Global Ventilation And Air Conditioning Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

3.97 Billion

2024

2032

USD

1.68 Billion

USD

3.97 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 3.97 Billion | |

|

|

|

|

Ventilation and Air Conditioning Market for Indoor Agriculture Market Size

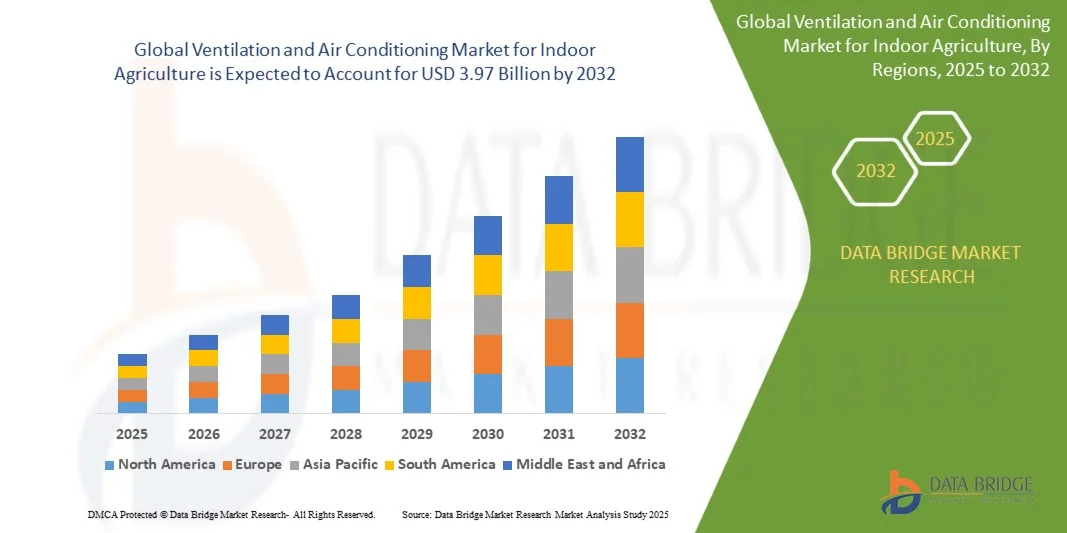

- The Ventilation and Air Conditioning Market for Indoor Agriculture Market size was valued at USD 1.68 billion in 2024 and is projected to reach USD 3.97 billion by 2032, growing at a CAGR of 11.30% during the forecast period

- Market growth is primarily driven by increasing demand for energy-efficient HVAC systems and advancements in smart ventilation technologies, promoting enhanced indoor air quality and comfort across residential and commercial sectors

- Additionally, growing awareness of environmental regulations and the adoption of IoT-enabled HVAC solutions are encouraging the integration of automated controls and predictive maintenance, further accelerating the market expansion globally

Ventilation and Air Conditioning Market for Indoor Agriculture Analysis

- Ventilation and air conditioning systems, essential for maintaining indoor air quality and thermal comfort, are increasingly integrated with smart technologies in both residential and commercial environments due to their energy efficiency, automation capabilities, and improved user control

- The growing demand for advanced HVAC solutions is primarily driven by rising awareness of energy conservation, stricter environmental regulations, and the increasing adoption of IoT-enabled smart ventilation systems for enhanced operational efficiency

- Asia-Pacific dominated the ventilation and air conditioning market for indoor agriculture for indoor agriculture 38.9% in 2024 and is expected to maintain its leading position throughout the forecast period, driven by a growing population and significant investments in the agriculture sector aimed at enhancing food production efficiency

- North America is projected to register the highest CAGR during the forecast period, supported by the presence of major industry players and substantial investments in advanced agricultural technologies and infrastructure

- The new installation segment held the largest market revenue share of 65.3% in 2024, driven by rapid urban development, new construction projects, and infrastructure expansion in emerging economies

Report Scope and Ventilation and Air Conditioning Market for Indoor Agriculture Segmentation

|

Attributes |

Ventilation and Air Conditioning Market for Indoor Agriculture key Market insight |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ventilation and Air Conditioning Market for Indoor Agriculture Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the global Ventilation and Air Conditioning Market is the deepening integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This fusion of technologies is greatly enhancing user convenience, energy efficiency, and control over HVAC systems.

- For instance, smart thermostats like the Google Nest and Ecobee seamlessly integrate with major voice assistants, allowing users to adjust temperature settings, control ventilation, and monitor energy U.S.ge with simple voice commands. Similarly, advanced HVAC controllers compatible with Apple HomeKit offer users centralized climate management through Siri.

