Global Vertigo Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

2.09 Billion

2024

2032

USD

1.48 Billion

USD

2.09 Billion

2024

2032

| 2025 –2032 | |

| USD 1.48 Billion | |

| USD 2.09 Billion | |

|

|

|

|

Vertigo Treatment Market Size

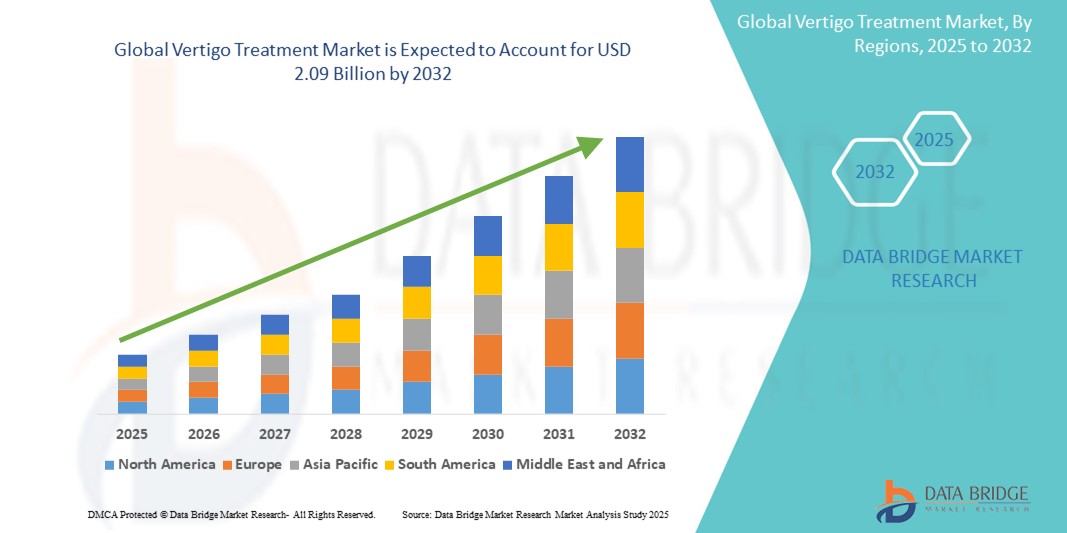

- The Global Vertigo Treatment Market size was valued at USD 1.48 billion in 2024 and is expected to reach USD 2.09 billion by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is primarily driven by the increasing prevalence of vestibular disorders such as benign paroxysmal positional vertigo (BPPV), Ménière’s disease, and vestibular neuritis, coupled with rising awareness and diagnosis rates.

- Additionally, advancements in treatment options—ranging from vestibular suppressants to surgical interventions—and a growing aging population more susceptible to balance-related disorders are contributing significantly to market expansion. These factors are collectively fostering the demand for effective and timely vertigo treatment solutions worldwide.

Vertigo Treatment Market Analysis

- Vertigo treatment includes a range of therapeutic interventions designed to manage dizziness and balance disorders caused by inner ear or central nervous system dysfunctions. These treatments encompass medications, physical therapy, and surgical options, and are gaining traction due to the increasing prevalence of vestibular disorders and the aging global population

- The rising incidence of peripheral vertigo—especially conditions like benign paroxysmal positional vertigo (BPPV), vestibular neuritis, and Ménière’s disease—is a major factor driving demand. Additionally, the increasing awareness among patients and healthcare providers regarding early diagnosis and effective management is further boosting market adoption

- North America leads the global vertigo treatment market with the largest revenue share of approximately 39.8% in 2024, driven by high healthcare spending, strong diagnostic infrastructure, and the availability of advanced treatment options. The U.S., in particular, is witnessing growth due to a higher prevalence of geriatric patients and widespread access to ENT specialists and neurologists

- Asia-Pacific is projected to be the fastest-growing region in the vertigo treatment market during the forecast period, attributed to improving healthcare infrastructure, increasing awareness about vertigo and dizziness disorders, and rising disposable income levels enabling access to better medical care

- The medication segment is expected to dominate the treatment type category, accounting for a market share of over 65% in 2024. This is largely due to the widespread prescription of vestibular suppressants and corticosteroids, which are considered first-line treatments for managing both acute and chronic vertigo conditions

Report Scope and Vertigo Treatment Market Segmentation

|

Attributes |

Vertigo Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vertigo Treatment Market Trends

“Technological Advancements in Diagnosis and Therapy Personalization”

