Gen2 reflects the market’s ongoing shift toward more accurate, patient-centric blood collection solutions. As the demand for diagnostic reliability grows, especially among vulnerable patient populations, technologically advanced devices like this contribute to improved clinical outcomes and reinforce the importance of innovation in driving market growth globally

- In March 2022, Vivasure Medical announced that the first patient had been enrolled in a U.S. early feasibility study evaluating its next-generation PerQseal+ device. PerQseal+ is designed for use in percutaneous transcatheter aortic valve replacement (TAVR) procedures and represents a significant advancement in vascular closure technology. These advancements complement the broader ecosystem of venous access and blood collection, emphasizing safety, ease of use, and improved patient outcomes, factors that are also propelling growth in the venous blood collection devices market

- In February 2022, Roche's Foundation Medicine received regulatory approval for an assay designed to detect circulatory tumor DNA (ctDNA) in plasma. This assay, which has been granted FDA breakthrough designation, is intended for the detection of molecular residual disease (MRD) in cancer patients following curative therapy. The approval of ctDNA assays underscores the growing importance of non-invasive blood-based diagnostic technologies in personalized medicine. This trend aligns with the increasing demand for advanced blood collection devices, as accurate sample collection and handling are essential for ensuring reliable diagnostic results

- In February 2024, Tasso, Inc. introduced Tasso Care for Prescreening, a comprehensive end-to-end service solution designed to improve the efficiency of prescreening programs. The launch of Tasso Care for Prescreening highlights the growing demand for innovative blood collection solutions in clinical trials. By integrating remote blood collection capabilities, Tasso is contributing to the shift toward more accessible and efficient healthcare services, which increases the need for advanced venous blood collection devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.