- AI integration in ventilation and air conditioning systems enables features such as learning user preferences and occupancy patterns to optimize energy consumption and improve indoor air quality automatically. For example, some systems use AI to predict peak U.S.ge times, adjust airflow, and provide intelligent alerts for maintenance needs or filter replacements. Voice control capabilities offer hands-free operation, allowing users to modify settings remotely with ease.

- The seamless integration of HVAC systems with digital assistants and broader smart home platforms facilitates centralized control over various home functions. Through a single interface, users can manage climate control alongside lighting, security, and other connected devices, creating a unified and automated living or working environment.

- This trend towards more intelligent, intuitive, and interconnected ventilation and air conditioning solutions is reshaping user expectations for comfort, convenience, and energy management. Consequently, companies such as Daikin and Honeywell are developing AI-enabled HVAC systems with features like predictive maintenance, adaptive learning, and voice control compatibility with Google Assistant and Amazon Alexa.

- The demand for smart ventilation and air conditioning systems offering seamless AI and voice control integration is rapidly growing across both residential and commercial sectors, as consumers increasingly prioritize convenience, energy savings, and comprehensive smart home functionality.

Ventilation and Air Conditioning Market for Indoor Agriculture Dynamics

Driver

Growing Need Due to Rising Energy Efficiency Concerns and Smart Building Adoption

- The increasing focus on energy efficiency and environmental sustainability, combined with the rapid adoption of smart building ecosystems, is a significant driver for the growing demand for advanced ventilation and air conditioning systems.

- For instance, in 2024, Daikin announced new IoT-enabled HVAC solutions designed to optimize energy consumption through real-time data analytics and predictive maintenance. Such innovations by key players are expected to accelerate market growth during the forecast period.

- As consumers and businesses become more aware of rising energy costs and environmental impacts, smart HVAC systems offer advanced features such as remote monitoring, adaptive climate control, and U.S.ge analytics, providing a compelling upgrade over conventional systems.

- Furthermore, the growing popularity of smart building devices and the desire for integrated, automated environments are making smart ventilation and air conditioning systems essential components of modern infrastructure, seamlessly connecting with lighting, security, and energy management platforms.

- The convenience of remote control, energy U.S.ge optimization, and predictive maintenance through smartphone applications are key factors driving adoption across residential, commercial, and industrial sectors. The trend towards DIY smart building solutions and the increasing availability of user-friendly HVAC smart devices also contribute to market expansion.

Restraint/Challenge

Concerns Regarding Cybersecurity Risks and High Initial Investment

- Concerns about cybersecurity vulnerabilities in connected HVAC systems pose a significant challenge to broader market adoption. As these systems rely on network connectivity and software, they are vulnerable to hacking attempts and data breaches, raising concerns about safety and privacy among potential users.

- For instance, reports highlighting security weaknesses in IoT-enabled building systems have caused some stakeholders to hesitate in fully embracing smart HVAC technologies.

- Addressing these cybersecurity risks through robust encryption, secure authentication, and regular software updates is critical to building user confidence. Companies such as Honeywell and Johnson Controls emphasize their advanced security protocols in marketing efforts to reassure customers. Additionally, the relatively high initial cost of smart ventilation and air conditioning systems compared to traditional units can be a barrier, particularly for price-sensitive buyers in developing markets or small businesses. While entry-level smart HVAC options are becoming more affordable, premium features like AI-driven optimization and integrated air quality sensors often carry a higher price tag.

- Despite gradual price reductions, the perceived premium for smart technology may still limit widespread adoption, especially among users who do not immediately recognize the long-term benefits of advanced features.

- Overcoming these challenges through enhanced cybersecurity measures, consumer education on energy savings and system benefits, and development of more cost-effective smart HVAC solutions will be crucial for sustained market growth.

Ventilation and Air Conditioning Market for Indoor Agriculture Scope

The ventilation and air conditioning market for indoor agriculture is segmented on the basis of product and type

- By Product

On the basis of product, the Global Ventilation and Air Conditioning Market is segmented into ventilation equipment and air conditioning equipment. The air conditioning equipment segment dominated the market with the largest revenue share of 58.7% in 2024, driven by increasing demand for climate control solutions across residential, commercial, and industrial sectors. Factors such as rising temperatures, urbanization, and growing awareness of indoor air quality have accelerated the adoption of air conditioning systems globally. Advanced features like inverter technology, energy efficiency, and smart controls further contribute to the segment’s dominance.