- A significant trend transforming the global vertigo treatment market is the integration of advanced diagnostic technologies and personalized therapeutic approaches. Innovations such as video nystagmography (VNG), vestibular evoked myogenic potentials (VEMP), and 3D balance assessments are enhancing the accuracy of vertigo diagnosis and enabling clinicians to tailor treatment plans more effectively

- For instance, diagnostic platforms like Interacoustics’ VisualEyes system allow ENT specialists to conduct comprehensive vestibular evaluations, offering real-time eye movement analysis that helps pinpoint the exact cause of vertigo symptoms. Similarly, AI-powered diagnostic tools are emerging, which analyze symptom patterns and medical history to suggest personalized medication or rehabilitation regimens

- Moreover, the trend toward digital therapeutics and remote vestibular rehabilitation is expanding access to care. Wearable devices and mobile applications are being developed to guide patients through exercises that retrain the brain’s response to inner ear signals, reducing symptoms over time. Companies such as Wesper and MindMaze are working on neuro-rehabilitation platforms that cater to vestibular disorders

- As healthcare systems emphasize value-based care and patient-centered outcomes, the demand for precision medicine in neurology and otology is increasing. This is encouraging pharmaceutical and medical device firms to develop targeted therapies for underlying vertigo causes, such as autoimmune inner ear diseases and vestibular migraines

- These advancements are not only improving diagnostic and treatment outcomes but are also fostering greater patient compliance and satisfaction, thus accelerating the evolution of vertigo care from generalized symptom management to precision healthcare

Vertigo Treatment Market Dynamics

Driver

“Rising Geriatric Population and Growing Prevalence of Vestibular Disorders”

- The increasing prevalence of age-related vestibular disorders, such as benign paroxysmal positional vertigo (BPPV) and Ménière’s disease, is a major driver of global demand for vertigo treatments. As people age, changes in the inner ear and balance systems make them more susceptible to dizziness and falls

- According to the National Institute on Deafness and Other Communication Disorders, over 35% of adults aged 40 and older in the U.S. alone experience some form of vestibular dysfunction, a statistic that reflects a significant global health burden. This demographic trend is translating into heightened demand for both pharmacological and rehabilitative interventions

- Furthermore, increasing awareness among healthcare providers and patients regarding early diagnosis and treatment of vertigo is accelerating market adoption. Hospitals and specialty clinics are expanding ENT and neurology departments to better cater to the growing number of patients with dizziness and balance-related complaints

- Government-funded healthcare programs and insurance coverage for dizziness-related diagnostic and treatment services are further boosting access in developed markets. Meanwhile, improving healthcare infrastructure in emerging economies is enabling earlier and more accurate diagnosis, widening the patient base for vertigo-related treatments

Restraint/Challenge

“Low Awareness and Misdiagnosis in Developing Regions”

- Despite the rising global burden of vestibular disorders, low awareness and frequent misdiagnosis—especially in low- and middle-income countries—continue to hinder early and effective treatment. Symptoms such as dizziness and imbalance are often overlooked or attributed to non-specific conditions, leading to underdiagnosis and inadequate care

- Many general practitioners lack access to specialized diagnostic tools like videonystagmography (VNG) or rotational chair testing, which are crucial for accurate differentiation between central and peripheral causes of vertigo. As a result, patients often receive ineffective or delayed treatment, worsening their condition and increasing healthcare costs

- Additionally, a shortage of trained vestibular specialists and ENT professionals in rural and underserved areas limits treatment access. Even when diagnosed, treatment adherence can be poor due to lack of follow-up systems or awareness of rehabilitation benefits

- Another major challenge is the limited pipeline of FDA-approved vertigo-specific drugs, as many current medications (e.g., antihistamines, benzodiazepines) are used off-label. The need for targeted, evidence-based therapies remains unmet, making R&D investment in this area crucial for long-term market growth

- Addressing these challenges will require investment in training programs, public awareness campaigns, affordable diagnostic infrastructure, and support for the development of novel therapeutics tailored to specific vertigo subtypes

Vertigo Treatment Market Scope

The market is segmented on the basis of basis of type, treatment type, drugs, route of administration, and end users.

