Global Veterinary Analgesicsanti Inflammatory Nsaids Market

Market Size in USD Billion

CAGR :

%

USD

2.39 Billion

USD

3.96 Billion

2024

2032

USD

2.39 Billion

USD

3.96 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 3.96 Billion | |

|

|

|

|

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Size

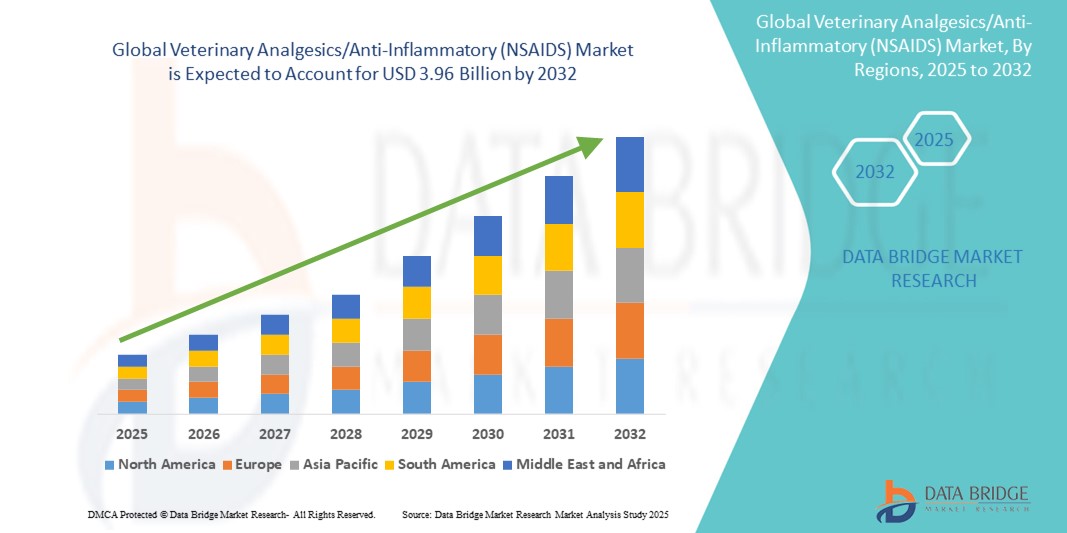

- The global veterinary analgesics/anti-inflammatory (NSAIDS) market size was valued at USD 2.39 billion in 2024 and is expected to reach USD 3.96 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is primarily driven by the increasing pet ownership worldwide and the rising awareness among veterinarians and pet owners about the importance of effective pain management in animals

- In addition, advancements in veterinary healthcare infrastructure, coupled with the growing demand for safe, targeted, and long-acting NSAID formulations for both companion and livestock animals, are contributing significantly to the market’s expansion. These converging trends are strengthening the adoption of veterinary NSAIDs as a critical component of animal pain therapy, thereby boosting overall market growth

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Analysis

- Veterinary Analgesics Veterinary NSAIDs, which are critical for managing pain and inflammation in animals, have become essential components of modern veterinary care for both companion and livestock animals due to their effectiveness, ease of administration, and wide applicability in post-operative, chronic, and musculoskeletal conditions

- The growing demand for veterinary NSAIDs is primarily driven by rising pet ownership, increased awareness of animal health and welfare, and a global push toward responsible pain management protocols in veterinary practice

- North America dominated the veterinary analgesics/anti-inflammatory (NSAIDS) market with the largest revenue share of 40.5% in 2024, supported by advanced veterinary infrastructure, higher pet healthcare spending, and the presence of leading pharmaceutical companies

- Asia-Pacific is expected to be the fastest-growing region in the veterinary analgesics/anti-inflammatory (NSAIDS) market during the forecast period due to growing livestock production, expanding veterinary services, and increasing disposable incomes in countries such as China and India

- Oral administration segment dominated the veterinary analgesics/anti-inflammatory (NSAIDS) market with a market share of 43.5% in 2024, driven by its convenience, better compliance among pet owners, and a broad availability of palatable formulations designed specifically for companion animals

Report Scope and Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Segmentation

|

Attributes |

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Trends

“Rising Preference for Long-Acting and Species-Specific Pain Management”

- A significant and accelerating trend in the global veterinary NSAIDs market is the growing preference for long-acting and species-specific formulations tailored to the unique physiological needs of companion and livestock animals. This evolution in treatment practices is significantly improving therapeutic outcomes and compliance

