Global Vertical Bagging Machine Market

Market Size in USD Billion

CAGR :

%

USD

4.95 Billion

USD

6.88 Billion

2024

2032

USD

4.95 Billion

USD

6.88 Billion

2024

2032

| 2025 –2032 | |

| USD 4.95 Billion | |

| USD 6.88 Billion | |

|

|

|

|

What is the Global Vertical Bagging Machine Market Size and Growth Rate?

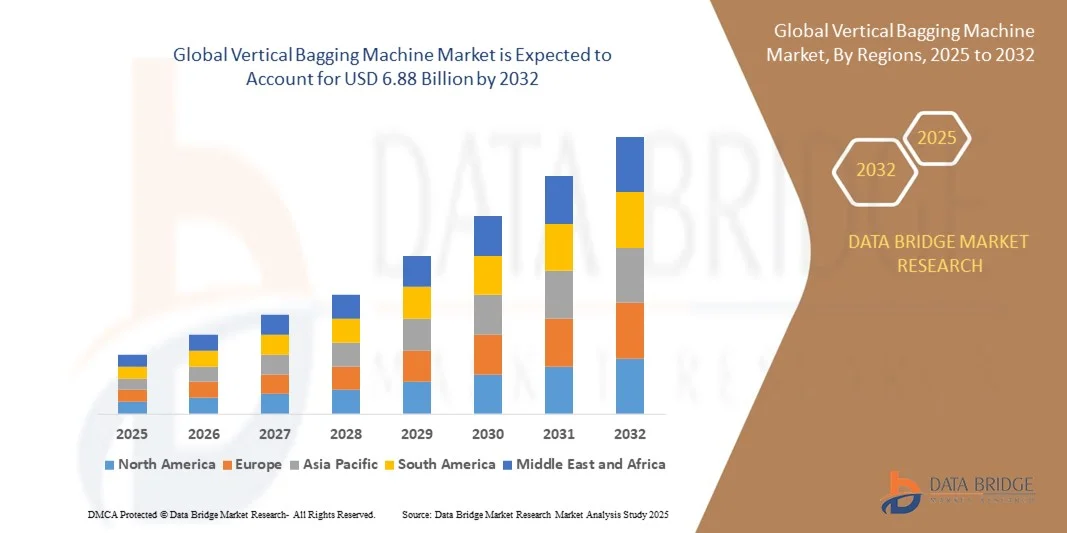

- The global vertical bagging machine market size was valued at USD 4.95 billion in 2024 and is expected to reach USD 6.88 billion by 2032, at a CAGR of 4.2% during the forecast period

- Rising demand for qualitative procedure for filling parental preparation is driving the growth in the market value. Growing demand from the food and beverages industry and growth and expansion of the pharmaceuticals industry especially in the developing economies will further induce growth in the market value

- Rising proliferation of e-commerce industry especially in the developing economies, growing demand for inventive packaging solutions are some other market growth determinants

What are the Major Takeaways of Vertical Bagging Machine Market?

- Increasing modernization, increased focus on the product customization by the major manufacturers, surging consumption of single unit dose drug products and increasing personal disposable income are some other indirect factors that will also promote the market growth rate

- North America dominated the vertical bagging machine market with the largest revenue share of 37.19% in 2024, driven by rising demand for automated packaging solutions and the growth of the food & beverage sector

- The Asia-Pacific market is projected to grow at the fastest CAGR of 9.98% from 2025 to 2032, driven by urbanization, rising disposable incomes, and booming food & beverage consumption in countries such as China, India, and Japan

- The automatic bagging machine segment dominated the market with the largest market revenue share of 55.6% in 2024, driven by its high operational efficiency, reduced labor dependency, and ability to handle large-scale packaging demands across industries such as food, beverages, and pharmaceuticals

Report Scope and Vertical Bagging Machine Market Segmentation

|

Attributes |

Vertical Bagging Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Vertical Bagging Machine Market?

Automation and Smart Packaging Integration

- A major and accelerating trend in the global vertical bagging machine market is the integration of automation technologies and smart packaging solutions, which are enhancing production efficiency and packaging flexibility. The adoption of Industry 4.0 practices is driving smarter operations and real-time data monitoring

- For instance, companies are increasingly deploying vertical bagging machines equipped with IoT sensors to enable predictive maintenance and reduce downtime in high-volume production environments. Similarly, advanced machines now feature touchless control panels and user-friendly interfaces, enhancing operator convenience and safety

- AI integration in Vertical Bagging Machines allows improved detection of packaging defects, automatic adjustment of machine parameters, and optimized energy usage. For instance, Bosch Packaging Technology has introduced automated models that self-adjust for different packaging sizes and materials, reducing human error

- The growing emphasis on sustainability has also led to machines capable of handling eco-friendly packaging films, including biodegradable and recyclable materials, without compromising on sealing quality

- This trend of combining automation, AI, and sustainability is reshaping customer expectations, with companies such as Rovema and Ishida innovating new models to meet demand for speed, precision, and eco-compliance

- As manufacturers prioritize efficiency, reduced waste, and smarter operations, the demand for intelligent Vertical Bagging Machines is expanding rapidly across food, pharmaceutical, and consumer goods industries

What are the Key Drivers of Vertical Bagging Machine Market?