- By Type

On the basis of type, the vertigo treatment market is segmented into Peripheral Vertigo and Central Vertigo. The peripheral vertigo segment held the largest market revenue share of approximately 72.6% in 2024, driven by the high prevalence of conditions such as benign paroxysmal positional vertigo (BPPV), Ménière’s disease, and vestibular neuritis. These disorders account for the vast majority of vertigo cases globally and are generally more straightforward to manage through medication and vestibular rehabilitation. The segment benefits from wide clinical awareness and availability of effective first-line treatments, contributing to its dominant share.

The central vertigo segment is projected to witness the fastest CAGR of 5.8% from 2025 to 2032, owing to advancements in diagnostic imaging and growing clinical recognition of neurologically-induced vertigo causes, such as vestibular migraine, brainstem stroke, and multiple sclerosis. Increased access to specialized neurology services and the development of advanced diagnostic platforms are enhancing the early identification and targeted management of central vertigo, fueling growth in this segment.

• By Treatment Type

On the basis of treatment type, the market is segmented into Medication and Surgery. The medication segment dominates the vertigo treatment market in 2024 with the largest revenue share, as it is the most common first-line therapy across both primary care and specialized settings. Drugs such as antihistamines, benzodiazepines, and vestibular suppressants are widely used for rapid symptom control, especially in acute cases.

The surgery segment is projected to grow at the fastest rate through 2032, fueled by rising awareness and advancements in minimally invasive procedures. Surgeries such as labyrinthectomy, vestibular nerve section, and endolymphatic sac decompression are increasingly performed for drug-resistant or severe vertigo cases. Technological progress in neurotologic surgery and improved post-operative outcomes are contributing to the segment’s expansion.

• By Drugs

On the basis of drugs, the market is segmented into Corticosteroids, Antibiotics, Vestibular Suppressants, and Others. Vestibular suppressants held the largest market revenue share in 2024, as they are commonly prescribed to manage symptoms such as dizziness, nausea, and imbalance across a wide range of vertigo types. These include antihistamines (e.g., meclizine), anticholinergics, and benzodiazepines, which offer immediate symptomatic relief.

The corticosteroids segment is expected to witness the fastest CAGR from 2025 to 2032, particularly due to their application in treating vestibular neuritis and sudden sensorineural hearing loss associated with vertigo. The effectiveness of corticosteroids in reducing inflammation in the vestibular nerve enhances their adoption in specialized ENT and neurology practices.

• By Route of Administration

On the basis of route of administration, the market is segmented into Oral and Injectable. The oral segment dominates the market with the largest revenue share in 2024, driven by the ease of administration, widespread availability, and patient preference for non-invasive treatment options. Most vestibular suppressants and corticosteroids are available in oral form, supporting this segment’s dominance.

The injectable segment is anticipated to grow at the fastest CAGR from 2025 to 2032, especially in hospital settings where intramuscular or intravenous drug administration is used for acute vertigo attacks or when rapid onset of action is needed. This includes corticosteroids and antiemetics administered in emergency care scenarios.

• By End Users

On the basis of end users, the market is segmented into Hospitals, Homecare, Specialty Clinics, and Others. The hospital segment held the largest market revenue share in 2024, due to the concentration of specialized ENT, neurology, and emergency departments equipped to diagnose and manage vertigo effectively. Hospitals are often the first point of care for patients experiencing severe or unexplained dizziness, driving their dominance.

The homecare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing availability of telemedicine consultations, home-based vestibular rehabilitation programs, and mobile health apps. Aging populations and a shift toward outpatient and remote care models are further supporting this growth trend.

Vertigo Treatment Market Regional Analysis

- North America dominates the vertigo treatment market with the largest revenue share of approximately 39.8% in 2024, primarily driven by the high prevalence of vestibular disorders and a well-established healthcare infrastructure that supports early diagnosis and specialized treatment.

- Patients in the region benefit from widespread access to ENT specialists, neurologists, and advanced diagnostic tools such as video nystagmography (VNG) and MRI, allowing for more accurate identification and management of both peripheral and central vertigo.

- The region’s dominance is further supported by a growing aging population, rising healthcare spending, and the increasing availability of treatment options through hospital systems and specialty clinics. Strong insurance coverage and the adoption of digital health solutions also contribute to greater accessibility and adherence to vertigo treatments across the U.S. and Canada.

U.S. Vertigo Treatment Market Insight

The U.S. vertigo treatment market captured the largest revenue share of approximately 82% within North America in 2025, driven by the high prevalence of vestibular disorders and an advanced healthcare infrastructure. The increasing awareness among both patients and healthcare providers about early diagnosis and effective treatment options—particularly for benign paroxysmal positional vertigo (BPPV) and vestibular migraines—is significantly contributing to market growth. The presence of specialized ENT and neurology centers, widespread insurance coverage, and growing adoption of digital diagnostic tools such as video nystagmography (VNG) and MRI also support the market's expansion. Furthermore, a growing elderly population and increased focus on fall prevention initiatives continue to drive demand for vertigo treatments.