The ventilation equipment segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by heightened awareness regarding indoor air quality and the need for energy-efficient airflow solutions in commercial buildings and healthcare facilities. Growing emphasis on sustainable building designs and regulatory mandates for proper ventilation also bolster demand in this segment, driving innovation in mechanical and natural ventilation technologies.

- By Type

On the basis of type, the Global Ventilation and Air Conditioning Market is segmented into new installation and retrofit. The new installation segment held the largest market revenue share of 65.3% in 2024, driven by rapid urban development, new construction projects, and infrastructure expansion in emerging economies. This segment benefits from growing investments in residential complexes, commercial offices, and industrial facilities where demand for modern, energy-efficient HVAC systems is highest. New installations often integrate smart, IoT-enabled technologies, offering long-term energy savings and operational efficiency.

The retrofit segment is anticipated to experience the fastest CAGR of 21.4% during the forecast period, supported by the increasing need to upgrade aging ventilation and air conditioning systems in existing buildings. Rising environmental regulations and the drive to reduce operational costs motivate building owners to replace or enhance current HVAC setups with energy-efficient, smart solutions. Retrofit projects are especially prominent in developed regions where infrastructure modernization is prioritized.

Ventilation and Air Conditioning Market for Indoor Agriculture Regional Analysis

- Asia-Pacific dominated the ventilation and air conditioning market for indoor agriculture 38.9% in 2024 and is expected to maintain its leading position throughout the forecast period, driven by a growing population and significant investments in the agriculture sector aimed at enhancing food production efficiency.

- Consumers and businesses in the region prioritize advanced climate control solutions that offer improved indoor air quality, enhanced energy savings, and seamless integration with smart home and building automation platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit.

- This widespread adoption is further supported by high disposable incomes, a strong focus on sustainability, and the presence of major HVAC manufacturers and technology innovators. Additionally, growing regulatory emphasis on energy efficiency and environmental standards encourages the deployment of cutting-edge ventilation and air conditioning systems, establishing North America as a key growth market globally.

Japan Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The Japan ventilation and air conditioning market for indoor agriculture is gaining traction due to its high rate of smart technology adoption, aging population, and focus on indoor environmental quality. Japan’s advanced construction standards and energy policies favor the use of automated, high-performance HVAC systems in both residential and commercial buildings. Integration with IoT devices, such as air quality sensors and smart thermostats, is accelerating the adoption of intelligent ventilation and air conditioning solutions. The growing demand for user-friendly systems—especially for elder care facilities and smart apartments—further supports market expansion, with key players introducing compact, efficient systems tailored for the Japanese market.

China Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The China ventilation and air conditioning market for indoor agriculture accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by a surge in urbanization, industrial expansion, and the development of smart city projects. The growing middle class, rising homeownership rates, and increasing investments in commercial infrastructure are driving demand for modern HVAC solutions. Local manufacturers are rapidly innovating, offering cost-effective and smart HVAC systems tailored to the domestic market. Government mandates on energy efficiency and green building standards further stimulate market growth, while consumer interest in air purification and intelligent climate control strengthens adoption in residential and high-rise developments.

North America Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The North America ventilation and air conditioning market for indoor agriculture is projected to maintain its market leadership. Market growth is fueled by increasing demand for energy-efficient and smart HVAC systems, supported by government incentives promoting sustainable and green buildings. The rapid integration of IoT-enabled ventilation and air conditioning units and the rising trend of smart home and indoor farming solutions are boosting adoption across the region.

U.S. Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The U.S. ventilation and air conditioning market for indoor agriculture captured the largest revenue share of 81% in 2024 within North America, driven by strong consumer demand for energy-efficient, smart HVAC systems and robust government initiatives promoting green buildings. The widespread adoption of IoT-enabled air conditioning and ventilation units, combined with the rising trend of smart home integration, is significantly boosting the market. Additionally, the presence of major manufacturers, a technologically advanced population, and growing awareness of indoor air quality are driving innovations in HVAC technology. Features such as voice control compatibility, mobile app management, and predictive maintenance tools are making HVAC systems more attractive for both residential and commercial applications.

Europe Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The Europe ventilation and air conditioning market for indoor agriculture is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent environmental regulations, rising energy efficiency standards, and increased awareness of sustainable living. As countries across Europe push toward achieving carbon neutrality goals, the demand for smart and eco-friendly HVAC systems is rising. Consumers are drawn to ventilation and air conditioning solutions that reduce energy consumption while offering automation and remote access. The market is seeing notable growth in both new buildings and retrofitting projects, particularly in Germany, France, and the Nordics, where sustainable construction practices are heavily emphasized.