- For instance, Galliprant (grapiprant) is designed specifically for dogs, offering targeted osteoarthritis relief with a lower risk of gastrointestinal side effects compared to traditional NSAIDs. Similarly, Equioxx is a once-daily NSAID exclusively formulated for horses, highlighting the industry's shift toward animal-specific pain solutions

- Long-acting NSAIDs help reduce dosing frequency, enhancing convenience for pet owners and ensuring consistent pain control in chronic conditions such as arthritis and post-surgical recovery. Palatable, chewable tablet formulations further improve compliance and user satisfaction

- In livestock, the increasing use of NSAIDs such as meloxicam during routine procedures such as dehorning or castration reflects heightened awareness of animal welfare and regulatory encouragement for humane treatment

- The move toward more targeted, effective, and longer-lasting NSAID therapies is reshaping veterinary pain management standards. As a result, pharmaceutical companies are focusing on developing innovative delivery systems and safer formulations to meet the rising demand for advanced veterinary care solutions

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Dynamics

Driver

“Increasing Pet Ownership and Rising Demand for Animal Welfare”

- The growing number of pet adoptions globally, along with heightened awareness of animal welfare, is a major driver of demand for veterinary NSAIDs. As pets are increasingly seen as family members, owners are more willing to invest in their healthcare, especially for pain relief and chronic disease management

- For instance, data from the American Pet Products Association (APPA) indicates a steady increase in pet healthcare spending, particularly in areas such as joint care and post-surgical recovery, where NSAIDs are routinely prescribed

- In livestock, the adoption of NSAIDs is expanding due to both ethical concerns and compliance with evolving animal welfare regulations. Pain control during husbandry practices such as tail docking and castration is becoming more common, especially in developed markets

- This demand is further supported by improved veterinary access, expanded product availability, and growing education among animal caregivers. Collectively, these factors are accelerating the uptake of veterinary NSAIDs across both companion and production animal segments

Restraint/Challenge

“Safety Concerns and Regulatory Complexity in Multi-Species Use

- Despite their proven efficacy, NSAIDs present safety challenges, particularly in species with limited approved options or sensitivity to specific drug compounds. Issues such as gastrointestinal irritation, renal complications, and off-label use create concerns among veterinarians and regulators.

- For instance, some NSAIDs are approved only for canine use, with limited safety data available for cats, horses, or exotic animals, thereby restricting their application. Misuse can result in serious health consequences, raising liability risks.

- Regulatory environments vary across regions, complicating global commercialization. Food-producing animals, in particular, are subject to strict drug residue and withdrawal period requirements, adding complexity to NSAID approval and usage.

- Addressing these concerns requires robust clinical testing, enhanced veterinary training, and innovation in safer drug formulations. Improved regulatory harmonization and clearer dosage guidelines will also be essential to ensure broader, safe adoption of NSAIDs across multiple animal species

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Scope

The market is segmented on the basis of animal type, route of administration, application, and end user.

- By Animal Type

On the basis of animal type, the veterinary analgesics/anti-inflammatory (NSAIDS) market is segmented into companion animals and livestock animals. The companion animals segment held the largest market revenue share in 2024, driven by rising global pet ownership, increased awareness of pet health, and higher spending on veterinary care. Dogs and cats frequently require NSAIDs for managing chronic conditions such as osteoarthritis, post-operative pain, and injuries, contributing to consistent product demand. In addition, the emotional connection between owners and pets is increasing the willingness to invest in advanced, long-acting pain relief treatments, especially in developed economies.

The livestock animals segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing emphasis on animal welfare in agricultural practices and regulatory support for the use of NSAIDs to manage pain during husbandry procedures. Countries in Asia-Pacific and Latin America are witnessing particularly high growth due to expanding livestock populations and greater veterinary outreach.

- By Route Of Administration

On the basis of route of administration, the veterinary analgesics/anti-inflammatory (NSAIDS) market is segmented into oral, injectable, topical, and transdermal. The oral segment dominated the market in 2024 with the largest share of 43.5%, attributed to the convenience of administering chewable and flavored tablets in home care settings. Oral NSAIDs are widely used for long-term pain control, especially in dogs and horses, and offer superior owner compliance. Availability of multiple dosage strengths and improved palatability enhance their acceptance in veterinary prescriptions.