Europe Vertigo Treatment Market Insight

The European vertigo treatment market is projected to grow at a substantial CAGR during the forecast period, supported by a rise in neurological and vestibular disorders across the region. Aging demographics in countries like Germany, Italy, and France are leading to an increasing patient population suffering from balance-related issues. Moreover, the adoption of advanced medical technologies, availability of public health reimbursement schemes, and strong ENT care infrastructure are contributing to the rising uptake of both pharmacological and rehabilitative vertigo treatments. Increased clinical research activities across the EU further reinforce the region’s role in expanding treatment options.

U.K. Vertigo Treatment Market Insight

The U.K. vertigo treatment market is anticipated to grow at a notable CAGR, fueled by greater clinical awareness and national focus on elderly care. The National Health Service (NHS) has been proactive in diagnosing vestibular disorders through its otolaryngology and neurology divisions, helping ensure early intervention and sustained treatment. Additionally, public health initiatives aimed at reducing fall-related injuries in older adults are contributing to the increasing demand for vertigo diagnostics and therapies. The market is also benefitting from innovation in vestibular physiotherapy and broader integration of ENT services into primary care.

Germany Vertigo Treatment Market Insight

The German vertigo treatment market is expected to expand at a considerable CAGR during the forecast period, driven by strong investments in healthcare R&D and a rising number of patients seeking specialized care for vestibular dysfunctions. Germany’s advanced hospital network and emphasis on precision diagnostics—such as vestibular evoked myogenic potentials (VEMP) and high-resolution imaging—are helping improve the treatment rate for both peripheral and central vertigo. The availability of specialized training programs for ENT professionals and continued innovation in neuro-rehabilitation technologies are further advancing the standard of vertigo care in the country.

Asia-Pacific Vertigo Treatment Market Insight

The Asia-Pacific vertigo treatment market is poised to grow at the fastest CAGR of over 6.5% in 2025, owing to a large undiagnosed patient population, improving healthcare access, and rising health awareness in countries like China, India, and Japan. The region is witnessing increasing government investments in ENT care infrastructure and awareness campaigns addressing balance disorders and dizziness. As digital health and telemedicine become more prominent, especially in post-pandemic environments, access to vertigo diagnosis and treatment is expected to grow. The affordability of generic medications and increasing participation in clinical trials are also driving momentum.

Japan Vertigo Treatment Market Insight

The Japan vertigo treatment market is gaining traction due to the country’s aging population and high emphasis on fall prevention and elder care. With over 28% of Japan’s population aged 65 and older, balance-related issues are a significant health concern. This demographic reality, coupled with Japan’s highly developed medical device and pharmaceutical industry, is accelerating the adoption of both drug-based and rehabilitative vertigo treatments. Technological advancements in vestibular diagnostics and increased use of wearable monitoring tools are expected to further drive market growth.

China Vertigo Treatment Market Insight

The China vertigo treatment market accounted for the largest revenue share in Asia-Pacific in 2025, fueled by rapid urbanization, an expanding middle class, and the integration of modern healthcare practices across public and private sectors. With a rising number of ENT and neurology specialists, and a national push toward early disease detection, the rate of vertigo diagnosis is improving steadily. Domestic pharmaceutical manufacturers are also investing in the development of vestibular drugs, while increasing healthcare digitalization is enabling broader access to rehabilitation therapies and specialist consultations across both urban and rural regions.

Vertigo Treatment Market Share

The Vertigo Treatment industry is primarily led by well-established companies, including:

- Mylan N.V. (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- Epic Pharma, LLC (U.S.)

- Endo Pharmaceuticals Inc. (U.S.)

- Novartis AG (Switzerland)

- Jubilant Life Sciences Ltd (India)

- Pfizer Inc. (U.S.)

- Vintage Labs (India)

- Teva Pharmaceutical Industries Ltd (Israel)

- Zydus Cadila (India)

- Lupin (India)

- Sagent Pharmaceuticals, Inc. (U.S.)

- Altamira Therapeutics (Switzerland)

- Sensorion (France)

- Casper Pharma (U.S.)