U.K. Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The U.K. ventilation and air conditioning market for indoor agriculture is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rapid urbanization, home automation trends, and the adoption of energy-efficient systems. Rising concerns over indoor air quality and energy costs are leading both households and businesses to invest in advanced ventilation and air conditioning technologies. Government initiatives to reduce carbon footprints and promote smart infrastructure further support this growth. Additionally, the integration of HVAC systems with voice-controlled assistants and building management systems (BMS) is gaining traction, enhancing user control and comfort in residential and commercial properties alike.

Germany Ventilation and Air Conditioning Market for Indoor Agriculture Insight

The Germany ventilation and air conditioning market for indoor agriculture is expected to expand at a considerable CAGR during the forecast period, supported by the country’s leadership in engineering, innovation, and environmental policy. With a strong focus on sustainable construction and energy efficiency, there is growing demand for advanced HVAC systems equipped with AI, IoT, and predictive analytics. Germany’s well-developed commercial infrastructure and ongoing smart city initiatives promote the integration of intelligent climate control systems. Furthermore, retrofit projects aimed at upgrading older buildings to meet new efficiency standards are creating new growth opportunities for the ventilation and air conditioning market in both public and private sectors.

Ventilation and Air Conditioning Market for Indoor Agriculture Share

The ventilation and air conditioning market for indoor agriculture is primarily led by well-established companies, including:

- 3M (U.S.)

- Emerson Electric Co. (U.S.)

- Testo SE & Co. KGaA (Germany)

- Siemens (Germany)

- Honeywell International Inc. (U.S.)

- Thermo Fisher Scientific (U.S.)

- TSI (U.S.)

- Aeroqual (New Zealand)

- Biovac System Inc. (U.S.)

- Kanomax U.S., Inc. (U.S.)

- FORBIX SEMICON India Pvt Ltd (India)

- Ventilation Control Products Sweden AB (Sweden)

- Dylos Corporation (U.S.)

- Veris Industries (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Servomex (UK)

- HORIBA Ltd (Japan)

- Tisch Environmental, Inc. (U.S.)

- Rave Innovations (U.S.)

- Merck & CO., Inc. (U.S.)

What are the Recent Developments in Global Ventilation and Air Conditioning Market?

- In April 2023, Daikin Industries, Ltd., a global leader in HVAC solutions, launched a new energy-efficient air conditioning line in India under its “Future Ready Homes” initiative. The series integrates AI-driven temperature regulation and IoT-enabled controls designed to adapt to user behavior and local climate conditions. This launch emphasizes Daikin’s strategic focus on delivering region-specific, sustainable comfort solutions while expanding its footprint in one of the fastest-growing HVAC markets globally.

- In March 2023, Carrier Global Corporation introduced the Abound HVAC Performance platform across North America—an advanced, cloud-based analytics system for commercial HVAC operations. Designed to enhance building performance through real-time diagnostics and predictive maintenance, the platform exemplifies Carrier’s commitment to digital transformation in the ventilation and air conditioning space, offering increased efficiency and reliability to enterprise-level clients.

- In March 2023, Johnson Controls announced the completion of its smart HVAC retrofit project for a major hospital network in Germany. Utilizing its OpenBlue platform, the company replaced legacy systems with AI-integrated ventilation and air conditioning solutions to optimize energy consumption and air quality. This project reflects Johnson Controls’ focus on healthcare sector innovation and sustainable infrastructure development through advanced HVAC technologies.

- In February 2023, LG Electronics unveiled its latest Dual Inverter Commercial AC Series at the AHR Expo 2023 in Atlanta, targeting small and medium-sized businesses in urban centers. Equipped with intelligent energy monitoring, motion sensors, and remote diagnostics, the new lineup is designed to offer high performance while reducing operational costs. This launch underscores LG’s strategy to empower commercial spaces with smarter, greener climate control solutions.

- In January 2023, Mitsubishi Electric Corporation introduced its Lossnay RVX Series Energy Recovery Ventilators in Europe, focusing on improved air exchange and indoor air quality for schools and office buildings. The RVX Series features high-efficiency heat exchangers and can be integrated with building management systems for centralized control. This move highlights Mitsubishi’s dedication to supporting healthy indoor environments and energy-saving practices across the European commercial HVAC landscape.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.