The transdermal segment is anticipated to witness the fastest growth from 2025 to 2032, driven by innovations in drug delivery technologies. These formulations allow for stress-free administration without needles or forceful ingestion, particularly benefiting feline and exotic species where traditional dosing can be challenging.

- By Application

On the basis of application, the veterinary analgesics/anti-inflammatory (NSAIDS) market is segmented into osteoarthritis, postoperative pain, cancer pain, musculoskeletal disorders, and others. The osteoarthritis segment held the largest market revenue share in 2024, as degenerative joint disease is highly prevalent in aging companion animals, especially dogs. Long-term NSAID therapy is the standard of care for managing inflammation and mobility issues, creating sustained demand in this segment.

The postoperative pain segment is expected to grow at the fastest CAGR through 2032, due to increasing surgical interventions in both pets and livestock, including spaying, orthopedic procedures, and dehorning. NSAIDs form a critical component of multimodal pain management protocols, and their expanding use across veterinary surgeries is driving growth in this segment.

- By End User

On the basis of end user, the veterinary analgesics/anti-inflammatory (NSAIDS) market is segmented into veterinary hospitals & clinics, retail pharmacies, and online pharmacies. The veterinary hospitals & clinics segment dominated the market with the largest revenue share of 82.49% in 2024. This is due to the prescription-based nature of most veterinary NSAIDs and the critical role of veterinarians in diagnosis and pain management. Clinics serve as the primary channel for both distribution and administration, particularly for injectable and high-potency NSAIDs.

The online pharmacies segment is projected to register the fastest CAGR from 2025 to 2032, supported by the rise of e-commerce in pet healthcare. Convenience, cost-effectiveness, and the availability of prescription fulfillment services are key drivers of this segment. The COVID-19 pandemic further accelerated digital adoption, which continues to influence consumer buying behavior in veterinary products.

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Regional Analysis

- North America dominated the veterinary analgesics/anti-inflammatory (NSAIDS) market with the largest revenue share of 40.5% in 2024, supported by advanced veterinary infrastructure, higher pet healthcare spending, and the presence of leading pharmaceutical companies. The U.S. continues to lead in adoption, particularly with the widespread use of oral NSAID formulations for osteoarthritis and post-surgical recovery in dogs and cats

- Pet owners in the region prioritize effective pain management solutions for conditions such as arthritis, injuries, and post-surgical recovery, leading to widespread use of NSAID therapies, especially in dogs and horses

- This growing demand is further supported by increased veterinary visits, greater access to companion animal care, and the presence of key pharmaceutical players, firmly positioning NSAIDs as a preferred pain management option across both companion and livestock animal segments

U.S. Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The U.S. veterinary analgesics/anti-inflammatory (NSAIDS) market captured the largest revenue share of 83% in 2024 within North America, fueled by the country's advanced veterinary care infrastructure, high pet ownership rates, and widespread awareness of pain management in animals. Companion animals, especially dogs and horses, drive consistent demand for NSAIDs due to the high prevalence of osteoarthritis and post-operative needs. The increasing emphasis on animal welfare, along with a robust ecosystem of veterinary clinics and pet insurance coverage, continues to support the growth of prescription-based NSAID therapies across both urban and rural settings.

Europe Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The Europe veterinary analgesics/anti-inflammatory (NSAIDS) market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong regulatory focus on animal welfare and the rising demand for pain management in both companion and livestock animals. Pet healthcare is well-established across key European countries, with veterinarians increasingly adopting NSAIDs for long-term management of chronic conditions. In addition, regulatory guidelines promoting humane treatment practices in livestock are bolstering the use of NSAIDs in agricultural settings, especially for pain mitigation during routine procedures.

U.K. Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The U.K. veterinary analgesics/anti-inflammatory (NSAIDS) market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a pet-loving population, proactive veterinary standards, and increasing awareness of companion animal health. NSAIDs are widely prescribed for managing arthritis, injuries, and post-surgical pain in pets, while livestock practices are also aligning with EU-based welfare regulations. The continued focus on preventive veterinary care and integration of advanced pain relief options into standard treatment plans is expected to drive further growth in the U.K. market

Germany Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The Germany veterinary analgesics/anti-inflammatory (NSAIDS) market is expected to expand at a considerable CAGR during the forecast period, fueled by high veterinary healthcare expenditure, strong regulatory compliance, and a growing demand for targeted pain relief solutions. Germany’s pet care sector is well-developed, with increasing veterinary visits and demand for safer, long-acting NSAID formulations. In addition, livestock producers are gradually incorporating pain management into animal welfare programs, supported by academic and regulatory emphasis on ethical farming practices.