- Indicus Pharma (India)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Eli Lilly and Company (U.S.)

- Sun Pharmaceutical Industries Ltd (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VERTIGO TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VERTIGO TREATMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VERTIGO TREATMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

5.5 PATEINT TREATMENT SUCCESS RATES

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH HEMATOLOGISTS

6.8 INTERVIEWS WITH ONCOLOGISTS

6.9 INTERVIEWS WITH CANCER ORGANIZATIONS

6.1 OTHER KOL SNAPSHOTS

7 PIPELINE ANALYSIS

7.1 CLINICAL TRIALS AND PHASE ANALYSIS

7.2 DRUG THERAPY PIPELINE

7.3 PHASE III CANDIDATES

7.4 PHASE II CANDIDATES

7.5 PHASE I CANDIDATES

7.6 OTHERS (PRE-CLINICAL AND RESEARCH)

8 REGULATORY FRAMEWORK

9 GLOBAL VERTIGO TREATMENT MARKET, BY TYPE

9.1 OVERVIEW

9.2 PERIPHERAL VERTIGO

9.2.1 BENIGN PAROXYSMAL POSITIONAL VERTIGO (BPPV)

9.2.2 VESTIBULAR NEURONITIS

9.2.3 MÉNIÈRE'S DISEASE

9.2.4 ACOUSTIC NEUROMAS

9.2.5 OTHERS

9.3 CENTRAL VERTIGO

9.3.1 CONCUSSION OR TRAUMATIC BRAIN INJURY

9.3.2 STROKES MAY CAUSE VERTIGO AND LOSS OF COORDINATION.

9.3.3 MULTIPLE SCLEROSIS

9.3.4 TUMORS OF THE BRAIN AND SPINAL CORD

9.3.5 OTHERS

10 GLOBAL VERTIGO TREATMENT MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 PHYSICAL THERAPY

10.2.1 CANALITH REPOSITIONING

10.2.2 BRANDT-DAROFF

10.2.3 SEMONT MANEUVER

10.2.4 LEMPERT MANEUVER

10.2.5 GUFONI MANEUVER

10.2.6 VESTIBULAR REHABILITATION EXERCISES

10.2.7 OTHERS

10.3 PHARMACOLOGICAL TREATMENT

10.3.1 HISTAMINE AGONISTS (BETAHISTINE)

10.3.2 ANTICHOLINERGICS

10.3.2.1. SCOPOLAMINE

10.3.2.2. HYOSCYAMINE

10.3.3 ANTIHISTAMINES

10.3.3.1. MECLIZINE

10.3.3.2. DIMENHYDRINATE

10.3.3.3. PROMETHAZINE

10.3.3.4. CINNARIZINE

10.3.4 BENZODIAZEPINES

10.3.4.1. DIAZEPAM

10.3.4.2. LORAZEPAM

10.3.4.3. CLONAZEPAM

10.3.5 CORTICOSTEROIDS

10.3.5.1. DEXAMETHASONE

10.3.5.2. PREDNISONE

10.3.5.3. METHYLPREDNISOLONE

10.3.6 DOPAMINE ANTAGONIST (METOCLOPRAMIDE)

10.3.7 ANTIEMETIC

10.3.7.1. METACLOPROMIDE

10.3.7.2. PROMETHAZINE

10.3.7.3. ONDANSTERONE

10.3.8 OTHERS

10.3.8.1. ACETYL-LEUCINE

10.3.8.2. GINKGO BILOBA

10.4 SURGERY

10.4.1 ENDOLYMPHATIC SUBARACHNOID SHUNT

10.4.2 RETROLABYRINTHINE VESTIBULAR NEURECTOMY

10.4.3 COCHLEOVESTIBULAR NEURECTOMY

10.4.4 POST AMPULLARY NERVE SECTION

11 GLOBAL VERTIGO TREATMENT MARKET, BY DIAGNOSIS

11.1 OVERVIEW

11.2 FUKUDA-UNTERBERGER’S TEST

11.3 ROMBERG’S TEST

11.4 HEAD IMPULSE TEST

11.5 VESTIBULAR TEST BATTERY

11.6 VIDEONYSTAGMOGRAPHY TESTING

11.7 AUDIOMETRIC TESTS

11.8 OTOACOUSTIC EMISSIONS

11.9 IMAGING TEST

11.9.1 CT

11.9.2 MRI

11.1 OTHERS

12 GLOBAL VERTIGO TREATMENT MARKET, BY DURATION OF EPISODES

12.1 OVERVIEW

12.2 SECONDS

12.3 HOURS

12.4 DAYS

12.5 MONTHS

13 GLOBAL VERTIGO TREATMENT MARKET, BY PRESCRIPTION TYPE

13.1 OVERVIEW

13.2 OTC

13.3 PRESCRIPTION

14 GLOBAL VERTIGO TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

14.1 OVERVIEW

14.2 ORAL

14.3 INJECTABLE

15 GLOBAL VERTIGO TREATMENT MARKET, BY RACE

15.1 OVERVIEW

15.2 CAUCASIAN

15.3 ASIAN

15.4 BLACK

15.5 AUSTRALOID

16 GLOBAL VERTIGO TREATMENT MARKET, BY POPULATION TYPE

16.1 OVERVIEW

16.2 PEDIATRIC

16.3 ADULTS

16.4 GERIATRIC

17 GLOBAL VERTIGO TREATMENT MARKET, BY END USER

17.1 OVERVIEW

17.2 HOSPITALS

17.3 SPECIALTY CLINICS

17.4 HOME HEALTHCARE

17.5 REHABILITATION CENTERS

17.6 OTHERS

18 GLOBAL VERTIGO TREATMENT MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 HOSPITALS

18.3 RETAIL SALES

18.3.1 ONLINE PHARMACY

18.3.2 RETAIL SHOP

18.4 OTHERS

19 GLOBAL VERTIGO TREATMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.2 COMPANY SHARE ANALYSIS: EUROPE

19.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.4 MERGERS & ACQUISITIONS

19.5 NEW PRODUCT DEVELOPMENT & APPROVALS

19.6 EXPANSIONS

19.7 REGULATORY CHANGES

19.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL VERTIGO TREATMENT MARKET, BY REGION

GLOBAL VERTIGO TREATMENT MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 FRANCE