- The rising demand for packaged food and beverages, coupled with the rapid growth of e-commerce, is a major driver fueling the adoption of vertical bagging machines across industries

- For instance, in February 2024, Rovema GmbH announced advancements in vertical form-fill-seal (VFFS) systems to cater to the increasing demand for sustainable and flexible packaging solutions. Such product innovations by leading players are expected to accelerate market growth during the forecast period

- Vertical Bagging Machines offer operational benefits such as reduced packaging time, minimized labor dependency, and enhanced sealing accuracy, making them highly attractive to manufacturers

- The versatility of these machines to handle a wide range of packaging formats, from pouches to sachets, supports their adoption across food, pharmaceuticals, chemicals, and consumer goods industries

- Furthermore, the rising preference for sustainable packaging films and the need to comply with strict food safety regulations are boosting the demand for advanced Vertical Bagging Machines

- The growing inclination toward automation, smart factories, and cost-efficiency in production lines continues to strengthen market adoption globally

Which Factor is Challenging the Growth of the Vertical Bagging Machine Market?

- High initial investment and maintenance costs of advanced vertical bagging machines present a significant barrier to adoption, particularly for small- and medium-sized enterprises (SMEs)

- For instance, packaging companies in emerging economies often struggle to justify the upfront expenses of automated systems compared to manual or semi-automatic alternatives. This creates a gap in adoption between large-scale manufacturers and SMEs

- The complexity of integrating Vertical Bagging Machines with existing production lines also poses challenges, requiring skilled operators and additional training costs

- In addition, fluctuations in raw material costs and the availability of low-cost alternatives in developing regions hinder widespread adoption

- While manufacturers are introducing cost-efficient models, the perception of Vertical Bagging Machines as premium technology can limit market penetration, especially in price-sensitive sectors

- Overcoming these hurdles through flexible financing options, simplified integration technologies, and ongoing technical support will be crucial for achieving sustained growth in the Vertical Bagging Machine market

How is the Vertical Bagging Machine Market Segmented?

The market is segmented on the basis of product, forming, and end user.

- By Product

On the basis of product, the vertical bagging machine market is segmented into automatic bagging machines, semi-automatic bagging machines, and manual bagging machines. The automatic bagging machine segment dominated the market with the largest market revenue share of 55.6% in 2024, driven by its high operational efficiency, reduced labor dependency, and ability to handle large-scale packaging demands across industries such as food, beverages, and pharmaceuticals. Automatic systems are particularly valued for their consistency, precision, and integration with advanced control technologies, enabling faster production cycles.

The semi-automatic bagging machine segment is expected to witness the fastest growth rate of 20.3% from 2025 to 2032, owing to their affordability and flexibility for small and medium-sized enterprises. These machines strike a balance between automation and manual operation, making them attractive for businesses with moderate production volumes. The rising adoption of semi-automated solutions in developing economies further contributes to this segment’s expansion.

- By Forming

On the basis of forming, the vertical bagging machine market is segmented into intermittent motion bagging machines and continuous motion bagging machines. The continuous motion bagging machine segment accounted for the largest market revenue share of 60.4% in 2024, as these systems deliver high-speed performance, reduced downtime, and greater throughput, making them ideal for industries with large-scale, continuous production needs such as packaged foods and household goods. Their ability to handle diverse packaging formats and materials further strengthens their market position.

The intermittent motion bagging machine segment is projected to grow at the fastest CAGR of 18.9% from 2025 to 2032, driven by its suitability for small-batch and specialty packaging applications. These machines are often preferred for packaging sensitive or premium products where precision and quality outweigh speed. The versatility and cost-effectiveness of intermittent systems make them appealing to emerging businesses in pharmaceuticals and niche product categories.

- By End User

On the basis of end user, the vertical bagging machine market is segmented into food & beverages, personal care & cosmetics, pharmaceuticals, chemicals, and others. The food & beverages segment dominated the market with the largest market revenue share of 47.8% in 2024, fueled by the rising consumption of packaged foods, growing demand for convenience products, and stricter safety and hygiene standards. Vertical bagging machines are widely deployed for packaging snacks, coffee, frozen foods, and ready-to-eat products, ensuring product freshness and extended shelf life.

The pharmaceuticals segment is anticipated to record the fastest growth at a CAGR of 21.1% from 2025 to 2032, as increasing regulatory requirements and the need for precision-driven, contamination-free packaging drive adoption. Vertical bagging machines in this sector are leveraged for securely packaging tablets, powders, and medical devices. Rising healthcare spending and global expansion of pharmaceutical manufacturing further accelerate demand for these systems.

Which Region Holds the Largest Share of the Vertical Bagging Machine Market?

