Global Vertical Turbine Pump Market

Market Size in USD Billion

CAGR :

%

USD

20.18 Billion

USD

28.79 Billion

2024

2032

USD

20.18 Billion

USD

28.79 Billion

2024

2032

| 2025 –2032 | |

| USD 20.18 Billion | |

| USD 28.79 Billion | |

|

|

|

|

Vertical Turbine Pump Market Size

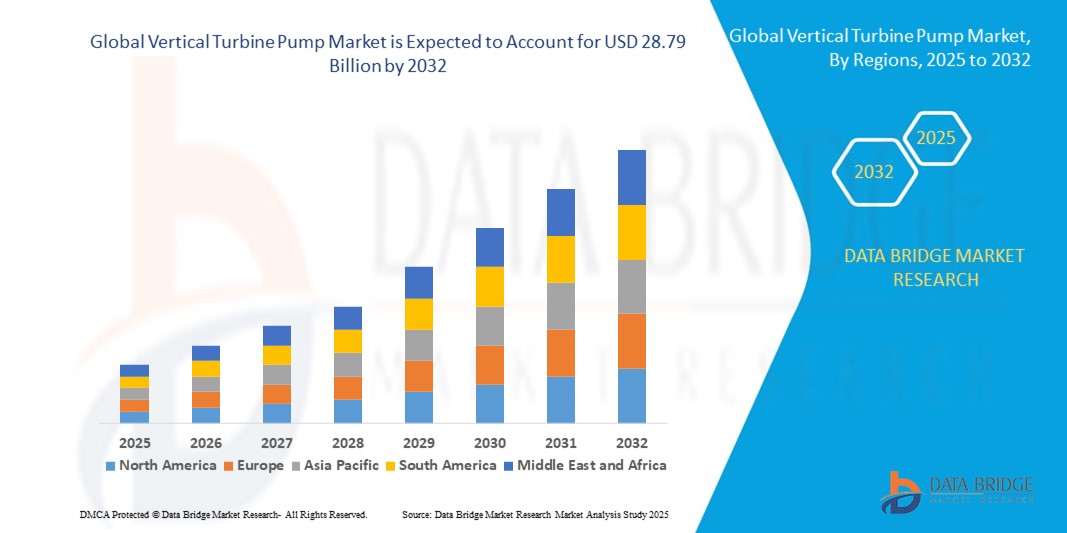

- The global vertical turbine pump market size was valued at USD 20.18 billion in 2024 and is expected to reach USD 28.79 billion by 2032, at a CAGR of 4.54% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient pumping solutions across industrial, municipal, and agricultural sectors

- Rising investments in water infrastructure projects, industrial expansion, and the need for reliable fluid handling systems are further driving market adoption

Vertical Turbine Pump Market Analysis

- The market is experiencing a shift toward energy-efficient, low-maintenance pumps suitable for high-volume applications in water treatment, power generation, and irrigation

- Growing emphasis on infrastructure modernization and urban development is boosting demand for vertical turbine pumps globally

- North America dominated the vertical turbine pump market with the largest revenue share of 38.5% in 2024, driven by expanding municipal, industrial, and agricultural infrastructure projects, coupled with increasing investment in water management and irrigation systems

- Asia-Pacific region is expected to witness the highest growth rate in the global vertical turbine pump market, driven by increasing infrastructure development, rising industrialization, and large-scale municipal and agricultural water projects. Rapid economic growth, technological adoption, and government investments in water management systems are key factors propelling market expansion

- The 500–2000 m segment held the largest market revenue share in 2024, driven by its widespread use in municipal water supply, irrigation projects, and industrial applications requiring medium to high lift capabilities. Pumps in this range provide optimal efficiency and reliability for large-scale water transfer and are preferred for both urban and agricultural infrastructure projects

Report Scope and Vertical Turbine Pump Market Segmentation

|

Attributes |

Vertical Turbine Pump Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand For Energy-Efficient Pumping Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Vertical Turbine Pump Market Trends

Growing Adoption of Energy-Efficient and High-Capacity Pumping Solutions

• The increasing demand for energy-efficient vertical turbine pumps is reshaping the pumping industry by providing high-performance solutions for municipal, industrial, and agricultural water management. The adoption of advanced pump designs allows for reduced energy consumption, improved reliability, and lower operational costs