20.2.3 U.K.

20.2.4 HUNGARY

20.2.5 LITHUANIA

20.2.6 AUSTRIA

20.2.7 IRELAND

20.2.8 NORWAY

20.2.9 POLAND

20.2.10 ITALY

20.2.11 SPAIN

20.2.12 RUSSIA

20.2.13 TURKEY

20.2.14 NETHERLANDS

20.2.15 SWITZERLAND

20.2.16 REST OF EUROPE

20.3 ASIA-PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 AUSTRALIA

20.3.6 SINGAPORE

20.3.7 THAILAND

20.3.8 MALAYSIA

20.3.9 INDONESIA

20.3.10 PHILIPPINES

20.3.11 VIETNAM

20.3.12 REST OF ASIA-PACIFIC

20.4 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21 GLOBAL VERTIGO TREATMENT MARKET, SWOT AND DBMR ANALYSIS

22 GLOBAL VERTIGO TREATMENT MARKET, COMPANY PROFILE

22.1 SERVICE PROVIDERS

22.1.1 SHEA CLINIC

22.1.1.1. COMPANY OVERVIEW

22.1.1.2. REVENUE ANALYSIS

22.1.1.3. GEOGRAPHIC PRESENCE

22.1.1.4. PRODUCT PORTFOLIO

22.1.1.5. RECENT DEVELOPEMENTS

22.1.2 PRIMUS HOSPITAL

22.1.2.1. COMPANY OVERVIEW

22.1.2.2. REVENUE ANALYSIS

22.1.2.3. GEOGRAPHIC PRESENCE

22.1.2.4. PRODUCT PORTFOLIO

22.1.2.5. RECENT DEVELOPMENTS

22.1.3 APOLLO HOSPITALS ENTERPRISE LTD.

22.1.3.1. COMPANY OVERVIEW

22.1.3.2. REVENUE ANALYSIS

22.1.3.3. GEOGRAPHIC PRESENCE

22.1.3.4. PRODUCT PORTFOLIO

22.1.3.5. RECENT DEVELOPMENTS

22.1.4 KOKILABEN DHIRUBHAI AMBANI HOSPITAL

22.1.4.1. COMPANY OVERVIEW

22.1.4.2. REVENUE ANALYSIS

22.1.4.3. GEOGRAPHIC PRESENCE

22.1.4.4. PRODUCT PORTFOLIO

22.1.4.5. RECENT DEVELOPMENTS

22.1.5 RIGSHOSPITALET

22.1.5.1. COMPANY OVERVIEW

22.1.5.2. REVENUE ANALYSIS

22.1.5.3. GEOGRAPHIC PRESENCE

22.1.5.4. PRODUCT PORTFOLIO

22.1.5.5. RECENT DEVELOPMENTS

22.1.6 THE UNIVERSITY OF IOWA.

22.1.6.1. COMPANY OVERVIEW

22.1.6.2. REVENUE ANALYSIS

22.1.6.3. GEOGRAPHIC PRESENCE

22.1.6.4. PRODUCT PORTFOLIO

22.1.6.5. RECENT DEVELOPMENTS

22.1.7 ADVENTIS ENT & COCHLEAR IMPLANT CLINIC

22.1.7.1. COMPANY OVERVIEW

22.1.7.2. REVENUE ANALYSIS

22.1.7.3. GEOGRAPHIC PRESENCE

22.1.7.4. PRODUCT PORTFOLIO

22.1.7.5. RECENT DEVELOPMENTS

22.1.8 BRISBANE HEADACHE AND MIGRAINE CLINIC

22.1.8.1. COMPANY OVERVIEW

22.1.8.2. REVENUE ANALYSIS

22.1.8.3. GEOGRAPHIC PRESENCE

22.1.8.4. PRODUCT PORTFOLIO