- North America dominated the vertical bagging machine market with the largest revenue share of 37.19% in 2024, driven by rising demand for automated packaging solutions and the growth of the food & beverage sector

- Manufacturers in the region emphasize efficiency, hygiene, and flexibility, making vertical bagging machines a preferred choice in industries ranging from food processing to pharmaceuticals

- Strong technological adoption, robust industrial automation, and increasing investments in modern packaging infrastructure strengthen North America’s leadership position in this market

U.S. Vertical Bagging Machine Market Insight

The U.S. market captured the largest revenue share of 81% in 2024 within North America, supported by growing automation across food manufacturing, e-commerce packaging, and consumer goods. The rising preference for cost-effective, flexible packaging formats, such as pouches and bags, is driving machine adoption. In addition, demand for energy-efficient and smart packaging equipment is fueling growth, with major producers focusing on innovation, integration of IoT-enabled systems, and sustainability features to stay competitive.

Europe Vertical Bagging Machine Market Insight

The Europe market is projected to grow at a substantial CAGR throughout the forecast period, driven by strict packaging and sustainability regulations. Increasing consumer demand for eco-friendly packaging and the region’s strong food & beverage exports foster widespread adoption of automated bagging systems. Furthermore, the push towards smart factories and digital packaging solutions enhances efficiency across both new installations and modernization of existing lines.

U.K. Vertical Bagging Machine Market Insight

The U.K. market is expected to expand at a notable CAGR, supported by the country’s emphasis on automation, food safety, and sustainability in packaging. Rising e-commerce penetration and demand for ready-to-eat packaged foods further accelerate the adoption of vertical bagging machines. In addition, manufacturers are investing in compact, versatile equipment that aligns with the U.K.’s growing preference for flexible, recyclable materials.

Germany Vertical Bagging Machine Market Insight

The Germany market is forecasted to grow considerably, underpinned by its advanced engineering expertise and industrial automation standards. Increasing demand for precision, sustainability, and digital integration in packaging solutions drives machine installations in both food and non-food industries. German companies also lead in adopting Industry 4.0-enabled bagging systems, ensuring high efficiency and eco-conscious operations across production lines.

Which Region is the Fastest Growing in the Vertical Bagging Machine Market?

The Asia-Pacific market is projected to grow at the fastest CAGR of 9.98% from 2025 to 2032, driven by urbanization, rising disposable incomes, and booming food & beverage consumption in countries such as China, India, and Japan. Government-backed digitalization initiatives and the region’s role as a manufacturing hub for packaging machinery significantly enhance affordability and accessibility, expanding adoption across small and large-scale industries.

Japan Vertical Bagging Machine Market Insight

The Japan market benefits from its tech-savvy culture and premium packaging demand, with strong adoption in convenience foods and pharmaceutical packaging. Integration with IoT and robotics, alongside the country’s aging population seeking user-friendly packaging systems, accelerates market growth.

China Vertical Bagging Machine Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by its large consumer base, strong domestic manufacturing, and rapid industrial automation. The push towards smart cities, affordable machine options, and high demand for flexible packaging positions China as a central hub for vertical bagging machine adoption in both domestic and global markets.

Which are the Top Companies in Vertical Bagging Machine Market?

The vertical bagging machine industry is primarily led by well-established companies, including:

- Rennco, LLC (U.S.)

- Ohlson Packaging (U.S.)

- Ferplast (Italy)

- Technik Packaging Machinery (U.S.)

- Tecnimodern (Canada)

- RMH Systems (U.S.)

- Rovema North America, Inc. (U.S.)

- Minipack - Torre Spa (Italy)

- Packmate (Zhongshan) Co., Ltd. (China)

- Foshan Dession Packaging Machinery Co., Ltd. (China)

- Foshan Soonk Packaging Machine Co., Ltd. (China)

What are the Recent Developments in Global Vertical Bagging Machine Market?

- In March 2025, ULMA Packaging introduced its latest TFX series of transforming machines designed for the food packaging sector, focusing on addressing industry challenges while improving production efficiency, digitalization, and sustainability. This initiative also supports environmental goals by reducing the carbon footprint. This launch positions ULMA Packaging as a forward-looking player committed to innovation and eco-friendly solutions

- In October 2024, Bosch Packaging Technology advanced its portfolio by unveiling fully automated, high-speed bagging systems aimed at boosting efficiency in both food and pharmaceutical packaging markets. This innovation further strengthens Bosch’s standing as a global leader in automation and packaging technologies

- In July 2024, Cama Group, a leading robotics and automation manufacturer, rolled out a new top-loading packaging machine designed to increase production rates and minimize machinery footprint. The development focuses on solving the complexities of multi-packaging in the food industry. This move enhances Cama Group’s reputation as a solution-driven innovator in the packaging space

- In June 2024, All Fill Inc. expanded its market presence in the packaging and bagging machinery sector by inaugurating a state-of-the-art facility aimed at scaling production capacity and improving customer service. This strategic expansion highlights All Fill Inc.’s commitment to meeting rising client demands with advanced infrastructure

- In March 2024, Statec Binder announced its partnership with key players in the food sector, with the goal of enhancing packaging speed and lowering production costs in food manufacturing lines. This collaboration underscores Statec Binder’s focus on efficiency and customer-centric solutions in the packaging industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vertical Bagging Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vertical Bagging Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vertical Bagging Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.