• Rising infrastructure development in urban and rural areas is driving the need for high-capacity vertical turbine pumps capable of handling large volumes of water efficiently. These pumps are increasingly integrated into water treatment plants, irrigation systems, and industrial applications to ensure consistent and reliable fluid transfer

• The ease of maintenance, durability, and adaptability of modern vertical turbine pumps make them attractive for long-term operations, reducing downtime and lifecycle costs. Manufacturers are focusing on modular designs and smart monitoring systems to enhance operational efficiency and predictive maintenance

• For instance, in 2023, several municipal water authorities in Europe upgraded their pumping systems with high-efficiency vertical turbine pumps, resulting in a significant reduction in energy usage and improved water distribution performance

• While demand is increasing, successful adoption depends on continual innovation, skilled workforce availability, and integration of digital monitoring solutions to optimize pump performance across various applications

Vertical Turbine Pump Market Dynamics

Driver

Infrastructure Expansion and Rising Water Management Needs

• The rapid expansion of municipal, industrial, and agricultural infrastructure is driving the demand for vertical turbine pumps that can handle high-capacity water transfer and distribution. These pumps play a critical role in ensuring efficient water supply and management across urban and rural regions. Growing urbanization, population expansion, and industrialization are further intensifying the need for reliable pumping solutions that can meet rising water demands consistently

• Increasing emphasis on energy-efficient and eco-friendly pumping solutions is encouraging governments and private enterprises to adopt modern vertical turbine pumps with higher hydraulic efficiency and lower energy consumption. Initiatives promoting sustainable water usage and green building standards are also accelerating the adoption of energy-saving pumps. Manufacturers are responding with innovative designs that reduce operational costs while meeting regulatory and environmental requirements

• Investment in large-scale irrigation projects, industrial water treatment facilities, and municipal waterworks is fueling growth, particularly in emerging markets where infrastructure development is accelerating. Public-private partnerships and government funding for water resource management projects are creating new opportunities for high-capacity vertical turbine pumps. The increasing complexity of water networks and need for continuous operation is driving demand for advanced, robust pump systems

• For instance, in 2022, a number of Middle Eastern and Asian countries implemented large-scale irrigation and desalination projects, boosting demand for vertical turbine pumps with advanced efficiency features. Such projects have also emphasized reliability, automation, and remote monitoring capabilities to ensure uninterrupted water supply. This trend is expected to continue as more regions invest in sustainable water infrastructure

• While infrastructure development is a strong driver, the market also relies on continuous innovation, local manufacturing capabilities, and adherence to regional water management regulations to sustain growth. Strategic partnerships between pump manufacturers, engineering firms, and government agencies are essential to implement modern water systems efficiently. Increasing focus on smart water grids and IoT-enabled monitoring solutions is expected to further expand market demand

Restraint/Challenge

High Capital Costs and Complex Installation Requirements

• Advanced vertical turbine pumps require significant capital investment for acquisition, installation, and commissioning, which can restrict their adoption among small-scale and budget-conscious operations. High initial costs remain a barrier to entry in developing regions, and return on investment can take longer in low-margin projects. This often leads decision-makers to prefer simpler, lower-cost pumping solutions despite lower efficiency

• The installation and maintenance of vertical turbine pumps often require specialized expertise and skilled personnel, limiting their widespread deployment in areas lacking technical infrastructure. Inadequate training, limited local service support, and complex commissioning procedures can result in operational delays and higher maintenance expenses. Manufacturers are increasingly offering training programs and service packages to overcome these barriers

• Supply chain challenges for critical components, especially in remote or underdeveloped regions, can delay project timelines and increase costs. Long lead times for materials such as impellers, shafts, and motors may disrupt project schedules. Logistics challenges, import restrictions, and regional geopolitical issues further exacerbate delays, particularly for large-scale industrial projects

• For instance, in 2023, several industrial projects in Sub-Saharan Africa experienced delays in pump installation due to difficulties in sourcing critical components and skilled labor. These delays led to project overruns, higher operational costs, and occasional reliance on temporary or less efficient pumping solutions. The situation highlighted the importance of local partnerships and regional manufacturing support

• To overcome these challenges, manufacturers and project developers must focus on modular designs, cost optimization, training programs, and decentralized supply solutions to improve accessibility and support broader market adoption. Incorporating predictive maintenance, automation, and remote monitoring capabilities can also reduce operational risks, increase reliability, and provide long-term value to end users. Strategic investments in local assembly and component production will further mitigate supply chain constraints

Vertical Turbine Pump Market Scope

The market is segmented on the basis of head, material type, stages, power rating, and end-use.