22.1.8.5. RECENT DEVELOPMENTS

22.1.9 THE ROYAL VICTORIAN EYE AND EAR HOSPITAL

22.1.9.1. COMPANY OVERVIEW

22.1.9.2. REVENUE ANALYSIS

22.1.9.3. GEOGRAPHIC PRESENCE

22.1.9.4. PRODUCT PORTFOLIO

22.1.9.5. RECENT DEVELOPMENTS

22.1.10 TRINITY HEARING & BALANCE

22.1.10.1. COMPANY OVERVIEW

22.1.10.2. REVENUE ANALYSIS

22.1.10.3. GEOGRAPHIC PRESENCE

22.1.10.4. PRODUCT PORTFOLIO

22.1.10.5. RECENT DEVELOPMENTS

22.1.11 DEENANATH MANGESHKAR HOSPITAL

22.1.11.1. COMPANY OVERVIEW

22.1.11.2. REVENUE ANALYSIS

22.1.11.3. GEOGRAPHIC PRESENCE

22.1.11.4. PRODUCT PORTFOLIO

22.1.11.5. RECENT DEVELOPEMENTS

22.1.12 HEARING HEALTH USA

22.1.12.1. COMPANY OVERVIEW

22.1.12.2. REVENUE ANALYSIS

22.1.12.3. GEOGRAPHIC PRESENCE

22.1.12.4. PRODUCT PORTFOLIO

22.1.12.5. RECENT DEVELOPMENTS

22.1.13 UNIVERSITY OF MARYLAND MEDICAL CENTER (UMMC)

22.1.13.1. COMPANY OVERVIEW

22.1.13.2. REVENUE ANALYSIS

22.1.13.3. GEOGRAPHIC PRESENCE

22.1.13.4. PRODUCT PORTFOLIO

22.1.13.5. RECENT DEVELOPMENTS

22.1.14 OAPC

22.1.14.1. COMPANY OVERVIEW

22.1.14.2. REVENUE ANALYSIS

22.1.14.3. GEOGRAPHIC PRESENCE

22.1.14.4. PRODUCT PORTFOLIO

22.1.14.5. RECENT DEVELOPMENTS

22.1.15 ENT SURGICAL CONSULTANTS, LTD

22.1.15.1. COMPANY OVERVIEW

22.1.15.2. REVENUE ANALYSIS

22.1.15.3. GEOGRAPHIC PRESENCE

22.1.15.4. PRODUCT PORTFOLIO

22.1.15.5. RECENT DEVELOPMENTS

22.1.16 HARTFORD HEALTHCARE

22.1.16.1. COMPANY OVERVIEW

22.1.16.2. REVENUE ANALYSIS

22.1.16.3. GEOGRAPHIC PRESENCE

22.1.16.4. PRODUCT PORTFOLIO

22.1.16.5. RECENT DEVELOPMENTS

22.1.17 ARNHEM PHYSIOTHERAPY SERVICES

22.1.17.1. COMPANY OVERVIEW

22.1.17.2. REVENUE ANALYSIS

22.1.17.3. GEOGRAPHIC PRESENCE

22.1.17.4. PRODUCT PORTFOLIO

22.1.17.5. RECENT DEVELOPMENTS

22.1.18 VIRINCHI HOSPITALS

22.1.18.1. COMPANY OVERVIEW

22.1.18.2. REVENUE ANALYSIS

22.1.18.3. GEOGRAPHIC PRESENCE

22.1.18.4. PRODUCT PORTFOLIO

22.1.18.5. RECENT DEVELOPMENTS

22.2 DRUG MANUFACTURERS

22.2.1 TAJ PHARMACEUTICALS LIMITED

22.2.1.1. COMPANY OVERVIEW

22.2.1.2. REVENUE ANALYSIS

22.2.1.3. GEOGRAPHIC PRESENCE