Asia-Pacific Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The Asia-Pacific veterinary analgesics/anti-inflammatory (NSAIDS) market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by expanding livestock populations, rising pet adoption, and improving access to veterinary services in countries such as China, India, and Japan. The region’s growing veterinary pharmaceutical manufacturing capabilities, alongside increasing regulatory emphasis on animal health, are accelerating the use of NSAIDs across both companion and farm animal segments. Government programs promoting rural veterinary outreach and urban pet care are further fueling the regional market.

Japan Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The Japan veterinary analgesics/anti-inflammatory (NSAIDS) market is gaining momentum due to its technologically advanced veterinary sector, high pet ownership rates, and emphasis on preventive healthcare. NSAIDs are commonly prescribed for chronic pain in elderly pets, while the integration of digital health tools is improving veterinary diagnosis and treatment planning. In addition, Japan’s aging pet population is expected to increase the long-term demand for safe and effective NSAID therapies across both small and large animal clinics

India Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Insight

The India veterinary analgesics/anti-inflammatory (NSAIDS) market accounted for the largest market revenue share in Asia Pacific in 2024, driven by its rapidly growing companion animal population, expanding dairy and poultry sectors, and increasing veterinary care access. Livestock applications of NSAIDs are rising, especially for pain management during dehorning, castration, and transport. Affordable pricing, supportive government welfare programs, and a strong domestic pharmaceutical manufacturing base are propelling widespread adoption of veterinary NSAIDs across both urban and rural markets.

Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Share

The veterinary analgesics/anti-inflammatory (NSAIDS) industry is primarily led by well-established companies, including:

- Zoetis Inc. (U.S.)

- Elanco Animal Health Incorporated (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Merck & Co., Inc. (U.S.)

- Ceva (France)

- Vetoquinol S.A. (France)

- Dechra Pharmaceuticals Limited (U.K.)

- Norbrook (U.K.)

- Virbac (France)

- Phibro Animal Health Corporation (U.S.)

- Chanelle Pharma (Ireland)

- HIPRA, S.A. (Spain)

- Intas Pharmaceuticals Ltd. (India)

- KRKA, d. d., Novo mesto (Slovenia)

- PetIQ, LLC. (U.S.)

- Bimeda Corporate (Ireland)

What are the Recent Developments in Global Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market?

- In April 2024, Elanco Animal Health Incorporated announced the launch of a new chewable NSAID tablet designed specifically for long-term osteoarthritis management in dogs. The product, developed with advanced COX-selective inhibition technology, aims to minimize gastrointestinal side effects while providing sustained pain relief. This launch reinforces Elanco’s commitment to addressing chronic pain in companion animals with innovative, safe, and palatable formulations that enhance treatment adherence and clinical outcomes

- In March 2024, Zoetis Inc. expanded its Solensia product line in Europe, introducing a monthly injectable monoclonal antibody therapy as an alternative to traditional NSAIDs for feline osteoarthritis. While not an NSAID itself, the product’s success underscores the growing demand for advanced pain management and complements NSAID offerings in multimodal treatment protocols. The move reflects Zoetis’ strategic investment in differentiated, species-specific pain solutions for underserved animal segments

- In February 2024, Boehringer Ingelheim launched an extended-release injectable NSAID for cattle in key Latin American markets. The formulation is designed to provide multi-day relief from pain and inflammation associated with common veterinary procedures such as castration and lameness treatment. This development highlights the company's focus on improving livestock welfare and productivity, in line with evolving regional animal health regulations and ethical farming practice

- In January 2024, Vetoquinol announced regulatory approval for its new oral NSAID in several Southeast Asian countries, targeting pain associated with musculoskeletal conditions in dogs. This expansion strengthens Vetoquinol’s presence in emerging markets and provides veterinarians with more affordable, convenient treatment options. The company aims to bridge the accessibility gap in veterinary pain management by combining clinical efficacy with regional market adaptability

- In December 2023, Ceva Santé Animale entered into a strategic collaboration with a biotechnology firm to explore the development of next-generation NSAID alternatives using nanocarrier technology. The initiative focuses on improving drug bioavailability and minimizing systemic side effects in small animals. This partnership underscores Ceva’s dedication to innovation in veterinary pain relief and its long-term strategy to evolve beyond traditional NSAID formulations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.