- By Head

On the basis of head, the vertical turbine pump market is segmented into up to 500 m, 500–2000 m, and 2000 m & above. The 500–2000 m segment held the largest market revenue share in 2024, driven by its widespread use in municipal water supply, irrigation projects, and industrial applications requiring medium to high lift capabilities. Pumps in this range provide optimal efficiency and reliability for large-scale water transfer and are preferred for both urban and agricultural infrastructure projects.

The 2000 m & above segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand for high-capacity water pumping in large industrial, hydroelectric, and desalination projects. These pumps are particularly valued for their high efficiency, robustness, and ability to handle demanding operational conditions.

- By Material Type

On the basis of material type, the vertical turbine pump market is segmented into ductile iron pump, stainless steel pump, bronze, and cast iron. The stainless steel pump segment held the largest market revenue share in 2024, driven by its superior corrosion resistance, durability, and suitability for water, chemical, and industrial applications. Bronze and ductile iron pumps are gaining traction due to their cost-effectiveness and strength, especially in agriculture and municipal sectors.

The cast iron segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by demand for durable and affordable pumping solutions in emerging markets.

- By Stages

On the basis of stages, the vertical turbine pump market is segmented into single-stage and multi-stage. The multi-stage segment held the largest market share in 2024, driven by its ability to achieve higher heads and enhanced performance for large-scale municipal and industrial water distribution projects.

Single-stage pumps is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing demand for simpler, energy-efficient, and low-maintenance pumping solutions in smaller installations and mid-sized infrastructure projects.

- By Power Rating

On the basis of power rating, the vertical turbine pump market is segmented into low power (up to 1500 Hp), medium power (1500 to 4000 Hp), and high power (4000 Hp & above). The medium power segment held the largest market revenue share in 2024, driven by its balance of performance, efficiency, and cost-effectiveness for municipal, industrial, and agricultural applications.

The high-power segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing demand in heavy industries, hydroelectric plants, and large-scale water management projects requiring high-capacity pumping solutions.

- By End-Use

On the basis of end-use, the vertical turbine pump market is segmented into residential, commercial, agriculture, industrial, municipal, and firefighting. The municipal segment held the largest market revenue share in 2024, owing to the expansion of urban water infrastructure, irrigation networks, and water treatment facilities.

The industrial and agriculture segments is expected to witness the fastest growth rate from 2025 to 2032, driven by rising water demand for industrial processes, irrigation projects, and energy generation across emerging and developed markets.

Vertical Turbine Pump Market Regional Analysis

• North America dominated the vertical turbine pump market with the largest revenue share of 38.5% in 2024, driven by expanding municipal, industrial, and agricultural infrastructure projects, coupled with increasing investment in water management and irrigation systems

• The region’s emphasis on energy-efficient and environmentally friendly pumping solutions, along with high adoption of advanced water distribution technologies, is supporting widespread market penetration

• Strong government initiatives, high disposable incomes, and well-developed industrial and municipal water infrastructure are further promoting the adoption of vertical turbine pumps across North America

U.S. Vertical Turbine Pump Market Insight

The U.S. vertical turbine pump market captured the largest revenue share in North America in 2024, fueled by large-scale irrigation projects, municipal waterworks expansion, and industrial water transfer needs. Growing emphasis on energy-efficient pumping solutions, modernization of water treatment plants, and adoption of advanced pump monitoring technologies are driving market growth. The integration of pumps with automation and remote monitoring systems is further enhancing operational efficiency and encouraging investments in new installations.

Europe Vertical Turbine Pump Market Insight

The Europe vertical turbine pump market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, modernization of municipal water infrastructure, and strict regulatory standards for water management efficiency. The region is witnessing growth in applications such as industrial water transfer, flood control, and irrigation. European end-users are favoring pumps with higher energy efficiency, durability, and low maintenance requirements, which contributes to sustained market growth.