22.2.1.4. PRODUCT PORTFOLIO

22.2.1.5. RECENT DEVELOPEMENTS

22.2.2 ABBOTT

22.2.2.1. COMPANY OVERVIEW

22.2.2.2. REVENUE ANALYSIS

22.2.2.3. GEOGRAPHIC PRESENCE

22.2.2.4. PRODUCT PORTFOLIO

22.2.2.5. RECENT DEVELOPMENTS

22.2.3 AURIS MEDICAL

22.2.3.1. COMPANY OVERVIEW

22.2.3.2. REVENUE ANALYSIS

22.2.3.3. GEOGRAPHIC PRESENCE

22.2.3.4. PRODUCT PORTFOLIO

22.2.3.5. RECENT DEVELOPMENTS

22.2.4 WELLONA PHARMA

22.2.4.1. COMPANY OVERVIEW

22.2.4.2. REVENUE ANALYSIS

22.2.4.3. GEOGRAPHIC PRESENCE

22.2.4.4. PRODUCT PORTFOLIO

22.2.4.5. RECENT DEVELOPMENTS

22.2.5 ANI PHARMACEUTICALS, INC.

22.2.5.1. COMPANY OVERVIEW

22.2.5.2. REVENUE ANALYSIS

22.2.5.3. GEOGRAPHIC PRESENCE

22.2.5.4. PRODUCT PORTFOLIO

22.2.5.5. RECENT DEVELOPMENTS

22.2.6 AMNEAL PHARMACEUTICALS LLC.

22.2.6.1. COMPANY OVERVIEW

22.2.6.2. REVENUE ANALYSIS

22.2.6.3. GEOGRAPHIC PRESENCE

22.2.6.4. PRODUCT PORTFOLIO

22.2.6.5. RECENT DEVELOPMENTS

22.2.7 AKORN OPERATING COMPANY LLC

22.2.7.1. COMPANY OVERVIEW

22.2.7.2. REVENUE ANALYSIS

22.2.7.3. GEOGRAPHIC PRESENCE

22.2.7.4. PRODUCT PORTFOLIO

22.2.7.5. RECENT DEVELOPMENTS

22.2.8 TEVA UK LIMITE

22.2.8.1. COMPANY OVERVIEW

22.2.8.2. REVENUE ANALYSIS

22.2.8.3. GEOGRAPHIC PRESENCE

22.2.8.4. PRODUCT PORTFOLIO

22.2.8.5. RECENT DEVELOPMENTS

22.2.9 ZYDUS PHARMACEUTICALS

22.2.9.1. COMPANY OVERVIEW

22.2.9.2. REVENUE ANALYSIS

22.2.9.3. GEOGRAPHIC PRESENCE

22.2.9.4. PRODUCT PORTFOLIO

22.2.9.5. RECENT DEVELOPMENTS

22.2.10 TARO PHARMACEUTICAL INDUSTRIES LTD

22.2.10.1. COMPANY OVERVIEW

22.2.10.2. REVENUE ANALYSIS

22.2.10.3. GEOGRAPHIC PRESENCE

22.2.10.4. PRODUCT PORTFOLIO

22.2.10.5. RECENT DEVELOPMENTS

22.2.11 STRIDES PHARMA SCIENCE LIMITED

22.2.11.1. COMPANY OVERVIEW

22.2.11.2. REVENUE ANALYSIS

22.2.11.3. GEOGRAPHIC PRESENCE

22.2.11.4. PRODUCT PORTFOLIO

22.2.11.5. RECENT DEVELOPMENTS

22.2.12 MAYNE PHARMA GROUP LIMITED

22.2.12.1. COMPANY OVERVIEW

22.2.12.2. REVENUE ANALYSIS

22.2.12.3. GEOGRAPHIC PRESENCE

22.2.12.4. PRODUCT PORTFOLIO

22.2.12.5. RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.