U.K. Vertical Turbine Pump Market Insight

The U.K. vertical turbine pump market is expected to witness the fastest growth rate from 2025 to 2032propelled by water infrastructure upgrades and increasing industrial water demands. Government-led projects to improve water distribution networks and address water scarcity concerns are encouraging adoption. The emphasis on reliable, low-maintenance pumps that reduce operational costs is driving both commercial and municipal usage in the country.

Germany Vertical Turbine Pump Market Insight

The Germany vertical turbine pump market is expected to witness the fastest growth rate from 2025 to 2032, supported by industrialization, infrastructure modernization, and demand for eco-efficient water pumping systems. Germany’s focus on sustainability, innovation in pump design, and integration with smart water management systems are key factors boosting market adoption. Industrial and municipal sectors are increasingly prioritizing high-capacity, energy-efficient vertical turbine pumps to meet growing water transfer needs.

Asia-Pacific Vertical Turbine Pump Market Insight

The Asia-Pacific vertical turbine pump market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing agricultural irrigation projects, and industrial water requirements in countries such as China, India, and Japan. Government initiatives for water infrastructure development, rising investments in hydroelectric and desalination projects, and the region’s growing manufacturing capabilities are fueling demand. Increasing affordability and local production of advanced pump systems are expanding accessibility across emerging markets.

Japan Vertical Turbine Pump Market Insight

The Japan vertical turbine pump market is expected to witness the fastest growth rate from 2025 to 2032, urban water management projects, and the need for efficient irrigation solutions. High technological adoption, combined with government initiatives to modernize municipal water systems, is accelerating market expansion. Vertical turbine pumps integrated with energy-saving technologies and automation features are particularly favored in residential, commercial, and industrial sectors.

China Vertical Turbine Pump Market Insight

The China vertical turbine pump market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising industrial water demand, and large-scale agricultural irrigation projects. The push toward water conservation, modernization of municipal waterworks, and adoption of advanced, high-capacity vertical turbine pumps are key factors propelling market growth. Strong domestic manufacturing capabilities and competitive pricing are further enhancing market penetration in both commercial and industrial segments.

Vertical Turbine Pump Market Share

The Vertical Turbine Pump industry is primarily led by well-established companies, including:

- Grundfos Pumps Corporation (Denmark)

- Pentair Aurora Pump (U.S.)

- Simflo Pump (U.S.)

- Process Systems (U.S.)

- Neptuno Pumps Ltda (U.S.)

- Sintech Precision Products Ltd. (India)

- Xylem (U.S.)

- Flowserve (U.S.)

- Ruhrpumpen (Germany)

- Kirloskar Brothers Limited (India)

- ITT INC. (U.S.)

- Gusher Pumps (U.S.)

- Hydroflo Pumps (U.S.)

- Sulzer (Switzerland)

- Wilo Pump (Germany)

- CNP PUMPS INDIA PVT. LTD (India)

- R.I. Pumps Private Limited (India)

- Hydroflo Pumps (U.S.)

- Sulzer (Switzerland)

Latest Developments in Global Vertical Turbine Pump Market

- In January 2024, ITT Inc., headquartered in New York, acquired Svanehøj Group A/S, a Danish manufacturer of specialized liquid and cryogenic pumps for the marine sector. The integration of Svanehøj’s operations into ITT’s industrial process segment strengthened the company’s product portfolio, expanded its market presence in marine pumping solutions, and enhanced its technological capabilities

- In February 2024, Wilo U.K., based in Staffordshire, completed the acquisition of Arfon Rewinds Limited, operating as Arfon Engineering Services. This strategic move enhances Wilo’s service offerings in installation, repair, condition monitoring, and pump maintenance, improving operational efficiency and customer support across the U.K. market

- In April 2024, Sulzer launched advanced pump production lines at its Easley, South Carolina facility in the U.S. The new lines incorporate cutting-edge technologies, boosting production capacity, improving efficiency, and enabling the company to meet rising global demand for high-performance industrial pumps

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vertical Turbine Pump Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vertical Turbine Pump Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vertical Turbine Pump Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.